Residence permits, permanent residence, and citizenship by investment in Europe: plain language

When I first started consulting with clients on relocation, I was surprised by how many myths exist around "golden visas" and investment residency. Some think it's something like "buy an apartment and get a passport tomorrow." Others think it's a privilege only for billionaires. The truth, as usual, is somewhere in the middle.

In simple terms, investment programs are an opportunity to “buy time and freedom.”.

By investing in a country's economy (most often in real estate), you gain access to a residence permit. And with it, access to the things that families value most: the right to live freely in Europe, study at the best universities, access healthcare, and start a business.

I remember well one client from Ukraine who said, " I'm not seeking citizenship for the sake of a nice passport; I want my children to have an alternative – an education in Europe and the opportunity to choose where to live ." And this, in my opinion, is the most honest motivation for investing in a residence permit.

"I always repeat: investing in a residence permit isn't about status, it's about choice. The ability to choose a country to live, study, or do business in—that's the real value.".

— Ksenia , investment consultant,

Vienna Property Investment

What's important to know about temporary residence permits, permanent residence permits, and citizenship: a simple explanation

Clients often get confused by terminology. Let's break it down:

A residence permit (VNZ) is the first step. It grants the right to live and travel within the country, and in the case of the EU, also within the Schengen area. It is usually issued for 1–2 years with the possibility of renewal.

Permanent residence (PMZh) is the next step. It can be obtained after several years of temporary residence, provided you actually live in the country. This is a long-term status without strict restrictions.

Citizenship is the end of the road. An EU passport opens all doors for you: from the right to vote in elections to visa-free travel to almost anywhere in the world.

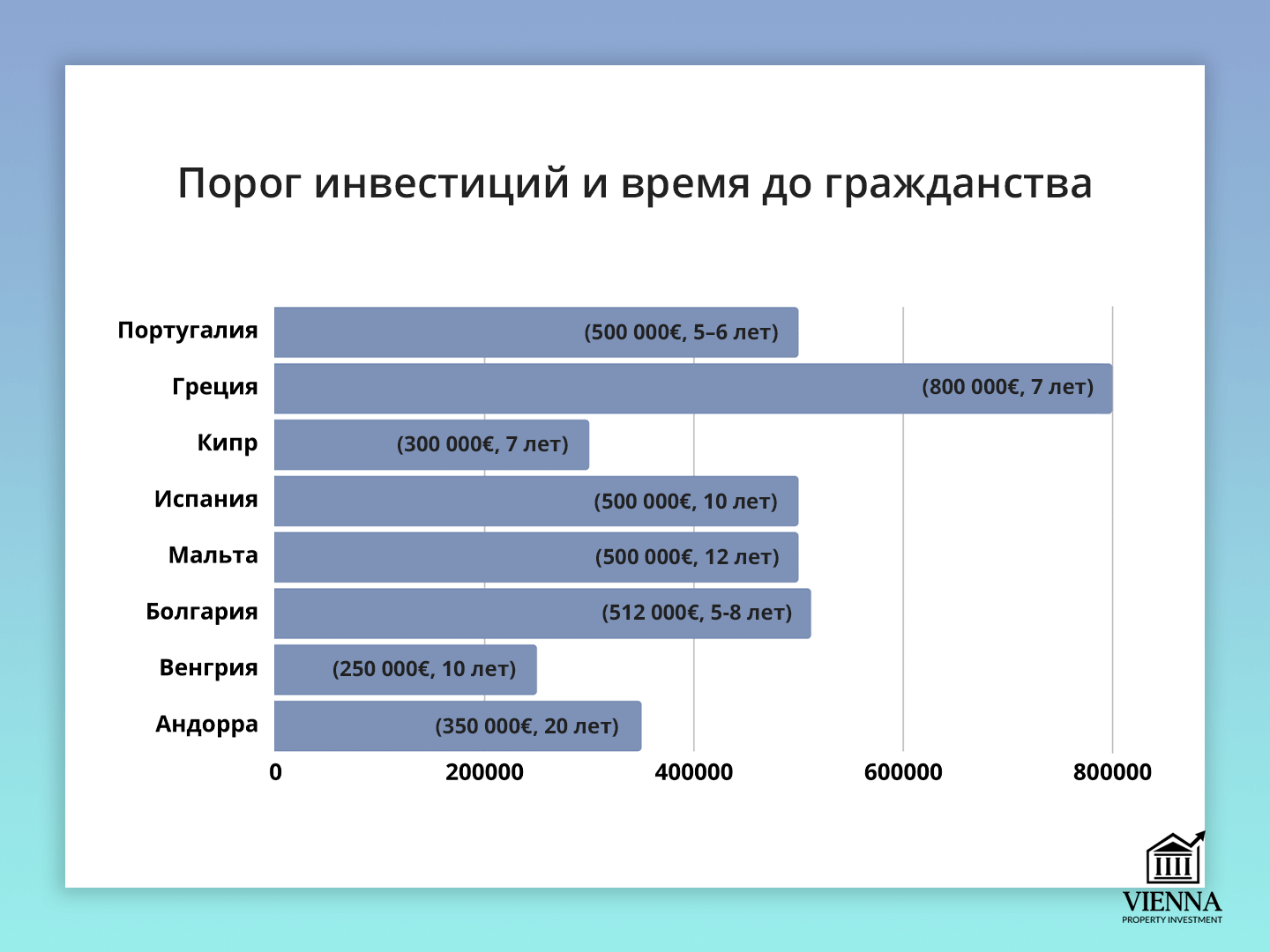

The timeframe depends on the country: in some countries, citizenship can be obtained in 5–7 years (Portugal, Spain), in others, in 10 (Austria), and there are options for accelerated acquisition (for example, in Malta).

I'd recommend thinking of it as a ladder. A residence permit is the bottom rung, which you can quickly climb through with investment. After that, it all depends on your strategy: whether you want to go all the way or whether having a residence permit for yourself and your family is enough.

Why invest: pros and cons

One might ask: why bother "buying" a residence permit at all when there are work visas, educational programs, marriage, and other options? The answer is simple: the investment route is the most predictable and fastest.

Pros:

- There is no need to prove employment.

- There is no need to depend on your employer every time.

- You control the process: invest – receive status.

- In most countries, you can include your family (spouse, children, sometimes parents).

Cons:

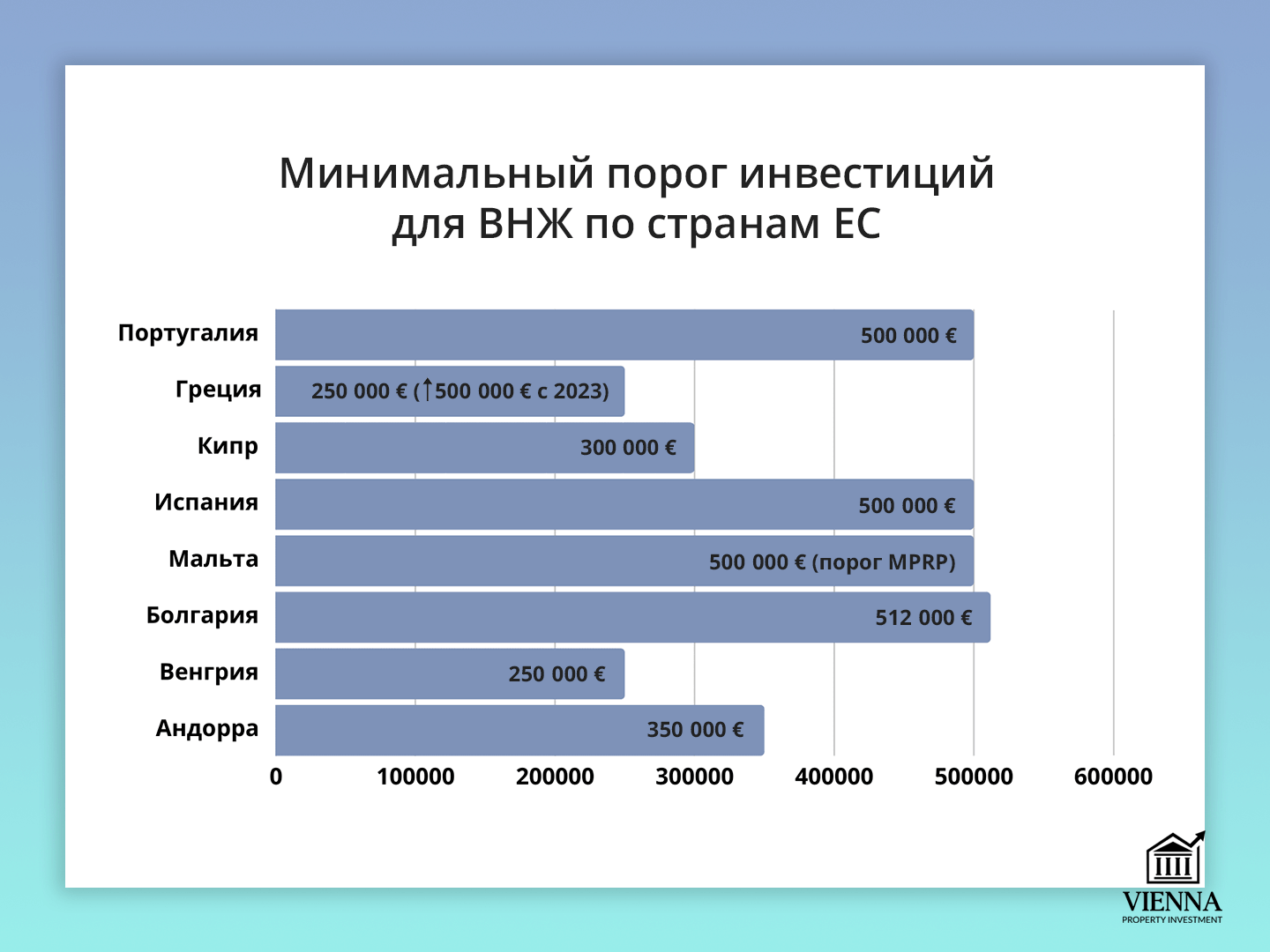

- High financial threshold. Minimum – 100–150 thousand euros, and most often 250–500 thousand.

- Risks: currency fluctuations, changes in laws, unpredictability of the real estate market.

- It is not always possible to quickly return investments: money is “frozen” for 5–7 years.

I always explain both sides of the coin honestly to my clients. Yes, it's a convenient tool, but it's not a one-way ticket. It's important to understand that investments must be prudent and well-thought-out.

Sometimes clients come to me with the question: " I want a residence permit, but what I buy is irrelevant ." I always stop them at that point. Property or a business abroad should be chosen not only based on the documents but also on its actual value.

How to choose a country for an investment residence permit: key criteria

When people are just starting to research the issue, they often ask, "Where is the easiest place to get a residence permit?" But there's no one-size-fits-all answer. Everything depends on your situation, goals, and budget. I always recommend breaking it down into these criteria:

Investment amount. The minimum threshold varies greatly: in Greece it's €250,000, in Spain it's from €500,000, and in Austria it's in the millions.

Residency requirements. Some countries require you to actually live there for most of the year (for example, Spain). Others are more lenient—a visit once a year is sufficient (like Greece).

Processing times. In some countries, documents can be obtained in 3–6 months, while in others, the process can take over a year.

Taxes. It's important to consider how income earned abroad is taxed. For example, Portugal is known for its NHR (new resident tax) .

The opportunity to obtain citizenship. There are countries where a temporary residence permit will remain just that (for example, Andorra), while in others it's truly a stepping stone to a passport.

I often tell my clients: when choosing a country for a residence permit, think not about pretty pictures, but about practicality. Where your children will have a comfortable education, and where you can run your business and pay reasonable taxes.

What is important for family and business

For family investors, the picture is slightly different than for single investors. Here, issues of education, healthcare, and standard of living come to the fore.

- Education. Portugal and Spain have strong universities, and EU degrees are highly regarded worldwide.

- Healthcare. Many choose Greece and Cyprus specifically for their access to the European healthcare system.

- Language. Spanish and Portuguese are easier to learn than, for example, Hungarian.

- Ease of adaptation. Greece and Cyprus are popular among Ukrainians and Russian speakers: they already have large diasporas, which makes everyday life easier.

If we are talking about business , there are other priorities:

- Taxes. Malta and Cyprus offer favorable tax regimes.

- Logistics. Spain and Portugal are convenient for companies working with Latin America.

- Prestige. Switzerland and Austria remain "heavy luxury" destinations for those seeking to emphasize status.

It's important to understand: "cheaper" doesn't always mean "better." Sometimes a family ends up spending more on education and healthcare in a "cheap" country than they would have spent on a more expensive but convenient option.

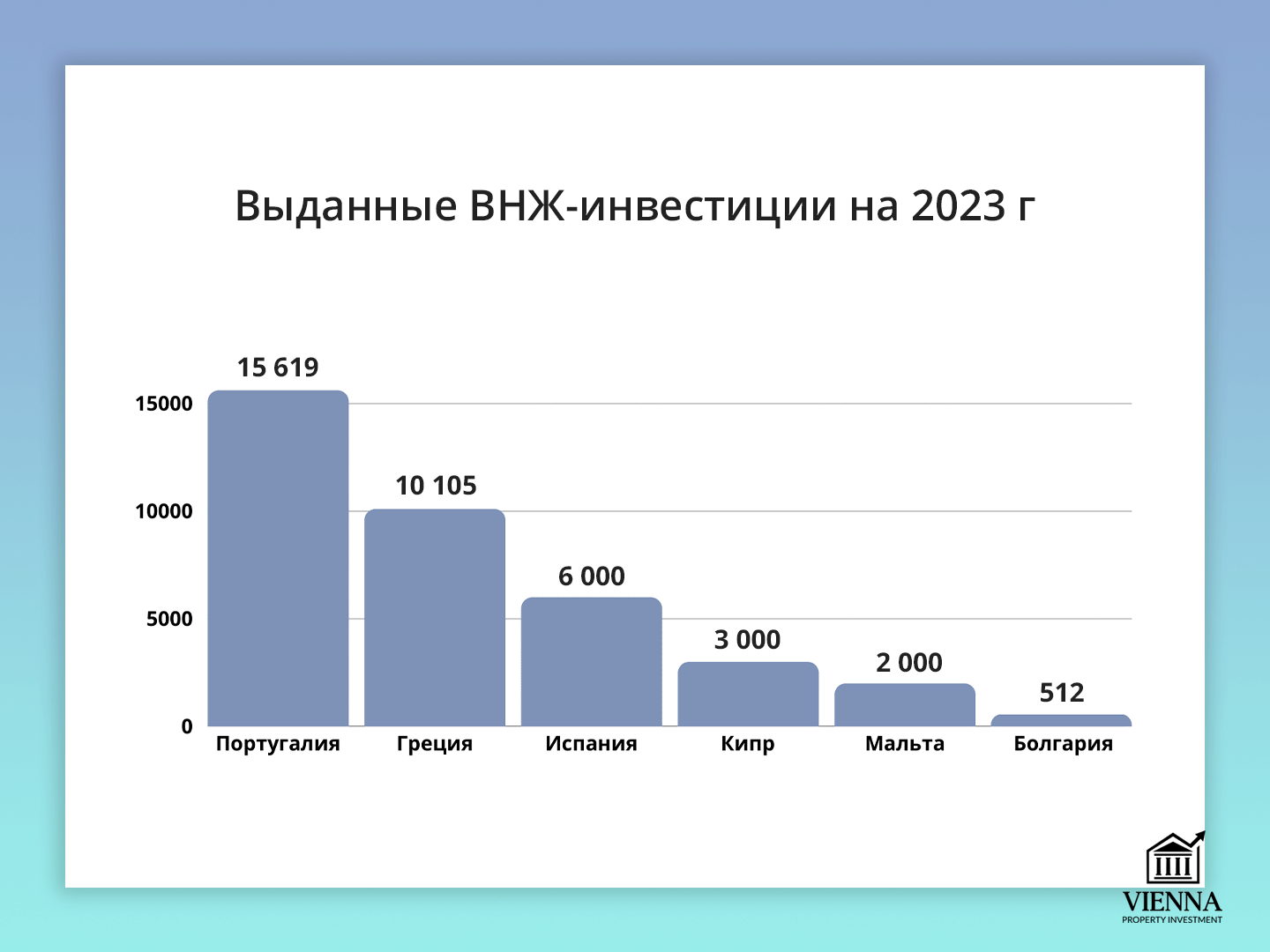

Top 3 destinations for investors: Portugal, Greece, Cyprus

Let's start with three countries that are often at the top of search queries.

Portugal

- The Golden Visa program has been operating since 2012.

- Minimum investment: from €250,000 (in art or funds), the classic option is €500,000 in real estate (some regions are cheaper).

- Accommodation: it is enough to visit the country once a year.

- After 5 years, you can apply for permanent residence or citizenship.

- Pro: NHR's favorable tax regime.

Greece

- The minimum threshold is €250,000 in real estate.

- A residence permit is issued to the entire family at once.

- It is not necessary to live here permanently – it is enough to come once a year.

- But citizenship is only available after actual residence for at least 7 years.

- A huge plus: a developed rental market, especially in Athens and the islands.

Cyprus

- A residence permit can be obtained by purchasing real estate worth at least €300,000.

- The family is included in the program automatically.

- Proof of income from abroad is required.

- Previously, there was a separate program for citizenship; now the conditions have changed, but Cyprus remains an attractive option for tax residency.

-

Case study: I had a client who was deciding between Greece and Portugal. We calculated all the expenses together: taxes, children's education, health insurance. And it turned out that although Portugal was more expensive initially, after five years the family saved more. Such calculations often make all the difference.

Spain: A Golden Visa with a Sunny Side

Spain remains one of the most popular destinations for those looking to combine investment with quality of life. It's simple:

- The minimum investment amount is €500,000 in real estate.

- Documents are processed fairly quickly – from 3 to 6 months.

- A residence permit is initially issued for 2 years, then extended for 5 years.

- To renew, it is enough to visit the country once a year.

-

An important detail: to obtain citizenship, Spain requires 10 years of actual residence and integration into society (language proficiency, cultural assessment). This is a significant barrier for those who don't plan to actually live in the country.

On the other hand, Spain offers a mild climate, excellent universities, and a developed rental market. Many families choose it specifically for its stable lifestyle and long-term prospects.

Malta: Investing in the Fund and the Path to a Passport

Malta is one of the few EU countries where investment can lead to citizenship in a relatively short period of time.

- A residence permit can be obtained by investing at least €150,000 in government bonds or funds, plus purchasing or renting a property.

- There is a separate program for citizenship ( Naturalisation for Exceptional Services by Direct Investment ): from €600,000 investment and 36 months of residence, or €750,000 and 12 months of residence.

- A residence permit is issued in approximately 4–6 months.

Malta's main advantages are its English language and favorable tax system. This is especially attractive for businesses.

I've noticed that entrepreneurs often choose Malta, while families prefer Spain or Portugal. This makes sense: Malta is ideal for registering companies, but a bit cramped for everyday life.

Bulgaria: the most affordable option for permanent residence in the EU

Bulgaria is deservedly considered an "affordable entry point" to the European Union:

- Minimum investment: €512,000 in government bonds (with repayment in 5 years).

- An alternative option is to invest from €250,000 in specific business projects.

- A residence permit can be obtained fairly quickly, but citizenship requires a residence period of at least 5 years (an accelerated procedure is possible by doubling the investment).

What investors like: Bulgaria offers a low cost of living, a mild climate, and proximity to the sea. However, the level of infrastructure and healthcare is inferior to Western Europe's.

| Spain | Malta | Bulgaria | |

|---|---|---|---|

| Minimum investment | €500,000 in real estate | from €150,000 in funds + housing | €512,000 in bonds |

| Timeframe for obtaining a residence permit | 3–6 months | 4–6 months | 6–9 months |

| Requirements for residence | Come once a year | Residence 12-36 months (for citizenship) | Minimum |

| Path to citizenship | 10 years of residence | from 1 year | 5 years (accelerated option is possible) |

Hungary: "reasonable entry threshold" and a relaxed pace of life

Hungary often appears on the short list of countries where you can obtain a residence permit by investment without exorbitant fees and with fairly straightforward bureaucracy. Budapest is an attractive but not overheated market, and life is slightly cheaper than in Western European capitals.

What usually attracts investors:

- Investment threshold. Moderate by EU standards (usually real estate or financial instruments).

- Family package. Spouse and children are usually included.

- Anchoring the Yield. Short-term rentals in central Budapest are traditionally in demand, especially during tourist seasons and international events.

- Language and adaptation. Hungarian is not easy, but there are many English-speaking specialists in the capital, and real estate services have long been "international."

What to remember:

- Citizenship will require long-term actual residence and integration (language, test, etc.).

- The real estate market is sensitive to rental and tourism regulations: rules can change, and this needs to be factored into the model.

- Hungary is a "comfortable middle ground": excellent quality-price ratio, but if you are critical of the country's prestige and status, compare it with Austria or Switzerland.

-

A practical case: the family of an IT entrepreneur initially considered Greece (€250,000 in real estate), but were put off by the high seasonality of rentals in tourist locations. Ultimately, they chose Budapest – two apartments for €200,000–230,000 each, in business-class buildings near the metro. The payback wasn't record-breaking, but it offered high occupancy year-round and stable cash flow.

If you're looking for a stable income and affordable rent, Budapest is a reasonable choice. But if you're looking for "European luxury" and maximum liquidity in the premium segment, then Vienna makes sense.

Andorra and Switzerland: Statuses for the Financially Independent and "Quiet Luxury"

These two jurisdictions are often considered when it comes to security, privacy, and a high standard of living. Their programs are not so much "investment" in the classic sense, but rather for financially independent residents (for Andorra) and for cantonal tax-fixing/leasing agreements (for Switzerland).

Andorra

- It attracts with its soft taxation and alpine quality of life.

- Passive resident format: you must demonstrate sufficient income/assets and meet the requirements for placing funds/investing within the country, plus housing.

- Suitable for those who value privacy, sports (skiing, hiking), and for whom living in a metropolis is not critical.

Switzerland

- In general, there is no “cheap” investment residence permit: it involves high costs and strict compliance.

- Lump sum tax arrangements are possible, but this is an individual story and a hefty ticket.

- Plus – impeccable infrastructure, private schools, healthcare, stability of the franc.

- The downside is the cost of entry and maintaining status.

Who makes sense: highly mobile entrepreneurs who value schools, security, privacy, and diversification of their personal jurisdiction. However, compared to the EU standard RBI (residence by investment) , both Andorra and Switzerland are about "lifestyle," not "cheap residency."

Clients often come to me with dreams of Switzerland. I'm honest: consider not only the "entrance fee" but also the "cost of ownership": rent/purchase, taxes, insurance, schools. This is a must-have calculation before making a choice.

Austria: Strict Standards, High Bars, and Premium Liquidity

As an expert, I'll give you an honest, mature perspective on Austria. This isn't a story about "the cheapest residence permit"—it's about quality, structure, and the long game.

Austrian investor statuses are strict, with stringent criteria for investment volume, capital origin, and integration. But in return, they enjoy some of the strongest premium liquidity in Central Asia and exemplary predictability.

Why investors are still looking at Vienna:

- Liquidity in the premium segment. Vienna's city center and the "right" districts (1st, 3rd, 4th, 7th, 9th, 19th, etc.) are assets that experience lower price declines in the volatile European market.

- Demand for Class A rentals. Diplomats, international organization employees, and international corporate relocations represent long-term demand, supporting rates and occupancy.

- Infrastructure and standards. Education (private and international schools), healthcare, safety, and transportation are all "standard."

What you will have to take into account:

- Entry threshold and requirements. This isn't Greece for €250,000. Austria is for those willing to structure their capital and demonstrate a "substantial contribution" to the economy.

- Deadlines and compliance. Processes are formalized, everything is verified, and funding sources are thoroughly verified.

- Language and integration. German is a plus, although English is widely used in everyday business environments.

-

Case study: An international family with two children was choosing between Portugal and Austria. Portugal offered an "easier" entry point; Austria offered a dream school, a 20-minute commute to the company headquarters, and high-quality medical facilities close by. The result: Vienna. Two years later, the family admitted, "Yes, it's more expensive. But every day we realize what we're paying for."

A small comparison for those thinking about alternatives:

- Greece/Portugal: easier entry and quicker residency approval; rental yields are more noticeable in seasonal locations.

- Austria: a more challenging start, but higher-quality assets, with a focus on a consistently high-quality tenant and low capital volatility.

"In short: Austria isn't about 'fast and cheap,' it's about 'preserving and enhancing capital' along with quality of life. And for many families, this is the deciding factor.".

— Ksenia , investment consultant,

Vienna Property Investment

Features of programs for Ukrainians and CIS investors

For Ukrainians, Belarusians, Kazakhs, and other CIS citizens, European residence permit programs often become not only a way to invest capital but also a matter of security and mobility. Here's what's especially important for our compatriots:

Poland. A number of simplified residence and work arrangements are available for Ukrainians. However, there is no traditional "investment residence permit" – long-term leases or business start-ups are more suitable. Poland is an interesting country for a start-up, but those considering EU citizenship should consider other options.

Greece and Cyprus. Very popular among Ukrainians and Russians: low entry thresholds, no strict residency requirements, and active Russian-speaking communities.

Spain and Portugal. Suitable for those ready to integrate—learn the language, and actually live there. Education is a big plus for children.

Austria and Germany. The standards are higher here, but the quality of infrastructure, healthcare, and education are at the premium level.

Simplicity is often the main criterion for Ukrainian clients. They want a quick and bureaucratic solution. In such cases, I recommend Greece or Cyprus as first options. But if the goal is long-term EU integration, then Spain, Portugal, or Austria.

Investing with Insight: How to Analyze and Manage Risk

When it comes to residence permits through investment, many people think only about the initial entry fee. But in practice, it's also important to consider what will happen to the investment in 5-10 years.

Main risks

Currency fluctuations. By investing in euros, you protect yourself from hryvnia or ruble devaluation, but you're exposed to euro/dollar fluctuations.

Changes in laws. Programs are subject to change. For example, Portugal recently reduced its real estate opportunities.

Bureaucracy. Even in the EU, there are delays and additional document checks.

Illiquid assets. If you buy the wrong property, it will be difficult to sell it in five years.

How to reduce risks

- Choose countries with a long history of the program (Portugal, Greece).

- Work with trusted developers and agents.

- Compare options: an apartment in the center of the capital versus a villa on the outskirts.

- Diversify: not only real estate, but also funds and bonds.

-

Case study: A client bought an apartment in a tourist region of Spain. He planned to rent it out year-round, but demand was minimal in winter. He had to increase his budget. Another client invested in an apartment in central Lisbon—more expensive, but rented it out consistently 12 months a year. Result: the second option turned out to be more profitable.

"I always say: look not only at the entry price but also at the exit liquidity. An asset that's easy to rent and sell is the best hedge against risk."

— Ksenia , investment consultant,

Vienna Property Investment

Easy and accessible ways to obtain a residence permit: where are the minimum requirements?

Not everyone needs "premium luxury." A common request is, "Where is the easiest and cheapest place to get a residence permit?" Examples:

- Greece. The threshold is €250,000; no permanent residence requirement.

- Bulgaria. There's an option through bonds or business, the amounts are moderate.

- Hungary. Moderate entry, simple bureaucracy.

- Montenegro (not an EU member, but a candidate country). It also has programs, often interesting as a stepping stone to Europe.

It's important to understand: a cheap residence permit doesn't always lead to citizenship. For example, in Greece, you need to actually live there for seven years to obtain a passport. In Bulgaria, the process is expedited, but the country's status within the EU is somewhat weaker in terms of prestige and infrastructure.

-

My advice: if your goal is simply a "backup" and the ability to travel freely within the EU, choose Greece. If your goal is truly citizenship and life in the EU, it's better to consider Portugal or Spain.

Investing in European Real Estate: Why It's the Most Popular Path

If you ask ten investors how they plan to obtain a residence permit in Europe, nine of them will say, "Through real estate." And this is no coincidence.

Why real estate?

Transparency. Purchase and receive a deed of ownership. Unlike funds or bonds, real estate can be touched.

Double benefit. You not only fulfill the residency requirement but also earn money from rent or appreciation.

A family asset. An apartment or house abroad is also a "second home" you can visit at any time.

Liquidity. In Europe, demand for housing in capital cities and tourist areas has historically been high.

I always say: if you want to sleep soundly, buy property in the capital or near universities. There will always be tenants there – from students to expats.

Peculiarities of different markets: Portugal, Poland, Spain, Greece

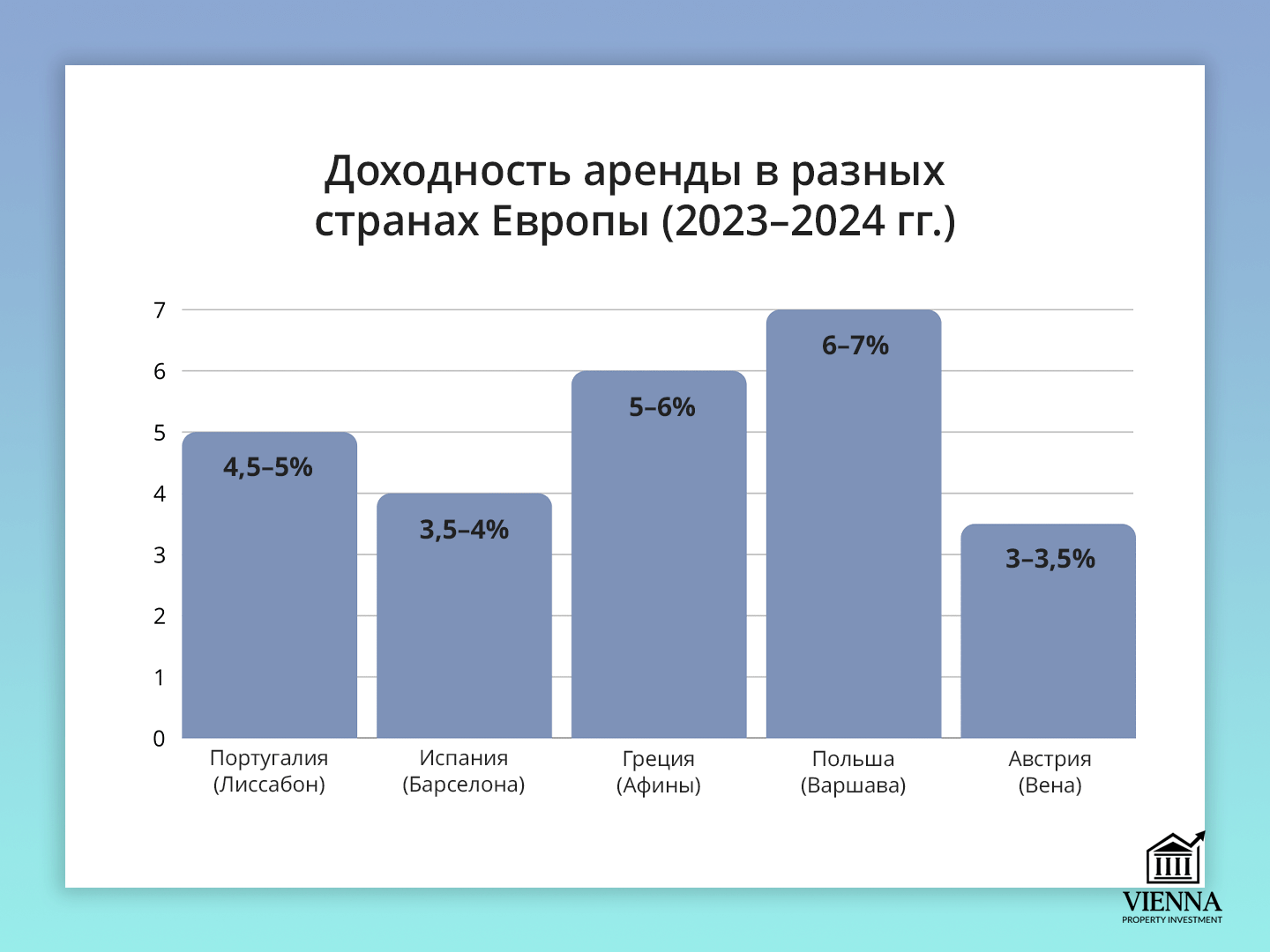

Portugal. Lisbon and Porto are magnets for investors. However, the market is overheated, with prices rising 60-70% over the past 10 years. Secondary cities or tourist regions offer good alternatives. Plus, the Golden Visa program allows real estate to be used as a tool for residency.

Poland. For Ukrainians, Poland is often the first step. Warsaw, Krakow, and Wroclaw have vibrant rental markets thanks to students and IT professionals. The entry barrier is lower than in Western Europe. Real estate in Poland doesn't always grant direct residence permits, but it is often used as a tool for long-term legalization and as an investment.

Spain. A highly segmented market: Barcelona and Madrid are for premium rentals, while the Costa del Sol and Costa Blanca are for tourist rentals. Demand is seasonal: occupancy rates are 90–95% in summer, but can drop to 50% in winter. It's important for investors to anticipate these winter gaps in advance.

Greece. Athens and Thessaloniki have stable demand due to students and internal migration. The islands are excellent rental options during the peak season, but everything depends on tourism. An apartment in Athens for €250,000 is a real ticket to residency.

How to choose real estate for a temporary residence permit: practical advice

A capital city or large city. Demand is more stable there. In Vienna, Lisbon, and Madrid, liquidity is almost always higher than in resort areas.

Transportation and infrastructure. A property near a metro station, school, or park will be more expensive initially, but will pay for itself more quickly.

Housing type: Apartments in new buildings are liquid but more expensive. Older housing in the city center means renovation is a risk, but there's high growth potential.

Target audience: If you're targeting students, it's best to choose compact housing. If you're targeting families, choose 2-3 bedroom apartments in quiet areas.

Legal due diligence. In Europe, it's important to check for encumbrances, debts, and rental permits (especially in tourist areas).

-

Case study: One client bought an apartment in Warsaw near the metro for €180,000. The rental yield was 6.5% per annum. Another invested €250,000 in Athens, but in an area with no infrastructure. The result: he received a residence permit, but he struggles to rent out the apartment, with a yield of less than 3%. The difference lies in the choice of location.

Real estate isn't just about status and square footage. It's about strategy. I always ask clients: do you want income or a second home? The answer to this question changes the entire choice.

| Country | Investment threshold | Rental yield | Seasonality risk | Prospects for price growth |

|---|---|---|---|---|

| Portugal | from €500,000 | 4,5–5% | short | moderate growth |

| Spain | from €500,000 | 3,5–4% | high | stable growth |

| Greece | from €250,000 | 5–6% | average | active growth |

| Poland | there is no direct connection | 6–7% | short | stable growth |

| Austria | from several million € | 3–3,5% | short | stable growth in the premium segment |

From Residence Permit to Citizenship: What and How

Obtaining a residence permit is just the beginning. The real goal for many investors is an EU passport. But the path to it varies from country to country. Here's how it works:

Permanent residence permit ( PR

Citizenship. In addition to the time limit, integration requirements are often required: language, cultural and historical exams, and proof of actual residence.

Examples:

- Portugal. After five years with a temporary residence permit, you can apply for permanent residency or citizenship. A basic knowledge of Portuguese is required.

- Greece. Citizenship is only possible after seven years of actual residence.

- Spain. Passport – after 10 years of residence, plus a mandatory exam.

- Malta. Accelerated naturalization – from 1 year of residence (with high investment).

- Austria. A difficult path: strict requirements, but the Austrian passport is one of the most prestigious.

Many clients think that a residence permit automatically turns into a passport. No. You need to consider the obligations: language, accommodation, integration. For some, this is a barrier, for others, it's a natural process.

Conclusion: A step-by-step action plan

If you're considering a residence permit by investment, you should proceed in stages:

- Determine your goal. Do you want a passport, a "backup plane," or simply an investment? The answer to this question is key.

- Select a country. Compare entry thresholds, residency requirements, taxes, and citizenship prospects.

- Choose an investment format. Real estate, funds, bonds, business. Each option has its own logic and risks.

- Conduct due diligence. Check the developer, the property, and the legal documents. This is a critical step.

- Complete the paperwork and submit your application. It's best to do this with a lawyer to avoid any bureaucratic surprises.

- Plan for the future. If your goal is to get a passport, start learning the language and integrating. If your goal is income, think about your rental strategy in advance.

"I often tell my clients: a residence permit isn't a goal in itself. It's a tool. And the clearer your strategy, the easier the process will be."

— Ksenia , investment consultant,

Vienna Property Investment