Property insurance in Austria and Vienna

Although property insurance isn't always legally required in Austria, it's the primary way to protect your investment. In practice, it's required by many key stakeholders: banks approve mortgages, management companies include it in their fees, and tenants are often required to insure their property by contract.

At its core, this type of insurance functions as a form of financial protection, very similar to the mandatory state social security system. That state system is also built on contributions and covers healthcare, pensions, and accidents. Unlike these mandatory types of insurance, however, property insurance is formally voluntary. However, in reality, it provides owners and investors with the same high level of reliability and security.

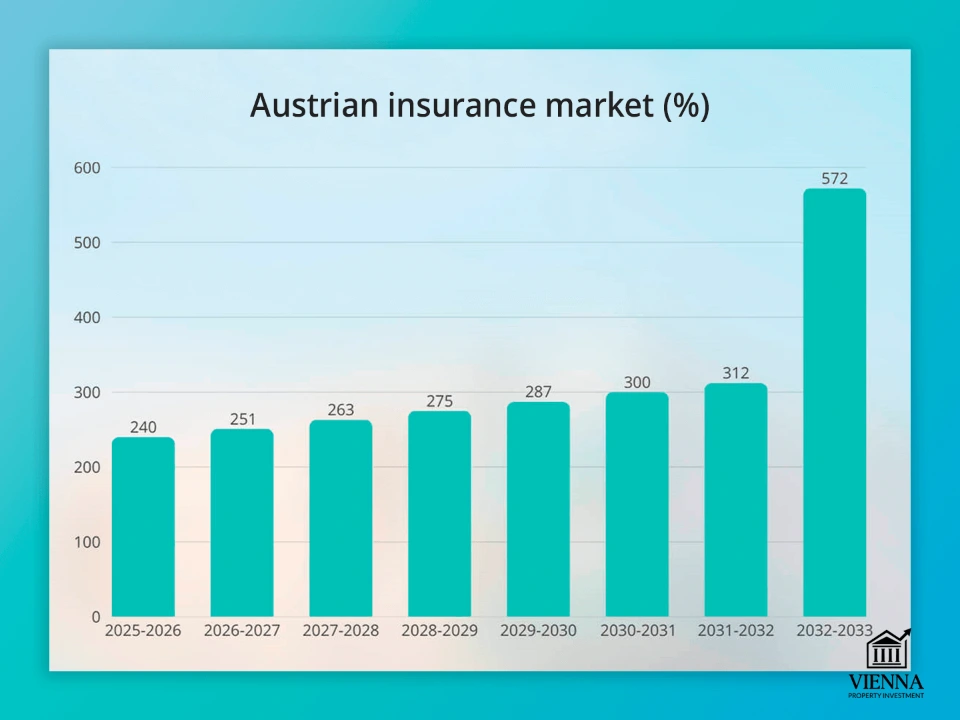

Property Insurance Market 2025:

- In the first quarter of 2025, insurance premium collections in Austria reached €7.3 billion, representing an increase of 4.8% compared to the first quarter of last year.

- The property and casualty insurance market is expected to grow at a compound annual growth rate of 5.29% by 2030, reaching $18.1 billion in 2025.

- Vienna accounts for the largest market share – 32.2% of all premiums in the property and liability insurance segment.

Austrian Insurance Market Growth (%)

(Source: https://www.datainsightsmarket.com/reports/austria-property-casualty-insurance-market-19773 )

Legal Framework for Property Insurance in Austria

Property insurance in Austria is governed by several important laws that establish the rights and responsibilities of owners, tenants and insurers.

Versicherungsvertragsgesetz (VersVG) is the main law governing insurance contracts. It outlines the client's obligations when entering into and complying with the contract, as well as the consequences of violating them. For example, concealing significant risk factors (such as previous damage to a building) may result in a reduced insurance payout or even a complete denial of the insurance claim.

Insurance Regulations (VAG 2016) and FMA Oversight. In Austria, insurance companies and their intermediaries are closely monitored. A special agency, the FMA, oversees this. It ensures that companies operate fairly and are financially sound, and that clients receive what they are entitled to under their contracts. If an apartment or house owner has a dispute with an insurer and is unable to reach an agreement, they can file a complaint with this organization—it's the primary authority here.

MRG §21. According to the Mietrechtsgesetz, building insurance costs can be charged to the tenants. Consequently, the burden of insurance costs is partially shifted to tenants, making it crucial to carefully review the invoices issued by the Hausverwaltung. This practice is most common in Vienna, where rental housing is highly concentrated.

WEG 2002. According to the Wohnungseigentumsgesetz, the activities of the Eigentümergemeinschaft (owners' association) are governed by established regulations that require the manager to ensure adequate building insurance coverage. For apartment owners in Vienna, this means that the collective policy typically includes insurance for the main structure, while interior decoration and personal property remain the responsibility of the owner.

Main types of property insurance policies in Austria

The Austrian property insurance market offers several core products, each covering specific risks. For property owners in Vienna, it's crucial to distinguish between which risks are covered by collective building insurance and which require individual coverage.

1. Haushaltsversicherung (property insurance)

- What's covered: your personal belongings in the apartment—all furniture, appliances, electronics, clothing, jewelry, and other valuables.

- What it protects against: fire, lightning strikes, burglary, flooding due to water leakage, hurricanes (wind speed from 60 km/h), hail, as well as damage to windows, doors or locks.

- Another thing often included is liability insurance (Haftpflichtversicherung). This will cover damages if you accidentally cause harm to others—for example, if you flood your neighbors' homes due to a broken washing machine or if your child damages someone else's property.

- Approximate cost: €120 to €250 per year for an apartment of 60–80 m². The price depends on the selected terms and the deductible (the amount you pay in the event of an insured event).

- Recommendations: Mandatory for tenants, many landlords include a policy requirement in the lease agreement.

- Who needs it and why: This type of insurance is mandatory for tenants. Landlords often explicitly state this requirement in their lease agreement.

2. Gebäudeversicherung (building insurance)

- For whom: for owners of apartments and private houses.

- What it protects: the home itself and its main parts – walls, roof, windows, engineering systems.

- What it protects against: fire, explosion, water leaks from pipes, storms, hail, floods, vandalism and natural disasters (if you add Elementarversicherung).

- Average cost: €250 to €500 per year for an 80-120 m² apartment. The price depends on the area (for example, if it's in a flood-prone zone) and the type of building.

- Additionally, you can activate Elementarversicherung to protect against floods, landslides and avalanches.

3. Haus- & Grundbesitzerhaftpflicht (homeowners' liability insurance)

- Why it's needed: It protects against expenses if other people are injured on your property—for example, if a passerby falls on a slippery road in winter.

- Cost: approximately €50–€100 per year for a house or plot of land in Vienna.

4. Rechtsschutzversicherung (legal expenses insurance)

- What it covers: attorney and court fees in disputes over rent, debt, eviction, and other legal matters.

- Why it's beneficial: You can defend your rights without spending a lot of money.

- Cost: €100 to €200 per year for basic protection for an apartment owner or landlord.

5. Elementarversicherung (disaster protection)

- What it covers: Natural disasters including floods, earthquakes, landslides and avalanches.

- How it is connected: most often it is issued as a supplement to the home contents insurance policy (Haushaltsversicherung) or building insurance (Wohngebäudeversicherung).

- Relevance for Vienna: Low-lying areas and areas near the Danube are characterized by an increased risk of flooding, which directly affects the cost of insurance.

- Prices: Typically a 10-20% premium to the base insurance price, depending on the risk category of the area.

6. Mietverlustversicherung (rent loss insurance)

- Insurance object: financial compensation to the property owner for lost rental income.

- Cost (average): The annual price of the policy varies between 80 and 200 euros.

- Who it's for: A key product for landlords, insuring them against financial losses during the period their property is uninhabitable.

7. Bauherrenversicherung (construction and renovation insurance)

- Coverage: Includes construction and repair work, liability for the actions of contractors and damage to third parties.

- Cost: on average, it ranges from €100 to €500 per year and depends on the scale of the work and the type of object.

- Recommendations: mandatory when implementing construction or major repair projects.

| Type of insurance | Coating | Approximate cost (€/year) | Key Features |

|---|---|---|---|

| Haushaltsversicherung | Personal belongings, furnishings, household appliances, digital devices, wardrobe, valuables; including Haftpflichtversicherung | 120–250 | Required for tenants; provides protection against accidental harm to third parties |

| Gebäudeversicherung | The building structure and its main elements: walls, roof, windows, utility systems; Elementarversicherung can be added | 250–500 | Designed for homeowners, it provides protection against fire, flooding, hurricanes, hail, vandalism, and natural disasters |

| Haus- & Grundbesitzerhaftpflicht | Liability for damage caused to third parties within your land or residential building | 50–100 | Compensates for damages in the event of accidents on the premises, such as falling on a slippery surface |

| Rechtsschutzversicherung | Legal services and legal fees arising from disputes over rent, debt collection, or eviction | 100–200 | Recommended for owners and landlords to ensure legal protection. |

| Elementarversicherung | Damage caused by natural phenomena: floods, earthquakes, landslides or avalanches | +10–20% to the basic policy | Can be a supplement to Haushalts- or Gebäudeversicherung; especially important in areas with a high risk of damage |

| Mietverlustversicherung | Lost income in the event of the tenant's inability to occupy the apartment due to damage | 80–200 | Beneficial for landlords, especially during renovations or in the event of an insured event |

| Bauherrenversicherung | Construction and repair work, as well as liability for the actions of contractors and damage caused to third parties | 100–500 | Required when carrying out construction work or large-scale reconstruction |

To plan your budget correctly, it's helpful to understand in advance which policies are considered additional expenses when purchasing real estate in Austria and which payments may arise as early as the first year of ownership.

Mortgage and insurance

When applying for a mortgage in Austria, banks typically require Gebäudeversicherung (building insurance). This is especially important for those planning to buy an apartment in Vienna with a mortgage: having the correct insurance is often a condition for loan approval. This requirement protects the bank's interests and guarantees:

- Preservation of mortgaged real estate in case of fire, natural disasters, flooding and other threats.

- The bank's right to demand the assignment of insurance claims (Abtretung der Ansprüche) in favor of the creditor - that is, insurance payments are transferred directly to the bank in the event of damage to property.

Before signing a contract, it's important to check that the insurance policy truly covers all relevant risks, especially if the property is located in potentially hazardous areas (for example, in the Vienna lowlands or near the Danube). All documents should be retained, and any changes to the insurance terms must be reported to the bank.

Thus, mortgage insurance in Austria not only ensures the safety of the property, but also serves as a mandatory tool for protecting the interests of the lender.

Real-life scenarios from my clients' practice

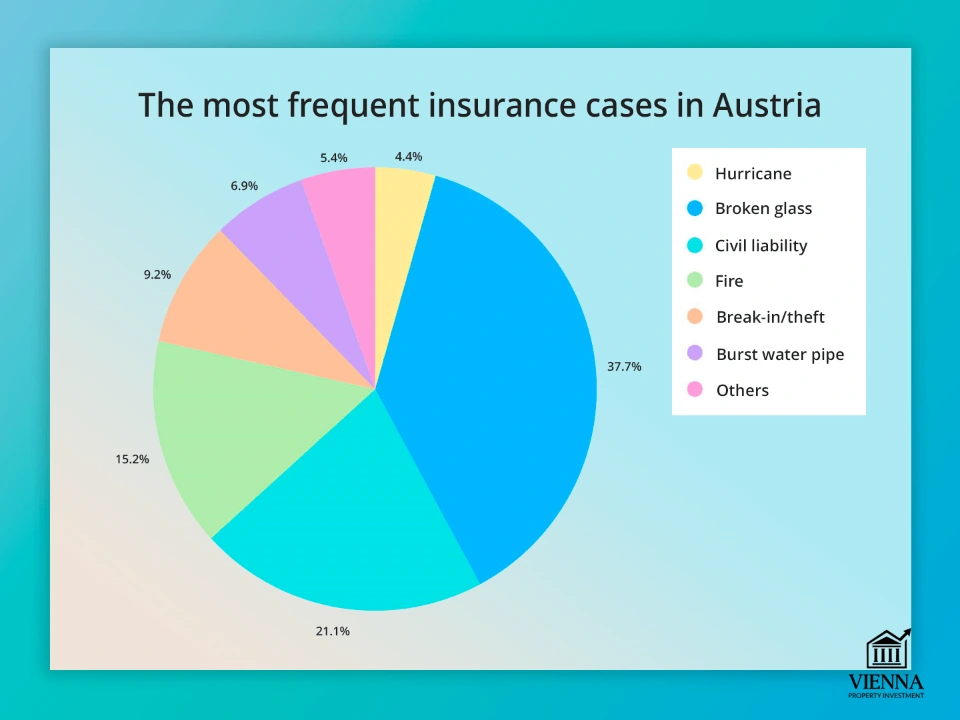

The most common insurance claims in Austria

(source: https://iminproperty.com/ru/guide/types-of-real-estate-insurance-in-austria/ )

1. Flooding of neighbors due to household appliances

My client rented an apartment in Vienna's 7th district. His washing machine suddenly leaked, damaging the apartment below. Because he had a Hauschaltersversicherung (Habitation of Ownership) extension, the insurance company reimbursed all the costs of replacing the flooring, furniture, and appliances in his neighbors' homes. Thus, the client avoided any personal financial losses.

2. Fire in an apartment with expensive equipment

My client, an apartment owner in Graz, experienced a faulty electrical wiring in a kitchen appliance, causing a fire. The fire destroyed furniture and appliances worth over €12,000. Under the Haushaltsversicherung (Hauschaltersversicherung) policy, the insurance company covered all restoration costs, including the installation of new kitchen furniture and appliances.

3. Storm and hail damage

In Salzburg, an investor who owned an apartment suffered damage to the roof and exterior of the building after a powerful hailstorm. Because he had insurance, the insurance company fully covered the costs of roof repairs and façade restoration.

4. Damage to other people's property by children and pets

In Vienna, a family with small children and a dog found themselves in a difficult situation: while playing, the child damaged their neighbors' furniture, and the pet scratched the walls and carpeting of the shared staircase. All costs for restoration and replacement of the damaged property were covered by the insurance company under the Haftpflichtversicherung (Hafting Insurance) policy.

5. Theft of personal property

In Leopoldstadt, a tenant returned from vacation to find his apartment burglarized. The insurance company, under its Haushaltsversicherung policy, compensated for the damage—new laptops, phones, jewelry, and household appliances totaling approximately €8,000.

How to choose a property insurance company in Austria

For homeowners and renters in Vienna and throughout Austria, choosing a reputable insurance company is especially important. This determines the speed of settlement and the full extent of compensation for damages in the event of a fire, flood, hurricane, or other unforeseen event.

1. What to consider when choosing

- Insurance type and coverage: Make sure the company offers a policy with the options you need.

- Reliability and reputation: Research independent insurance ratings on websites like www.qualitaetstest.at and read customer reviews.

- The claims process: how quickly claims are processed, whether support is available in English, and what documents are required to receive compensation are important.

- Price and deductible: Pay attention not only to the premium price, but also to the deductible level and the list of coverage exclusions.

2. Insurance companies in Vienna

Trusted companies with a reliable reputation:

- Zurich is an international insurance group with a wide range of insurance products.

- Wüstenrot specializes in comprehensive insurance packages for property owners.

- Oberösterreichische Versicherung - offers comprehensive insurance for families and investments.

- muki is aimed at renters, featuring easy online registration and attractive prices.

3. Insurance brokers

The main advantage of a broker is that they search for the best policy for your needs, working with multiple insurers. The client doesn't have to pay for their work—the broker's commission is paid by the insurance company itself. This means you receive free and unbiased assistance in choosing a policy.

- They are able to evaluate specific details: for example, what a house is built from, what area it is located in, and how many people live in it.

- Indispensable for expats and those who invest in real estate but are not well versed in local insurance regulations.

- They save your time and budget by immediately comparing prices and conditions on the market.

4. Online portals and tariff comparison

Well-known online services include durchblicker.at, vergleich.at, check24.at, versichern24.at, versicherung.at, financescout24.at and tarifcheck.at.

- They allow you to quickly compare price offers and conditions from multiple insurers.

- They are great for getting a feel for the market, but for a final decision it is recommended to consult with a specialist or broker.

First, talk to an insurance broker to clarify the details and understand what risks the insurance actually covers. Then, choose whether to sign the contract directly with the company or through an online service. This approach will allow you to combine a reasonable price, the required coverage, and convenient service.

What to do if an insured event occurs: a practical guide

If an insured event occurs (flooding, fire, storm, theft, etc.), follow the step-by-step procedure and act promptly—this will help ensure full compensation for damages:

- Record the consequences immediately

- Take photos and videos of damaged areas, save damaged items and papers.

- Prepare a detailed inventory of the property that was damaged.

- Contact your insurance company

- Notify the employer of the incident as soon as possible—many contracts stipulate a notice limit of 24-48 hours.

- Find out what documents and forms you will need to complete your application.

- Prevent further damage

- If possible, eliminate the source of the problem (for example, turn off the water if there is a leak, dry out the room).

- Avoid major and expensive repairs without prior approval from your insurance company.

- Prepare an evidence base

- Collect receipts, rental agreements, equipment receipts, and photographs of the damage.

- If there are eyewitnesses, write down their contact information.

- Interact with an insurance company representative

- The insurer may send a specialist to assess the damage.

- Provide him with all the prepared materials and be open in describing the circumstances.

- Monitor the payment process

- Track the progress of your case through your personal account or with the help of a broker.

- In case of delays or disagreements, please contact your broker, the VKI (Verein für Konsumenteninformation) or the FMA.

The more quickly and thoroughly you gather evidence of the incident and report it to your insurance company, the higher your chances of receiving full compensation. In Vienna, for example, my clients immediately take photos and video recordings of floods or other damage—this significantly simplifies the process of receiving compensation.

Features of Viennese risks in real estate insurance

When purchasing property insurance in Vienna, it's important to consider local specifics and increased risks, which may impact your policy choice and cost.

- Floods and the Danube

- Houses and apartments located along the Danube are particularly vulnerable to flooding during the spring floods.

- Before purchasing a property or concluding an insurance contract, it is recommended to check its location using the official risk map - HORA (Hochwasserrisikozonenkarte Austria).

- To ensure protection against damage caused by flooding, it is worth adding Elementarversicherung coverage to your policy.

- Rückstau (check valve)

- Many Austrian insurance companies require a backwater valve in the sewer system as a standard requirement.

- Without it, flood claims may be denied, as the valve prevents wastewater from flowing back into basements and apartments.

- Old Foundation (Altbau)

- Old buildings in Vienna are popular among tenants and investors, but they are more susceptible to leaks, fires, and electrical faults.

- For such properties, it is extremely important to take out compulsory property insurance in Austria, including both Haushaltsversicherung and Wohngebäudeversicherung.

- Renters are also advised to purchase rental home insurance to protect their personal property and third-party liability.

Many of my clients who buy apartments in old buildings in Vienna insure not only the building itself but also their personal belongings, and also add coverage against natural disasters. This reduces the risk of losing money and ensures they receive compensation in any difficult situation.

Property insurance for different categories of Austrian residents

- Pensioners

- In Austria, home insurance is not mandatory for pensioners, but many choose to take out such policies to protect their assets and cover potential third-party liability.

- Insurance companies often offer pensioners special discounts on Haushaltsversicherung and Gebäudeversicherung, which can range from 5 to 15%.

- To choose the most suitable option, taking into account personal risks and financial capabilities, retirees are advised to seek advice from insurance brokers.

- Ukrainians

- Ukrainians granted temporary asylum in Austria must obtain property insurance under the same conditions as citizens of the country.

- Haushaltsversicherung (property insurance) and Gebäudeversicherung (building insurance) policies are available to both tenants and homeowners.

- To obtain up-to-date information on available insurance products, Ukrainians should ensure their residency status is up-to-date and contact their local social security authorities.

- Foreign citizens

- Foreign owners and tenants of real estate in Austria are required to take out property and building insurance policies in accordance with applicable requirements.

- Additional documents may be required to obtain insurance, but some insurance companies offer information and service in English.

- General recommendations for all categories:

- Before purchasing an Elementarversicherung, it is important to clarify whether the property is located in high-risk areas (flooding, avalanches, landslides).

- To reduce costs, it is worth considering comprehensive insurance packages that combine Haushalts-, Gebäude- and Haftpflichtversicherung.

- Consider signing a contract in advance, especially if you are purchasing a property with a mortgage or renting it in Vienna.

"Want to protect your property in Austria? The right insurance will help protect your home or apartment from unexpected problems. I'll help you choose the right option and make everything as easy as possible."

— Ksenia , investment consultant,

Vienna Property Investment

Common Mistakes When Insuring Property in Austria

Even experienced owners and tenants often make mistakes when entering into insurance policies, which can ultimately result in reduced insurance payments or complete denial of compensation. Below are the most common situations:

- Underestimation of the insured amount

- Some insurers deliberately understate the actual value of a home or property in order to pay lower premiums.

- However, when an insured event occurs, compensation in this case turns out to be significantly lower than the losses incurred.

- Lack of Elementarversicherung in "water" zones

- Residential areas near the Danube and in low-lying areas have a high risk of flooding.

- Policyholders without the extended Elementarversicherung coverage risk not receiving compensation in the event of a flood.

- Ignoring gross negligence

- If the damage was caused by serious negligence (for example, an electrical appliance left on unattended and causing a fire), the insurance company has the right to refuse compensation.

- Therefore, in practice, it is extremely important to carefully follow the rules for using housing and household appliances.

- Airbnb and short-term rentals without additional insurance

- Renting out an apartment for a short term without notifying the insurance company is often the reason for denial of compensation.

- Most standard policies only cover personal accommodations, so Airbnb accommodations require separate insurance or an extension to your existing policy.

- Repair and construction without Bauherren coating

- Any damage caused to neighbors or their property during the renovation process is the personal financial responsibility of the owner unless a Bauherrenversicherung has been issued.

- For buildings in Vienna that are of historical value, such a solution is highly undesirable, since the age of the communications and structures greatly increases the chances of unforeseen events occurring.

Many of my clients, particularly investors in Vienna, prefer to combine basic home insurance in Vienna with Haushaltsversicherung (homeowners' insurance) and Elementarversicherung (homeowners' insurance), and also take out additional policies for short-term rentals. This approach helps avoid common mistakes and provides protection with guaranteed payouts even in unforeseen circumstances.