How much will real estate cost in Germany in 2026?

The German real estate market is showing signs of stable growth in 2025 after the downward adjustment of recent years. According to Europace, the average apartment purchase price in the country is approximately €3,400 per square meter, with prices in prime cities like Munich exceeding €7,000 per square meter, while in less sought-after regions, they can be two to three times lower.

According to a report by the Institute of German Economics (IW Consult), 82% of German regions will see price increases from 2024 to 2025, an average of 2.3%, confirming a gradual market recovery.

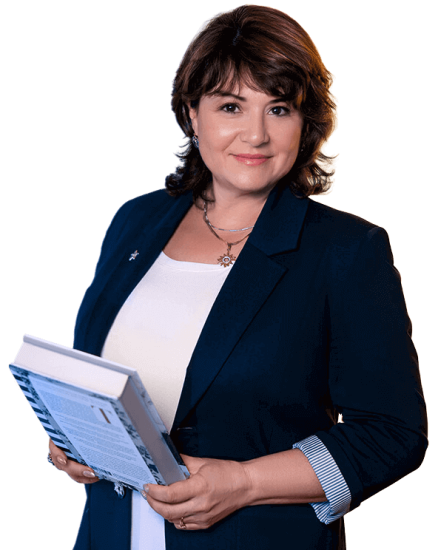

Rising property prices in Germany

(source: https://www.drklein.de/immobilienpreise.html )

Under these conditions, Germany remains one of the most attractive destinations for investors seeking long-term capital protection and stable income. It combines high legal protection for property owners, transparent transaction procedures, and strong domestic demand for rental housing, particularly in the largest cities—Berlin, Munich, and Frankfurt.

Unlike southern European countries with more volatile markets, the German market is characterized by stability and predictability, making it an “anchor” in the portfolio of an international investor.

"Real estate in Germany is traditionally considered a reliable instrument for investors, but behind this apparent stability lie complex tax rules and strict market regulation. My goal is to show you how to navigate these nuances, protect your investment, and turn your purchase into a truly profitable strategy."

— Ksenia , investment consultant, Vienna Property Investment

I, Ksenia Levina, am a lawyer with international experience in real estate and investment. I work on projects across Europe, including transaction support and construction projects. In this article, I will discuss the specifics of buying real estate in Germany, its investment attractiveness, legal and tax aspects, and compare the market with Austria.

Germany vs. Austria: Where is the best place to invest in real estate?

Germany and Austria are both characterized by stability and high investment protection, but differ in tax burdens and market dynamics. Germany , particularly Berlin, attracts investors with its scale, variety of properties, and high rental demand, but investors must consider more complex regulations, tax costs, and periodic price fluctuations.

Austria, on the other hand, demonstrates a more balanced model: legislation is more transparent, risks are lower, and the market consistently shows property value growth. Vienna outperforms Berlin not only in terms of stability, but also in terms of projected price growth and demand—real estate inquiries in Austria remain consistently high. This makes the country particularly attractive to conservative investors who value capital preservation and a long-term perspective.

For investors seeking a more predictable and stable market, buying an apartment in Vienna often comes naturally: the city combines stable demand for housing, clear regulations, and moderate but steady growth in property prices.

Germany on the investment map of Europe

Germany has long been considered the EU's "anchor" real estate market. This is no coincidence: the country combines a large market, a stable economy, and clear regulations for investors. High property rights protection and predictable returns are two critical factors that make German real estate a valuable asset for long-term investment.

In practice, I often see clients choose Berlin or Munich precisely for these reasons: although apartments in Germany are more expensive than in many neighboring countries, the risk of capital loss is minimal. For example, one of my clients purchased a two-bedroom apartment in Berlin for €4,300/m², and within two years, the rental income consistently covered the mortgage and taxes.

Ratings and transparency

According to PWC, the World Bank, and Numbeo, Germany ranks among the top European countries for transaction transparency and investor protection. In the Property Transparency Index (PWC, 2024), Germany scores 84/100, putting it on par with the Netherlands and Austria, while Spain and Portugal score around 65–70/100, and Greece scores around 58/100.

According to the World Bank Doing Business 2023, Germany ranks first in the EU for ease of registering property, with a score of 97/100, reflecting the speed and transparency of transactions.

For investors, this means fewer hidden risks, a more predictable tax burden, and clear procedures. In practice, I recommend my clients thoroughly check the Grundbuch and use a local notary to avoid legal issues—especially when buying apartments in Germany in prestigious areas.

Competitors

| Country | Market stability | Average housing price (€/m²) | Rental yield (%) | Taxes and fees | Features for investors |

|---|---|---|---|---|---|

| Germany | Very high | 3,400 (average apartment), up to 7,000 in Munich/Berlin | 3–5% | Purchase: 3-7%, rental income tax 25-42% | Transparent transactions, high protection for owners, stable rental demand |

| Austria | Very high | 3 100–6 500 | 2–4% | Purchase: 3.5–6%, income tax 25–55% | Stable market, moderate price growth, especially in Vienna, smaller market scale |

| Netherlands | Medium-high | 3 500–6 000 | 3–4% | Purchase: 2–6%, income tax 30–49% | Dynamic market, high housing prices, difficult for non-residents |

| France | Average | 3 200–8 500 | 2–4% | Purchase: 7-10%, income tax 30-45% | High bureaucracy, more complicated paperwork for foreigners; buying premium real estate in France is expensive |

| Switzerland | High | 7 000–15 000 | 1,5–3% | Purchase: 3-5%, income tax 15-40% | Very expensive entry, low rental yields, strict rules for non-residents |

I often see investors starting with smaller German cities (Leipzig, Dresden), where housing costs are lower than in Berlin or Munich, but the growth potential is higher. This allows for a lower entry price while still generating stable rental income.

Why Investors Choose Germany

- A stable economy and legislation. Even during the crisis years, real estate prices in major cities fell moderately.

- Rental demand is high, especially in university towns and major business hubs.

- Transparency and protection. The legal system minimizes the risks of fraud and hidden problems.

- Long-term investment prospects. Even with relatively low rental yields, investing in real estate in Germany is worth the investment in capital protection.

My advice: when choosing a property, always consider not only the price of an apartment in Germany but also the potential rental demand, infrastructure, and planned development of the area. One of my cases: buying an apartment in Leipzig for €2,800/m² – three years later, the price had increased by almost 15%, while the rental rate remained stable, confirming the soundness of my strategy.

German Real Estate Market Overview

Real estate in Germany is traditionally considered one of the most reliable instruments for preserving and increasing capital in Europe. This market is resilient even during periods of economic fluctuation, and stable domestic demand makes it particularly attractive to long-term investors.

The German Real Estate Market 2018–2030

(source: https://www.grandviewresearch.com/horizon/outlook/real-estate-market/germany )

History and dynamics of the market

The German real estate market has gone through several key stages over the past 15 years. Following the 2008–2010 crisis, housing prices began to rise steadily, peaking in 2021–2022. During this period, apartment prices in popular German cities could increase by 10–15% per year.

A moderate correction was observed in 2023–2024, with prices declining by 10–15% on average across the country. However, by the first quarter of 2025, the market had stabilized, and, according to experts, a smooth growth of 1–3% is expected in most regions.

In practice, I see that it's precisely during periods of price correction that the opportunity to buy an apartment in Germany at an attractive price arises, especially when considering resale properties with a proven ownership history. For example, one of my clients purchased a two-bedroom apartment in Leipzig during a price decline for €2,800/m², and a year later, the price had increased by 8%, and the property was already generating a stable rental income.

Geography of transactions: where investments are concentrated

The greatest activity is observed in the largest cities:

- Berlin is the capital and center of economic activity, with high liquidity and stable rental demand.

- Munich is a premium segment, with expensive apartments, low rental yields, but reliable capitalization.

- Frankfurt and Hamburg are financial and logistics hubs of interest to institutional investors.

- Leipzig, Dresden, Düsseldorf are cities with growing demand and more affordable prices.

I recommend investors look beyond the top cities. For example, buying a house in Germany's Leipzig or Dresden offers a low entry price and high growth potential—an approach particularly suitable for investors looking to diversify their portfolio.

Object types

The German market is diverse:

The secondary market is the main segment, offering affordable options and predictable rental yields.

New developments are in short supply, especially in large cities; prices are higher, but the properties are energy-efficient and feature modern layouts.

The premium segment includes Munich, Frankfurt, and Berlin; they offer high capitalization but a long payback period.

Apartment buildings (Mehrfamilienhaus) are attractive to institutional and private investors; they offer a stable flow of rental payments.

I often see investors starting out by purchasing existing properties in Germany to gauge rental demand and gradually expand their portfolio with new builds and Mehrfamilienhaus.

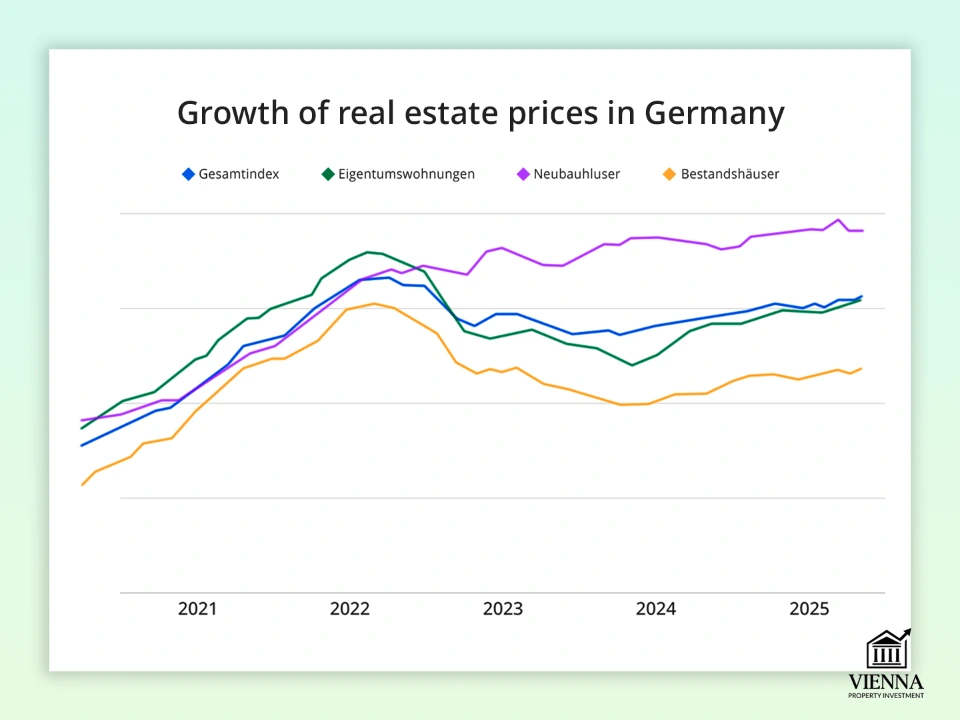

German Residential Real Estate Market 2024

(source: https://www.mordorintelligence.com/industry-reports/residential-real-estate-market-in-germany )

Who buys?

The German real estate market remains one of the most balanced in Europe. According to the Bundesbank, in 2024, approximately 82% of all residential real estate transactions will be completed by Germans themselves, while foreign investors account for approximately 18% of the market.

- Germans buy primarily for their own residence and long-term investment, often choosing resale properties or houses in Germany.

- Foreign investors are active in the rental and premium property segments. Prominent among them are buyers from Austria, Switzerland, the Netherlands, China, and the Middle East.

- Institutional funds (pension, insurance companies) remain the main players in the market of apartment buildings (Mehrfamilienhaus).

Foreign buyers often focus on new developments in Berlin and Frankfurt, where premium-class apartments in Germany can start at €8,000–€10,000/m², but they are willing to pay a premium for the guarantee of stable rental demand.

The role of domestic demand

The key factor in the market's stability is strong domestic demand. Even during periods of reduced international activity, it is the Germans who support the market.

- In 2023–2024, despite a 10–15% price drop, the number of domestic transactions fell by only about 5%, indicating continued buyer activity.

- In major cities, rents are rising faster than housing prices. For example, in Berlin and Munich, rents have risen by an average of 6-8% per year, further stimulating interest from local buyers.

In 2023, Frankfurt clients purchased an apartment for €6,200 per square meter, expecting rental income. Within a year, the yield was 3.8%, which is considered a very good result for Germany, given the low risk.

Ownership formats and investment methods

When it comes to buying real estate in Germany, it's important to understand not only the price of an apartment in Germany, but also the legal ownership structure, which directly affects the investor's rights and risks.

Absolute Ownership (Freies Eigentum): complete control over an asset

This is the most common option—the classic form of home or apartment ownership in Germany. The owner owns both the building itself and the land beneath it. The property can be freely disposed of: rented out, sold, or passed on by inheritance.

For long-term investors, this is the best option—minimal restrictions and predictable value growth. One of my clients purchased a house in Munich for €1.2 million back in 2018. Today, its market value exceeds €1.8 million—and the property is free of any third-party rights.

Hereditary Building Right (Erbbaurecht): long-term land lease

Essentially, it's a "land lease" for up to 99 years with the right to build and use the property. The owner pays Erbbauzins (annual rent to the landowner). At the end of the lease, the land is returned to the owner, and the fate of the buildings depends on the contract.

In practice, such transactions are more common in cities where land is particularly expensive (for example, Frankfurt or Hamburg). I usually recommend that clients carefully calculate the return on investment: sometimes the low price of an apartment in Germany under Erbbaurecht is offset by high annual payments.

Joint ownership (Miteigentum and Wohnungseigentum)

- Miteigentum is a common shared property where each owner has a percentage share.

- Wohnungseigentum is a form of ownership of individual apartments in an apartment building with a share in the common areas (stairs, roof, basement).

When buying an apartment in Berlin, I always point out the cost of maintaining common areas to my clients. While housing prices in Germany may seem attractive, maintenance can be expensive (especially in historic buildings).

Other formats: Wohnrecht and Genossenschaften

- Wohnrecht (right of residence) – often used in inheritance: for example, parents retain the right to live in a house even if they pass it on to their children.

- Housing cooperatives (Genossenschaften) – the housing is owned by the cooperative, not by an individual. Members receive the right to use the apartment but cannot freely sell it.

Cooperative housing is sometimes suitable for students or retirees, but it is rarely of interest to investors: buying an apartment in Germany in this format means less control and zero liquidity when selling.

Alternative investment strategies

In addition to direct purchase, the following are becoming increasingly popular:

- Investments through funds (Immobilienfonds) are convenient for those who want to minimize their involvement in management.

- Shared purchases and family trusts are solutions for family capital, where the property is passed on to future generations.

I recently supported a Nuremberg family's transaction, which involved registering their home in Germany through a family trust. This allowed them to immediately provide for inheritance and avoid high taxes on subsequent transfers to their children.

Local legal restrictions for non-residents

Unlike Austria or Switzerland, where foreigners are subject to strict quotas and permits, non-residents in Germany can freely purchase real estate. However, there's a catch: without a residence permit or income, banks are reluctant to issue mortgages in Germany, and the tax burden is higher than for locals. Furthermore, banks and notaries are required to verify the origin of funds and check buyers against international sanctions lists.

I had a client from Ukraine who purchased an apartment in Germany (priced at €420,000 in Düsseldorf) with his own funds, but was unable to secure a mortgage due to his lack of German residency. In such situations, I recommend planning the purchase structure in advance—for example, through the creation of a GmbH or a family foundation if it's a large portfolio.

Legal aspects of purchasing real estate in Germany

Purchasing real estate in Germany—whether it's an apartment in Berlin, a house in Bavaria, or a rental property in Leipzig—is always accompanied by a strict legal process. While it may seem complicated at first glance, this system provides a high degree of protection for both buyer and seller.

Step-by-step transaction process

The process includes several key stages:

- Preliminary agreement – the parties agree on the main terms: the price of the apartment in Germany, the terms, and sources of financing.

- Prepare the agreement with a notary - without notarization, the transaction is not valid.

- Financial due diligence – the bank or lawyer assesses the origin of the capital and the buyer's readiness for the transaction.

- Notarial signing - the notary certifies the agreement and explains its consequences.

- Entry into the Grundbuch (property register) is the step that makes the buyer the legal owner of the property in Germany.

A client from the Czech Republic once wanted to buy an apartment in Germany remotely. Thanks to the correct power of attorney, the transaction went through quickly, but the bank also requested documents proving the source of the funds. Advice: prepare a package of financial documents in advance.

| Stage | Required documents | Deadlines |

|---|---|---|

| Preliminary agreement (Reservierungsvereinbarung) | Passport, proof of solvency (bank statement or mortgage approval) | 1–2 weeks |

| Preparation of a contract with a notary (Kaufvertragsentwurf) | Passport details, extract from the Grundbuch (land register), information about the seller | 2-3 weeks before signing |

| Financial verification (KYC, AML) | Documents on the origin of funds, tax returns, bank statements | 1–2 weeks |

| Notarial signing of the contract (Beurkundung) | Passport, power of attorney (if the buyer acts through a representative) | Day 1 |

| Pre-registration registration in the Grundbuch (Auflassungsvormerkung) | Notarial agreement, extract from the register | 2–6 weeks |

| Final calculation and payment of tax (Grunderwerbsteuer) | Bank details, tax authority notification | 2-4 weeks |

| Final registration of ownership in Grundbuch | Confirmation of tax payment, notarized agreement | 2-3 months |

The role of a lawyer and agent

- The agent helps find the property and conduct negotiations.

- A lawyer checks the legal purity of the transaction: the presence of encumbrances, the status of the owner, and the transparency of all conditions.

I always advise clients not to skimp on legal advice: once, an inspection revealed that the house they were considering in Hamburg had an open litigation dispute. This helped avoid significant risks.

Requirements for the buyer

To purchase an apartment in Germany, an investor must prove:

- legal origin of funds,

- sufficient capital (usually at least 20-30% of the property value for the down payment if a mortgage is used),

absence from sanctions or blacklists.

Remote purchase by proxy

Foreigners can complete the transaction even without being present in person—through a proxy. The power of attorney must be notarized and apostilled in the buyer's country.

In practice, this option is often chosen by investors from Asia who cannot travel to the signing. However, notaries in Germany are increasingly requiring video identification to reduce the risk of fraud.

Checking the legal purity of the object

The main document is the Grundbuchauszug (extract from the land registry). It reflects:

- owner,

- encumbrances (mortgages, leases under Erbbaurecht, easements),

- restrictions on use.

One client in Leipzig at Grundbuch discovered an easement on part of their yard—a right of way for neighbors to use. We took this into account during negotiations and reduced the price by 4%.

Taxes, fees and expenses when buying real estate in Germany

When buying real estate in Germany, it's important to consider not only housing prices but also additional costs. These can add 10-15% to the property's price, especially for premium properties or apartment buildings.

Grunderwerbsteuer: acquisition tax

- The tax amount depends on the federal state: from 3.5% to 6.5% of the value of the apartment or house.

- In Bavaria and Saxony – 3.5%, in Berlin, Hamburg and Hesse – up to 6.5%.

In my experience, when a client purchased an apartment in Berlin for €450,000, the tax was approximately €29,000. This is one of the items that is often underestimated by foreign investors.

Notary, lawyer and agent services

- Notary + registration in Grundbuch: ~1% of the property price.

- Agent: usually 3–7% plus VAT, depending on the region and terms of the agreement.

- Lawyer: individually, depending on the complexity of the audit and transaction support.

I always recommend clarifying the agent's commission percentage in advance and including it in your purchase budget. For example, when purchasing a house in Munich for €1.2 million, commissions and notary fees added almost €60,000 to the total.

Annual property tax (Grundsteuer)

- In Germany, property owners are required to pay Grundsteuer, usually 0.26–0.35% of the cadastral value of the property.

- This is a small expense compared to taxes on rental income or capital gains, but it is important to consider when calculating your return on investment.

For a portfolio investment in several apartments in Düsseldorf, the total annual property taxes amounted to approximately €4,500, which fits easily into the budget for income-generating properties.

Tax on rental income

- If you rent out an apartment in Germany, the rental income is subject to income tax at a progressive rate of up to 45%.

- Non-residents are only taxed on income from German real estate.

Always calculate the net income after taxes. For example, an apartment in Berlin with an income of €2,000/month at a tax rate of 30% yields a real income of €1,400/month.

Capital gains tax (Speculationssteuer)

- Applies if you sell an apartment in Germany within 10 years of purchase. The tax rate corresponds to the owner's income bracket—up to 45% for high incomes.

- If the property is held for more than 10 years, no tax is levied.

The tax is calculated on the difference between the sale price and the purchase price, taking into account the costs of acquiring and improving the property. A client purchased an apartment in Leipzig for €300,000, renovated it for €30,000, and sold it eight years later for €400,000. Capital gains tax was calculated on €70,000 (400,000 – 300,000 – 30,000), resulting in a net profit of approximately €50,000.

Comparison with Austria

| Parameter | Germany | Austria |

|---|---|---|

| Capital gains tax | Up to 45% when sold within 10 years | Only 30% (or exemption under certain conditions) |

| Purchase tax (Grunderwerbsteuer / Grunderwerbsteuer) | 3,5–6,5% | 3,5% |

| Annual property tax | 0.26–0.35% of the cadastral value | Typically 0.2–0.3% |

| Agent commission | 3–7% plus VAT | 3–4% |

| Rental income | Progressive rate up to 45% | The rate is progressive up to 50%, but discounts are possible for long-term rentals |

| Price dynamics | Steady growth, but a recent correction in 2023–2024 | More moderate but predictable growth |

In practice, I see Vienna as a winner due to its stability, projected price growth, and level of demand, especially for those planning to resell in 5-7 years. Germany is more attractive to investors looking for long-term rentals and capital protection, but for short-term speculation, Austria often looks more advantageous.

Residence permits and visas through real estate in Germany

Unlike Greece or Portugal, purchasing real estate in Germany does not automatically grant residency. Even if you buy an apartment for €500,000 or a house for a million, this does not automatically qualify you for a visa or residency status.

Why Germany Isn't a Golden Visa

German law does not link home ownership with the right of residence. Residency requires a legal basis: employment, study, business investment, family reunification, or proof of financial independence.

Owning real estate can support your application by showing that you are invested in the economy and plan to stay in the country, but it does not provide any benefits on its own.

Residence permit through business and self-employment

- Business investment: Non-residents can obtain a residence permit if they invest in a German company and create jobs.

- Self-employed / freelance / digital nomads: Self-employed visas allow you to live and work in Germany, but require proof of income and economic benefit to the country.

In 2025, Germany will simplify the process of obtaining residence permits and citizenship for skilled professionals and their families. Faster pathways to permanent residency have been introduced, salary requirements for EU Blue Cards have been updated, and new rules for professionals with practical experience have been introduced.

One of my clients from Asia opened an IT company in Berlin and simultaneously bought an apartment in the Prenzlauer Berg district. The apartment helped demonstrate his seriousness, but he obtained a residence permit through business registration.

Comparison with Austria

Austria offers Category D (Self-Sufficiency)—a residence permit for financially independent individuals, where real estate can be used as proof of financial solvency. Germany does not have such a direct program. Here, everything is based on genuine economic or professional qualifications, not the cost of the apartment.

Rental and Property Income in Germany: Reality and Figures

When buying an apartment in Germany, it's important to understand that the rental market is strictly regulated, and returns vary depending on the rental type, region, and legal restrictions.

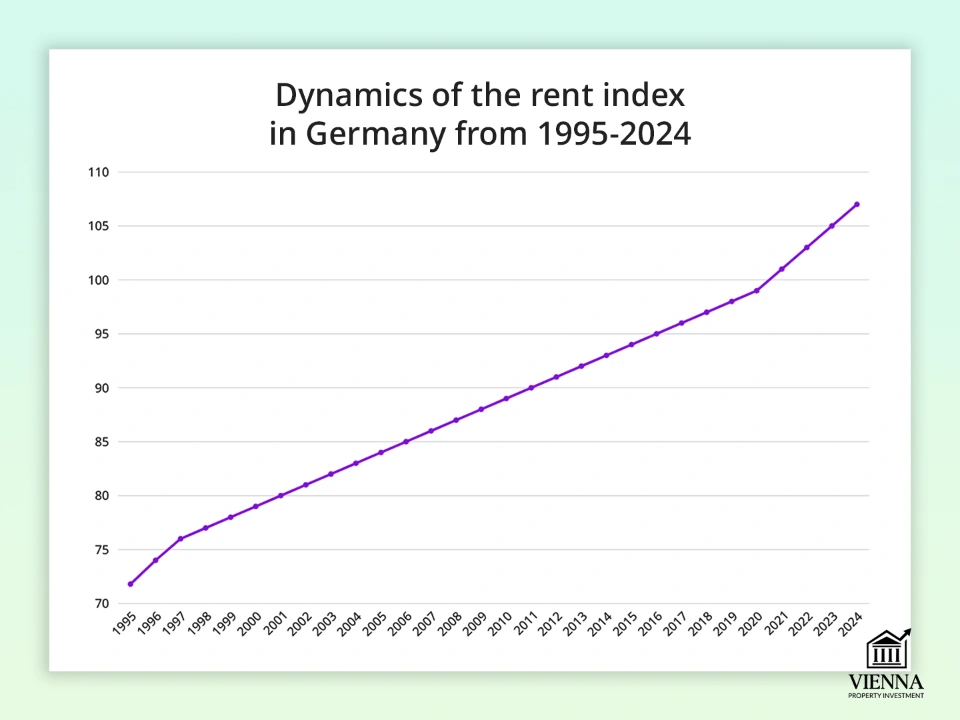

Dynamics of the rent index in Germany from 1995 to 2024

(source: https://www.statista.com/statistics/1270341/rental-index-development-germany/ )

Short-term rentals: restrictions and risks

- Airbnb, Booking: In major cities, especially Berlin and Munich, short-term rentals are strictly restricted by local municipal laws.

- Private investors often require permission or face fines.

Clients who tried to rent out apartments in Berlin on Airbnb without permission have received fines of up to €10,000. Therefore, I always recommend checking local regulations beforehand.

Short-term rentals only make sense in small towns or officially registered tourist regions.

Long-term rental: stability and moderate income

- The main market segment is long-term contracts.

- The average yield is 2–4% per annum of the apartment’s value.

- Strong tenant protection through the Mietspiegel and Mietendeckel limits rent increases, especially in metropolitan areas.

A €400,000 apartment in Berlin is rented for €1,500/month. Net yield after taxes and fees is ~3%.

Rental yields by region in Germany

| Region / City | Average apartment price (€ per m²) | Average long-term rental yield | Features / Liquidity |

|---|---|---|---|

| Berlin | 5 000–7 000 | 2–3% | High demand, strict restrictions on short-term rentals |

| Munich | 7 000–10 000 | 2–3% | Very expensive real estate, high demand |

| Frankfurt | 6 000–8 000 | 2–3% | Financial center, stable demand |

| Hamburg | 5 500–7 500 | 2–3% | Stable market, tourist areas |

| Leipzig | 3 000–4 500 | 3–4% | East Germany, high yield, less liquid |

| Dresden | 2 500–4 000 | 3–4% | East Germany, growing demand |

| Dusseldorf | 5 000–7 000 | 2–3% | Large city, good areas for rent |

Eastern Germany (Leipzig, Dresden) offers higher yields—up to 4% per annum—but properties there are less liquid and finding tenants is more difficult. Large cities such as Berlin, Munich, Frankfurt, and Hamburg offer stable demand and high liquidity, but yields are limited to 2–3%. For long-term investments, it's better to focus on large cities, while for higher returns, consider the eastern regions.

Management companies and Hausverwaltung:

When purchasing real estate in Germany, proper property management is especially important. Even if an apartment in Berlin or a house in Leipzig is in good condition, without professional oversight, problems can arise, including late rent payments, unscheduled repairs, and disputes with tenants.

Hausverwaltung is a professional management company that takes care of all administrative and technical tasks:

- rent collection and payment control;

- organization of repairs and maintenance;

- maintaining documentation and interacting with tenants;

- compliance with all legal and tax requirements.

For investors with multiple properties or those living abroad, professional real estate management is practically essential, as it ensures remote management and minimizes risks. The cost of these services typically ranges from 0.8% to 1.5% of annual rental income, which often pays for itself through stability and risk mitigation.

Taxation of rental income

Rental income is subject to a progressive income tax rate of up to 45%. Non-residents pay tax only on income from German real estate. Deductions for repairs, depreciation, and management expenses are possible.

Comparison with Austria

| Parameter | Germany | Austria | Conclusion |

|---|---|---|---|

| Long-term rental yield | 2–4% | 2–4% | Similar returns, but Austria is slightly more relaxed in regulation |

| Short-term rental restrictions | Strict in large cities | Softer, More Opportunities for Airbnb | Austria wins for tourism-focused investors |

| Tenant Protection | Strong (Mietspiegel, Mietendeckel) | Yes, but with fewer restrictions | Germany is safer for residents, but more difficult for investors |

If your goal is to buy an apartment in Germany for rental and long-term income, it's best to focus on the stable long-term rental segment. Austria is sometimes more advantageous for short-term rentals and the tourist segment.

Where to Buy Property in Germany: Neighborhoods, Prices, and Demand

The choice of region directly impacts the price of an apartment in Germany, rental yield, and liquidity. Below is an overview of key cities and regions.

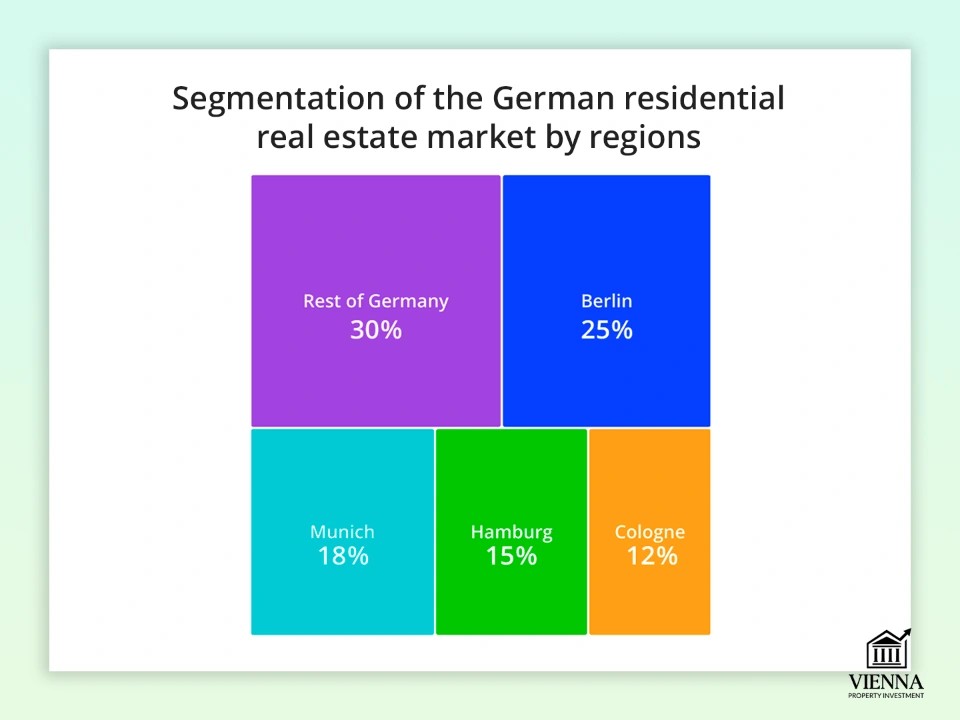

Segmentation of the German residential real estate market by region

(source: https://www.datainsightsmarket.com/reports/germany-residential-real-estate-industry-17455 )

Berlin: A Growth Driver and Strict Rules

- Housing prices: €5,000–7,000/m² for apartments, houses are more expensive.

- Districts: Mitte, Prenzlauer Berg, Charlottenburg – high demand, Friedrichshain, Neukölln – promising for rent.

- Demand: consistently high, especially for long-term rentals.

- Features: strict restrictions on short-term rentals, Mietspiegel regulates rent increases.

Apartments in Mitte quickly find tenants, but renting them out on Airbnb without permission is impossible.

Munich – premium and stability

- House prices: €7,000–10,000/m², houses can exceed €12,000/m².

- Districts: Schwabing, Maxvorstadt, Bogenhausen - top for premium.

- Demand: High, especially among affluent renters and expats.

- Features: stable market, low return compared to entry price.

It's better to focus on long-term rentals; short-term rentals are almost impossible due to city regulations.

Hamburg – a port hub and commercial real estate

- Housing prices: €5,500–7,500/m².

- Districts: HafenCity, Altona, Eppendorf – growing interest in investment.

- Demand: high for apartments in the center, moderate in outlying areas.

- Features: strong corporate segment, good for business rentals.

Frankfurt is a financial center

- Housing prices: €6,000–8,000/m².

- Districts: Westend, Nordend, Sachsenhausen - prestigious, high demand from bank employees.

- Demand: Consistently high for long-term rentals for professionals and expats.

- Features: Investments in apartments for employees of financial companies pay off faster.

The client bought an apartment in Westend for €650,000, with long-term rental yielding ~3% per annum.

Leipzig and Dresden – Dynamics and a Low Entry Price

- Housing prices: €2,500–4,500/m².

- Districts: Zentrum, Südvorstadt (Leipzig), Neustadt, Altstadt (Dresden).

- Demand: growing, especially among students and young professionals.

- Features: high yield of 3–4%, but liquidity is lower than in Berlin or Munich.

Buying apartments in Leipzig allows you to earn above-average income, but selling takes longer.

North Rhine-Westphalia – Industry and Universities

- Housing prices: €3,500–6,000/m², cities: Düsseldorf, Cologne.

- Districts: Innenstadt (Düsseldorf), Ehrenfeld (Cologne).

- Demand: High in university and business districts.

- Features: a combination of stable rent and prospects for price growth.

| City / Region | Average apartment price (€ per m²) | Average rental yield | Liquidity | Infrastructure, transport, ecology |

|---|---|---|---|---|

| Berlin | 5 000–7 000 | 2–3% | High | Excellent infrastructure, metro, parks, high environmental standards |

| Munich | 7 000–10 000 | 2–3% | High | Excellent infrastructure, transportation, green areas, safe neighborhoods |

| Frankfurt | 6 000–8 000 | 2–3% | High | Developed business center, good schools, transport accessibility |

| Hamburg | 5 500–7 500 | 2–3% | Average | A port city with convenient transportation, parks, and business districts |

| Leipzig | 2 500–4 500 | 3–4% | Medium/low | A growing city, developing transport, green areas, students and young people |

| Dresden | 2 500–4 000 | 3–4% | Medium/low | Developing infrastructure, good transport links, green areas |

| Dusseldorf | 3 500–6 000 | 2–3% | Average | Universities, industry, transport accessibility, parks |

| Cologne | 3 500–6 000 | 2–3% | Average | Universities, developed infrastructure, transportation, green areas |

Investment Map: Reliable vs. Promising

Reliable : Munich, Frankfurt, Berlin – high liquidity, stable demand, but high entry price.

Promising : Leipzig, Dresden, some areas of Hamburg – low entry price, higher profitability, but longer sales period.

For investments, it is better to combine large cities for stability and dynamic regions for profitability in order to balance liquidity and profitability.

Secondary market and new buildings: what an investor needs to know

In Germany, choosing between new builds and existing homes is a strategic decision. The construction sector is experiencing a downturn: the number of new permits is declining, and housing prices are rising. In practice, I see that investors are more likely to choose existing homes because new builds are scarce, expensive, and require a long wait. Meanwhile, older homes (Altbau) remain in demand due to their unique architecture and locations.

Dominance of the secondary market

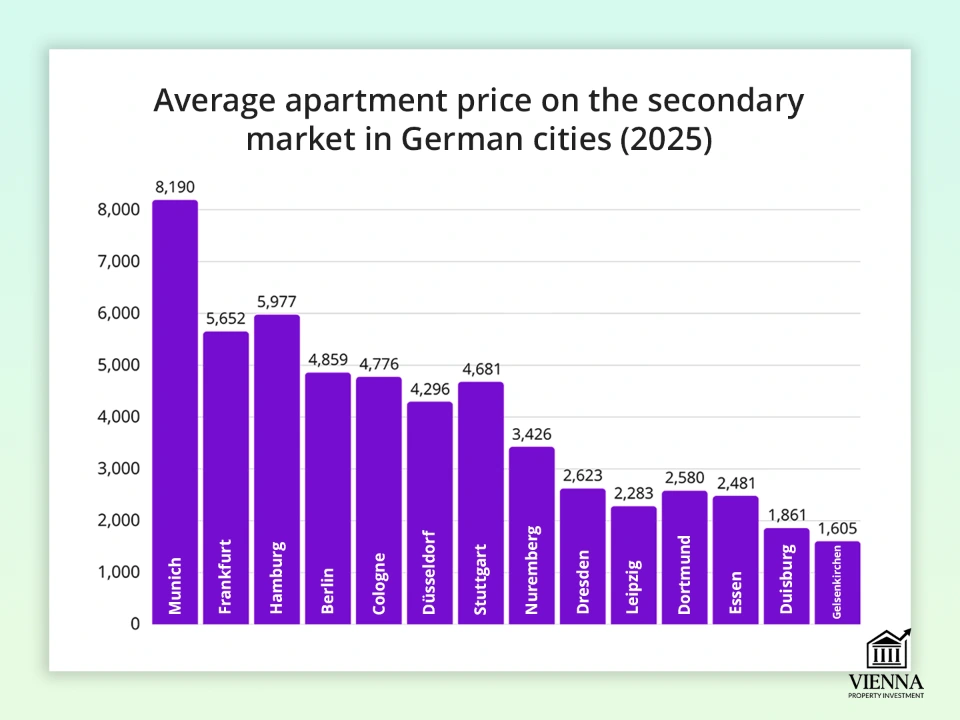

Average price of apartments on the secondary market in German cities (2025)

(source: https://internationalinvestment.biz/real-estate/5596-stroitelnyj-krizis-v-germanii-kak-deficit-zhilja-menjaet-rynok-v-2025-godu.html )

Over 70% of transactions in Germany occur on the existing market. The reason is simple: new buildings are scarce, and bureaucracy slows down the issuance of permits. In Berlin, for example, approval processes can drag on for years.

In Berlin, a client bought a three-room Altbau apartment for €550,000 in the Prenzlauer Berg district. After two years, the price has increased by 18%, and the apartment is still rented out.

Altbau – a sought-after classic

Altbau (Old Housing Estate) are historic buildings with high ceilings and large windows. Demand for them in Berlin and Leipzig is consistently high. A client recently purchased a three-room apartment in Altbau in central Leipzig for €280,000 and rented it out long-term six months later for €1,200 per month.

New buildings: shortage and high entry costs

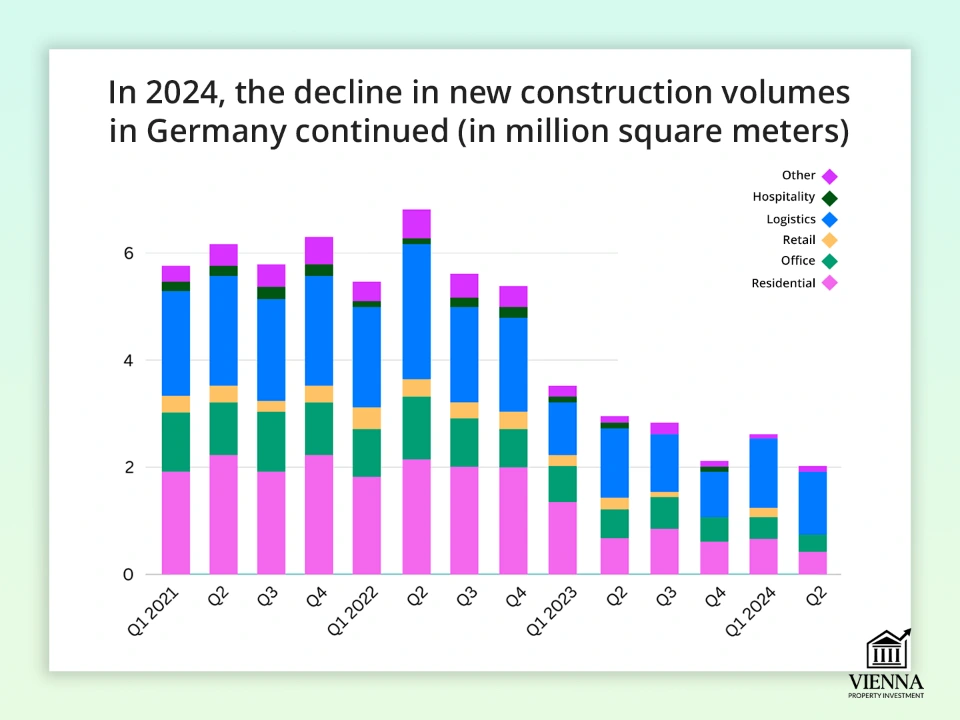

The pace of new construction in Germany

(source: https://www.reuters.com/markets/europe/german-property-sector-cracks-show-new-building-starts-tumble-2024-07-17/ )

New home construction in Germany has fallen by 30% since 2022. The reasons include rising material costs, expensive loans, and strict ESG standards. New buildings are attractive due to their modern layouts and energy efficiency (ESG standards), but prices are 20-30% higher than resale prices. In Munich, a square meter in a new building costs €10,000-11,000, while in Berlin, it's €6,500-8,000.

Trend: Energy Efficiency and ESG

Starting in 2024, building energy performance standards (EnEV) will become more stringent. In practice, this means that older buildings will need to be modernized, including insulated façades, new windows, and modern heating systems. Many investors underestimate these costs. Always check the property's energy performance certificate (Energieausweis).

Comparing the Secondary and New Build Markets: Germany vs. Austria

| Criterion | Germany | Austria |

|---|---|---|

| Secondary market share | >70% of transactions, high demand for Altbau | 60–65%, but there are more new buildings |

| New buildings | Shortages, long construction periods, and price increases of 20–30% | Less bureaucracy, projects are completed faster |

| Energy efficiency | Modernization of the old stock is required (Energieausweis is mandatory) | New buildings are more often ESG compliant |

| Secondary housing prices | Berlin €5,000–6,500/m², Leipzig €2,800–3,500/m² | Vienna €6,000–8,000/m² |

| Prices for new buildings | Berlin €6,500–8,000/m², Munich €10,000–12,000/m² | Vienna €7,500–9,500/m² |

| Construction risks | High (delays, increased cost of materials) | Lower, easier financing |

| Regulation | Strict energy efficiency standards, difficult permitting | Slightly softer standards and terms |

Germany wins in terms of long-term price growth, especially in Berlin, Munich, and Leipzig. However, Austria is more convenient for those looking for a new build without bureaucratic risks – Vienna offers a more predictable process and high-quality ready-made projects.

- If the goal is capitalization and liquidity in 5-10 years, Germany is more interesting (especially secondary housing in large cities).

- If low risks and energy efficiency are important right away, I would look towards Austria.

How to earn more in the German market

When buying a single apartment in Germany seems too obvious a strategy, investors are considering more flexible and profitable approaches. Here are the key trends I see in practice.

Tenement houses (Mehrfamilienhaus): concentration of capital

Instead of purchasing a single apartment, it's more profitable to invest in an entire apartment building with 4-10 apartments. In Leipzig, such properties can be found starting from €600,000, and in Berlin from €1.5 million. This reduces the risk of downtime and allows for scalable returns. It's suitable for investors with capital starting from €500,000. I supported a transaction in Dresden: the client purchased a six-apartment building for €720,000, yielding 5.2%.

Renovating Old Buildings: Altbau as Gold

Old buildings (Altbau) are popular in Berlin, Leipzig, and Dresden. They can be purchased below market price, renovated, and sold at a premium. For example, an apartment in Berlin priced at €3,000/m² sells for €4,500/m² after renovation. This approach pays for itself in 18–24 months, provided you budget wisely and choose a reliable contractor.

Commercial real estate: offices, retail, warehouses

Warehouse complexes and logistics are growing thanks to e-commerce, while retail in top locations is stable. Profitability is typically 4–6%, higher than residential real estate. This option is for experienced investors: the risks are higher, but the returns are faster.

Investing through funds: passive income

Suitable for those who don't want to manage their property themselves. The entry threshold starts at €50,000, and the portfolio can include a variety of assets. The downside is less control and dependence on the management company. This option is often chosen by clients who want to invest in Germany without purchasing an apartment.

Land plots: a bet on the future

Development land remains scarce in major cities, but there are options in the suburbs. In the Berlin area, prices start at €200–€400 per square meter. This is a long-term strategy with potential for growth.

Comparison with Vienna: Scale versus Stability

Vienna is more compact and predictable, demand is stable, and prices rise steadily. Germany offers greater opportunities for scaling, but the market is more complex: bureaucracy and rental regulations. Clients choose Germany for its volume and potential, and Austria for peace of mind.

Germany is the largest real estate market in the EU, with more options and more strategies (from apartments to apartment buildings and warehouses). Vienna is more boutique: fewer options, but each property is more predictable in price and demand.

Risks and Disadvantages: What an Investor Needs to Consider

Investing in real estate in Germany appears to be a reliable instrument, but the reality is more complex. According to the Statistisches Bundesamt, transaction volume fell by almost 30% in 2023 due to falling prices and rising rates. This has forced many investors to reconsider their strategies. Germany remains attractive due to its strong economy and demand for housing, but a number of factors directly impact returns and liquidity.

High tax burden

When purchasing an apartment in Germany, investors are faced with a purchase tax (Grunderwerbsteuer, 3.5–6.5% depending on the state), an annual property tax, and rental income tax. This significantly reduces the net return. Many underestimate the impact of taxes and calculate the gross income. My advice: budget at least 30% for taxes and maintenance costs from the start.

Strict tenant protection

Evicting a tenant who is not paying rent or unilaterally terminating the lease is virtually impossible. Even selling an apartment in Germany with a tenant still in place does not release the new owner from the lease.

I had a case in Berlin: a client bought a property with a long-term lease and was unable to re-rent it at market price. The solution was to check the tenant and draw up temporary contracts if you plan to resell.

Bureaucracy and long transaction times

Registering a purchase through Grundbuch can take 3-6 months. This is standard in Germany. Austria is a bit faster, but still not instantaneous. If your goal is to buy an apartment in Germany quickly, it's important to plan accordingly.

Restrictions on short-term rentals

In Berlin and Munich, Airbnb rentals are almost completely banned. My experience: clients who were hoping to make money from daily rentals were disappointed. For profitability, it's best to rely on long-term contracts.

Price volatility

In 2023–2024, real estate prices in Germany fell by 10–15% in several regions. This demonstrated that growth is not inexhaustible. The market is currently stabilizing, but it is important to analyze the location and prospects for recovery.

Comparison with Austria

| Criterion | Germany | Austria |

|---|---|---|

| Purchase tax (Grunderwerbsteuer) | 3.5–6.5% depending on the soil | 3.5% fixed |

| Tax burden on rent | High, requires tax residency or consultant | Similar, but less complex in terms of costs |

| Tenant Protection | Very strict: eviction is almost impossible without a court order | Even stricter: long-term contracts, strong tenant rights |

| Registration of the transaction | 3-6 months, bureaucratic | Faster: 1.5–3 months |

| Short-term rentals (Airbnb) | Strict restrictions in major cities (Berlin, Munich) | Also limited, especially in Vienna |

| Price volatility (2023–2024) | -10–15% in some regions | Minimal decline, the market is more stable |

| Average rental yield | 2.5–3.5% (with a competent strategy up to 4%) | 1.5–2.5% (Vienna – lower yield) |

| The cost of the apartment | Berlin 4,500–6,000 €/m², Leipzig 2,500–3,500 €/m² | Vienna 6,000–8,500 €/m² |

| Growth potential | Available in eastern and central cities | Limited, the market is already saturated |

Austria proved more stable: price declines were minimal, and renters were even more protected. However, apartment prices in Vienna are higher and yields are lower. Germany offers greater opportunities for capital growth, but requires more active management and risk tolerance.

Life and comfort: what does the investor get?

Investing in German real estate is not only a way to preserve and grow your capital, but also a chance to live in a country with a high level of comfort. Healthcare, education, transportation, and safety make life here convenient and predictable. Buying an apartment in Germany allows you to combine investment goals with quality of life.

Medicine: high standard and accessible

Public and private clinics are equipped with modern equipment, and insurance covers most expenses. For foreigners without insurance, a visit to a general practitioner will cost on average €50–€80, a specialist consultation €100–€150, dental services cost €70–€250, and a night in a hospital starts at €350. In my experience, I've noticed that clients particularly value the ability to access healthcare reliably, which is important for families and the elderly.

Education: Schools and Universities

Education in Germany is at a high level. State schools are free for residents, while international schools charge a fee, averaging €15,000–€25,000 per year. Private gymnasiums cost €10,000–€18,000, and universities are virtually free—€250–€500 per semester.

Many English-language programs are available for international students, especially in large cities and at technical universities. International schools and universities often offer tailored courses and support for children and students from abroad.

Safety

Germany is among the safest countries in Europe, with some challenging neighborhoods found only in large cities. For investors planning to rent out their property, it's important to choose neighborhoods with a good reputation to minimize risks and ensure stable rental income.

Cost of living: housing, food, services

The cost of living in Germany is higher than in Eastern Europe, but lower than in Switzerland. Rent for a middle-class apartment in Berlin is approximately €1,200–€1,800 per month, while in Munich it is €2,000–€3,000. Grocery for a family of four costs €400–€600 per month, lunch in a café costs around €12–€25, and coffee costs €3–€4. Real estate prices vary greatly: €4,500–€6,000/m² in Berlin, €2,500–€3,500/m² in Leipzig, and €7,000–€8,500/m² in Munich.

Transport and communications

Transportation and communications in Germany are highly developed. Metros, autobahns, and railways make it easy to travel between cities, and banking and internet services are convenient for both residents and foreigners. I advise investors to consider the availability of infrastructure when choosing an apartment, especially if they plan to rent it out.

Comparison with Austria

Germany is more dynamic: there are more opportunities for career advancement and investment, the market is more diverse, and properties vary in type and price. Austria wins for tranquility and predictability—especially in Vienna, where prices rise more slowly and rents are more stable. Investors seeking capital growth and flexibility often choose Germany, while those who value stability and a more measured lifestyle favor Austria.

Purchasing in Germany as a "European anchor"

Buying real estate in Germany is not only an investment but also a way to protect capital and gain stability and security in Europe. For investors seeking property rights protection and long-term security, Germany remains an excellent choice. Liquidity is highest in major cities, and properties retain their value well.

For citizens of unstable countries, buying an apartment in Germany is becoming a way to protect their savings. Transparent transaction rules and a strong legal system guarantee capital protection. In practice, I see properties in Berlin and Munich retain their value even during periods of economic fluctuation.

for retirees : apartments in major cities cost between €4,500 and €8,500 per square meter. However, long-term ownership offers tax benefits, and sales after 10 years are exempt from capital gains tax.

digital nomads and freelancers with its developed infrastructure and stable internet, but tax regulations require attention. My clients often consult with tax experts to properly report their employment and rental income.

Germany offers a more dynamic market and a variety of properties, while Vienna offers stability and predictability. For active investment and capital growth, Germany is better; for a more relaxed long-term strategy, Vienna is better.

How to exit investments in Germany

Exiting an investment is no less important than purchasing a property. A successful sale, inheritance, or gift requires understanding the local market, tax regulations, and the liquidity of the property. Planning ahead helps preserve capital and maximize returns, as well as avoid unexpected expenses and complications with the transfer of ownership.

Property for sale: high liquidity in major cities

Apartments in Germany, especially in Berlin, Munich, and Frankfurt, sell relatively quickly thanks to stable demand and transparent transactions. According to ImmobilienScout24, the average time to sell an apartment in Berlin in 2025 is approximately 4-5 months, while in Munich it's 3-4 months, and the average sale price has increased by 2-3% compared to last year.

In practice, I see that properties in popular areas often find a buyer within 3-6 months. Smaller cities and regions in eastern Germany take longer, but even here, property can be sold with the right marketing.

Restrictions and taxes on sale

If you sell an apartment in Germany less than 10 years after purchase, a capital gains tax (Speculationssteuer) applies. This is important to consider when planning your exit, especially if the property was purchased as an investment with the intention of resale.

Inheritance and donation

Transferring an apartment by inheritance or gift is also subject to taxes, which depend on the degree of kinship and the value of the property. I recommend planning such transactions in advance to minimize the tax burden and avoid problems with heirs' rights.

Liquidity Comparison: Germany vs Austria

Germany has the advantage of liquidity over major cities: properties sell quickly, and demand remains stable. In Austria, particularly Vienna, the market is more measured and predictable, but sales can sometimes take longer due to the limited number of buyers.

My advice to clients: if speed of exit and value preservation are important, large German cities would be preferable, while Austria is suitable for a quieter long-term strategy.

Expert opinion: Ksenia Levina

Real estate isn't just a purchase, it's a carefully crafted strategy. I research markets, forecast returns, and select properties that best suit each investor's goals. Some are interested in Germany with its rising prices, while others value the predictability of Vienna.

Which option do you choose?

— Ksenia , investment consultant, Vienna Property Investment

In my practice, I've encountered a variety of European markets: from dynamic German cities to stable Vienna. Germany, for example, shows that major cities like Berlin, Munich, and Frankfurt provide stable demand and transparent transactions. Clients often approach me to buy an apartment in Germany and immediately rent it out—this allows them to generate income almost from the first day of ownership.

When purchasing real estate in Germany, it's important to thoroughly check the property's legal status: Grundbuchauszug (Ground Tax Certificate), Belastungen (Belastungen), and its compliance with energy efficiency standards. Properties with properly executed documents sell faster and are less likely to cause disputes with tax or insurance authorities.

My approach to capital allocation is based on a combination of stable and growing markets. For example, some funds could be invested in apartments in Berlin or Munich for long-term stability, and the rest in Leipzig or Dresden for higher returns and growth potential. This approach reduces risk and strikes a balance between profitability and security.

If the goal is capital growth and active investing, I would choose Germany : large cities, liquidity, and a variety of properties. If the goal is a more relaxed long-term strategy with minimal risk and stable returns, Austria wins: the market is more measured, rents are stable, and bureaucracy is simpler.

Conclusion

Germany is the best choice for investors who value stability, property rights protection, and liquidity. Major cities like Berlin and Munich ensure high demand and transparent transactions, making buying an apartment in Germany a reliable investment.

Austria is more suitable for long-term real estate investments with predictable income and a stable market, particularly in Vienna, where prices rise gradually and rents remain stable. Furthermore, Austria benefits from bureaucratic simplicity and lower market volatility, making it a convenient choice for conservative investors.

Before purchasing real estate, it's important to thoroughly check the legal status of the property, consider taxes, management costs, and potential returns. Distribute capital between stable and emerging markets to mitigate risk. In practice, I've seen that sound planning and professional legal support significantly simplify transactions and protect investors.

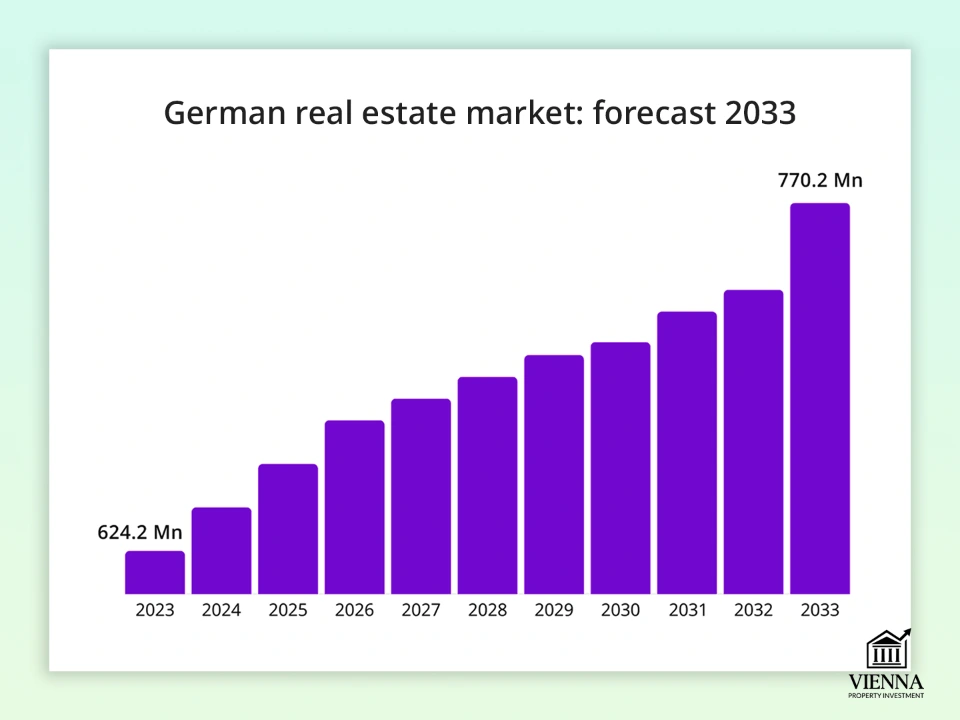

Germany's Real Estate Market: Forecast to 2033

(Source: https://www.sphericalinsights.com/reports/germany-real-estate-market )

By 2030, the German real estate market will evolve under the influence of urbanization, migration, and strict ESG standards. Reforms to taxes and rental housing regulations could impact yields, so it's important to consider these trends when planning the purchase of an apartment or other property in Germany. Investors who proactively adapt their strategy to new regulations and sustainable standards will be able to maintain returns and minimize risks.

Appendices and tables

Comparison table of profitability by region

| Region / City | Average rental yield |

|---|---|

| Berlin | 2–3% |

| Munich | 2–3% |

| Frankfurt | 2–3% |

| Hamburg | 2–3% |

| Leipzig | 4–5% |

| Dresden | 4–5% |

| Dusseldorf | 3–4% |

| Cologne | 3–4% |

Price/Profitability Map

| City / Region | Average apartment price (€/m²) | Average rental yield | Market Features |

|---|---|---|---|

| Berlin | 5 500–7 000 | 2–3% | High demand, strict restrictions Mietspiegel |

| Munich | 7 000–9 000 | 2–3% | Premium market, high entry price |

| Frankfurt | 6 000–8 000 | 2–3% | Financial center, business rent |

| Hamburg | 5 500–7 500 | 2–3% | Port hub, commercial real estate |

| Leipzig | 3 000–4 500 | 4–5% | Fast growing market, low entry cost |

| Dresden | 2 800–4 200 | 4–5% | Promising, but less liquid |

| Dusseldorf | 5 000–6 500 | 3–4% | Industry, universities |

| Cologne | 5 200–6 800 | 3–4% | High demand for rent, students |

Tax Comparison: Germany vs. Austria

| Tax / Expense | Germany | Austria |

|---|---|---|

| Acquisition tax | 3.5–6.5% depending on the soil | 3.5%–6% depending on the land |

| Notary services and registration | ~1% of the property value | ~1,5%–2% |

| Realtor/Agent Services | 3–7% + VAT | 3–4% + VAT |

| Annual property tax | 0.26–0.35% of the cadastral value | ~0.2–0.3% of the cadastral value |

| Income tax on rental income | Progressive rate up to 45% | 25%–30% depending on income level |

| Capital gains tax | Released after possession for more than 10 years | 30% on capital gains on sale if the property is not the main one |

| Total transaction costs | 10–15% of the property value | 8–12% of the property value |

Investor's Checklist: Real Estate in Germany

1. Determine your investment purpose. Decide what you're buying the property for: long-term rental, income-generating properties, capitalization, residential use, or a combination of these purposes.

2. Select a region and city. Research apartment prices in Germany, rental yields, and liquidity. Compare major cities (Berlin, Munich, Frankfurt) with promising markets (Leipzig, Dresden).

3. Ownership format. Determine the type of ownership: absolute right (Freies Eigentum), hereditary building right (Erbbaurecht), shared ownership, or cooperative.

4. Legal due diligence. Order a legal due diligence check and a property tax audit to ensure there are no encumbrances or debts.

5. Budget and taxes. Calculate all expenses: land tax, notary, agent, registration, annual land tax, rental income tax, and speculation tax if selling within 10 years.

6. Financing and credit check. Check mortgage eligibility for non-residents, assess rental yield, and evaluate your financial capabilities.

7. Property selection. Resale or new construction, apartments or apartment buildings (Mehrfamilienhaus), building condition assessment, energy efficiency, ESG standards.

8. Property Management. Decide whether to manage the property yourself or hire a real estate agency, especially if you live abroad or are investing in multiple properties.

9. Exit strategy. Consider sale scenarios: liquidity in your region, taxes on the sale, and the possibility of inheritance or gifting.

10. Comparison with other markets. If possible, evaluate Austria as an alternative: the stability of Vienna, taxes, rental yield.

11. Consult with specialists. Be sure to consult with a lawyer and tax advisor to minimize risks and ensure the legal integrity of the transaction.

Investor scenarios

1. Investor with €300,000

Objective: purchase of an apartment for rent with an income of 4–5% per annum.

I found an apartment in Leipzig for €295,000 (65 m²). The client used the remaining funds for minor renovations and furnishings. A year later, the apartment was fully rented out, the rental income covered all expenses, and the property's value had increased by approximately 5-6%.

2. Pensioner with €500,000

Objective: a safe investment with minimal risks and the possibility of long-term rental.

I found an apartment in a Munich suburb for €500,000 (80 m²). The client used part of the budget for furnishings and upgrading the heating system. The apartment is rented long-term, yielding around 2.5%, and the property maintains high liquidity and a stable value.

3. Family with children

Objective: comfortable housing for a family with the possibility of renting out part of the property.

I found a house in a Frankfurt suburb for €550,000 (120 m²). Part of the budget went toward landscaping the garden and interior finishing. The family moved in, part of the house is rented out, the income covers some of the expenses, and the house's value has increased by 4-5% over the past year.