Restrictions on the purchase of real estate by foreigners in Austria

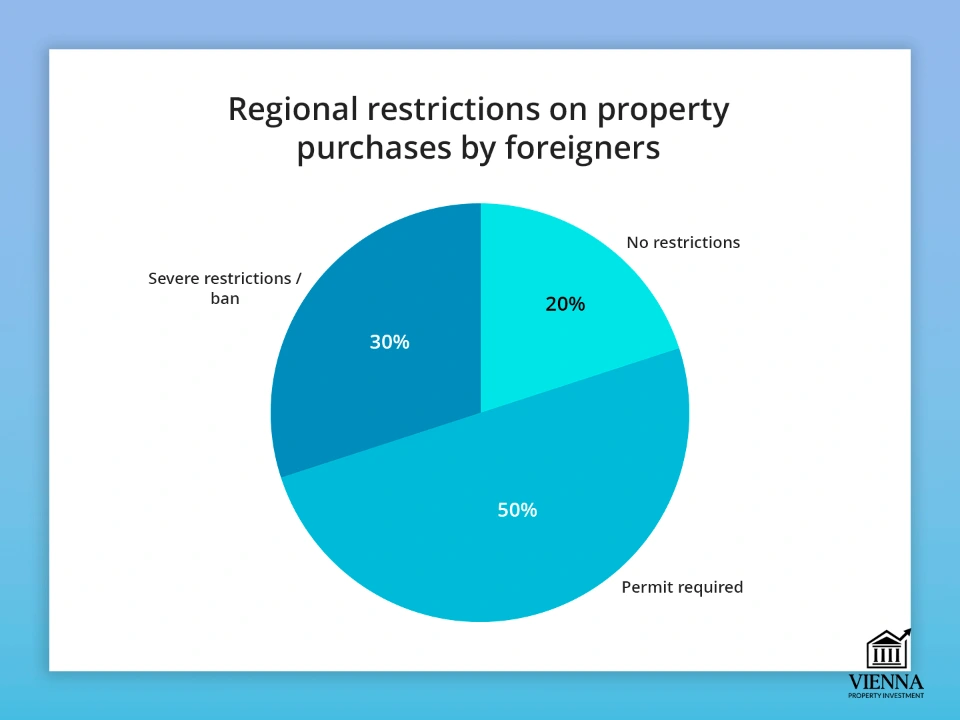

Purchasing real estate in Austria is one of the most strictly regulated transactions in Europe, and this is no coincidence. The main peculiarity of the Austrian market is that foreigners cannot freely acquire real estate: access to transactions for most non-residents is restricted by law and is possible only after obtaining special permission from local authorities.

However, there are no uniform rules – each federal state establishes its own conditions, procedures and restrictions, which may differ significantly from each other.

It is this particularity that makes Austria unique compared to most European countries. While a foreign buyer can easily purchase a property in Spain, Portugal, or Germany, in Austria they will face requirements, additional checks, or even an outright ban.

In states such as Tyrol or Carinthia, purchasing property by foreigners without permission is either almost impossible or completely prohibited, especially when it comes to “second homes” or properties located in tourist and resort areas.

This approach isn't a temporary policy—it's a fundamental part of the country's legal architecture. Austria strives to protect its domestic market from overheating, maintain affordable housing for local residents, and maintain control over property in regions where a high share of foreign capital could alter the social or economic structure. Therefore, having the necessary funds, a residence permit, or transparent proof of capital origin does not guarantee a permit.

The main mistake many international investors make is treating a transaction in Austria the same way they would in other EU countries. However, the Austrian system operates differently—from the choice of federal state and property type to the form of ownership and the application process.

A well-thought-out legal and strategic approach is required: understanding your status, properly preparing documents, analyzing the restrictions of a specific region, and carefully planning the entire procedure.

"Austria is a market where the winner isn't the one with the most capital, but the one with the best understanding of the rules. By considering regional restrictions, selecting a property that suits their legal status, and developing a permitting strategy, investors gain access to one of the most stable and secure markets in Europe."

— Ksenia , investment consultant,

Vienna Property Investment

General legal basis

The legal framework for foreigners purchasing real estate in Austria is one of the most complex and strictly structured systems in Europe. Unlike most EU countries, where transactions for non-residents are either completely free or restricted by a single national law, Austria applies the principle of regional competence: each federal state has its own laws, its own authorities, and its own criteria for determining whether a foreigner can purchase real estate within its territory.

This system is enshrined in legal practice and is noted by sources such as GEUER Rechtsanwälte OG , which emphasize that there is no single “Austrian law” on the purchase of real estate by foreigners – there are eight different legal regimes (corresponding to the number of states, excluding Vienna as a separate city-state).

Why are there restrictions?

Historically, Austria has pursued a policy of protecting its domestic market from speculative capital and excessive infrastructure pressure. Unlike larger European countries, Austria faces limited land resources, a high proportion of protected areas, and particularly sensitive tourism regions.

Therefore, the legislation of various federal states introduces barriers aimed at:

- protecting housing affordability for local residents, especially in regions with high competition;

- control over foreign ownership in resort areas, mountainous regions and natural areas;

- curbing speculation in the secondary housing market;

- limiting the growth of “second homes” (Zweitwohnsitz), which can create pressure on local infrastructure;

- maintaining cultural and social balance, especially in rural and alpine regions.

According to industry portals, it is in the tourist regions of Tyrol, Vorarlberg, and Salzburg that restrictions are the most stringent.

Thus, the restrictions are not a temporary measure, but a fundamental part of state policy aimed at long-term market stability.

Regional norms and legal acts

Since each state regulates access for foreigners independently, the legal regime can differ significantly even between neighboring regions.

| Federal state | Basic Law | Peculiarities |

|---|---|---|

| Wien | Wiener Ausländergrunderwerbsgesetz | One of the most liberal regimes, but foreigners from third countries still require permission. |

| Tyrol | Tiroler Grundverkehrsgesetz | The strictest restrictions: bans on the purchase of "second homes" and strict control of tourist areas. |

| Salzburg | Salzburger Grundverkehrsgesetz | Restrictions are similar to those in Tyrol, especially in tourist areas. |

| Kurfenland, Styria, Carinthia | Own regional laws | Regulations range from moderate to strict, especially in mountainous and tourist areas. |

| Lower and Upper Austria | Less strict standards | Regulations are more relaxed, but permission is required for citizens of “third countries”. |

| Vorarlberg | Very strict standards | Numerous zones with a ban on purchases by foreigners. |

Importantly, even within a single state, restrictions vary between municipalities. What's legal to buy in one district of Tyrol may be completely prohibited in a neighboring one.

Distinction between EU/EEA citizens and third-country nationals

The legal framework for purchasing real estate in Austria directly depends on the buyer's category. This is a key factor determining the complexity of the transaction, the need for permits, the availability of different types of properties, and the likelihood of refusal.

Austria legally divides all foreign buyers into two large groups :

- Citizens of the EU, EEA and Switzerland

- Third-country (non-EU/EEA) nationals

These two categories are in fundamentally different legal conditions.

1. EU/EEA/Swiss citizens: a regime of almost complete equality

Citizens of EU countries, the European Economic Area and Switzerland have the same property rights in Austria as local residents.

It means:

- they can freely purchase housing and commercial real estate;

- no permission from authorities is required;

- the transaction takes place according to the usual notarial procedure;

- there are no restrictions on the type of property (apartment, house, land).

Legally, this is enshrined in the principle of Gleichbehandlung – equal treatment.

Such buyers also automatically avoid the “foreigner verification” procedure (Ausländergrundverkehr), which is mandatory for non-residents of third countries.

Some nuances

Even EU citizens may face formal restrictions, but these are rare and exist mainly in rural Alpine regions:

- the municipality may request confirmation that the property will be used as a primary residence and not as a “second home” or tourist attraction;

- The purchase of large areas of land in conservation areas may require approval.

However, these cases are exceptional and do not concern the status of the EU citizen, but the nature of the specific object.

2. Third-country nationals: a complex, permit-based and often unpredictable procedure

Buyers who are not EU/EEA/Swiss citizens are subject to special state laws regarding the purchase of real estate by foreigners.

The following rule applies to them: Without special permission from the land authorities, the transaction is legally impossible.

It means:

- a formal application for purchase is submitted;

- the origin of capital is being checked;

- the authority analyses the impact of the purchase on the local market;

- a decision is made to allow or refuse.

And most importantly:

Even a perfectly prepared package of documents does not guarantee approval.

How do authorities evaluate applications?

The Commission (Grundverkehrsbehörde) may refuse if:

- the purchase is considered a threat to housing affordability for local residents;

- the object is located in a tourist area;

- the property can be turned into a “second home”;

- the land has a conservation status;

- the investor cannot prove a connection with Austria;

- there is no confirmation of the economic or social "benefits" of the transaction.

Each state formulates the concept of “public interest” in its own way, which makes the procedure even more individual.

EU/EEA vs. third countries

| Criterion | EU/EEA/Swiss citizens | Third-country nationals |

|---|---|---|

| Purchase Permission | Not required | This is a must |

| Probability of failure | Almost zero | Medium to high (depending on the soil) |

| Accessibility of tourist attractions | Usually allowed | Often banned |

| Land purchase | No restrictions | Requires special approval |

| Buying a second home | Usually allowed | In some lands it is impossible |

| Verification of the origin of funds | Standard banking | Extended + documentary confirmation |

| Participation of the Grundverkehr Commission | No | Yes |

| A lawyer is recommended | Desirable | Necessarily |

| Basic term of the transaction | 4–8 weeks | 3–6 months (sometimes up to 12) |

Why does the state make such a differentiation?

The Austrian system for regulating real estate purchases by foreigners is based on a fundamental distinction between two categories of buyers: EU/EEA citizens and citizens of so-called "third countries." This distinction is not a technical formality, but a fundamental part of state policy aimed at protecting the national market, social balance, and territorial stability.

EU citizens as part of the single market

Austria views EU citizens as participants in the Single European Economic Area. In terms of real estate, this means almost complete equality with Austrian citizens. Their access to transactions is based on the EU right to the free movement of capital and the state's obligation to avoid discrimination within the Union.

For Austria, such buyers are not an external force, but an extension of the single market, integrated into common economic, legal, and social norms. From the state's perspective, their market activity poses no systemic risks, as they operate within a stable European legal framework.

Buyers from third countries as an external factor of influence

The government views buyers from outside the EU/EEA quite differently. This group of investors is seen as a source of increased market pressure: they may have greater purchasing power, actively participate in short-term investments, and increase pressure on limited supply, especially in regions where construction space is extremely limited, such as in the Alps.

The history of European markets shows that it is foreign capital that often leads to speculative price hikes, the buyout of properties for second homes, and the gradual displacement of local residents. For small municipalities, even a small influx of foreign investors can completely change price dynamics.

Protecting key interests and preserving territories

This approach allows Austria to protect housing affordability, especially in high-density cities, preserve conservation areas, manage resort areas, and support the sustainability of socially sensitive areas. The Alpine region views real estate not as a commodity, but as part of a cultural and natural heritage whose area cannot be expanded.

Therefore, restrictions on foreigners are one of the tools used to protect these areas from abandonment or excessive commercialization. Austria strives to prevent scenarios in which a significant portion of real estate is owned by non-residents and used only a few weeks a year. Similar examples have already been observed in a number of European countries, and Austria is consciously building a model that minimizes such risks.

This is precisely why differentiation based on citizenship is not a temporary measure or a political stance. It is a carefully integrated mechanism within the legislative framework that regulates the long-term stability of the market.

How does the process work for "third countries"/non-residents?

For citizens of countries outside the EU/EEA and Switzerland, purchasing real estate in Austria is only possible through a special permitting process. This is a key stage of the transaction, determining whether the property can be purchased.

Unlike EU buyers, for whom the purchasing procedure is almost identical to that of Austrians, non-residents face a control system built around the principles of local market protection and territorial sustainability.

The need to obtain permission from the land authority

The main body that determines the legality of a transaction is the Grundverkehrsbehörde – the state commission for real estate matters.

Its role is not simply an administrative document check, but an assessment of the economic and socio-territorial admissibility of a purchase by a specific foreigner.

What does she check:

- does the buyer meet the category of those entitled to purchase this type of property;

- whether the purchase poses a threat to the market and price balance;

- whether the property falls under the category of “second home”, tourist accommodation or protected land;

- does the buyer have a valid connection with Austria (residence permit, business activity, personal interests);

- whether the purchase is in the public interest of the region.

In fact, it is the commission that determines whether the transaction will take place or not, and the purchase and sale agreement comes into force only with the permission.

Who is formally considered a “foreigner” and subject to control?

Austrian law defines the term "foreigner" quite broadly. This is important, as restrictions sometimes apply not only to individuals but also to the entities through which they are attempting to purchase a property.

Categories of persons subject to the Grundverkehr rules:

| Category | Description |

|---|---|

| Individuals – third-country nationals | Any person who does not hold Austrian or EU/EEA/Swiss citizenship. |

| Legal entities registered abroad | Companies established and operating outside Austria and the EU, even if the owners are residents of Austria. |

| Companies with headquarters outside Austria/EU | Even if there is an Austrian branch, the place of registration is considered decisive. |

| Holdings and trusts with foreign control | Structures where control is exercised by a third-country national. |

Thus, formally establishing a company does not always allow one to bypass restrictions – it is important to determine who controls the structure and where its real control center is located.

Possible legal ways to ease restrictions

Although Austria has one of the strictest regulations in Europe for foreign property purchases, there are legal mechanisms that can facilitate the process or make the transaction possible.

These aren't ways to circumvent the law, but rather ways to properly integrate investors into the country's legal system. Each option requires documentary evidence and depends on the specific federal state.

1. Purchase through a structure registered in the EU or Austria

One of the most common and at the same time most difficult ways is to acquire real estate through a legal entity registered in Austria or another EU country.

The idea behind this approach is that European companies are not subject to the same restrictions as third-country nationals. Some federal states allow acquisitions if the structure:

- registered in Austria or the EU,

- conducts real commercial activities,

- has a confirmed center of economic interests in Europe.

However, this approach is only effective if several conditions are met. The buyer must prove that the company is not a shell company created solely for the purpose of the transaction. Land authorities require confirmation of a transparent ownership structure, tax reporting, and the presence of employees or offices.

Every transaction in Austria is unique: much depends on land legislation and the investor's status. We help clients choose the right ownership strategy, avoid mistakes, and navigate the permitting process without unnecessary risks. If you're considering a purchase, we can discuss possible options and find the right one.

"Land commissions increasingly require evidence of economic activity, capital transparency, and the investor's long-term plans, so we begin by analyzing the goals, conditions, and risks to select the optimal strategy—personal ownership, a European structure, or a combination of both."

— Ksenia , investment consultant,

Vienna Property Investment

2. Possession of a residence permit in Austria

Obtaining a residence permit is another way to facilitate access to the real estate market. In some federal states, having a residence permit doesn't completely eliminate the need for a permit, but it does make the process significantly easier and, in some cases, practically guarantees a positive decision.

The following statuses are especially significant:

- long-term residence permit,

- Residence permit for work or business,

- family reunification,

- student residence permit in combination with long-term residence.

Resident status effectively demonstrates a person's connection to Austria: they live here, pay taxes, and are integrated into the system. Therefore, land commissions treat such buyers more leniently than those who plan to use the property solely as an investment asset.

3. Economically and socially justified motives

Sometimes the commission's decision depends on how convincingly the applicant can explain the need for the purchase.

We are talking about situations when:

- a person moves to Austria for work or business reasons;

- buys housing for permanent residence of the family;

- carries out activities that are beneficial to a specific land (for example, creating jobs);

- already lives in the region and is integrated into the local community.

In such cases, permission may be issued more quickly than usual. The commission evaluates not only formal criteria but also the potential benefits of the investor's presence in the region.

Important! All of the above mechanisms do not guarantee automatic approval, but they significantly increase the chances. A successful transaction is achieved not by finding loopholes, but by the right legal and strategic approach—taking into account all regional nuances, the buyer's status, and the buyer's motives for residency or investment.

The main difficulties faced by non-residents

Obtaining a permit to purchase real estate as a non-resident is not a simple formality. It involves a comprehensive administrative review, often taking several months and including an assessment of the region, the buyer's status, the property's characteristics, and even the potential impact of the transaction on the local community.

Non-residents most often face the following difficulties.

The unpredictability of the commission's decision. Land authorities have considerable autonomy and can refuse applications for reasons that are not always disclosed in detail. The commission is guided not only by the law but also by the interests of the region: social, economic, demographic, and environmental.

Lengthy processing times. Even a properly completed application is rarely processed quickly. Typical processing times are two to six months, but in regions with high demand, such as Tyrol or Salzburg, the process can take up to a year.

This is related to:

- multi-stage verification,

- the need for additional requests,

- in agreement with municipalities.

Tourist areas have particularly strict regulations. The Alpine regions view any purchase by a foreigner as a potential risk to the local market. Transactions with:

- apartments in tourist complexes,

- second home objects,

- houses in resort villages,

- objects near lakes and ski areas.

It is in these regions that the refusal rate among non-residents is the highest.

Refusals due to a lack of sufficient connection to Austria. The federal states require proof that the buyer does not intend to use the property solely as an investment.

Refusal is possible if:

- the buyer does not live in Austria;

- does not conduct economic activity here;

- cannot justify the personal need for the purchase.

Regulations vary across the federal states. Regulations in Vienna can be significantly more lenient than in Tyrol, Carinthia, or Vorarlberg. A non-resident who successfully purchased a home in one region may unexpectedly be categorically refused in another.

All these factors make the purchasing process unpredictable and require careful legal planning even before choosing a property.

Why do the rules differ across federal states?

The reasons why the approach to foreigners varies from lenient to extremely strict are deeply connected with the peculiarities of the regions.

Economic pressure and market size. Vienna has a large, flexible, and diverse housing market. The smaller mountain municipalities of Tyrol have a more limited market, where every sale can impact prices.

Therefore, the same non-resident, who poses no risk in the capital, can be perceived as a threat to stability in a small Alpine region.

The share of tourist areas. Tyrol, Salzburg, and parts of Carinthia are world-class resorts. The demand for housing there is disproportionate to the local population, and the federal states are striving to prevent a scenario where "second homes" completely displace local residents.

Environmental protection factor. Alpine territories are resource-constrained areas. They are impossible to expand, and excessive development poses environmental risks. Therefore, many lands include special protected areas, where foreign transactions are virtually impossible.

Social sustainability of small municipalities. In small villages and resort towns, it's important to preserve the permanent population, jobs, and infrastructure. The mass acquisition of properties by non-residents leads to "empty villages," something that has already happened in Italy and Switzerland—a situation Austria is preventing proactively.

Each federal state develops its own regulatory model based on its territorial, economic, and social interests. Therefore, investors should begin their analysis not only with their personal status but also with a regional map—understanding that the rules in Vienna and Tyrol belong to two different legal realities.

Comparison of land loyalty to foreign buyers

| Earth | General level of restrictions | Features and facts |

|---|---|---|

| Vienna | Soft | Urban environment, high rental demand, transparent procedures, focus on residential real estate. |

| Lower Austria | Soft | Suitable for individual houses and apartments, moderate control. |

| Styria | Average | There are protected areas, but transactions are possible. |

| Carinthia | Medium/strict | Resort areas and lands near lakes – increased control. |

| Tyrol | Very strict | Some of the strictest rules in Europe. Tourist attractions are practically inaccessible. |

| Salzburg | Strict | "Red zones" where transactions by foreigners are not permitted. |

| Vorarlberg | Strict | Control over second homes, protected mountain areas. |

| Burgenland | Softer | There is regulation, but it is not that restrictive. |

| Upper Austria | Average | Depends on the municipality, especially around lakes. |

This table shows that choosing a region is a strategically important step. For a buyer from a third country, purchasing an apartment in Vienna or Graz may be entirely feasible, while buying in Kitzbühel or Seefeld is almost impossible, regardless of budget.

Property type and purpose: how does this affect the ability to purchase

In Austria, a foreign buyer's accessibility to a property is determined not only by citizenship and region, but also by the specific type of property they wish to purchase. The law treats different categories of property differently, as each type carries its own level of risk to the market, social stability, or tourist areas.

Therefore, the same investor can easily buy a city apartment in Vienna, but encounter almost insurmountable obstacles when trying to buy an apartment in Tyrol for seasonal living.

Primary residence (Hauptwohnsitz). Property intended for permanent residence is generally subject to more lenient regulations. If a foreign buyer explains that they require housing for long-term work, study, or business in Austria, their chances of obtaining approval are significantly increased.

Such real estate is considered a social necessity rather than an investment speculation, so even in sensitive regions, authorities are prepared to view such purchases more favorably.

Secondary housing, summer cottages, and vacation homes. The situation here is much more stringent. Austria consistently restricts the conversion of tourist areas into seasonal villages, where properties remain unoccupied for most of the year. Therefore, the purchase of a "second home" by non-residents is often either completely prohibited or permitted only under specific conditions.

In the Alpine regions (Tyrol, Salzburg, Vorarlberg), a strict regime exists, meaning that only a small percentage of properties are officially approved for use as second homes (Nebenwohnsitz). It's nearly impossible for a foreigner to purchase such a property.

Tourist real estate and serviced apartments. This is the most sensitive segment. Tourist apartments (touristische Nutzung) are always under special scrutiny. Länder fear uncontrolled commercialization, which could lead to rising prices and a reduction in affordable housing for local residents.

Therefore, the purchase of a property designated for tourism by a foreigner not only requires the commission's approval but is often denied. Even if the property is formally sold, a buyer from a "third country" may be required to prove economic ties to the region or provide a business plan.

Commercial real estate and purchase through a company. A completely different approach is applied to business properties. Commercial real estate—offices, retail space, warehouses, and industrial premises—often falls under a more flexible legal regime. The logic is simple: such properties stimulate the economy, create jobs, and do not impact the housing market.

Legal entities registered in Austria or the EU can acquire commercial properties more easily than private foreigners, even if the company's ultimate owner is a non-resident. However, proof of the business's validity and compliance with corporate regulations is required.

Availability of property types for non-residents

| Property type | Accessibility for non-residents | Comment |

|---|---|---|

| Main residence (Hauptwohnsitz) | Average | Possible with a residence permit, work, family, and long-term relationships |

| Secondary housing / dacha | Low | Almost inaccessible in tourist areas |

| Tourist apartments | Very low | High risk of failure, strict verification required |

| City apartment without tourist status | Medium / High | Available in major cities with permission |

| Commercial real estate | High | The most flexible category |

| Purchase through a company | Medium / High | Upon registration in the EU and proven economic nature of the activity |

The Impact of Legal Status on Financing and Mortgages

In Austria, simply obtaining a permit to purchase real estate does not guarantee access to mortgage financing. The country's banking system operates under strict regulation and risk assessment standards, which influence lending terms even more than the purchase price or the buyer's financial situation.

The investor's legal status—whether they are a resident or non-resident, an EU citizen or a citizen of a third country—becomes a key factor that determines the possibility of obtaining a loan and its parameters.

Why do banks prefer residents?

Austrian banks evaluate borrowers not only based on income but also on how easily they can collect the debt in the event of problems. Residency implies a higher level of connection to the country: employment, taxes, banking history, registered residence, and availability of official data. For non-residents, however, most of these parameters are absent or more difficult to verify, and legal mechanisms for debt collection abroad are significantly less effective.

This is why a foreign investor with a high income, a prestigious job, and significant assets often receives less favorable terms than an average Austrian resident with an average income. The bank prioritizes the client's manageability, not just their solvency.

Why is the down payment higher for non-residents?

One of the most noticeable consequences of non-resident status is the increased required down payment. While local residents and EU citizens can expect to finance 80-90% of the property's value, non-residents must contribute significantly more of their own funds.

Standard terms for non-residents are 40–50%, sometimes 60%. Only select clients with verified EU income, European assets, and an impeccable credit history can expect a 70% interest rate. When purchasing tourist property or existing homes, banks take an even stricter approach, as these properties pose a higher liquidity risk.

This approach is partly explained by the fact that for a non-resident, real estate effectively becomes the only collateral for the loan. The bank seeks to minimize its own risk by increasing the buyer's share of "own" funds.

Enhanced borrower verification: a more complex and lengthy procedure

Credit institutions conduct significantly more thorough due diligence on non-residents. This is due not only to internal banking regulations but also to pan-European AML and KYC standards, which require detailed confirmation of the origin of funds and the client's financial stability.

Foreign buyers are required to provide an expanded set of documents: proof of income for several years, certified translations of financial statements, bank statements from the country of origin, documents on tax residency and asset structure.

For those who do not have a residence permit in Austria, verification often involves additional steps and inquiries, as the bank does not have access to the usual internal registers.

In some cases, the financial institution may request clarification of business activities or sources of capital, which significantly increases the duration of the application review.

The type of property also affects the lending terms.

The status of the property directly influences the bank's decision. When it comes to purchasing a primary residence, banks are usually willing to accommodate: such properties are considered more stable and less risky.

However, secondary housing, summer cottages, and seasonal properties fall into the high-risk zone, as they are often used sporadically and retain less value upon resale.

An even more cautious approach is taken with tourist properties and serviced apartments. Such properties are subject to seasonality, leasing restrictions, and changes in regional tourism policies. Banks may offer such loans only under strict terms or refuse to finance them altogether.

Commercial real estate stands apart: it is valued based on business profitability, and for a non-resident investor, it is often more affordable in terms of financing than residential property.

Why is it important to consider bank requirements in advance?

Situations where legal permission to purchase has been obtained, but financing suddenly becomes unavailable, are very common. For non-residents, these are among the most unpleasant and risky scenarios.

If the buyer has signed a preliminary contract and made a down payment, a bank refusal could mean the buyer will have to purchase the property without a loan or lose the deposit. Therefore, the financial aspect of the transaction should be considered in conjunction with a legal due diligence of the property and a preliminary analysis of the permitting requirements in the specific federal state.

The optimal strategy: a combination of legal and financial due diligence

For foreign investors, sequencing the process correctly is critical. First, it's essential to clearly define your legal status and the restrictions of the land on which the property is located.

Next, get a preliminary opinion from the bank regarding the lending terms specifically for your situation. Only then should you proceed to selecting specific properties, taking into account the actual availability of financing.

This strategy helps avoid mistakes that could lead to unnecessary costs, refusals, or the inability to complete a transaction on acceptable terms.

Strategies and schemes to ease restrictions for non-residents

Austrian legislation is strict yet flexible, allowing for legally facilitating the purchase process if the investor is willing to ensure transparency and compliance.

It is important to understand that we are not talking about “loopholes” here, but about legal strategies that fit within the framework of the Austrian legal system.

1. Purchase through a legal entity registered in the EU or Austria

If an investor registers a company in Austria or another EU country, then, provided that it has actual operations, this entity is considered a subject of the domestic market. In some federal states, transactions in this case are processed more quickly, and sometimes even without the involvement of the state commission.

However, the key requirement is the reality of the business. The company must conduct economic activity, have accounts, reports, and actual operations.

2. Obtaining a residence permit or residency in Austria

This is one of the most understandable and reliable strategies.

By obtaining a residence permit (for example, through the "Residence Permit without the Right to Work" program, through an employment contract, or through a business), the buyer significantly increases the chances of a successful transaction.

In some states, having a residence permit makes the buyer legally equivalent to an EU citizen in terms of access to real estate.

3. Selecting loyal regions

Austria is not a single market – in some states, restrictions are extremely strict, while in others, legislation is aimed at attracting capital.

For example, in Vienna or Lower Austria, purchasing an apartment as a non-resident is often possible through the standard procedure, whereas in Tyrol or Salzburg, purchasing a similar property may be almost impossible.

Why these strategies work

Austrian law protects the market but does not seek to discourage investors. The system is oriented toward those willing to integrate into the country's economic space, ensuring capital transparency and compliance with regulations. Therefore, legal options for simplifying the procedure are always linked to the investor's genuine integration into the system—legal, economic, or social.

Practical risks and pitfalls

Even well-prepared investors familiar with the basic rules of the Austrian real estate market encounter unexpected circumstances that can alter the transaction price, timeframe, and even the ability to complete the purchase. Austria is a country with highly structured yet complex land transaction laws, meaning that simply having the funds or a willingness to invest does not guarantee a successful outcome.

Risk of permit denial - even with full financial preparedness

One of the most underestimated risks is the possibility of being rejected by the Land Commission (Grundverkehrsbehörde). This can happen even if the buyer has transparent income, a clean financial profile, and serious intentions to use the property legally.

The reasons for refusal vary: regional quotas, restrictions on sales to foreigners, protection of the local market, requirements to preserve housing for local residents, or suspicions that the property will be used for tourism. In some federal states, refusal is common practice, especially in popular ski areas or resort areas where real estate is considered a strategic resource.

Long review periods and impact on the transaction

The permitting process can take anywhere from several weeks to several months. This creates significant risks, especially in a dynamic market where sought-after properties sell quickly.

The problem is that sellers are often unwilling to "hold" the property for an extended period, leaving the buyer trapped in bureaucracy. If a more favorable buyer, whether a resident or an EU company, appears during this period, the owner may back out of the deal. Therefore, when purchasing real estate in Austria, it's important to anticipate potential delays and negotiate the terms of your reservation in advance.

Rental Rules: More Restrictions Than You Think

For investors relying on rental income, especially from short-term tourist accommodations, the regulations may come as an unpleasant surprise. Austria is actively combating unregulated Airbnb rentals, and in a number of federal states, tourist rentals are prohibited or only permitted with a special property category.

In some regions, rentals are permitted only on an annual basis, while in others, short-term occupancy is strictly prohibited. Rental permits are often tied to the building type, zone, design purpose, or even the presence of hotel infrastructure within the same complex.

This means that high tourist traffic alone does not guarantee rental income. A thorough preliminary review of each property and its permitted use is necessary.

The opacity of regional legislation and the importance of local expertise

In Austria, there is no single federal law regulating the purchase of land and real estate by foreigners. Each federal state—Tyrol, Vorarlberg, Salzburg, Carinthia, Styria, Lower Austria, Upper Austria, Burgenland, and Vienna—establishes its own rules.

Sometimes the differences between them are so significant that an object located just a few kilometers from the border of a neighboring land is regulated completely differently.

In some cases, laws can be interpreted ambiguously, and enforcement practices by commissions vary from city to city. This leads to situations where an investor expects one thing, but in fact receives completely different requirements or restrictions.

Taxes, fees, expenses: the cost structure is more complex than it seems

Even if the legal part of the transaction is successful, the buyer faces additional expenses that can significantly impact the overall budget. These include:

- real estate acquisition tax (Grunderwerbsteuer);

- Land Register Registration Fee (Grundbucheintragungsgebühr);

- notary fees;

- real estate appraisal costs;

- intermediary commissions;

- bank fees when transferring capital from abroad;

- legal support costs;

- additional obligations when purchasing through a company (audit, tax services, reporting).

To avoid unpleasant surprises, investors should prepare a detailed estimate of the entire transaction in advance, rather than relying solely on the property's price.

Approximate structure of additional costs

| Expense item | Approximate value | Description |

|---|---|---|

| Grunderwerbsteuer | 3,5% | Property purchase tax |

| Grundbuch | 1,1% | Registration in the land register |

| Notary services | 1–2% | Preparation of the contract and certification |

| Agent commission | 3% + VAT | It may be lower for new buildings. |

| Bank fees | 0,5–1,5% | Depending on the bank and country of origin of the funds |

| Legal support | Individually | Especially important for non-residents |

| Company Contents (if used) | From €2,000/year | Accounting, reporting |

Practical recommendations for investors (especially non-residents)

Buying real estate in Austria is a project that requires a comprehensive approach. It's important to consider not only the property itself, but also the buyer's legal status, the property's location in a specific land zone, any restrictions on use, and the specifics of bank financing, which can be found on the official government website .

For foreign investors, every mistake or omission can cost months of time and significant financial losses, so preparation must be methodical and step-by-step.

1. Verifying land jurisdiction is a fundamental step

The first thing an investor should do is determine which federal state the property belongs to and what regulations apply there. Austria is not governed by a uniform law on foreign purchases: each state has its own requirements, its own transaction review committees, and its own definition of what constitutes a "foreign buyer."

Very often, two properties located just a few kilometers apart are subject to completely different rules: one may be accessible to a foreigner without restrictions, while the other may require a lengthy permit or be completely prohibited for non-residents.

What is important to check in advance:

- Is a Grundverkehrsbehörde permit required?

- Is it permissible for a person without EU/EEA citizenship to purchase?

- Are there any restrictions on change, especially for tourists?

- Is Hauptwohnsitz permitted or is the property located in a zone where permanent residence is prohibited?

- whether the area falls under recreational or protected areas;

- how the land classifies the type of use (residential, secondary, tourist, mixed, etc.).

These issues need to be resolved before the advance payment is made, as its return is usually not guaranteed.

"In Austria, a successful transaction depends not on the beauty of the property, but on preparation: jurisdictional analysis, financing verification, and legal due diligence reduce the risk of rejection and loss of funds. I can point out key red flags for free."

— Ksenia , investment consultant,

Vienna Property Investment

2. Working with an experienced lawyer is a prerequisite for a safe transaction

Austrian real estate legislation is considered one of the most detailed in Europe. It's virtually impossible for a foreigner, especially a non-resident, to independently navigate all the nuances: from a property's status in the cadastral register to the rules for its future use and the permitting process.

The lawyer becomes a key figure, monitoring the correctness of the transaction and preventing risks that may not surface either during the inspection or during negotiations with the seller.

A competent specialist helps:

- conduct a legal examination of the property;

- identify hidden restrictions on use or surrender;

- correctly complete the application for a permit;

- accompany the process of interaction with the land commission;

- protect the interests of the buyer when concluding a contract;

- prevent the deal from falling through due to legal inconsistencies.

The cost of a lawyer's services is an investment in security that pays for itself many times over, given the potential consequences of a foreign buyer's mistakes.

3. Consideration of purchasing through a company or obtaining a residence permit

Depending on the investor's objectives, it may be worth considering alternative ownership structures. In some cases, purchasing through a company (for example, an Austrian GmbH or a European holding structure) simplifies interactions with state authorities or banks, although it adds corporate tax and reporting issues.

Obtaining a temporary residence permit or resident status can also change bank attitudes, simplify permitting, and expand the types of real estate available for purchase. However, each decision requires preliminary legal and tax assessment.

When structure can be beneficial

| Investor's goal | Possible solution | Advantages |

|---|---|---|

| Long-term ownership | Residence permit | Greater access to facilities |

| Commercial investment | GmbH | Flexibility, optimization, financial history in Austria |

| Managing multiple objects | Company | Centralized ownership |

| Buying in difficult land | Residence permit or GmbH | Reducing the risk of failure |

4. Realistic assessment of deadlines and procedures

It's important for foreign investors to understand that Austrian processes are rarely fast, especially if the transaction requires approval from the Grundverkehrsbehörde (Federal Property Authority) or involves unusual circumstances. Time is a valuable resource, and it should be taken into account even at the property selection stage.

The full cycle may include:

- from 2 to 16 weeks - permission review;

- from 2 to 6 weeks – notary registration and transfers;

- from 1 to 3 months – registration of property rights;

- additional terms if the property has restrictions on rental or purpose.

If the investor is counting on rental income, it should be taken into account that some regions may require permission to rent out or prohibit it altogether.

5. Planning a complete ownership and exit strategy

Purchasing real estate is just the beginning. For an asset to generate income or retain its value, it's important to consider its future use. This is especially important for investors who are purchasing a property as a source of income or considering resale in a few years.

It is important to think about:

- admissibility of rent (long-term or tourist);

- calculation of operating expenses (Hausverwaltung, repairs, utility bills);

- income tax regime and property status;

- Exit strategy: timing of sale, impact of land regulations, capital gains tax.

The more clearly the path from purchase to subsequent operation is thought out, the more stable the income and the lower the risks.

CHECKLIST: What to check before buying real estate in Austria

I. Determination of legal status

Please clarify whether you are an EU/EEA/Swiss citizen or a third-country citizen. If you are a third-country citizen, please assess your availability or ability to obtain:

- Residence permit in Austria,

- Residence permit in another EU country,

- business activity in Austria.

II. Analysis of a specific federal state

Determine the laws of which land the transaction will take place.

Find out the current legal regulations for foreigners in this state.

Check:

- Is a Grundverkehrsbehörde permit required?

- Are there any restrictions on tourist rentals?

- whether the object belongs to the category Hauptwohnsitz / Zweitwohnsitz / Freizeitwohnsitz,

- Is it permissible for a foreigner to purchase this type of property?

III. Checking the type of property

Determine the purpose of the object:

- primary residence,

- second home,

- tourist real estate,

- commercial real estate.

Make sure your status allows you to purchase this type of property.

IV. Financial readiness

Compare bank offers:

- what is the down payment required,

- Are there any restrictions on lending for non-local income?

- Is proof of origin of funds required?

Get a preliminary decision from the bank before searching for a property.

V. Legal training

Find a lawyer who specializes in international transactions.

Check the property's documents:

- extract from the register,

- purpose of the object,

- compliance of actual and legal use,

- the presence of debts or restrictions.

Prepare a set of documents for the commission (if necessary).

VI. Risk assessment

- Estimate the probability of failure.

- Agree on the terms of the transaction with the seller (taking into account possible delays of 2-6 months).

- Consider alternative options: purchasing through a legal entity, obtaining a residence permit, or choosing a different land.

VII. Decision Making

A deal is worthwhile if three conditions are met:

- the land permits purchase,

- the commission is ready to consider the petition,

- The bank confirms financing.

Conclusion

The Austrian real estate market remains one of the most stable and attractive in Central Europe for prudent investment : economic and political stability, developed infrastructure, high rental demand in major cities and the popularity of resort regions create a solid basis for long-term capital protection.

However, for foreign buyers, and especially for citizens of non-EU/EEA countries, this market is essentially a two-layered one: the ability and terms of purchase depend not only on the price but also on the buyer's legal status, the intended use of the property, and the land jurisdiction. Without taking these factors into account, an attractive transaction may prove legally impossible or economically unviable.

Why Austria is an interesting but demanding market

On the one hand, investing in Viennese or well-located provincial real estate offers low volatility, stable rental demand, and long-term capital protection.

On the other hand, the unique feature of Austrian regulation—the distribution of powers between federal states and strict practices for protecting local interests—makes the purchasing process for non-residents more complex and multifaceted.

Key points that distinguish Austria from many other countries:

- The legal status of the buyer plays a decisive role: EU citizens are effectively treated as residents, while buyers from "third countries" undergo a separate permitting procedure.

- The type of property and its purpose (Hauptwohnsitz vs. Zweitwohnsitz vs. tourist apartment vs. commercial property) significantly change the chances of approval and financing conditions.

- Regional differences: Vienna and some states are more lenient; Tyrol, Salzburg, and Vorarlberg are particularly strict.

- Banking conditions for non-residents are often stricter: a larger down payment, enhanced due diligence, and a limited share of credit for risky projects.

Austria remains an attractive market for real estate investment, but a successful transaction for a foreigner is impossible without comprehensive preparation: legal due diligence of the land jurisdiction, a transparent ownership structure, a well-developed financing plan, and professional support. With this approach, restrictions are less of a barrier and more of a manageable factor—and then a property in Austria can truly become a reliable part of a portfolio.

FAQ

- Can foreigners even buy property in Austria?

Yes, but the conditions depend on citizenship and the specific federal state.

EU/EEA citizens face virtually no restrictions and can purchase property under almost the same conditions as Austrians.

Citizens of "third countries" (Russia, the USA, the UAE, the UK, Kazakhstan, etc.) are required to obtain a special permit from the state authority (Grundverkehrsbehörde). Without such a permit, the transaction is legally void.

- Why are there such strict restrictions for non-residents?

Austria protects the local market balance and prevents speculation. In tourist and mountainous regions, housing supply is limited, and if the market is overwhelmed by foreign demand, local residents simply won't be able to afford it.

Furthermore, the state oversees the use of protected areas and socially sensitive municipalities. Therefore, regulation is not directed against foreign investors, but rather toward protecting local sustainability.

- What types of real estate are easiest for foreigners to buy, and which are more difficult?

The easiest option is standard city apartments, especially in Vienna or other large cities. There, legislation is more flexible and demand is stable. When planning your budget, it makes sense to consider current apartment prices in Vienna , one of the country's most representative markets.

More complicated are existing homes, tourist apartments, and properties in mountainous regions (Tyrol, Salzburg, Vorarlberg). These zones often have strict restrictions or even prohibit purchases by non-residents.

Commercial real estate is generally more leniently regulated, especially if the purchase is related to actual business activities.

- How long does it take to obtain a purchase permit for third country nationals?

From 2-3 months in more lenient regions (for example, Vienna) to 6-12 months in tourist regions. The period depends on the specifics of the property, the commission's workload, and the need to provide additional documents.

Sometimes approval is granted quickly, but in other cases, investors wait six months or more for a decision—so it's important to plan the transaction in advance.

- Can the commission refuse – and why?

Yes, and without a detailed explanation. Most often, the refusal is due to the fact that the landowner considers the purchase to be contrary to the interests of the region. The reasons can be various:

- the property is located in a tourist area where housing must remain affordable for locals;

- the buyer does not have sufficient connections with Austria;

- the purpose of the object does not correspond to the stated goal;

- There is a risk that the property will be used as a tourist attraction without permission.

- Does having a residence permit or purchasing through an EU company help?

Yes, in most cases. A buyer with an Austrian residence permit is often viewed more favorably by the state than a completely non-resident investor.

Purchasing through a company registered in the EU or Austria can also mitigate restrictions, but only if the company is genuinely active and the ownership structure is transparent. Such solutions require proper legal documentation.

- What additional costs should foreigners take into account?

In addition to standard expenses (taxes, notary fees, agent commission), non-residents should consider:

- translation and certification of documents;

- services of a lawyer specializing in transactions for foreigners;

- possible costs of obtaining permits;

- higher down payment and stricter lending terms;

- rental taxes if the property is planned to be used as an investment property.

All these costs can increase the overall cost of the transaction by 1-2%, sometimes more, depending on the land and ownership structure.