New tax for second homes in Vienna 2026

Vienna is considered one of the most livable cities, so housing is in high demand. However, in recent years, a problem has emerged: more and more people are buying apartments and houses not for permanent residence, but as "second homes"—visiting them only occasionally or leaving them empty altogether.

This has resulted in fewer affordable apartments for those who want to live in the city full-time, and rental and purchase prices, especially in the city center, continue to rise. This is especially noticeable in central areas, where houses in Austria are often purchased for future use and used only occasionally.

Vienna's city authorities have decided to introduce an additional tax on residential properties that are not permanently occupied. They intend to encourage owners to manage their apartments and houses more efficiently. The proceeds are planned to be spent on urban improvements, including road improvements, public transportation development, and support for cultural initiatives that make Vienna comfortable to live in and a tourist destination.

This article aims to explain in simple terms how the new housing tax in Austria will operate, which owners it will apply to, what benefits and exceptions are provided, as well as compare the situation with practices in other European cities and discuss what changes it may bring to the housing market in Vienna.

Reasons for the introduction of the new tax

In recent years, Vienna has seen an increasing number of apartments being built without permanent occupancy. Some people buy these properties as investment properties or only move in for short periods. As a result, a significant portion of the properties remain empty, exacerbating the housing shortage.

Key issues:

- Rising housing costs.

Due to high demand and low supply, rental and purchase prices are rising, especially in sought-after areas such as the 1st, 7th, and 8th arrondissements.

- The gap between social groups.

Wealthy residents can afford several apartments or houses, while young families and students are finding it increasingly difficult to find affordable housing.

- Unused apartments.

According to authorities, there are thousands of empty apartments in Vienna, which negatively impacts the life of the city as a whole.

In 2024, authorities have proposed introducing a new tax on second homes in Vienna, those not used as primary residences. The idea behind this measure is to reduce the profits from owning "extra" apartments and thereby encourage owners to either rent them out or sell them to those willing to live there permanently.

Experience of other European cities

This situation has arisen before, and Vienna is no exception. Many major European cities have already introduced similar taxes:

| City | Taxation Features | Result of the introduction |

|---|---|---|

| Berlin | A second home tax is charged annually, the amount of which depends on its size and location. | More apartments will be offered for long-term rent. |

| Paris | A higher rate applies to empty apartments and short-term rentals (such as through Airbnb). | More affordable housing will appear on the market. |

| Zurich | Strict restrictions have been introduced on the purchase of second homes by foreigners. | The number of transactions made for quick profit will decrease. |

Conclusion: The introduction of a new tax in Vienna reflects a general European trend, the aim of which is to address housing problems and protect the rights of people living in the city permanently.

Main parameters of the new tax

A new tax on second homes is expected to be introduced in early 2025, if the law is passed in the first half of 2024. Its amount will be calculated annually and directly depend on the size of the apartment or house.

Tax rates

| Area of the second house | Tax rate (€ per year) |

|---|---|

| Up to 60 m² | 300 |

| 60-130 m² | 450 |

| More than 130 m² | 550 |

Example: The owner of a 75 m² apartment will pay €450 in tax per year. If they own another similar apartment, the tax on the second one will increase by 50%, to €675 per year.

Surcharges and discounts

The surcharge and discount mechanism plays a key role in the flexible application of the new second-home tax in Vienna. It allows for the consideration of different types of owners and the characteristics of their properties, making the tax fairer and encouraging rational use of apartments.

Allowances

The surcharges were introduced to discourage a single person from acquiring multiple second apartments. If an owner owns multiple such properties, the tax on each additional one will increase by 50%.

Operating principle:

| Number of second homes | Base rate (€) | Surcharge (%) | Total tax (€) |

|---|---|---|---|

| 1 object | 450 | 0% | 450 |

| 2 objects | 450 | +50% | 675 |

| 3 objects | 450 | +100% | 900 |

Example: If a person owns three apartments of 80 m² each, his tax will be:

- for the first – €450

- for the second – €675,

- for the third – €900.

The total tax amount will be €2,025 per year.

Purpose of the bonus:

- to prevent large quantities of housing from ending up in the hands of individual investors or speculators.

- encourage owners to either rent out their apartments or sell them to people who will live in them permanently.

Discounts

The Austrian Tax Authority has provided discounts for cases where an apartment or house does not generate income for the owner and is not used for business or speculation.

Types of discounts:

Property without electricity.

- If there is no electricity in a house, it is practically uninhabitable.

- For such properties, the tax is reduced to almost the minimum level, which eases the financial burden for owners.

Emergency buildings.

- In cases where housing is considered unsafe, the tax for the owner is significantly reduced.

- This encourages either the restoration of such buildings or their sale for new development.

Discount for objects undergoing restoration.

- City officials are discussing the possibility of a temporary tax reduction for owners who invest in the restoration of old buildings to preserve Vienna's historical heritage.

Calculation example:

| Situation | Standard tax (€) | Applied discount | Total tax (€) |

|---|---|---|---|

| House 75 m² without electricity | 450 | -70% | 135 |

| Emergency building 140 m² | 550 | -50% | 275 |

Purpose of discounts:

- not to burden with taxes the owners of empty or temporarily unfit for habitation buildings;

- encourage them to repair or sell these properties.

Exceptions

Certain properties are completely exempt from taxation because they serve social or public functions. This helps protect vulnerable residents and support urban initiatives.

| Property category | Reason for tax exemption |

|---|---|

| Student dormitories | Assistance to students and educational institutions, creation of affordable housing. |

| Nursing homes | Housing with a social function for the elderly and those in need of care. |

| Work hostels | Temporary housing for workers employed at large construction sites and enterprises in the city. |

All exceptions will be strictly monitored by city authorities to prevent fraud. Owners will be required to provide proof, such as a contract with a university or social services.

The entire system of allowances, benefits and exemptions is created with the aim of:

- Reduce speculation – the more second homes an owner owns, the higher the tax.

- Encourage efficient use of housing – empty apartments should be rented out or sold.

- To protect socially significant facilities , educational, medical, and work buildings are completely exempt from taxes.

- Support the restoration of old buildings – incentives for abandoned and dilapidated buildings will help preserve Vienna's historic architecture.

Who will be affected by the new tax?

New taxes on houses in Austria will apply to owners who own apartments or houses not as permanent residences, but as secondary properties—for vacations, investment, or rental purposes. This measure is due to the growing number of empty apartments, which reduces the available supply and leads to rising rental rates.

Main categories of payers:

| Category | Description | Example |

|---|---|---|

| Owners of housing that is not listed as Hauptwohnsitz (permanent place of residence) | The property is not registered as a permanent residence address (in Meldezettel documents) | The family lives in one area of the city, but has another apartment in the center, which they use only during rare visits |

| Foreign owners | Foreign owners who have purchased apartments or houses in Vienna for holidays, investment or rental purposes | A German investor purchased an apartment to rent it out to tourists for short periods via Airbnb |

| Investors and landlords | People who own an apartment and rent it out for commercial purposes, but do not live in it themselves | The owner owns three apartments, which he rents out under long-term lease agreements |

-

It's also important to consider the legal aspects of the purchase: restrictions on foreigners purchasing real estate in Austria can affect how the transaction is formalized and what permits are required in a particular state.

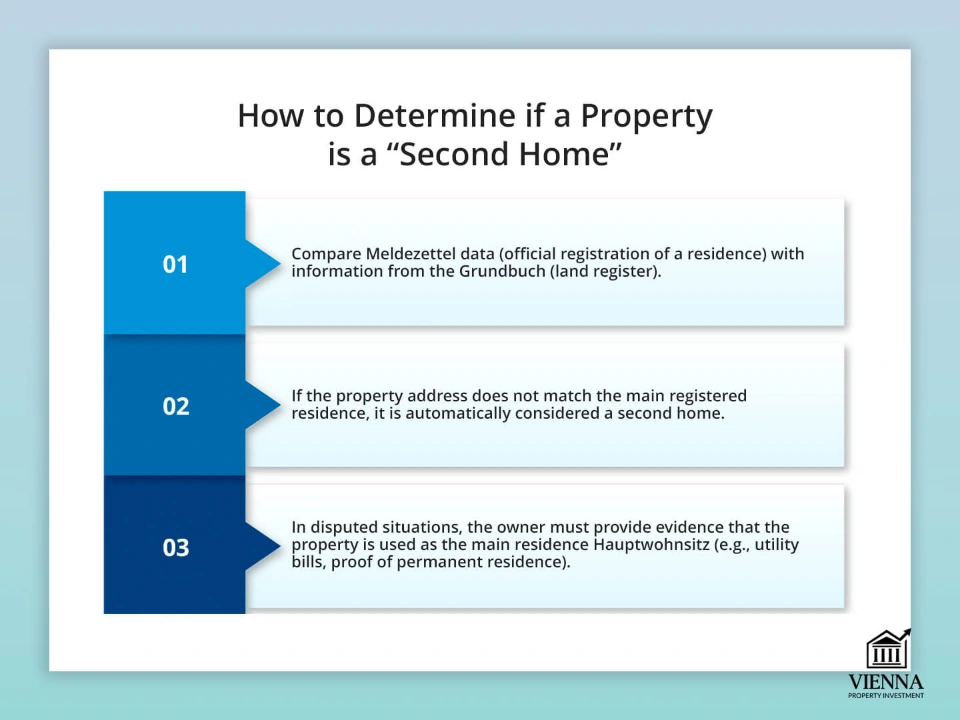

How to understand that a property is a “second home”:

- The information from the Meldezettel – the official registration of the place of residence – is compared with the data from the Grundbuch (land register).

- If the apartment's address does not match the primary registered place of residence, the property is automatically recognized as a second home.

- In disputed cases, the owner will have to prove that the property is being used as a Hauptwohnsitz, for example through utility bills or documents confirming permanent residence.

Scenarios for landlords and investors:

| Scenario | Tax status | Comment |

|---|---|---|

| The property is rented out under a long-term official lease agreement | Tax is mandatory | The owner is obliged to indicate the property as a second home |

| The apartment is available for short-term accommodation through services such as Airbnb or Booking | The tax is mandatory and may be increased | City authorities are closely monitoring this sector due to possible speculation |

| The owner uses the apartment as a "second home" for personal visits | Tax is mandatory | This rule applies regardless of whether the apartment is empty most of the time |

Payment mechanism and control

To ensure the tax is effective, the Vienna government has created a digital platform for its accounting, which will reduce bureaucracy and ensure greater transparency.

Payment process:

1. Register your property through the official online portal of the city of Vienna (wien).

2. Automatic verification of data with Meldezettel and Grundbuch to determine whether the property is used as a primary residence.

3. Generate an annual tax notice that can be paid:

- by bank transfer,

- through the e-Government online service,

- directly at city tax departments.

4. The tax must be paid no later than the end of the first quarter of each year.

| Data source | Purpose of the inspection | The body responsible for control |

|---|---|---|

| Meldezettel (registration) | Verification of primary residence | Vienna Magistrate |

| Grundbuch (land register) | Confirmation of ownership | Federal Land Service |

| Airbnb and other platforms databases | Short-term rental control | Department of Tourism and Taxes |

Fines and penalties

If an owner intentionally evades paying taxes, they will face serious penalties:

- Fine up to €5,000 for failure to comply with obligations.

- Additional charges for each month of delay (up to 5% of the tax amount).

- Risk of legal action by the financial prosecutor's office.

Transparency and e-Government

- The tax system will be linked to the city's digital services.

- Owners will have access to information about charges and payments through their personal online account.

- It is planned to send reminders via SMS and email to ensure that owners do not miss payment deadlines.

Exceptions and benefits

Income tax rates will vary for different types of housing. Authorities have completely exempted some properties, while temporary tax breaks have been provided for socially important projects.

Full tax exemption:

| Object category | Reason for release | Example |

|---|---|---|

| Student dormitories | Assistance to students and universities to keep student housing prices affordable. | Dormitory at the University of Vienna. |

| Nursing homes | Social role - providing housing to people from vulnerable categories. | State or private boarding house for the elderly. |

| Workers' dormitories | Organization of temporary accommodation for workers employed at construction sites and enterprises. | Hostel for construction workers in the Sonnwendviertel area. |

Temporary relief:

- New social housing properties do not pay taxes for the first three years after commissioning.

- This encourages developers to create affordable housing for city residents.

- After the end of the grace period, the tax is collected according to the usual rules.

Individual tax credits:

The owner has the right to request a personal benefit if there are compelling reasons:

- temporary disability or loss of income;

- repair work that makes the property temporarily unfit for habitation;

- force majeure circumstances such as fire, flood and other emergency situations.

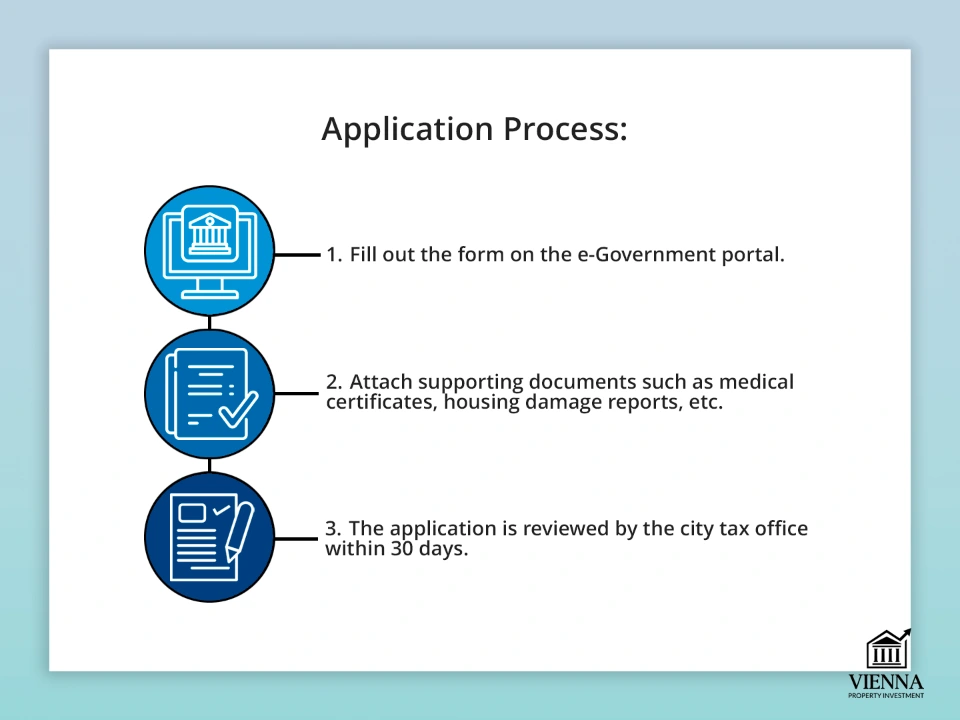

Application process:

- Submit an application using the form on the e-Government portal.

- Attach the necessary evidence (medical certificates, damage reports, etc.).

- The city tax service reviews the application within 30 days.

The impact of tax on the real estate market

The introduction of a second-home tax in Vienna will be a key factor in transforming the real estate market in the coming years. Experts estimate that this will not only increase city revenues but also lead to more efficient use of the housing stock.

Experts' forecasts:

- Reduction in the number of empty apartments.

It will become economically unprofitable for owners to leave their apartments empty most of the time. This will lead to an increase in the supply of affordable rental housing, especially in the city center, where there is currently a shortage.

- Reduction in speculative purchases.

Foreign investors and large buyers who buy apartments only for resale will become more cautious due to the increase in taxes.

- Growing interest in long-term rentals.

To cover tax costs, owners of second apartments will likely begin renting them out long-term, which will have a positive impact on the rental market.

Impact on prices:

| Indicator | Forecast for 2025. | Comment |

|---|---|---|

| Rental prices | Stabilization or slight decrease (up to -3%) | Growing the supply of affordable housing will make renting more affordable |

| Apartment sales prices | Growth will slow down (1-2% per year) | The tax will help limit speculative price increases |

| Number of transactions | Moderate decrease (up to -5%) | Investors will take a more measured approach to purchasing second apartments |

Market participants' opinion:

- Real estate agencies believe this will make the market more transparent and stable, reducing the number of empty apartments.

- Investors are concerned that the return on their investments may decline, but long-term investments in quality housing will remain attractive.

- City residents generally support the reform, as it will improve housing affordability.

Comparison with other taxes

The introduction of the second home tax coincides with the abolition of the state tax (GIS), which was previously paid for television and radio. A new tax (ORF) is planned to replace it from 2025 to fund national broadcasting.

As a result, Viennese residents will face a new tax system in Austria, which combines the goals of supporting society and urban infrastructure. To understand the broader context (what else do homeowners pay beyond this tax), it's helpful to look at how property taxes are structured in Austria in general.

Comparison with international practice:

| City / Country | Type of tax | Tax amount | Purpose of introduction |

|---|---|---|---|

| Vienna | Second Home Tax | €300-550 + surcharges | Encouraging the rational use of apartments and houses, as well as replenishing the city budget |

| Paris | Tax on vacant apartments | 60% of the annual rental cost | Investors are concerned that the return on their investments may decline, but long-term investments in quality housing will remain attractive. |

| Berlin | Tax on second property | Depends on the cadastral value | City residents generally support the reform, as it will improve housing affordability. |

Advantages of the new system:

- Transparency through digital systems and e-Government integration.

- A progressive tax that encourages owners to rent out their apartments.

- International experience confirms that such a measure produces a positive effect in the long term.

Cons:

- In the near future, some owners may experience increased tax expenses.

- Foreign investors may become less active, which will lead to a reduction in the inflow of foreign capital into the real estate market.

How property owners can prepare

Owners of second apartments should prepare for the tax's introduction in advance to avoid unnecessary expenses and fines.

Practical steps:

1. Ensure that your primary residence is correctly registered with Meldezettel.

If the information is provided incorrectly, the property may be mistakenly considered a second home.

2. Consider leasing your apartment long-term.

This way, it is possible to cover the costs of the tax and at the same time contribute to increasing the housing supply.

3. Seek advice from a tax expert.

He will advise you on how to reduce tax expenses and correctly file your tax return.

4. Monitor official updates and possible amendments.

The bill may be amended during the discussion.

Conclusion

The second-home tax in Vienna is a key element of housing policy. Its primary goal is to regulate the real estate market: reducing the number of vacant properties, increasing supply in the long-term rental market, and, consequently, increasing housing affordability for permanent residents.

The main goal of these changes is to find a happy medium that benefits apartment owners, renters, and the city itself. This is essential for a stable and healthy housing market.

Owners are best advised to get everything sorted out in advance to avoid penalties and, on the contrary, reap the benefits. For example, they can start renting out their property, sign up for preferential programs, or manage their property more efficiently.

The main advice for everyone is to keep up to date with new laws and, if necessary, consult with specialists. This is the surest way to easily and smoothly adapt to new requirements.