Real Estate in Vietnam: What Investors Need to Know

Real estate investments in Vietnam are increasingly attracting the attention of foreign buyers. This market is attractive not only for rental income but also as a lifestyle asset and a means of diversifying capital in Asia.

Unlike European countries with established regulatory systems, such as Austria, where stability and predictability are the primary advantages, Vietnam today offers a completely different story: it is a dynamically developing country with high potential for price growth and a relatively low entry barrier. For investors, this offers an opportunity to enter a market that is actively developing, thereby achieving returns higher than in mature jurisdictions.

Now is a particularly interesting time to consider Vietnam as an investment destination. Following the pandemic, the country has reopened its borders, tourism is recovering at an accelerated pace, and the government is investing in large-scale infrastructure projects – from highways to international airports. All of this is creating the foundation for rising housing prices and increased tourist traffic, thereby increasing the attractiveness of rental properties.

I, Ksenia Levina, am a lawyer with experience in both Asia (Vietnam, Thailand) and Europe (EU countries). I work with foreign investors, supporting them throughout the entire process – from due diligence and KYC/AML procedures to property management. This international experience allows me to understand the strengths and weaknesses of Asian markets compared to European ones.

"Real estate in Vietnam is an investment in a fast-growing market with returns higher than in many European countries: tourism is growing, infrastructure is developing, and the entry barrier remains low."

— Ksenia , investment consultant,

Vienna Property Investment

Vietnam on the Asian Investment Map

Southeast Asia has long been a magnet for tourism and international business. Vietnam is increasingly prominent on this map, combining its role as an industrial hub and a tourist destination.

The two main cities – Ho Chi Minh City and Hanoi – remain the main points of attraction Ho Chi Minh City is the country's financial heart, home to businesses, banks, startups, and the main premium residential complexes. It's here that price increases and rental demand from expats are most strongly felt. Hanoi is the capital and cultural hub, where rental prices are driven by both international professionals and students.

A separate segment is resort real estate: Nha Trang, Da Nang, and Phu Quoc Island. These regions are actively developing as tourist clusters, and the growth in the number of hotels, apartments, and villas there is directly related to the tourist flow. For investors, this is a typical lifestyle scenario: the property can be rented out during the high season and used for personal vacations.

The legal environment in Vietnam differs from Europe. According to Juwai, foreigners can own apartments through a leasehold system—a long-term lease of up to 50 years, with the option to renew. Land remains state-owned, reflecting the socialist model of governance.

Unlike Austria, where the owner receives full title to the property and operates within the predictable EU jurisdiction, in Vietnam, the contractual framework and proper legal support for the transaction are crucial.

According to international indices, Vietnam is demonstrating steady growth. According to the World Bank , Doing Business indicators are improving, and real estate prices in major cities are growing by 5-10% annually. Rental yields in tourist areas and metropolitan areas are significantly higher than in Austria, where you can typically expect 2-3% per annum.

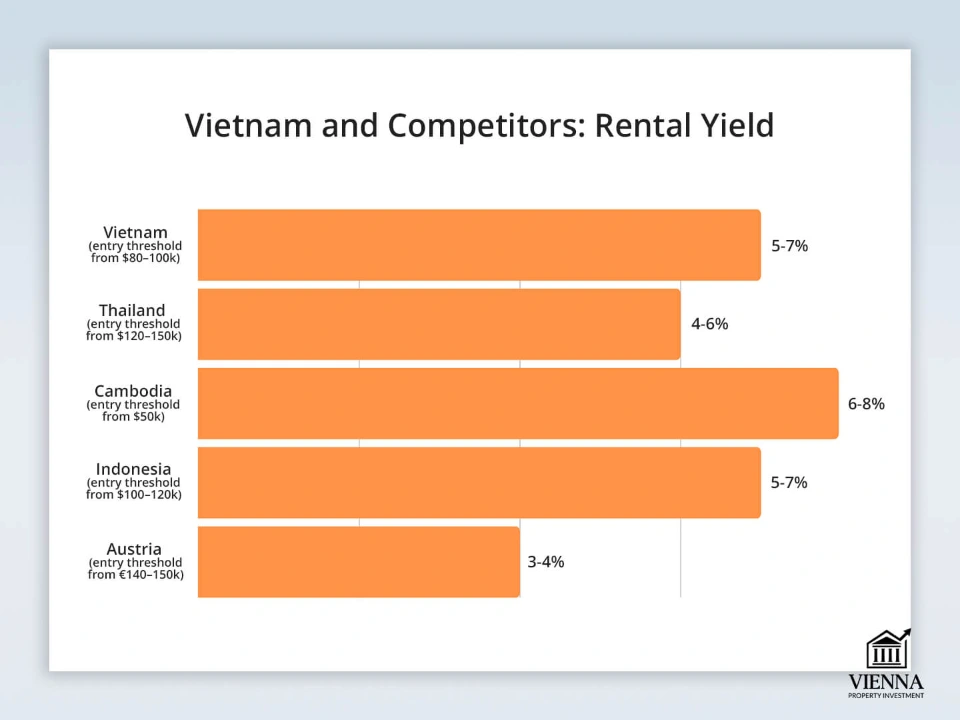

Kiplinger argues that Thailand, Cambodia, and Indonesia could be considered competitors to Vietnam. However, Vietnam currently stands out due to its combination of economic boom, industrial growth, and tourism potential.

Vietnam's Real Estate Market Overview

The Vietnamese real estate market is relatively young. According to Realtique, until 2015, foreigners were virtually unable to purchase property. The liberalization of legislation led to a sharp surge in interest, and within a few years, prices in major cities increased by 50% to 200%. The pandemic temporarily slowed growth, but the market has been actively recovering since 2022.

Ho Chi Minh City and Hanoi are showing the highest growth rates, where housing demand is supported by internal migration flows, a growing middle class, and the development of international companies. In resort areas, the dynamics are less stable: Nha Trang, Da Nang, and Phu Quoc depend on seasonality and tourist flows, but these regions are becoming prime destinations for lifestyle investments.

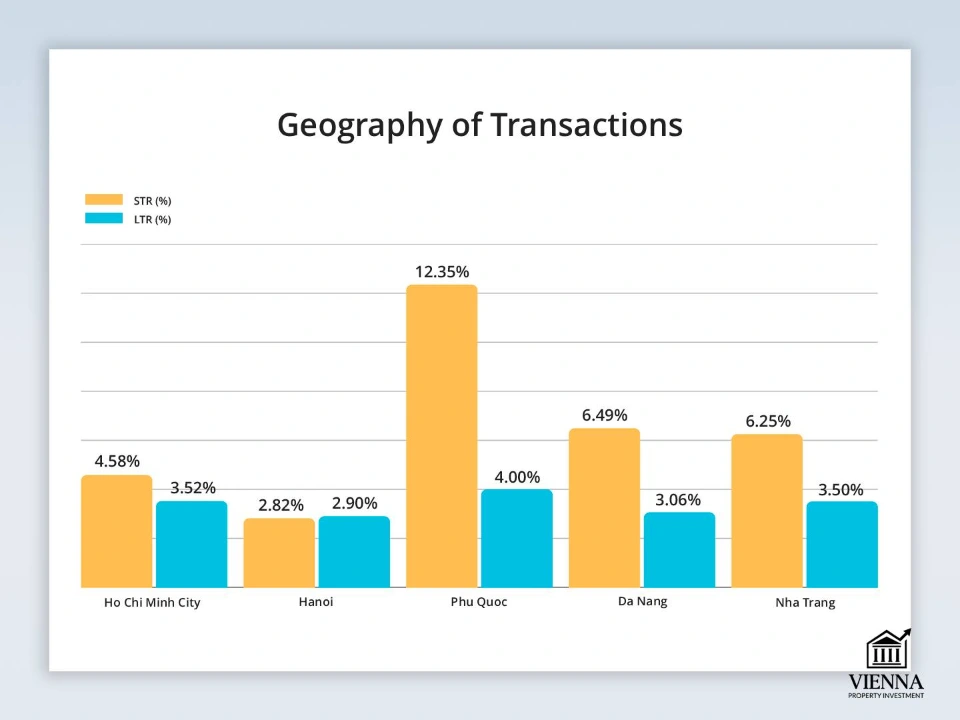

The typical geography of transactions is as follows. Ho Chi Minh City sees a mix of premium (elite condominiums) and mass-market properties. Hanoi is a more academic market, with a large number of tenants among students and international professionals. Da Nang, Nha Trang, and Phu Quoc are developing as tourist hubs, where foreigners are more likely to purchase apartments in condo hotels or seaside villas.

The types of properties available to foreign buyers are limited: primarily condominium apartments, apartments, and resort villas. Land is not available to foreigners for private ownership, a key difference from Austria, where land and houses are available for direct purchase.

The main buyers of Vietnamese real estate are citizens of South Korea, China, Japan, as well as Russians and Americans. Tenant demand is driven by tourists, expats, students, and international company professionals.

Comparing Price Growth and Yields: Vietnam vs. Austria

| Indicator | Vietnam (Ho Chi Minh City/Da Nang) | Austria (Vienna/Salzburg) |

|---|---|---|

| Average price increase (10 years) | 7-10% per year | 2-3% per year |

| Rental yield | 5-8% | 2-3% |

| Minimum entry threshold | from $100,150 thousand. | from €250-300 thousand. |

| Ownership | Leasehold (50 years) | Freehold (full ownership) |

| Dependence on tourism | High | Average |

Competitors

When considering the Vietnamese real estate market, one cannot ignore its regional competitors. The main ones are Thailand, Cambodia, and Indonesia. Each of these markets has its own dynamics and specifics, but the general trend is to attract foreign investment capital through tourism, affordable entry barriers, and growing economies.

Thailand is considered a more mature market: short-term rental mechanisms, a tourism infrastructure, and strong branding are already in place for destinations like Phuket, Koh Samui, and Bangkok. However, this maturity also translates into high competition and higher entry costs, reducing the potential for super profits.

Cambodia has long attracted investors thanks to its minimal ownership restrictions and favorable tax system, but its infrastructure and institutional structure lags behind Vietnam. Real estate is often cheaper here, but the risks are higher, particularly in terms of regulation and political stability.

Indonesia is betting on tourist regions, particularly Bali. This market has long been popular among expats, digital nomads, and investors, but restrictions on direct foreign ownership and complex legal structures make it less transparent.

Vietnam occupies a middle ground: on the one hand, it offers low entry barriers and rapid growth, but on the other, it requires legal expertise when structuring transactions. It is this balance between dynamism and the potential for diversification that makes the country competitive in the region.

| Parameter | Vietnam | Thailand | Cambodia | Indonesia |

|---|---|---|---|---|

| Entry threshold | Low ($80,000-$100,000) | Average (from $120-150 thousand) | Very low (from $50 thousand) | Average ($100-120 thousand) |

| Ownership | Leasehold up to 50 years for foreigners | Freehold for Thais, leasehold for foreigners | Freehold apartments for foreigners | Leasehold only, complex schemes |

| Rental yield | 5-7% in resort regions | 4-6%, but higher competition | 6-8%, but liquidity risks | 5-7%, highly seasonal |

| Tourism | Rapid growth, new projects | A stable, established market | Local, inferior to neighbors | High demand in Bali |

| Political risks | Moderate, regulated market | Low, mature market | Higher, weaker institutions | Average, volatility possible |

| Infrastructure | Actively developing | High level | Limited | Strong in Bali, weaker in the regions |

Ownership formats and investment methods

In Vietnam , foreign investors cannot purchase real estate on a freehold basis, unlike citizens. Leasehold ownership remains the primary option for non-residents, with a term of up to 50 years, renewable.

In practice, this means that the buyer becomes the full owner of the apartment in the condominium, but the period of ownership is limited, and after the lease expires, renewal depends on the decisions of the state and the developer.

In Austria, the situation is diametrically opposed: foreigners can purchase property outright (although this often requires approval from the regional authorities), and there are no time limits. This creates a greater sense of security for investors, but the entry and ownership costs are significantly higher.

other forms of ownership structuring are widely used in Vietnam Some investors establish a local company (usually with a Vietnamese partner), which allows them to purchase land and properties as full owners, but requires extensive legal support and ongoing compliance.

Co-ownership arrangements are also in demand —for example, when purchasing an apartment or villa with multiple investors. This is especially relevant for resort properties, where expenses and income are divided proportionally. Inheritance issues are also important to consider: Vietnamese law allows for the transfer of ownership to foreign heirs, but requires notarization and the payment of fees.

Additional attention should be paid to bank accounts and compliance. A foreign buyer will need a Vietnamese bank account for payments, as well as proof of origin of funds. This is standard practice to protect against money laundering, but the process itself may take longer than in Austria, where the banking sector is well-established and operates within strict EU regulations.

Legal aspects of purchase

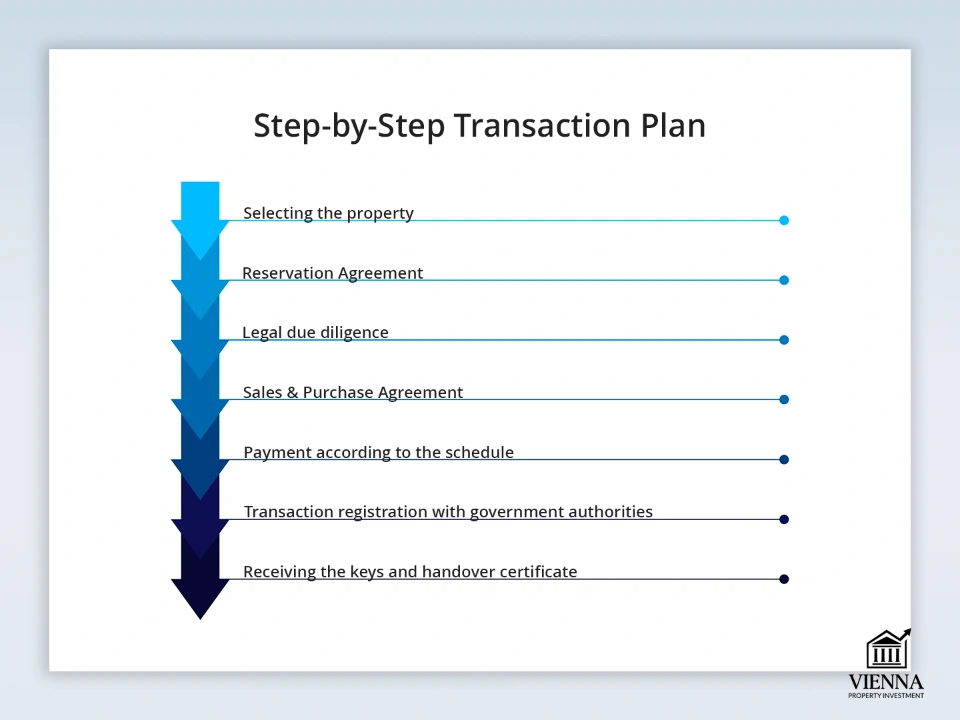

The process of purchasing real estate in Vietnam consists of several stages. First, a property is selected and a reservation agreement is signed, along with a small deposit. This is followed by a document review, which includes an analysis of the developer's licenses, land titles, and project status. Due diligence —a thorough legal review—plays a crucial role at this stage, as without it, there's a high risk of ending up with unfinished construction or restrictions on the property's use.

After successful completion of the inspection, the parties enter into the main purchase and sale agreement, which is registered with the relevant government agencies. Unlike Austria, where registration in the land registry guarantees absolute protection of rights, in Vietnam, the protection of buyers' rights depends largely on the quality of the documentation and the integrity of the developer.

This is why investors are strongly advised to work through licensed lawyers and advisors.

Particular attention should be paid to off-plan transactions (purchases during the construction phase). This format is very popular due to its low entry price and potential price appreciation after completion. However, it also carries the greatest risks: construction delays, lack of necessary licenses, or problems connecting to infrastructure.

| Action | Explanation |

|---|---|

| Selecting an object | At this stage, the investor determines the location (Ho Chi Minh City, Da Nang, Phu Quoc, etc.), the property type (apartment, condo, villa), and compares projects from different developers. Rental potential and liquidity are also important considerations. |

| Reservation Agreement | A preliminary agreement is signed with the developer or seller. A deposit (5 to 10% of the property price) is typically paid. This step secures the buyer's interest and reserves the property. |

| Due diligence | At this stage, the lawyer verifies documents: developer licenses, land titles, project compliance with legislation, and the availability of construction permits. This is a key step in mitigating risks. |

| Main Sales & Purchase Agreement | Following a positive due diligence assessment, the main contract is concluded. It outlines the payment terms, the delivery date, and the parties' responsibilities. |

| Payment according to schedule | If it's an off-plan transaction, payments are made in stages (as construction progresses). In the case of completed housing, full payment is due upon signing the contract. |

| Registration of the transaction with government agencies | Ownership rights (leaseholds for foreigners) are registered with the relevant authorities. The investor receives documents confirming ownership of the property for the agreed-upon period. |

| Receiving keys and the acceptance certificate | The final stage. The investor accepts the property, confirms the quality of the finishes and utilities, and signs the acceptance certificate. After this, the property can be rented out or used for personal residence. |

In Austria, off-plan transactions are more secure thanks to strict developer regulations and mandatory escrow accounts. In Vietnam, such guarantees are fewer, requiring even more stringent oversight.

Remote purchase

In recent years, remote real estate purchases in Vietnam have become a key model for foreign investors. This is due to the rapidly growing interest in the market and the parallel development of digital services that allow transactions to be completed without the need for a permanent presence in the country. This investment method is especially relevant for those considering Vietnam as part of an international portfolio and not planning to relocate immediately.

The remote purchase process revolves around a trusted representative —usually a lawyer or a specialized consulting firm. Through a notarized power of attorney, the representative acts on behalf of the investor: signing the reservation agreement, reviewing title documents, participating in negotiations with the developer, and overseeing the property registration process. This approach minimizes risks and eliminates the need for multiple trips.

Modern developers in Vietnam are actively implementing online tools: virtual tours of properties, electronic floor plan catalogs, video presentations, and even online signing of individual documents. This allows investors to evaluate in advance not only the project itself but also its surroundings, infrastructure, and neighborhood dynamics.

to compliance and financial matters during remote transactions The foreign buyer opens a bank account in Vietnam, through which all payments are processed. The bank verifies the origin of the funds, which is mandatory under local law.

Unlike Austria, where transactions can be completed online thanks to European digital jurisdiction and high legal transparency, in Vietnam, remote purchases require greater legal oversight. However, with the right support, they become a convenient tool for entering a growing market without requiring a long-term presence in the country.

Vietnam vs. Austria

| Stage / aspect | Vietnam | Austria |

|---|---|---|

| Legal status | Foreigners can own apartments in condominiums under a leasehold system for up to 50 years. The land remains state property. | Foreigners can purchase real estate in full ownership (freehold), including land and houses. |

| Legal support | A trusted person (lawyer, consultant) with a notarized power of attorney is required. | Remote transactions through a notary with an electronic signature and EU digital services are possible. |

| Documents | Power of attorney, passport, translation of documents, verification of the developer and the project. | Passport, proof of funds, electronic signatures. These documents are standardized across the EU. |

| Bank account and compliance | A local bank account in Vietnam is required. The bank verifies the origin of funds (AML/KYC). | Transfers are possible directly through EU banks. Compliance is strict, but the process is transparent. |

| Online tools | Virtual tours, video presentations, digital catalogs. Contracts are usually signed in person or through a trusted representative. | Full digitalization: virtual showings, electronic registers, online signing through a notary. |

| Risks | Bureaucracy, restrictions on ownership forms, lengthy audits. Due diligence is highly important. | Minimal legal risks. Highly predictable legislation. |

| Transaction speed | 1-3 months, including checks and account opening. | 2-6 weeks if all documents are available. |

| Cost of support | Lawyers and agency: $3,000-6,000 depending on complexity. | Notary and registration fees: 3-5% of the property value. |

| Rental yield | 5-9% in megacities and resorts. | 2-3% on average across the country. |

| Flexibility for the investor | High profit potential, but more complex legal structure. | Maximum protection of owner rights, but low profitability. |

Taxes, fees and expenses

The tax burden on real estate in Vietnam is relatively low, which is one of the main factors making the market attractive. A registration fee of 0.5% of the transaction price is charged when purchasing real estate. For owners, the tax burden is minimal: land and property taxes exist, but the rates are extremely low, often not exceeding a few hundred dollars per year.

When selling real estate, there is a capital gains tax of 2%, which is significantly lower than in Austria, where capital gains tax can reach 25-30% depending on the ownership structure and holding period.

-

For more information on taxes in Austria, see the article " Property Taxes in Austria – Complete Instructions ."

Regarding rental income, in Vietnam the tax rate ranges from 5 to 10% depending on income, allowing investors to retain most of the profit. In Austria, the tax burden on rental income is higher: both income tax and social security contributions are added to it.

Comparison with Austria

| Tax stage/type | Vietnam | Austria |

|---|---|---|

| Purchase | Registration fee – 0.5% | Purchase tax – 3.5-6% |

| Ownership | Land/property tax is low | The annual property tax is higher, utility bills are more expensive |

| Sale | Capital gains tax – 2% | Capital gains tax – up to 30% |

| Rent | Income tax – 5-10% | Income tax – up to 25-35% |

Visas and residency

Purchasing real estate in Vietnam does not, in itself, grant residency. This is a key difference from some European jurisdictions, where real estate investments can directly lead to residency or even citizenship. In Austria, for example, purchasing real estate also does not provide residency, but the country offers special programs for investors and entrepreneurs, where real estate can be part of the investment package.

Vietnam offers a long-term visa system. Foreigners can obtain business visas, investment visas, or work permits, allowing stays of one to several years with the possibility of extension. Wealthy investors may also consider registering a business in Vietnam, which facilitates obtaining a multiple-entry visa and official residency.

From a lifestyle perspective, Vietnam is attractive due to its relatively low cost of living: rent, services, transportation, and food are significantly cheaper than in Austria or other European countries. The climate plays a decisive role: it's warm year-round, and in resort areas like Da Nang or Phu Quoc, life is closely linked to the sea.

Tourism is rapidly developing, offering a variety of services, cafes, restaurants, and sporting and cultural events. For digital nomads and those seeking a warm climate and affordable prices, Vietnam is becoming one of the best options in Asia.

Rent and profitability

The rental market in Vietnam is divided into two key segments: short-term and long-term rentals.

Short-term rentals are geared toward tourists. Cities and islands like Nha Trang, Da Nang, and Phu Quoc have become tourist hotspots: condominiums and aparthotels are being built rapidly, and the rental market is driven by domestic and international tourism. Seasonality plays a role, but thanks to the year-round climate, the low-season decline is less pronounced than in Europe, for example.

Long-term rentals are common in Ho Chi Minh City and Hanoi. These cities enjoy stable demand from expats, students, and employees of international companies. The rental market here is less volatile than in tourist regions, offering the opportunity to count on a stable income.

Profitability by region

| Location | Profitability (annual) | Main tenants |

|---|---|---|

| Ho Chi Minh City | 5-7% | Expats, employees of international companies |

| Hanoi | 4-6% | Students, civil servants, expats |

| Resorts (Nha Trang, Da Nang, Phu Quoc) | 6-9% | Tourists (domestic and international) |

According to Eurostat and national sources, the share of rental housing in Austria is much lower, while home ownership is more common; global data on ownership confirms this trend – 69% of EU residents live in their own homes.

Where to buy in Vietnam

The choice of location directly depends on the investor's strategy.

Ho Chi Minh City is the country's economic capital and its largest real estate market. A thriving business environment and a vibrant international corporate sector ensure rental demand from expats remains high. Investments in Ho Chi Minh City are suitable for those seeking a stable income and long-term investment prospects.

Basic apartments (studios, 35-5 m²): from $60,000-100,000.

- 2 bedroom condos: $150,000-$240,000.

- Premium properties (District 2, District 7): $150,000-600,000, price $2,200-6,500/m².

Promising areas:

- Thao Dien, Thu Thiem (District 2): a magnet for expats.

- Phu My Hung (District 7): family-friendly expat communities, infrastructure.

- Binh Thanh, Thu Duc (District 9): new projects, capitalization forecast up to 60–90% in 5 years.

Hanoi, as a political capital, has a unique demand structure. Government agencies, universities, and embassies are concentrated here. The rental market is targeted at students, faculty, and employees of government and international organizations. Yields here are lower than in resort areas, but the stability of demand makes Hanoi an attractive long-term strategy.

- Primary market: about $2,836/m² (~72 million VND/m²).

- Secondary market: $1,900/m² (~48-49 million VND/m²).

- Minimum prices for an apartment: $120,000-180,000 (secondary market).

Popular areas:

- Tay Ho (West Lake): $2,500-4,000/m², rent for expats.

- Ba Dinh, Hoan Kiem: $2,000-3,200/m², business and administrative center.

Da Nang, Nha Trang , and Phu Quoc are resort destinations. The main focus here is on short-term rentals for tourists. Such investments are more profitable, but also riskier: seasonality, dependence on international tourism, and competition with the hotel industry. On the other hand, resorts offer the opportunity to combine investment with personal use – so-called lifestyle investments.

Resort locations

- Da Nang: $1800 - 3000/m², investments from $150,000 - 300,000.

- Nha Trang: $1,500–2,500/m², from $120,000–250,000 per property.

- Phu Quoc: $1,600–3,000/m², from $130,000–300,000, high tourist flow.

- Focus: short-term rentals for tourists, combining profitability and lifestyle.

Metropolis vs. resort

| Parameter | Ho Chi Minh City / Hanoi | Da Nang / Nha Trang / Phu Quoc |

|---|---|---|

| Profitability | 4-7% | 6-9% |

| Type of tenants | Expats, students, civil servants | Tourists (domestic and international) |

| Risks | Minimum, stable demand | Seasonality, dependence on tourist flow |

| Lifestyle | Business atmosphere, urbanization | Seaside vacation, lifestyle investment |

| Comparison with Austria | Closer to Vienna: Low yield in Austria (2-4%), higher stability | Similar to Alpine resorts, but more accessible and profitable |

Secondary cities and suburbs

- Binh Duong (near Ho Chi Minh City): $1300 - 2200/m².

- Minimum investment: from $100,000 to $150,000.

- Potential: growth in infrastructure and demand due to the relocation of production.

Compared to Austria, one could say that the metropolis in Vietnam is analogous to Vienna in terms of stability, but with a higher yield, while the resort regions are closer to the model of the Alpine or lake resorts of Austria, only with a significantly lower entry threshold and greater risks.

- Austria (Vienna, Salzburg): starting prices from €250,000 even for a small apartment in Vienna .

- Profitability: 2–4% per annum.

- Vietnam: entry from $60,000–100,000, yield 5–9%, but higher legal and market risks.

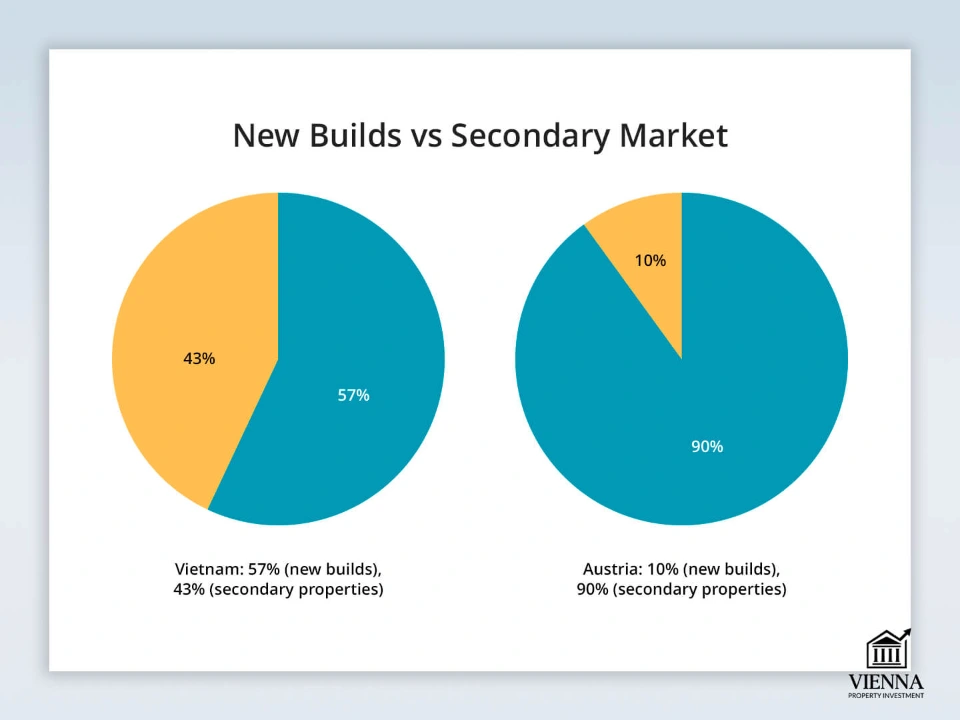

Secondary market and new buildings

For foreign investors, the Vietnamese market almost always begins with new developments: it is the primary segment that generates the bulk of properties available for purchase (quotas for foreigners in condominiums, transparent booking procedures and staged payments, standardized contracts and developer services).

The right of ownership is granted in the form of a leasehold, and key documents (including the “pink book” for the apartment) are issued after the building is put into operation.

Buying early in the construction phase allows you to lock in a lower entry price and profit from revaluations at the time of delivery, but it requires disciplined due diligence: checking land rights, building permits, the status of the project's escrow/accounts, the developer's history, and its contracting chain.

In reality, many projects provide a convenient customer journey: electronic booking, a standardized Sales & Purchase Agreement, payment schedules, defects liability, and subsequent building management by the developer's management company.

The secondary market is more challenging for foreigners for three reasons. First, there's a "foreign quota" in the building: if the limit is reached, foreigners cannot purchase, which impacts liquidity and the pool of potential buyers during resale.

Secondly, the procedure for re-registering leasehold rights between private individuals requires careful legal work (checking the "pink book" status, the absence of liens/encumbrances, utility and tax arrears, and the correct fixing of the price in the contract).

Thirdly, financing for non-residents for existing properties is limited, so transactions are more often all-cash or with short-term bridge loans. The strengths of existing properties include a ready rental pipeline, the ability to assess the building's technical and operational performance (HOA fund, maintenance rates, and realistic operating costs), and a lower risk of construction delays.

The price guidelines are as follows: starting lots in Ho Chi Minh City in the early stages of the project are possible from ~$80k (usually compact apartments in developing areas/clusters), and in resort locations (Da Nang, Nha Trang, Phu Quoc) the lower limit is often around $120k for apartments by the sea.

Naturally, central districts and emerging expat clusters are more expensive; what matters there isn't the "lowest price," but a balance of location, management quality, and tenant profile.

For comparison with Austria, even entry-level city apartments in the Viennese market typically start at €250k+, but investors receive full freehold and a predictable land registry process. In exchange, they receive lower yields and a longer payback period.

New buildings vs. resale

| Criterion | New buildings | Secondary market |

|---|---|---|

| Accessibility for foreigners | High: sale within the project's "foreign quota" | Limited by house quota; important to check if "foreign share" is available |

| Entry price | Lower in early stages; growth towards completion | Closer to the market; negotiation is possible if the seller needs it |

| Legal risks | Permits/land/construction timeframes | Clear title, "pink book", no encumbrances |

| Financing | Schedule of staged payments from the developer | Mostly all-cash; bank financing is limited |

| Instant profitability | Delayed until introduction | Yes: you can estimate the actual cash flow |

| Operating expenses | Transparent, but sometimes adjusted after launch | Known for history, HOA and maintenance fees |

| Exit liquidity | Higher in "top projects", lower in the mass segment | Depends on the quota and demand in a particular building/cluster |

In Austria, the contrast is different: the secondary market is liquid and standardized, while the primary market is protected by notary-escrow models; prices are higher, yields are lower, but legal certainty is maximal.

Alternative strategies

Beyond the "classic" buy-to-let option, Vietnam offers a range of niche strategies that allow for a more precise risk/return profile.

Income apartments

Income apartments are fully furnished units in condominiums, aimed at expat rentals in metropolitan areas (Ho Chi Minh City/Hanoi).

Pros: predictable demand, ability to enter into long-term contracts with corporations/relocators, relatively stable occupancy.

Disadvantages: the need for a high standard of furnishings and service, sensitivity to office conditions and personnel migration.

Resort condo hotels

Resort condo hotels are a format where apartments are managed by a hotel operator with a focus on short-term stays. These properties often offer higher returns, but dependence on tourist flow and seasonality is a key risk.

It's important to check revenue pool terms, reporting transparency, operator fees, and low-season scenarios. For a disciplined investor, a condo hotel can become a component of a portfolio with a more aggressive income profile.

Villas

Villa rentals in Da Nang, Nha Trang, and Phu Quoc target premium tourism and groups/families. Management is more complex (staff, service, marketing), but the average bill is higher and product differentiation is stronger. Corporate resorts with a developed master plan offer better liquidity than stand-alone properties.

Commercial real estate

Commercial real estate (offices, street retail) is a professional segment. In Ho Chi Minh City, small office blocks in business clusters and well-positioned corner retail lots in high-pedestrian areas are of interest. Here, the assessment of rental rates, operating expenses, indexation, and the tenant's creditworthiness are critical.

Entry barriers are higher, and due diligence is mandatory. By comparison, in Austria, core offices and prime retail offer low but highly stable returns, while in Vietnam, the yield spread is wider, but the risks (including vacancies and rent holidays) are also higher.

Alternative Strategy Profiles

| Strategy | Yield benchmark* | Demand driver | Key risks | Investor profile |

|---|---|---|---|---|

| Income apartments (metropolis) | ~5-7% | Expats, corporate rentals | Office/relocation conditions, competition | Balanced, focused on stable cash flow |

| Condo hotels (resorts) | ~6-9% (volatile) | Tourism, operator workload | Seasonality, revenue-share, commissions, short-term regulation | Aggressive/experienced driver |

| Villas for rent | ~6-8% (lower vacancy – higher income) | Premium tourism, groups | High CAPEX/operational risk | An investor ready for active management |

| Commercial (office/retail) | ~6-10% (case-by-case) | Business activity, traffic | Vacancy, repairs, contract risks | Profile/institutional |

*Ranges are indicative and depend on location, operator, asset quality, and transaction structure.

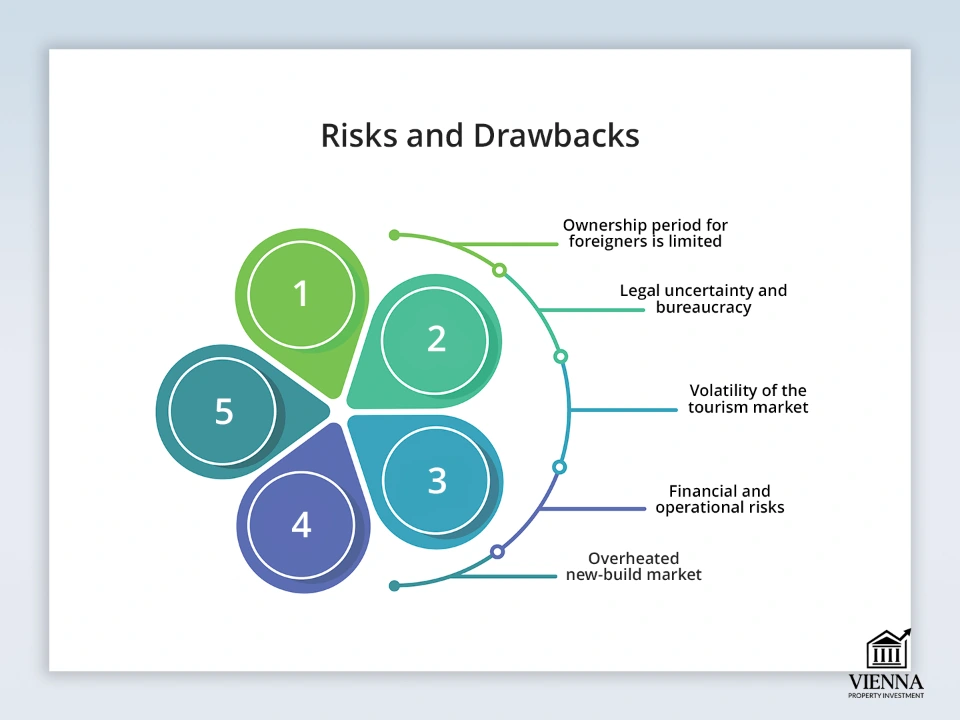

Risks and Disadvantages

The main conceptual risk in Vietnam is leasehold. Foreigners have a limited tenure (usually up to 50 years) for an apartment. Extension is possible, but not automatically guaranteed. It's always important to understand whose land the project is on, the developer's lease term, and the regulatory mechanisms that ensure extension. This is a fundamental difference from Austria, where freehold ownership is perpetual and protected by EU law.

The second set of risks is legal uncertainty and bureaucracy. The regulatory environment is evolving, but procedures may differ from province to province, and approval timelines may vary. Due diligence is critical: land status, construction permit, compliance with the quota for foreign residents in the building, the pink book process, the absence of liens or disputes, and the correctness of management agreements. Without an experienced local lawyer and a clear roadmap, it's easy to waste time and undermine the transaction's economics.

The third factor is the volatility of the tourism market. Resort areas are sensitive to global shocks (borders, air travel), weather events (typhoons), and competition from hotels and other apartment projects. For short-term rentals, marketing, the OTA ecosystem, property ratings, flexible pricing policies, and the presence of a local manager capable of mitigating seasonality with packages and average stays are crucial.

There are also financial and operational risks: currency (income in VND/expenses or targets in USD/EUR), exit liquidity (quotas for foreigners limit the circle of buyers during resale), quality of construction/maintenance (HOA budgets, depreciation of MEP systems, elevators, facades), compliance (confirmation of the source of funds, banking procedures).

In Austria, these risks are lower thanks to a standardized notarial model, land registry, and predictable judicial practice; the downside is lower returns and a more expensive entry point.

Risk map and mitigation measures

| Risk | How does it manifest itself? | Probability/Influence | What to do |

|---|---|---|---|

| Leasehold/tenure | Limited term, uncertainty of extension | Medium / High | Buy in projects with long-term land leases; include key provisions in the contract; keep the investment horizon shorter than the leasehold term |

| Legal uncertainty | Pink book delays, differences in practices | Medium / Medium-high | Full due diligence, local lawyer, permit and quota verification, correct payment/penalty formulas |

| Construction delays (off-plan) | Shifting the dates, postponing the launch of the lease | Average / Medium | Strong developer, SPA protection clauses, payment schedule upon completion, liquidity reserve |

| Tourism volatility | Decreasing occupancy, lower tariffs | Medium / High (for resorts) | Diversify: part of the portfolio in metropolitan areas; choose an operator with a stable network; work with a seasonal pricing matrix |

| Currency and repatriation | VND/EUR exchange rate, withdrawal procedures | Average / Medium | Hedge in target currency, store documentation (contracts, invoices, tax receipts) for repatriation |

| Exit liquidity | A narrow circle of foreign buyers | Average / Medium | Buy in popular clusters (expat/business/tourist), with a 5-7 year horizon |

| Quality of operation | Rising HOA fees, deteriorating engineering | Average / Medium | Evaluate the management company, HOA budgets, capital repair reserves, and technical audit before purchasing a resale property |

Comparison with Austria

- Legal model: Vietnam – leasehold and varied practices across provinces; Austria – freehold, strict notarial and cadastral systems.

- Transaction economics: Vietnam – low entry, higher returns and growth potential; Austria – high entry, low but stable yield.

- Operational factors: Vietnam – management and a local partner are important; Austria – standardized processes and cost predictability.

If growth and profitability are your goals, Vietnam offers more opportunities with proper risk management. If capital preservation and legal certainty are key, the Austrian model is more suitable, but be prepared for more modest returns and higher entry barriers.

Accommodation and lifestyle

Life in Vietnam is governed by two major paradigms: the rapid urbanization of the largest metropolises and the leisurely, leisure-oriented daily life of the resort areas. The megacities of Ho Chi Minh City and Hanoi are dynamic, energetic cities with a high business density, intensive construction, and distinct expat communities.

For those accustomed to the urban rhythm and looking to combine investment with a career or entrepreneurial activity, these cities offer everything they need: international companies, co-working spaces, English-language clinics and schools, developed logistics, and a rich cultural program.

Expat communities here are vibrant and professionally oriented – networking events, business clubs, international schools, and relocation services facilitate relatively rapid integration. At the same time, high density and rapid growth also mean a more challenging infrastructure: traffic jams, lengthy construction sites, noise; for those who value peace and quiet, this isn't always comfort.

Resort regions—Da Nang, Nha Trang, Phu Quoc, and other coastal areas—create a completely different lifestyle: a maritime climate, daily beach access, a well-developed service infrastructure for vacationers, and relatively low costs for household services.

For many investors, resort locations are synonymous with "lifestyle investing" : you buy a property that serves as a family vacation spot and also generates income during peak season. Life in resorts is simpler and cheaper in terms of basic expenses: groceries, services, and entertainment are often significantly cheaper than in European cities.

However, this comes with the seasonality of service and a limited selection of premium medical and educational institutions within the resort itself—in most cases, for serious medical or educational services, you'll have to turn to larger cities.

Vietnamese culture is a multilayered blend of local traditions, colonial heritage, and a rapidly growing urban contemporary scene. Cuisine is one of the driving forces of everyday comfort: high-quality and affordable street food, and numerous cafes and restaurants serving international cuisine in major cities.

Expats and families value access to international schools and a reliable level of private healthcare: Ho Chi Minh City and Hanoi boast international clinics and hospitals offering standards close to Western standards, but significantly more affordable than those in Austria.

Education for children of foreign nationals is typically provided through private international schools with English as the language of instruction; their network is growing, but space and cost can be limiting factors, especially in privileged areas.

Compared to Austria, I'd note several key differences: in Austria, the level of government services, public safety, and healthcare are generally higher and more stable; the infrastructure is predictably well-developed; and the quality of life is linked to the cold climate and European lifestyle.

In Vietnam, you get a warmer climate, lower fixed costs, and vibrant cultural dynamics, but you pay for them with a higher degree of uncertainty in public services and less predictability in some safety, social, and environmental factors.

| Parameter | Vietnam is a megacity (Ho Chi Minh City/Hanoi) | Vietnam – resorts (Da Nang/Phu Quoc) | Austria – Vienna |

|---|---|---|---|

| Cost of living (monthly) | Low-medium | Low | High |

| Climate and lifestyle | Warm, dynamic urbanism | Tropical/marine vacation | Temperate/Continental |

| Medicine (private) | Affordable, good quality | Limited locally | Very high, public and private |

| Education (international schools) | Availability in capital cities | Limited | A wide network of international and national |

| Expat community | Widely developed | Seasonal, tourism | Developed, stable |

| Level of security and legal predictability | Average, depends on the region | Average | High |

| Suitable for | Career, business, long-term relocation | Leisure, lifestyle, short-term accommodation | Long-term family, stable environment |

Vietnam as an "Asian hub"

In recent years, Vietnam has been transforming from a local market into a regional hub for digital nomads, IT professionals, and entrepreneurs seeking a combination of a low operating base and a fast-growing market with access to the rest of Southeast Asia.

Flexible visa policies, the emergence of coworking spaces, and the availability of internet and mobile payments make large cities a natural platform for remote work and startups. Digital nomads value not only low accommodation and food costs but also an ecosystem of services: cafes with fast Wi-Fi, community events, access to business incubators, and easy international flight logistics from Ho Chi Minh City or Da Nang.

For growth-oriented investors, Vietnam offers clear advantages: a young population, an influx of foreign investment into industrial parks and the IT sector, large-scale infrastructure projects (road and rail corridors, ports, airports), and active urbanization.

All of this creates increased demand for housing for employees of international companies and creates a stable tenant base, while simultaneously increasing capitalization prospects.

For families, Vietnam offers an affordable lifestyle: lower daily expenses, a warm climate, and the opportunity to provide children with an international education at a significantly lower cost than in Austria. However, families should consider issues such as insurance, the quality of public education, and long-term social infrastructure, which are superior in Austria.

From a strategic perspective, Vietnam is interesting as a diversification point: investors from Europe and Asia include local assets in their portfolios to increase returns and reduce correlation with EU markets.

In this context, Austria serves as an "anchor of stability" for many—a place where capital can be preserved with minimal legal risks; Vietnam, on the other hand, is a "growth engine" where higher returns can be achieved while taking on additional operational and regulatory risks.

Exiting an investment

Exit planning is an integral part of any investment strategy, and in Vietnam, this is especially relevant due to the specific legal model and market conditions. The first and most important point is to understand the nature of leasehold: in most cases, an investor does not receive a perpetual freehold title to the land, but rather purchases a renewable right of use (usually for up to 50 years).

Therefore, one practical measure is to focus on a transaction profile in which the expected investment horizon is significantly shorter than the leasehold term, or to acquire properties in projects where the developer has long-term land guarantees and a transparent extension policy.

Selling an apartment "before the leasehold expires" is a common exit scenario; investors prefer properties with a long remaining lease term because buyer demand and prices fall as the lease term shortens.

Market exposure periods in Vietnam are typically longer than in mature European jurisdictions. The most liquid projects in top locations can sell within a few months with proper pricing and marketing; however, for properties outside expat clusters or with foreigner quota issues, the sales cycle often extends to a year or two.

This is due to the limited pool of buyers (foreign quotas), the volatility of demand on the secondary market, and the need for all-cash buyers for many transactions. Keep in mind that in resort developments, seasonality also affects the timing and price of the sale – listing a lot during the "low season" may require a significant discount.

The tax aspects of exit are simple compared to Austria – rates are lower, but bureaucratic procedures and document requirements (confirmation of sources of funds, certified transfers, local account numbers, etc.) require careful preparation.

Typical taxes on a sale include capital gains tax (in Vietnam often around 2% of the transaction price or another flat rate depending on the structure), as well as registration fees and possible transfer fees.

In Austria, the tax burden on sales may be higher, but the tax calculation and payment process is more standardized and transparent. In Vietnam, it is important to have a local tax consultant who can help you properly structure the transaction and minimize fiscal risks within the law.

Vietnam vs. Austria

| Question | Vietnam | Austria |

|---|---|---|

| The main way out | Sale on the secondary market; less often, purchase by the developer | Sale, refinancing, long-term lease |

| Exposure times (typical) | 6-24 months (depending on location and quotas) | 3-12 months (in large cities) |

| Sales/Gain Tax | Typically ~2% fixed / locally variable | Up to 25-30% (depending on the structure and period of ownership) |

| Restrictions on buyers | Foreign quotas in the project; smaller circle of buyers | Wide circle, free market |

| Liquidity | Average/low outside top locations | High in the Veins of the Market (Vienna, Salzburg) |

| Risks of exiting | Quotas, legal complexities, currency regulation | Minimal, legal protection is strong |

In practical terms, it makes sense for investors to develop exit scenarios in advance: consider channel diversification (brokers, international platforms, local agencies), have a reserve of funds for marketing and possible price adjustments, and maintain a "package of documents" in order—contracts, rental histories, utility bills, and proof of tax payment—which increase the confidence of potential buyers and reduce due diligence time.

Real-life real estate investment cases in Vietnam

Case 1: Ho Chi Minh City – 45 m² apartment, 5.5% yield

A Singaporean investor purchased a studio apartment in District 2 (Thao Dien), a popular location among expats. The apartment was priced at approximately $95,000. The property was purchased off-plan, offering a 12% discount on the market price upon completion.

The apartment was leased long-term to an IT specialist working in Ho Chi Minh City. The average yield was 5.5% per annum. Furthermore, the capitalization grew by 15% over two years.

Case 2: Hanoi – 70 m² apartment, 4.8% yield

A German investor purchased a two-bedroom apartment in the Cau Giay district, home to universities and international corporate offices. The price is $110,000.

After furnishing and minor renovations, the apartment was rented out to a group of international students on a long-term basis. The yield was 4.8% per annum. The main advantage is the stable demand from students and government employees. The disadvantage is less flexibility compared to resort locations.

Case 3: Da Nang – 55 m² condo apartment, 7.0% yield

An Australian investor has invested in apartments near My Khe Beach, one of Da Nang's key tourist areas. The purchase price is $120,000.

The apartments were transferred to a local management company, which rented them out to tourists through Booking and Airbnb. The average annual yield was 7.0%, despite seasonality. During peak periods (winter and spring), occupancy reached 90%.

Case 4: Nha Trang – 60 m² resort apartments, 8.2% yield

A Russian investor purchased apartments in a new beachfront complex in Nha Trang for $125,000. Management was transferred to the developer, who guaranteed a minimum return of 7% for the first three years.

In fact, the return was 8.2%, as tourist traffic to Nha Trang quickly recovered after the pandemic. The main risk is the high dependence on Chinese and Korean tourists.

Case 5: Phu Quoc – 120 m² villa, 9.5% yield

An investor from South Korea purchased a villa in a premium beachfront complex for $280,000.

The villa was rented out through an international operator (Accor). Due to high demand in Fukuoka, the yield was 9.5% per annum. Additionally, the investor used the villa for vacations up to 30 days a year. The main risk was the high dependence on air travel and seasonality.

Case 6: Ho Chi Minh City – 90 m² commercial space, 6.3% yield

An Austrian investor purchased a ground-floor property in a residential complex in District 7 (Phu My Hung), a prestigious neighborhood with a large expat population and businesses. The purchase price was $210,000.

The premises were leased to a café and coffee shop under a long-term contract (5 years). The yield was 6.3% per annum. The advantage was tenant stability; the disadvantage was the high initial cost and dependence on consumer demand.

Case 7: Hanoi – 50 m² apartment, 5.0% yield

A French investor purchased a small apartment near West Lake (Ho Tay), a popular expat neighborhood, for $100,000.

The apartment was rented out through Airbnb on a short-term basis. The average annual yield was 5.0%, and due to the area's popularity, the apartment's price increased by 12% over two years.

Expert opinion: Ksenia Levina

My experience covers transactions in both Asia and Europe (including Austria). This allows me to understand not only the differences in legal regimes and market transparency, but also the real-world return and risk scenarios for investors.

In Asia—particularly Vietnam and Thailand—the investor's key task is not to choose a property "based on a picture," but to conduct thorough due diligence: checking the developer, ownership structure, land rights, and the project's readiness for commissioning.

While Austria's strong cadastral system, strict EU regulations, and notarial transactions minimize most legal risks, in Vietnam, legal expertise is crucial to success.

How to select an object:

- Checking the developer's reputation (completed projects, customer reviews, legal cases).

- Analysis of the legal framework: the developer's statutory documents, land rights, quotas for foreigners.

- Financial transparency: payment structure, bank guarantees or escrow accounts (where applicable).

- Comparative price analysis: comparing the cost per square meter of the current project with similar properties already built in the region.

Ownership forms and taxes:

Regarding ownership formats and taxes, in Vietnam, foreigners generally receive leasehold (a long-term lease, usually for up to 50 years), which can be extended. Freehold is extremely limited, unlike in Austria, where absolute property rights, protected by the constitution, prevail.

Taxation in Vietnam is simpler and lower: capital gains tax is often flat (~2%), and rental tax is around 10% combined (VAT + PIT). In Austria, however, rental income tax can reach 25-30%, and the capital gains tax (Immobilienertragsteuer) is strictly regulated and depends on the length of ownership.

Depending on the investor's strategy, I offer several investment scenarios:

- Conservative: Apartment in Ho Chi Minh City. Strong domestic demand, expats, students, and international employees provide stable rentals. Returns are 4-6% per annum, but with low risk.

- Balanced: apartments in Da Nang. Tourism + growing expat cluster, yield 6-8% with potential for capital growth.

- Aggressive: resort condo hotels in Phu Quoc. Peak returns can reach 10-12%, but there are high risks of seasonality, regulation, and management errors.

"My job is to help clients navigate the entire process safely and efficiently. I analyze the market, conduct due diligence on the developer and project, develop tax and legal strategies, and propose the optimal scenario based on the investor's goals."

— Ksenia , investment consultant,

Vienna Property Investment

Conclusion

The question of whether it is better to invest in Vietnam or Thailand depends on the investor’s priorities.

When is Vietnam a better choice: if the goal is higher returns, a focus on tourism growth, or a desire to "enter the market before it becomes fully institutionalized." Suitable for investors willing to conduct due diligence and have a high risk tolerance.

When is Thailand better: if transparency, developed infrastructure for expat life, quick exit from investments, and high liquidity of the secondary market are priorities.

-

If you're also considering this market, I recommend a separate analysis: How to Profitably Invest in Real Estate in Thailand .

Tips for investors:

- Always work with a lawyer who understands local law.

- Conduct due diligence of the project and the developer.

- Develop an exit strategy even before the purchase (leasehold → sale plan 5–10 years before the end).

- Compare tax models in different countries to optimize income.

Forecast to 2030 for Vietnam:

- Tourism will continue to grow: international passenger traffic is expected to increase to 50 million people.

- Infrastructure – new airports (for example, Long Thanh near Ho Chi Minh City), highways and ports will enhance the attractiveness of resorts.

- Prices in resort areas (Da Nang, Nha Trang, Phu Quoc) will rise faster than in metropolitan areas due to limited land near the sea and the influx of foreign capital.

- The market will become more institutionalized, but the window of “higher returns with higher risks” will remain for several more years.

Tables and appendices

Real estate investment scenarios in Vietnam

| Scenario | Locations | Profitability | Minimum prices | Advantages | Main risks | Comparison with Austria |

|---|---|---|---|---|---|---|

| Short term at the sea | Da Nang, Nha Trang | 6-9% | from $120k | High tourist flow, lifestyle | Seasonality, dependence on tourism | 2-3 times higher returns, but higher risks |

| Long-term for expats | Hanoi, Ho Chi Minh City | 4-7% | from $80k | Stability, constant demand | Competition, limits for foreigners | More profitable, but less predictable |

| Lifestyle investment | Phu Quoc | 6-8% | from $120k (apartments), $250k (villas) | Growth of tourism, personal use | Off-plan risks, tourism dependence | Entry is cheaper, income is higher, but more volatile |

Investor checklist

- Preparatory stage

Determine your investment goals: income, lifestyle, diversification, or speculative growth.

Choose a strategy:

- metropolis (Ho Chi Minh City, Hanoi) → stable rent;

- resort (Da Nang, Nha Trang, Phu Quoc) → high profitability, but more seasonal.

Compare with alternatives in Europe: Austria has lower risks and a clear legal environment, but higher entry barriers and lower returns.

2. Legal issues

Understanding ownership forms:

- foreigners only have access to leasehold for up to 50 years;

- freehold – only for Vietnamese citizens;

- Ownership through a company is possible if commercial properties are needed.

Check for inheritance and joint ownership (marriage or partnership).

Open a bank account in Vietnam for payments and rent (follow compliance rules).

Hire a lawyer familiar with local law—mistakes in due diligence can cost more than the savings on consultations.

3. Search and check the object

Market analysis: determine where demand and prices are currently growing (compare metropolitan areas and resorts).

Choosing a developer: study their reputation, completed projects, and availability of licenses.

Object verification (due diligence):

- land status (state, private, leased);

- availability of building permits;

- compliance with the limits for foreigners (no more than 30% of apartments in the building).

Evaluate profitability: compare short-term and long-term rentals, real rates.

4. Purchase transaction

Steps of the transaction:

- Booking agreement and deposit payment.

- Signing the purchase and sale agreement.

- Payment according to schedule (especially when purchasing off-plan).

- Registration of rights in the land department.

- Record all payments through a bank – this is a mandatory requirement for foreigners.

- Keep all documents (especially permits and certificates of ownership).

5. Taxes and expenses

Upon purchase: registration fee 0.5%.

When owning: land and property taxes are minimal.

When renting: tax 5-10% depending on income.

On sale: capital gains tax 2%.

Comparison with Austria: Vietnam has lower taxes, but more bureaucracy and uncertainty.

6. Property management

Determine your rental strategy:

- short-term → tourism, high profitability, but more work and seasonality;

- long-term → expats, students, business clients, lower profitability, but stability.

Choose a management company if you don't plan to handle the rental yourself.

Maintain compliance – income must be transferred through official accounts.

7. Exiting the investment

Plan ahead: the leasehold period is limited, it is better to sell 5-10 years before the end.

Consider exposure: in Vietnam, properties take longer to sell than in Europe (up to 6-12 months).

Calculate taxes upon sale: capital gains tax is fixed at 2% of the transaction price.

Comparison with Austria: in Europe, real estate sales are more predictable, while in Vietnam, demand fluctuations are more likely.

8. Personal comfort and lifestyle

Megacities: business activity, expat communities, high rental demand.

Resorts: low cost of living, warm climate, lifestyle investment.

Consider the infrastructure: medicine, education, transportation.

Comparison with Austria: Europe offers a more stable infrastructure and legal system, Vietnam offers more opportunities for growth and a lower barrier to entry.