Real estate in Portugal for investment and personal residence

According to Property Market-Index , Portugal saw the highest real estate price growth in the EU in the first half of 2025, up 15.2% year-on-year, while the EU average was only 5.1%. Average housing prices in Portugal have increased by 106% over the past decade. Market protection and tax incentives (such as the NHR (Non-Habitual Resident) regime) have made Portugal even more attractive to foreign residents and investors.

This article presents a systematic analysis of Portugal's real estate investment attractiveness. We will examine the current market status, its dynamics, economic and tax incentives, and compare Portugal with Austria as an alternative investment option in Europe.

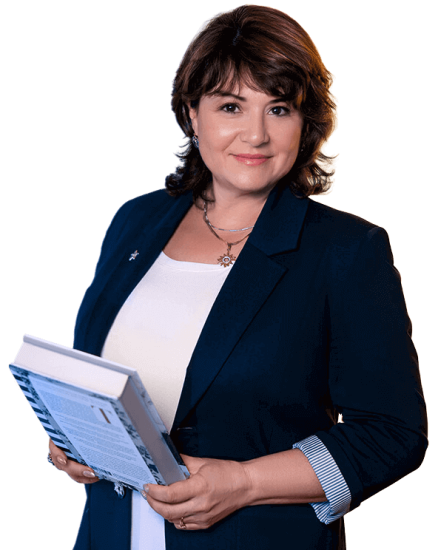

Change in property prices in Portugal over the past 5 years, %

(source: https://www.facebook.com/immigrant.invest.en/posts/property-prices-in-portugal-rose-by-163-over-the-past-year-according-to-the-nati/1252355816900939/ )

Portugal remains one of Europe's most attractive markets, with strong demand for housing supported by residency programs and interest from expats and investors, while limited supply in Lisbon, Porto, and coastal regions increases the potential for price growth and stable rental yields.

"Real estate in Portugal is one of the most dynamic markets in Europe. Rising prices, tax incentives, and residency programs make it attractive, but they require knowledge. I'll show you how to invest wisely and protect your capital."

— Ksenia , investment consultant, Vienna Property Investment

I'm Ksenia Levina, a lawyer by training with extensive experience in investment and construction. My practice encompasses real estate transaction support in Europe, strategy development for private and corporate clients, and project management across multiple jurisdictions. I combine legal expertise with practical market knowledge to help investors not only preserve capital but also maximize value in a rapidly changing economy.

Austria or Portugal?

Austria is a stable and attractive investment destination, but it's more suited to conservative investors: here, investing in the real estate market is primarily a way to preserve capital with moderate, predictable growth. Investing is more complex, and the requirements are stricter, but:

- Market stability and predictability: prices rise smoothly, without sudden jumps;

- Legal security of transactions and transparency of procedures;

- High quality real estate – modern and reliable houses, apartments and commercial properties;

- Long-term capital security – Austria is considered a safe haven for investors;

- The presence of developed infrastructure and a high standard of living, which maintains the demand for housing on a permanent basis.

Portugal , in turn, offers more dynamic opportunities:

- Low threshold for starting investments (from €250,000);

- Flexible rules for obtaining a residence permit and the Golden Visa program;

- High demand for housing due to tourists and foreigners, which results in rental yields of up to 5–7% in popular regions;

- Potential for price growth due to infrastructure development and the country's popularity among expats.

The choice between Austria and Portugal depends on your goals: high returns and dynamics with elements of risk or stability, reliability and long-term capital protection.

Portugal's place on the European investment map

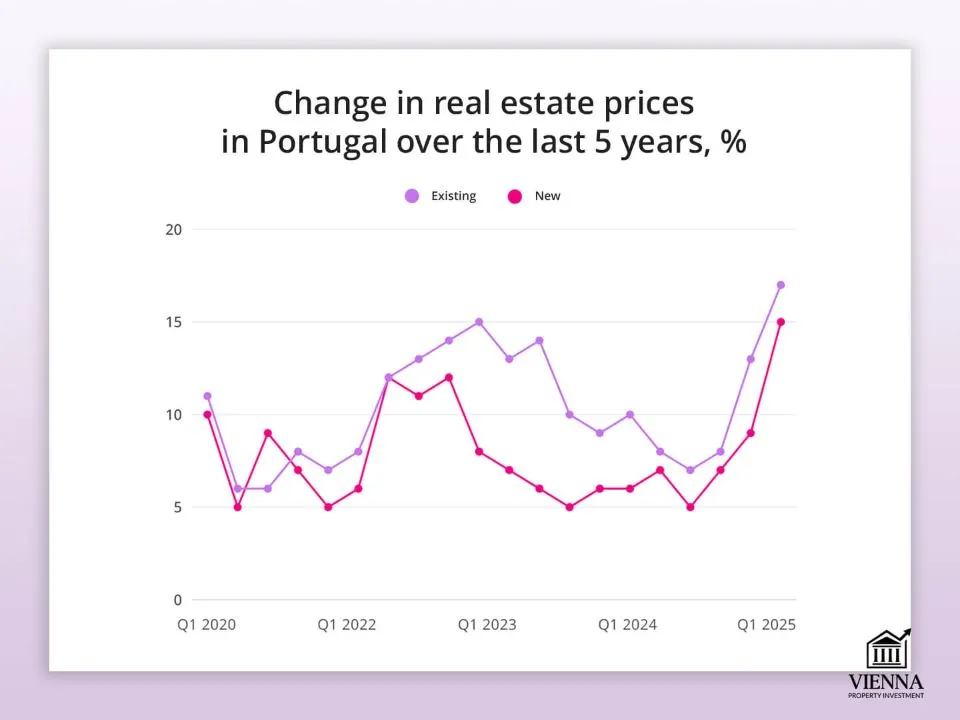

Changes in residential property prices in Portugal

(source: https://imin-portugal.com/blog/buying-property-in-portugal/ )

Portugal has firmly established itself as one of the most attractive real estate markets in Europe. Real estate investment is expected to grow by 8% in 2025, reaching €2.5 billion.

Portugal combines the stability of a developed economy with high demand for housing thanks to tourism and residency programs. Lisbon, Porto, and the Algarve remain leaders in investment attractiveness.

According to PwC's Emerging Trends in Real Estate Europe 2024 report, Lisbon is ranked 8th among the most attractive cities for real estate investment in Europe.

Profitability and investment potential

According to Numbeo, Lisbon will rank 25th among global cities in terms of real estate price index in 2025, indicating strong demand and potential for price growth. My experience confirms this: clients who have invested in Lisbon and Porto real estate report stable price growth and attractive rental conditions, particularly in tourist areas.

Portugal has established itself as a country with a transparent legal system, as confirmed by ratings from PwC and the World Bank. This makes the real estate purchasing process clear and predictable for foreign investors.

Comparison with competitors

| Location | Average rental yield | Entry threshold (min.) | Main advantages | Main disadvantages |

|---|---|---|---|---|

| Portugal | 4–6% per annum (Lisbon, Algarve) | €250 000–€500 000 | High tourist flow, residency programs, transparent transactions | Rising prices may limit profitability, high competition in popular areas |

| Spain | 3–5% per annum (Madrid, Barcelona, Costa Brava) | €250 000–€400 000 | Large market, developed infrastructure, popular rental destinations | High competition, regional restrictions on short-term rentals |

| Greece | 5–7% per annum (Athens, islands) | €250 000–€500 000 | Tourist demand, Golden Visa programs | Regulatory risks, seasonality, bureaucracy |

| Italy | 3–4% per annum (Rome, Florence, Milan) | €200 000–€400 000 | Cultural appeal, historical property | Difficulties with renting, bureaucracy, slow price growth |

| Cyprus | 4–6% per annum (Limassol, Paphos) | €300 000–€500 000 | Residency programs, taxation, tourism market | Limited market, political instability |

Why investors are fleeing overheated markets for Portugal

Many investors, particularly from Spain, France, and some Northern European countries, are seeking new opportunities amid overheated markets where property prices have reached historic highs and rental yields are declining. Portugal attracts them with its combination of robust economic growth, transparent legal system, and high demand for housing, particularly in Lisbon, Porto, and the tourist regions of the Algarve and Madeira.

Furthermore, the country offers residency programs and tax incentives for foreign investors, making the real estate purchasing process more profitable and predictable. This is especially relevant for those looking to buy an apartment in Portugal for both personal residence and long-term rental.

Portugal Real Estate Market Overview

The Portuguese real estate market combines a history of post-crisis recovery, dynamic price growth, and a diverse range of investment options. Understanding these factors helps make informed decisions when buying a home and investing in Portuguese real estate.

History and Impact of the 2008 Crisis

Real GDP growth in Portugal (1986–2018)

(source: https://www.mdpi.com/1911-8074/16/1/46 )

Following the 2008 financial crisis, Portugal's real estate market experienced a sharp decline in prices, particularly in Lisbon and Porto. However, a recovery began in 2012. Programs such as the Golden Visa played a key role in attracting foreign investment, particularly in Lisbon and Porto. According to a study by the IZA Institute of Labor Economics, since 2012, the number of real estate transactions worth €500,000 has increased by 60% compared to the period before the program's introduction.

Price dynamics

The market has been growing steadily since 2015. In 2024, the average growth rate was 7-8%, with popular areas of Lisbon and the Algarve showing even higher growth. If you're looking to buy an apartment in Portugal for rental purposes, it's worth focusing on these dynamic markets, where demand exceeds supply.

However, in October 2023, the government suspended the possibility of obtaining a Golden Visa through real estate investment, which affected price dynamics in central areas.

Portugal's main real estate centers

Lisbon is the country's capital and the main hub of business and tourism. It is home to office and residential complexes, historic districts, and prestigious neighborhoods such as Alfama, Baixa, and Parque das Naçoes. The average apartment price in central Lisbon ranges from €4,500 to €6,500 per square meter, with short-term rental yields reaching 5-7% per annum.

Porto is a cultural and economic hub in the north of the country, a city with developed infrastructure, an international airport, and attractive tourism. The average housing price in Porto is €3,000–4,500 per square meter, with rental yields of approximately 4–5%. Both resale apartments in the historic center and new developments for long-term rental are popular here.

The Algarve is a coastline with high demand for tourist and luxury real estate. The average price of villas and apartments is €3,500–7,500/m², with seasonal yields reaching 6–8%. My clients often choose the Algarve for short-term rentals and high-season income, particularly in Lagos and Albufeira.

Madeira and the Azores are tranquil regions for investors seeking premium properties, ocean views, and a quiet lifestyle. Average property prices range from €2,500–5,000 per square meter. Madeira is particularly popular for personal residences or long-term rentals, while the Azores is a niche market for experienced investors.

Object types

Popular on the Portuguese market:

- Resale real estate often offers the possibility of renovation, which can increase profitability.

- New buildings and the luxury segment – for investors focused on the premium market.

- Tourist real estate - apartments and villas for Airbnb and long-term rentals.

Tip : Buying property in Portugal in tourist areas requires careful analysis of short-term rental regulations to minimize risks and maximize returns.

Who buys?

The main foreign buyers are citizens of France and the UK, as well as investors from the US, China, and Brazil. They are looking for property in Portugal for personal use, rental purposes, or participation in residency programs. My experience with clients shows that Europeans often choose existing properties in large cities, while investors from Asia and America prefer new builds and luxury properties.

Domestic demand and mortgages

Domestic demand plays a key role in the Portuguese real estate market. Local residents are actively buying homes, particularly in Lisbon, Porto, and the Algarve, maintaining market stability and preventing prices from falling sharply even in the face of fluctuations in external factors.

The role of the mortgage market is particularly noteworthy: interest rates remain relatively low (3.3-4%), making homeownership affordable for the majority of the population. It's important to note that mortgage rates are subject to change depending on the economic situation and the policies of the European Central Bank.

For foreign investors looking to buy property in Portugal, banks typically offer loans of up to 80% of the property's value. Lenders consider the borrower's income, credit history, and financial stability when determining loan terms.

Ownership Formats and Investment Strategies for Real Estate in Portugal

The choice of transaction method directly impacts taxes, property management, and exit strategy. Portugal offers flexible terms, with optimal formats for different investor categories.

Purchase by an individual

This is the simplest and most common way to buy property in Portugal. It's most often chosen by clients planning long-term ownership or personal use of the property. For example, one of my clients from France registered an apartment in the Algarve in her own name to reduce administrative costs. The downside is limited tax optimization options upon resale.

Through a company in the EU

Establishing a company in Portugal or an EU jurisdiction (a combination of Portugal and Malta is often used) is suitable for large investors and those planning to manage multiple properties. This offers tax advantages and simplifies asset transfers. I often recommend this format to clients who are purchasing not just one apartment, but a whole property package.

Funds and REITs (SIGI in Portugal)

Investing through real estate funds allows you to participate in the market without having to manage the property yourself. Portugal uses the SIGI (Sociedades de Investimento e Gestão Imobiliária) format, a tax-incentive equivalent of a REIT. This method is chosen by investors focused on dividends and long-term growth.

Share purchases, inheritance, and family trusts

Fractional ownership and trust structures are popular for family investments. This reduces the risk of disputes between heirs and simplifies management. I had a client from Brazil who transferred ownership of a villa in the Algarve to a family trust to protect assets and structure inheritance.

Legal restrictions for non-residents

Portugal has a distinct advantage over many other countries in that it imposes no restrictions on foreign buyers. Non-residents have the same rights as citizens: they can purchase apartments, houses, or commercial properties in Portugal in any size. To complete the transaction, you must obtain a tax identification number (NIF) and pay an annual property tax (IMI), which typically amounts to 0.3–0.8% of the cadastral value.

Legal aspects of buying property in Portugal

The process of purchasing real estate in Portugal is fairly transparent, but it does require following a number of procedures and engaging specialists. Mistakes at this stage can be costly, so it's important to understand the steps and risks involved.

Step-by-step transaction process

- Obtaining a NIF (1 day) – a tax number (Número de Identificação Fiscal) is mandatory for all transactions, including the purchase of real estate in Portugal.

- Opening a bank account (1-3 days) in a Portuguese bank to settle the transaction.

- Involve a lawyer – he will inspect the property (5–10 days), prepare contracts and protect your interests.

- Signing of the preliminary contract (CPCV) (1–2 days) and payment of a deposit (usually 10%).

- Conclusion of the final transaction at the notary and payment of the remaining amount (30–60 days).

- Registration at the Conservatória do Registo Predial (Property Registry) to formalise ownership (2–5 days).

Average duration: 1.5–2 months (for mortgages up to 3 months). If you're in Portugal in person, you'll need a translator, as all documentation is in Portuguese.

The role of a lawyer and agent

A lawyer checks the legal status of the property (debts, mortgages, and permits for use), prepares contracts, and oversees all stages of the transaction. An agent helps select a property and facilitates negotiations, but does not replace a lawyer.

One of my clients was trying to save money on a lawyer but ran into a problem with an existing mortgage on the property. We brought in a lawyer at a late stage, but it delayed the deal by two months.

My opinion: Always use an independent lawyer, not one recommended by the seller or agent.

Requirements for the buyer

- Passport or other valid identification document.

- NIF (Número de Identificação Fiscal) – Portuguese tax number.

- Visa or residence permit – although foreigners can purchase real estate without a residence permit, an entry visa or resident status may be required for a long-term stay and to resolve issues related to the purchase.

- Portuguese bank account for settlement of the transaction.

- Confirmation of source of funds (within the framework of AML regulations – combating money laundering).

- Sales and purchase agreement (signed by both parties).

- Documents required for a mortgage (if purchasing with a loan): income certificate, tax returns, proof of employment or business, credit history (sometimes requested).

To obtain a mortgage in Portugal, both residents and non-residents must have a good credit history, sufficient income, and a down payment of 30 to 50% of the property's value.

Peculiarities of transactions on the islands (Madeira and the Azores)

Legally, the process of purchasing real estate in Madeira and the Azores is identical to transactions in mainland Portugal: a NIF, a preliminary contract (CPCV), signature before a notary, and registration with the Conservatorium are required. There are no restrictions for foreign investors, and all rights are fully preserved.

However, there are a few caveats. Firstly, due to the geographical remoteness, obtaining documents and approvals may take longer (especially in the Azores). Secondly, when purchasing tourist properties or rental apartments in Madeira and the Azores, you should check for an Alojamento Local (AL) license and ensure the property complies with local regulations. These licenses are regulated by municipalities, and some areas have restrictions on new ones.

Possibility of remote purchase by proxy

In Portugal, purchasing real estate remotely is a common practice, especially among foreign investors. The transaction is formalized through a power of attorney (Procuração), certified by a notary in the buyer's country of residence and legalized with an apostille. With this power of attorney, a lawyer or authorized representative can sign all documents, including the CPCV and the final deed.

There are no additional restrictions for non-residents, but it is important that the power of attorney be properly drafted according to the Portuguese template and translated into Portuguese. In practice, I recommend checking that the power of attorney covers all necessary powers: opening a bank account, obtaining a NIF, signing the contract, and registering the property. This will avoid delays at the final stage.

Taxes, fees and costs when buying property in Portugal

When planning a property purchase in Portugal, it's important to consider all tax obligations and associated costs in advance. These impact the property's actual value and investment strategy.

IMT – property transfer tax

IMT (Imposto Municipal sobre Transmissões) is paid when purchasing a home. The rate is progressive, ranging from 1% to 7.5%, depending on the property's value and whether it will be used as a primary residence. For example, for an apartment costing €300,000, the tax would be approximately €8,000–9,000.

Tip: If you're buying multiple properties, it's more profitable to register the transactions in the names of different parties to reduce the rate.

| Property price (€) | Primary residence (%) | Second home (%) |

|---|---|---|

| Up to 92,407 | 0 | 1 |

| 92 407 – 126 403 | 2 | 2 |

| 126 403 – 172 348 | 5 | 3 |

| 172 348 – 287 213 | 7 | 6 |

| 287 213 – 574 323 | 8 | 7 |

| Over 574,323 | 6 | 6 |

Stamp duty (IS)

The Imposto do Selo (Imposto do Selo) is a fixed 0.8% of the transaction price and is paid on the day the contract is signed at the notary's office. This is a fixed tax on the property purchase price. If the property is financed with a mortgage, an additional 0.6% stamp duty is added to the loan amount.

IMI – annual municipal tax

After the transaction is completed, the property owner in Portugal is required to pay the IMI (Imposto Municipal sobre Imóveis)—a property tax equivalent. The rate is 0.3–0.45% of the property's cadastral value.

The cadastral value (CV) is calculated by the Tax Office (AT) based on the property's characteristics: location, area, type of use, and other parameters. For example, for an apartment in Lisbon with a CV of €200,000, the annual tax would be approximately €600–900.

VAT on new buildings

When purchasing an apartment in a new building, VAT is already included in the price and amounts to 23% (for commercial properties). For residential properties, the tax is included in the price; no additional payments are required.

Tax Optimization – NHR Regime

NHR (Non-Habitual Resident) status allows for significant tax reductions on income, including rent and income from abroad, for up to 10 years. This regime makes Portuguese real estate particularly attractive to investors planning to live or obtain a residence permit. It's best to apply for NHR status within the first year of residence to avoid losing eligibility for benefits.

Portugal vs Austria

| Indicator | Portugal | Austria |

|---|---|---|

| Property transfer tax | IMT: 1–7.5% (primary residence) | Grunderwerbssteuer: 3.5% |

| Stamp Duty | IS: 0.8% + 0.6% for mortgages | Stamp duty: 1.1% |

| Annual property tax | IMI: 0.3–0.45% of VPT | Municipal tax: 0.2–0.5% |

| VAT on new buildings | Included in the price, up to 23% | Usually 20% |

| Total transaction costs | 6–8% of the property value | 7–10% |

| Tax benefits for residents | NHR status allows you to reduce taxes for up to 10 years | There are no benefits for foreign buyers |

Austria wins for market stability and high real estate liquidity. Here, prices rise predictably, demand for properties remains stable, and the process of selling and transferring ownership is quick and straightforward. Portugal , on the other hand, attracts investors with higher yields and tax incentives, but the market is more dynamic and seasonal, and liquidity varies by region and property type.

Golden Visa in Portugal: New Opportunities and Changes

The Portuguese Golden Visa has long been one of the most attractive instruments for foreign investors. Since 2024, the program has changed its terms: real estate purchases are no longer considered a direct route to residency. This opens up new opportunities through investments in funds, businesses, or cultural projects, but requires careful consideration to avoid wasting time and money.

New thresholds and investment options

Investment funds (Fund Units) – minimum contribution of €500,000 to Portuguese investment funds. I recommend this option to clients who want to earn passive income without managing real estate.

Starting or investing in a company – either creating at least 10 new jobs or investing €500,000 in an existing business. One of my clients chose this path, opening a business in Lisbon focused on IT services.

Donations to culture – a minimum of €250,000 to national heritage or research projects. An excellent opportunity to support culture and simultaneously obtain a residence permit.

To maintain residency status, you must spend an average of 7 days per year in Portugal.

If the goal is to live without major investments, alternative options are suitable:

- D7 Visa – based on stable income from abroad.

- Digital Nomad Visa – for remote work.

Benefits of residency through Golden Visa

Obtaining residency in Portugal opens a wide range of opportunities for the investor and his family:

- The right of residence in Portugal means free entry and residence in the country for all family members.

- Access to the Schengen area – the opportunity to travel to 27 European countries without a visa.

- Tax incentives and optimization – when combined with the NHR regime, it is possible to significantly reduce the taxation of income received abroad.

- Stable legal environment – Portugal is a member of the EU, has transparent legislation, and investor rights are protected.

- Education and healthcare – access to public schools and universities, quality healthcare for residents.

- Flexibility for entrepreneurs and digital nomads – you can run a business, invest, and simultaneously enjoy the benefits of the European residency program.

Common mistakes investors make when applying for a Golden Visa:

- Attempting to obtain a residence permit through the purchase of real estate after 2024.

- Insufficient minimum period of stay in Portugal (7 days per year).

- Errors in powers of attorney and document translations.

- Unaccounted expenses for fees, legal services and taxes.

- Incorrect confirmation of the legality of income sources.

Path to Citizenship through the Golden Visa

Currently, after holding a Portuguese Golden Visa for five years, an investor and their family can apply for Portuguese citizenship and an EU passport. This requires:

- Reside in Portugal for at least 7 days per year;

- Possess a legal residence permit and comply with all program conditions;

- Confirm your knowledge of Portuguese at level A2;

- Have no serious criminal record;

- Confirm the legality of income sources.

Obtaining citizenship grants full access to the Schengen Area, the right to work and study in any EU country, and the ability to pass citizenship on to children. For investors, this is a strategic tool: investing in Portugal simultaneously provides a legal European passport and tax advantages through the NHR regime.

What changed in 2023–2025

The Golden Visa program has undergone key changes:

- Exclusion of real estate as a direct path to a residence permit (from 2024).

- Focus on investments in foundations, businesses and culture: minimum amounts are €500,000 for foundations and companies, €250,000 for cultural donations.

Tightening of requirements for citizenship (draft law of June 23, 2025):

- They plan to increase the minimum period of residence for most applicants to 10 years (7 years for CPLP countries);

- Mandatory knowledge of Portuguese (level A2);

- Culture and Rights Test;

- Tightening of criminal record checks;

- Closing the path through Sephardic Jewish origins.

- Increased transparency of fees and responsibilities – all fees, including legal ones, have been updated and are now fixed for different investment types.

Comparison with Austria

Austria offers another route to citizenship through the D-visa or Self-Sufficiency program, but the process is more rigorous and lengthy:

- Proof of stable high income or large investments is required;

- The minimum period of residence before applying for citizenship is 10 years;

- There is less flexibility: investments in real estate do not directly grant citizenship;

- The naturalization process is more complicated and bureaucratic.

Austria excels in terms of stability, predictability, and long-term protection of investor rights. It offers fewer risks, stricter and more transparent regulations, and higher real estate liquidity and faster citizenship acquisition than Portugal.

Rentals and Income: Investing in Portuguese Real Estate

The rental market in Portugal is growing rapidly, but it requires careful consideration. Understanding the differences between short-term and long-term rentals helps investors choose a strategy that optimally balances returns and risks.

Short-term rentals: Airbnb and Booking

Short-term rentals remain popular in tourist areas such as Lisbon, Porto, the Algarve, and Madeira. Returns are typically 5–7% per annum, but there are restrictions on AL (Alojamento Local) licenses.

New rules: Cities are introducing quotas on the number of licenses to regulate the market and reduce pressure on local residents' housing. Client example: the owner of an apartment in the Algarve rents it out on Airbnb, but obtained a license in advance—helping avoid fines and continue to generate income.

Long-term rentals: stability and predictable income

Long-term contracts attract investors with their stability: returns of 3–5% per annum and fewer seasonal fluctuations. This option appeals to clients who value a predictable income stream and minimal risk.

For portfolio investors, it makes sense to combine several properties—some for short-term rentals, some for long-term rentals—to balance profitability and stability.

Rental yields by region in Portugal

| Region | Average price €/m² | Short-term rentals (Airbnb, Booking) | Long-term lease | Notes |

|---|---|---|---|---|

| Lisbon | 4 500–5 500 | 6–7% | 3–4% | High demand, rising prices, AL license restrictions |

| Porto | 3 500–4 500 | 5–6% | 3–4% | A promising market with stable demand for long-term rentals |

| Algarve | 3 000–4 000 | 6–7% | 3–5% | Strong tourist season, seasonal fluctuations in income |

| Madeira | 2 500–3 500 | 5% | 3% | Less saturated market, stable but low returns |

| Azores | 2 000–3 000 | 4–5% | 2–3% | More remote regions, limited tourist flow |

| Évora / Alentejo | 1 500–2 500 | 4–5% | 3% | Regions with lower demand, but cheaper entry and low competition |

Management companies and taxation

Management companies help optimize income and resolve tax issues.

The main functions of management companies are:

- Short-term rental management and AL licensing.

- Selection and control of tenants for long-term leases.

- Rent collection and financial reporting.

- Organization of cleaning, repair and maintenance of housing.

- Resolving legal issues and interaction with tax authorities.

- Consultations on income optimization and risk minimization.

When renting out real estate, residents pay income tax on a progressive scale ranging from 14% to 48%, depending on the annual income. Non-residents are subject to a flat rate of 25%. However, only income earned in Portugal is taxed.

Rental Comparison: Austria vs. Portugal

| Country | Short-term rental | Long-term lease | Rent regulation | Taxation |

|---|---|---|---|---|

| Portugal | 5–7% per annum | 3–5% per annum | AL short-term rental licenses, quotas in Lisbon and Porto | 28% for non-residents, progressive scale for residents, optimization possible through NHR |

| Austria | 2–3% per annum | 2–3% per annum | Strict regulation, Airbnb permits in major cities | Progressive scale of up to 30% on income, rent is strictly regulated by law |

Yields in the Portuguese market are higher, but rental regulations are stricter and subject to change. In Austria, yields are lower (2–3%), but the market is stable, regulations are predictable, and the risk of fines is minimal. Against this backdrop, real estate prices in Germany's major cities are often perceived as too high for conservative strategies.

Where to Buy: An Analysis of Portugal's Regions

The choice of region for purchasing real estate directly impacts profitability, liquidity, and risk. Let's examine key regions in terms of demand, infrastructure, and investment potential.

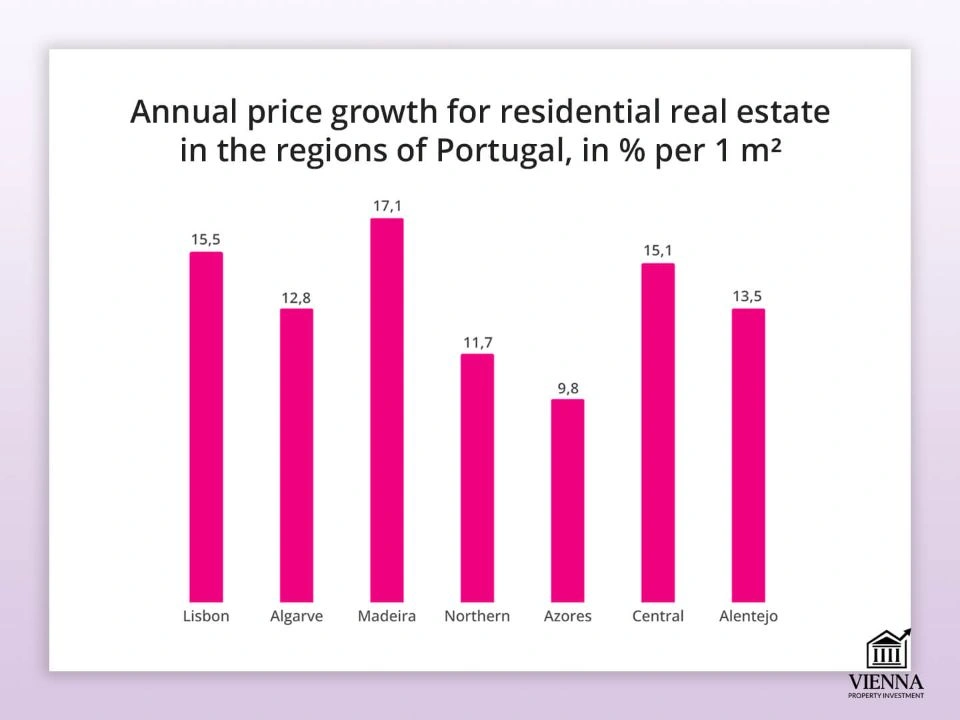

Annual growth of residential property prices in Portugal's regions

(source: https://imin-portugal.com/blog/real-estate-portugal/ )

Lisbon: Top Segment and High Demand

Lisbon remains a hub of economic and tourist activity. Strong demand for short-term and long-term rentals is driving up prices.

- Average price: €4,500–€5,500/m²

- Rental yield: short-term 6-7%, long-term 3-4%

Porto: An accessible and promising market

Porto attracts tourists and students, and demand for long-term rentals is stable. Prices are lower than in Lisbon, but demand continues to grow.

- Average price: €3,500–€4,500/m²

- Rental yield: short-term 5-6%, long-term 3-4%

Algarve: luxury and seasonal rentals

The region is popular with tourists, especially during the summer season. Seasonal rentals offer high returns, but demand fluctuates.

- Average price: €3,000–€4,000/m²

- Rental yield: short-term 6-7%, long-term 3-5%

Madeira: Climate and Tax Benefits

The region is attractive to aging investors and digital nomads. Tax incentives and a stable tourist flow make the market promising.

- Average price: €2,500–€3,500/m²

- Rental yield: short-term 5%, long-term 3%

The Azores: A Niche for Long-Term Investors

The market is less saturated and suitable for long-term investments with a 5-10-year horizon. Returns are lower, but prices are low.

- Average price: €2,000–€3,000/m²

- Rental yield: short-term 4-5%, long-term 2-3%

| Category | Region | Infrastructure and transport | Tenant demand |

|---|---|---|---|

| Where are they buying now? | Lisbon | Metro, international airport, expressways | Business professionals, relocators, tourists |

| Porto | Airport, railway junction, city center | Tourists, IT, students | |

| Algarve | Beaches, airport, roads to resorts | Tourists, premium segment | |

| Madeira | Airport, roads on the island | Tourists, long-term residents | |

| Azores | Airport, limited transport network | Tourists, long-term tenants | |

| Where growth is expected | Lisbon suburbs | New roads, metro stations, schools | Families, relocates |

| Porto suburbs | Development of transport and infrastructure | Students, young families | |

| Algarve interior | New resort areas, roads | Tourists, seasonal rentals | |

| Madeira inland | Improving infrastructure, roads | Long-term residents |

Secondary market and new buildings: what to choose

Choosing between resale and new build properties in Portugal depends on your investment goals, budget, and preferences. Both segments have their advantages and limitations.

In 2024, 156,325 residential properties were sold in Portugal, an increase of 14.5% compared to the previous year. Of these, 124,445 (79.6%) were existing properties, and 31,880 (20.4%) were new properties.

Secondary market: historic buildings and renovation

Advantages : The secondary market accounts for approximately 80% of all transactions, with most properties located in the historic centers of Lisbon, Porto, and other major cities. These properties are attractive for both tourist rentals and long-term residences.

Restrictions : Restoring such properties requires compliance with architectural regulations and obtaining reconstruction permits. Some buildings require extensive renovations, which increases the purchase price.

One of my clients purchased an apartment in the historic center of Lisbon for €380,000. Despite additional renovation costs, the property generates a stable income from short-term rentals.

New buildings: limited supply and growing demand

Features : New construction accounts for approximately 20% of transactions. New apartments and villas offer modern layouts, energy efficiency, and developer warranties.

Advantage for investors : New buildings are easier to rent out long-term or sell with an increase in value.

In the Algarve, one client invested €600,000 in a new apartment by the sea, and after two years the property had increased in price by 15%.

Projects with AL license

Advantages : Short-term rentals through Airbnb or Booking platforms provide income of up to 6-7% per annum, especially in Lisbon and Porto.

Features : An AL license is required to legally rent out apartments to tourists. In some areas, quotas are limited.

Examples of properties with a budget of €250,000–€1 million

| Budget (€) | Object type | Region | Price per m² (€) | Peculiarities |

|---|---|---|---|---|

| 250,000 | Apartment | Porto | 2,500 | Secondary market, city center |

| 500,000 | Villa | Algarve | 3,000 | New building, close to the beach |

| 750,000 | Apartments | Lisbon | 4,000 | Historic center, renovation |

| 1,000,000 | Penthouse | Madeira | 3,500 | Panoramic view, premium segment |

Comparison of new buildings in Portugal and Austria

New developments in Portugal offer more affordable prices and potentially higher rental yields, especially in popular tourist areas and Lisbon. However, Austria has advantages in terms of price stability, construction quality, and energy efficiency—properties are easier to sell and maintain liquidity even in volatile years.

| Parameter | Portugal | Austria |

|---|---|---|

| Construction quality | High, especially in new buildings | Very high, strict standards |

| ESG | Growing attention to environmental friendliness | Developed sustainable construction programs |

| Rental yield | Higher, especially with an AL license | Lower but stable |

| Risks | Rent regulation, competition | High cost, tax burden |

Alternative Investor Strategies: Where to Look for Opportunities

Investing in Portuguese real estate isn't limited to the standard purchase of a rental apartment. There are several alternative approaches that can optimize returns, reduce risks, and expand your investment portfolio.

Renovation of the old stock: Lisboa and Porto

Purchasing old apartments or buildings, then renovating them and renting or reselling them remains a popular strategy. The existing market offers properties below average prices, and after renovation, their prices and profitability increase significantly.

For example, one of my clients purchased an apartment in central Lisbon for €320,000, invested €50,000 in renovations, and a year later was able to rent it out on Airbnb with an annual return of around 6%. It's important to consider architectural restrictions and the need for renovation permits.

Investments in tourism infrastructure

Investing in mini-hotels, aparthotels and guest houses allows you to generate a stable income due to the high demand for tourist accommodation in Lisbon, the Algarve and the islands.

One client invested in an aparthotel in the Algarve for €700,000, with an average occupancy rate of approximately 70%, resulting in a yield of approximately 7% per annum. It is recommended to use management companies to optimize income and comply with short-term rental laws.

Investing through funds: an alternative to the Golden Visa

Investing in Portuguese REITs (SIGI) or real estate investment funds allows you to generate income from the market without directly managing the property and reduces legal risks.

For example, a client invested €500,000 in a Portuguese real estate fund and receives passive income from dividends while retaining residency. Before investing, it's important to check the fund's reputation and fee structure.

Building Land: Algarve and Islands

Purchasing land for residential or tourist real estate development remains a promising strategy, as the potential for land value growth is higher than that of completed properties.

One of my clients purchased a plot of land in Madeira for €300,000, and its value is now estimated at €420,000 after the infrastructure projects are completed. When choosing a plot, it's important to consider the availability of infrastructure, environmental restrictions, and construction restrictions on the islands.

Comparison with Vienna: Dynamics vs. Stability

Portugal offers high potential for price volatility and the opportunity to earn high yields, but regulatory and seasonal risks remain significant. Austria, by contrast, offers market stability, predictable liquidity, and returns, although the entry barrier is higher.

For investors with a flexible strategy and a willingness to manage assets, Portugal offers more opportunities, while for conservative investors, Austria remains the best choice.

Risks and Disadvantages of Investing in Portuguese Real Estate

Investing in Portuguese real estate offers high returns and attractive opportunities. Whether you're considering a house or apartment in Portugal, understanding the risks will help you avoid unexpected problems.

Bureaucracy and registration

The process of purchasing and registering real estate in Portugal can take longer than investors expect. Obtaining a tax identification number (NIF), legal due diligence, and registering with the Conservatorium are sometimes accompanied by delays.

For example, one of my clients waited almost two months to finalize a Lisbon apartment deal due to Encargos audits and mortgage encumbrances. Always work with an experienced lawyer and agent to minimize bureaucratic risks.

Regulation of Airbnb and short-term rentals

Short-term rentals through platforms like Airbnb and Booking require an AL (Alojamento Local) license, and popular cities like Lisbon and Porto have quotas for issuing new permits. Clients often face restrictions on renewing their licenses or fines for violating the regulations.

Seasonality of income in resort areas

In regions with high tourist demand, such as the Algarve, Madeira, and the Azores, rental income varies greatly depending on the season. For example, in the summer, yields can reach 7-8%, while in the winter they drop to 2-3%. To reduce risk, clients combine short-term and long-term rentals or focus on properties in Lisbon and Porto, where demand is more stable. It's important to evaluate property prices in Portugal and potential yields given seasonal fluctuations.

Limited supply of new buildings

The new-build market in Portugal is limited, especially in popular tourist areas. This impacts the selection of properties and may slow portfolio growth for investors targeting new apartments and houses in Portugal with an AL license.

Liquidity in small regions

In smaller towns and on islands, properties take longer to sell than in Lisbon, Porto, or the Algarve. For example, an apartment in the Azores can remain on the market for up to a year. Consider liquidity when choosing a property and try to buy in areas with constant demand or tourist traffic.

Comparison with Austria

Portugal offers higher returns and market dynamics, but is fraught with regulatory and seasonal risks. Austria offers stability, predictability, and liquidity, making it more suitable for conservative investors. Ultimately, the choice depends on your strategy: high returns with risk management in Portugal or stable growth and capital protection in Austria.

Accommodation and lifestyle in Portugal

When investing in real estate in Portugal, Ukrainians and other foreign buyers should consider not only the profitability but also the level of comfort, infrastructure, and service. Understanding the living conditions helps them assess how daily life will be after purchasing a house or apartment in Portugal.

Climate, medicine and education

Portugal is renowned for its mild Mediterranean climate, making life comfortable year-round. Average winter temperatures in Lisbon are 12°C (53°F), summer temperatures are 28°C (82°F), and on the southern Algarve coast, summers are hot and dry.

healthcare . Residents have access to the public healthcare system (SNS), where basic services are free or cost a nominal fee. Non-residents and foreign investors can take out private insurance, which covers hospitalization, outpatient care, and emergency treatment. Insurance costs start at €50–€100 per month per person, and €150–€250 for families.

Education is also diverse: state schools are free for residents, while private and international schools offer programs in English and other languages. Prices for international schools range from €5,000 to €15,000 per year, depending on the level and location.

Cost of living

The average cost of living in Portugal is lower than in Austria. Grocery and services in Lisbon cost approximately €700–1,000 per month per person, rent for a one- or two-bedroom apartment in the city center costs €1,000–1,500, and utilities are around €150–200. On the islands and in smaller towns, prices can be 10–20% lower.

Banking system and transport

The Portuguese banking system is transparent, with numerous international banks and online banking services. Non-residents can open bank accounts and obtain mortgages. The transportation infrastructure is well-developed: the metro, trams, high-speed trains, and international airports ensure comfortable travel. Clients buying real estate in Portugal often note the ease of integration into local life thanks to these systems.

Comparison with Austria

In terms of service and infrastructure, Austria wins: fast registration, high-quality healthcare, and transportation. Portugal, on the other hand, offers a unique lifestyle: a warm climate, sea, an active social life, and low cost of ownership. For investors, the choice depends on their priorities: Austria favors stability and service, while Portugal favors comfort, climate, and lifestyle.

A safe haven in Europe for investors and residents

If you consider real estate in Portugal as a form of capital protection and a "European haven ," the country offers a stable market and legal transparency. For example, many of my Ukrainian clients buy property in Portugal to preserve their assets in European currencies and enjoy the freedom to live peacefully in a safe country.

Portugal is actively attracting freelancers and digital nomads . Cities like Lisbon and Porto offer coworking spaces, stable internet, and comfortable conditions for remote work. Buying an apartment in Portugal or a beachfront property allows you to combine leisure and work, and the ease of obtaining a D7 visa or residency status makes the country even more attractive.

Retirees choose Portugal for its warm climate, low cost of living, and special tax incentives, including the NHR regime. By purchasing a house or apartment in Portugal, senior investors have the opportunity to live comfortably and affordably while remaining within the Schengen Area.

Austria generally wins in terms of stability, service level, and infrastructure. However, Portugal offers a unique lifestyle: freedom, comfort, a warm climate, and a lower cost of living. If you prioritize quiet stability and strict rules, choose Austria.

Selling real estate in Portugal without losses

Exiting a real estate investment in Portugal requires planning and understanding all the tax and legal nuances. Investors should consider in advance the timing of the sale, the methods of property transfer, and the impact of the Golden Visa program, if used during the purchase.

Selling real estate: deadlines and taxes

Selling a house in Portugal, an apartment in Portugal, or any other property requires careful consideration of taxes and documentation. The average sale period in popular areas like Lisbon or Porto is 3 to 6 months, while in less liquid areas, it can take up to a year.

The sale is subject to capital gains tax, which varies depending on the seller's residency and the type of property. For example, one of my clients sold a property in Lisbon, Portugal, in seven months, cleverly optimizing taxes through his NHR status. As a result, he paid only about 14% capital gains tax instead of the standard 28%.

Features of the Golden Visa

If a property was purchased for the Golden Visa program, it's important to consider the program's rules when selling. Previously purchased property allowed you to retain residency, but when exiting, you need to properly formalize the transaction to avoid losing your status. My experience shows that working with a lawyer and agent can help avoid fines and complications with renewing your residency.

Transfer of property within the family

Transferring a house or apartment in Portugal to relatives is possible through a gift or will. This is especially relevant for family investors who want to keep assets within the family and optimize taxation. One of my clients transferred property to his children through a power of attorney and registered the ownership correctly, minimizing taxes. He paid approximately 0.8% stamp duty (SD) on the property's value.

Comparison with Austria: Liquidity and Stability

Austria wins in terms of market liquidity and stability. Property sales there are typically faster, and legal and tax processes are more predictable. In Portugal, yields are higher, but transactions can take longer, especially in smaller regions or on islands.

Expert opinion: Ksenia Levina

Every purchase of an apartment or house is a step toward your goals, not just a transaction. Some people seek passive income and appreciation, while others value a comfortable lifestyle. I'll show you where this is possible: Austria for stability, Portugal and Poland for growth. Which country do you see as your asset?

— Ksenia , investment consultant, Vienna Property Investment

Over the years, I've been involved in dozens of transactions involving houses, apartments, and commercial properties in Portugal. Experience shows that proper planning and document verification can expedite the purchase process and minimize risks when selling real estate in Portugal.

When investing in real estate in Portugal, it's important to conduct a thorough due diligence: check for legal compliance, absence of encumbrances, compliance with licenses (AL, if the property is intended for short-term rental), technical condition, and energy efficiency. When inspecting a property in Portugal, it's crucial to engage an experienced lawyer and realtor to avoid mistakes that could cost tens of thousands of euros. I recommend that clients always check the Encargos, Hipotecas, and License of Utilization before signing a contract.

My approach involves investing part of my capital in stable countries with high liquidity, such as Austria, and part in dynamic markets with high growth potential, such as Portugal. Portuguese real estate offers high returns and benefits (NHR, Golden Visa), but the market requires active management. This balance allows for minimizing risks and increasing portfolio returns.

Conclusion

Choosing between real estate in Portugal and Austria depends on your goals. If you're looking for a dynamic lifestyle, more affordable housing, and a mild climate, Portugal is a great option. You can buy a house by the ocean or choose an apartment in Portugal for renting to tourists. This market will continue to grow, especially in Lisbon, Porto, and the Algarve, thanks to the migration of freelancers and retirees.

Austria, on the other hand, is all about stability and predictability. If the goal is long-term capital preservation and high-quality service, the Viennese market is ideal, and buying an apartment in Vienna logically fits into such a conservative strategy.

Before purchasing, always check the property's documents, request a registry extract, and ensure there are no encumbrances. If you're planning to buy property in Portugal for rental purposes, consider the rules for tourist licenses and tax implications. When transacting through the Golden Visa or NHR regime, it's important to structure the ownership structure correctly to minimize taxes upon sale.

In my experience, the Portuguese real estate market will grow due to the migration of digital nomads, retirees, and investors seeking a second home in Europe. Prices for Portuguese houses and apartments in top locations are already steadily increasing by 5-7% per year. Austria will remain a stable investment zone, but growth will be moderate—around 2-3% annually—but liquidity is higher.

Appendices and tables

Rental yields by city in Portugal

| City | Average yield (%) |

|---|---|

| Lisbon | 3.6 – 4.6 % |

| Porto | 5.5 – 5.7 % |

| Setubal | 5.1 – 5.4 % |

| Sintra | 6.2 – 6.4 % |

| Braga | 6.5 – 6.9 % |

| Faro (Algarve) | 5.8 – 6.8% (during the season up to 9%) |

| Aveiro | 5.4 – 5.9 % |

| Coimbra | 5.0 – 5.3 % |

| Guimarães | 6.0 – 6.6 % |

| Viana do Castelo | 6.3 – 6.8 % |

Price/Profitability Map

| City | Price per m² (€) | Average rent per m² (€) | Profitability (%) |

|---|---|---|---|

| Lisbon | 5 200 – 6 000 | 20 – 23 | 3.6 – 4.6 |

| Porto | 3 200 – 4 000 | 15 – 18 | 5.5 – 5.7 |

| Setubal | 2 700 – 3 200 | 12 – 14 | 5.1 – 5.4 |

| Sintra | 2 900 – 3 500 | 14 – 16 | 6.2 – 6.4 |

| Braga | 2 200 – 2 700 | 12 – 13 | 6.5 – 6.9 |

| Faro (Algarve) | 3 800 – 4 500 | 18 – 22 | 5.8 – 6.8 (up to 9% season) |

| Aveiro | 2 600 – 3 200 | 13 – 15 | 5.4 – 5.9 |

| Coimbra | 2 500 – 3 000 | 11 – 13 | 5.0 – 5.3 |

| Guimarães | 2 300 – 2 800 | 12 – 13 | 6.0 – 6.6 |

| Viana do Castelo | 2 400 – 2 900 | 13 – 14 | 6.3 – 6.8 |

Tax Comparison: Portugal vs. Austria

| Indicator | Portugal | Austria |

|---|---|---|

| Purchase Tax (IMT/GrESt) | 0–7.5% (progressive scale, depends on price) | Grunderwerbssteuer 3.5–6.5% |

| VAT on new buildings | 23% (only in the primary market) | 20% (when purchasing from the developer) |

| Annual Property Tax (IMI) | 0.3–0.45% of the cadastral value | 0.1–0.2% (Grundsteuer, depending on the region) |

| Rent tax (personal income tax) | 28% fixed (for non-residents) | 20–30% progressively |

| Capital gains tax | 28% (for non-residents) | Released after 10 years of ownership |

| Registration of the transaction | €250–€500 | €300–€500 |

Investor's Checklist: Real Estate in Portugal

1. Determine the investment objective

- Why buy: rent, resale, "European refuge"?

- Calculate your budget: the cost of an apartment in Portugal starts from €150,000 in small towns and from €250,000 in Lisbon.

2. Select a location

- Lisbon - high liquidity, but expensive entry.

- Porto – stable demand and development of tourism.

- Algarve is a resort area, rental season.

- Analyze: profitability, infrastructure, prospects for price growth.

3. Check the property and the seller

- Legal purity: extract from the Registro Predial (real estate register).

- Checking tax and utility debts.

- Make sure you have rental licenses (especially for Airbnb).

4. Calculate taxes and expenses

- IMT (purchase tax): up to 7.5%.

- IMI (annual tax): 0.3–0.45%.

- Rent tax: 28% (for non-residents).

- Consider the costs of a lawyer (€1,500–€3,000) and registration of the transaction.

5. Resolve the funding issue

- Mortgage for non-residents: up to 70% of the cost.

- Loan rate in 2025: 4–5% per annum.

6. Plan for rent and income

- Average yield: 4–6% in large cities.

- In resort regions it is higher, but there is a seasonality.

7. Prepare to exit the investment

- Sale: Capital gains tax – 28%.

- Plan your timing: in Lisbon, the exit takes 6-9 months.

8. Compare with alternatives

- Austria has a more stable economy, but lower profitability.

- Portugal – higher returns and flexibility, but more regulatory risks.

Investor scenarios

1. Investor with €250,000: rental income

My client, an IT specialist from Ukraine, was looking for an apartment in Portugal for rent and as a "European reserve.".

- What we found: a 1+1 apartment in Porto (52 m²) in a new building near the university.

- Price: €245,000.

- What I got: average rent of €1,100/month, 5.4% annual yield, the opportunity to apply for a Digital Nomad Visa and live in Portugal.

2. Pensioner with €500,000: comfort and ocean views

A client from the Czech Republic wanted a house in Portugal by the sea for her children to live and relax in.

- What we chose: a villa in the Algarve (160 m², 3 bedrooms, terrace with ocean views).

- Price: €495,000.

- What I got: clean air, a mild climate, tax breaks under the NHR program (for 10 years), the ability to transfer real estate to children with minimal taxes.

3. Family with children: life and education

A married couple with two children were looking for housing in Portugal to move to and send their children to an international school.

- What we found: a house in the suburbs of Lisbon (Carcavelos), 150 m², garden, 3 bedrooms.

- Price: €420,000.

- What we got: a British international school nearby, a quiet area, 25 minutes to the center of Lisbon, the possibility of renting out part of the house (up to €1,500/month).