Real Estate in Poland: How and Why to Invest

Today, Poland is one of the most dynamically developing markets in Europe. The combination of a stable economy, rising housing prices, and high liquidity makes Polish real estate attractive for both investment and personal residence.

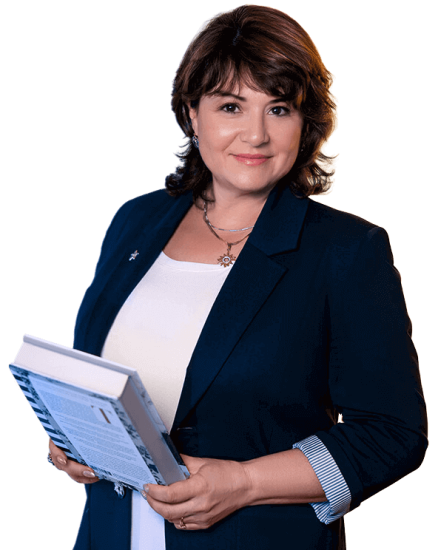

According to Statistics Poland, in the first quarter of 2025, housing prices in Poland increased by 6.6% year-on-year: +7.0% in the primary market and +6.2% in the secondary market. JLL forecasts that by the end of 2025, the price per square meter in Warsaw could reach around €3,100 (+6.2%), in Krakow – €2,800 (+5.7%), and in Poznan – €2,420 (+5.2%).

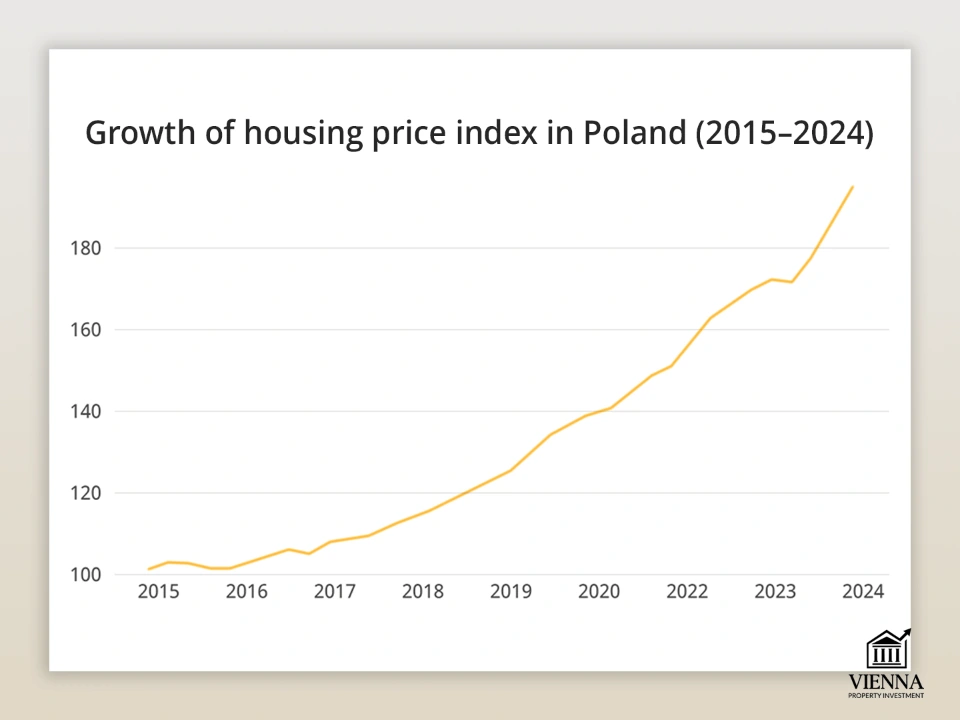

House price index in Poland

(source: https://ru.tradingeconomics.com/poland/housing-index )

The purpose of this article is to provide a comprehensive picture of why it's worth buying an apartment in Poznań now, examine how to buy a house in Poland profitably, and generally explain the real estate market in Poland for both investors and those seeking stable housing. It also provides a comparison with the Austrian real estate market.

"Investing in Polish real estate seems simple, but in practice, you need to consider laws, taxes, and regional specifics. I help clients navigate this process without making mistakes, ensuring every transaction is safe and profitable.".

— Ksenia , investment consultant, Vienna Property Investment

My name is Ksenia Levina. I am a lawyer with international practice and a real estate investor with over 10 years of experience working in European markets. Over the years, I have advised clients on purchasing property in the EU, helped them build investment portfolios, and supported transactions from property inspections to title registration.

Why now?

Poland demonstrates stable economic growth, progressive infrastructure development, and favorable conditions for foreigners. Nearshoring—the redirection of businesses closer to Western and Central European markets—is gaining ground here, and migration to the EU is also growing.

Poland vs. Austria: Which to Choose?

Austria is a market of stability and predictability: low risks, high transaction transparency, moderate but stable returns, and long-term price growth. Austrian real estate is valued as a safe haven for conservative investors who value reliability and capital preservation.

Poland, by contrast, is a dynamic market with more affordable housing prices, rapid development, and high potential for value appreciation. Here, one can expect higher rental yields and capitalization, but the risk level is also higher—the market is less predictable and sensitive to economic fluctuations and politics.

Austria is therefore better suited for those seeking stability and long-term investment protection, while Poland is attractive to investors willing to take greater risks for the potential for higher returns.

Poland's place on the European investment map

France has long held a strong position among Europe's leading markets. Its legal framework protects investors' rights, and its high liquidity allows properties to find buyers and tenants.

According to Mordor Intelligence Source, the French residential real estate market is valued at $528.33 billion in 2025 and is projected to grow to $697.52 billion by 2030, representing a compound annual growth rate (CAGR) of 5.92%.

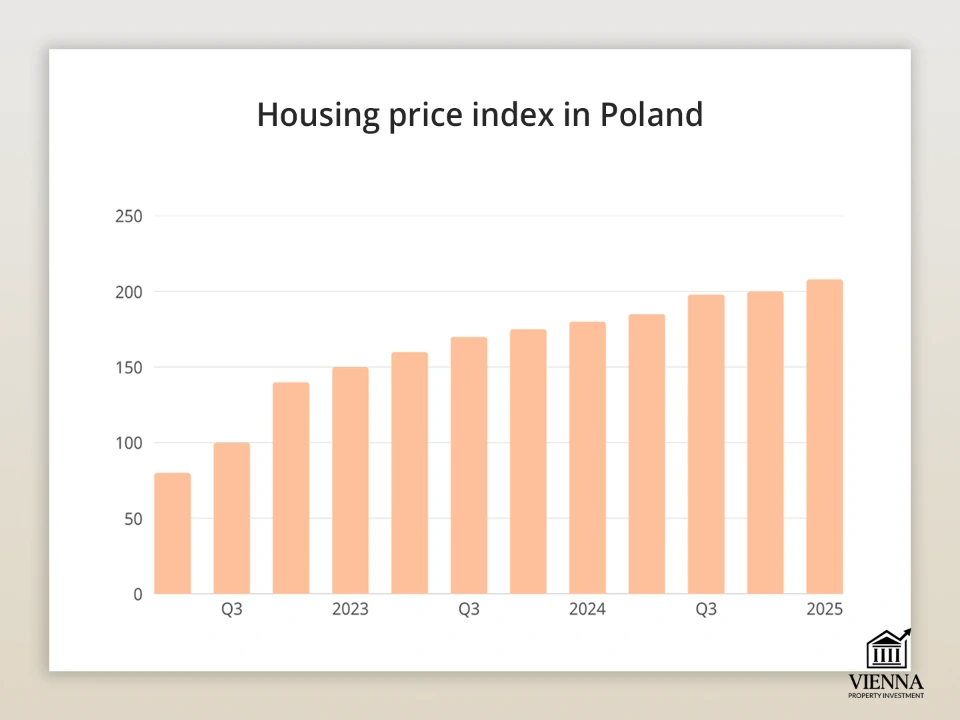

House Price Index (EU countries)

(source: https://towardsdatascience.com/how-cheap-mortgages-transformed-polands-real-estate-market-0e81f8c3611c/ )

Investors are increasingly considering Poland as a strategic location for real estate investments. Amid fluctuations in Western European markets, Central Europe is demonstrating stable growth, with Poland playing a leading role. Why this is happening and how to take advantage of this trend to buy an apartment or house in Poland—we'll explore below.

Poland as a 'growth market' in Central Europe

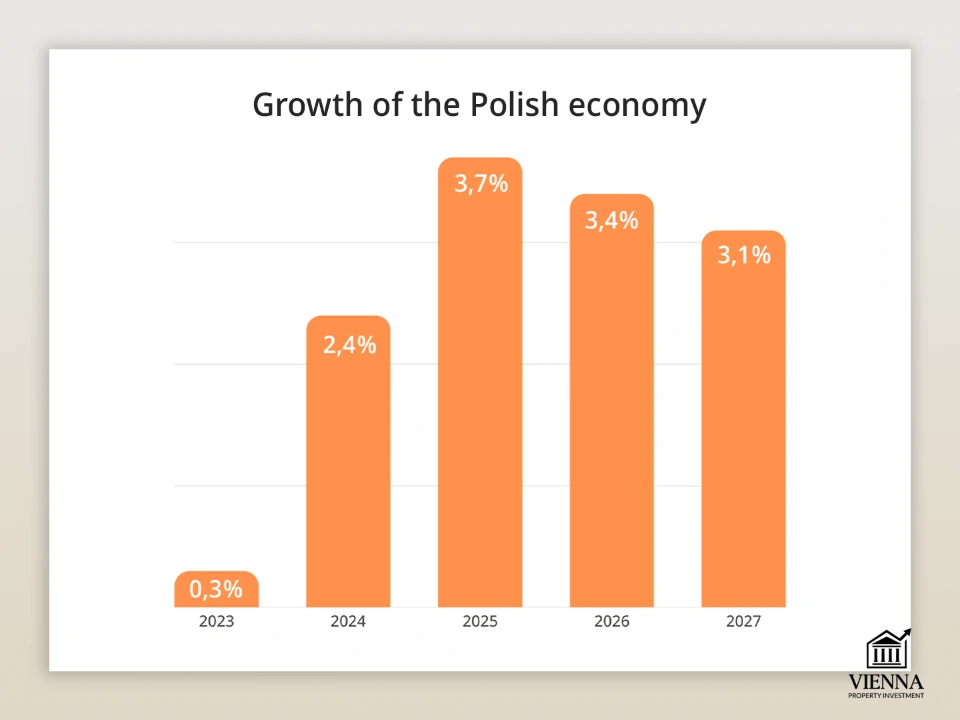

The 2024–2025 period confirmed the trend: Poland remains one of the most dynamically developing markets in the region. GDP growth above the EU average (around 3% in 2024, forecast to reach 3.2% in 2025), robust domestic demand, and active attraction of foreign companies form the basis for a stable housing market.

My opinion: this growth is not a bubble. Unlike Western Europe, where prices have reached their ceiling, in Poland they are still rising, but at a moderate pace, creating potential for long-term investment. For example, one of my clients bought an apartment in a new building in Poznań for €125,000 in 2023, while similar properties are now priced at €140,000.

Tip: If you're choosing between Warsaw and regional centers, consider Krakow and Poznan—they offer excellent rental yields and are in high demand among students and IT professionals.

Profitability and transparency of transactions

According to PWC and World Bank data for 2024, Poland ranks highly in the region for transaction transparency and protection of property rights. According to Numbeo, the cost of living index here is 30–40% lower than in Germany, further stimulating rental demand.

In practice, registering a transaction takes 4-6 weeks, which I consider optimal for Europe. Furthermore, banks are willing to lend to non-residents, making it possible to get a mortgage at 6.5-7% per annum (better than in Hungary or the Czech Republic).

Comparison of Poland with competitors

France combines relatively high returns, stability and predictability, and a lifestyle that is attractive to many buyers.

At the same time, real estate in Germany is traditionally perceived as one of the most stable segments in Europe: yields are lower than in Poland, but the market is more mature and predictable, with a high level of protection of property rights.

| Country | Average yield | Entry threshold | Currency risks | Demand for rent |

|---|---|---|---|---|

| Poland | 5–6% | €120–150k | Low | High (Warsaw, Krakow, Poznan) |

| Czech Republic | 3–4% | €180k+ | Low | High (Prague) |

| Hungary | 4–5% | €110–140k | Average | Average |

| Slovakia | 3,5–4,5% | €120–150k | Low | Average |

| East Germany | 2–3% | €150–200k | Low | Average |

Why is capital leaving Western Europe for Poland?

Investors are increasingly choosing Central Europe over Germany, France, or Spain. The reason is simple: yield and growth potential. In Poland, rental yields 5-6% per annum, compared to 2-3% in Western countries, yet the market remains dynamic.

One client abandoned his €320,000 Berlin apartment and instead purchased two houses in Lodz, Poland, for €150,000 each. His monthly rental income is €2,200, compared to the projected €1,100 in Germany.

Tip: Look for properties near universities and transport hubs—they're always in demand among renters.

Poland's Real Estate Market: How It's Changing and What's Important to Know

The Polish real estate market has gone through several stages of development and is now considered one of the most dynamic in Central Europe. Let's examine how historical factors, the geography of demand, and buyer behavior shape current trends.

House Price Index (EU countries)

(source: https://towardsdatascience.com/how-cheap-mortgages-transformed-polands-real-estate-market-0e81f8c3611c/ )

From EU accession to the IT boom: how it all began

After Poland joined the EU in 2004, the market began to experience steady growth—affordable mortgages, foreign investment, and infrastructure development all contributed. A second powerful boost came after 2020. The reasons for this include the mass relocation of IT companies, an influx of migrants from Ukraine and Belarus, and the growth of the freelance sector.

My opinion: the market is currently in a phase of stable growth, not overheating. Unlike Western Europe, there's still potential here, especially if you're planning to buy a house in Poland for rent or to live in.

I had a client from Kyiv who moved to Poznan in 2022. He bought a two-bedroom apartment in a new building for €115,000; its current value exceeds €135,000, plus the rental income brings in around €650 per month.

Growth rates: how much prices have increased in recent years

In 2023–2024, the market demonstrated impressive growth, with prices growing by 8–10% annually. Warsaw traditionally leads in price, but Krakow holds a strong second place.

Growth is slowing to 5-7% per annum; according to JLL, expected prices by the end of 2025 are:

- Warsaw: up to €3,100 (+6.2%)

- Krakow: up to €2,800 (+5.7%)

- Poznań: up to €2,420 (+5.2%)

The growth is particularly noticeable in the new-build segment. The resale market is also growing, but not as rapidly. If your goal is capitalization, new-builds are better. If you want to rent out immediately, then resale.

If you're thinking about buying an apartment in Poznań, now is a good time: the rate is slowing from double digits to a more stable 5-7%. This creates a balance between growth and predictability.

Geographic focus: which cities are most active?

Warsaw remains the most expensive and liquid city in Poland, especially the central districts and Mokotów, where prices are around 16,500 PLN/m² (~€4,250) and there is high demand for long-term rentals and office space.

Krakow attracts students and tourists, especially the Old Town and Podgórze, where apartments cost around 15,100 PLN/m² (~€3,900) and are actively bought for rent.

Wrocław is of interest to IT specialists and relocators; the Krzyków and Ołting districts – 12,700 PLN/m² (~€3,275) – are well suited for long-term rentals and investments in new buildings.

Gdańsk and the Tricity are popular for short-term rentals, especially the Old Town and Sopot, where prices range from 11,500 to 12,300 PLN/m² (~€3,000), with apartments yielding up to 8–10%.

Poznań combines an affordable entry barrier and high demand, especially the Grunwald and Jeżyce districts, where prices of around 10,800 PLN/m² (~€2,800) are attractive to families and students.

Łódź is attractive to investors on a budget, with the Śródmieście and Polesie districts offering affordable apartments – around PLN 7,800/m² (~€2,015), while demand for long-term rentals remains stable.

Object formats: what's in demand now

New buildings offer a 10-15% appreciation before completion, making them ideal for long-term investments. Example: A client purchased an apartment in Poznan for €118,000, but a year later its price had risen to €135,000, plus rent of €650/month.

The secondary market – can be rented out immediately, especially relevant in Krakow and Wroclaw for students.

Short-term apartments – yield up to 8–10% in tourist cities (Gdansk, Sopot, Krakow), but management and seasonality considerations are required.

Commercial real estate – long-term contracts, high entry threshold (€250,000+), small offices and coworking spaces in Warsaw and Wroclaw are promising.

Beginners are better off with new buildings or resale properties, while advanced buyers should consider apartments and commercial properties. The "buy a house in Poland for a family" strategy is popular in Łódź and its surrounding areas.

Who buys real estate in Poland?

Domestic demand remains the key driver of the Polish real estate market. Most transactions are completed by Poles using mortgages, which ensures a stable flow of buyers and reduces dependence on external factors. In major cities such as Warsaw, Krakow, and Poznań, high demand is driven by students, young families, and employees of large companies.

- Poles are the main market driver, actively using mortgages, buying housing for families and renting it out.

- Ukrainians are one of the largest groups of foreign buyers, especially in Warsaw, Krakow, and Poznan, with the motive being permanent residence and investment.

- Belarusians are seeking stability and a residence permit, preferring apartments in border regions.

- EU investors are diversifying their portfolios, purchasing apartments and commercial real estate in major cities.

- US investors view Poland as an emerging market with high potential for price growth.

The diversity of buyers supports the market's dynamism and stability; Polish real estate is attractive for both long-term investment and rental purposes. In 2024, foreigners purchased over 17,000 properties (~5% of the total market), with Ukrainians accounting for approximately 20% of all foreign transactions in Warsaw.

| Nationality of the buyer | Market share | Preferred locations |

|---|---|---|

| Ukrainians | 40% of foreign buyers | Warsaw, Wroclaw, Krakow |

| Belarusians | 15% of foreign buyers | Warsaw, Gdansk |

| Germans | 8% of foreign buyers | Wroclaw, Poznan |

| Other EU countries | 20% of foreign buyers | Major cities |

| Asians / Middle East | 17% of foreign buyers | Warsaw, premium segment |

Ownership formats and investment methods

The Polish market offers a variety of ownership formats and investment methods suitable for both individuals and companies. Understanding these is important to choose the right strategy and minimize risks.

Owning as an individual: a simple and straightforward option

Individuals (including non-residents) can freely purchase apartments and flats in Poland. Restrictions apply only to land, particularly in border areas and on plots larger than 1 hectare.

If you're looking to buy an apartment in Poznan or a house in Poland for yourself or to rent, this option is the easiest and fastest. One client from Ukraine purchased a two-bedroom apartment in Poznan, registered it in his own name, without using a company, and within a year, the rental income was steady.

Purchase through a company: Sp. z oo or a foreign legal entity

Establishing a company in Poland or using an existing EU firm offers additional opportunities: tax optimization, joint investments, and participation in major projects.

For private investors, this isn't always feasible, but for those planning multiple properties or commercial investments, a company is a convenient tool. An investor from Germany purchased three apartments in Wroclaw for rent through Sp. z oo, which allowed him to record all expenses and income through the company, simplifying accounting.

Investing through funds: REIT analogue

There are still few funds operating as REITs in Poland, but there are investment options through collective structures. This is suitable for those who want to participate in the market without having to deal with operational and property management. For beginners, it's a way to diversify risks without getting bogged down in the details of leasing and renovations.

Joint purchase, inheritance and trusts

You can team up with partners, formalize joint ownership, or use inheritance mechanisms and trusts. My observation: this is convenient if purchasing an expensive property or investing in several apartments exceeds the budget of a single investor.

Two of my clients jointly purchased two apartments in Krakow – they share rental income and management costs, making the investment more secure.

Restrictions for non-EU citizens

- Apartments: freely available for purchase by citizens of any country.

- Land and houses: for plots larger than 1 hectare or border areas, permission from the Ministry of Internal Affairs is required.

If you want to buy a house in Poland, check with a lawyer to see if a permit is required, especially for large plots.

Ownership Formats: How Real Estate Is Officially Registered

- Pełna własność (full ownership) – the owner has all rights to the property, including sale, lease, and redevelopment.

- Spółdzielcze własnościowe (cooperative law) – the property is registered to the cooperative, but the owner can dispose of the apartment.

- Towarzystwo Budownictwa Społecznego (association property) – residents rent apartments, pay rent, without ownership rights.

For investment and rental purposes, it is better to choose full ownership to make it easier to manage income and sell properties.

Legal aspects of purchasing real estate in Poland

Buying real estate in Poland requires an understanding of local laws and standard procedures. Knowing the steps and requirements will help you invest safely and avoid mistakes, especially for foreign investors.

Step by step: from PESEL to notary

The purchase process begins with obtaining a PESEL tax number for non-residents, finding a lawyer and agent, drawing up a contract, paying a deposit, and notarizing the transaction.

| Stage | Required documents | Deadlines (approximately) |

|---|---|---|

| Obtaining a PESEL tax number | Passport or ID, application to the local office (Urząd Miasta) | 1–3 days |

| Choosing a lawyer and agent | Agreement with a lawyer/agent, identification document | 1–7 days |

| Checking the object | Księga wieczysta, certificates of absence of debts and encumbrances | 3–7 days |

| Drawing up a contract | Purchase and sale agreement, agreement of terms, review by a lawyer | 3–10 days |

| Making a deposit | Bank transfer, confirmation of receipt of deposit | Day 1 |

| Notarization of the transaction | Sales contract, passports of the parties, notary | Day 1 |

| Registration of property rights | Signed contract, tax payment receipt, notary documents | 7–14 days |

The Role of a Lawyer and Agent: Protecting Interests

A lawyer verifies the transaction's legality, checks the title and the contract, and an agent helps find a liquid property and negotiate a price. Even if you're an experienced investor, it's best to work with a lawyer—it saves time and reduces risks. One of my clients saved €5,000 when a lawyer uncovered an encumbrance on an apartment in Wroclaw before signing the contract.

Buyer requirements: KYC and financial verification

When purchasing real estate in Poland, especially for foreign citizens, banks and notaries require proof of identity and the legal origin of funds. This is standard practice, protecting both parties to the transaction and reducing the risk of money laundering.

Basic requirements:

- Identity document - passport or ID.

- Residential address - for non-residents, confirmed by a certificate of residence.

- Proof of income - bank statements, salary or income certificates.

- Origin of funds - documents on the sale of property, investments or savings.

- Information about the buyer - KYC questionnaire, sometimes indicating the purpose of the purchase (investment, permanent residence).

Peculiarities of purchasing commercial and land real estate

Commercial real estate includes offices, retail space, and warehouses. Transactions are often conducted through companies, especially for larger properties, and the yield can be higher than for residential properties. A client from Germany purchased an office in Wroclaw through Sp. z oo and received stable income from tenants for several years.

The purchase of land and houses by citizens of non-EU countries requires permission from the Ministry of Internal Affairs for plots larger than 1 hectare or in border areas. Before investing, it is important to check the land's intended use in the local development plan.

Remote purchase of real estate by proxy

In Poland, you can purchase real estate without being in the country by appointing a representative with a power of attorney. This method is especially relevant for foreign investors looking to buy an apartment in Poznań or a house in Poland while abroad.

A power of attorney is issued by a notary and authorizes the representative to sign the purchase and sale agreement, pay a deposit, and receive documents on behalf of the buyer. The power of attorney can be time-limited or action-limited, depending on the investor's wishes.

My US client purchased an apartment in Poznań using a power of attorney while in New York. The transaction went smoothly, and the property registration took only a week thanks to the expertly prepared documentation.

Checking the object: księga wieczysta

Every property in Poland has a księga wieczysta (public title register), which records all legal details about the apartment, house, or land plot. A lawyer checks for any encumbrances, mortgages, debts, and third-party claims. This is a mandatory step, especially if you plan to buy an apartment in Poland for investment or rental purposes.

Registration of property rights

After the contract is signed and notarized, the property rights are registered in the land registry. This is the final stage of the transaction, officially confirming your rights to the property and allowing you to manage it: rent it out, sell it, or register it through a company.

The registration process usually takes 1-2 weeks, but may take longer if the documents are incomplete. It's best to prepare all receipts, certificates, and notarial deeds in advance.

Taxes, fees, and expenses when buying real estate in Poland

Poland offers a transparent and relatively favorable tax system for investors. However, it's important to consider all expenses to accurately calculate your return.

Property Tax: Annual Costs

The annual tax on residential properties is 1.00 PLN per m² (~0.25 €). For a 50 m² apartment, this is 50 PLN (~12.5 €) per year. In larger cities such as Warsaw or Krakow, rates may be slightly higher – up to 2 PLN/m² (~0.5 €).

PCC - secondary market tax

When purchasing a resale property, a PCC of 2% of the property's value is charged. For example, an apartment for PLN 500,000 (~€125,000) → PCC = PLN 10,000 (~€2,500). Factor the PCC into your overall cost estimate to accurately calculate your ROI.

VAT on new buildings and commercial real estate

- New residential buildings up to 150 m²: VAT 8% → apartment 600,000 PLN (~150,000 €) = 48,000 PLN (~12,000 €).

- Commercial real estate: VAT 23% → office 1,000,000 PLN (~250,000 €) = 230,000 PLN (~57,500 €).

Small apartments in new buildings are more profitable – they have lower VAT and rapid price growth.

Notary, lawyer and agent fees

Total costs amount to 5–6% of the property value. Example: apartment for 500,000 PLN (~€125,000) → costs 25,000–30,000 PLN (~€6,250–7,500).

Comparison with Austria

| Expense item | Poland | Austria |

|---|---|---|

| Property tax | 1–2 PLN/m² (~0.25–0.5 €/m²) | ~0.5–1.5% of the property value |

| PCC / Grunderwerbssteuer | 2% on the secondary market (~€2,500 at €125,000) | 3.5–6.5% (~€4,375–€8,125 at €125,000) |

| VAT on new buildings | 8% up to 150 m² (~12,000 € for an apartment of 150,000 €) | Depends on the category, usually included in the price |

| VAT on commercial real estate | 23% (~57,500 € for an office of 250,000 €) | 20% standard rate |

| Notary, lawyer, agent | 5–6% (~€6,250–€7,500 on €125,000) | 3–5% (~€3,750–€6,250 on €125,000) |

Although Poland has a lower tax and fee burden, Austria offers greater market stability, rising prices, and high demand for real estate. For investors seeking long-term investments and a stable market, Austria may be more attractive, despite its higher costs.

In practice, this often looks like this: an investor keeps one or two apartments in Vienna as the core of the portfolio and adds to them more profitable, but more volatile properties in Poland to increase overall returns.

Possible schemes for optimizing rental income tax

The Polish tax system offers investors several legal ways to reduce their tax burden and increase returns.

Selecting a taxation method:

- A flat tax of 19% is convenient for investors with multiple properties, simplifies accounting, and allows for income planning in advance.

- The progressive tax rate of 17–32% is beneficial for investors with a small total income, as the first 17% is taxed minimally.

Write-off of expenses:

- Costs for repairs, furniture, utilities and property management can be included as expenses, reducing taxable income.

- Example: a client bought an apartment in Poznań, spent 20,000 PLN (~5,000 €) on renovations and furniture – this reduced the tax base, saving about 3,800 PLN (~950 €) at a 19% rate.

Registration through the company:

- If the property is registered to a legal entity, additional tax deductions and reduced rates on corporate income can be used.

- Suitable for investors with multiple properties or commercial real estate.

A smart combination of tax treatment, expense deductions, and corporate structure can increase net returns by 10–15%, especially for a portfolio of multiple properties.

Residence permit through real estate in Poland

Many clients mistakenly believe that buying an apartment in Poznan or a house in Poland automatically paves the way for a residence permit. In practice, this isn't the case, but using the property wisely can help demonstrate financial solvency and a commitment to staying in the country for the long term.

Other legal grounds for a residence permit

To obtain a residence permit, one of the following grounds is required:

- Employment contract with a Polish employer.

- Having your own business or entrepreneurial activity.

- Marriage with a Polish citizen.

- Close family ties with a Polish citizen.

- Naturalization or other grounds provided by law.

For example, my client opened an IT company in Poznan, bought an apartment to live in, and demonstrated that he had permanent residence—a residence permit was issued quickly.

Citizenship after 10 years of residence

After 10 years of legal residence in Poland, you can apply for citizenship. Real estate helps demonstrate strong ties to the country, facilitating the naturalization process. Even if the goal is not residence but investment, purchasing real estate in Poland creates an additional bonus for future documents.

Comparison with Austria

In Austria, there is a category D (Self-Sufficiency), where foreigners can obtain a residence permit without running a business, but simply by confirming income and availability of housing.

Advantages of Austria:

- A direct path to a residence permit without the need to run a business.

- Possibility of obtaining citizenship subject to compliance with residence conditions.

- High stability of the real estate market and predictable price growth.

- Strong demand for real estate, making investments more secure.

Poland doesn't offer a Golden Visa, but real estate can indirectly help with residency through business, employment, or family connections. Austria benefits from market stability, rising prices, and demand for real estate, making it more attractive to long-term investors.

Property rentals and profitability in Poland

Investing in real estate in Poland allows you to earn a stable rental income. Different rental types and regions offer varying yields, and proper management increases profits and reduces risks.

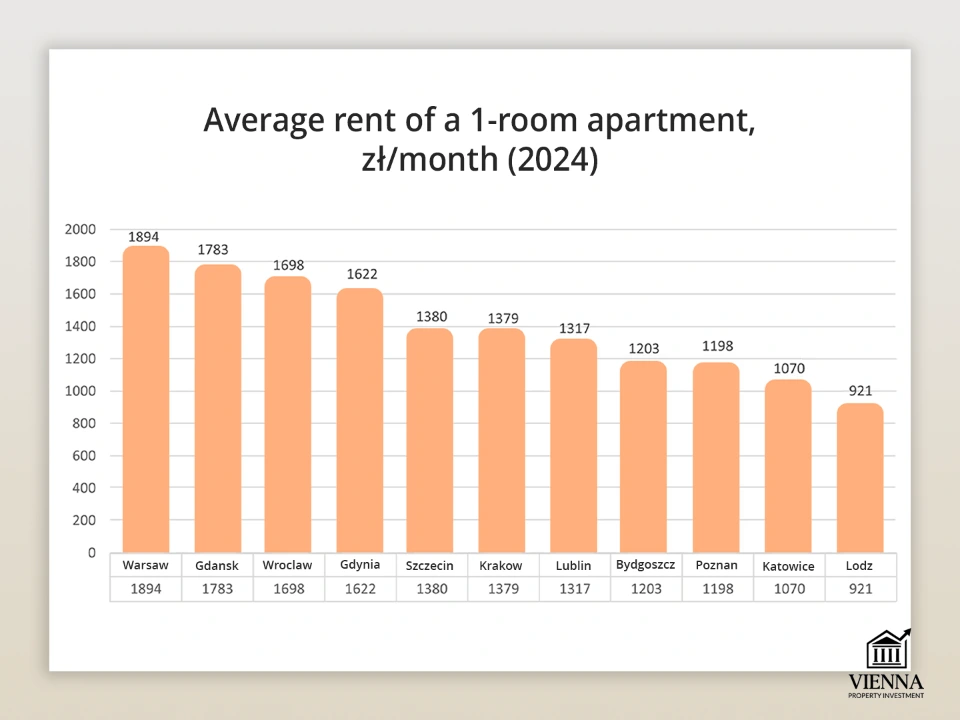

Average rental price for a one-room apartment in the budget segment, PLN/month

(source: https://tvojarabota.pl/novosti/stoimost-arendy-1-k-kvartiry-v-polshe-iyul-2024-g-1998 )

Short-Term Rentals: Airbnb and Apartments

Short-term rentals through platforms like Airbnb can generate returns of 6-8% per annum. However, in large cities like Warsaw and Krakow, regulations are becoming stricter: owners are required to register and comply with fire safety regulations.

The client purchased an apartment in Poznań for short-term rental and receives a stable income of 7%, while using a management company for bookings and cleaning.

Long-term lease: stability with restrictions

Long-term rentals generate income of 4-6% per annum and are in steady demand, especially among students and relocators. For investors who value stability and minimized risk, long-term rentals are the best option. A client from Germany bought an apartment in Poznan and rents it out to students—the yield is around 5%, with low risk of vacancy.

Profitability by region

| City | Average price €/m² | Long-term lease | Short-term rental | The main investment factor |

|---|---|---|---|---|

| Warsaw | 3 200–3 500 € | 4–5% | 6–7% | High liquidity, stable demand |

| Krakow | 2 800–3 100 € | 5–6% | 6–8% | Students, tourists, cultural center |

| Wroclaw | 2 700–3 000 € | 5–6% | 6–7% | Developed IT sector, growing market |

| Poznan | 2 500–2 800 € | 5–6% | 6–7% | Students, relocators, stable demand |

| Lodz | 1 800–2 200 € | 6% | 7% | Higher yield, less liquid market |

Management companies

Management companies help investors rent out their properties without any personal involvement. The average commission is 10–15% of the rent. They provide:

- selection of tenants;

- registration and renewal of contracts;

- rent collection;

- cleaning and minor repairs;

- control over the condition of the apartment.

A client purchased an apartment in Poznań for short-term rental through Airbnb and transferred management to the company. The yield remains at 7%, and the apartment is always available for guests.

Taxes on rental income

Real estate investment returns in France and Austria remain comparatively low. However, the differences between the countries are clear:

- Austria provides greater stability and liquidity;

- France remains attractive for those looking to combine investment with personal use of housing and a premium lifestyle.

For an investor seeking stability and minimal risk, Austria is preferable. For those also considering real estate as part of a personal lifestyle project, France is a more attractive choice.

Comparison with Austria

| Country | Short-term rental | Long-term lease | Rent regulation | Taxation |

|---|---|---|---|---|

| Poland | 6-8% yield, Airbnb, high demand | 4–6% yield, stable demand (students, relocators) | Tightening rules in Warsaw and Krakow, mandatory registration | 19% flat tax or progressive, repair and management costs can be written off |

| Austria | 2-3% return, strict rules | 2-3% yield, stable demand | Strict rental rules, short-term rental permits are mandatory | Progressive scale up to 30%, fewer opportunities to write off expenses |

Austria is a market of stability and predictability: low risks, transparent regulations, moderate but stable yields, and long-term price growth. Rental yields are lower here than in Poland, but demand is more stable, and properties are more liquid and easier to sell or rent out over the long term.

Poland, on the other hand, offers more affordable prices and higher rental yields, but the market is sensitive to economic fluctuations and the level of risk is higher.

Where to Buy: An Analysis of Poland's Regions

The choice of city and region for investment greatly impacts the profitability, liquidity, and future growth of real estate. Let's look at key regions from an investor's perspective.

Warsaw is the heart of business and finance

Warsaw is a hub of business and finance, with high demand for long-term rentals. Despite low yields, apartments sell and rent quickly, especially in business districts.

- Average price: €3,200–€3,500/m²

- Profitability: 4–5% per annum (long-term lease)

- Attractiveness: high liquidity, stable demand, corporate tenants

Krakow – students, tourism, IT

Krakow attracts students and tourists, generating high rental demand. IT companies also generate a steady flow of relocators, supporting the market.

- Average price: €2,800–€3,100/m²

- Profitability: 5–6% (long-term lease), 6–8% (short-term)

- Attractiveness: students, tourists, IT sector, cultural center

Wroclaw – an IT hub in high demand

Wroclaw is a rapidly growing IT hub with numerous offices and startups. Apartments near business centers rent out faster and generate a stable income.

- Average price: €2,700–€3,000/m²

- Profitability: 5–6%

- Attractiveness: IT companies, relocators, growing demand for rentals

Gdansk, Sopot, Gdynia – Coastal and Premium

The Baltic coast attracts tourists in the summer, providing high short-term rental yields. It's an ideal region for premium apartments or houses for seasonal rentals.

- Average price: €3,500–€4,500/m²

- Yield: 6-8% in summer (short-term rentals)

- Attractiveness: premium segment, tourist flow, seasonal rental opportunity

Lodz and Lublin – Affordable Investments with Growth Potential

These cities are attractive to investors on a budget. Low prices per square meter and growing rental demand make them promising long-term investments.

- Average price: €1,800–€2,200/m²

- Profitability: 6%

- Attractiveness: low price, high growth potential, students and relocators

Villages and country real estate are a trend after the pandemic

Since the pandemic, demand for country houses has increased, both for permanent residence and for rental. The Masurian Lake District, Subcarpathia, and the Carpathian Mountains are popular. Many of my clients are choosing older houses for renovation for €50,000–€80,000, with subsequent rental potential. This is especially advantageous for families and those looking to buy a house in rural Poland at an affordable price.

- Average price: €800–€1,500/m² (often houses with a plot of 15–30 acres)

- Profitability: up to 6% (long-term), seasonal rental 8–10% in tourist regions

- Attractiveness: ecotourism, remote work, vacation homes

| Category | Region | Infrastructure and transport | Tenant demand |

|---|---|---|---|

| Where are they buying now? | Warsaw | Metro, international airport, high-speed trains | Business professionals, relocators, students |

| Krakow | Airport, railway junction, developed tourism | Tourists, IT, students | |

| Wroclaw | Highways, railways, airport | IT specialists, young families | |

| Gdansk, Sopot, Gdynia | Port, airport, highways | Tourists, premium segment | |

| Lodz | New roads, high-speed railway | Students, budget tenants | |

| Where growth is expected | Poznan | Airport, highways, growing IT sector | IT specialists, students |

| Lublin | Road development, universities | Students, local families | |

| Szczecin | Proximity to Germany, port, new highways | Logistics and business workers | |

| Masurian Lakes | Tourism development, eco-projects | Tourists, seasonal tenants | |

| Subcarpathia (villages) | Tourism, roads to Slovakia | Tourists, renting eco-homes |

Secondary market and new buildings: what should an investor choose?

Forecasts for 2025 suggest fragmented growth in prices for new buildings in Poland, on average not exceeding 2024 levels (approximately 5–7%), while the secondary market is expected to stagnate.

Housing prices vary greatly by city; for example, in March 2025, Warsaw and Gdansk were the most expensive, while cities like Łódź and Bydgoszcz offered more affordable options. This makes the choice between new builds and existing properties particularly important for investors focused on yield and capital growth prospects.

New buildings: trend and high standards

- Market share: more than 50% of transactions in large cities.

- Prices: Warsaw — €3,000–5,000/m², Krakow — €2,800–4,000/m².

- Features: modern layouts, underground parking, energy efficiency.

New buildings are ideal for rentals, especially in Warsaw, Wroclaw, and Gdańsk. Many of my clients have chosen new apartments in the Mokotów district of Warsaw for long-term rentals, resulting in stable yields of 4.5% per annum and high liquidity upon resale.

Secondary market: 40–50% of transactions and potential for renovation

- Prices: Lodz — €1,500–2,500/m², Lublin — from €1,200/m².

- Pros: lower cost, ready-to-rent property, quick turnaround time.

- Cons: often requires renovation (from €200/m²).

Old apartments in city centers are attractive to investors willing to invest in renovations. For example, a client of mine bought an apartment in Krakow for €90,000, invested €15,000 in renovations, and now rents it out on Airbnb with a yield of around 8% per annum.

A House in a Polish Village: A Countryside Living Trend

- Prices: from €30,000 for a small house in the village (often with a plot of 10–20 acres), houses in good condition - €70,000–100,000.

- Why it's interesting: Demand for homes in Poland is growing due to remote working and a desire to live closer to nature.

- Popular regions: Masurian Lakes, Subcarpathia, Carpathians.

If you're looking to buy a house in a Polish village at a low price, look for classified ads on OLX.pl. Some clients buy older houses for €40,000, do minimal renovations (€10,000–15,000), and rent them out to tourists for €100–150 per night during the season. The yield is 8–10%.

Comparison with new buildings in Austria: more expensive, ESG trend

Austria: New build prices start at €6,000–8,000/m² (Vienna), up to €12,000/m² in prime areas. Features: strict energy-saving standards (ESG), a stable market, low yields (2–3%), but high stability. Poland remains a more affordable market for investors with a budget of up to €150,000.

| Segment | Poland | Austria | Comment |

|---|---|---|---|

| Economy | €1,500–2,000/m² (Lodz, Bydgoszcz) | €3,500–4,500/m² (Vienna suburbs, small towns) | In Austria, even the economy segment is twice as expensive, but the quality is higher. |

| Average | €2,500–3,500/m² (Poznan, Krakow) | €5,000–7,000/m² (Vienna, Graz) | Poland wins in terms of profitability and accessibility for investors. |

| Premium | €4,000–5,500/m² (Gdansk, Warsaw city center) | €8,000–12,000/m² (Vienna city center, Salzburg) | Austria leads in prestige and stability, but the entry barrier is extremely high. |

Alternative investor strategies

The Polish real estate market offers a wide range of opportunities for investors. Beyond traditional apartments for long-term rental, there are several alternative strategies that can increase yields and capitalize on growing demand for specific segments.

Micro-apartments for students and relocators

Small apartments of 20–35 square meters are in high demand among students and young professionals, especially in cities with major universities and IT hubs, such as Poznan, Krakow, and Wroclaw. The average price of a micro-apartment in Poznan is €50,000–70,000. My experience shows that such apartments easily rent for €300–400 per month, and with proper furnishings, the yield can reach 6–7% per annum.

Renovation of the old building stock

Old apartments and houses often require renovation, but this creates opportunities to increase the property's value and profitability. For example, a client bought an apartment in Łódź for €60,000, invested €15,000 in renovations, and now rents it out on Airbnb for approximately €600–700 per month. Renovation is particularly profitable in areas with a limited supply of new buildings, where renovated apartments attract high-income tenants.

Investments in regions with industrial growth

Cities with growing industrial, logistics, and IT sectors (e.g., Poznań, Lublin, Szczecin) are becoming attractive to investors focused on long-term rentals. Tenant demand is steadily growing, and housing prices remain relatively affordable: €1,800–2,500 per square meter. My advice to clients is to look for areas with new infrastructure and transport accessibility, which increases the property's liquidity.

Aparthotels and tourist properties

Investing in aparthotels or short-term rentals in tourist areas generates returns of up to 8-10% per season. Properties on the coast (Gdansk, Sopot) and in the mountains (Carpathians, Tatra Mountains) are especially popular. One of my clients bought an apartment in Sopot for €90,000 and earned €10,000 in the first season, confirming the effectiveness of this strategy.

Investments through funds and joint purchases

For those who don't want to manage real estate themselves, investments through funds or joint projects are available. These schemes allow for risk diversification and participation in large projects without large investments. This is convenient for foreign investors looking to invest €50,000–€100,000 in several properties at once.

Land for logistics and warehouse complexes

With the development of e-commerce and logistics, demand for land for warehouses and industrial properties is growing. Prices per hectare near major cities can start at €50,000–70,000, but the yield on these projects is significantly higher than traditional residential rentals. My clients who purchased plots for small warehouses in Poznań and Wrocław received stable income from long-term tenants with 5–10-year contracts.

Risks and disadvantages of investing in Poland

Investing in real estate in Poland is attractive due to its high returns, but it's important to consider the potential risks to make informed decisions. Below, I discuss the key issues facing investors and share my observations and practical examples.

Slowing price growth

After record growth in 2022–2023, the rate of housing price increases has slowed. Forecasts for 2025 show new-build prices growing by approximately 5–7%, while the existing market is virtually stable. For example, one of my clients wanted to buy an apartment in Poznań for resale, but we decided to postpone the transaction to wait for more favorable terms and assess price trends.

Bureaucracy and language barrier

The purchase process includes registration, obtaining a PESEL, notarial transactions, and verification of the legal status. For foreigners, especially those without knowledge of Polish, this can be complicated. I recommend working with reputable lawyers and agents: they can help expedite the process and avoid errors in the paperwork.

Restrictions on land purchases

Non-EU residents are restricted from purchasing land and houses outside cities or on plots larger than 1 hectare. For example, one of my clients wanted to buy a house in a Polish village at a low price, but had to obtain permission from the Ministry of the Interior, which added several months to the transaction.

Political and tax uncertainty

Polish tax policy changes periodically, which can impact rental yields or taxation upon sale. It's important to take this into account when planning investments. My advice is to calculate your return with a reserve for possible changes in tax rates.

Comparison with Austria

Compared to Austria, Poland wins in terms of rental yields and price growth potential, especially in the economy and secondary market segments. However, Austria offers greater stability, predictable growth, and simpler market regulation. Investors must decide for themselves what is more important: higher returns with risk, or stability with lower returns.

Accommodation and lifestyle in Poland

Investors are attracted to France not only for its income potential, but also for its standard of living, developed infrastructure, mild climate, and cultural diversity. For many buyers, real estate in France is not just an investment but also a chance to live comfortably and enjoy the country's unique way of life.

Medicine and education

Medical services in Poland are accessible and high-quality for both residents and non-residents. Foreigners can access private clinics with English-language services, and consultations and examinations cost the same as local ones—€25–40 for a general practitioner consultation and €100–200 for comprehensive examinations.

Education for non-residents is also actively represented: international and English-language schools operate in major cities (Warsaw, Krakow, Poznan, Wroclaw). Annual tuition at these schools ranges from €4,000 to €12,000, depending on the program and level.

The difference for non-residents is that additional documents and proof of residency may be required upon admission, but access to schools and educational materials is fully preserved. My clients with children often choose apartments in areas with such schools to simultaneously invest and provide comfort for their family.

Security and infrastructure

Poland is a NATO member, and its security level is high. The city's infrastructure is well-developed, with convenient banking, internet, and mobile phone coverage, as well as transportation networks ranging from the Warsaw metro to high-speed trains between major cities. This facilitates both daily life and remote property management.

Comparison with Austria

Austria excels in terms of stability and predictability across all social and economic factors. The standard of living is higher here: the education system and international schools are recognized as among the best in Europe, healthcare is high-quality and accessible, and the infrastructure and environment make the country a comfortable place for long-term residence.

Poland offers a balance between comfort, affordability, and investment potential, particularly in segments with high yields and rising rental rates. Investors considering buying an apartment in Poznań or a house in Poland often choose it as a more advantageous entry point into European real estate while maintaining an acceptable quality of life for themselves and their families.

Poland as an alternative to European asylum

Poland is becoming an increasingly popular destination for people seeking a safe and comfortable place to live in Europe. In addition to real estate investments, the country attracts those looking to relocate from unstable regions, retirees, and digital nomads.

Residence permit for citizens of unstable countries

For residents of countries experiencing economic or political instability, Poland offers a convenient route to temporary or permanent residence through employment, entrepreneurship, or real estate investment.

One of my clients from Ukraine purchased an apartment in Poznan to obtain a residence permit through his business—this provided him with legal status and comfortable living conditions for his family.

Pensioners: Comfort and Safety

Poland is a suitable destination for retirees thanks to its high level of safety, stable infrastructure, and reasonable cost of living. The cost of food, utilities, and healthcare is significantly lower than in Germany or the Czech Republic, making relocation financially convenient.

Some of my clients choose houses in Polish villages or apartments in second-tier cities to enjoy a quiet life and nature while remaining within Europe.

Digital nomads and business relocation

For IT professionals and digital nomads, Poland is attractive due to its developed infrastructure, high-quality internet, and international business cluster zones. Many clients I've advised have purchased apartments in Krakow and Warsaw not only for residential use but also as a base for company registration and business relocation. This allows for comfortable living with tax and corporate benefits.

Comparison with Austria

Vienna offers high prestige and complete predictability of all social and economic factors, but real estate prices and the standard of living are significantly higher. However, Austria is particularly attractive to citizens from unstable countries seeking a safe and secure jurisdiction to reside and preserve their wealth.

For retirees, Austria offers high-quality healthcare, developed infrastructure, and a relaxed pace of life. And for digital nomads and remote professionals, the country is becoming increasingly attractive thanks to its high standards of living, stable internet, cultural diversity, and potential programs for attracting skilled workers.

Poland is attractive due to its market dynamics, affordable housing, and potential for income growth. However, in terms of security, prestige, and quality of life, it lags behind Austria.

How and when to sell real estate in Poland

When planning an investment in Polish real estate, it's important to understand how and when to exit the project to maximize income and liquidity. Let's look at key aspects of the sale and practical examples.

Market liquidity

Warsaw and other major cities (Krakow, Wroclaw, Gdansk) offer high liquidity—apartments there sell faster and with smaller discounts. In second-tier regions, such as Łódź or Lublin, liquidity is lower, and the sale process can take longer.

One of my clients bought an apartment in Poznań for long-term rent, and when he needed to resell it after two years, he was able to sell it with minimal losses, thanks to an active market and interest from investors.

Resale terms

Once the property title is registered, the apartment can be sold. If this occurs within five years of the purchase date, a 19% tax must be paid on the profit. This is important to consider when calculating the expected return.

It's important to keep in mind that economy-class properties sell faster than premium-class properties, where buyers are looking for specific features. I advise clients to plan their exits in advance, taking seasonal demand and price movements into account.

Impact on residence permit

For investors with a Polish residence permit through business or entrepreneurial activity, selling real estate does not affect their status as long as other grounds for residence remain. For example, one of my clients retained his residence permit after selling his apartment while continuing to develop his business in Poland.

Comparison with Austria

Although economy and mid-price properties sell faster in Poland, Austria has a more stable and predictable market. Liquidity is high even for the premium segment, resale periods are more predictable, and tax policies are transparent.

For investors who value security and long-term certainty of value preservation, Austria remains a safer option, despite higher property and living costs.

Expert opinion: Ksenia Levina

Investing in real estate isn't just about buying an apartment; it's a strategic decision. I help investors choose properties based on price growth, yield, and personal goals. Some prefer growing markets like Poland and Slovakia, while others prioritize the stability of Austria.

Which path will you choose?

— Ksenia , investment consultant, Vienna Property Investment

Over the past few years, I've participated in dozens of transactions in Austria, Slovakia, Poland, and Germany. Each country has its own unique characteristics. Austria is a stable market with minimal risks, but with low yields and a high entry barrier. Poland, on the other hand, is a dynamically developing market where you can still buy an apartment in Poznan or Gdansk at a reasonable price and expect appreciation.

When investing in real estate in Poland, it's important to conduct a thorough legal due diligence: ensure the title deeds are clear and there are no outstanding utility or tax arrears. Many clients ask how to avoid VAT issues when purchasing commercial properties—a lawyer is essential here. Another point: when selling an apartment within five years of purchase, you must pay 19% income tax. This is often overlooked when calculating profitability.

My recommendation for investors with capital of €500,000 or more is not to concentrate everything in one market. For example, invest part of it in Austria (Vienna or Salzburg) for stability and long-term capital protection, and the rest in Poland, where returns are higher.

If my goal were to preserve capital with minimal risk, I would choose Austria : investing in Austrian real estate offers the combination of stability and predictability that conservative investors seek. If growth and profitability are my priorities, then Poland would be my choice. Today, you can still buy a house in Poland or an apartment in Krakow at a price that will seem low in a few years. For families with children and a long-term perspective of life in the EU, in my opinion, a combined scenario is optimal: a home in Austria for living and a property in Poland for rent.

Conclusion

Poland is currently a "window of opportunity" for those willing to engage with a dynamic market and embrace its unique characteristics. While the risks are higher here compared to Austria, the growth potential is significant, particularly in cities with rapidly developing infrastructure, such as Poznan or Wroclaw.

Austria benefits from market stability, price predictability, and low risk. Even if yields are lower than in Poland, premium and mid-price properties retain their value over the long term.

Before purchasing, it's important to verify all legal aspects: clear title, absence of encumbrances and debts, and tax liabilities. I recommend investors plan their exit in advance, consider resale taxes, and assess the region's liquidity. For example, properties in Poznan and Warsaw sell faster than in smaller cities, reducing the risk of delays.

Polish Economic Growth 2023–2027

(source: https://investropa.com/blogs/news/poland-buy-property )

Demand for housing in Poland is forecast to grow through 2030, driven by continued urbanization, increased migration to major cities, and a growing rental market for students and expats. For investors, this means that properties in Warsaw, Poznań, Krakow, and Wrocław retain growth potential. Austria, meanwhile, will remain a stable market, with property values rising slowly but reliably.

Appendices and tables

Profitability table by city in Poland

| Region | Average annual rental yield (%) |

|---|---|

| Warsaw | 4–5% |

| Krakow | 5–6% |

| Wroclaw | 5–6% |

| Gdansk/Sopot/Gdynia | 4–5% |

| Poznan | 5–6% |

| Lodz | 6–7% |

| Lublin | 6–7% |

| Bydgoszcz | 6–7% |

| Regitz | 6–7% |

Price/Profitability Map

| Region | Average price per m² (€) | Average annual rental yield (%) | Market Features |

|---|---|---|---|

| Warsaw | 3 700–4 000 | 4–5% | High liquidity, stable demand, but also high prices. The rental market is adjusting following price increases, creating entry opportunities. |

| Krakow | 3 550–3 600 | 6,5% | Popularity among students and tourists ensures high profitability. |

| Wroclaw | 3 300–3 400 | 5–6% | One of the leaders in price growth (+12% per year), attractive for long-term investments. |

| Poznan | 3 100–3 200 | 5–6% | A stable market with moderate price growth, suitable for beginning investors. |

| Gdansk | 3 200–3 300 | 4,5–5% | Popularity among tourists and expats supports rental demand. |

| Lodz | 2 300–2 400 | 6–7% | One of the most accessible markets, with high potential for price growth. |

| Rzeszow | 2 200–2 300 | 6–7% | Low prices and high rental demand make it attractive to investors. |

| Bydgoszcz | 2 000–2 100 | 6,5–7% | High returns with low entry costs. |

| Lublin | 2 400–2 500 | 5,5–6% | Moderate price growth and stable rental demand. |

| Szczecin | 2 500–2 600 | 5–5,5% | Proximity to Germany supports rental demand. |

Tax Comparison: Poland vs. Austria

| Type of tax | Poland | Austria |

|---|---|---|

| Purchase tax (PCC/NDS) | 2% for secondary housing (PCC), 8% for new buildings up to 150 m², 23% for commercial | Grunderwerbssteuer 3.5–6.5% |

| Property tax | Low, depends on m² and municipality (~0.1–0.5% of the cadastral value) | ~0.2–0.5% of the cadastral value |

| Tax on rental income | 19% flat tax or according to the scale | 20–30% progressively |

| Notary, lawyer, agent | 2–6% in total | 3–6% in total |

| Capital gains tax | 19% when sold within 5 years | Released after 10 years of ownership |

Investor's Checklist: Real Estate in Poland

1. Determine your investment goals

- Long term rental or short term (Airbnb).

- Profit from resale or capital accumulation.

- Obtaining a residence permit or personal residence.

2. Select region and city

- Warsaw, Krakow, Wroclaw – high liquidity, stable demand.

- Poznan, Lodz, Bydgoszcz – affordable prices, growth potential.

- Gdansk/Sopot/Gdynia – premium segment, tourist rentals.

- Consider villages and suburban areas for affordable options.

3. Analysis of the property

- New building or secondary market.

- Condition of the apartment, need for renovation.

- Type of property: Pełna własność, Spółdzielcze, Towarzystwo Budownictwa Społecznego.

4. Legal checks

- Verification księga wieczysta (ownership).

- The presence of encumbrances and debts.

- Agreements with the developer or previous owner.

5. Finance and taxes

- Purchase tax (PCC/NDS).

- Property tax and rental income.

- Expenses for a notary, lawyer, agent.

- Possible tax optimization schemes.

6. Property management

- Choosing a management company or managing it yourself.

- Rental service agreement, property insurance.

- Monitoring profitability and payback.

7. Exit strategy

- Market liquidity: Warsaw, Krakow, Wroclaw are selling faster.

- Resale period: 1-3 years, possibly more than 5 years to minimize taxes.

- Retaining a residence permit upon sale (if there is a business or other grounds).

8. Additional points

- Consider domestic demand (mortgages, students, relocators).

- Follow market forecasts and infrastructure projects.

- Compare with other EU markets to balance your portfolio (Austria, Slovakia).

Investor scenarios

1. Investor with €150,000

I found a 50 sq m apartment in Poznań. I'm looking for long-term rental income with a 5-6% annual return. The newly built property offers high liquidity and capital growth potential. It's an ideal option for an investor looking for a stable income on a budget.

2. Pensioner with €300,000

For comfortable living and partial rental, I selected an 80 sq m apartment in Krakow. The proximity to the city center, infrastructure, and everyday amenities were important. This option is suitable for those who want to combine private living with additional income.

3. Family with children from €400,000

I found a 130 sq m house for my family in a Warsaw suburb. The main goals were comfortable living and long-term capitalization. The house is located near schools and transportation hubs. Resale is possible in 5-10 years with the potential for appreciation, making it an attractive option for both living and investing.