Real estate in Georgia: sea, mountains or Tbilisi?

Georgia's real estate market is currently one of the most accessible and easy to enter. Apartments can be purchased quickly and without unnecessary bureaucracy, taxes are minimal, and renting out property in Tbilisi or Batumi generates a stable income higher than in many European countries.

In this article, I'll explain how to buy an apartment in Georgia, what expenses to consider, where to invest, how to obtain a residence permit, and when it might be wiser to consider Austria or Vienna for a more secure and stable investment.

Georgia is rapidly establishing itself as a "new hotspot" for investors in Europe and the post-Soviet space. And there are plenty of reasons to pay attention to its real estate market:

- Simple rules for foreigners : apartments or flats can be purchased directly; restrictions apply only to agricultural land. Property registration takes one day and costs between 50 and 350 GEL.

- Taxes are minimal – there is no stamp duty on purchase, rent is subject to a flat 5% tax, and property tax for most families is between 0 and 0.2%.

- Tourism is growing – more than 7 million tourists visited the country in 2024, and Batumi has become a leader in short-term rentals on Airbnb and Booking.

- Infrastructure and cultural projects include the development of tourist areas in Batumi and Kobuleti, the renovation of Tbilisi's historic center, new mountain cable cars, and large-scale seaport modernization projects.

"An apartment in Georgia isn't just a place to live, it's also an investment with a good return. My goal is to help you choose a property that's both profitable and reliable."

— Ksenia , investment consultant,

Vienna Property Investment

My name is Ksenia Levina, and I'm an international real estate investment consultant. In this article, I'll discuss the opportunities offered by the Georgian market and how it differs from Austria, where things are more strict and stable.

In practice, I see that buying an apartment in Tbilisi or a seaside house in Batumi isn't just about comfort but also about profit. One of my clients bought a small apartment in Tbilisi, quickly rented it out long-term, and used the proceeds to buy an apartment on the coast. As a result, he created two streams of income in just a few months.

Austria vs. Georgia: Which is Safer?

Georgia has become a real magnet for investors in recent years thanks to its low entry barriers and simple rules for foreigners. Property ownership is quick, taxes are minimal, and apartments in Tbilisi and Batumi offer significantly higher rental yields than in most EU countries. This makes the market attractive to those looking to enter the market quickly and see results.

At the same time, Vienna and all of Austria remain a symbol of stability. There are no sharp fluctuations, demand is high and constant, and housing prices have been rising steadily for decades. For most long-term investors, Austria is a winner—it's a predictable and reliable market where capital can be preserved and invested without unnecessary risks.

| Parameter | Georgia | Vienna (Austria) |

|---|---|---|

| Prices per m² | Below, easy start | High but predictable |

| Rental yield | 6-8%, quick earnings | 2–4%, stable income |

| Price increase | Fast but unstable | Slow but steady |

| Taxes and fees | Minimum | Higher, more procedures |

| Bureaucracy | Simplified rules | More control |

| Risks | Volatility, dependence on tourism | Very low, the market is protected |

| Liquidity | Good only in top locations | High almost everywhere |

Georgia's place on the world investment map

Georgia is confidently establishing itself as a prominent player on Europe's investment map. The country is strategically located at the intersection of transport routes between Europe and Asia, making it a natural logistics and trade hub. According to the National Bank of Georgia, foreign direct investment exceeded $2.0 billion in 2023, 12% in 2024 primarily due to investments from the Netherlands, the UK, and the US.

Economic policy remains one of the most liberal in the region: corporate income tax is 15%, dividend tax for residents is 5%, and property ownership registration takes just one day. Georgia ranked 7th globally in the 2019 and maintains a high score in the "investor protection" category.

An additional driver of attractiveness is the country's commitment to integration with the European Union: the country already has candidate status for membership and operates under the Association Agreement. This makes the real estate and logistics markets particularly attractive to European investors seeking a location with a lower entry barrier and growth potential.

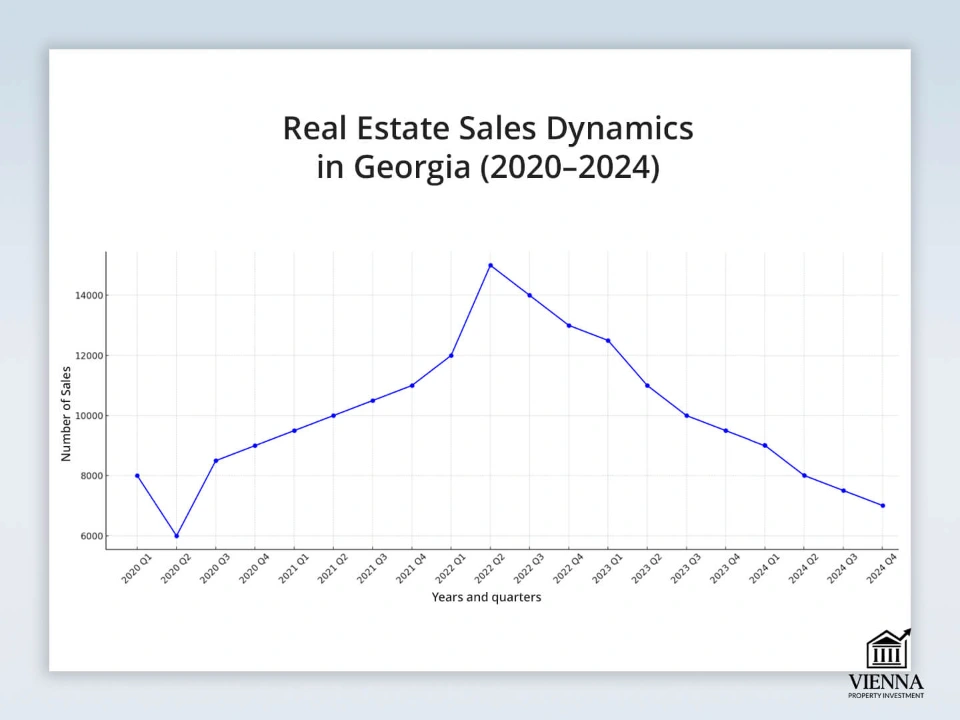

But despite all the advantages, there are also risks. Since 2024, the country has been in the grip of a political crisis, and issues of territorial integrity remain pressing. Nevertheless, even taking these factors into account, the market continues to grow: according to Colliers Georgia, in 2025, the average home price in Tbilisi increased by approximately 6-7% compared to the previous year, and rental rates stabilized at a level providing a yield of approximately 6-8% per annum.

Profitability and Transparency Ratings

According to PwC, World Bank and Numbeo, Georgia is among the countries with the highest transaction transparency in Eastern Europe.

- Doing Business (World Bank): 7th in the world for ease of doing business.

- Numbeo (2024): Tbilisi consistently ranks among the top 20 European cities for housing affordability.

- PwC: Georgia is noted as one of the jurisdictions with low taxes and simple rules for property registration.

For investors, this means: transactions are completed quickly, costs are minimal, and the protection of property rights is quite reliable by regional standards.

Competitors: Portugal, Spain, Cyprus, Türkiye

Portugal. Popular thanks to its Golden Visa and stable tourist flow. Strong demand in Lisbon and the Algarve has driven up prices: entry thresholds range from €280,000–350,000, and rental yields an average of only 3–4% per annum. The market is considered overheated and is better suited for capital preservation than quick returns. If your goal is not only an investment but also a move/lifestyle to the EU, it makes sense to compare real estate in Portugal with Georgian options.

Spain. Offers stability and liquidity, but comes with high taxes. Non-residents face rental taxes of up to 24%, and capital gains tax applies when selling. As a result, real returns are 2–3% per year, but the market is reliable and prices rise smoothly.

Cyprus. Combining seaside properties with tax breaks, it's popular with those seeking seaside villas. However, following the banking crisis, confidence has declined, and liquidity outside of resort areas is low. Profitability is average, but the country is highly dependent on tourism. Meanwhile, investing in Cyprus real estate is often chosen by those seeking a combination of the sea, a clear European jurisdiction, and a more resort-like lifestyle, albeit with seasonality in mind.

Turkey. Attractive due to its low prices and market scale—from Istanbul to Antalya. However, inflation and the unstable lira make yield forecasts difficult. For investors with a high risk appetite, the market remains attractive, but less predictable than in Europe.

Why investors are shifting their focus from Europe to Georgia

Many investors, having tried the Spanish or Portuguese markets and encountered high taxes and low returns, choose Georgia as a more flexible and profitable option. It's easier to enter the market, close the deal faster, and immediately start leasing the property.

- My German clients initially considered apartments in Lisbon, but after comparing prices and yields, they chose apartments in Batumi. They ultimately achieved a 7% annual return, compared to the projected 3% in Portugal.

Thus, Georgia is today perceived as a second-tier market: still “young,” but precisely because of this, more profitable and promising.

The Georgian real estate market

Investors like Georgia because everything is simple: property registration takes just one day, taxes are minimal, and there's a wide choice of housing—from affordable apartments in Tbilisi to apartments on the Black Sea coast. Since 2018, prices have been steadily rising, and foreigners can freely purchase property.

History: Crisis, Falling Prices, and Recovery

After the 2008–2012 crisis, the Georgian real estate market hit rock bottom. In Tbilisi and Batumi, prices per square meter fell by 25–30%, and foreign demand virtually disappeared. But the situation changed after 2016: the country more actively integrated into Europe, visa-free travel with the EU was established, and tourism began to grow at record rates.

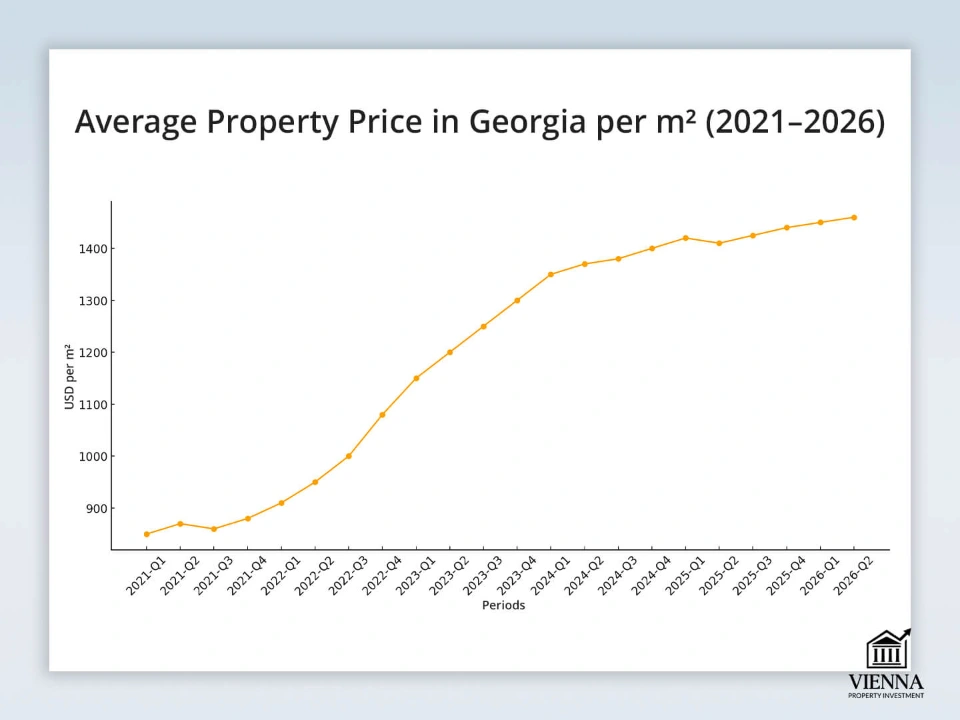

From that point on, a gradual recovery began: since 2018, apartment prices have steadily increased by an average of 6-7% per year. The market has recovered particularly quickly in resort areas such as Batumi, Gudauri, and Kobuleti. According to the National Statistics Agency of Georgia, average annual housing price growth in 2024 was 6.6%, and analysts predict similar growth in 2025.

Price dynamics 2018–2025

It's important for investors to understand that the Georgian market is steadily growing. In Tbilisi, prices are steadily rising in the central districts of Vake, Saburtalo, and Mtatsminda. In Batumi, the price of a square meter of seaside property has almost doubled over the past five years, despite starting prices being very low by European standards.

Even in the regions, there's a surge in activity: Kakheti (a wine region) and Kutaisi (the second-largest city) have followed the capital's lead. And in mountain resorts like Bakuriani and Gudauri, interest in chalets and short-term rental apartments is only growing.

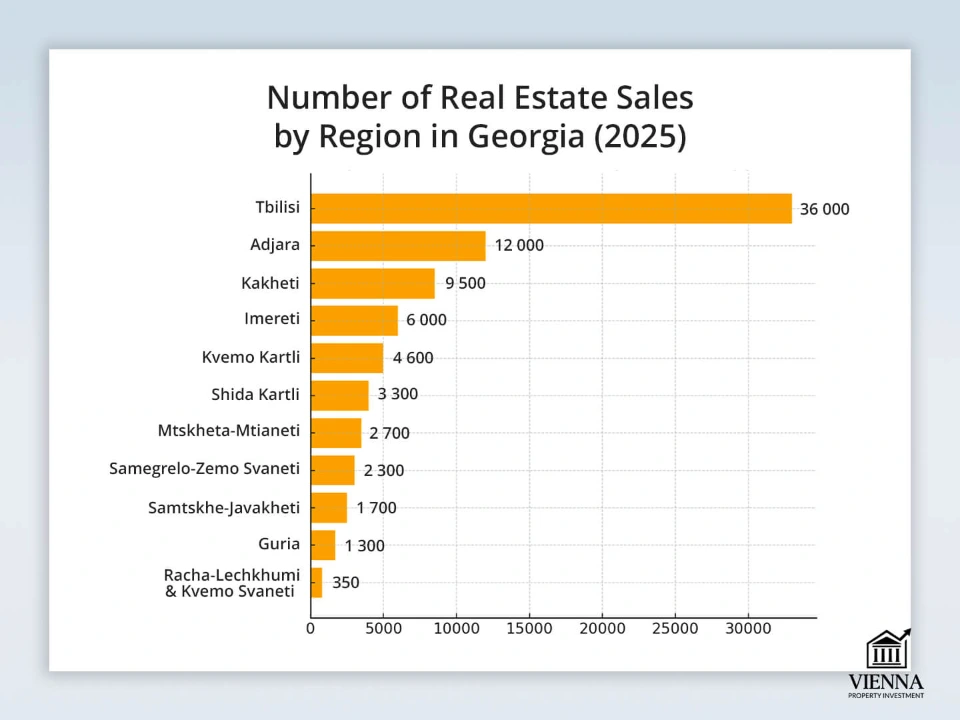

Geography of transactions: where demand is concentrated

- Tbilisi is the country's main market, a leader in long-term rentals and stable demand. It offers affordable apartments in new buildings for rent to expats and students.

- Batumi is the second-largest city and the clear favorite among foreign investors. The city thrives on tourism, so rental yields are higher than in Tbilisi, especially in the summer.

- Kutaisi is cheaper than the capital, but is actively developing thanks to its airport and internal migration.

- Mountainous areas (Gudauri, Bakuriani) are a new trend: tourists are increasingly choosing ski resorts, and investors are buying up apartments in ski-in/ski-out packages.

Interestingly, experienced investors often combine these two strategies: they buy one apartment in Tbilisi for stability and another property by the sea or in the mountains for seasonal income. This portfolio is balanced and protects against rental inactivity.

What types of real estate do investors choose?

Resale (approximately 70% of transactions) are older apartments that are profitable to buy for renovation and rent out. This is the most affordable way to enter the market.

New buildings are actively being built in Tbilisi and Batumi. Developers offer installment plans starting with a 10% down payment, which is convenient for foreigners.

Luxury apartments are premium apartments by the sea or in central Tbilisi. Demand is limited, but yields are above average.

Aparthotels and managed hotels have become a trend in recent years. Investors purchase a room or apartment, transfer it to a management company, and receive a fixed percentage of the revenue without the headaches.

Who buys real estate in Georgia?

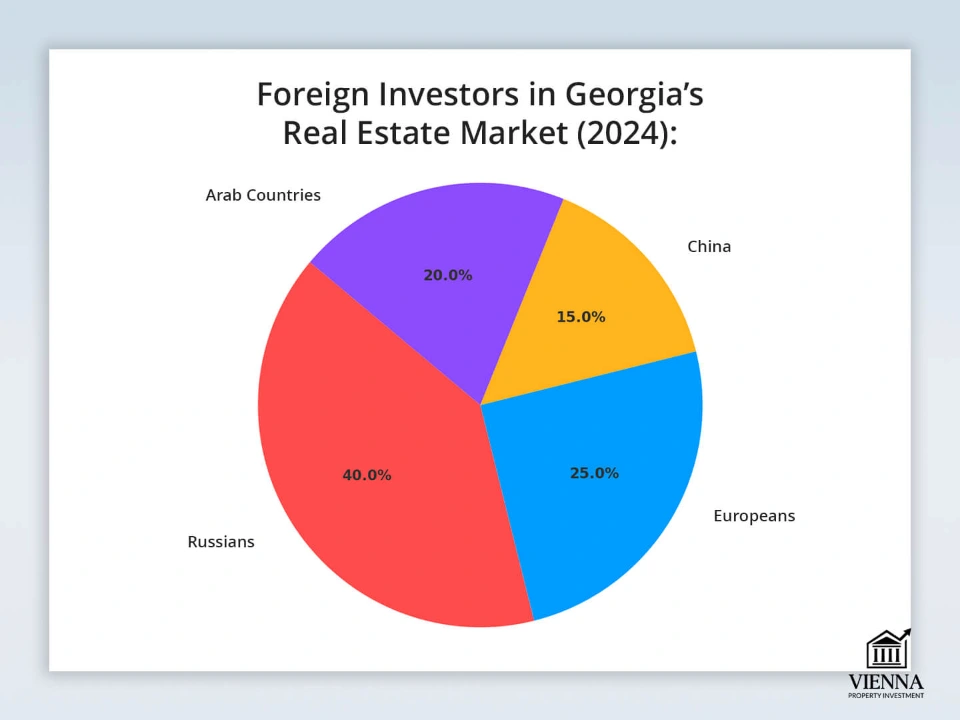

Foreign investors are currently driving a significant portion of demand in the Georgian housing market, particularly in Batumi and Tbilisi. According to developers, the share of foreign buyers in total transactions increased by almost 40% in 2024, and they already constitute the majority in resort towns.

- Russians. Since 2022, Russians have become the largest group of buyers, both due to relocation and a desire to secure capital. They are primarily purchasing apartments in Tbilisi (for permanent residence and long-term rentals), as well as seaside apartments in Batumi.

- Europeans. Investors from Germany, the UK, and the Baltic states lead the way. For many, this is a way to diversify their portfolios and access a more affordable market than the EU. Europeans most often choose new buildings in Tbilisi and apartments in Batumi, focusing on income from short-term rentals through Airbnb and Booking.

- Chinese investors. Their interest lies primarily in the commercial segment—offices, hotels, and retail space. However, in recent years, they have also been actively purchasing new buildings in Tbilisi, viewing them as long-term investments. A significant factor is the participation of Chinese companies in construction projects, which further stimulates demand.

- Arab countries. Investors from the UAE, Saudi Arabia, and Kuwait are gravitating toward the premium segment: luxury apartments in Batumi, hotel complexes on the coast, and elite apartments in central Tbilisi. For them, Georgia is attractive as an affordable yet promising "second tier" after Dubai and Doha.

-

For more information on purchasing real estate in the UAE, see the articles " Real Estate in Abu Dhabi " and "Real Estate in Dubai ."

In practice, foreign demand significantly influences the market structure. While Tbilisi balances locals and foreigners, in Batumi, foreigners essentially form the majority of buyers of new homes. This explains why prices here have risen faster in recent years than in other regions of the country.

Ownership formats and investment methods

Unlike many EU countries, foreigners can purchase real estate in Georgia with virtually no restrictions. The main exception is agricultural land, which foreigners are prohibited from directly owning. Otherwise, various ownership and investment options are available:

Freehold ownership. When you purchase an apartment or house, you become the full owner of the property. This right is perpetual and includes the ability to rent, resell, gift, or bequeath it.

Through a company (LLC in Georgia or a firm in the EU). This is a popular option for investors who want to circumvent the ban on purchasing agricultural land. By registering a company, you can legally purchase a plot of land, for example, in the mountains or by the sea, and build a house or hotel.

REICs / real estate investment trusts. Georgia is still developing its real estate investment trust market, but the first examples (in Tbilisi and Batumi) have already emerged. This is a way to invest through a trust and generate income without directly managing the properties.

Joint purchases, inheritance, and family trusts. Often used when acquiring property for family or business partners. Inheritance law in Georgia is quite simple: a will or deed of gift is sufficient. For multiple properties, lawyers recommend family trusts or registration through a company.

Ownership formats in Georgia

| Aspect | Full ownership | Company (LLC) | Funds / REIC | Joint purchase/trust |

|---|---|---|---|---|

| Ownership | Full, indefinite | For the company, you are the beneficiary | Ownership through a foundation | Shares between participants |

| Term | Unlimited | Unlimited | While the fund is active | Unlimited |

| Resale | Free, without restrictions | Through the sale of a company or asset | Share for sale | Free |

| Suitable for | Apartments, flats, houses | Land, hotels, construction | Investors without time for management | Family and collective investments |

Purchasing as a private individual is the easiest and fastest option, especially when it comes to apartments in Tbilisi or Batumi. The transaction is completed in 1–2 days.

If the goal is mountain land or hotel construction, then a company (LLC) is formed. This takes up to 2-3 days and costs approximately $100-150.

Family trusts and inheritance

In Georgia, inheritance rules are fairly simple: by law, property automatically passes to the closest relatives—the spouse, children, and parents. If there is a will, the procedure is even more transparent and almost always resolves without litigation.

This is convenient for foreign investors, but there's a caveat: the processing and recognition of documents may depend on the heirs' country of citizenship. Therefore, many prefer to structure their ownership in advance.

An LLC is often used to register a property : in this case, the inheritance is not the apartment or house itself, but a share in the company. This simplifies the transfer of assets and avoids additional expenses.

Another option is a family trust. This structure gives the investor control over how and to whom the property will be transferred, protects assets from division in family disputes, and ensures confidentiality. Although the trust system itself is not yet as developed in Georgia as in the UK or Austria, local lawyers suggest establishing trusts in EU or US jurisdictions and "linking" Georgian real estate to them.

Thus, the investor has a choice:

- leave inheritance by default (automatic transfer to relatives),

- draw up a will in Georgia,

- or structure the asset in advance through a company or trust to eliminate bureaucracy and make the process as predictable as possible.

Restrictions for non-residents

The main restriction is that foreigners cannot directly own agricultural land. However, this rule can be circumvented by registering a company. There are no restrictions for apartments, condos, commercial properties, and seaside homes.

Comparison with Austria: fewer barriers, but less stability

In Georgia, the purchase procedure is simple: a foreigner can become the owner of an apartment in one day and immediately rent it out. In Austria, things are more complicated: licenses, notary procedures, and often approval from land authorities are required.

But Vienna and other cities have an advantage: the market is more stable, prices rise slowly but reliably, and demand is more predictable. In Georgia, returns are higher, entry is cheaper, but the risks (exchange rates, politics, demand) are significantly higher.

Legal aspects of purchasing real estate in Georgia

Although the purchase process in Georgia is simpler than in most European countries, it's important to consider several key legal steps. Proper registration ensures that the property truly belongs to the buyer and is not encumbered by debts or disputes.

Step-by-step transaction process

- Obtaining a tax identification number (TIN).

Foreigners need it to register a transaction at the House of Justice. This can be obtained in one day. - Preliminary agreement and deposit.

Typically concluded with the developer or owner, the deposit is 5–10% of the purchase price. - Property inspection by a lawyer.

The lawyer analyzes the cadastral extract, verifies ownership, and checks for any debts or encumbrances. - Notarization of the contract.

Residential transactions require a notary in most cases, especially if payment is made in installments or the property is registered to multiple owners. - Registration in the Cadastre (Public Registry).

Georgia operates on a "one-stop shop" principle: ownership is entered into the electronic registry and confirmed by an extract. - Obtaining a certificate of ownership.

The extract is issued within 1–4 business days (expedited registration – same day for 350 GEL).

The role of a lawyer and agent

In Georgia, the purchase process is transparent, but foreign investors almost always need a lawyer. An agent helps find the property, negotiate, and verify market prices. The lawyer, in turn, handles all legal due diligence: checking the cadastral history, drafting the purchase agreement, ensuring the correct transfer of funds, and registering the property with the Public Registry.

In practice, this is more important than it seems: many apartments, especially in older buildings in Tbilisi, may have unspecified issues—inheritance disputes, old utility bills, or illegal renovations. A lawyer checks for these risks in advance.

Requirements for the buyer

To buy an apartment or house in Georgia, you only need:

- be of legal age (18 years or older),

- present a valid passport,

- For large transactions, confirm the origin of funds (standard AML rules).

A residence permit or visa is not required for the purchase. This means that a foreigner can even arrive in the country as a tourist and complete the transaction in just a few days.

The main restriction is that foreigners cannot directly own agricultural land . This is resolved by registering a company (LLC) or rezoning the land.

Peculiarities of buying property by the sea or in the mountains

The coastline (Batumi, Kobuleti) is focused on apartments in residential complexes and hotel-type properties. Most new projects are sold with management companies, simplifying rentals. This is convenient for those who want to generate income without being permanently based in Georgia.

In mountainous regions (Gudauri, Bakuriani), people mostly buy apartments in aparthotels or land plots for the construction of hotels and chalets. However, foreigners only obtain land through companies. These plots are in demand due to year-round tourism, but they require greater oversight and investment.

Buy remotely

Georgia is one of the few countries where you can register real estate completely remotely.

To do this:

- A power of attorney is issued by a notary at the place of residence.

- The documents are sent to Georgia and certified.

- A lawyer or authorized representative signs the agreement and registers the transaction.

The process takes 1-2 weeks. Interestingly, many transactions in 2022-2024 followed exactly this pattern: buyers from Russia and Europe purchased apartments in Batumi and Tbilisi without having to visit in person.

Legal due diligence and registration of property rights

Before purchasing real estate in Georgia, it's essential to conduct a legal due diligence check. You need to ensure the apartment or house is free of liens, debts, or litigation, and that the new building has all the necessary permits. It's also important to check whether the developer is registered and authorized to sell. This is especially true for residential complexes in Batumi, where some projects are launched without full documentation. A lawyer can help avoid the risk of buying a "paper" home.

After verification, the transaction is registered at the Public Service Hall (House of Justice) —a modern, one-stop shop where you can submit documents, pay the fee, and receive an electronic title deed.

- Standard registration takes up to 4 business days.

- Expedited processing is possible in 1 day upon payment of an additional fee (approximately 350 GEL).

The resulting certificate has full legal force and is recognized by all government agencies, and can also be used in international transactions, such as mortgages or inheritances.

Taxes and expenses when buying real estate in Georgia

Purchasing real estate in Georgia is more advantageous than in many EU countries, as the tax system is simpler and less expensive. Foreign investors don't face stamp duties or high registration costs, and the main expenses are related to registration and legal fees.

Main taxes and fees

Property tax

For individuals, the rate depends on the family income:

- for income up to 100,000 lari - from 0.05% to 0.2% of the market value of the property;

- for incomes above 100,000 lari – 0.8–1%.

For companies, the rate is fixed at 1% of the book value.

Income Tax:

For rental income, the rate is 5% if the owner is registered in the landlord register. Otherwise, the general rate of 20% applies.

Corporate Tax:

Resident companies are subject to a 15% rate, but the tax is levied only on profit distributions (the "Estonian model"). International companies and the IT sector are subject to tax breaks of 0-5%.

VAT

rate is 18%, but it is not applied to residential property purchases by individuals. Export and tourism services are also exempt.

Excise tax

applies only to excisable goods (alcohol, tobacco, fuel) and has no direct relation to real estate.

Additional taxes and features

Additional taxes and special considerations in Georgia primarily affect non-residents and companies working with foreign contractors. For example, when non-residents provide services, a refundable VAT rate of 18% applies.

In addition, if a non-resident receives income from sources in Georgia, a withholding tax applies: the standard rate is 10%, a preferential rate of 5% applies to dividends and royalties, and in the case of payments to offshore jurisdictions, the tax increases to 15%.

The tax system also provides penalties for late filing. Late filing of a tax return carries a fine of 100 lari, and late payment is subject to a penalty of 0.05% for each day of delay.

If the arrears persist for more than two months, the fine may range from 5 to 10% of the unpaid tax. Thus, tax compliance in Georgia remains strict yet transparent: investors understand not only the amount of their obligations but also the consequences of failure to comply.

Costs of transaction execution

When purchasing real estate, the investor pays:

- legal services - usually 1-2% of the transaction amount,

- agent services - 2-3% (if the property is purchased through an agency),

- state fee for registration - 50 GEL (4 working days) or 350 GEL (1 day).

In total, expenses rarely exceed 2–5% of the transaction value, which is significantly lower than in Austria, where taxes and notary fees can reach 7–10%.

Comparison with Austria

In Austria, purchasing real estate always involves significant additional costs—more on this in the article " Property Taxes in Austria ." In addition to the Grunderwerbsteuer (3.5%), the investor pays a land registry fee (1.1%), notary and legal fees (usually an additional 2-3%). If the property is later sold, a capital gains tax is payable—the rate depends on the length of ownership and ranges from 4.2% to 30%. Therefore, total transaction costs in Austria often amount to 7-10% of the property value, and this does not include current taxes on income or property maintenance.

In Georgia, the situation is quite different. There is no stamp duty or purchase tax, registration takes 1-4 days, and costs between 50 and 350 GEL (approximately €15-100). The investor's main expenses are the fees for a lawyer and agent, typically amounting to 2-5% of the transaction.

When reselling a property, individuals are exempt from capital gains tax if the apartment has been owned for more than two years. This makes the Georgian market much more accessible and quicker to enter, although Austria certainly offers a higher level of stability and transparency.

Residence permit by investment in Georgia

Georgia doesn't have a traditional "Golden Visa" program like Portugal or Greece, but foreign investors can obtain residency through investment. The primary route is an investment of at least $300,000 in the Georgian economy or the purchase of real estate (excluding agricultural land) of similar value.

To properly assess this path, it is useful to compare it with how temporary residence permits, permanent residence permits, and citizenship by investment programs operate in Europe : the requirements for amounts, terms, residency, and reporting are usually significantly stricter there.

Entry threshold

To obtain a residence permit in Georgia through investment, you must invest at least $300,000. These funds can be used to purchase an apartment, house, suite, or hotel, or invest in a business. It's important to note that the property's market value must be confirmed by a certified appraiser.

To compare "European" scenarios, it's useful to separately examine how and why people buy property in Greece : there, the logic often revolves around residency status, family relocation, and long-term ownership, not just high current returns.

The issued residence permit is valid for five years and offers the investor a wide range of opportunities: legal residence in the country, the right to conduct business, and access to healthcare and education. The program applies not only to the investor but also to their family members—spouses, minor children, and dependents—who can obtain a residence permit along with the main applicant.

This makes the scheme attractive to those who see Georgia not only as an investment destination, but also as a place to relocate the entire family.

Restrictions and conditions on turnover

An investment residence permit in Georgia is not a direct path to citizenship. Even if the investor has invested the required funds, obtaining a passport requires at least 10 years and meeting additional criteria, including language proficiency and basic integration into society. Furthermore, a residence permit itself does not grant the right to work for hire—this requires a separate permit, while business activity is free from day one.

The program is designed for real investors, so it includes monitoring of annual business turnover:

- $50,000 in the first year,

- $100,000 in the second,

- $120,000 in the third and further.

These indicators are confirmed annually by reporting to the Agency for the Development of Public Services.

What changed in 2023–2025

Previously, foreigners simply needed to purchase real estate for $300,000 to obtain a residence permit almost automatically. Since 2023, the requirements have been tightened: now, it is mandatory to demonstrate business turnover and evidence that the investment is actually working in the country's economy. This is intended to combat "dormant visas," where investors simply buy apartments without participating in market development.

Comparison with Austria

| Criterion | Georgia | Austria |

|---|---|---|

| Entry threshold | from $300,000 (real estate or business) | from €1–2 million (investments, self-sufficiency, D-visas) |

| Validity of the residence permit | 5 years, extended upon fulfillment of turnover conditions | 1–2 years, then extension |

| Conditions | Requires proof of annual turnover: $50k → $100k → $120k | Proof of income, investments and housing |

| Citizenship | After 10 years of residence, investments do not provide direct benefits | Possibly in 10 years, in some cases faster |

| Registration | Fast, in 1-4 days | More complicated, takes months |

| Market stability | The yield is higher, but the market is volatile | Stable, prices rise slowly but predictably |

| Risks | Political, economic, limited access to citizenship | High costs but minimal legal risks |

Common mistakes when filing

- Purchase of agricultural land (foreigners have no right to it).

- Underestimating turnover requirements – if a business fails to meet the required figures, the residence permit will not be extended.

- Registration at a reduced value: the cadastral register takes into account the market value, not the price in the contract.

Rent and income in Georgia

Airbnb and Booking remain the main rental platforms in Tbilisi and Batumi. Returns can reach 7-9% per annum, especially during the holiday season, but high competition and seasonality must be taken into account. Apartments in Batumi are often unoccupied during winter, while in Tbilisi, demand drops during off-peak tourist periods.

Demand for long-term contracts is stable in the capital. Expats, students, and employees of international companies prefer to rent apartments for a year or longer. The yield is lower— 5–6% per annum— but it's more reliable and offers lower downtime risks.

Georgia hasn't yet introduced strict restrictions on short-term rentals, as many European capitals have. However, Tbilisi is actively discussing the need for regulations for the Airbnb sector, and some investors are already switching to a long-term model to avoid being dependent on potential changes.

Profitability by region

- Tbilisi: apartments in the center yield 5-6% in long-term rentals, while studios in Saburtalo or Vake can yield up to 7% in short-term rentals.

- Batumi: In summer, seaside apartments bring in up to 9–10%, but in the off-season, profitability drops sharply.

- Gudauri and Bakuriani: Aparthotels near ski resorts yield 6–8% when managed properly.

- Kutaisi: a growing market, yields are moderate – 4–5%, but demand is steadily growing thanks to the airport.

Management companies

Many owners entrust their apartments to management companies. In Batumi and Gudauri, developers often offer a simple solution: you purchase the apartment, and the company takes care of the rental and maintenance, paying you a fixed percentage of the income (usually 6-8% per year).

Taxation

Rental income is taxed at 5% if the owner is registered in the landlord registry. If not registered, the standard 20% rate applies. This makes official registration cost-effective and straightforward.

Comparison with Austria

In Austria, rental yields rarely exceed 2-3% per annum, and the market is strictly regulated. Investing in the Austrian real estate market is more like a capital preservation strategy: investments are long-term, risks are minimal, prices rise steadily over decades, and the legal framework reliably protects owners.

In Georgia, returns are 2-3 times higher, but this comes at the cost of greater seasonality and a higher risk of downtime. This market is suitable for investors prepared for active management and seeking a balance between high returns and volatility.

Where to Buy: Regional Analysis

Tbilisi

The capital remains the country's most stable market. There's high demand for long-term rentals from expats, students, and employees of international companies. Average yields in the city center are around 5-6%, 7% for short-term rentals Housing prices continue to rise by 6-8% annually, especially in areas with developed infrastructure. Tbilisi is suitable for investors seeking security and liquidity.

Batumi (Adjara)

A major resort and a flagship investment destination, Batumi is experiencing steady growth, fueled by the arrival of major developer EMAAR Group, which is constructing an entire $6 billion district. The most promising locations include Heroes' Alley, New Boulevard , and the Batumi Island projects. In the summer, short-term rental yields can reach 9-10%, while apartments are generally unoccupied in the winter. For those willing to embrace seasonality, Batumi offers one of the highest yields in the country.

Kutaisi (Imereti)

Kutaisi is becoming a new investment hub thanks to its international airport and growing tourist flow. Prices here are significantly lower than in Tbilisi or Batumi, making the city attractive to investors on a budget. Returns average 4–5%, but the growth potential is high: the city is actively developing its hotel and tourism infrastructure.

Gudauri and Bakuriani

Georgia's main ski resorts. Aparthotels are actively being built here, yielding 6-8% annual returns when managed properly. In winter, profitability is high due to the influx of tourists; in summer, demand is lower, but this is offset by domestic tourism. This area remains promising for investors focused on tourism real estate.

Kakheti

A wine-producing region that is gradually becoming a magnet for agritourism and premium country real estate. Demand for houses with land plots is stable here, especially near tourist routes (Telavi, Sighnaghi). Profitability is moderate—around 4–6% —but the value of land and houses in Kakheti is growing thanks to the popularity of wine tours and agribusiness investment projects.

Samegrelo-Zemo Svaneti

This region is primarily interesting for the city of Mestia, which has become a center for winter and summer tourism. Investments in small hotels and apartments generate above-average returns—up to 8% during peak seasons. The market is still developing, creating opportunities for early investors.

Samtskhe-Javakheti

The region centered on Akhaltsikhe and the popular Bakuriani resort. There's a noticeable interest in private homes and apartments near the ski resort. Yields are 5-7%, but the market is more local than in Gudauri.

Houri

One of the smallest and most undervalued regions, it boasts low real estate prices and limited demand. Its potential lies in the development of domestic tourism, but it's not yet the most attractive destination for large foreign investors.

Infrastructure and transport

- Tbilisi boasts the most developed infrastructure: new roads and interchanges, metro expansion, green space projects, and landscaping. This makes residential real estate in the central and surrounding areas particularly sought after.

- Batumi is developing as a seaside resort, with investments in its waterfront and parks. New roads connect the coastal areas with the city center, ports are being improved, and promenades and recreation areas are being built—all of this is increasing the appeal of prime beachfront properties.

- Mountainous regions (Gudauri, Bakuriani, Svaneti): transportation is of poorer quality than on the coast, but projects to improve access—road access, resort infrastructure, and the growth of tourism—make them attractive. The resilience of infrastructure to weather conditions is especially important.

Ecology and environmental quality

Clean air, mountains, and the sea are key advantages of many regions of Georgia. The Batumi and Adjara regions have higher humidity and precipitation, which may be a drawback for some investors, but many appreciate the sea and tropical vegetation.

In mountainous regions, environmental considerations are key. Tourists seek nature, fresh air, and views. This means that environmentally friendly projects will stand out.

Tbilisi has a higher environmental burden: pollution, traffic, and noise. Therefore, properties in areas with green spaces and good infrastructure are a big plus.

Tenant demand

- In Tbilisi, demand is consistently high among expats, international company employees, and students: they value renovated apartments with convenient access to business centers and transportation.

- Batumi is a hotspot for tourists and short-term renters: in summer, demand is particularly high for studios and apartments by the sea, with balconies and views.

- Mountain resorts attract tourists in both winter and summer, allowing aparthotel-type properties to rent out well during the seasons.

- In Kutaisi and smaller towns, demand is more long-term, from local residents and workers in the tourism and service infrastructure.

Investment map: where are they buying now, where is the growth?

In 2025, Batumi and the entire Adjara region remain the main focus of investors. The signing of a memorandum with developer EMAAR Group and the construction of a new district have given the market additional impetus. Combined with maritime logistics and a steady flow of tourists, this means rising prices, especially in seafront properties and premium projects.

| Region | Why are people buying now? | Growth potential |

|---|---|---|

| Batumi | Tourism, EMAAR projects, the sea | Rising prices for first-line and luxury residential complexes |

| Tbilisi | Business center, Saburtalo and Vake | Steady growth of new complexes |

| Gudauri | Resorts, aparthotels, tourism | Seasonal yield 6-8% |

| Kutaisi | Low prices, airport, tourism | Gradual stable growth |

| Kakheti | Wine, ecotourism, nature | Luxury homes and boutique hotels |

Secondary market and new buildings in Georgia

Georgia's real estate market combines both existing and new homes. The largest share of transactions—over 65% —comes from the existing market, driven by affordable prices and the opportunity to purchase in areas with well-developed infrastructure. Meanwhile, new projects offer modern layouts and energy-efficient solutions, but are more expensive and currently represent a smaller portion of the market.

Secondary market

The secondary market accounts for more than two-thirds of transactions in Georgia and remains the main source of affordable housing. Its key advantage is a lower price per square meter compared to new buildings. For example, in residential areas of Tbilisi or Batumi, you can find apartments almost half the price of new complexes by the sea or in the city center.

Another important advantage is well-developed infrastructure. Most of these properties are located in areas with existing schools, kindergartens, public transportation, and shops. This is especially valuable for families and those planning long-term rentals: tenants often choose these apartments for their convenience in everyday life.

But the secondary market also has its limitations. Some buildings built before the 1980s require major repairs and renovations. This is particularly noticeable in Tbilisi and Batumi: old Khrushchev-era buildings and panel houses require energy-efficient upgrades and are often inferior in quality to modern designs. For investors, such properties may only be attractive as budget housing or resale projects after renovation.

New buildings

- The advantage is modern architecture, new engineering systems, energy efficiency.

- Properties are often sold as "white frame" (no finishing), allowing for design freedom.

- The downside is that the pace of construction remains relatively slow, and the finished supply is limited.

Prices and dynamics

Price ranges vary greatly by district. In Tbilisi, resale apartments can be found from $800–900 per square meter in residential areas, while new buildings in the center or Vake start at $1,500–1,800 per square meter. In Batumi, the resale market starts at $700 per square meter, but new complexes by the sea cost $1,200–1,500 and above. Overall, housing prices increased by an average of 7–8% in the fourth quarter of 2024, a trend that is expected to continue into 2025.

Taxation

Income from the sale of real estate is subject to tax:

- 5% - if we are talking about residential rental or sale after less than 2 years of ownership;

- 20% - for commercial real estate and profitable sales in a short time.

- The sale of an object that has been owned for more than 2 years is not subject to tax.

Accessibility for foreigners

Real estate in Georgia is open to foreign buyers: apartments, condos, and houses are eligible for purchase. The only exception is agricultural land.

Comparison with Austria

Compared to Austria, Georgian new buildings are inferior in terms of construction quality, energy efficiency, and ESG standards. However, Georgia has the advantage of low entry barriers and fast transaction times: a purchase takes just a few days, whereas in Austria the process can drag on for months.

At the same time, in Vienna, especially in the 1st district – the Central District – real estate is considered the benchmark for stability and prestige: prices here are high, but they provide maximum capital protection and long-term liquidity.

Alternative Investor Strategies in Georgia

Real estate remains a key focus for foreign investors, but the Georgian market offers other strategies that can be equally profitable. Thanks to an open business environment, low taxes, and its geographical location, the country is becoming a platform for a variety of investments.

Classic real estate strategies

- Purchasing multiple studio apartments instead of a single apartment allows you to diversify risks and rent out properties to different categories of tenants.

- Renovating old housing stock —buying apartments in buildings built before the 1980s, then renovating and reselling them—can generate above-average returns.

- Investments in tourism infrastructure —apartment hotels, mini-hotels, and boutique hotels in Batumi, Tbilisi, and mountain resorts—are becoming a popular format.

- Investments through funds (REIC, AEEAP) allow you to receive income from real estate without direct management.

- Land plots for construction are particularly attractive in Batumi and Kakheti, where demand is growing and supply is limited.

Alternative directions

Tourism and HoReCa remain the driving force of Georgia's economy. As tourism increases, so does demand for hotels, restaurants, and agencies, making this sector particularly profitable.

Agriculture and winemaking are traditionally strong: investments in vineyards, orchards, and processing generate income from both exports and agritourism. The food industry complements this sector, creating value-added products.

Logistics and transportation are being strengthened thanks to the country's advantageous location at the crossroads of Europe and Asia. Warehouses, terminals, and freight transportation are becoming part of long-term projects.

IT and medicine are experiencing rapid growth, with startups, digital services, and telemedicine in high demand. The risks are higher, but the potential for profitability is significantly greater.

Investing in an existing business and its benefits

In addition to real estate, many investors are considering acquiring a stake or full package of shares in existing companies. This approach is particularly attractive in the energy and telecommunications sectors, where income is more predictable and not subject to seasonal fluctuations, as in tourism or agriculture.

Georgia makes such investments even more accessible thanks to its simple regulatory environment: business registration can be completed in just a few days. The country's economy is showing steady growth, evidenced by the interest of large international corporations actively investing in local projects.

An additional advantage remains accessibility: the cost of living and business start-up costs in Georgia are lower than in Austria or other EU countries, which lowers the barrier to entry and makes the market particularly attractive to foreign investors.

Georgia vs. Vienna: Dynamics vs. Stability

| Direction | Georgia | Vienna |

|---|---|---|

| Real estate | 6–10% return, fast growth, higher risks | 2-3% yield, slow growth, stability |

| Renovation | Cheap old stock, fast deals | Expensive, but the value lasts for decades |

| Tourism | Fast return, seasonality | The sector is saturated, returns are moderate |

| Business | Accessible entry, new industries (IT, energy) | High threshold, strong competition |

Georgia is attractive for its dynamism and low entry barriers, but it requires a willingness to accept risks. Vienna, on the other hand, is more suitable for investors seeking long-term stability and capital protection.

"In Georgia, it's important not just to buy real estate, but to understand the purpose: for some, it's renting in Tbilisi, for others, it's a house by the sea or in the mountains as a long-term asset.

Which option is right for you?

— Ksenia , investment consultant,

Vienna Property Investment

Risks and Disadvantages

Despite its attractiveness, the Georgian market also has its vulnerabilities. Bureaucracy and legislative instability remain among the main risks. Although the country generally simplifies business regulations, real estate laws and regulations are subject to change, creating uncertainty for investors.

An additional complication is short-term rentals: regulations are gradually tightening in large cities and resort areas, which can limit profitability. Seasonality also affects the market: in Batumi, demand rises sharply in the summer and almost fades in the winter, while in mountain resorts the opposite is true, with activity concentrated in the winter.

There are also infrastructure risks. In coastal areas, flooding and humidity play a significant role, while in the regions, transport accessibility plays a role. Furthermore, liquidity outside Tbilisi and Batumi is limited: selling a property in Kakheti or smaller towns is often more difficult and takes longer.

Compared to Austria, the Georgian market wins in terms of returns but falls short in terms of stability and capital protection. Vienna offers low but predictable interest rates, while Georgia offers greater opportunities for rapid growth, but also significantly higher risks.

Accommodation and lifestyle

Georgia amazes with its contrasts: you can have breakfast by the sea in Batumi and go skiing in the evening in Gudauri. The coastline boasts a mild and humid climate, perfect for those who appreciate warm winters and year-round greenery. In the mountains, on the other hand, winters are long and snowy, while summers are cool—a true paradise for nature lovers.

Unlike Austria, where the climate is more predictable and "balanced," Georgia offers the luxury of choice - from subtropical to alpine landscapes within a few hours' drive.

Medicine and education

Basic medical services are readily available and cost significantly less than in Europe. Private clinics in Tbilisi and Batumi offer excellent care, and for major surgeries, many still prefer Austria or Germany.

Education is also developing: Tbilisi has international schools where instruction is conducted in English, French, or German. For families with children, this is one of the factors why they choose Georgia for life or long-term residence.

Standard and cost of living

Life in Georgia is significantly cheaper: rent, groceries, transportation, and even restaurants are on average 40-60% cheaper than in Austria. For example, in Tbilisi, you can rent a good two-bedroom apartment for $500-600 per month, while in Vienna, a similar one would cost €1,200-1,500. This makes the country especially attractive to expats, freelancers, and investors looking to reduce expenses while maintaining comfort.

Infrastructure and transport

Despite the stereotypes, Georgia has made significant progress in digitalization and service convenience. Online banking is stable, domestic and international transfers take minutes, and most bills (utilities, taxes, mobile phone bills) can be paid through online apps. Internet is fast and affordable, even in the regions: the average price is around 30-40 GEL ($11-15) per month for a high-speed connection.

When it comes to transport, the country is focusing on accessibility rather than expensive systems, as in Austria:

- Trains: operate between Tbilisi, Batumi, Kutaisi, and Zugdidi. A ticket for the high-speed Stadler train from Tbilisi to Batumi costs 25–35 GEL ($9–13).

- Buses and minibuses are the most popular form of transport in the regions. A ride within the city costs 1 GEL ($0.35), while intercity routes (e.g., Tbilisi–Kutaisi) start at 15 GEL ($5.50).

- Taxi: Thanks to Bolt and Yandex.Taxi, a trip around Tbilisi will cost you on average 5–10 GEL ($2–4), which is several times cheaper than in Vienna.

- Flights: Domestic flights (e.g. Tbilisi–Batumi or Tbilisi–Mestia) cost from 100–150 GEL ($35–55) one way.

- Tbilisi Metro: two active routes, fare only 1 GEL ($0.35).

Comparison with Austria

While life in Vienna is associated with stability, high-quality healthcare, and education, Georgia wins out due to its price, climate, and ease of integration. It's easier to get started here: housing is cheaper, residency is easier to obtain, and starting a business is more accessible.

Austria remains a safe haven for capital and comfort, but Georgia offers a sense of freedom, dynamism, and the opportunity to live closer to nature while maintaining all basic amenities.

Buying real estate in Georgia as an alternative to a "European refuge"

Georgia is increasingly becoming a haven for those seeking a relatively safe and affordable European jurisdiction. It has lenient legislation for foreigners, and purchasing an apartment or house takes just a few days. Foreign buyers can register property without restrictions (except for agricultural land), which distinguishes Georgia from several EU countries.

Furthermore, purchasing real estate worth at least $300,000 opens the door to a five-year residence permit. For citizens of unstable countries, this means legalization of residence, the ability to open a bank account, and enjoy basic residency rights.

For pensioners

Georgia is attractive to retirees thanks to its combination of a mild climate, affordable living, and accessible healthcare. The average pension in the EU or even the CIS allows for a comfortable life here. For example, renting a one-bedroom apartment in Tbilisi costs $400–500 , while a dinner at a good restaurant costs $15–20 for two.

Retirees also appreciate the social climate: the country is welcoming, with numerous Russian- and English-speaking communities. Legalization is simplified—residence permits are easily obtained when purchasing a home, and long-term residence (10 years) can lead to citizenship.

For digital nomads

Georgia has become a popular destination for freelancers and remote workers, largely due to its low prices and ease of registration. Internet is fast (average speeds exceed 50 Mbps in Tbilisi), mobile phone service costs $5–10 per month, and coffee at a coffee shop costs just $1.50–2.

Digital nomads choose Tbilisi or Batumi, where coworking spaces, international communities, and long-term rental options are available. Unlike Austria, where bureaucracy and taxes are higher, in Georgia, you can quickly register as a sole proprietor, pay a flat tax (1–5%), and officially work with foreign clients.

Which to choose: Vienna or Georgia

The comparison looks like this:

- Vienna – stability, high level of medicine and education, expensive but reliable investments.

- Georgia – lifestyle and freedom: low entry barriers, fast transaction processing, flexible tax system, and market dynamics.

For an investor, it's a choice between a "safe haven" and a "growing market." In Vienna, real estate appreciation is slow (2-4% per year), but steady. In Georgia, growth can reach 6-10% per year, but with greater volatility.

How to exit real estate investments in Georgia

When buying real estate in Georgia, it's important to consider not only the purchase but also the exit strategy in advance. Selling, transferring the property to relatives, or maintaining a residence permit through investment—all these steps impact the final return and the investor's future plans.

Sale of property

In Tbilisi and Batumi, apartments sell on average within 1-3 months, provided the price is right and the location is good. Apartments in the city center and on the seafront sell the fastest—they're bought for both rental and personal use. In the regions, the selling period is longer: for example, in Kutaisi or Kakheti, a property can take six months or longer to sell.

Advice: Before selling, it's worth carrying out high-quality repairs or at least cosmetic updates, preparing the land registry documents, and focusing on average market prices. This can speed up the transaction by 20-30%.

Sale with an investment residence permit

If real estate was purchased to obtain a residence permit (worth at least $300,000), selling it automatically jeopardizes the investor's right to reside. However, the law allows the investor to maintain their status if they purchase another property or confirm their investment in a business. Thus, the investor can change assets without losing their right to reside in the country.

Possibility of re-registration to relatives

Real estate in Georgia is easily transferred to spouses, children, or other relatives. Inheritance is also simplified: the property automatically passes to the immediate heirs. Many investors use family trusts or companies to keep assets within the family and reduce the bureaucracy of transfers.

Liquidity Comparison: Georgia and Austria

- Georgia remains a dynamic market. In Tbilisi and Batumi, liquidity is high, and sales periods are comparable to those in European capitals. However, in the regions—especially Kutaisi, Kakheti, and mountain resorts—property sales can take longer and depend on seasonality.

- In Austria, the market is more stable: there's always demand, especially in Vienna, and transactions are slow but predictable. In Georgia, by contrast, you can make money faster, but the risks are higher: liquidity is uneven, and property prices are more dependent on the location and infrastructure.

Expert opinion: Ksenia Levina

Over the past few years, I've helped many clients purchase real estate in Georgia. In practice, the market has proven simpler than it seems: transactions are transparent, registration is done electronically, and purchase taxes are minimal—unlike in Europe. The process from selection to completion often takes 2-3 weeks, making Georgia attractive to those looking to enter the market quickly.

Investing in real estate isn't about "to buy or not to buy," but rather "why and where." For some, an apartment in Tbilisi with its high rental demand is profitable, while for others, a house by the sea in Batumi is a reliable asset.

Which option is right for you?

— Ksenia , investment consultant,

Vienna Property Investment

Features of the Georgian market:

- Foreigners can purchase properties in full ownership (freehold).

- The restrictions apply only to agricultural land—it can be acquired through a company or by changing its category.

- Rental yields reach 8–10% per annum, especially in tourist areas.

- The most promising locations are the center of Tbilisi and coastal apartments in Batumi.

I compare investing in Georgian real estate to investing in a dynamically developing market in its growth phase. Apartment prices in Tbilisi and Batumi continue to rise thanks to foreign buyers and tourism.

I compare investing in Georgian real estate to investing in a dynamically developing market in its growth phase. Rental yields here can reach 8-10% per annum, especially in tourist areas, and apartment prices in Tbilisi and Batumi continue to rise thanks to foreign buyers and the growing number of tourists. The most promising options are mid-range housing in central Tbilisi and seaside apartments in Batumi.

In Austria, things are different: the market is stable, returns are more modest (2-4% per annum), but the risks are minimal, and assets are protected for decades. Many clients combine these two approaches: placing part of their capital in Georgia for rapid growth and high returns, and the rest in Austria for security. This balance allows not only to earn money but also to preserve capital over the long term.

Personally, I would choose a combined approach. In Georgia, I would buy a seaside apartment or an apartment in Tbilisi for rental income and appreciation. I would invest the remaining portion of my investment in Austria to ensure long-term stability. I believe this balance between dynamism and reliability is the optimal strategy.

Conclusion

In fact, the choice between real estate in Georgia and Austria is determined not by which is “better”, but by what your goals are.

If you're looking for high yields, growing rental demand, and the prospect of price growth, consider Georgia. Tourism and infrastructure are rapidly developing here, and the market remains accessible. Tbilisi, Batumi, and Kutaisi are particularly promising, with demand consistently exceeding supply.

Austria is a safe haven. I often see investors who started in Georgia for the income, then transfer part of their funds to Vienna or Salzburg to protect their capital. One client, after selling an apartment in Batumi, invested in real estate in Salzburg—the yield is lower there, but the legal framework and inheritance guarantee long-term protection.

- If you want income and value growth, choose Georgia.

- Reliability and stability are more important – Austria is suitable.

The optimal strategy is to split investments: part in the dynamic Georgian market, part in stable Europe.

Georgia expects growth through 2030 thanks to tourism, foreign investment, and infrastructure development. Real estate prices will rise faster than in Austria, but the risks are higher—the market remains less predictable.

Austria will remain a safe haven, offering modest returns but reliably protected capital. Therefore, the best option is to combine both: capitalize on growth and rental income in Georgia, while preserving assets in Europe.

Appendices and tables

Comparison table of profitability by region

| Region | Average annual rental yield (%) |

|---|---|

| Tbilisi (center) | 7–8% |

| Tbilisi (suburb) | 6–7% |

| Batumi (first line) | 8–10% |

| Batumi (second line) | 6–8% |

| Kutaisi | 6–7% |

| Gudauri (ski resort) | 7–9% |

| Kobuleti | 6–7% |

Price/Profitability Map

| Region | Average price per m² (€) | Average annual rental yield (%) | Market Features |

|---|---|---|---|

| Tbilisi (center) | 1,100–1,400 | 7–8% | Business and cultural center, high demand for rentals from expats and students. |

| Tbilisi (suburb) | 800–1,000 | 6–7% | More affordable housing aimed at long-term renters. |

| Batumi (first line) | 1,500–1,800 | 8–10% | Apartments by the sea, high demand for short-term rentals from tourists. |

| Batumi (second line) | 1,000–1,300 | 6–8% | More affordable apartments, rent all year round, but lower profitability. |

| Kutaisi | 700–900 | 6–7% | A promising region thanks to the new airport and the development of tourism. |

| Gudauri | 1,200–1,500 | 7–9% | Ski resort, profitability is higher in the winter season. |

| Kobuleti | 900–1,100 | 6–7% | A quiet resort town, popular among family tourists. |

Tax Comparison: Georgia vs. Austria

| Indicator | Georgia | Austria |

|---|---|---|

| Property purchase tax | No | 3.5% acquisition tax + 1.1% registration fee |

| Tax on rental income | 5% (fixed rate for individuals) | 10–55% (progressive scale) |

| Capital gains tax | No (if the property has been owned for >2 years) | ~30% |

| Property tax (annual) | No | 0.1–0.5% of the cadastral value |

| VAT on purchase | No | 20% (for new buildings and commercial properties) |

| Inheritance/gift tax | No | Yes (progressive, up to 60%) |

| Notary and registration fees | 0.1–0.2% of the cost | 1.1–1.5% of the transaction value |

An Investor's Checklist for the Georgian Real Estate Market

-

Define your investment goals

- Rental income or asset appreciation.

- Short-term or long-term strategies.

- Diversification between Georgia and Europe.

-

Selecting a location

- Tbilisi (center for rent, suburbs for long-term).

- Batumi (first line - tourists, second line - families).

- Gudauri and Kutaisi - growth prospects.

-

Property type

- Apartments, flats, townhouses, villas.

- Freehold for foreigners (except agricultural land).

- New buildings or secondary market.

-

Legal review

- Checking ownership rights through the National Registry of Georgia.

- Clarification as to whether the property is agricultural land.

- Checking permits and the status of a new building.

-

Financial analysis

- Determining the total cost of purchase and additional expenses.

- Accounting for registration and service fees.

- Projected rental yield and price growth.

-

Taxes and fees

- No purchase tax.

- Rental income is subject to a flat tax of 5%.

- No capital gains tax if owned for >2 years.

-

Rental strategy

- Short-term (Airbnb, Booking) - profitable in Batumi and Gudauri.

- Long-term – in demand in Tbilisi.

- Management companies for turnkey rentals.

-

Exit from investments

- High liquidity in Tbilisi and Batumi.

- Possibility of sale to foreign investors.

- Price increases until 2030 make the market attractive.

-

Investment protection

- Consultations with a lawyer.

- Signing of the contract with translation into English.

- Project profitability audit.

-

Personal control

- Inspection of the object.

- Inspection of the area's infrastructure.

- Comparison of profitability with alternatives (eg Austria).

Investor scenarios

1. Investor with €250,000

Goal: high profitability and quick payback.

We found a beachfront apartment in Batumi for €240,000. Renting it out through Airbnb yields up to 9% per annum. Full payback is expected in 11–12 years

2. Pensioner with €500,000

Goal: comfort and capital protection.

A spacious apartment in central Tbilisi was chosen for €490,000. The area, with its parks, cafes, and cultural attractions, is ideal for a quiet lifestyle. Some of the apartments are rented out to long-term tenants, yielding 6-7% annual returns.

3. Family with children

Objective: comfortable housing for permanent residence.

We found a 200 m² house in Kutaisi for €750,000, close to a school and new infrastructure. The family lives in an environmentally friendly neighborhood, and the property could be sold or rented out profitably in the future.