Real estate in Graz is an affordable market with high growth potential.

Graz is the capital of the state of Styria and the second-largest city in Austria. It is home to approximately 300,000 people, and together with the metropolitan area, the population exceeds half a million. It is not only a major regional center but also a key point on Austria's economic map: a university town, an industrial hub, and the cultural heart of Styria.

Real estate in Graz has been consistently in demand among both locals and foreigners for many years. The reasons are obvious: prices are lower than in Vienna and Salzburg, yet the standard of living remains high. Graz is rapidly growing, and this is reflected in the housing market: new neighborhoods are being built, older areas are being modernized, and rental demand is supported by a large number of students and international professionals.

Why Graz is popular with buyers

Graz combines several factors that make it attractive to different categories of buyers:

- Universities and students.

The University of Graz, the Technical University of Graz, and the Medical University of Graz are located here. More than 60,000 students create a steady demand for rentals. Small apartments and studios near the campuses are always available. - Industry and jobs.

International companies like Magna Steyr, as well as dozens of mechanical engineering and IT companies, are creating jobs. Engineers, specialists, and their families, who need housing, are drawn here. - A cultural hub,

Graz's Old Town is a UNESCO World Heritage Site. Music festivals, theaters, and exhibitions make it a popular destination for tourists and culture lovers. - Affordable prices.

Buying an affordable apartment in Austria is easier in Graz. While prices per square meter in Vienna have long exceeded €6,000–7,000, in Graz you can still find quality housing for €4,000–5,000. - Geographical location.

Graz is connected by rail and highways to Vienna, Slovenia, Hungary, and Italy. It is a convenient hub for business and travel.

-

Interesting fact : Graz is often called Austria's "green city." More than 50% of the city's territory is covered by parks, gardens, and forests, making it particularly attractive for families.

Districts and their features

Graz is a city with many different faces. Here you'll find a historic center with palaces and museums, youthful neighborhoods teeming with student life, and leafy, quieter, more spacious suburbs.

Each district attracts its own audience of buyers and renters: some seek prestige and status, others seek profitable rentals, and still others seek a quiet, family-friendly environment. To better understand where to buy an apartment in Austria, it's important to consider the differences between Graz's key neighborhoods.

| District | Character | Average purchase prices (€ per m²) | Average rent (€ per m²/month) | For whom |

|---|---|---|---|---|

| Innere Stadt | Historic center, prestige, monuments | 6 500–7 500 | 17–19 | Foreigners who value status |

| Geidorf | Universities, students, youth | 5 500–6 000 | 15–17 | Investors for rent |

| Lend | Art quarter, cafe, creativity | 4 500–5 200 | 14–16 | Young professionals, tenants |

| Jakomini | The station area is vibrant | 4 800–5 500 | 15–16 | Families, young couples |

| Mariatrost | Calm and green | 4 000–4 500 | 12–14 | Pensioners, families |

| Puntigam | Industry + housing | 3 500–4 200 | 11–13 | Workers, accessible segment |

Innere Stadt – the heart of Graz

Innere Stadt is a historic center listed as a UNESCO World Heritage Site. Narrow streets, historic buildings, squares with fountains and open-air restaurants make it not only a tourist attraction but also an investment gem. Apartments here rarely come onto the market, and every transaction is considered an event.

Central-city properties are primarily purchased by foreigners seeking to emphasize their status and own a piece of history. For investors, it's more of a "quiet asset"—rental yields aren't the highest, but prestige and steady price growth are guaranteed.

Geidorf – university energy

Geidorf is a district brimming with student life. Tens of thousands of students flock here to study at Karl-Franzens University and the Technical University. That's why small apartments and studios are literally at a premium here.

Investors love Geidorf for its fast turnover: apartments are rented out almost instantly. Demand is driven not only by students but also by young professionals working in scientific and medical centers. This is a neighborhood where rents are stable year-round, and apartment prices are rising faster than the city average.

Lend – creative cluster

In recent years, Lend has transformed from a quiet working-class neighborhood into a trendy hub for creative youth. Art galleries, coworking spaces, cafes serving signature cuisine, and bar streets are opening here. The neighborhood's atmosphere is reminiscent of Berlin's creative clusters, making it popular with renters.

Prices here are still lower than in the city center, but the upward trend is clear: demand for housing from freelancers, designers, and IT specialists is increasingly pushing the market upward. For investors, Lend offers a chance to "enter the area before it becomes elite."

Jakomini – transport and dynamics

Jakomini is one of the most convenient neighborhoods to live in. It's close to the main train station, tram lines, and business districts. The area is vibrant, noisy, and dynamic, making it attractive to families and young couples seeking a combination of accessibility and amenities.

There are schools, shops, sports centers, and parks here. Apartments are cheaper than in the city center but more expensive than in Lend, making the area a "golden mean." Investors are also drawn to Jakomini because of its stable and long-term rental rates.

Mariatrost – Green Island

Mariatrost is a quiet and green neighborhood located slightly away from the city center. It's a place for those who want to live close to nature while still having access to city amenities. Villas with gardens, spacious apartments with balconies, and views of the hills make Mariatrost especially popular with families with children and retirees.

Prices here are more affordable than in the city center, and the atmosphere is more relaxed. For investors, this is a long-term rental area: homes are rented not to tourists, but to families who have been living there for years.

Puntigam – a practical choice

Puntigam is a mix of industrial and residential areas. Located here are factories, shopping centers, and logistics companies, so the demand for housing is driven by workers and employees of these companies.

Apartments and houses in Puntigam are less expensive than in other areas of Graz, making it attractive to buyers looking to enter the market with a smaller investment. For investors, this is a stable, but not the most prestigious, segment: there are yields, but the prospects for price growth are lower than in the city center or student areas.

"Real estate in Graz means both living in the cultural capital of Styria and making a profitable investment. I'll help you navigate this path with confidence."

— Ksenia , investment consultant,

Vienna Property Investment

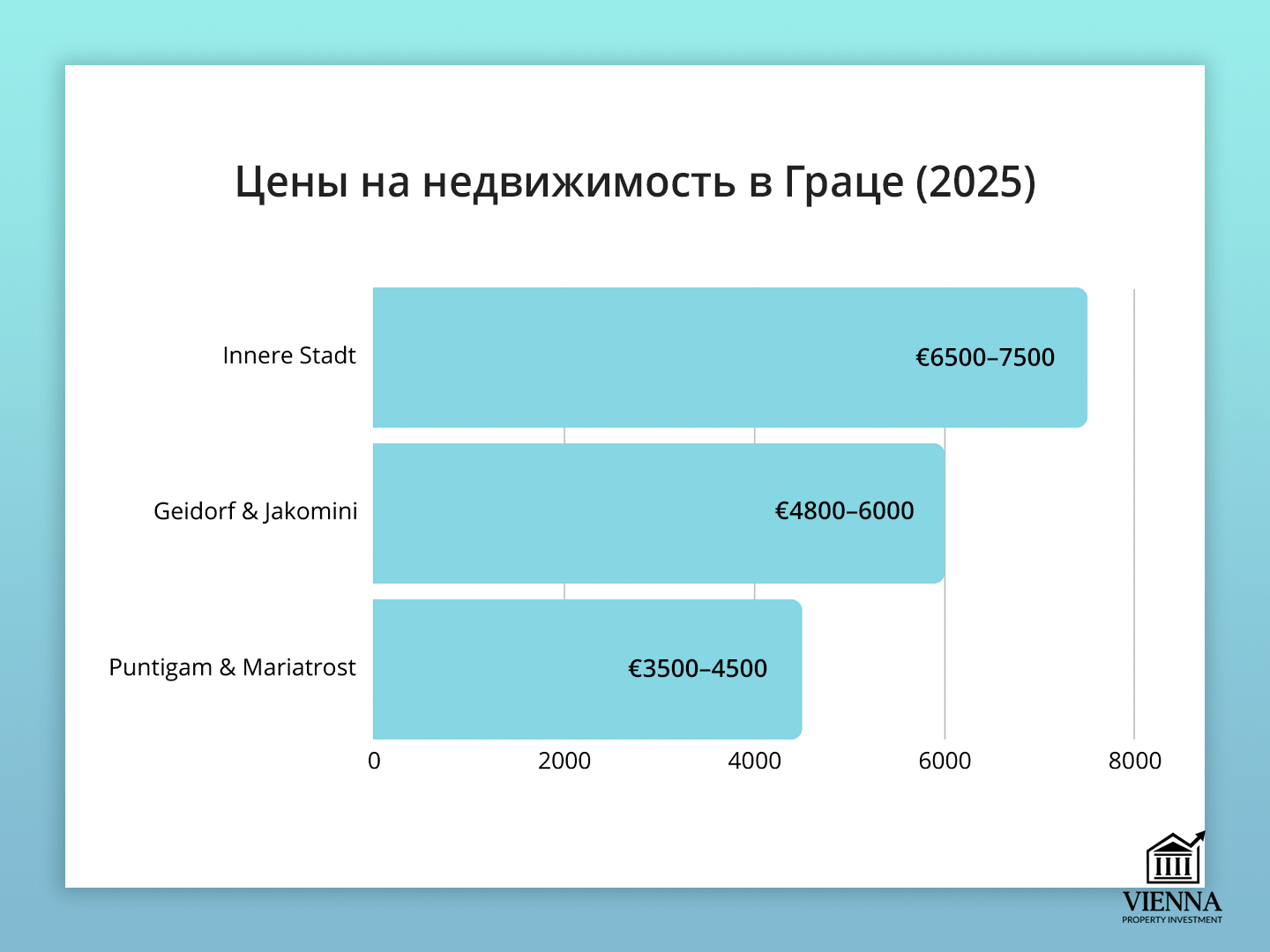

Property prices in Graz

The Graz housing market in 2025 shows a clear division by district. The city center remains the most expensive segment: apartments in Innere Stadt and surrounding streets sell for €6,500–7,500 per square meter, and in some cases, premium properties fetch even more, depending on the building's condition, views, and cultural value.

The second tier is formed by Geidorf and Jakomini , where housing costs between €4,800 and €6,000 per square meter. These neighborhoods are prized for their versatility: they offer comfortable living conditions for families, but also generate high demand from renters such as students and young professionals.

More affordable locations include Puntigam and Mariatrost , where the average price ranges from €3,500 to €4,500 per square meter. Apartments and houses here may not be as prestigious, but they offer the opportunity to enter the market on a smaller budget. This is especially important for families looking for space or for buyers looking for a "first home" without overpaying for status.

Rent

The rental situation in Graz further demonstrates its attractiveness for investors.

- In the center, the rate reaches €18 per m² , and such apartments are most often rented by foreign specialists or rented for short-term formats.

- In Geidorf and Jakomini, rents are hovering around €15–16 per square meter. Demand is driven by students and families, so apartments are readily available.

- Lend offers slightly lower rates—€14–15 per m²—but liquidity is high, with properties snapped up by young tenants and creative audiences.

- On the outskirts and in industrial areas like Puntigam, prices drop to €11–13 per square meter. This makes renting affordable, but owners should also keep in mind that such apartments rent quickly, but they won't sell for more.

Comparison: Rentals in Graz and Austria

- Austria average: €13.5/m² .

- Graz: €15.5/m² .

For example, a 70 m² apartment in Graz earns its owner approximately €140 per month more than the national average for a similar property. Over a year, this represents approximately €1,600 in additional income, and over ten years, it's an amount that could cover a significant portion of renovation costs or even mortgage interest.

The reason is that Graz combines several factors simultaneously: students and young professionals generate steady demand, while tourists and business travelers support short-term rentals. As a result, the rental market is not dependent on a single source of income, making it more resilient than other Austrian cities.

For investors, this means that even with the same risks as in other federal states, returns in Graz are higher and more stable.

What are buyers and renters looking for?

The profile of buyers and renters in Graz varies widely, depending on the district.

- Students and young professionals most often choose apartments up to 60 square meters. Studios and two-room apartments in Geidorf and Lend, located near universities and vibrant city life, are especially popular. Here, the quality of the renovation is more important than convenience and proximity to public transportation.

- Families prefer apartments of 85–100 square meters with three or four rooms. They are interested in the Jakomini and Mariatrost , which boast schools, green spaces, and shops. A balcony or terrace is essential, as life in Austria is closely tied to the outdoors.

- Foreign investors tend to buy compact apartments in Innere Stadt . These properties are ideal for short-term rentals (for tourists and business professionals) and also retain liquidity upon resale.

- Retirees prefer quieter, greener neighborhoods. Mariatrost is their favorite: quiet streets, spacious apartments, views of the hills, and the opportunity to relax in a private garden or terrace.

Interestingly, tenants in Graz place far less emphasis on the presence of an elevator or garage. Much more important are a modern kitchen, a good view, and proximity to public transportation.

The process of buying real estate

The home buying process in Graz is designed to be as transparent and secure as possible for the buyer. It all starts with setting a goal : if students are looking to rent an apartment, the Geidorf and Lend neighborhoods are typically the focus; for families, Jakomini or Mariatrost are more suitable; and those seeking prestige and status often look for properties in Innere Stadt .

Next comes the property selection stage . Realtors present various options, and it's important to evaluate not only price and location but also technical characteristics: year of construction, energy efficiency, and utility costs. In 2025, homes with good thermal insulation and modern heating systems will be particularly in demand, as this directly impacts monthly expenses.

Once a property has been selected, legal due diligence . In Austria, all transactions are registered in the Grundbuch (land registry), which guarantees the buyer protection from hidden debts or encumbrances. Only then does a notary or lawyer draw up a sales contract (Kaufvertrag), which sets out all key terms: price, delivery timeframe, and the parties' obligations.

It's important to factor in additional costs: approximately 8-10% is added to the apartment's price. This includes property transfer tax (3.5%), title registration (1.1%), legal or notary fees (approximately 1.5-2%), and agency fees, which can reach 3.6%.

For EU citizens, the purchase procedure is relatively simple. However, if the buyer is coming from a country outside the EU, a special permit from the land commission may be required, especially when purchasing a plot of land or a house in a protected area.

Investment potential

Real estate in Graz has long been considered one of the most reliable assets in Austria. Unlike the more overheated market in Vienna and exclusive Salzburg, prices here have grown steadily and without sudden surges. Over the past ten years, the average annual increase in home prices has been around 4-6% , which is quite comparable to traditional European real estate markets, while Graz offers a lower entry barrier.

"Housing in Graz combines the prestige of the old town with the accessibility of the university center. I'll help you choose the best option for your family or investment."

— Ksenia , investment consultant,

Vienna Property Investment

The most significant growth is being recorded in central districts and university areas . It is here that demand remains stable even during periods of economic fluctuation. Students, researchers, and visiting professionals create a constant flow of tenants, while tourists and business visitors complete the picture. As a result, investors experience not only an increase in the value of the apartment or house itself but also a reliable rental income.

Rental yield in Graz

The average rental yield in Graz is 4-5% per annum, slightly higher than the Austrian average. However, the range by district is quite wide:

- In student neighborhoods (Geidorf, Lend), yields can reach 6%, especially for compact apartments up to 60 m². These properties rent quickly and rarely remain vacant.

- In the premium segment (Altstadt, Innere Stadt), yields are more modest—around 3–4%—but there's another factor at play: these apartments appreciate most quickly upon resale. Investors view them as "quiet capital" that increases in value over time.

- In family-friendly areas (Jakomini, Mariatrost), rent offers a stable 4–5%, but the main advantage is low risk: families usually rent for years, not months.

Unlike resort areas, where profitability is highly seasonal, the Graz market operates year-round. Universities and businesses generate constant demand, and festivals and cultural events further enhance it.

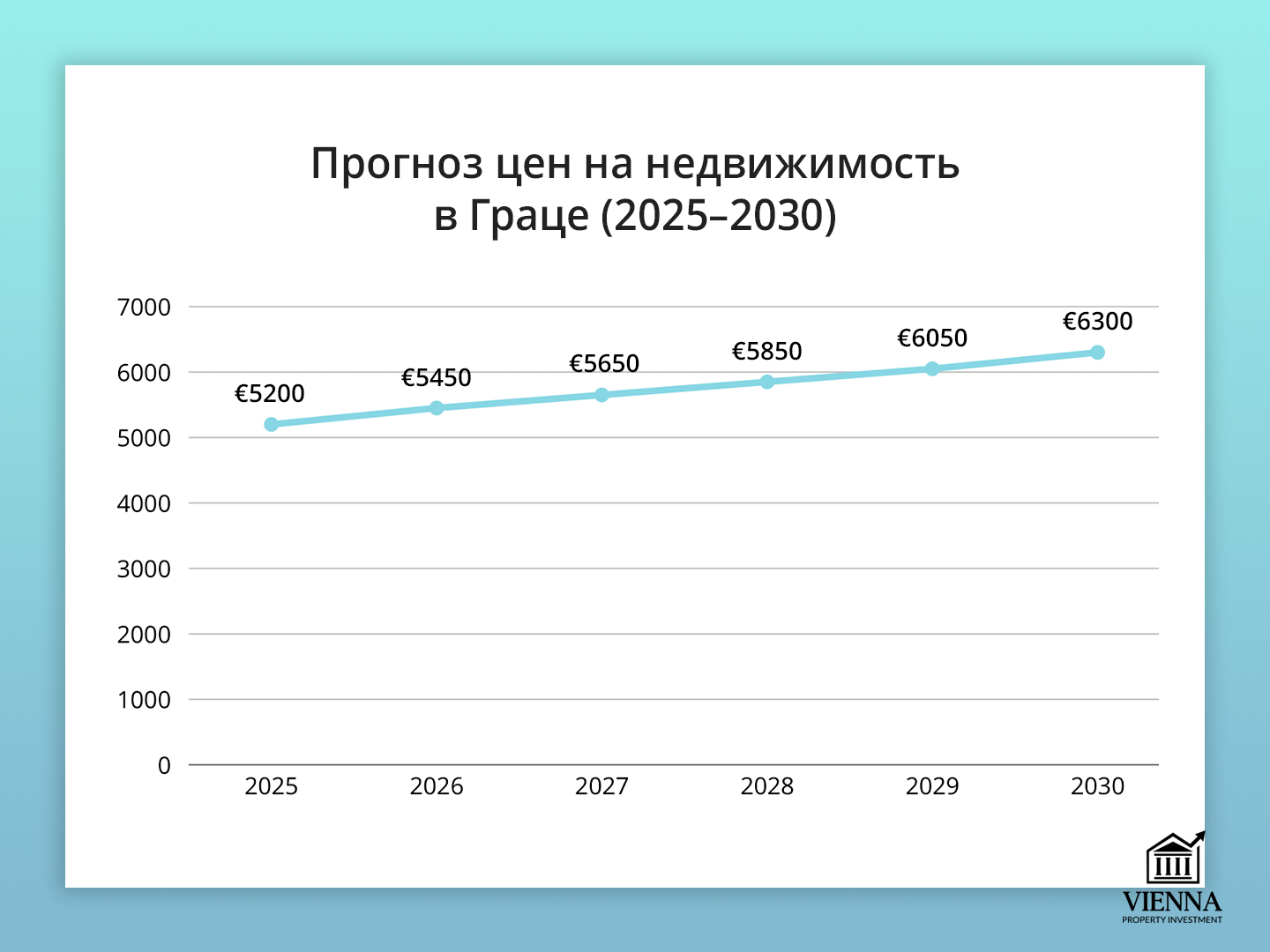

Chart: Price forecast for 2025–2030

We see a gradual increase: from €5,200 per m² in 2025 to approximately €6,300 per m² in 2030. This is not a sharp jump, but a steady upward movement, which is ideal for investors who prefer stability and a long-term perspective.

This means that if you invest in an apartment worth €300,000, its price could reach €360,000–370,000 . Add in rental income (an average of 4–5% per annum), and the property not only preserves capital but also actively works for the owner.

This scenario is especially interesting for long-term investors who are not looking for quick profits, but for a gradual increase in the asset's value.

Short-term rental tax

In July 2025, changes came into effect in Styria that directly affect apartment owners who rent out their properties through Airbnb, Booking, and similar platforms . These properties are now subject to an additional tax.

For owners, this means that the simple "buy an apartment and rent it out to tourists" model no longer works as well as it once did. Profits remain, but a portion of the income must be given to the state. As a result, many owners are beginning to change their strategy: some are switching to long-term rentals to students or families, others are raising rents, and some are even considering selling.

On the one hand, this law makes the market more regulated and fair: city residents receive affordable housing, and the budget receives additional taxes. On the other hand, it is a challenge for investors, requiring flexibility and a rethinking of traditional income models.

This is precisely what makes the Graz market unique in 2025: it will no longer be possible to copy the strategies of Salzburg or Vienna; it will have to adapt to new conditions.

Market Comparison: Vienna and Graz

| Parameter | Vienna | Graz |

|---|---|---|

| Average purchase price | €6,500–8,500 per m² (central areas up to €12,000) | €4,500–6,000 per m² (center up to €7,500) |

| Average rent | €17–19 per m² | €15–16 per m² |

| Demand | International, high, especially among investors | Mixed: students, families, professionals |

| Availability | Higher entry barrier, elite market | More accessible, suitable for the "first step" |

| Rate of price growth | 3–5% per year | 4–6% per year |

| Rental yield | 3–4 % | 4–5%, up to 6% in student areas |

| Peculiarities | Capital, international business and culture | A university center that balances cultural life and accessibility |

Comparing Vienna and Graz, it's clear that Vienna remains the largest and most prestigious real estate market in Austria , with high prices and huge international interest. Apartments in the capital's central districts sell for €10,000–12,000 per square meter, making the market inaccessible to many investors. Moreover, rental yields are lower here, around 3–4%, as the high purchase price eats into some of the profits.

Graz , by contrast, is considered a more affordable entry point into Austrian real estate. Average prices are lower, and rental yields are higher, especially in areas where universities and student life are concentrated. For those seeking stable capital growth and a reliable flow of tenants, Graz is a logical choice.

So, if Vienna is a market for status and prestigious investments , then Graz is a market for practical solutions and long-term returns .

The Pros and Cons of Buying Property in Graz

Pros:

- More affordable prices than in Vienna or Salzburg

make Graz a great place to enter the real estate market with a smaller investment. Many investors view it as a "stepping stone" to Austria: here, you can buy an apartment or house at a reasonable price and gradually build your capital without spending millions upfront. - Stable rental demand.

Universities, tourists, young professionals, and business travelers create a constant flow of tenants. This means apartments in Graz are virtually always available, and owners can count on a stable income year-round, with no pronounced seasonality. - Transparency of transactions.

Every purchase is recorded in the Grundbuch (land register), which lists ownership rights and encumbrances. For investors, this guarantees that the transaction is secure and the apartment truly belongs to the seller. This level of legal protection is especially important for foreigners. - The city's cultural richness.

Festivals, concerts, theaters, and rich architecture make Graz not just a place to live, but the cultural capital of Styria. This increases rental prices and the appeal of housing, as the city appeals to both students and wealthy foreigners.

Cons:

- High prices in the city center.

In Innere Stadt , prices per square meter easily reach €7,500 and above. For many, this is a barrier, and although these apartments are appreciating the fastest, the barrier to entry remains too high. - Bureaucracy for foreigners.

If the buyer is not an EU citizen, permission from the land commission will be required. This process can take several months and requires additional documentation. The transaction remains possible, but it becomes longer and more complicated. - New taxation of short-term rentals.

Starting in 2025, apartments rented through Airbnb and similar services will be subject to an additional tax. This reduces net income and forces owners to switch to long-term rentals or raise rents.

Results

Real estate in Graz offers a balance between affordability and profitability. Prices here are lower than in Vienna or Salzburg, but rising prices and rental demand make the market no less attractive. For investors, Graz offers an opportunity to enter Austria with a lower investment and achieve returns of 4-5% per annum, and even higher in student areas.

Vienna, on the other hand, remains a status market: apartments there are more expensive, yields are lower, but the very fact of owning a home in the capital lends credibility to the investment. Graz, on the other hand, benefits from its versatility—it's suitable for students, families, retirees, and investors seeking a practical and effective tool for preserving and growing their capital.

This is precisely why Graz can be called the "golden mean" of the Austrian market: it lacks the excessive pretentiousness of a capital city, but offers stable growth, culture, universities, and a quality of life.