Egyptian Real Estate: Is It Worth Buying in 2026? Investor Advice

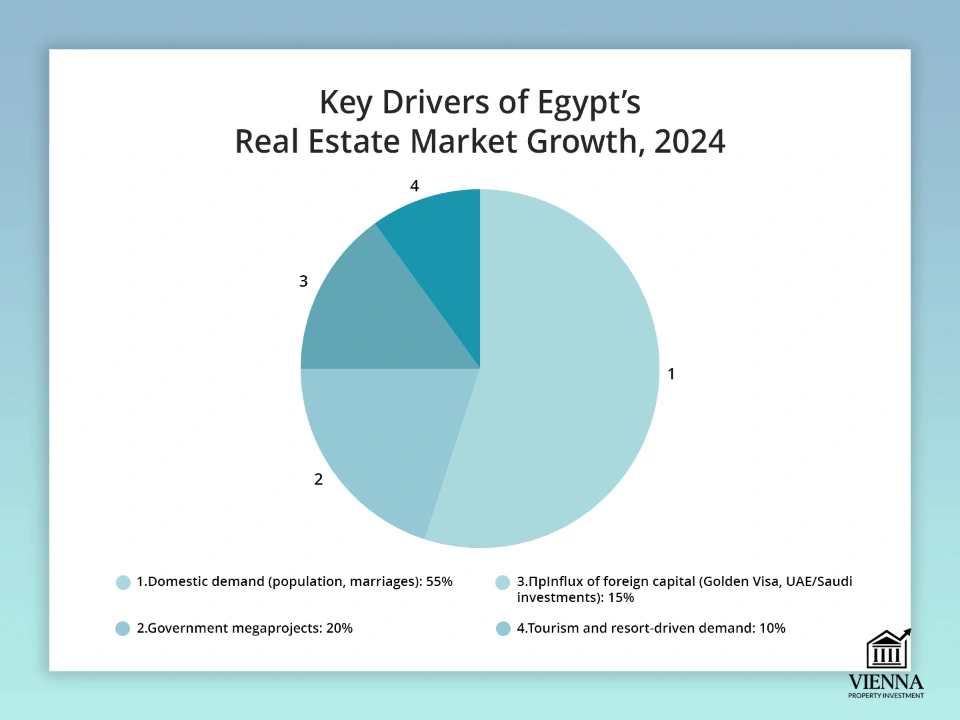

Investor interest in Egyptian real estate is growing as the country implements economic reforms, tourism is increasing, and the government encourages foreign investment.

I, Ksenia Levina, investment consultant and lawyer at Vienna Property Investment, have prepared a comprehensive overview of buying real estate in Egypt. We'll explore laws, taxes, and profitability, compare with Austria (Vienna), and highlight when Egypt is more advantageous and when European stability is crucial.

The purpose of this article is to systematically analyze Egypt's investment appeal. You'll learn whether it's possible to buy an apartment in Egypt, what laws govern transactions with foreigners, and who benefits from it.

We'll look at the global and regional context: why it's worth paying attention to Africa/Middle East now, what's happening with Egypt's economy, and what global trends are influencing the market.

For example, demand for resort housing is growing worldwide: it is logical to compare Egypt with other "warm" destinations (Türkiye, Greece, Morocco), as well as with stable Austria.

Austria acts as the "base" here: it wins on 70% of the criteria (stability, price growth, reliability), but we will see where Egypt can offer higher returns or lower costs.

Why now? After several years of instability (political upheaval after 2011 and recent currency crises), Egypt's economy has gradually recovered: starting in 2016, the government introduced a devaluation system and managed to emerge from a protracted crisis in 2022; in 2023, with inflation averaging 30–35% (though falling toward the end of the year), GDP growth was ~3.8%.

Unfortunately, the state budget is highly dependent on foreign loans, but at the same time, EGYPT has become more active in attracting investors: in 2023, restrictions on the number of properties purchased by foreigners were lifted, a "golden visa" for investors was introduced, new megaprojects (New Capital, Egyptian Bridge over the Suez Canal) are being built, and resorts are being developed.

The global trend of the "blue economy" (maritime tourism, ports, infrastructure) is catching up with Egypt. However, keep in mind that Egypt still needs much reform, and investing there is riskier than in the EU.

A brief overview of Egypt's reputation: agencies and magazines describe it as "stable but changing." Global rankings (such as the World Bank Doing Business) place Egypt around 114th in 2020, while Austria is in the top thirty. Egypt also ranks behind the EU in the corruption/transparency index.

On the other hand, Egypt's population (110+ million, young and growing) creates strong local demand for housing, while free zones and tourism reduce the tax burden for investors. This makes Egypt a "growth market" according to PWC/Numbeo statistics, but with less stability.

Egypt's place on the investment map

Egypt is the largest Arab country by population and real estate market. Economically, Egypt is considered an "emerging economy of the Middle East," with its own advantages and disadvantages.

Compared to Europe, it can be called a “new market” – very democratic and potentially profitable (profitability and price growth are high), but it requires patience and a willingness to take risks.

Alternatives

Regional context (MENA). Competitors in the Mediterranean zone – Turkey and Morocco:

- Türkiye offers higher incomes, but it has hyperinflation and unstable policies (the lira will fall, like Egypt, in 2021/22).

- Morocco is more conservative, but the market is smaller.

- Egypt has a strong population (over 110 million people) and tourism: it has the Suez Canal, two seas, pyramids, and an affordable cost of living.

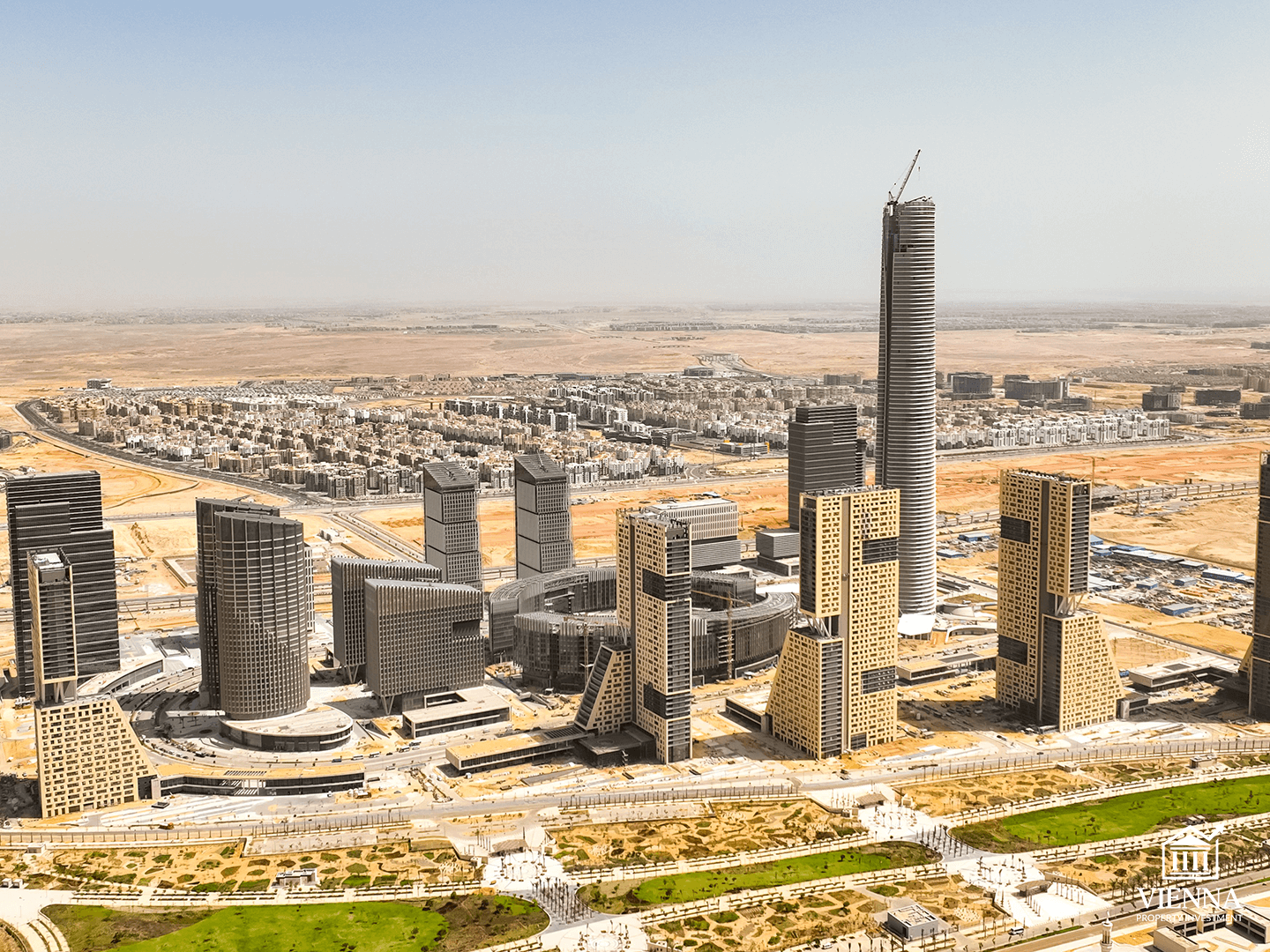

- Plus, the government is actively building new things (for example, the New Administrative Center, where European-style neighborhoods are already planned).

Global rankings. According to Ease of Doing Business, Egypt ranked 114th in 2020 (average across all parameters), while Austria ranked approximately 27th. This means:

- Doing business (and buying property) in Austria is 70% easier – there are fewer procedures, money transfers are more transparent, and the laws are well-established.

- Egypt often requires permits (for example, as already mentioned, approval from the Cabinet of Ministers is required for the purchase of any property) and compliance with currency regulations.

- The downsides include significant bureaucracy and the potential for political change (they will also have to adapt to IMF reforms, which could change regulations).

Economic background. In recent years, Egypt's economy has demonstrated stable growth after previous crises. According to the Egyptian Ministry of Economic Development, the country's GDP grew by ~6.6% in 2021/22 and by 3.8% in 2022/23.

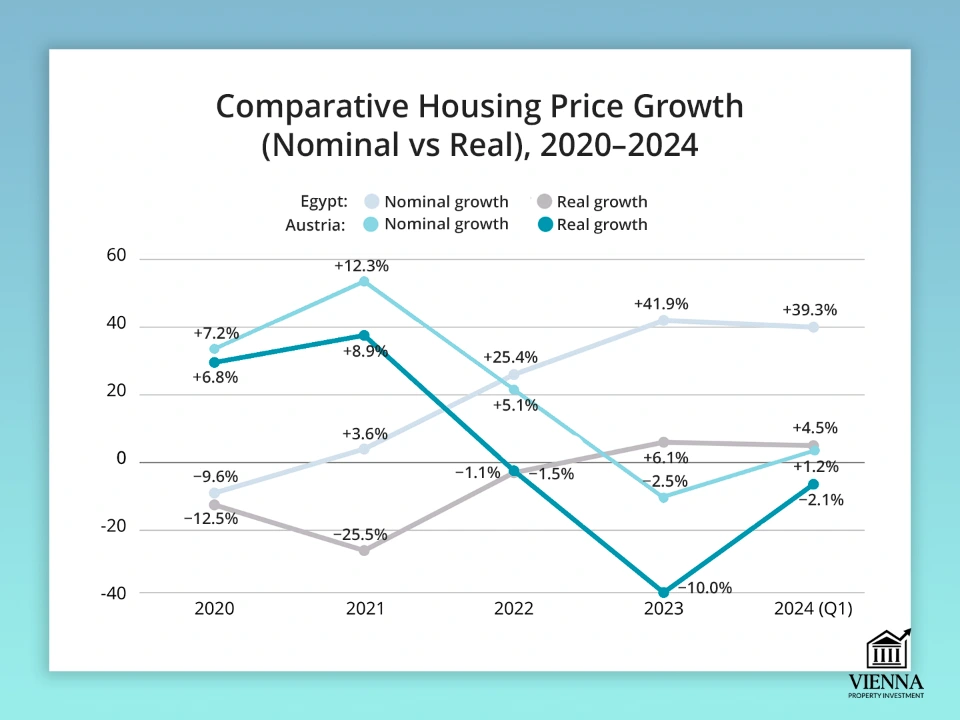

Inflation is still in double digits (~35% in 2023), but has begun to slow. This situation leads to two key conclusions: first, real estate in Egypt is appreciating faster than in stable Europe (in 2023, housing prices in some resort areas increased by 20-40%); second, the exchange rate instability means that investors should not keep all their funds in pounds.

Southern Europe. Egypt is sometimes compared to Turkey or Greece (or Cyprus):

- Greece offers a "golden visa" for €250,000–500,000. It's a member of the European Union, but the market is small. It's helpful to look at how to buy property in Greece —it helps to distill the various procedures into a simple checklist.

- Egypt is not in the EU, but it has lower prices (buying an apartment in Cairo or Hurghada is cheaper than a similar one in Athens) and slightly higher returns (for example, compare: the average rented apartment in Cairo yields 5-7% per annum versus 2-3% in most cities in Austria).

- Cyprus and Türkiye are also cheaper than Austria, but Egypt is larger and offers interesting resort locations (the Red Sea).

Why are investors paying attention to Egypt? The answer is simple: it's currently undervalued. During crises, investors fled Egypt (for example, due to the 2011 revolution or the depreciation of the pound), and prices fell.

Now that the country is overcoming financial difficulties, foreign capital is pouring in: the latest news is that the Emirates and Saudi Arabia are planning to invest tens of billions in developing resort areas (for example, the $35 billion Ras El-Hekma project). This indicates that investment in Egypt will grow over the next decade.

Compare this to Vienna. Around 70% of the investment environment in Austria is better: a European legal system, low inflation, and predictable policies. The return on investment (ROI) in Austria is weaker due to price growth ( prices here will almost stabilize ). However, rental income (there are no rate caps, but demand is moderate) yields around 2–3%. Growth potential is higher in Egypt, but risks there require more active risk monitoring.

Egypt Real Estate Market Overview

The Egyptian real estate market has undergone a remarkable evolution over the past 15 years.

History: Fall and Rise

After the 2011 revolution, many buyers abandoned the market, leading to a decline in prices (especially between 2012 and 2015). As the government consolidated its grip, prices gradually began to rise. This was supported by construction giants (Talaat Mustafa Group, Palm Hills, Orascom, SODIC) and state-owned projects (such as the Misra social housing project).

In 2016, another shock occurred – a sharp devaluation of the lira (from 8 EGP/$ to 30 EGP/$) – due to the reform, there was a surge in inflation, and against this difficult background, the dominance of the secondary market quickly flowed into new buildings in the mass sector.

Dynamics

rose by approximately 15–40% in nominal terms in 2023. In 2024, the pace accelerated: in the first months, growth reached 24% per annum in new areas (New Cairo).

According to CAPMAS statistics , the private construction sector built a record number of residential units in 2022/23 (approximately 1.3 million, up 21% from the previous year). This indicates that the market is currently under the focus of both developers and buyers.

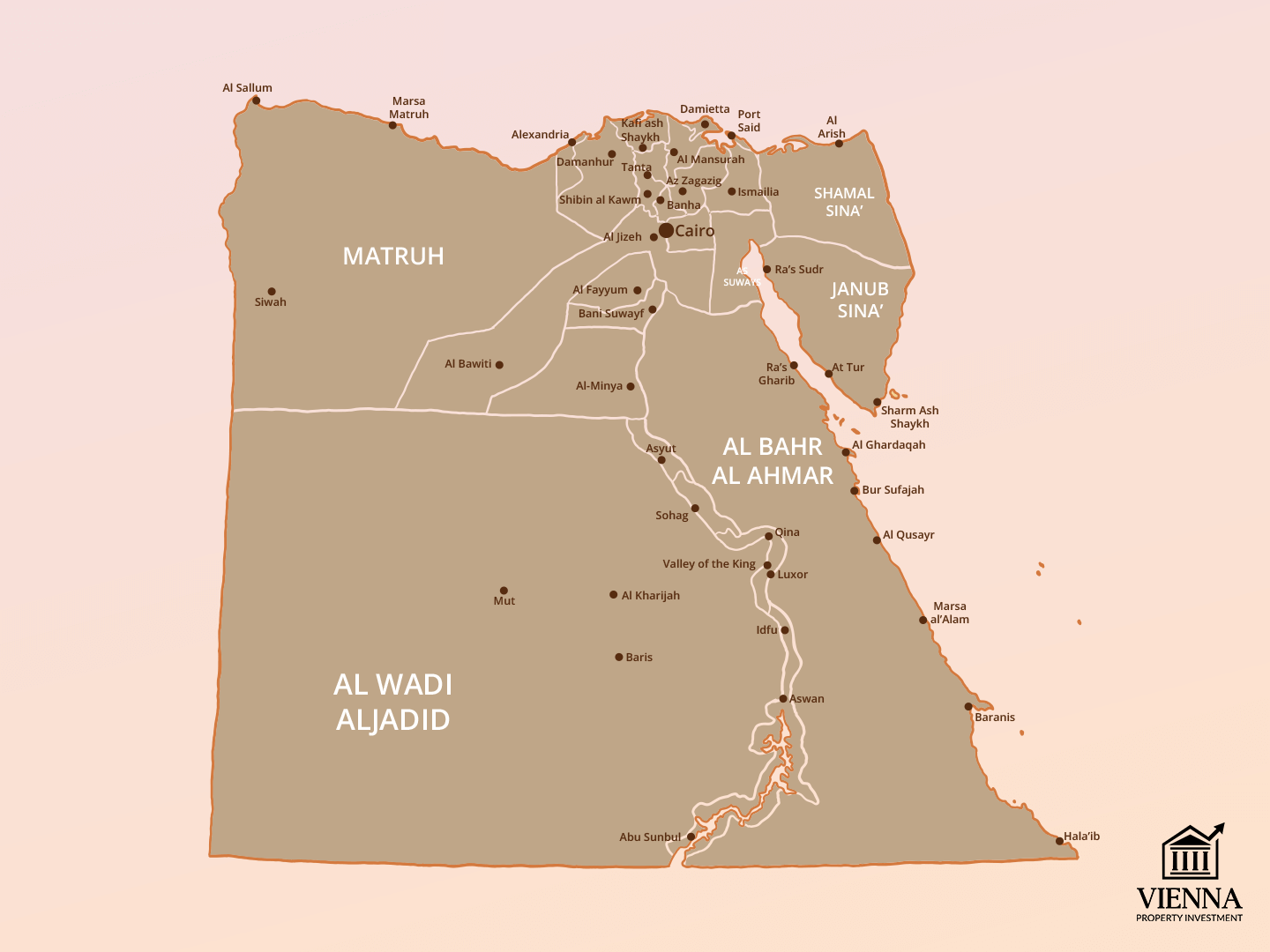

Geography of transactions

The centers are all large cities and resorts:

Cairo and its suburbs. This is where the majority of the population lives (approximately 20 million in the metropolitan area). Prices on the secondary market in older neighborhoods (Shubra, Zamanih, Masr el-Adima) are low, but demand is also weak.

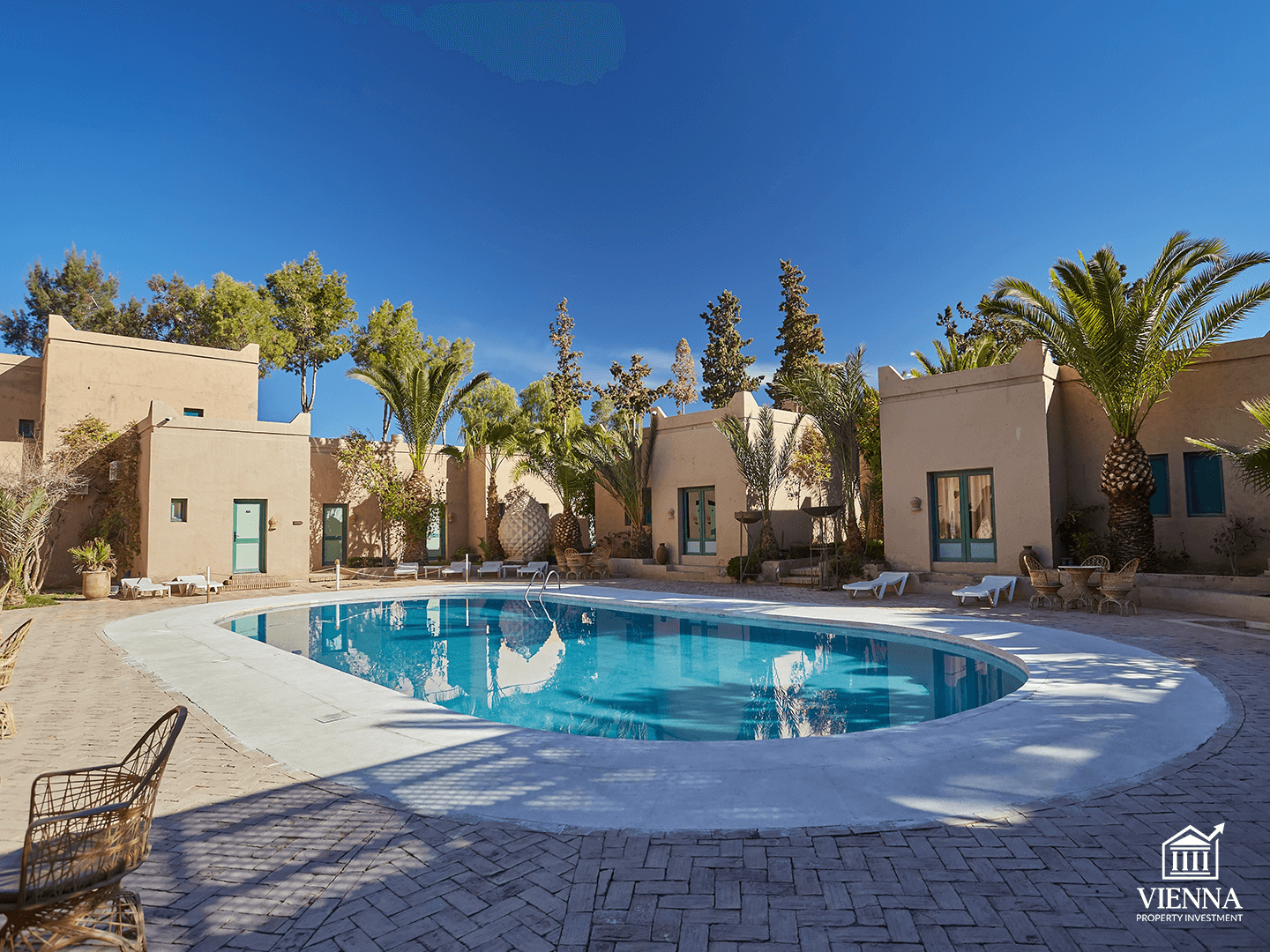

However, in the new cities around Cairo (New Cairo, 6th of October, Sheikh Zayed, Madinaty, etc.), the supply is rapidly growing: here you can buy an apartment in Cairo for any budget – from a one-room studio to a mansion with a swimming pool.

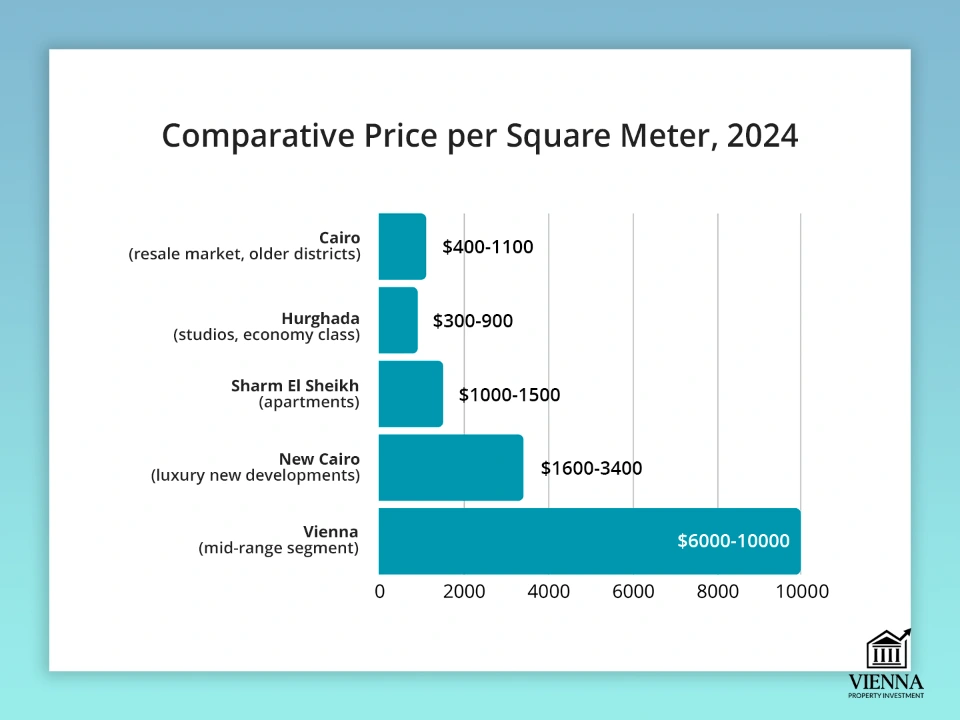

Prices in the suburbs are typically 1.5–2 times higher than in Cairo itself (approximately $60,000–$100,000 for a one-bedroom apartment). The residential real estate market in Cairo is traditionally driven by domestic demand (locals buying homes for themselves) and student rentals (there are many of them, including 60 universities, plus foreign partners and consulting firms).

Red Sea resorts. Hurghada and Sharm el-Sheikh are the main tourist centers. They attract Europeans and wealthy Middle Easterners. There are many new buildings and condominiums (developed complexes with hotel infrastructure).

You can buy an apartment in Hurghada from $50,000 to $80,000 for a modest studio; a more prestigious villa costs $300,000 to $500,000.

Prices are noticeably higher than in Cairo: here, people are willing to pay for a sea view. It's best to buy in dollars (prices are pegged to the currency), as the pound is weakening more.

The North Coast (New El Alamein and the Alexandria area). This is where the boom began in 2017–2019. The Marassi, Dunes, and Sidi Abdelrahman complexes, followed by the new Alamein Heights and North Coast, are among them. Infrastructure is still limited, but construction is proceeding at a rapid pace.

Prices: one-bedroom apartments from $60,000, villas up to $200,000. The market is largely speculative, and many apartments are currently empty off-season.

A new administrative capital and other projects. The government is building a massive "satellite" capital near Cairo. While its residential areas are not yet fully populated (roads and a metro are still under construction), many investors are attracted by the prospect of renting land to government officials.

Prices here are high (startups cost $300,000–600,000), and the offer is high-rise buildings and offices.

Others. In Alexandria and along the Mediterranean coast (for example, Hurghada to the west, El Arish), prices are lower, but demand is also low. Specific features: northern Egypt is closer to Europe and warmer in winter; Cairo has more work and study opportunities; the Red Sea is known for its active tourism.

Object types

In Egypt, the secondary market still dominates (over 60% of transactions). Many Egyptians still exchange "old stock" (houses built before the 1980s), especially low-rise apartments in the poorer outskirts of Cairo.

New developments (new neighborhoods, cottage complexes) are filling the niche for more expensive housing and tourist apartments. Among the new developments are business-class projects (SODIC One in Cairo, Palm Hills Madinaty) and luxury ones (Marassi villas).

Hotels managed by international brands also offer investment projects: for example, apartments in Hotel Apartments near the Sofitel hotel in Cairo or villa projects in El Gouna.

Buyers are primarily local: middle and upper class, bank employees, doctors, and retired military personnel. Foreign investors have traditionally included Chinese workers and companies (previously involved in construction), European retirees (often British, with French renting), Russian capital (especially in the north and Hurghada), and now there's noticeable interest from the UAE and Saudi Arabia (along with infrastructure investment).

Interestingly, there is a trend within the region : for example, it recently became known that Egypt has offered benefits to homebuyers from regional countries (tax holidays and similar conditions for Saudis and Emiratis).

-

Case Study: A Central European family with two children was considering Egypt as a "backup home." They wanted to buy a house in Egypt for €500,000: part of the money was to be spent on Austria ( an apartment in Vienna for tenants), and the other part on Sharm el-Sheikh (due to their love of diving).

We showed them that in Sharm el-Sheikh, you can buy a decent villa in a complex for $250,000–$300,000 (with a pool and sea views) and rent it out to tourists in the summer. In Vienna, they were considering a modest apartment for €250,000 (about 50 m²).

Ultimately, renting an Egyptian villa yielded 6-8% per annum during peak season, compared to just 3% in Vienna. But in return, an Austrian property promises stability and long-term savings.

Overall, domestic demand (from Asians, Africans, and Egyptians themselves) accounts for the majority of transactions. Foreigners' share of total purchases is small, but they are key for the most expensive properties.

Egyptian real estate is still considered an attractive "budget alternative" to European real estate: prices are significantly lower than in global cities with developed infrastructure. In short, the Egyptian market is a young, rapidly growing market with its own specific characteristics (focus on tourism and housing for domestic consumers), which is inherently more speculative than the "stable" Austrian market.

Forms of ownership and investment methods

Individuals. Any citizen (foreign or Egyptian) can purchase a residential property or land plot. Since 2023, the "two-property limit" has been lifted, allowing individuals to purchase as many apartments or houses as they wish (although they must notify government agencies about each one).

A company. Often purchased through a company—an Egyptian corporation (LTD/GPSC) or a branch of a foreign one. This provides certain tax advantages: if the organization earns income (for example, from rent), it pays corporate tax, which is sometimes lower than individual rates.

However, keep in mind that most foreigners also need a representative or co-founder to open an Egyptian company (at least registered with EGX). To minimize taxes, some purchase through a Cyprus or Estonian company and control the transaction through these jurisdictions, but the property is formally registered to the Egyptian subsidiary.

REITs (funds). Egypt has legal collective investment vehicles: REITs (Real Estate Investment Trusts), regulated by the Bank and the Exchange (FRA). However, their share in the segment is small.

The conditions are as follows: by law, a REIT must invest at least 80-90% of its assets in rental real estate and pay a 22.5% tax on its profits (there are no incentives for investors). In 2018-2020, there were attempts to launch exchange-traded REITs (several funds of Misr Insurance and Banque du Caire), but their capitalization is still small.

If you're prepared for bureaucracy and want to invest "indirectly" (more liquidity, but also the risk of agreeing on a structure), you might consider local REITs (if the markets steadily grow, they'll start to appreciate).

Methods

Purchasing in your own name (solo or married). The easiest way is to register the purchase in the name of an individual or both spouses. It's important to consider inheritance and gifting issues: if a mother purchases an apartment in her own name, she can later pass it on to her children (but under Egyptian law, this requires a will, which must be properly executed).

Since 2018, Egypt has recognized prenuptial agreements as a means of dividing property, making "buying for two" a common practice for families.

Through an investment trust or foundation. Almost none: Western-style family trusts (like those in Austria) are not available in Egypt.

However, there are options for "estate planning": real estate can be registered to a company or a "special fund" that manages the property (under the supervision of a financial regulator). This is a complex arrangement and is generally not necessary for foreign investments of up to ~1 million euros.

Purchasing through a proxy (power of attorney). Many foreigners cannot fly in immediately, so they make the purchase through a proxy (an Egyptian citizen or a company) under a general power of attorney with a notary.

The law permits this: a notary issues a power of attorney in Egypt or abroad (after an apostille). The attorney-in-fact enters into a preliminary agreement (mushakhasah), provides a deposit, and then formalizes the final transaction.

-

Case study: One of our clients from Germany purchased an apartment in Santiago de Meja, Egypt, entirely remotely: we used a power of attorney to oversee the lawyer's inspection, sign the contract, and register the transaction. However, we still recommend attending in person, at least at the final stage, as not all details can be resolved remotely.

Non-resident vs. resident. There are no legal restrictions: a foreigner (non-resident) can purchase real estate under the same conditions as an Egyptian, provided they have received approval from the Ministry of Foreign Affairs/Investment Commission.

Approval is almost always granted (they just check for any violations). Non-Europeans do not receive an automatic visa upon purchase, but a residence permit (1–5 years) is issued under the investment program.

Legal aspects of purchase

The purchasing process in Egypt consists of several mandatory steps:

Obtaining a Tax Identification Number (Muhsid/Tax Card). As in many MENA countries, foreigners first need to obtain a local identification number (NIN) from the Egyptian Tax Authority. This is simple and is usually done through banking (using your passport to obtain a card). Without this number, transactions cannot be recorded.

Letter of Intent (Mushakhasah) and Deposit. After selecting a property, the parties sign a preliminary agreement (usually for 10-15 days), under which the buyer pays a security deposit (usually 5-10% of the purchase price). This agreement protects both parties: the seller promises not to sell the property to anyone else, and the buyer guarantees their intention to purchase.

Legal due diligence. Almost mandatory. An Egyptian real estate lawyer verifies the property's documentation: the seller's title, any encumbrances, and the correct registration. This process is often called a "due diligence." The final sales contract is signed here, in the agent's office or with the lawyer.

Notary and registration. The final step is submitting the documents to a notary (usually at the local Title Registration Office). The notary then deposits the full amount (preferably via bank transfer in Egypt). The notary formalizes the purchase and registers the title in the buyer's name.

Timeframe: With all the necessary documents, the process typically takes 1–2 weeks. Payment is key. until the end of 2025 , but fees are still charged: stamp duty (~2.5%), notary fees of up to 1–3%, and lawyer/agent fees (usually no more than 2%).

Registration for the new owners. After the notary, the title deed is registered in the buyer's name.

-

An important detail for foreigners: under the old law (No. 230/1996), they could only obtain a development right ("usufruct") for up to 99 years on land, and the building was registered in their name. However, since 2023, amendments have allowed direct ownership of land and buildings without area restrictions. Therefore, foreigners now become full owners (freehold), just like Egyptians.

The Role of a Lawyer and Agent. I strongly recommend hiring a local lawyer and an experienced agent or realtor. A lawyer will verify the transaction's integrity, assist with paperwork, and certify the translation of important documents into Arabic. An agent will advise on the area's risks and the realistic price (advertised prices are often inflated).

"We've seen more than once that an agent tries to include a clause in the contract stating that they take a commission, even though, by law, the buyer and seller agree on this themselves. Our lawyers always eliminate such loopholes.".

— Ksenia , investment consultant,

Vienna Property Investment

Buyer requirements. Formally, this includes having sufficient funds and the absence of any restrictions (for example, the property being in a military zone). It is assumed that the buyer is of legal age and legally competent.

Foreigners are registered in the Foreign Property Register. Law 230/1996 prohibited foreigners from owning real estate in "strategically important" locations, but the 2023 amendments removed this restriction for residential properties (unless the property is a closed military unit).

Island real estate considerations. Some popular resorts (Helmondib Island, the Red Sea Islands) are located in specially protected areas. These areas often require separate permission from the military authorities before a transaction. This is rare, but it's important to check with a lawyer beforehand.

Buying remotely. As mentioned, you can do it with a power of attorney. Clients often tell me, "I don't want to travel," but I recommend visiting at least once—it's important to see the property and understand the surroundings. However, all formalities can be handled remotely: lawyers can sign on your behalf, and a notary works with a certified power of attorney.

Due diligence. In Egypt, the following points must be verified: no one is disputing the property's ownership (for example, there is no jurisdiction over someone else's inheritance), the property is not mortgaged (in which case you need to request a certificate of no outstanding debt), and all utility bills have been paid. Government agencies are required to present a certificate of no outstanding debt before selling.

Registration of title. After notarization, the buyer receives a Certificate of Registration—the Egyptian "certificate of ownership."

-

Important: In Egypt, there is no traditional notarial deed; instead, this certificate from the land registry is used. If you need to confirm your ownership at a bank or for a visa, this document is required as proof of ownership.

Taxes, fees and expenses

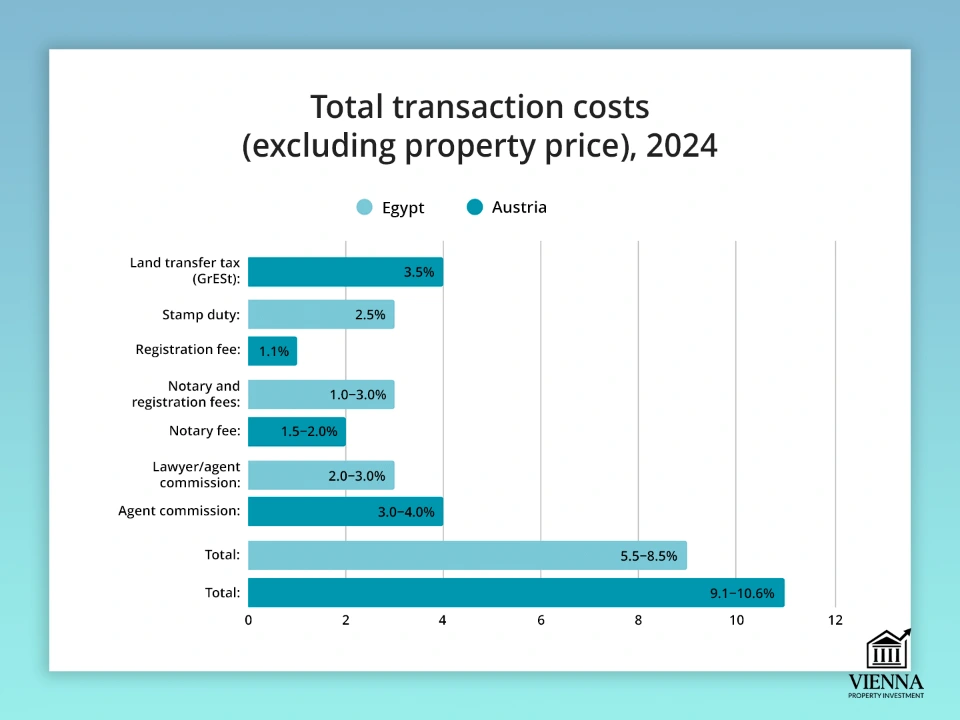

When purchasing real estate in Egypt, an investor needs to consider the following costs:

Stamp duty. Typically 2.5% of the transaction price (included in the contract). It's paid by the seller, but is often factored into the price during negotiation.

Notary and registration fees. Notary and property registration fees account for approximately 1–3% of the transaction cost.

Lawyer/Agent. Approximately 2–3% of the purchase price (the amount is discussed with the agent). This is not a government fee, but is paid by the buyer or shared with the seller by agreement.

VAT. Subsistence minimum – new residential buildings are exempt from VAT until the end of 2025 (as stipulated by the law on economic reforms) – meaning you don't pay additional VAT on your apartment in a residential project.

-

Let me remind you: in Austria, a zero VAT tax exemption on new buildings for private buyers is also in effect until the end of 2025.

Unified Real Estate Tax. Real Estate Tax on rental properties , levied at a rate of 10% of the official rental value (plus a 30% deduction). This means that if you rent out your property, 10% of your turnover (after the 30% deduction) goes to the budget.

-

Compare: in Austria, rental income is subject to the usual personal income tax (the highest rate is up to 50%), but there are also benefits (the official "Nettomietwert" for private apartments).

Municipal tax (local, similar to the Austrian Gemeindesteuer). It's insignificant and usually included in the owners' annual maintenance fee and passed on to tenants.

Investment tax. Egypt does not have a special "non-domicile" or "deferred" tax regime, as some countries do (such as the Austrian Self-Sufficiency Scheme).

Here, taxes are paid traditionally; foreign income is not accounted for at the personal budget level (meaning, an Egyptian resident pays tax only on income that "came to Egypt" or was received here). However, this is irrelevant for non-residents.

In total, when purchasing, be prepared to spend up to 7-10% of the transaction price on various fees and commissions.

Comparison with Austria. In Austria, buyers pay a 3.5% Grunderwerbsteuer (GrESt), a registration fee of ~1.1%, and a notary fee of ~1.5%, for a total of approximately 6–7%. They also pay a 20% VAT when purchasing a new building (if you're a resident and buying a large project, but foreigners may be partially exempt).

Thus, Austrian taxes are generally higher (especially VAT), but services are also made much more efficient (transparent, immediately included).

Capital Gains Tax. In Egypt, it's typically 10% of the difference between the sale and purchase price (for individuals). However, there's a caveat: if you've owned the apartment for more than two years, the additional tax is effectively waived, as sales of older properties aren't subject to standard tax accounting. For non-residents, the transfer is usually withheld by the buyer.

In Austria, the rules are different. If you sell an apartment that was your primary residence, there is no tax. Otherwise, if you sell within 10 years of construction, a 30% tax rate applies on the profit. After 10 years, there is an exemption.

-

In summary, a purchase in Egypt will cost 1-2% more (all-inclusive) than in Austria, if you compare only the translation and notary fees. However, you don't have to pay VAT on residential property (unless it's commercial), while mortgages and rental taxes are higher in Austria.

Residence permit (Egypt's golden visa)

Egypt offers a residency program for real estate investors. Essentially, it's similar to the Golden Visa: there are requirements for purchasing real estate, allowing for residency for 1, 3, or 5 years. The rules (last reformed in 2023) are as follows:

- 1 year: real estate worth at least $50,000 or a bank deposit of $50,000 (in an Egyptian bank).

- 3 years: purchases from $100,000 or deposit $100,000.

- 5 years: from $200,000 of real estate.

In each case, the visa is extended indefinitely as long as you have bank confirmation or own the required property. There are no residency requirements (bonus!).

The only thing is that the property must be registered in the national register, meaning that purchasing in a project under construction may not be possible without registration (but this is expected to be relaxed).

-

Important: This residency does not grant the right to work in Egypt; a separate work permit is required. It also does not grant citizenship—only a residence permit.

Comparison with Austria: Austria doesn't offer a "golden visa" for real estate purchases. We have a residence permit for wealthy individuals (§56 of the Act on Residence Without Work), but it requires a very high annual income (around €2,550 monthly for an individual, and substantial financial security).

Our "Aufenthalt" card isn't tied to a purchase, but is more like a pension or savings residence permit. For investors in Austria, the Red-White-Red Card for self-employed individuals is an option: it requires a business plan, an investment of approximately €100,000, and job creation. Therefore, to invest and stay, an Austrian must either open a business or prove wealth, not simply buy an apartment.

Mistakes. Many newcomers confuse "tourist visas" and "investment residency":

- Purchasing an apartment in Egypt does not automatically guarantee permanent residency; after the transaction is completed, the investor applies for a "residence permit for the property owner.".

- For example, a consortium of lawyers has already established that foreigners cannot reside in Egypt for more than six months without a visa and must register with the Immigration Service. Therefore, automatic residence permits cannot be obtained based on property alone, without an application.

- Other restrictions: you cannot obtain a residence permit for a residential building up to 100 m² in Cairo's new district – you must purchase it for at least $50,000.

What has changed (2023–2025): The Residence by Investment program was officially approved in the summer of 2023 (though parliament is still in the process of approving changes to citizenship laws).

The main innovation is the direct removal of the "2 properties" limit, as well as clarifications regarding deposits. Thus, with $250,000 in investments in the economy (or real estate), a foreign investor receives resident status.

Comparison with Austria. Austrian permanent residence is granted, for example, through a D-visa (study/work visa) or a Deka Card (retirement visa). This means you can't "simply buy a house and live in Austria" – you have to follow standard immigration channels.

Rent and profitability

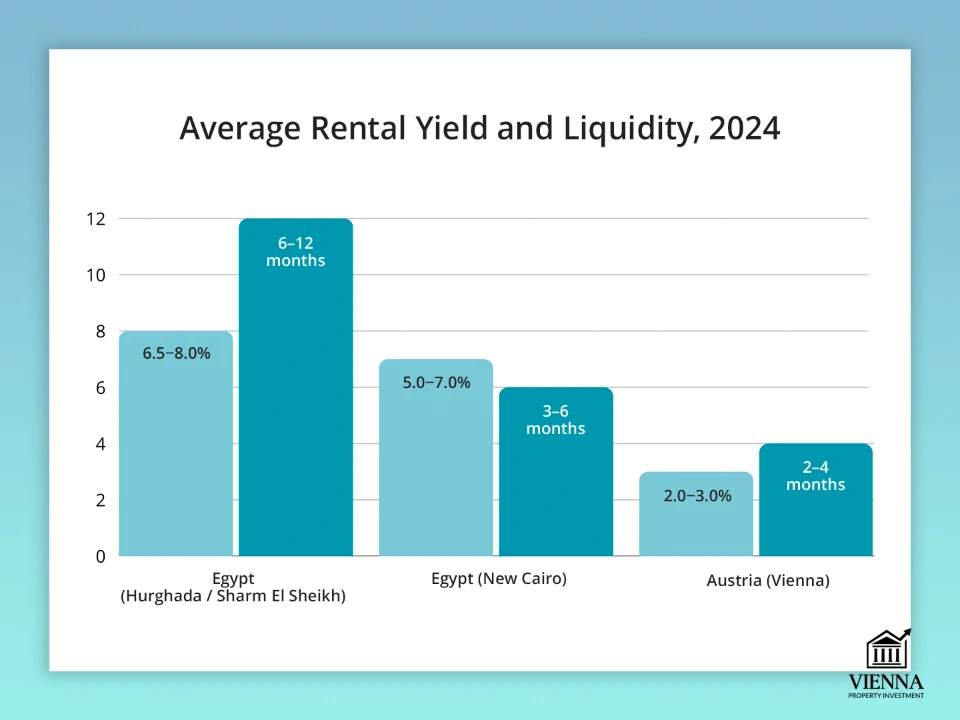

Short-term rentals (Airbnb, Booking, etc.) can offer very high returns – in the best cases, 6–8% per annum or higher (in local currency), especially at popular resorts in winter and during the holidays.

For example, a $300,000 seaside villa can bring in $20,000 for a couple of months of the season – up to 6–7% of the total.

But there are significant risks and restrictions: new laws tighten regulations. For example, the Egyptian government, following the example of many countries, requires guests to register and pay taxes, just like hotels. In Cairo, the city council has authorized rentals for up to 30 days and has mandated the payment of a tourist tax ; and on the Red Sea, similar regulations are being developed – a complete ban on "unclassified" apartments has already been introduced (fines from owners and travel agencies).

As a result, short-term rentals are currently "on the brink of legality": many segments of the market are still illegal. If you rent a property on Airbnb, be prepared to face fines or new restrictions (registration with the Ministry of Tourism may be required).

Long-term rentals are less risky. For rentals of 3-5 years (apartments in Cairo are often rented by government employees, doctors, and expats), the yield is more stable but lower—around 4-6% per annum (ruble investments will yield a higher return due to inflation, but "in real terms" it's usually around 5%).

For example, in Cairo itself, the average rent for an 80-100 sq m apartment is approximately $400-$600 per month, while an apartment can be purchased for $50,000-$70,000, yielding approximately 6-7% gross income. In Sharm el-Sheikh, similar apartments are more expensive (up to $1,000 per month), and the rental yield there is theoretically up to 8%.

But in practice, such apartments are often used by their owners themselves, so renting them out is only popular during the season.

Property managers and agencies. In large cities, there are specialized companies ("Property Management") that manage rental properties (they typically charge a 20-25% commission).

For example, Al Burouj in Cairo or Egyptian Homes in Hurghada. They handle finding tenants, collecting payments, and maintaining services, but take a percentage. I often advise newcomers to use an agency initially, although this reduces profitability.

Rental income taxation. The standard rate is 10% of the official rent (after a 30% deduction). So, if you rent for $600/month (and declare this income), the tax will be $720/year ($60/month).

Comparison with Austria: In Austria, rental income is added to other income and taxed progressively (up to 50%), but utility costs and depreciation are deductible.

In terms of tax efficiency, Egypt appears fairer: 10% of gross income is lower than in Europe. Compare this to Austrian property owners who also pay 30% on change and municipal taxes, for a total of over 30% of their income.

A comparison of yields. A rough figure: about 7% in Egypt versus 3% in Austria. Of course, this is nominal; in Egypt, a large portion of the income may be lost to inflation/increased staff salaries, but when purchasing in foreign currency, the yield is still higher. However, in Vienna or Graz, rent drops are almost never seen, and properties are easily leased to established German tenants under contract.

Where to Buy: Regional Analysis

Cairo, Egypt's main business center:

- Infrastructure. Airports, metro (metro lines 2), high-class hospitals, international schools (New Cairo School, American School in Cairo) – all on par with large cities.

- Architecture. From simple dwellings to residences.

- Neighborhoods for investment. Maadi, Nubaria, and Nexus Bay (south Cairo) are prestigious suburbs with parks and good schools; Zamalek and Garden City (Nile Island, downtown) are upscale, but the prices are exorbitant ($7,000-$10,000 per square meter). New Cairo and Madinty, the new city, have many new neighborhoods and ready-made homes. Conversely, the old center (Izzetlmamplit, Shubra) is not recommended, as it's poorly maintained and offers low housing quality.

- For rent. Students and expats are interested in Maadi, New Cairo, and Heliopolis. Buyers from the EU or US should consider the New Cairo area and Maadi, where apartments can be found starting from $100,000.

Thessaloniki, Egypt 's second-largest market, is Alexandria. Prices here are 20-30% lower than in Cairo.

- Alexandria's "Swiss zone" (Zizinia, Sidi Bishr) is reminiscent of Mediterranean Europe: quiet, green, but less work.

- Investors sometimes consider the North Coast (New El Alamein, Marsa Matrouh), where construction is currently in full swing. Prices there are low (villas from $70,000), but the infrastructure is still weak.

- There is not much demand from foreigners in Alexandria (a bit like the Middle East), but locals are renting out in circles (there are not many tourists in Alexandria).

Islands and the Red Sea:

- Sharm el-Sheikh is an expensive destination. Apartments here start at around $100,000 (for a 50 sq m apartment in a decent complex), and villas range from $300,000–$400,000 to $1 million and up. High season (December–February) fills these houses with apartments, but summer can be empty.

- Hurghada is slightly cheaper than Sharm el-Sheikh but more accessible, thanks to its well-developed "flat coast" (Sahl Hasheesh, Safaga). Prices: studios from $50,000, villas from $150,000–$300,000. Rentals are easier to find because they are crowded with tourists in the summer (discounted in winter).

- Dahab is a small backpacker town, but it's also part of the tourist zone and is cheaper (studios start at $30,000). The beaches of the Northern Red Sea (Taba, Rash el-Hekma) offer unique locations (near Jordan and Israel), but the demand is more for temporary stays than permanent ones.

The Peloponnese Peninsula. There's no alternative here: we're talking about Egypt's inland provinces, where everything is incredibly cheap (up to $300 for an apartment):

- In El Minya, Fayoum, or Qena, houses are a pittance compared to the European Union. But demand is only local.

- Investments there are mainly considered by Egyptians, and very rarely by foreigners.

- Such properties are very easily accessible ($3-5 thousand for a house in the village), but it will be difficult to sell them later – there is nowhere to sell them.

Infrastructure. A little more detail about communications. Cairo and major cities (Alexandria, Hurghada) have international airports, expressways, hotels, and world-class hospitals (Deutsche Bank Clinic and Agouza Hospital in Cairo, and Hospital in Hurghada). This is a plus for investors: even if you won't be living there yourself, tourists and renters want everything to be close by.

For example, a European buyer with children will appreciate the presence of an international school in Cairo, trips to the sea (diving courses are available), reasonable flight times, and good medical services.

Comparison with Austria. Vienna and Austria in general certainly have a higher standard of living: clean air, excellent hospitals, free higher education, but all of this also costs two to three times more than Egypt.

Investment map

The most popular purchases today are:

Cairo. Family apartments for rent (people insist on stable rental income) and speculative "index purchases" (for example, relatively inexpensive apartments in a new project, hoping to resell them once the infrastructure is completed).

Hurghada/Sharm. Typically, owners seek income through short-term rentals and pay "permanent residence by the sea."

New El Alamein. A rapidly growing area where major developers are investing. Apartment and villa packages are being sold – purely for investment, in the hopes of coastal development.

Inner regional cities. Only 5% of investment comes from rare speculators who see cheap land as a gold mine for building urban suburbs.

Secondary market and new buildings

The secondary market (>65% of transactions) consists primarily of apartments and houses built before 2000, sometimes still in need of renovation. Many of them require renovation (bathroom renovations, internet access).

From experience, Egypt's "old stock" is usually only suitable for locals—the historic quarters of Cairo, dilapidated buildings in Alexandria. However, in this segment, you can find bargains for €30,000–40,000 for a large apartment (but sometimes they don't even have air conditioning!).

Features of the secondary market. Built before 1980, these properties have low energy efficiency. In the summer, the houses get hot, and the air conditioners consume a lot of energy.

Therefore, I advise clients to either renovate such houses with insulation and new windows (not an effective investment), or plan to rent them out only as short-term rentals (tourists are already prepared to tolerate the "Mediterranean romance").

Bonus: resale properties are often 20-30% cheaper than new builds (for similar square meters). However, liquidity is lower: finding a buyer can take a month or two, especially if you're buying remotely. Conveniently, prices in the most expensive areas (Maadi, New Cairo) have only slightly fallen following inflation, and resale properties there are still expensive (at the same price as new builders).

New developments. At least 35% of the market. This includes residential complexes from developers (MISR, Palm Hills, SODIC, Orascom, etc.), as well as special aparthotel projects.

The pace of construction in Egypt is moderate by our standards, but quite fast for locals. When purchasing a property under construction, consider the completion date (say, 1-2 years). Developers often offer installment plans (0% interest for 5 to 10 years)—this is convenient for investors: pay in installments and receive the property within a year.

Quality comparison. Some projects (Marassi, El Gouna) are built to European standards (with a strong focus on infrastructure).

Overall, the quality of new construction is, on average, inferior to Austria: there are complaints about the finishes and quality of materials.

For example, I heard complaints that in one SODIC complex, the tiles were poorly installed and the waterproofing was done perfunctorily, resulting in mold appearing on the basalts after a year of rain.

However, Austria sets strict standards in construction – and projects in Vienna are built with energy efficiency, sound insulation, and fire safety in mind much better than in Egypt.

Therefore, when buying a new building in Egypt, I recommend setting aside 5-10% of the cost for "imperfections" right away - even the most modern Egyptian house will need local repairs after 5 years (installing a new air conditioner, painting the facade, etc.).

Examples of objects:

- Up to $100,000: Frequent offers include small studios or 1-bedroom apartments in Cairo, as well as linear apartments in Hurghada (up to 60 m²).

- $100–250,000: “Mid-range” class: 2–3-room apartments in Cairo (80–120 m²), or townhouses in Cairo/New Cairo (small cottage 150 m²), or decent 2-room apartments in Hurghada/Sharm.

- $250–500,000+: 120–150 m² apartments in Cairo's best neighborhoods, large townhouses and villas, complexes with swimming pools.

Comparison of new buildings with Austria. In Austria, new buildings come standard with a smart home system, an elevator, parking, a fully finished, and an enclosed courtyard.

In Egypt, these standards aren't universal. Quality can be worse, especially in areas populated by migrant workers (near the sea, closer to the poor). However, new residential areas (Madinty, New Cairo, El Gouna) have a fairly high level of infrastructure (schools, shopping centers), and there's demand for new construction there.

One advantage of Egypt: land in coastal areas is still cheaper than in Europe, so a complex purchase (for example, an aparthotel with 100 rooms, each with a kitchen) on the Red Sea coast can be found for a price comparable to a small B&B in Central Europe.

In general, the risk associated with new construction in Egypt is delays and possible modifications. Austrian developers rarely miss deadlines, while Egyptian ones can delay delivery by a year in the event of force majeure (see the pandemic).

Alternative investor strategies

In addition to "classic" apartment investments, let's consider several unconventional approaches:

Several studio apartments instead of one large apartment. Many of our clients from Asia and Europe (especially during the pandemic) have chosen to purchase two or three adjoining studio apartments instead of one large one. This increases profitability (each studio is sold separately, the rent for two studios is usually higher than the combined rent for a single two-bedroom apartment, and the risk of vacancy is reduced).

Disadvantage: twice the work with multiple contracts, possibly two mortgage products. The main thing is that the price of a two-bedroom apartment, including additional fees, doesn't exceed the price of three studio apartments.

Flipping is a popular method in Egypt: you buy an old apartment in central Cairo, spend 10-20% on renovations, and sell it as a turnkey property for a higher price.

However, the market here has slumped since 2022 (due to exchange rates and the pandemic), and everything should be converted into pounds. If you buy in Egyptian pounds and find a cheap apartment, the premium could be 15-30% after renovation.

-

Advice: hire local builders to do the renovations cheaply (for example, when buying in Cairo, they often invited a team of builders from the regions who would re-tile and replace the double-glazed windows for $3,000).

Aparthotels and mini-hotels. Tourism projects are often sold as "hotel apartments"—you own a studio apartment that the hoteliers rent out and manage. The advantage here is ready-made service, but the disadvantage is less control over revenue.

Sometimes such apartments are sold at above-market prices (due to the hotel's brand). The solution: with a good complex, you can expect a stable percentage of the hotel's profits (~5%); however, I prefer direct, independent rentals, if the owner-manager is the one in charge.

Investments in land and long-term construction projects. Land purchases are still permitted in Egypt (outside protected areas). There are offers, for example, on the outskirts of Cairo or the North Coast (priced from $10–20 per square meter). This is a high-risk asset: you have to wait for the region to be developed.

Example: the government recently announced plans to develop "New Luxor," and the community is expecting a tender for new desert roads in 2024. If you buy nearby land, you can build later at a large profit (or sell it to a developer). But if the project is a success, finding buyers will be difficult.

Through funds and instruments (REITs, etc.). As we mentioned, there are only a few REITs in Egypt, and they're still accumulating capital. The advantage of this type of investment is diversification (you're investing in a commercial real estate portfolio). The disadvantage is, as already mentioned, taxes on REITs are higher (22.5% instead of 10%).

There are also non-governmental funds and shareholders in residential projects (sometimes the developer offers an "investor pool" – the purchase of several apartments and their complete lease to the manager).

At Vienna Property don't often consult on such schemes, but for large capital ($1 million+), they can make sense: dependence on a single property is reduced, and the income is "smoothed out."

Comparison with strategies in Vienna. In Austria, people often buy one good property in a prime location and hold it for decades (they plan to retire on a stable rental income). Speculation is rare: due to low price growth, flipping is unattractive here—there are no tax incentives.

"Austria is your deposit with a modest income, Egypt is a risky growth of cumulative capital.".

— Ksenia , investment consultant,

Vienna Property Investment

For a portfolio, I personally recommend keeping 70% in a conservative option (an apartment in Vienna, a real estate investment fund) and 30% in a growing option (new markets like Cairo or Egypt).

We offer this strategy to several clients: we invest part of the money in anti-crisis funds (Eurobonds, stabilization funds, German real estate), and the remaining amount in more aggressive projects (USA, Egypt, Cyprus).

Risks and Disadvantages

Despite all the advantages, it's important to be honest: Egypt faces serious risks. The main ones are national and natural:

Bureaucracy and changing laws. In 2023, foreigners were brought out of the shadows, but tomorrow they could tweak things again (like recently with the requirement to pay in pounds through banks). Remember that just five years ago, a Golden Visa required a passport no older than 15 years.

Therefore, every investor should have a reliable lawyer who monitors changes (for example, how exactly income can be documented, etc.). Regularly check the current regulations, including through your embassy or consulate.

Short-term rentals. The rules change frequently: in 2023, the government began passing tough laws against unlicensed Airbnb. Therefore, counting on super-profits from short-term rentals today is risky: tomorrow, an order could be issued to fine safe-renters 100,000 EGP.

Seasonality. Egypt's biggest drawback is its extreme climate. Rental demand in Cairo is almost seasonal: in the summer, many people head south or to Europe. Resort towns, on the other hand, are packed in the winter (with tourists from Europe and the Middle East) and deserted in the summer due to the heat.

Your income "sags" during the off-season. In Austria, rental demand is generally consistent year-round.

Infrastructure risks. Some regions suffer from road and water shortages.

For example, southern Cairo, on the route to the El-Haram pyramid, is periodically choked by traffic jams; the northern African coast desperately needs a reliable water supply in the summer – if you've bought a villa in the northern desert, stock up on eco-water plans (even though salty wells are not suitable for drinking, nearby settlements clearly lack reservoirs).

Natural hazards. Precipitation is rare, but heavy downpours can lead to rental holidays in the south. Earthquakes are unlikely, but there are small seismic zones. Areas far from the Nile are prone to flooding.

Liquidity. If you bought on an island or in a small region, selling it can be difficult (depending on the local infrastructure). An apartment in Cairo will sell in 2-3 months, a villa in the desert can take up to a year.

Currency risks. Buying in dollars is good, but spending in pounds can eat into your dividends. Consider this in advance: when buying a euro-denominated property, be prepared for exchange rate fluctuations to impact your actual return.

When taking out a mortgage, it's better to take out loans in dollars (although Egyptian banks mostly issue loans in pounds). Conversion channels have improved, but remember that fluctuations are not uncommon. Austria wins here: the euro is one of the most stable currencies.

Comparison with Austria. Austria's main advantages are its stability. There's no seasonality (the same wave of students arrives every year), no legal surprises (rental regulations change very rarely), and no safety issues.

For clients accustomed to stability, Austria is preferable in approximately 70% of cases (less risk, guaranteed elevator and heating in the building, clear title deeds). Egypt, however, represents the remaining 30%: curiosity, a long-term hedge against the future of the Middle Eastern market, and a quicker, but riskier, return.

Accommodation and lifestyle

Buying real estate isn't just about the money, it's also about living inside the property. The standard of living and everyday life in Egypt differs significantly from that in Austria, and this must be taken into account.

Climate. Egypt is a continental-subtropical country. Winters are warm (15–25°C in Cairo), and summers are very hot (40–45°C in the shade, every year). On the Red Sea coast, summers are slightly cooler (up to 35°C), and in the Sinai Mountains, nights reach 30°C.

If you're a family with children or elderly people, climate is a key factor. Austria offers moderate summers (+20…+25°C) and mild winters (-5…+5°C in Vienna), without any sweltering extremes. However, the sea is not within walking distance.

Healthcare and insurance. Egypt has good private clinics (Cleopatra Hospital, MedStar). Residents have access to high-quality hospitals, but these are not free. There is no mandatory insurance, so Europeans typically purchase private international health insurance when moving.

In Austria, healthcare is state-run (the Krankenkasse system), and it is considered one of the best: people from all over the world flock here for treatment.

Education. There are international schools in Cairo (for example, Egypt Marriott School, Cairo American College), but their fees are significant ($6,000–$15,000 per year per child). Pros: instruction in English or French, international diploma.

Schools closer to Austrian quality (Steirische, etc.) are rare. In Austria, education is public; you only pay for language courses or private German schools, but overall, your child will receive free, high-quality education.

Security. Egypt has officially been fighting terrorism in recent years (specifically monitoring resort areas). Police provide security in tourist areas (Hurghada, Sharm).

However, risks remain: pickpockets can be common near the Cairo metro, but this is rare. Austria is a very safe country by any standard (crime is minimal, the police are polite).

Standard of living and prices. The cost of household services in Egypt is much lower than in Europe. A cafe bill is five times lower, and gas and utilities are three to four times cheaper. Meanwhile, the quality of brands in supermarkets (Carrefour, Metro) is comparable to European ones.

In Vienna, rent is a hundred times more expensive, food is more expensive (with the same quality), but salaries are also high.

Transportation and communications. Cairo has a long-standing metro system (two lines), decent buses, and new toll roads (there's a highway between Cairo and the Alexandria Highway). Public transportation in other cities is more limited (a car is required).

The banking system is developing: you can now deposit dollars at banks, pay rent with a card, and mortgages (if you're creditworthy) are still offered under the old terms (up to 5-6% per annum). Telephone and internet coverage in Egypt is good (4G covers almost the entire country).

By comparison, Austria is a country with excellent transport and communications, but it is also an expensive pleasure.

Simplified legalization and relocation. It's worth noting that when purchasing real estate, an investor can obtain a residence permit (as described above), which includes the right to live with their family (spouses and minor children). However, there are language and bureaucratic barriers in Egypt: you must register your arrival (for those who need to, the Egyptian consulate simply stamps your passport).

Examples: many people are happy with a short-term move to Egypt (six months on a visa) – the weather and prices are favorable, but there are questions about long-term options. Families with children should be aware that good international kindergartens and schools are only available in Cairo/Alexandria. If you buy in Sharm el-Sheikh, your children will have to move to Cairo or to the so-called "British School of Sharm" for school.

Comparison with Austria:

- Safety: Vienna is about 10 times safer than Cairo overall.

- Housing quality: Austrian houses are more energy efficient and soundproofed.

- Comfort: Egypt wins in climate and recreational opportunities (seas, deserts) – this brings quality of life for nature lovers.

- Everyday life: Europe provides a more balanced life with weekends, services, and a language environment – this is already a question of personal priorities.

Egypt as an alternative to the "European refuge"

For whom might buying Egyptian real estate be a solution given restrictions in other countries?

Citizens of unstable regions. If you don't have easy access to European citizenship or permanent residency (for example, if you're from a non-EU country with unpredictable politics), Egypt can at least offer housing flexibility.

Egypt issues tourist visas and residency permits, and they don't bar you from other countries (the EU). Meanwhile, the Austrian red-white-red card is very expensive (requiring a minimum of a million rubles in your account, proven business activity, or a 1 million euro investment under a special program).

Retirees. Egypt's warm climate makes it attractive to European retirees (provided they have around $100,000–$200,000). Healthcare here is comparable to its neighbors (with a well-developed private sector).

For $1,500 a month, you can rent or buy (or rather, take out a mortgage) adequate housing and live well (including a personal driver and housekeeper). In Austria, retirees have to pay for everything: rent, food, and healthcare will cost twice as much per year.

-

A nuance: Egyptian retirees lose the country's social benefits, but they get sunshine and low prices. I met a couple of such families (in Sharm el-Sheikh and Maadi): they live on their savings, their children fly in from Europe occasionally, and they're happy with this balance.

Digital nomads. Egypt is an interesting destination for freelancers and digital nomads. There are plenty of coworking spaces in Cairo/Alexandria, affordable office space (or just a great cafe with internet by the sea).

In Austria, visa regulations are quite strict: without a work permit, you can work for a maximum of 90 days every six months, after which you'll face problems. In Egypt, however, a real estate resident can work online unofficially (or set up a sole proprietorship locally).

Yes, taxes are not paid on foreign income in Egypt unless it comes from abroad (incidentally, the EU has a non-domicile regime for some countries, but Egypt has not introduced such a regulation – this issue is simply less relevant here).

The classic dilemma of Vienna versus Egypt

Vienna – quality and order. Reliable legislation, clean streets, Eastern European wage levels, and a nearly complete investment guarantee. German precision, mortgages with very stable rates (1–2% per annum), and a well-established property management system.

Essentially, it's like buying a "Eurobond with bricks" - with a small yield, but complete safety.

Egypt – lifestyle and freedom. If you want to live the southern lifestyle, wearing a swimsuit and diving once a week, without investing more than €100,000, Egypt gives you the chance to expand your horizons. Risks (exchange rates, bureaucracy, seasonality) are higher here, but the rewards can be two to three times greater.

Egypt is suitable for those who are prepared to be an "active investor": monitoring the situation, communicating with hired managers, and searching for and selling property independently. If you're a "buy it and forget it" kind of person, Austria is better than Egypt.

"I tell my clients openly: 'Egypt is a highly speculative market that requires constant monitoring.' We often say that Austria is like a bailout fund: it won't grow wildly, but it won't collapse either.".

— Ksenia , investment consultant,

Vienna Property Investment

What does an investment exit look like?

Do you plan to retire in 5-10 years? Knowing your exit scenario is important:

Selling your property. In Cairo, you can sell an apartment relatively quickly (2-6 months) if it's liquid (likely in the city center or near a good metro station). In resort areas, it can take longer, especially if prices have fallen. If you plan to return your money in euros, consider the currency you're selling in: you'll lose on the exchange rate for 2020-25 (currently 1 € = 35 EGP).

After selling your residence permit. If your residence permit was issued for this property, selling it does not immediately cancel your residence permit (EGP Flexible). However, since renewal requires proof of ownership or deposits, you simply cannot renew it for another term after the sale.

Under current rules, you'll have to find another property or deposit to maintain your status. If you don't, your residence permit will expire after a year or two.

Transferring residence to relatives. In Egypt, there is no such thing as conditional transfer of residence "by inheritance." If you transfer a share of the property to another person, it will be a regular purchase and sale transaction, and your residence permit will not be retained.

Yes, the legislation at the stage of transfer of rights remained the same as for citizens - everything through donation/inheritance according to Islamic law (Sharia).

I'll add: we've seen examples where relatives of deceased investors registered their inheritance and, in essence, the "heirs" extended their residence permits for themselves, but this is a complicated procedure with a long wait (as in any country for a residence permit under the family category).

Liquidity – Austria vs. Egypt. Austrian real estate typically sells faster (due to international demand and overall market stability). In Egypt, it all depends on the region: apartments in Cairo will find a buyer in a few months, but a house in Neve el-Alamein or a rural villa in Fayoum can sit for years.

Moreover, if you need an investment quickly, in Austria you have more freedom to manage it (sell through an agency or auction), while in Egypt, the paperwork and verification are very time-consuming.

Expert opinion

From my personal experience investing in the EU (Germany, Austria, Cyprus) and Egypt, I have formulated several key lessons:

Capital segregation. I never recommend investing everything in one pot. If a client's goal is to preserve capital, we always advise holding a reserve in highly liquid currencies or assets. Furthermore, I believe it's important to have a focus on different markets.

For example, I'm often asked, "What would you choose in 2025, a €300k investment – Egypt or Vienna?" I answer, "It's reasonable to split the difference – invest €200k in long-term Vienna real estate (less growth, but a stable income), and risk €100k in Egypt for a high return. If a foreigner or Russian-speaker prefers to put everything on one card, let them consider whether they're willing to give up their comfort for this."

Property inspection. A lawyer's job is to ensure the seller has sufficient documentation. In practice, I've seen cases where new owners discovered violations of construction regulations (apartments were being flooded by neighbors upstairs!) or incomplete registration (the owner hadn't actually purchased the land in full).

Sometimes foreigners disregard the risk, thinking, "Nobody cares, let it be, and I'll just rent it out later ." My advice: the law in Egypt is complex and depends on Sunni heritage, so always hire a lawyer with local experience. At Vienna Property thoroughly vet each partner lawyer through reviews to ensure the client has complete control.

Allocation between stable and growing markets. I typically split my strategy like this: 30% – high-risk markets with potential (Egypt, Turkey, Mexico, etc.); 70% – traditional assets (EU real estate, EU and US bonds).

What would I choose for myself? I prefer a stable growth scenario: I'd sell some of my Egyptian shares and invest them in a "comfortable" fund in Austria. My goals are to provide for my family and future retirement, so I trust Austria for the most part.

But I will say frankly: I do not rule out entering Egypt again if the market falls sharply and discounts appear – then I will enter as soon as I am sure that the country's economy has truly stabilized.

"Egypt is a speculative market, Austria is counter-cyclical; it's best to hold both in a portfolio.".

— Ksenia , investment consultant,

Vienna Property Investment

Conclusion

Egypt is a market with great prospects and high risks.

When should you choose Egypt? When you're prepared to manage your investments: carefully analyze properties, consider currency fluctuations, and be prepared for surprises. In this case, you'll enjoy high returns and favorable terms (low initial prices, a "golden visa" for purchases of $50,000–$100,000).

When is Austria the best choice? When stability and security are more important to you than maximum profit. Austria is more advantageous in 70% of respects: transaction transparency, secure property rights, slow but steady price growth, and minimal bureaucratic risks.

General advice from an investment lawyer:

- Always involve a local lawyer (at least to check and prepare documents).

- Under no circumstances should you invest all your savings in one investment (divide your investments by country and asset).

- Keep an eye on the economy and politics (inflation, exchange rate, legislation) – this is a direct factor in your income in Egypt.

- Invest in a liquid location (with good demand). If in doubt, start with properties in Cairo or a resort town center.

- Don't forget about insurance and property maintenance (any apartment may require repairs once every year or two).

Outlook to 2030. By 2030, we expect continued growth in tourism to Egypt, along with the implementation of major projects (the new Suez Canal portal, the development of the Red Sea). This could boost the real estate market by another 10–20%.

At the same time, Egypt will focus on attracting foreign investment (new permanent residence programs, possibly liberalization of banking operations). We will be monitoring these trends: Vienna Property plans to launch special projects in Egypt (in collaboration with local developers) so that clients can invest under the supervision of European professionals.