Property Taxes in Austria 2026 – A Complete Guide

Austrian real estate has long attracted not only locals but also foreign buyers. The reasons are obvious: a stable economy, a high standard of living, and a robust legal system.

I often remind my clients that investing in real estate in Austria should be viewed as a business. It's important to consider not only the price of the apartment or house, but also all associated expenses, primarily taxes. This is especially important if you're planning to buy an apartment in Vienna : an additional 4-8% in transaction costs can significantly impact your final budget.

It's important to understand that the amount stated in the purchase agreement is far from final, as taxes and mandatory fees are added. Furthermore, tax laws are updated from time to time, so it's best to understand the current regulations in advance and plan your budget accordingly.

In this article, we'll take a detailed look at the taxes and fees owners face at various stages—when buying, owning, renting, and selling real estate in Austria. We'll also look at how to optimize these costs.

Property Ownership Options: Residents and Foreigners

Purchasing real estate in Austria is generally possible for foreigners, but the procedure depends on the buyer's status. For citizens of EU and EEA countries, purchasing an apartment or house in Austria is generally straightforward, but the situation with land is more complicated, as some regions have their own regulations.

Special restrictions apply to agricultural land and plots in so-called "no-go zones." In such cases, foreigners must obtain a special permit under the land law— a Grundverkehrsgenehmigung ( ). For more information on where and when this is required, see the article " Restrictions on Foreigners Purchasing Real Estate in Austria .

These requirements also apply to buyers from non-EU countries. Therefore, before purchasing land or a country house, it is important to check the laws of the specific federal state in advance.

In terms of property types, foreigners can purchase the same types of real estate as Austrians: apartments, houses, or plots of land. Vienna and large cities like Salzburg and Graz are traditionally the most popular, as this is where most of the inventory is concentrated.

At the same time, resort regions like Tyrol and Salzburg (Kitzbühel, Hintersbrunn, etc.) are also popular. However, in tourist areas, authorities often restrict the purchase of second homes to prevent excessive price increases.

In my experience, foreign buyers often assume the process will be as simple as possible, but in practice they encounter bureaucracy. Banks, for example, carefully check the origin of funds, and municipalities may specify the intended use of the property.

"My advice: consult with a lawyer or agent in advance and consider transferring funds through official channels. This reduces the risk of problems with currency controls and taxes in Austria.".

— Ksenia , investment consultant,

Vienna Property Investment

Purchase costs: taxes and fees (for the buyer)

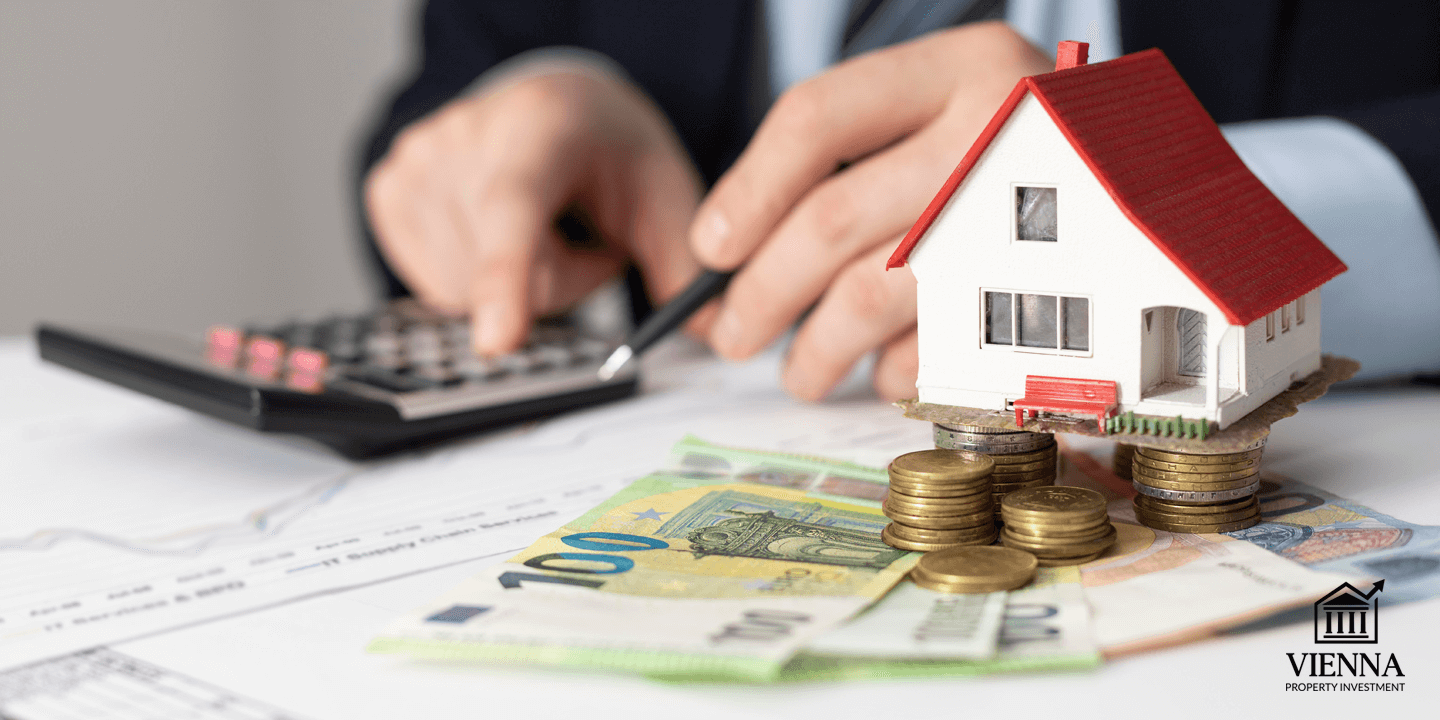

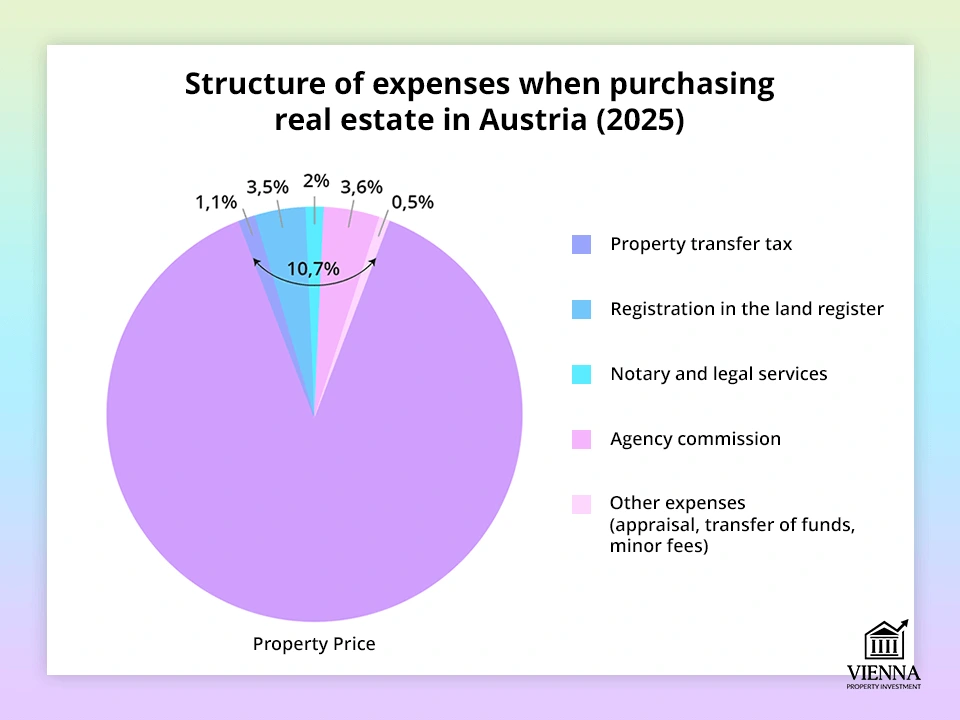

The property price is only a portion of the total transaction cost. Buyers must consider mandatory Austrian taxes and fees, which often catch investors off guard.

State fee for the transfer of real estate (Grunderwerbsteuer)

The main tax on real estate purchases in Austria is the Grunderwerbsteuer , or real estate transfer tax. Its standard rate is 3.5% of the transaction price (or market value of the property).

Example: if an apartment costs €300,000, the tax will be €10,500.

-

Important: When gifting or inheriting, a progressive tax rate applies: the first €250,000 is taxed at 0.5%; the next €150,000 is taxed at 2%; and anything above that is taxed at 3.5%. This is much more advantageous than paying 3.5% of the entire amount upfront.

Furthermore, for transactions within the family (for example, between spouses, parents, and children), the tax is often reduced to 0.5–2%. Therefore, it is better to formalize the transaction when inheriting real estate, as this will reduce the tax bill.

Registration of property rights (Grundbuch)

After paying the Grunderwerbsteuer, the transfer of ownership must be registered in the land register ( Grundbuch ). A separate fee of 1.1% of the property's value is charged for this.

Typically, all calculations and payments are handled by a notary or lawyer. As a result, government fees alone when purchasing a home in Austria amount to approximately 4.6% of the property's value.

Hidden costs: notary, translator, appraisal, money transfer

In addition to mandatory taxes, the buyer should also consider additional costs associated with the transaction. These primarily include notary services and legal support. The notary prepares the purchase and sale agreement and is responsible for the "Verbücherung" (official registration of the deed) procedure at the regional court. Their services typically cost approximately 1-2% of the property's value.

Exact rates depend on the specific situation and the complexity of the contract, but on average, it's reasonable to plan for around 1.5–2% for notary fees. In some cases, a translator may also be required (if the buyer doesn't speak German). This will also typically cost several hundred euros.

In addition to this, there are other possible costs: for example, the cost of a real estate appraisal (banks often require such an assessment when applying for a mortgage), currency exchange fees if funds are received from abroad, and other expenses.

When all is added up, "hidden" costs typically amount to around 2-4% of the transaction amount. And with taxes, the final cost can reach 6-8% or even higher.

That's why it's important to consider these costs in advance. The price of an apartment that initially seems attractive may end up significantly higher than expected after all fees and payments have been incurred.

Real Estate Ownership: Regular Taxes and Payments

After purchasing a property, expenses don't end—there are regular payments and taxes that need to be taken into account in advance.

Land tax (Grundsteuer)

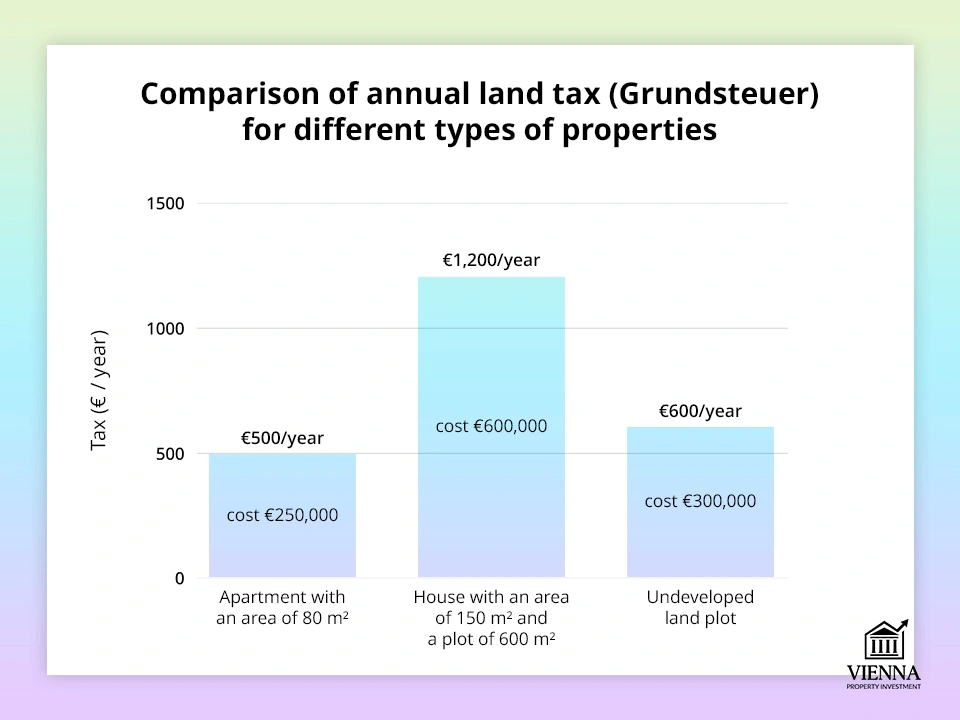

Every property owner in Austria is required to pay land tax, or Grundsteuer . This tax is calculated based on the property's "official value," or Einheitswert, determined by the tax office.

The calculation formula looks like this:

Grundsteuer = Einheitswert × Steuermesszahl × Hebesatz.

The Steuermesszahl (meaning "tax rate") is a tariff that depends on the type of property (apartment or house) and gradually increases for more expensive properties. The Hebesatz (meaning "heavy duty") is a coefficient set by each municipality independently (usually up to 500%).

To illustrate, here is an example: if the Einheitswert is €50,000 and the maximum Hebesatz of 500% applies in Vienna, the calculation would be: €87.23 × 5 = €436.15 per year.

Thus, we're talking about relatively small amounts—usually hundreds of euros per year, not thousands. The tax amount depends directly on both the Einheitswert and the policies of a particular city or town.

In large cities, such as Vienna, the rate is typically close to the upper limit (500%), while in smaller municipalities it can be significantly lower. If the tax amount exceeds €75, it can be paid in four equal installments throughout the year rather than all at once.

Formally, the tax is paid by the owner, but in practice, many owners who rent out apartments shift it to tenants by including Grundsteuer in utility bills.

On average, owners of apartments with an area of 70–100 m² in Austria spend between €200 and €500 per year on Grundsteuer. A good estimate is approximately €100–€200 per quarter for a larger apartment or private home.

Many foreign buyers are surprised by how low this tax is. Indeed, compared to other countries, it's practically symbolic. But despite its small size, it's still important to consider when planning your budget.

Rental Income Tax (for investors)

If the property is not used for personal residence but is rented out, the income from it is taxable. This income is added to the owner's total personal income and is taxed at the standard progressive income tax rate—from 20% to 55%.

Austria has a tax-free income limit of up to €13,300 per year (as of 2024). This means that if your rental income after expenses does not exceed this amount, you will not have to pay tax. Anything above this amount is taxed at the appropriate rate – 20%, 30%, and so on, up to 55% for very high incomes.

For example, an apartment rents for €12,000 per year. After expenses are taken into account, the taxable income may fall into one of the lower brackets, reducing the actual tax burden.

-

Important: expenses can be deducted from income. The list of such expenses is quite broad:

- repair work,

- object management,

- depreciation,

- insurance payments,

- interest on a mortgage loan .

These expenses allow to significantly reduce the tax base.

Real Estate Sales: Taxes and Optimization

When it comes time to sell real estate in Austria, the main question is not only the transaction price, but also how much income tax will have to be paid – and how to legally reduce it.

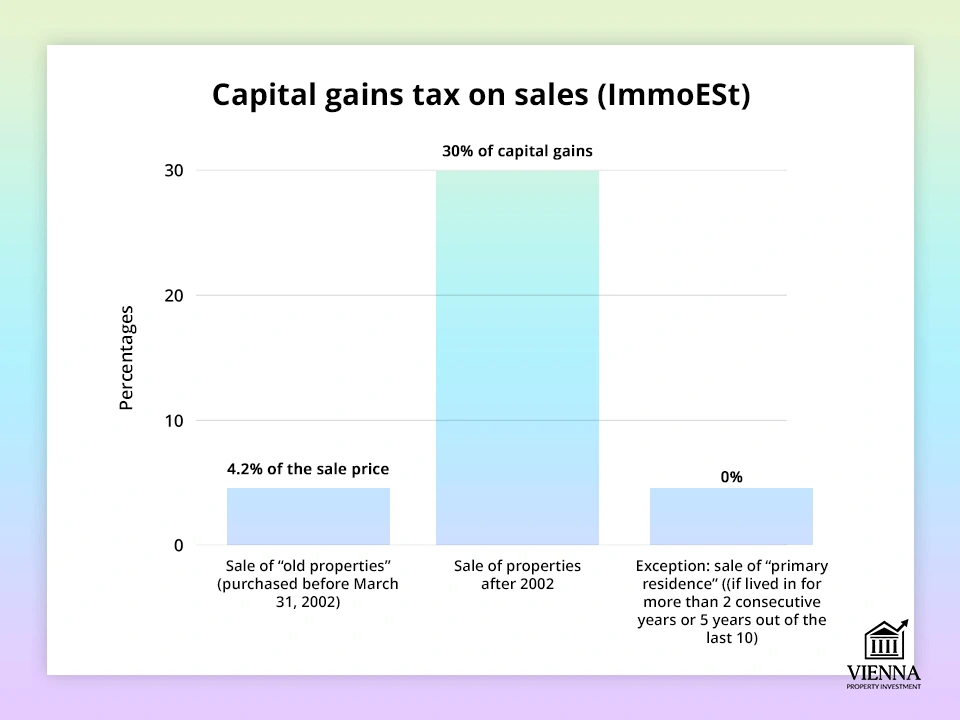

Capital Gains Tax (Immobilienertragsteuer, ImmoESt)

If an owner decides to sell real estate in Austria, another tax is imposed: the Immobilienertragsteuer , or capital gains tax. It was introduced in 2012 and amounts to 30% of the profit received (the difference between the sale price and the purchase price).

This tax is paid by the seller, and the period of ownership of the property is not important, except in certain special cases.

-

Let me give you an example: an apartment was purchased for €200,000 and sold for €300,000. The difference is €100,000. In this case, ImmoESt = 30% × 100,000 = €30,000.

The tax is withheld either immediately upon sale (through a notary) or later – when filing a declaration.

It's important to retain all documents confirming expenses related to the purchase and improvement of the property: notary fees, purchase taxes, repairs, and modernization. All these expenses can be offset, thereby reducing taxable income.

For legal entities, the rate is lower – 23%. However, for individuals, the standard tax rate remains 30%.

It's also worth noting that capital gains tax doesn't affect other income. This means that even if you have a high salary or business income, ImmoESt remains a flat 30% tax and doesn't increase the rate on other types of income.

Tax benefits and exemptions on sale

Although a 30% rate seems quite high, there are situations where capital gains tax on the sale of real estate can be waived entirely. The key requirement is personal residence. If the owner used the apartment as their primary residence for at least two consecutive years immediately prior to the sale, ImmoESt tax is not levied.

There's another, more flexible rule: " 5 out of 10. " This means that if a person has lived in a house or apartment as their primary residence for at least five years during the last ten years, no tax is charged upon sale of the property. This rule is designed to take into account long-term residence, even if the person recently moved.

-

Important: If you inherit an apartment, the two-year residence requirement does not apply, as no purchase was made.

However, the "5 out of 10" rule also takes into account the residence of previous owners. This means that if the property was a family home for a long time, the heir or beneficiary may be eligible for this exemption. It all depends on who actually lived in the property and for how long.

If the apartment was inherited and immediately resold, the tax is still levied on the difference between the sale price and the original value. The only way to avoid this tax is to live in the property for at least two years.

There's another interesting benefit—the so-called " Herstellerbefreiung " (" production benefit "). If the owner builds a house on a plot of land themselves and later sells it, the profit from the building itself is exempt from ImmoESt.

However, profits made on land under a house in Austria are taxed as usual. This rule is especially relevant for those who purchased a plot of land, built a house on it, and then decided to sell the property.

"When I advise clients on sales, we always simulate various scenarios. It often turns out that waiting a couple more years is enough to avoid the tax entirely."

— Ksenia , investment consultant,

Vienna Property Investment

Inheritance and gifting: modern rules

Since August 1, 2008, Austria has not had a separate inheritance or gift tax. This means that transferring an apartment or house to a relative is not subject to a special tax.

However, when inheriting or gifting real estate in Austria, a property acquisition tax ( Grunderwerbsteuer . Close relatives are subject to a preferential rate: 0.5% on the first €250,000 and 2% on amounts above this threshold. By comparison, the rate for a standard purchase is 3.5%.

For example, if a father transfers ownership of a house to his son, the costs will only amount to a few thousand euros, whereas with a regular sale through a purchase and sale, the tax amount could reach tens of thousands.

Every gift or inheritance transaction must be officially declared to the tax authorities ( Anzeigepflicht ). However, beyond the GrESt, no additional taxes are payable.

Gifting or inheritance within a family is significantly cheaper and simpler than in Switzerland or Germany, where property transfers by inheritance are subject to tax.

-

It's important to remember that if property is transferred through a chain of gifts to different people within five years, tax authorities may reclassify the transaction as a "hidden sale" and assess the full tax rate.

Therefore, if several transfers are planned in a row, it is better to discuss the details with a lawyer in advance.

How to save on taxes

The Austrian property tax system is quite flexible and offers several ways to reduce the burden:

Exemption from Grundsteuer for new properties. In some federal states and municipalities, new apartments built through state subsidy programs (geförderte Wohnobjekte) are temporarily exempt from land tax. This exemption period can last from 5 to 10 years. To take advantage of this exemption, you must submit an application to your city hall.

Depreciation and rental deductions. Rental property owners can reduce their taxable income by covering expenses such as repairs, insurance, maintenance, and building depreciation.

Standard rates are 2% per annum for houses and 2.5% for apartments. With proper accounting of expenses, taxable profits can be minimized.

Small business tax relief (Kleinunternehmerregelung). Rent may be considered a service, and income may be subject to VAT (20%), especially for short-term rentals.

However, according to the “small entrepreneur” rules (Kleinunternehmerregelung), if the turnover does not exceed €55,000 per year ( from 2025 ), the owner is exempt from VAT.

-

This means that the tenant pays the net amount minus the 20% tax deduction, and the owner is not required to file VAT returns. Input VAT cannot be deducted for this, but this is not particularly important for private owners. This benefit also applies to EU-resident companies doing business in Austria.

Other government benefits. In addition to tax breaks, there are support programs for young families, professionals, and others. These programs provide additional bonuses for home purchases, although they don't directly affect taxation.

Features of land purchase and construction

Purchasing land in Austria is subject to the same basic taxes as purchasing an apartment or house: GrESt at 3.5% (or a preferential rate for purchases within a family) and a registration fee of 1.1%.

However, land has its own unique characteristics. One of the key ones is the Widmung (commercial permit for the use of the land for construction). If construction is planned, it is necessary to clarify the status of the land and the possibility of obtaining such a permit in advance . Sometimes the transaction may require additional checks and payments.

If land is listed as agricultural, rezoning it for construction purposes is only possible with the permission of local authorities. This rezoning will trigger a new tax on future sales (more on this below).

Building a house on your own property comes with new costs. All construction contractors invoice you with 20% VAT included—the standard rate in Austria.

For a private buyer, these 20% are already included in the estimate: the tax is not allocated separately, but it effectively increases the cost of construction by one-fifth.

-

More importantly, consider additional fees for obtaining a building permit and connecting to utilities (water, electricity, etc.). These costs can amount to several thousand euros.

That's why I always recommend engaging an architect or lawyer before purchasing land. This will allow you to calculate potential costs in advance and avoid any unpleasant surprises when signing the contract.

New laws and breaking news: what will change in 2025?

The Austrian tax system is quite dynamic. Several changes have already been approved, which will come into effect in 2025 and will directly impact property owners.

Reassessment of income thresholds. , income rates will . The tax-free minimum is €13,308 (up from €12,816 previously), and the maximum rate of 55% will only apply to incomes over €1 million.

For investors, this means that a portion of rental income will remain tax-free, which is especially noticeable for smaller amounts.

Small business reform. Starting in 2025, the VAT exemption limit will be increased. Now, income of up to €55,000 per year (instead of the previous €35,000) exempts the owner from VAT. This represents a significant relief for landlords: they can rent out their apartments without the 20% additional tax on their tenants' bills.

-

Please note: this exemption only applies to entrepreneurs from the EU. Owners from third countries will need to register their business in Austria to take advantage of it.

Tightening of share-deals regulations. Effective July 2025, the rules for companies owning real estate have changed. If a property is sold indirectly, but through the sale of shares in the company that owns the apartment, the GrESt tax will be calculated not based on the "Einheitswert" (Early Sales Tax), but on the market value of the entire property portfolio. This effectively means you'll have to pay 3.5%, as with a regular purchase.

The measure is aimed at combating tax evasion schemes through "company sales." This will particularly impact investors in large projects and developers.

Redevelopment tax (Umwidmungszuschlag). Another new measure is an additional tax on the sale of land converted from agricultural use to construction use. If a plot of land was converted from Grünland to Bauland after 2024, then the profit from the land will be increased by 30% and subject to tax if sold after mid-2025.

In other words, speculation on “cheap agricultural land” will now become significantly less profitable.

The future of Grundsteuer. A land tax reform is also being discussed. The last Einheitswert assessment was conducted back in 2012, and a new reassessment is planned for 2025–2027. This could lead to an increase in the tax base for Grundsteuer.

Property values in many areas have increased significantly compared to previous estimates. Against this backdrop, new legislation could change tax rules: either increasing the tax itself or redistributing it so that owners of properties in prestigious and expensive areas pay a larger share.

That's why it's crucial to stay up-to-date with current news. I strongly recommend that investors subscribe to newsletters from the Austrian tax authorities. It's also a good idea to regularly consult with local tax and real estate experts to avoid any unpleasant surprises from a reform.

-

Where can I stay up-to-date? I recommend the official website of the Austrian Ministry of Finance (BMF) and the Austrian government services – they publish current changes to tax laws.

We also have our dedicated blog, ViennaProperty , and other reputable agencies with expert experts. I personally share the latest updates on our Telegram channel so you're always up-to-date and can plan your transactions without any unpleasant surprises.

Conclusion: Key Findings and Recommendations

Property taxes in Austria are low compared to many countries, but they are mandatory and require attention:

- When purchasing real estate, it is worth considering additional costs - usually around 4-8% of the price.

- The annual land tax is low. But if the property is rented out, this expense still needs to be managed.

- A 30% capital gains tax applies to sales, which can have a significant impact on your bottom line.

- Gifts and inheritance of real estate in Austria are virtually tax-free. This makes transferring property within a family particularly advantageous.

The main rule is simple: always calculate not only the purchase price, but also all subsequent Austrian taxes and expenses.

"I always say: it's better to carefully calculate all the possible scenarios once than to unexpectedly pay 30% of the apartment's value in taxes."

— Ksenia , investment consultant,

Vienna Property Investment

Property taxes in Austria aren't exactly high, especially compared to other European countries. But that doesn't mean they can be ignored:

Ultimately, sound tax planning becomes the key to successful real estate investment .

- Buyers should research the structure of additional costs in advance and consult with an accountant.

- Sellers should check whether they can take advantage of the tax exemption.

- for all investors to stay up-to-date on legislative changes—as we see, new regulations will come into force as early as 2025, which will impact the market.

With this approach, Austrian real estate becomes not a risky lottery, but a truly reliable tool for preserving and increasing capital.