The best areas to rent and rent out property in Vienna in 2026

Vienna is one of the most reliable and developed real estate markets in Central Europe. Even with significant price increases in recent years, rentals remain in demand. This makes the city attractive to both those seeking housing—students, families, and expatriates—and investors hoping for a stable rental income.

By 2025, demand for rental housing in Vienna will rise again. This is due to population growth, an influx of migrants, young families, and workers. Students and professionals living in the city temporarily and increasingly choosing to rent also have a significant impact. Meanwhile, prices continue to rise due to a shortage of apartments, especially new and high-quality ones.

With such demand, the neighborhood plays a crucial role. It determines rent levels, profitability, how quickly a tenant finds a home, how reliable they are, and how easy it is to sell the property. In this article, we'll look at the neighborhoods for apartment rentals in Vienna that currently offer the best combination of demand, stable income, and prospects—for both investors and property owners.

An overview of the current market situation in Vienna

By 2025, Vienna was showing steady population and housing market growth. The city's population exceeded approximately 2.03 million, representing a 12-13% increase over the past ten years— the city has added approximately 230,000 residents since 2015. This growth is the primary driver of high demand for housing and rentals, fueled by migration, internal relocation, and an influx of young families, which means demand for residential properties remains consistently high.

The second key trend is rising rental rates across Vienna in 2024-2025. According to market analytics and aggregators, rents in several segments have grown at double-digit rates compared to last year. By the end of 2025, the average rent in the city will be around €20 per m², with direct rentals reaching approximately €20.1 per m². Overall, rents range from €15 per m² (according to ImmoScout/Immopreise ) in more affordable areas to €25-28 per m² in central and prestigious districts such as Innere Stadt and Neubau .

In 2025, prices for new listings increased by approximately 6-9% compared to last year, depending on the type of property and the data source.

The third trend is the growing disparity between districts. Central and near-central districts, such as Innere Stadt , Neubau , Leopoldstadt , and Mariahilf , maintain high rental rates and good liquidity, but due to high acquisition costs, their interest rates are typically lower.

Outer districts such as Donaustadt, Floridsdorf, Favoriten , and Simmeringoffer more affordable prices per square meter and often offer higher current rental yields. New family-oriented residential complexes (Neubau) are being actively built here, with demand driven by workers and young families. However, in areas with a high proportion of social housing Wiener Wohnen), investors may face greater competition and restrictions when reselling or releasing properties.

The fourth aspect is the special role of social and municipal housing. Vienna has historically had a strong sector of social housing and public Wien : in some segments, more than half of the rental housing is owned by the city or non-profit developers.

This creates a unique balance in the market: on the one hand, affordable social housing curbs price growth in the lower segment, while on the other, the private market focuses on mid-range and more expensive housing, where demand and prices are growing faster.

Finally, market cyclicality and regulatory risks should be considered. Vienna has already experienced migration waves in the 2020s (for example, in 2015 and 2022), which temporarily increased pressure on the housing and rental markets. At the same time, authorities are tightening short-term rental regulations, including restrictions on Airbnb, and increasingly focusing on housing affordability and rent control. All these factors directly impact the level of risks that investors and landlords must consider.

How to determine the best area for renting/renting

"Choosing a neighborhood is the key to successful rentals. In Vienna, a good location can offer a 20-30% difference in rent and vacancy rates. The best neighborhood is one with stable demand, infrastructure, and development plans. Don't judge by a 'pretty street,' but by the data: residents, transportation, new projects, and competition."

— Ksenia , investment consultant,

Vienna Property Investment

To determine the best areas to rent apartments in Vienna, we conducted a comprehensive market study. It takes into account economic data, demand, infrastructure quality, and local regulations.

Compare rental rates

Our method is based on a comparison of average rental prices in euros per square meter in both older buildings (Altbau) with regulated rates (Richtwert) and new buildings. We also analyze rental rate trends from 2015 to 2025 to assess long-term income growth and demand sustainability.

A key indicator is property occupancy —that is, the average tenant stays. Areas with rapid rental rates have a lower risk of vacancy and provide a steady income. Profitability analysis considers both gross and net income. This allows for an assessment of the actual financial result after deducting operating expenses, taxes, and potential repair costs.

An important factor is the initial cost—the average price per square meter when purchasing real estate. It influences the total investment and the time it takes to recoup the investment.

Tenant profile

The type of tenant also influences the neighborhood's assessment: demand is more volatile in student neighborhoods, stable in family-friendly areas, and higher affordability in areas with a high concentration of foreign professionals. Geographic factors include an analysis of transportation accessibility: proximity to metro lines, tram routes, and major transportation hubs.

Developed infrastructure—schools, kindergartens, clinics, shops, and parks—makes a neighborhood more attractive and encourages renters to stay longer.

Regulatory risks

Particular attention is paid to legal risks: rent regulation in older housing stock (Altbau), the application of the recommended rent system (Richtwertmietzins), restrictions on short-term rentals, and municipal regulations defining the permissible use of real estate. These factors can both reduce potential income and ensure market stability and predictability.

from Stadt Wien (MA 23) and Statistik Austria are primarily used , providing official information on population, migration, household composition, and housing stock. Secondary sources include major marketplace platforms such as ImmoScout24 , Willhaben, and Immopreise , which display real market offers and price trends.

Wien er Wohnen data provide valuable complements . They provide a more professional perspective on the market, help gain a deeper understanding of the situation in specific areas and segments, and assess current changes and trends.

The resulting methodology is a step-by-step analysis that combines economic and social indicators, market data, infrastructure, and legal restrictions. This approach allows for an objective identification of Vienna's districts with the greatest rental potential.

Criteria, metrics and source priority

| Criterion | Measurable metric | How to get / tool |

|---|---|---|

| Average rent €/m² | €/m² according to Bezirk, Altbau/Neubau | Immopreise (Preisspiegel), ImmoScout, ohne-makler Immopreise, ImmoScout, ohne-makler |

| Rate dynamics | CAGR 2015–2025, annual % growth | ImmoScout/Immopreise, EHL report series |

| Time-to-rent | days on market, % rented in 30/90 days. | ImmoScout (listing data), agent reports |

| Profitability (gross/net) | % gross yield, net yield | Purchase price (Immopreise) + rental (ImmoScout) |

| Tenant profile | % of students/families/expats | MA 23 (demographics), advertisements, local research |

| Transport/INFRA | minutes to U-Bahn, accessibility index | Stadt Wien maps, MA 23 |

| Regulations | applicable MIET regulations, Airbnb rules | Stadt Wien, legislation, EHL |

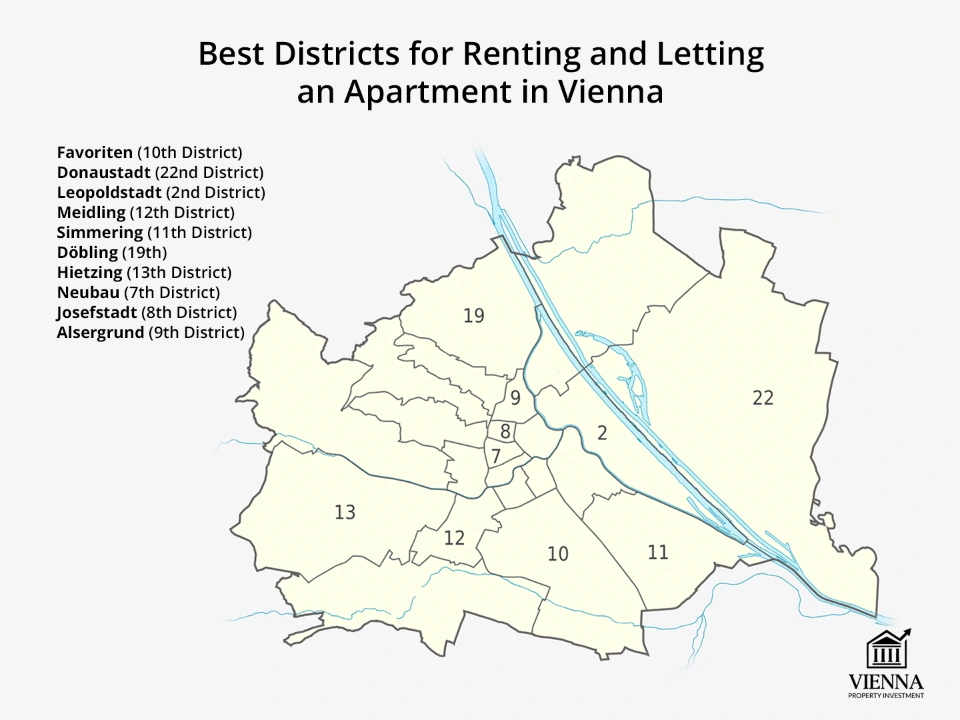

Comparison of districts: top candidates for delivery and their profiles

The neighborhood plays a crucial role in successful real estate rentals in Vienna. Each neighborhood has its own characteristics: social environment, demand level, rental rate dynamics, and regulations. All of this directly impacts the property's profitability and tenant stability.

When evaluating neighborhoods, it's important to consider more than just the average rent per square meter. Liquidity, tenant profile, urban development plans, transport accessibility, and potential risks are equally important. Below are the neighborhoods considered the most promising in 2025 for investors and owners focused on stable demand and balanced returns.

Favoriten (10th district) – mass demand

Brief description. Favoriten is a large and densely populated district in the south of Vienna. Its development has accelerated significantly since the launch of transport and rail projects near Hauptbahnhof. The district is dominated by new buildings and apartment buildings of various categories, and the urban environment continues to improve, with new shops, services, and jobs.

Who it's for. Favoriten is ideal for low- and middle-income families, workers, young couples, and students. This area is also of interest to investors planning to rent out their properties to the mass market.

Average rent and range. The approximate rental price is €12-15 per square meter. The price depends on the apartment's condition and its proximity to public transportation. Simpler and smaller apartments in more remote areas are cheaper, while newer apartments near train stations are more expensive.

Expected yield. Gross yields are typically around 3.5-4.5% with a reasonable purchase price and proper property management. In new buildings ( Neubau ), yields may be slightly lower, as the price per square meter is higher.

Risks and limitations. The mass-market segment is highly competitive, demand may fluctuate seasonally, and some older properties may deteriorate rapidly. The large number of affordable options may constrain rental price growth. It's also important to factor in regulations and additional costs, including utility bills (Betriebskosten), when calculating rental prices.

Donaustadt (22nd district) – growth, new neighborhoods

Brief description. Donaustadt is the largest district in eastern Vienna. In recent years, new residential complexes ( Neubau ), office centers, and recreational areas along the Danube have been actively built here. These modern neighborhoods offer apartments with convenient layouts, parks, and playgrounds.

Who it's for: This area is often chosen by families, expats, employees of new business centers, and people who value more space and proximity to green spaces.

Average rent and range. Approximately €15–20 per square meter: lower prices in remote areas and older buildings, higher prices in new residential complexes with a good standard of amenities.

Expected yield. In new projects ( Neubau ), gross yields can be around 3.8-4.6% if the purchase price is moderate and there is high demand from long-term renters.

Risks and Limitations. The main risk for this area is a potential oversupply. If many new apartments hit the market at once, this could lead to an increase in vacancies and a temporary drop in rental rates. Furthermore, the area's distance from the city center could reduce its appeal to renters who work in the city center and lack the ability to work remotely or have flexible commuting options.

Leopoldstadt (2nd district) - central, sought-after, dynamic

Brief description. Leopoldstadt is a connecting link between the center and the east. It includes near-central neighborhoods, embankments, and island areas. The district is attractive due to its well-developed transportation network, comprehensive livable infrastructure, and proximity to the city's main park (Prater) and important cultural venues.

Suitable for: The area is popular among young professionals, expats, and renters with middle and upper incomes. It's well-suited for short- and medium-term rentals, especially for those who want to live close to the city center but not directly in the Innere Stadt .

Average rent and range. Approximately €20–26 per m²; prices can be even higher in areas very close to the city center.

Expected yield. 3.2-4.0% gross yield—high rent is offset by a high purchase price, so overall efficiency is average.

Risks and limitations. The main risk is the high purchase price per square meter, which reduces the yield. Also possible is intense competition in the expat housing market and seasonal fluctuations in short-term rental demand.

Meidling (12th district) - accessible, well connected

Brief description : Meidling is a classic residential area with convenient transportation links, including the S-Bahn and U-Bahn, and a wide selection of shops and services. It combines older apartment buildings with new residential developments.

Suitable for: A diverse audience: families, mid-level professionals, and couples. The area is ideal for investors targeting the stable middle class.

Average rent and range. Approximately €17-21 per m²—price depends on the specific location in the area and the apartment's standard.

Expected yield. Approximately 3.2-4.2% gross yield. Profitability is largely determined by the favorable purchase price and utility costs.

Risks and limitations. Potential risks include competition from neighboring areas and the varying conditions of the housing stock. Therefore, it is important to carefully evaluate a specific neighborhood in Meidling , especially its proximity to transportation and infrastructure.

Simmering (District 11) – development, affordable prices

Brief description. Simmering is undergoing a significant transformation: from a traditional industrial district, it is becoming a magnet for new residential developments. Its modern appeal is built on its offering of affordable housing and excellent transport accessibility.

Suitable for: This is Vienna's premier rental district for young families, budget-conscious renters, and workers. Investors seeking affordable housing can find affordable rental options in this area.

Average rent and range. Approximately €16–19/m² (some estimates range from €18–19/m²).

Expected yield. Gross yield is around 3.5-4.3%, especially for new and well-designed apartments.

Risks and limitations. Demand and population remain stable, but the area may be less liquid than prime locations. Prospects largely depend on the pace of new projects being launched.

Döbling (19th) and Hietzing (13th) - premium, green area

Brief description. Döbling and Hietzing are prestigious, green neighborhoods with villas, townhouses, and high-quality apartment buildings. They offer a high standard of living, excellent schools, and low-density development.

Suitable for: Reliable and affluent tenants live here: high-income families, diplomats, and executives. The area is ideal for long-term rentals.

Average rent and range. Rental rates here are high—approximately €22–30 per square meter, and even higher for some properties. Prices for villas and luxury properties can significantly exceed this level.

Expected yield. Gross yields are typically lower (≈2.5–3.5%) due to high purchase prices. However, such properties retain their value well and are highly liquid.

Risks and limitations. Interest rates are low, but the risk of downtime is lower. Investors in the premium segment should focus on long-term property appreciation rather than quick monthly profits.

Neubau (7th), Josefstadt (8th), Alsergrund (9th) – central districts for students and professionals

Brief description. These locations are located near the city center, close to universities, business spaces, and cultural institutions. They offer a high concentration of rental housing and demonstrate consistent interest from students and young professionals.

Suitable for: The main tenants are students, young professionals, expats, and creative professionals. The areas are well suited for both short- and medium-term rentals.

Average rent and range: €20-28/m²; rates can be even higher for quality apartments in central areas.

Expected yield: 3.0-4.0% gross yield depending on the purchase price and the level of equipment in the apartment.

Risks and limitations. Risks include high entry costs and intense competition. In the short-term rental segment, it's also important to consider regulatory restrictions, such as the rules for Airbnb-style rentals.

Summary table - a summary with recommendations for the investor

| District | Investor strategy - which is better? | Recommended object type |

|---|---|---|

| Favoriten | Buy & hold for mass rentals; value-add (repair) | 1-2-room apartments in Neubau/Altbau |

| Donaustadt | Long-term rental to families; Neubau projects | 2-3-room apartments in new buildings |

| Leopoldstadt | Target expats/young professionals; mid-to-high rent | cozy 1-2-room apartments, furnished |

| Meidling | stable cash flow, mid-range segment | 2-room apartments with convenient transport links |

| Simmering | budget segment, high profitability | modest 1-2-room apartments, affordable renovations |

| Döbling / Hietzing | capitalization and premium segment | villas, family houses, luxury apartments |

| Neubau / Josefstadt / Alsergrund | students/professionals, short/medium term rentals | small apartments, studios, furnished apartments |

Legal aspects and regulations of rent in Vienna: what is important for a landlord to know

In Austria, laws strongly protect tenants. For an apartment owner, it's not as simple as "rent it out and forget it." They must strictly adhere to the rules: adhere to contract terms, not exceed permitted rental rates, manage utility bills correctly, pay taxes, and remember that renting out an apartment "for a couple of days to tourists" is generally prohibited. All of this is governed by strict regulations.

Failure to comply with these regulations entails real risks, ranging from financial losses to administrative penalties and lengthy court proceedings. Therefore, it is critical for property owners in Vienna to understand the key aspects of the law, which we will examine below.

1. Types of lease agreements in Austria: befristet and unbefristet, Richtwert for Altbau

In Austria there are two main types of lease agreements: permanent (unbefristet) and fixed-term (befristet).

Open-ended contract (unbefristeter Mietvertrag)

This type of agreement provides maximum protection for the tenant. The landlord can terminate the agreement only for strictly defined reasons, such as the tenant's intention to continue living in the apartment or serious violations by the tenant.

A perpetual lease typically reduces profitability but increases the property's liquidity, as such housing is more often chosen by tenants looking for a long-term lease.

Fixed-term contract (befristeter Mietvertrag)

Typically, the lease is for three years, less commonly for five or ten years. It can be renewed multiple times, but after the second renewal, the tenant has the right to request an indefinite lease. For the landlord, a fixed-term lease is more convenient because it offers more flexibility and allows for the possibility of revising the rent if necessary.

Richtwert - marginal rates for the old fund (Altbau)

For older buildings built before 1945, a system called Richtwertmiete (Rental Allowance)—a legally established rent cap—applies. Each federal region sets its own Richtwert. Additional charges (Zuschläge) are permitted for certain characteristics, such as:

- good condition of the apartment;

- developed infrastructure;

- availability of an elevator;

- the modernization carried out.

Even with surcharges, the final rental rate remains limited by law. Because of this, the yields of older buildings are often lower than those of new construction (Neubau), but the risks of long-term rentals are usually lower.

2. Rights and obligations of the landlord

Austrian law protects both tenants and landlords, but the majority of responsibilities usually fall on the landlord.

Main responsibilities:

- maintaining housing in a habitable condition;

- carrying out necessary repairs, especially those related to the building structure;

- Providing a clear and transparent calculation of Betriebskosten (utility and operating costs);

- return of the deposit (Kaution) at the end of the lease - usually in the amount of 2-3 monthly rent payments;

- compliance with minimum energy efficiency requirements, including Heizwärmebedarf.

Landlord's rights:

- checking the tenant's solvency (Bonitätsprüfung);

- change in rent within the limits permitted by law;

- retention of part of the collateral in the event of damage to the property;

- termination of the contract in the event of serious violations on the part of the tenant.

It is important to remember that violating these rules can lead to legal action and fines, so a good understanding of the law is key.

3. Regulation of short-term rentals in Vienna

Short-term rentals through platforms like Airbnb are strictly regulated in Vienna. The main goal of these rules is to preserve housing for long-term stays and prevent residential buildings from being converted into hotels.

Main limitations:

- the need for consent of all co-owners of an apartment building;

- a ban on short-term rentals in buildings intended for permanent residence (Hauptwohnsitz);

- additional local restrictions in certain areas;

- Fines for violations can reach €50,000.

This means that landlords need to check in advance whether short-term rentals are permitted and obtain all necessary approvals to avoid significant fines and other penalties.

4. Taxation of rental income: what an investor should consider

Rental income is subject to income tax (Einkommensteuer). However, the tax is not paid on the entire rental amount, but only on the profit after deducting permitted expenses.

What can be written off:

- annual depreciation of residential real estate (Abschreibung) in the amount of 1.5%;

- utility and maintenance fees (Betriebskosten) borne by the owner;

- interest on mortgage loans;

- expenses for repairs and part of the costs for housing renovation;

- costs associated with managing a property.

"Working with investors in Vienna, I see that successful rentals depend on the property and compliance with local regulations. Law in Austria is complex—it's important to choose the rental format in advance and draft the contract correctly. I help build a legal rental model, mitigating risks and maintaining profitability. It's best to discuss the strategy beforehand."

— Ksenia , investment consultant,

Vienna Property Investment

Practical advice on property management

Knowing the laws is just the starting point. To truly generate rental income, it's important to understand the market, the property's condition, the potential for improvement, and the ability to effectively manage tenants. An effective landlord combines thoughtful management, financial prudence, and attention to the property's quality.

Profitability assessment

Before purchasing an apartment or renting it out, it's important to estimate the potential profitability. Two metrics are commonly used for this: gross yield and net yield.

Gross yield reflects the “basic” profitability of the property—the ratio of annual rental income to the purchase price of the apartment.

Formula:

Net yield reflects real profitability, as it includes all expenses and taxes.

Formula:

Example for a 60 m² apartment in Favoriten:

| Parameter | Meaning |

|---|---|

| Average rent | €1,100 / month |

| Annual rent | €13 200 |

| Betriebskosten | €1,500 / year |

| Control | €600 / year |

| Repair fund | €400 / year |

| Tax | €1 500 |

| Purchase price | €280 000 |

Gross yield = 4,7 %

Net yield ≈ 3,2 %

Repair and modernization

Proper apartment improvements directly increase its value, attract tenant interest, and increase the likelihood of a quick sale. Energy-efficient solutions—new windows, a modern heating system, and high-quality insulation—significantly reduce utility costs for residents and improve the energy efficiency of the property. This makes the apartment more attractive and easier to rent or sell.

A modern kitchen is a key factor when choosing an apartment. Renters value the convenience and appearance of the kitchen area, and a well-equipped kitchen can increase rent and help find a tenant faster.

A good bathroom is equally important A modern, neat, and functional bathroom makes living more comfortable and enhances the overall feel of the apartment.

A balcony or loggia has become especially important in recent years, as people spend more time at home, and having their own outdoor space is considered a major plus. The quality of the flooring also greatly influences the apartment's appeal : durable flooring such as laminate or parquet lasts a long time, is easy to maintain, and makes the home more comfortable.

Beyond major renovations, it's important to consider the nuances that create a feeling of well-maintained, high-quality space. Reliable plumbing, thoughtful lighting, updated surfaces, and neat details enhance occupant comfort, reduce wear and tear, and enhance property value. This approach to modernization encompasses not only appearance but also practical solutions that make the apartment more comfortable and durable.

Examples of investment districts: in central districts—for example, Innere Stadt (1st arrondissement) and Leopoldstadt (2nd arrondissement)—well-renovated apartments quickly find tenants and command high rents, but the purchase price is significantly higher. More affordable options with good returns are found in Favoriten (10th arrondissement), Meidling (12th arrondissement), and Simmering (11th arrondissement). In these districts, apartment renovations significantly increase tenant interest and help ensure a stable income.

Selecting the target audience

When planning your rental, it's important to understand who your tenants will be, as this will impact how you manage your property and your income level.

Students often change housing frequently, so a more flexible approach is needed. They value furnished apartments with reliable internet access, ready to move in immediately without any renovations. Districts with a high number of universities, such as Alsergrund (9th arrondissement) and Döbling (19th arrondissement), are particularly popular with this demographic.

Families are typically long-term residents and value stability. They seek spacious apartments, a quiet environment, and convenient access to schools, kindergartens, and parks. Neighborhoods with good infrastructure and plenty of green space, such as Hietzing (13th arrondissement) and Währing (18th arrondissement), are well-suited for families. Expats and international professionals are generally willing to pay above-average prices if the housing meets high standards, is conveniently located, and has good public transportation links close to their workplace.

They most often prefer the central districts of Innere Stadt, Landstraße (3rd district) and Leopoldstadt, where convenient transportation is combined with modern residential buildings.

Older renters typically lead a quiet lifestyle and take good care of their homes. When choosing an apartment, they especially value a convenient layout, easy accessibility, and the absence of long stairs. More open-plan neighborhoods like Döbling , Hietzing , and Liesing (23rd arrondissement) offer comfortable living conditions for this group.

Clearly defining the target group enables intelligent planning of improvements and the development of a suitable rental model. As a result, the property better meets tenant expectations and generates more sustainable profits over time.

Practical recommendations for tenants

Renting or searching for housing in Vienna can often be challenging, especially for first-time buyers. Choosing a location wisely, understanding listings, managing costs, and understanding your rights can help you avoid unnecessary expenses, save time, and live more comfortably. Below are practical tips to help you navigate the market and make informed decisions.

How to choose a neighborhood according to your needs

Choosing a neighborhood to rent out a home in Vienna plays a crucial role when renting: it determines the convenience of living, daily expenses, and how easy it is to get to work, school, shops, and public transportation.

For students and young professionals, housing located near universities and convenient transportation is especially important. Neighborhoods like Alsergrund (9th arrondissement) and Leopoldstadt (2nd arrondissement) are highly sought after by students due to their proximity to universities and well-developed infrastructure, including cafes, gyms, and libraries.

Families are advised to consider neighborhoods with good schools, kindergartens, and parks for walks. Hietzing (13th arrondissement), Währing (18th arrondissement), and Döbling (19th arrondissement) offer a quiet atmosphere, more open-plan development, and a high level of safety.

For expats and professionals, convenient transportation and well-developed infrastructure are key. Innere Stadt (1st district), Landstraße (3rd district), and Leopoldstadt districts offer easy commutes, international schools, and convenient shopping.

For older renters, easy access, no stairs, an elevator, and a quiet environment are especially important. Neighborhoods such as Döbling , Hietzing , and Liesing (23rd arrondissement) are well-suited.

How to read an ad: what's important

When choosing a place to live in Vienna, it's important to carefully read the information in listings. Misunderstanding the terms and costs involved can lead to unnecessary expenses or an apartment that doesn't meet your needs.

The first thing to pay attention to is the Betriebskosten, or operating costs. These are mandatory monthly payments for the upkeep of the building, including cleaning, garbage collection, building maintenance, and insurance. They are usually paid separately from the base rent, and their amounts can vary significantly. Failure to account for these costs can result in the final cost of the property being much higher than expected.

The second important factor is heating costs (Heizkosten). The difference between old and new buildings is particularly noticeable here. Older buildings (Altbau) often have outdated heating systems that retain heat poorly, leading to very high winter bills. Newer buildings ( Neubau ) have better insulated walls and windows, and more modern and efficient heating systems. When planning your budget, it's important to consider not only rent but also the increased winter heating costs.

The condition of the apartment also plays a significant role. Apartments in older buildings (Altbau) typically feature high ceilings, large windows, and interesting architecture, but often require renovations and additional repair costs. Newer buildings ( Neubau ), on the other hand, offer modern amenities, good finishes, and energy-efficient solutions, but rent is usually more expensive. Understanding the differences between these housing types helps you more accurately estimate future expenses and comfort levels.

Cost-cutting tips

Reducing rent costs requires a thoughtful approach. One of the most popular ways to pay less is through shared housing (WG). When rent and utilities are split between multiple tenants, individual costs are significantly reduced, making them especially convenient for students and young professionals.

Vienna has government support programs, such as Wohnbeihilfe, designed for people with low incomes. The amount of assistance depends on income level, family composition, and housing costs and can cover part of the rent, reducing the overall financial burden.

Renting through an agency typically involves a provisioning fee, which can amount to up to two months' rent. You can reduce costs by searching directly with the owner, which is especially advantageous in popular areas of the city.

Timing is equally important. Apartments in popular areas rent very quickly, so it's best to start searching 1-2 months before moving. Planning ahead gives you more choice and helps avoid inflated prices.

These steps not only reduce costs but also make the rental process more understandable and convenient.

Tenant rights and where to apply

Tenants in Vienna are protected by law, and understanding your rights helps avoid disputes and improper actions by the landlord. Key rights include:

- the right to transparent calculation and correct accrual of utility bills, including Betriebskosten;

- the landlord's responsibility to maintain the apartment in a habitable condition and carry out necessary repairs;

- the ability to challenge illegal rent increases;

- protection from unjustified or arbitrary eviction.

If problems arise, tenants can seek advice and support from the Mietervereinigung (tenants' association) and city services, such as Stadt Wien – Wohnservice. These services provide explanations and support in German, help resolve conflicts, verify the legality of contracts, and advocate for tenants.

"Working with landlords and tenants in Vienna, I emphasize: understanding tenant rights reduces risks. In Austria, rentals are strictly regulated, and landlord errors lead to conflicts and losses. I help establish proper management—from the contract to transparent expense accounting—to ensure a smooth rental process."

— Ksenia , investment consultant,

Vienna Property Investment

Risks and Pitfalls of Investing in Rental Properties in Vienna

Investing in rental properties in Vienna is considered a safe bet, but it does come with certain risks. It's important to consider these in advance to minimize potential losses and maximize overall returns.

Risk of oversupply Neubau There are areas of Vienna where the volume of new construction has been excessive. This is increasing competition in the rental market and could negatively impact property yields. This is particularly true in Favoriten , Simmering , and Floridsdorf , where a significant number of new apartments have been built in recent years.

To properly assess the market and plan investments, it's worth regularly monitoring its dynamics through specialized portals, such as immosuchmaschine.at. This helps select areas where supply and demand are more balanced.

Regulatory risk. In Austria, rental relationships are strictly regulated by law. Restrictions on rent levels in older buildings (Altbau) and stricter regulations for short-term rentals, such as through Airbnb, may reduce investment returns.

It's important for owners to regularly monitor changes in legislation through sources such as ehl.at and the Vienna City Council (Stadt Wien) to adjust their rental strategy promptly.

Risk of vacancy. Long periods without tenants often arise from mispositioning a property or underestimating seasonality. For example, student housing often remains vacant during the summer months, and apartments aimed at expats may lose demand due to changes in corporate programs.

Proper property positioning, marketing, and precise targeting can reduce downtime and maintain a stable income level.

Financial risks. Investment returns are directly impacted by the economic situation, rental demand, and mortgage rates. Rising interest rates increase landlord expenses, while declining demand necessitates flexible measures—for example, adjusting rent or renovating the apartment to retain tenants.

| Risk | Consequences | Methods of minimization |

|---|---|---|

| Overproduction Neubau | Lower profits, high competition | Market analysis, selection of areas with stable demand |

| Regulatory | Rent restrictions, ban on short-term rentals | Legislation monitoring, legal advice |

| Simple | Revenue decline due to seasonal fluctuations or incorrect targeting | Marketing, choosing the right target segment |

| Financial | Increased expenses, decreased income during an economic downturn | Reserve fund, flexible pricing policy, housing modernization |

Forecasts and recommendations for 3–5 years

When investing in rental property in Vienna, it's important to consider not only the current situation but also the market's medium-term development. Over the next three to five years, demand for housing is expected to grow gradually, with growth rates varying depending on location, property type, and demographic changes.

The development of the transportation network and the volume of new construction have a significant impact on the market's prospects For example, the expansion of the U1 metro line and the emergence of new residential projects in Favoriten and Simmering are increasing the attractiveness of these areas and supporting demand. At the same time, active construction Neubau is increasing competition among property owners, which is important to consider when assessing future profitability.

In prestigious neighborhoods like Döbling and Hietzing , the situation is different. The number of properties here is limited, and interest in long-term rentals from families and expats remains stable. The high purchase price is usually offset by the low risk of vacancy and the ability to maintain rental rates without sudden fluctuations.

Interest from expats and young professionals is concentrated in the Leopoldstadt and Landstraße , particularly near the new office and business clusters. At the same time, Floridsdorf and Liesing are becoming increasingly popular among middle-income families seeking spacious apartments and good infrastructure, even though they are located further from the city center.

Vienna's apartment rental districts are roughly divided into three types based on rental prospects: developing areas with good infrastructure offer moderate but unstable yield growth; prime locations ensure stable demand; and remote or typical neighborhoods show modest growth but offer opportunities for profitability through major renovations and resale.

| District | Demand forecast | Main drivers | Potential risks |

|---|---|---|---|

| Favoriten, Simmering | Height | U1 development, new residential complexes | Overproduction Neubau |

| Döbling, Hietzing | Steady growth | Premium segment, families, expats | High purchase cost |

| Leopoldstadt, Landstraße | Moderate growth | Expats, new business centers | Competition with Neubau |

| Floridsdorf, Liesing | Short stature | Family housing, affordability | Long occupancy time |

Investment strategies

The right investment strategy depends on the type of property you're buying and who you plan to rent it to. Three proven approaches are most often effective in the Viennese market.

The "value add" strategy involves purchasing a property in need of improvement and then performing high-quality renovations. It's particularly effective in mid-priced neighborhoods like Favoriten and Simmering , where upgrades can increase rents and reduce vacancy rates.

This could include work such as installing new windows, upgrading the heating system, or updating the kitchen and bathroom, making the apartment more attractive to tenants.

The "buy and hold" strategy involves purchasing a property for long-term rental, typically to families or expats. Prime neighborhoods like Döbling and Hietzing are ideal for this model: demand is stable, apartments are occupied, and high rents are maintained for years.

This could include work such as installing new windows, upgrading the heating system, or updating the kitchen and bathroom, making the apartment more attractive to tenants.

The "short-term flip" strategy involves short-term rentals, often through Airbnb. Central districts like Innere Stadt and Leopoldstadt offer high tourist revenue but carry significant risks: seasonality, strict regulations, and the need for active management.

| Strategy | Districts | Income potential | Risks | Key measures |

|---|---|---|---|---|

| Value add | Favoriten, Simmering | Medium-high | Overproduction Neubau, downtime | Repair, modernization, marketing |

| Buy & hold | Döbling, Hietzing | Stable | High purchase cost | Long-term tenants, premium segment |

| Short-term flip | Innere Stadt, Leopoldstadt | High | Regulatory restrictions, seasonality | Short-term contracts, licenses, management |

Practical steps for the investor

Successfully purchasing a rental property requires systematic preparation. The first step is analyzing the location: accessibility of transportation, the presence of schools and shops, and development plans all impact long-term demand. The second step is studying the competition: this will help set an appropriate rental price and estimate the potential for future income growth.

A technical inspection helps determine whether investments in renovations, energy efficiency, and compliance with modern requirements are necessary. A legal review confirms the property's legal title and the absence of rental restrictions. A financial analysis includes calculations of CAPEX, taxes, and operating expenses, as well as a profitability forecast, to assess the feasibility of the investment.

An investor first needs to determine a strategy: long-term rental, renovation and resale, or short-term rental. Then, budget for repairs and unexpected expenses. Engaging professionals, such as a management company, realtor, and tax consultant, will significantly reduce risks at all stages.

Brief conclusion: which areas are best for which strategy

The choice of area for renting out an apartment in Vienna directly depends on the chosen investment strategy, the target audience of tenants, and the type of property.

In the mass-market segment with active development ( Neubau ) and unstable demand, districts like Favoriten and Simmering . Here, a "value-add" strategy, including renovations and modernization, helps increase rental income and reduce the risk of apartment vacancy.

These locations attract investors willing to finance housing upgrades and cater to demand from students, young professionals, and families seeking affordable housing.

Döbling and Hietzing are ideal for long-term rentals for families and premium tenants . Limited supply and stable demand make the buy-and-hold strategy extremely secure: although yields may be lower here than in the mass market segment, the risk of abandonment is virtually nonexistent, and the property maintains its liquidity under any market conditions.

For short-term rentals and tourist-oriented businesses, it's best to choose central districts, such as Innere Stadt and Leopoldstadt . The "short-term flip" strategy here can generate high income, but is subject to seasonal slowdowns and strict Airbnb rental rules.

| District | Strategy type | Target audience | Income potential | Risks |

|---|---|---|---|---|

| Favoriten, Simmering | Value Add | Students, young professionals, families | Medium-high | Neubauoverproduction, seasonal fluctuations |

| Döbling, Hietzing | Buy & Hold | Families, expats | Stable | High purchase price, limited supply |

| Innere Stadt, Leopoldstadt | Short-Term Flip | Tourists, expats | High | Regulatory restrictions, seasonality, management |

Therefore, it is important for investors to define their strategy in advance, understand which tenants they are targeting, and what kind of return they are looking for in order to choose the right area and a suitable investment property.

A step-by-step checklist for a landlord/investor

| Checklist item | Description / What to look for |

|---|---|

| 1. Analysis of the area and infrastructure | Transport accessibility, the presence of schools, shops, parks, and business centers directly impact demand and rental rates. |

| 2. Assessment of demand and competition | The number of comparable properties, the pace of construction Neubau and the current level of rental rates in the area. |

| 3. Technical condition of the object | Altbau or Neubau, need for repairs, level of energy efficiency and condition of communications (heating, water supply, electricity). |

| 4. Legal verification | Checking the ownership rights, the presence of encumbrances, restrictions on leasing and the compliance of documents with legal requirements. |

| 5. Financial assessment | Calculation of CAPEX (repairs and modernization), Betriebskosten, taxes; forecast of gross yield and net yield. |

| 6. Defining a rental strategy | Selecting the appropriate strategy: value add, buy & hold, short-term flip or cohabitation (WG). |

| 7. Preparing a lease agreement | Checking the contract for compliance with the law, the correctness of the terms, as well as the amount and procedure for making a deposit (Kaution). |

| 8. Financial cushion and reserve | Reserves for repairs, coverage of downtime periods, tax liabilities and possible unforeseen expenses. |

| 9. Organization of facility management | Decide between managing the property yourself or hiring a property manager to select tenants, oversee repairs, and handle utility issues. |

| 10. Market monitoring and strategy adjustment | Continuous monitoring of prices, demand, new regulatory requirements, and seasonal fluctuations, followed by timely adjustments to the rental strategy. |

Conclusion

"Vienna is one of the few European cities where rents hold up even during the crisis. But only professional solutions yield results: a neighborhood analysis, net yield calculations, and a pre-transaction management plan. Treat real estate as an asset—and an apartment in Vienna will generate a stable income for years."

— Ksenia , investment consultant,

Vienna Property Investment

Vienna real estate is one of the most stable ways to preserve and grow wealth in Europe. The city offers high rental demand, limited new construction, and predictable rules of the game. By choosing the right neighborhood, calculating the right yield, and developing a strategy (from value-add to buy & hold), you can achieve a stable cash flow and hedge against inflation. Your success depends directly on your preparation: the more thorough your analysis, the higher your returns and the lower your risks.