Buying Property in Europe with Cryptocurrency: A Complete Guide

Until recently, paying for real estate with cryptocurrency seemed like a futuristic idea. From 2017 to 2019, such transactions were considered rare, and notaries in Europe refused to record payments in Bitcoin, Ethereum, or stablecoins. But by 2025, everything had changed: digital assets had become commonplace, many sellers were willing to accept crypto, and some European countries had developed special mechanisms for formalizing crypto transactions.

Investors, startups, Web3 players, and owners of large digital assets are increasingly looking to buy real estate in Europe with cryptocurrency—whether it's a seaside apartment in Spain, a villa in Portugal, a city apartment in Berlin, or an investment property in the Czech Republic.

However, such transactions require strict compliance with legislation: AML/KYC, verification of sources of funds, tax planning, as well as the correct choice of country.

This comprehensive guide explains how buying real estate with cryptocurrency works in 2025, which European countries are ready for such transactions, what to expect from new EU laws, and what to look out for when paying with BTC, ETH, USDT, or USDC.

How do transactions take place?

Purchasing real estate with cryptocurrency in Europe isn't like buying an apartment for Bitcoin, but a complex legal process involving a notary, an escrow account, and compliance checks.

Three cryptocurrency payment models

| Model | How it works | Where is it used? |

|---|---|---|

| 1. Direct payment in crypto to the seller | The buyer transfers BTC/ETH/USDT, the lawyer fixes the price | Portugal, Malta |

| 2. Cryptocurrency → licensed conversion → euro | Through a payment provider, with a report for the notary | Germany, Spain, Austria |

| 3. Via a crypto payment service with a fixed exchange rate | The platform fixes the exchange rate and sends fiat to the notary. | Czech Republic, Poland, Spain |

A notary in Europe is required to record the transaction value in euros, even if the actual payment is made in cryptocurrency. This requirement stems from the fact that land registries in all European countries work exclusively with fiat currency, and the property value must be reflected in the national currency.

Before signing the agreement, the origin of the cryptocurrency undergoes a detailed check in accordance with AML regulations: a notary or designated compliance specialist analyzes asset movement reports on exchanges, the history of transfers between wallets, and documents confirming the source of funds.

These reports became a mandatory part of any transaction after the 2024-2025 updates, and without them no notary in the EU is allowed to register the transfer of ownership.

The buyer also undergoes a KYC (Know Your Customer) process, during which they provide a passport, proof of address, and information about their business activities. Several European countries have additional requirements: for example, in Germany, Austria, and the Czech Republic, cryptocurrency must be converted to fiat currency before the transaction is registered to ensure transaction transparency and create a verifiable banking trail.

European countries where you can actually buy real estate with cryptocurrency

This year, cryptocurrency real estate transactions have become more common. It's already clear in which countries such purchases are quick and legal, and where crypto is used merely as a supplementary tool.

Increasingly, real estate purchased with cryptocurrency is being viewed not only as an investment but also as a way to obtain temporary residence, permanent residency, or citizenship in Europe through existing investment programs. For your convenience, here's a breakdown of the most active options.

"There are countries in Europe where purchasing real estate with cryptocurrency has become a real and legal practice. If you want to understand where such transactions are easiest and what properties are available, I'll tell you."

— Ksenia , investment consultant,

Vienna Property Investment

Spain

Spain has become one of the flagship countries of the European crypto real estate market. Resort regions have long been active with foreign buyers, so the transition to payments in BTC, ETH, and USDT occurred more quickly than in other countries.

Where is crypto most commonly accepted?

- Marbella

- Malaga

- Alicante

- Torrevieja

- Barcelona

- Madrid

These are areas where the market has already adapted to the needs of crypto investors, and agencies have learned to work with digital assets at a fully legal level.

In these cities, you can find realtors who don't simply accept cryptocurrency "by agreement," but actually have a well-established infrastructure: collaboration with notaries who know how to record crypto payments in contracts; partnerships with licensed crypto-processing companies; clear AML/KYC procedures; and, most importantly, experience in completed transactions.

How does the purchase process work?

Spain uses a hybrid model: cryptocurrency is transferred through a licensed provider, converted into euros, and deposited into a notary account. This is convenient for the seller—they receive fiat currency. It's convenient for the buyer—the exchange rate is fixed in advance, and the provider issues a full AML report.

-

Example of a transaction

A Dubai investor bought a villa in Marbella for €1.2 million, paying in ETH.

The transaction was completed within five business days—the cryptocurrency was automatically converted into euros via processing, and the notary received the necessary AML reports.

Why Spain is a convenient destination for crypto buyers

- high demand for tourist rentals - yields above the EU average;

- sellers are accustomed to working with foreign capital;

- many properties qualify for Golden Visa → €500,000 after conversion;

- Notaries already know how to formalize such transactions correctly.

Portugal

Portugal has long been considered a crypto-friendly country, especially after the surge in interest in Lisbon as a European Web3 hub.

Here, cryptocurrency is perceived not as a risk, but as a modern means of payment. Therefore, transactions involving digital assets are processed faster than in any other EU country.

Why Portugal is the leader

Portugal has become a leading European hub for crypto transactions thanks to a combination of lenient regulations and a genuine market readiness for digital assets. Local tax regulations remain among the most favorable in the EU: long-term cryptocurrency holdings are virtually tax-free, making the country attractive to investors looking to pay with USDT or Bitcoin without incurring additional losses.

Portugal's real estate, whether for investment or personal residence, is traditionally considered one of the most profitable in Europe. The Algarve, Lisbon, and Porto offer two strong points: stable rental yields for investors and a high level of comfort for those planning to relocate to the country. The market is growing dynamically, infrastructure is being modernized, and demand from foreigners remains stable even during economic fluctuations in the EU.

Notaries in Portugal have become accustomed to cryptocurrency reports and treat them as naturally as bank statements, making the process of verifying the origin of funds quicker and easier than in Germany or Austria. Many developers, particularly in Lisbon and the Algarve, officially accept stablecoins, fixing the exchange rate through crypto-processing platforms, allowing for transactions to be completed in just a few days.

Thanks to this, Portugal has become the first country in Europe where purchasing real estate with cryptocurrency feels not like an exception, but rather like a fully-fledged, proven practice.

How do transactions take place?

Unlike Spain, Portugal often doesn't require cryptocurrency to be converted into euros. The buyer can pay for the property in BTC or USDT, and the notary will record the price at the time of the transaction.

-

Example of a transaction

An apartment in the Algarve was purchased for €200,000, paid in USDT. The seller received fiat, the buyer received a digital exchange agreement, and a notary confirmed the property's value at the official exchange rate at the time of payment.

Malta

Malta remains one of the most crypto-friendly countries in Europe. It was the first to create a separate legal zone for crypto companies, so the local real estate market has naturally adapted to digital asset transactions.

Why is Malta called the Blockchain Island?

"Blockchain Island" status was no accident. It was one of the first countries in Europe to recognize that the future of financial infrastructure lay in digital assets and decided to create an officially regulated environment for them. Not only did it allow crypto exchanges and blockchain companies to operate, but the government developed a separate set of laws that govern the work of providers, digital asset custodians, cryptocurrency payment services, and even the procedures for tokenized transactions.

Thanks to this, cryptocurrency transactions have become part of a transparent financial system rather than a gray area. What causes legal debate in other countries has long been defined by law in Malta: which crypto companies must obtain licenses, how a notary must record the value of an asset, what documents confirm the origin of funds, and what reports must be submitted to government agencies after a transaction.

-

Example of a transaction

A German investor purchased an apartment in Sliema for €480,000, paying the entire amount in USDT through a licensed cryptocurrency processor, which immediately converted the funds into euros for the notary. The transaction took just four days, as all crypto reports and confirmations were accepted without additional checks.

This is why Malta's real estate market was one of the first in Europe to embrace cryptocurrency. Here, digital assets aren't perceived as a risk or a passing fad—legislation provides clear rules of the game, and businesses freely embrace cryptocurrency, knowing that legal liability is clearly defined.

Market Features

In Malta, real estate is often sold through agencies that have long worked with cryptocurrency and have dozens of successful transactions under their belt. Sellers aren't surprised when buyers offer to pay in BTC or ETH—they view it as natural as a bank transfer.

The market is particularly active in Sliema, Valletta, and St. Julian's, where many IT companies are located, so crypto has become an almost standard instrument.

How does the purchase process work?

In Malta, purchasing real estate with cryptocurrency is based on three officially recognized schemes, each of which is completely legal. The specific option chosen depends on the seller's requirements, the buyer's preferences, and the recommendations of the lawyer handling the transaction.

| Scheme | What it looks like in practice |

|---|---|

| Direct payment in cryptocurrency | The buyer transfers BTC/ETH → the notary records the price in euros |

| Through cryptoprocessing | A licensed service accepts cryptocurrency, converts it into euros, and sends it to a notary. |

| Through bank conversion | Cryptocurrency is sold on the exchange → euros are transferred to a notary escrow account |

Despite the different transaction formats, all are treated equally by Maltese notaries—the main thing is that the buyer has a complete set of cryptocurrency reports. These documents serve as official proof of the origin of the funds and are included in the notary file, just like bank statements for a regular purchase.

This is why Malta is considered one of the most convenient countries in Europe for those looking to purchase real estate with cryptocurrency: the legal framework is well-established, and all market participants know how to properly formalize such transactions.

Advice to the buyer

If the seller agrees to accept cryptocurrency directly, be sure to fix the exchange rate through a licensed processing platform, not through a simple verbal agreement. These services record the value of BTC, ETH, or USDT at the time of the transaction and generate an official report that the notary can include in the transaction documents.

This is important not only to protect the buyer, to avoid overpayments in the event of a sharp drop in the exchange rate, but also for the safety of the seller, who needs a legally confirmed equivalent amount in euros.

The use of cryptoprocessing transforms crypto payments into a fully-fledged financial instrument, protected from market fluctuations, technical delays in the blockchain, or potential disputes over the exchange rate at which the transaction was carried out.

Taxes

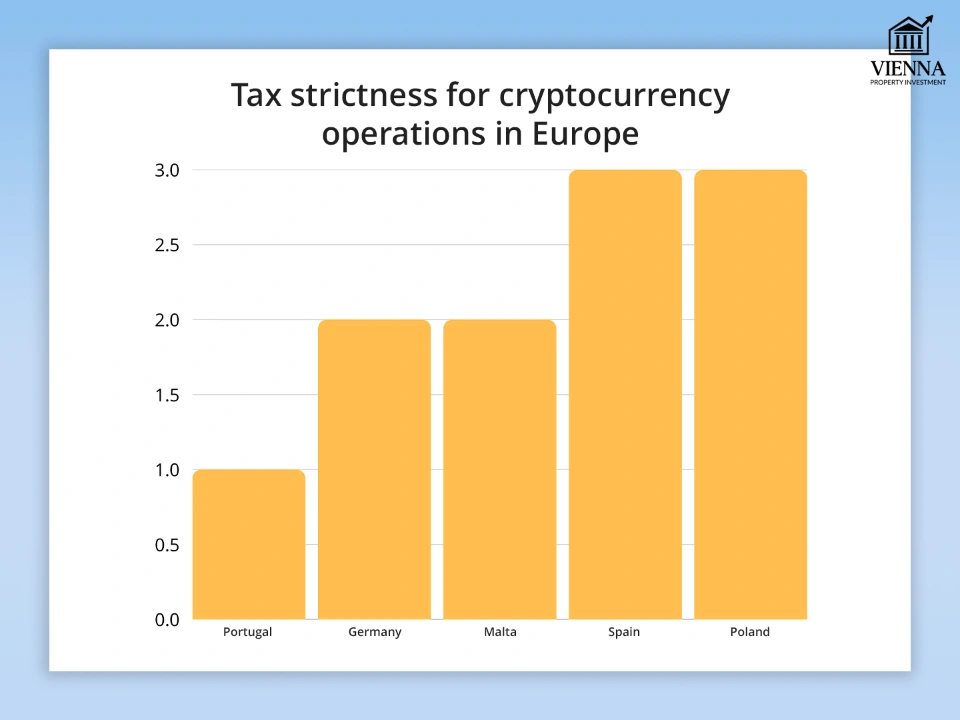

Tax burden is one of the key factors to consider when purchasing real estate in Europe with cryptocurrency. It's important to understand that each country views crypto differently: some treat it as an asset, others as a foreign currency, and in some jurisdictions, transactions with it are tax-free altogether.

In most European countries, converting cryptocurrency to euros is considered a taxable event. This means that if you've held crypto for a long time and its value has increased, tax authorities may require capital gains tax. For example, in Germany, the rate depends on how long the asset has been held, while in Portugal, long-term holding still falls under a lenient regime.

Tax authorities pay particular attention to large transactions. Real estate always attracts heightened interest from regulators, which is why it's important for buyers to prepare documents in advance: transaction history, exchange reports, proof of cryptocurrency purchase and its origin. Using cryptocurrency processing with automatic conversion to euros simplifies transaction transparency and reduces the likelihood of additional audits.

Table: How the EU taxes crypto

| Country | Tax on crypto withdrawals | What does this mean in practice? |

|---|---|---|

| Portugal | soft regime | For long-term storage, the tax is often zero, making the country attractive to large crypto holders. |

| Spain | There is | Any sale of cryptocurrency is considered income, and the rate must be fixed on the day of the transaction—even if it's a payment for real estate. |

| Germany | depends on the term | If you hold crypto for more than a year, the tax rate is 0%; if you hold it for less, the rates are significantly higher. |

| Malta | flexible system | Taxes depend on status and type of income; many private transactions are not taxed at all. |

| Poland | There is | A fixed rate on any crypto profit is a simple, but not the most profitable, option. |

What is important to understand

In Europe, tax authorities treat cryptocurrency not as money, but as an asset. Therefore, the moment it is sold or exchanged for euros is automatically recorded as potential profit. This means that even if the buyer purchased real estate directly in USDT or BTC, they must still provide reports showing the price at which the cryptocurrency was purchased.

For example, an investor who purchased Bitcoin at €20,000 and spent it at €35,000 would have to explain the difference as profit – and that profit would be taxed according to the rules of the particular country.

Portugal is the least strict: long-term investors often avoid taxes altogether. Germany is the most straightforward: if you want 0%, hold crypto for more than a year. Spain and Poland require tax on all profits, regardless of the term. Malta is the most flexible option, especially for non-residents.

MiCA 2025 and new EU regulations

MiCA is a key EU regulation that has changed the rules of the game for all crypto investors. With its key provisions coming into force in 2024–2025, real estate transactions have become much more transparent and secure.

What has changed for buyers?

MiCA standardized the approach to verifying the origin of funds: now all EU countries have a unified AML analysis methodology for cryptocurrency. Notaries no longer interpret crypto reports differently—everyone uses the same verification format. This has significantly reduced transaction times and reduced the risk of rejections.

Another important change is the emergence of officially licensed cryptocurrency payment providers in the EU. These companies can act as a bridge between cryptocurrency and the banking system, ensuring transaction security at every stage.

For buyers, this means that crypto has become a completely legitimate tool for purchasing real estate, rather than a "gray area" that causes problems for notaries or banks.

The main risks of cryptocurrency transactions

Although crypto has become much more regulated, trading in Europe still carries certain risks. However, most of these are easily avoided with proper preparation.

Volatility

BTC and ETH prices can fluctuate dramatically within a few hours. To avoid losses, you should lock in the exchange rate before making a trade using cryptocurrency processing.

Problems with proving the origin of funds

If the reports are incomplete or the transaction history is unclear, the notary may suspend the transaction. Many buyers underestimate this point, although it is critically important.

Legal uncertainty in a number of countries

In some EU countries, cryptocurrency is not banned, but the procedure is not fully defined. Therefore, transactions require additional legal support.

Risk of funds being blocked by an exchange or bank

This happens if the platform deems the crypto withdrawal suspicious. A professional lawyer will check the platform in advance and advise on how to withdraw funds correctly.

-

Risk Reduction Advice

The most reliable strategy is to use only those crypto platforms that are EU-licensed and provide a full AML report. This reduces the likelihood of blocking to almost zero.

Working schemes of transactions

Over the past three years, crypto transactions in Europe have evolved from a novelty to a stable market practice. Numerous notary chambers, processing companies, and banks have developed algorithms for working with digital assets, so by 2025, three officially operating schemes —these are the ones used in real transactions and ensure legal protection for buyers.

Each scheme reflects the maturity of a specific market: the development of crypto infrastructure, the approach of notaries, bank requirements, and the level of trust in digital payments.

1. Cryptocurrency → Notary Processing → Euro

The most stable, secure, and legally sound model. This scheme has become the standard in most EU countries. It satisfies all parties involved: the buyer, the notary, the seller, and the bank.

How processing works:

- The buyer sends cryptocurrency (BTC, ETH, USDT, USDC) to the wallet of a licensed operator.

- The operator fixes the rate at the moment the funds are received.

- Processing automatically converts crypto into euros.

- Euros are transferred to a notary escrow account.

Why this scheme is the most popular:

- fully complies with AML5, MiCA and banking control requirements;

- the notary receives fiat → legal risks are reduced;

- the seller does not face exchange rate volatility;

- The buyer receives an official report on the legal origin of the funds.

Where is it used most often?

This model has become the standard in countries where the notary system is highly formalized and the risks of volatility and AML violations are taken seriously. This is why Germany, Austria, and Spain have switched to a strict peg for crypto transactions to fiat.

| Country | Cause |

|---|---|

| Germany | Notaries require fiat; processing is mandatory |

| Austria | Strict AML rules, crypto is only allowed through licensed services |

| Spain | Sellers prefer the euro due to exchange rate risks |

2. Direct crypto payment to the seller

The fastest, but not always the most suitable, method. Direct payment with cryptocurrency is a format that has become especially popular in countries where the market has long been accustomed to working with digital assets.

This is not an experiment or a risky strategy – it is a working, proven model used by both private sellers and agencies.

What it looks like in reality

The buyer simply transfers cryptocurrency to the seller's wallet—no banks, no intermediaries, no lengthy checks.

The notary records the transaction value in euros (for example, “€325,000”), even if the entire transaction was made in USDT or BTC.

The seller then acts at his own discretion:

- converts crypto immediately;

- holds it as an investment;

- distributes between several wallets;

- transfers management to a stock or OTC operator.

This suits sellers, as many of them already work with digital assets and see them as a way to diversify their capital.

There are no bank fees, no 2-3-day wait for an international transfer, and no intermediary processing is required. In terms of speed, this is the fastest way to purchase real estate in Europe.

The advantages are particularly noticeable in countries where the approach to crypto remains conservative. For example, in France, real estate purchasing is structured differently, and it's here that foreign investors make the most mistakes. French notaries almost always require prior conversion of cryptocurrency to euros, detailed proof of the origin of the funds, and full compliance with banking regulations.

Therefore, those planning transactions in France are advised to gather reports from stock exchanges, prepare tax documents, and select a lawyer familiar with local practices in advance—otherwise, the transaction could drag on for months.

It's precisely this contrast that makes direct crypto payments even more advantageous: the buyer completely bypasses bank compliance, doesn't have to explain the origin of the funds multiple times, as is the case in Germany, Austria, or France, and the transaction itself is much faster.

3. Sell crypto in advance → bank transfer → standard transaction

When cryptocurrency "disappears from the picture," and the transaction proceeds as usual. This format is favored in European countries where cryptocurrencies are not yet integrated into legal practice.

Notaries may not understand the mechanics of cryptocurrency transactions, banks may require additional verification, and legislation may not provide clear regulations. Therefore, buyers prefer to withdraw cryptocurrency in advance to ensure the transaction is as predictable as possible.

How does the transaction work in practice?

In fact, the cryptocurrency is not included in the documents—it is converted into euros even before the purchase is processed.

The diagram looks like this:

- The buyer sells the cryptocurrency on an exchange —most often Binance, Kraken, or Bitstamp—where detailed AML reports are available.

- The exchange transfers the euros to the buyer's bank account. This is usually a SEPA transfer, which takes anywhere from a few hours to one or two days.

- The buyer sends euros to the notary, and the transaction then proceeds as a standard purchase transaction.

For the notary and the land registry, such a purchase is no different from a regular one. There's no mention of crypto in the contract, no fixed exchange rate, no digital assets—just a standard bank payment.

Why do buyers choose this scheme?

It creates a sense of complete legal transparency:

- the notary sees a regular bank transfer and calmly processes the documents;

- the seller does not need to understand crypto;

- Government agencies conduct a standard review of the transaction without any additional questions.

This scheme is especially popular among those who do not want to explain the origin of their cryptocurrency to a notary or who fear that their transaction will be denied registration.

"Buying real estate with cryptocurrency today isn't a risk, but a smart strategy. If you need help analyzing a property, calculating taxes, or choosing a country, I'll be with you every step of the way."

— Ksenia , investment consultant,

Vienna Property Investment

Step-by-step purchase scenario

The process of purchasing real estate with crypto in the EU is almost always the same, even if the rules vary from country to country. It's important to understand the general logic: first, you prepare the necessary documents, then choose the property and payment method, and only then proceed to the notary transaction.

1. Decide which country you want to buy in and what your taxes are

The first thing you need to decide is your tax residency and how that country treats cryptocurrency income. Sometimes it's more advantageous to remain a resident of Portugal or Malta and buy property there. Sometimes it's the other way around: first deduct your income in Germany (where cryptocurrency is not taxed after one year of ownership) and then buy property.

This helps to avoid problems with the tax authorities a year or two after the transaction.

2. Prepare documents in advance

Any real estate transaction involving cryptocurrency requires transparency. Therefore, it's important to gather the following information in advance:

- history of transactions from the exchange,

- wallet reports,

- A short explanation of the origins of the crypt.

If you try to gather everything at the last minute, the notary or bank will simply postpone the transaction. Savvy buyers always prepare their documentation package in advance.

3. Find a lawyer or agency that has done crypto transactions before

This is one of the most important steps. A specialist who has conducted such transactions at least a few times already knows:

- Which notaries are best to choose?

- What wording is needed in the contract?

- What reports are suitable for a bank or registrar?

Using an agency without experience in crypto transactions almost guarantees delays and confusion.

4. Select a payment plan

There are currently three common options in Europe:

- Cryptocurrency via processing → euro → notary.

The safest and most official option. - Direct cryptocurrency payments to the merchant.

This works in countries like Portugal and Malta, where notaries are already accustomed to crypto. - Selling crypto in advance → payment in euros.

A classic setup for countries where crypto is unpopular or poorly understood.

The choice determines what documents are needed, who and how fixes the exchange rate, and how long the transaction will take.

5. Book the property and sign the preliminary agreement

After selecting a property, a reservation document is signed, which sets out the price and terms of the transaction. In cryptocurrency transactions, it's especially important to immediately specify how payment will be processed and when the property is considered paid for.

It's also important to determine in advance who bears the risk of exchange rate changes—without this, the amount could change the very next day, and the parties will be faced with misunderstandings.

6. A lawyer checks the property

In parallel, a legal audit of the property is carried out:

- who is the owner,

- are there any debts or arrests?

- Is the property mortgaged for a loan?

- whether there are any controversial or unregistered transactions in the past.

This stage is the same in all countries – crypto has nothing to do with it yet.

7. Preparation for payment

If payment is made through processing, an account is opened, verification is carried out, and a test transfer is made.

If payment is made directly, the seller's wallet is agreed upon, the exchange rate and payment confirmation procedure are fixed.

8. The day of the transaction at the notary's office

On the day of signing the transaction, everything happens quite simply, but the procedure is always strictly followed. The notary begins by reviewing the parties' documents and the terms of the contract, after which he officially records the property's value in euros—even if payment is made in cryptocurrency.

Next, they wait for payment confirmation: this could be a bank notification from the crypto processor or a screenshot of the successful transaction if the parties are using direct crypto payments with a pre-agreed exchange rate. Once the notary receives confirmation, they sign the purchase and sale agreement and submit the documents to the land registry to register the new owner.

In countries accustomed to crypto transactions, the entire process is very fast—sometimes a single visit and a couple of hours are sufficient. In more restrictive jurisdictions, a notary may conduct the registration in stages: first, verification and signatures, then payment confirmation and filing with the registry within one or two days.

9. Property registration

After payment, the notary sends the data to the registry.

It's very important to understand that the land registry does not indicate that you paid with cryptocurrency.

There will only be:

- price in euros,

- your details as a buyer,

- seller's details,

- information about the notary.

The cryptocurrency exists only in the form of reports that remain in the notary's archive. To the state, this appears to be a normal transaction.

New Directions 2025: Where Europe is heading next

While Portugal, Spain, Malta, and Turkey hold the lead, new jurisdictions gradually becoming crypto-friendly emerged in 2025. These are countries where crypto payments are not yet legally mandated, but are already becoming part of real-world transactions—through agencies, processors, or direct agreements.

Countries Seeking Growth in Cryptocurrency Transactions

| Country | Why does interest arise? | What the market says |

|---|---|---|

| Greece | a huge flow of investors, an attractive island market | Agents are increasingly processing payments through USDT processing. |

| Cyprus | A strong IT ecosystem, with many residents with crypto-income | Lawyers have begun using hybrid payment models. |

| Slovenia | one of the most crypto-friendly economies in the EU | The first transactions through licensed providers have already been completed |

| Croatia | growing tourism market, investment in the coast | Crypto payments are allowed with notarized euro registration |

| Italy (north) | Buyers from Switzerland and Germany pay through processing | individual regions are more lenient than the law as a whole |

These countries aren't yet promoting crypto deals as actively as Malta or Portugal, but the market is already changing from the ground up, through the practices of agencies and clients.

What objects are most often purchased?

A clear trend has long been evident in crypto transactions: different types of real estate attract different categories of crypto investors. This year, the market has already established its "favorite" segments—those that are easier to purchase with digital assets, easier to rent out, and more profitable to hold long-term.

1. Condos and apartments by the sea

Beachfront condos are the absolute top crypto purchase.

The reason is simple: such properties are suitable for both personal recreation and rental, and sellers in tourist regions have long been accustomed to cryptocurrency.

Where people buy most often:

Portugal (Algarve), Spain (Costa del Sol, Costa Blanca), Turkey (Antalya), Montenegro (Budva, Kotor), Cyprus (Limassol).

Why them:

- a stable flow of tourists → high daily rental income;

- clear liquidity - such apartments are easy to resell;

- sellers and developers on the coast are more flexible than in large capitals;

- Cryptoprocessing is already built into transactions.

Many crypto buyers don't plan to live in these properties at all—they use the property as a "quiet cash flow" and a way to diversify their capital.

In 2025, the Algarve and Budva saw particularly high numbers of transactions, with up to 60% of buyers paying for apartments in USDT or BTC.

2. New buildings from developers

Developers are the most technologically advanced category of sellers.

They were the first to officially implement crypto payments, often through licensed European processors.

Geography:

Portugal, Spain, Malta, Turkey, Cyprus, and the UAE (if the buyer is an EU resident).

Why new buildings are convenient for crypto transactions:

- Developers have their own lawyers who already work with crypto;

- Payment can be made in stages of construction (this is especially convenient in crypto);

- the rate can be fixed in advance, which reduces volatility;

- The legal structure is clear: from booking to handing over the keys.

In Malta and Portugal, developers already officially advertise USDT payments in their brochures, listing the cryptocurrency alongside the euro. This has become standard, not something out of the ordinary.

3. City apartments in tourist capitals

Cryptocurrency buyers are also actively entering traditional urban markets. This is especially noticeable in capital cities and major tourist destinations, where demand always outstrips supply.

Here, people buy not for the thrill of it, but for long-term capital growth—which is why investors simultaneously analyze neighboring markets, look at the most expensive apartments in Austria , compare regional trends, and decide where to invest profitably over a 5-10-year horizon.

-

Cities where people buy most often:

Prague, Lisbon, Barcelona, Athens, Berlin, Warsaw.

These properties are chosen by investors who want to invest not in short-term rentals, but in long-term growth in value.

Reasons:

- large cities are always liquid;

- constant rise in prices - even during recession years;

- rent brings a stable income all year round;

- It is easier for foreign investors to service the property through management companies.

In 2025, Lisbon became the number one city for crypto transactions in the EU: approximately 15% of all purchases from non-residents are processed through crypto processing.

Homeowners who made their capital in the Web3 sector have been particularly active in crypto transactions—for them, crypto has become a natural form of payment.

"City apartments in tourist capitals offer convenience, dynamism, and high demand. If you need recommendations on neighborhoods or choosing a reliable property, I'm here to help."

— Ksenia , investment consultant,

Vienna Property Investment

4. Premium villas

In the luxury real estate segment, cryptocurrency is used even more often than in the budget segment.

This is because owners of large villas are often crypto investors themselves or have raised capital on Web3 markets.

Where to buy villas with cryptocurrency:

- Spain - Marbella, Malaga, Costa del Sol;

- Italy - Liguria, Tuscany, Sardinia;

- France - Cote d'Azur, Nice, Cannes;

- Malta - Dingli, Mdina, Sliema;

- Cyprus - Paphos, Limassol.

Elite sellers typically:

- have already worked with crypto buyers;

- ready to fix the rate through OTC platforms;

- accept large amounts of BTC, ETH or USDT without discussion.

One of the common schemes is partial payment in crypto and partial in fiat.

For example, a villa worth €2.5 million can be paid for:

- €1.8 million through crypto processing,

- 700,000 € by bank transfer.

This way, the seller reduces risks, and the buyer flexibly uses different sources of capital.

Conclusion

Purchasing real estate with cryptocurrency in Europe in 2025 has ceased to be an experiment and has become a clear, structured instrument. What required lawyers to improvise just a couple of years ago is now based on clear MiCA regulations, the experience of notaries, and established cryptocurrency processing schemes.

Crypto has become a natural part of the market: apartments by the ocean are paid for in USDT, new buildings accept payment through licensed platforms, and luxury villas in Marbella or Limassol are often purchased entirely in BTC. European banks have stopped panicking at the sight of large transfers, and notaries have received instructions on how to fix the exchange rate and verify the origin of funds.

But despite their apparent simplicity, crypto transactions remain legally sensitive. There's no room for haste: proper document preparation, accurate exchange rate fixing, choosing the right payment method, and, most importantly, working with lawyers and agencies who understand the inner workings of a crypto transaction are essential. Mistakes can be costly—sometimes hundreds of thousands of euros.

If you follow the rules, buying real estate in Europe with cryptocurrency is no more difficult than paying a regular fee. Moreover, choosing the right country and property allows investors to:

- optimize taxes;

- preserve capital in a predictable jurisdiction;

- get a liquid asset without converting all your crypto into fiat;

- diversify your portfolio and protect yourself from market volatility.

The European market has already adapted to crypto buyers, and this trend will only intensify. More and more agencies are introducing crypto departments, developers are creating their own processing solutions, and countries like Portugal, Malta, and Montenegro are becoming full-fledged hubs for crypto investors.

For those willing to work transparently, prepare documents in advance, and select professional support, crypto opens up a new reality: real estate can be purchased quickly, conveniently, and without unnecessary barriers.