Buying an apartment for cash in Europe: features, risks, and benefits

European real estate has traditionally been considered a reliable way to preserve and grow capital. In recent years, interest has been growing in the option of purchasing an apartment in Europe with cash—without a mortgage or bank involvement. This strategy is particularly attractive to investors who value speed of transaction, minimal bureaucracy, and the ability to negotiate favorably with the seller.

However, simply having the funds doesn't always guarantee a smooth purchase. Even with sufficient cash, the buyer will need to consider local laws, anti-money laundering (AML/KYC) regulations, registration requirements, and, in some countries, special permits for real estate purchases, especially for foreigners. Cash can significantly simplify the transaction, but it doesn't eliminate the necessary bureaucratic processes.

It's important to remember that the EU will soon introduce new restrictions on cash payments: starting in the summer of 2027, the limit will be €10,000. However, "cash" in the context of real estate purchases doesn't refer to physical money, but rather, typically, a bank transfer from the buyer's account to the seller's. These nuances demonstrate that cash isn't so much cash in hand as a tool for a secure and transparent transaction, requiring proper goal setting and legal preparation.

"Want to buy real estate in Europe without the hassle? Cash is fast, transparent, and cost-effective. I'll show you verified properties and help you through the entire process without stress or unexpected complications!"

— Ksenia , investment consultant,

Vienna Property Investment

Is it possible to buy an apartment with cash in Europe?

Yes, buying an apartment with cash in Europe is possible, but it's not always as simple as it seems. The law doesn't prohibit such transactions, but the conditions can vary greatly depending on the country. In Austria, for example, cash simplifies the process from the standpoint of potential bank loan refusal, but it doesn't eliminate the need to go through legal and administrative procedures.

The role of the notary and banks

Even if you pay in cash, the money usually goes through an escrow account with a notary or bank. This step ensures the transaction is secure and transparent for both parties. In practice, this means there's no point in bringing a suitcase full of cash—all payments are processed via bank transfer.

Personally, I always recommend thoroughly vetting the notary you choose. A reliable notary not only ensures the secure transfer of funds but also helps structure the transaction correctly to minimize the risk of permission being denied or funds being frozen.

What to look for:

- Licenses and reputation. The notary must be officially registered and have positive client reviews. The bank or financial intermediary must be licensed to handle large cross-border transfers and have experience working with foreign investors.

- Transparency of procedures. All transactions must be documented: statements, agreements, and transfer confirmations. A notary verifies the transaction's compliance with the law, verifies the legal origin of funds, and ensures AML/KYC compliance.

- Experience working with foreign clients. This is especially important if the buyer is not an EU resident. The notary's and bank's experience in such transactions minimizes the risk of refusal or delays. In Austria, Germany, and Switzerland, notaries often assist with transactions for non-residents, verifying all documents and properly setting up an escrow account.

The main question is the origin of the funds

The most important aspect when buying an apartment with cash in Europe is confirming the legality of the source of funds. Banks and notaries typically require documentation proving the source of the funds: this could be the sale of a business, real estate, accumulated income, or funds transferred through official bank accounts.

For example, one of my clients wanted to buy an apartment in Vienna in cash. The sum was substantial, but thanks to a properly prepared set of documents detailing the source of the capital and a trusted notary, the transaction went smoothly.

My experience shows that those who present prepared documents and a transparent transfer scheme pass verification faster and often receive better terms when purchasing for cash, including the possibility of small discounts from the seller.

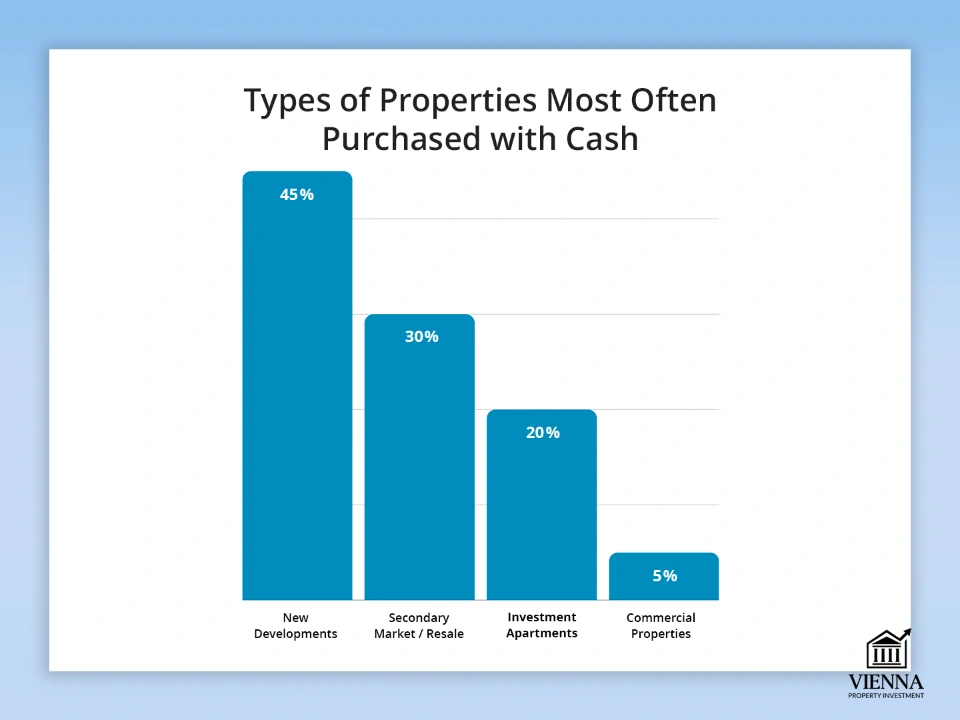

Restrictions and requirements by country

Purchasing an apartment with cash in Europe requires careful consideration, even if it's formally permitted. The main restrictions relate to:

- Anti-Money Laundering/Know Your Customer (AML/KYC) checks. Banks and notaries are required to verify that funds were obtained legally. Preparing a complete set of documents confirming the source of funds is key to a smooth transaction.

- Purchase permits for foreigners. This issue is particularly strictly regulated in Austria, Switzerland, and some German states. Even if you have cash, you still need to obtain permits or notify local authorities.

- Cash limits. In most countries, all large transactions are conducted via bank transfer; physical cash payments are not possible.

- Company registration requirements. In some countries, purchasing real estate through a company (for example, a GmbH in Austria) simplifies the process for foreigners, but adds obligations to comply with ownership and tax laws.

| Country | AML/KYC | Permits for foreigners | Cash limit | Company registration for non-residents |

|---|---|---|---|---|

| Austria | Necessarily | Often required, especially for non-residents in the states of Carinthia and Tyrol; Vienna is easier | All payments are made through bank/escrow | GmbH is possible, simplifies the process |

| Germany | Necessarily | Required for some states (depending on local federal laws) | Usually bank transfer | It can be accelerated through the company |

| Switzerland | Necessarily | Strict checks for non-residents | Bank transfer, physical cash is rare | Company registration is possible |

| Spain | Necessarily | A permit is not required for most buyers, but there is an income test | Bank transfer | Rarely used, but possible |

| France | Necessarily | Permission is usually not required | Bank transfer, cash limits | Usually not required |

| Italy | Necessarily | Permission is not required for non-residents | Bank transfer | Possible for investment schemes |

How does a transaction work when paying in cash?

Even when buying with cash, the real estate acquisition process requires strict adherence to legal and financial procedures. Having cash expedites the transaction and gives you an advantage over buyers with a mortgage, but without a notary and proper paperwork, it's impossible to complete.

Selecting an object

- Determine the type of property and region of purchase.

- Recommendation: research restrictions for foreigners, specifics of land laws, and the liquidity of the property.

Due diligence

- Checking property rights, debts, encumbrances and history of the property.

- It is important to make sure that the seller actually owns the property and that there are no hidden risks.

Preliminary agreement

- The parties enter into a booking agreement or preliminary contract.

- Often accompanied by a deposit, which also goes through an escrow account.

Escrow account with a notary or bank

- Even when paying in cash, the money is transferred to a temporary account with the notary or bank, ensuring the security of the transaction.

- Example: A client in Vienna paid €850,000 via escrow, and the money was only credited to the seller after all documents had been successfully verified.

Verification of the origin of funds (AML/KYC)

- A notary or bank verifies the legality of the source of funds: business, sale of assets, income, deposits, or cryptocurrency through legal channels.

- Prepare documents proving the origin of your funds in advance – this will speed up the entire process and reduce the risk of blocking.

Payment

- After all checks and signing of the final documents, the money is debited from the temporary account and credited to the seller's account.

- All settlements are carried out without physical cash handling.

Registration of property rights

- The notary registers the transaction in the land register, and the buyer becomes the official owner.

"Invest smart: cash = fast transaction speed, discounts, and priority over mortgage buyers. I'll help you choose the best property in Austria!"

— Ksenia , investment consultant,

Vienna Property Investment

Benefits of buying with cash

Buying property in Europe with cash has several clear advantages that make it particularly attractive to investors and private buyers.

1. Quick deal

- Eliminating the need for credit approval or mortgage inspection allows you to complete your purchase much faster.

- Example: A deal in Vienna, where the buyer paid the full price of the apartment in cash, was closed in 4 weeks instead of the typical 8-12 weeks with a mortgage.

2. Possibility of a discount

- Sellers value buyers willing to pay upfront. This often results in a discount of 2-7% off the original price.

- Recommendation: during negotiations, use the fact of cash payment as an argument for reducing the price.

3. Minimizing dependence on banks

- There is no need to wait for the bank's decision on the loan or pay interest.

- For large transactions, this saves significant amounts of money and reduces bureaucracy.

4. Advantage over buyers with a mortgage

- In competitive environments, such as auctions or when purchasing popular properties, sellers often choose cash buyers because it ensures a fast and secure process.

5. Austria: Vienna and popular tourist destinations are especially advantageous

- In Austria, buying with cash gives an advantage in Vienna, Salzburg and popular tourist destinations where competition for properties is high.

- Example: A buyer obtained a property in the center of Vienna at a slight discount because he could close the deal in two weeks, while other participants with a mortgage were waiting for bank approval.

Why "cash" when buying real estate isn't physical bills

Many people think that buying with cash means they can simply bring cash in a suitcase and buy an apartment in Europe. In practice, this is impossible: large transactions always go through official channels.

When purchasing real estate, funds are transferred using a secure and transparent scheme:

- Bank transfer is the primary payment method; funds are transferred from the buyer's account to the notary's or seller's account.

- Escrow account with a notary – funds are blocked until all checks are completed and documents are signed.

- AML/KYC verification – confirmation of the legal origin of capital (sale of business, real estate, official income, deposits).

In Europe, large-value transactions are strictly regulated to prevent money laundering and ensure transparency of financial flows:

- The EU Anti-Money Laundering Directive (AMLD 6) obliges banks, notaries and other financial institutions to check the origin of large amounts of money and report suspicious transactions.

- Cash payment limits are in place in a number of EU countries: for example, France, Italy, and Spain limit payments over €10,000 (with gradual tightening by 2027).

- Monitoring financial flows protects both parties to a transaction – the buyer and the seller – from the risk of funds being blocked, fines, or fraud.

In Austria and most EU countries, such schemes are mandatory for all major real estate transactions.

The main barrier for foreigners is not money

When buying real estate with cash in Europe, people often think the main challenge is finding the necessary funds. In practice, the biggest challenge for foreigners is legal restrictions and obtaining purchase permits, especially in strictly regulated countries like Germany and Austria.

EU citizens – the process is simple

- Citizens of European Union countries face fewer bureaucratic obstacles.

- In most EU countries, they can buy property almost as freely as local residents.

Non-EU residents – land restrictions

For foreign buyers, the main difficulty is not money, but legal restrictions in certain regions.

- Austria: Non-EU residents face particular difficulties purchasing property in the states of Carinthia and Tyrol, where restrictions on foreigners purchasing property in Austria and approval from the local Erwerbskommission may be required. In Vienna, purchasing is possible, but also requires notification to local authorities and proof of the legal origin of the funds.

- Germany: Some states, such as Bavaria, impose restrictions on foreign buyers purchasing properties in tourist or historically significant areas.

- Switzerland: Foreigners are prohibited from purchasing property in resort and protected areas without government permission.

- Spain: Most regions have no strict restrictions, but some municipalities, particularly on the Costa Brava or Costa del Sol, may require permission from local authorities.

- France and Italy: Generally easier, but purchases in “highly sensitive” or historic areas may also require approval from local authorities.

Before purchasing, it's important to check the requirements for foreigners in a particular state or municipality. In some cases, transacting through a registered company can simplify the process and expedite approval.

Legal schemes for proving the origin of money

Confirming the legality of your capital source is one of the key steps when purchasing real estate with cash in Europe. Without proper documentation, the transaction may be delayed or even blocked.

The main methods of confirming funds:

- Sale of a business or real estate. If the funds were received from the sale of an existing business or other real estate, you must provide transaction documents: a purchase agreement, bank statements, and proof of receipt of funds.

- Deposit programs. Funds in deposits or savings accounts are confirmed by bank statements. Ensure that the bank can issue official confirmation of the origin of the funds that complies with AML/KYC requirements.

- Official income. Income from the past several years (salary, dividends, royalties) can also serve as proof of legal capital. Tax returns, payroll statements, or income statements must be provided.

- Cryptocurrency → bank → escrow → transaction. If funds were received in cryptocurrency, they must be legalized through an official bank transfer to the buyer's account, and then through an escrow account held by a notary or bank. Direct crypto → real estate exchanges are prohibited and are not accepted by banks. Use legitimate exchange platforms and document all transactions to ensure they comply with AML/KYC requirements.

Risks for foreign buyers

Buying property with cash in Europe seems straightforward, but there are specific risks for foreign buyers that are important to be aware of in advance.

Denial of purchase permission

- In some countries and regions (e.g. Austria: Carinthia, Tyrol; Switzerland: resort areas) foreigners may be denied permission to purchase real estate, even if the funds are completely legal.

- Check the requirements for your specific region and gather all documents confirming your source of capital in advance.

Long checks

- AML/KYC procedures can take several weeks or months.

- Example: A buyer from outside the EU waited almost 2 months for approval in Vienna, despite paying in cash, due to the need to verify all transactions and the origin of the funds.

Blocking funds in case of AML violation

- If a notary or bank has doubts about the legality of the funds, the money may be frozen in the account or escrow until an investigation is carried out.

- Use official bank transfers and pre-prepared documents.

Incorrect transaction structure

- Purchasing through an inappropriate legal form (such as an unregistered company) may result in denial of permission or additional tax liabilities.

- Consult with a notary and lawyer in advance, especially if the purchase will be made through a company or in highly regulated regions.

Use transparent fund transfer schemes through escrow and official banking channels. Document preparation and proper transaction structure reduce all of these risks and expedite property registration.

Commissions and expenses

When buying a home with cash in Europe, it's important to consider all associated costs in advance to properly budget. Key expenses include:

- Notary – ensures the legality of the transaction, registration of property rights and control over the escrow account.

- Broker – services for finding a property, negotiations and transaction support.

- Purchase tax ( Grunderwerbsteuer / Transfer Tax / Imposta di registro) – varies by country and region, usually calculated as a percentage of the property’s value.

- Bank transfer - a fee for international transfers, especially for large amounts.

- Escrow is a fee charged by a notary or bank for maintaining a temporary account for the secure transfer of funds.

| Country | Notary | Broker | Purchase tax | Bank transfer | Escrow account |

|---|---|---|---|---|---|

| Austria | 1-3 % | 3-5 % | 3,5-6 % | €50-200 | 0,5-1 % |

| Germany | 1-1,5 % | 3-6 % | 3,5-6,5 % | €30-150 | 0,5-1 % |

| Switzerland | 0,5-1 % | 2-4 % | 1-3,3 % | CHF 50-200 | 0,5-1 % |

| Spain | 0,5-1 % | 3-5 % | 8-10 % | €30-100 | 0,5-1 % |

| France | 0,7-1,5 % | 3-6 % | 5-6 % | €30-100 | 0,5-1 % |

| Italy | 0,5-1 % | 2-5 % | 7-10 % | €30-100 | 0,5-1 % |

Purchasing real estate through a company: schemes and nuances

Purchasing an apartment in cash through a company is a popular strategy among foreign investors in Europe. This arrangement can simplify certain procedures and provide additional capital protection, but it requires careful adherence to laws and regulations.

Possible schemes:

- GmbH (Austria) – a local limited liability company. It allows foreigners to simplify the transaction process, especially in states with restrictions on non-residents.

- Foreign companies – registration through a company outside the country of purchase (e.g., Estonian OÜ, Cyprus Ltd, Malta Ltd). In some cases, this simplifies the transaction structure and tax planning.

Advantages:

- Simplification of procedures – especially in countries with strict requirements for foreigners (Austria, Switzerland, Germany).

- Capital protection – limited liability and the ability to segregate assets.

- Flexibility in property management – leasing, transferring rights, or subsequent sale through a legal entity is easier to arrange than through an individual.

Be sure to follow the beneficial owner disclosure rules to avoid transaction blocking or penalties.

Buying with cash and cryptocurrency

Using cryptocurrency to purchase real estate is becoming increasingly popular, but it's important to understand that directly exchanging tokens for real estate is not possible. Any cryptocurrency transactions require legalization through official financial channels.

Purchase scheme:

- Crypto → bank / non-bank. Cryptocurrency must first be transferred to an account that can be recognized as an official source of funds. This could be a bank account or a licensed exchange platform that provides documentary proof of the transfer.

- Bank / Non-Bank → Escrow. Funds are then transferred to the notary's or bank's escrow account, which ensures the transaction is secure and all legal procedures are followed.

- Escrow → transaction. After verifying the origin of funds and all documents, the money is transferred to the seller, and the title is registered in the land registry.

Important points:

Direct exchange of USDT or other cryptocurrency for real estate is prohibited.

- All transactions must be transparent and documented to pass AML/KYC checks.

- Using an escrow account protects the buyer and seller from the risk of funds being frozen.

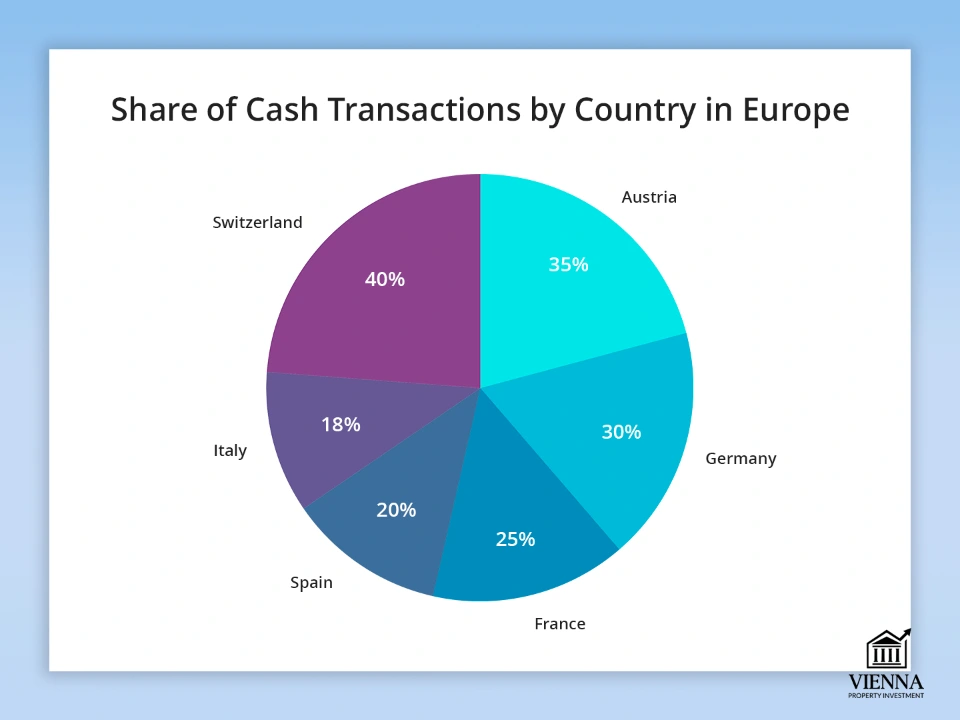

Types of properties most often purchased with cash

Having sufficient funds allows investors to quickly respond to market changes, selecting the most attractive properties. These can range from new apartments to commercial properties that require quick transaction completion.

Main types of objects:

- New developments. Buying directly from the developer allows you to receive a discount and choose the best options. This is especially true for large cities and tourist areas.

- Secondary market. Buying for cash often speeds up the transaction and makes the offer more attractive to the seller. This can be a huge advantage in a competitive market with multiple buyers.

- Investment apartments. Properties purchased for rental or resale. Cash payments simplify auction participation and speed up the closing process compared to mortgage buyers.

- Commercial properties. Shops, offices, warehouses. Cash purchases in Europe are often required for high-valued properties or in markets with limited financing.

| Object type | Share of cash purchases | Example countries/regions | Features and tips |

|---|---|---|---|

| New buildings | 40-50 % | Austria (Vienna, Salzburg), Germany (Berlin) | Discounts are available, and you can choose the best floors and layouts |

| Secondary market | 30-35 % | France (Paris), Spain (Barcelona) | Faster closing process, advantage over mortgage buyers |

| Investment apartments | 15-25 % | Austria, Germany, Spain | Participation in auctions, rental income, high liquidity |

| Commercial properties | 5-10 % | Switzerland, Germany, Austria | Transparency of the source of funds is required, often at a high price |

When paying in cash is really beneficial

Paying for a property upfront, without a loan, opens the door to a more profitable deal and a quick closing, especially in highly competitive European markets such as Austria, Germany or Switzerland.

- Discount of 2-7%. Sellers value prompt buyers willing to pay the full price upfront. For example, buying an apartment in Vienna with cash often allows for a discount of 3-5% of the property price.

- Faster processing and less bureaucracy. No need to wait for loan or mortgage approval. The verification and registration process is faster, especially if all documents regarding the source of capital are prepared.

- Winning at auctions. At auctions, those who can close the deal immediately gain an advantage. Sellers often choose cash buyers, as this guarantees a successful bidding. In Austria, this is especially true in large cities such as Vienna or Salzburg, where quick payment and a transparent transaction make buyers more competitive.

"Europe is waiting for enterprising investors! Buying an apartment with cash minimizes bureaucratic processes and increases real income. Find out how to do it right!"

— Ksenia , investment consultant,

Vienna Property Investment

Increased cash controls in the EU: reasons and goals

In recent years, the European Union has seen a trend toward tightening controls over cash transactions. Starting in 2026-2027, restrictions on large cash payments are planned, including a €10,000 limit, to increase the transparency of financial flows.

The main reasons for the changes:

- Combating money laundering and terrorist financing. Banks and notaries are required to monitor large transfers and payments to prevent the illegal use of funds. The EU Anti-Money Laundering Directive (AMLD 6) requires all financial transactions to be transparent and documented.

- Control and security of financial flows. Restrictions on cash payments protect both sellers and buyers from fraud and the blocking of funds. All transactions are processed through official channels: bank transfer or escrow account, reducing risks for all market participants.

- Transparency and tax compliance. This new form of control allows states to monitor large transactions and minimize tax evasion. This is especially important for real estate transactions, where the amounts can reach millions of euros.

The restriction on the use of cash does not prohibit the purchase of real estate with physical cash—the funds must simply be processed through bank transfers and escrow accounts. For investors, this means they must prepare proof of the legal origin of their capital in advance and plan transparent transfer schemes.

What's changing from 2026: new rules for cash transactions

Starting in 2026, stricter requirements for cash payments and verification of the origin of funds will come into effect in EU countries. These changes apply to both EU citizens and non-residents and directly impact cash real estate purchases.

- Tightening AML/KYC regulations. Banks and notaries will be required to conduct more thorough verification of the legality of the source of funds. Any transactions involving large sums will require a full set of documents on the origin of funds.

- Lowering cash limits. From 2027, a single limit on cash payments will be introduced – €10,000 per transaction within the EU. This limit applies to all business transactions: between stores, developers, real estate sellers, and other professional participants. Direct exchange of large amounts of cash will no longer be possible.

- Stricter checks for non-residents. For foreigners, verifying the origin of funds and ensuring the transparency of the transfer process are critical. Any documentation error can lead to transaction delays or funds being blocked.

In practice, "cash purchases" are limited to transfers through escrow and official bank accounts. Planning the transaction in advance becomes essential to ensure all checks are successfully completed and the purchase is completed without delays.

Conclusion

Purchasing an apartment in Europe with cash is possible, but having the funds alone doesn't guarantee success. The key is to properly formalize the transaction, complete all necessary due diligence, select the appropriate country and property, and structure the purchase to comply with local laws and new EU regulations.

Only with this approach can purchasing real estate for cash become safe, fast, and profitable. A "cash purchase" is essentially conducted via a bank transfer or a notary escrow account, guaranteeing the legality and security of the transaction for both parties.

Proper document preparation, transparent fund transfers through banks and escrow accounts, and compliance with AML/KYC requirements help minimize risks and take advantage of all the benefits of a cash transaction, including faster processing, discounts, and an advantage in competitive markets compared to mortgage buyers.