Buying an apartment in Austria with cryptocurrency: is it possible and how does it work?

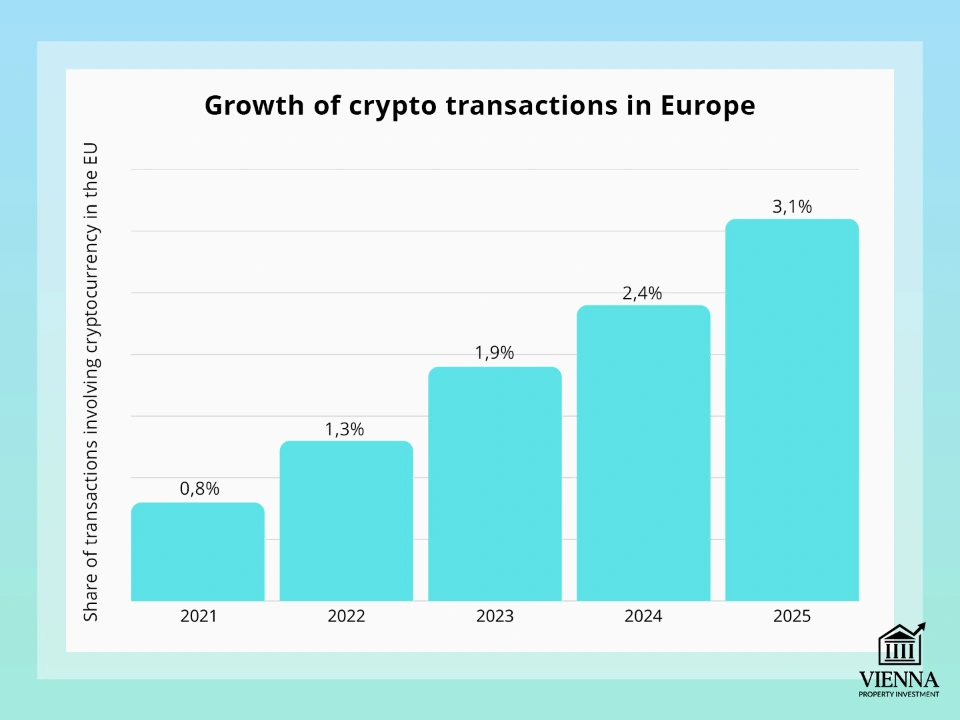

In Europe, more and more people are willing to buy real estate with cryptocurrency. According to Realty+, 3-5% of listings in major cities already allow payment in digital currencies. This demonstrates that cryptocurrency is gradually becoming part of the regular economy, and investors are increasingly willing to use it for large purchases like houses and apartments.

Austria is known in Europe for its strictest AML and KYC regulations. Any cryptocurrency transactions here require complete transparency: the source of the funds must be confirmed, and the transaction must involve a notary and a bank. As a real estate expert, I can say that this makes the Austrian market very safe, but also much more demanding in terms of paperwork.

It's possible to buy an apartment in Austria with cryptocurrency, but such transactions are not conducted directly. Typically, cryptocurrencies are first exchanged for euros through a licensed operator or through escrow accounts overseen by a notary. This ensures compliance with legal requirements and the secure use of digital assets in real estate transactions.

Do you have cryptocurrency and are planning to buy an apartment in Austria?

I'll help you prepare the transaction: choosing a property, AML requirements, escrow accounts, cryptocurrency conversion, and working with the notary and bank. I'll explain the steps in simple terms, highlight the risks, and help you comply with Austrian law."

— Ksenia , investment consultant,

Vienna Property Investment

Why can't you just trade cryptocurrency for real estate?

In Austria, cryptocurrency is considered a legal form of property, but strict rules apply when purchasing real estate. Notaries only accept payments in fiat currency, and transactions are conducted through trust or escrow accounts to ensure transparency and legality. Furthermore, banks are required to verify the origin of funds according to anti-money laundering (AML) regulations, so direct transfers of cryptocurrency are not permitted when purchasing an apartment.

As a result, direct payments in cryptocurrency are subject to strict restrictions and risks:

- It is not possible to buy an apartment directly with Bitcoin.

- You can't just send cryptocurrency to the seller's wallet.

Even if the seller agrees to accept cryptocurrency, Austrian laws and notary requirements effectively prevent such a transaction from being conducted directly. Payment must be made through verified payment methods, with funds transferred in euros and mandatory verification checks—only then will the purchase be legal and secure for both buyer and seller.

How does the transaction work in practice?

In practice, purchasing an apartment in Austria with cryptocurrency requires additional steps and compliance with legal and anti-money laundering regulations. Three main methods are commonly used:

Option A: Sell cryptocurrency → convert to fiat → buy

- Preparation of documents – the purchase and sale agreement is drawn up strictly in accordance with Austrian laws.

- Trust or intermediary - the cryptocurrency is first sold through a trusted platform or trust to lock in the price and verify the origin of the funds.

- Bank account - received euros are credited to the buyer's account or to an escrow account.

- Notarization - the final contract is signed by a notary, who only accepts payments in regular money.

It's best to choose an exchange platform in advance to lock in the exchange rate at the time of the transaction; otherwise, you could lose money due to fluctuations in the cryptocurrency price.

Option B: Purchase through a legal structure

- Foreign company / SPV / holding - the buyer creates a legal entity to purchase real estate.

- Payment in euros - cryptocurrency is exchanged for euros within the company.

- The transaction is formalized —the property is registered to the company, and the buyer receives ownership rights through a share or corporate documents.

Option C: Paying the intermediary with cryptocurrency

- An OTC desk or licensed exchanger —the buyer transfers the cryptocurrency to an intermediary, who officially exchanges it for euros.

- Why Binance P2P isn't suitable: P2P services don't provide notary support or full AML verification, so an Austrian notary won't accept such a transaction.

Use only licensed intermediaries, preferably those with experience in real estate transactions. This will help avoid account freezes and questions from banks and regulators.

When purchasing real estate in Austria, banks are responsible for the legality and transparency of the transaction. They conduct strict KYC and AML checks to confirm the funds are of legitimate origin.

What do banks check:

- The origin of the cryptocurrency and the legality of the assets, the history of the movement of funds through wallets and licensed exchanges, and AML/sanctions compliance.

- The movement of funds is a continuous, traceable, and documented chain of origin of this particular amount: from officially declared income (for example, dividends), its crediting to a bank account, and further until the moment of payment for the transaction.

- Buyer's identity - passport, proof of identity and address, notarized verification if necessary.

- Source of funds / source of wealth — documents confirming the legality of income, tax residency, and the absence of PEP and sanction risks.

The bank may request:

- Tax returns and financial statements.

- Statements from crypto exchanges and exchange services.

- Documents confirming place of residence (proof of address).

Main difficulties:

- Banks do not work with anonymous money—all transactions must be fully documented.

- The EU has strict restrictions on cash payments, so direct payments are not possible.

- Any attempt to exchange cryptocurrency without verification usually results in the bank refusing to process the payment.

Gather all documents confirming the origin of your funds and a complete transaction history in advance. Use only licensed exchanges and OTC platforms—this will significantly speed up transaction approval and reduce the risk of bank rejection.

Do I need a bank account in Austria?

In most Austrian real estate transactions, especially those paid for in cryptocurrency, approximately 95% of transactions are conducted through a notary escrow account. This standard practice ensures transparency, locks in the exchange rate, and protects both buyer and seller from potential risks.

Why can't I pay the seller directly?

Direct transfer of cryptocurrency to the seller's wallet is prohibited: the notary and bank are required to verify the source of funds and ensure the transaction complies with AML/KYC regulations. Direct payment bypasses these procedures, making it legally impossible to complete a transaction this way.

Is it possible to use a foreign bank?

Using a foreign bank account is possible, but there are important conditions: your foreign bank must be willing to conduct a full AML/KYC check on the origin of funds, and an Austrian notary must approve the use of this account for escrow. In practice, it's easier and faster to open an account with an Austrian bank or use a local notary escrow account. This will significantly reduce bureaucracy and reduce the risk of transaction refusal or delays.

Even if you plan to make payment through a foreign bank, discuss all the details of the transaction with the notary and your bank in advance. This will help avoid delays and unforeseen problems during the title process.

Fees and taxes when selling cryptocurrency

When purchasing an apartment in Austria with cryptocurrency, you need to consider in advance the taxes and fees that arise when exchanging it for fiat currency.

Key aspects:

- Capital Gains Tax — In Austria, income from the sale of cryptocurrency is taxed if it exceeds established limits or is not considered a long-term investment. The tax amount depends on how much the asset has appreciated in value and how long you've held it.

- Buyer's tax residency : Tax rates and obligations may differ depending on whether the buyer is a tax resident of Austria or another country. To avoid double taxation, it is best to consult a tax professional in advance.

- Risk management – when exchanging cryptocurrency for euros, exchange rate fluctuations, exchange platform and bank fees, and legal and tax risks are possible. These are important to factor into your calculations if you're considering purchasing Austrian real estate as an investment . It's important to consider all of this upfront to ensure the final purchase price is clear and predictable.

Before selling cryptocurrency to purchase real estate, it's best to consult with an accountant or tax advisor in advance to discuss the transaction details and consider all fees and tax liabilities. For a secure exchange, it's important to use only licensed exchanges or OTC platforms.

| Type of operation | Conditions | Tax rate | Notes |

|---|---|---|---|

| Sale of cryptocurrency by an individual | If the cryptocurrency is sold within 1 year of purchase | 27.5% (Kapitalertragsteuer, KEST) | Such income is considered speculative and is subject to taxation |

| Sale of cryptocurrency by an individual | Holding for more than 1 year | 0 % | If you hold an asset for a long period of time, the tax may not apply |

| Sale through a legal entity | Any period of ownership | Corporate tax 25% | The income received is included in the overall financial result of the company |

| Converting cryptocurrency to euros via an exchange/OTC | Any operation | Depends on the seller's status (individual or legal entity) | Exchange commissions are not a tax, but they reduce the amount of profit |

Follow-up checks

Since Austria participates in the Automatic Exchange of Financial Information (CRS), data transfer between countries occurs in both directions. This means that even after a transaction is successfully completed, tax and regulatory authorities in your home country or the country where the funds are being transferred may revisit the transaction later and request further clarification.

It is important to understand:

- Tax authorities may ask questions both at the time of the transaction and later.

- If the data is inconsistent or incomplete, additional confirmation of the legality of the funds may be required.

- Therefore, it is extremely important to keep a complete set of documents confirming the origin of the money, the history of the cryptocurrency, the exchange to euros, bank statements, and all payments.

We recommend storing:

- Tax returns

- Proof of receipt of income (e.g. dividends, sale of assets)

- Bank and crypto exchange statements

- Exchange and crediting documents

- Purchase and sale agreement and financial confirmations for the transaction

This will allow you to calmly answer any possible requests, even years later.

What tightening measures might be introduced in Austria and Vienna based on the experience of other countries?

Global practice shows that requirements for financial transaction transparency and verification of the origin of funds continue to strengthen. Based on the experience of other countries, it can be assumed that similar measures may eventually be introduced in Austria/Vienna. For example:

- Strengthening Source of Funds/Source of Wealth verification when selling real estate, as is already implemented in the UK and UAE—whereby confirmation of the source of funds may be required not only upon purchase but also upon exit.

- Additional financial monitoring and reporting, as in Dubai, where AML procedures and controls on large real estate transactions are being strengthened.

- Expanding control within the framework of European initiatives – a number of EU countries are already introducing stricter requirements for documentation, income verification, and transaction transparency.

It's also worth considering that in some countries, audits may be conducted not only at the time of a transaction but also later. Statutes of limitations for tax and financial investigations are often lengthy and can be extended if suspicions arise. Therefore, long-term retention of a complete set of documents on the origin of funds and all stages of the transaction remains a prudent practice.

What objects can be purchased?

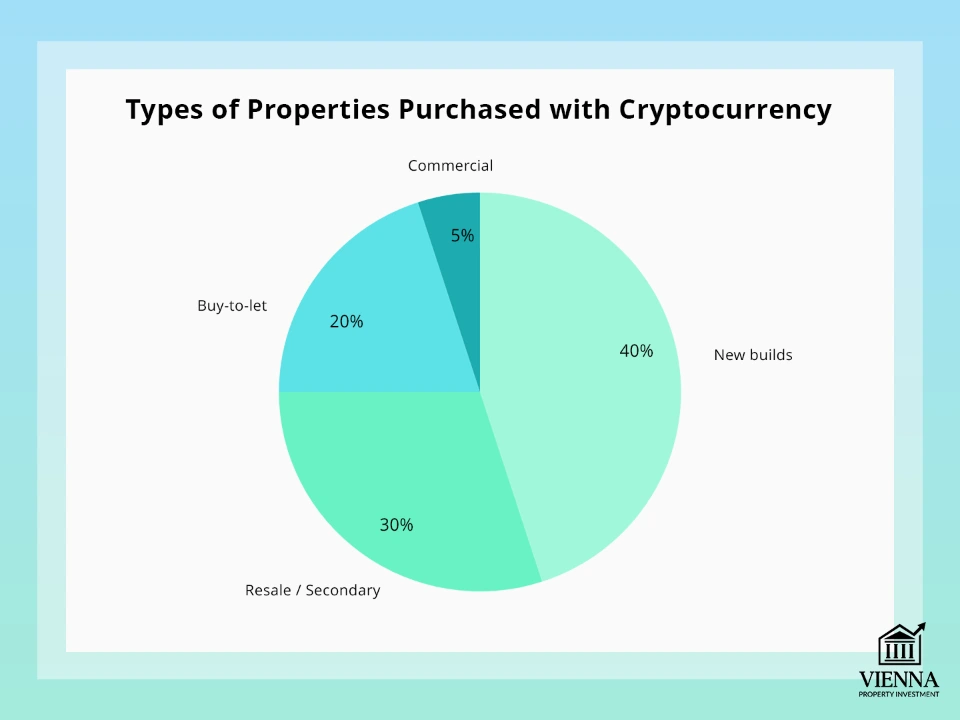

Purchasing real estate in Austria using cryptocurrency is possible for various types of properties, depending on the buyer's goals:

- The secondary market consists of apartments and houses that have already been occupied; they are often chosen for investment and short-term rentals.

- New developments – housing in projects under construction or recently completed; suitable for investors who anticipate price growth and modern housing standards.

- Buy-to-let — properties specifically designed for rental purposes; a popular option for those seeking regular rental income, both long-term and short-term.

- For living and relocating , consider apartments and houses for permanent residence in Austria; it's important to consider residence permit requirements and restrictions on real estate purchases by foreigners .

When choosing a property to purchase with cryptocurrency, it's important to agree on the payment method with the seller and notary in advance. This ensures that the transaction and its terms fully comply with Austrian law. In practice, resale properties are usually more easily processed through a standard escrow account, while new construction purchases may require separate approval from the developer, including fixing the cryptocurrency exchange rate.

Typical mistakes

Even experienced investors can encounter difficulties if they don't follow the rules for buying real estate in Austria. The most common mistakes include:

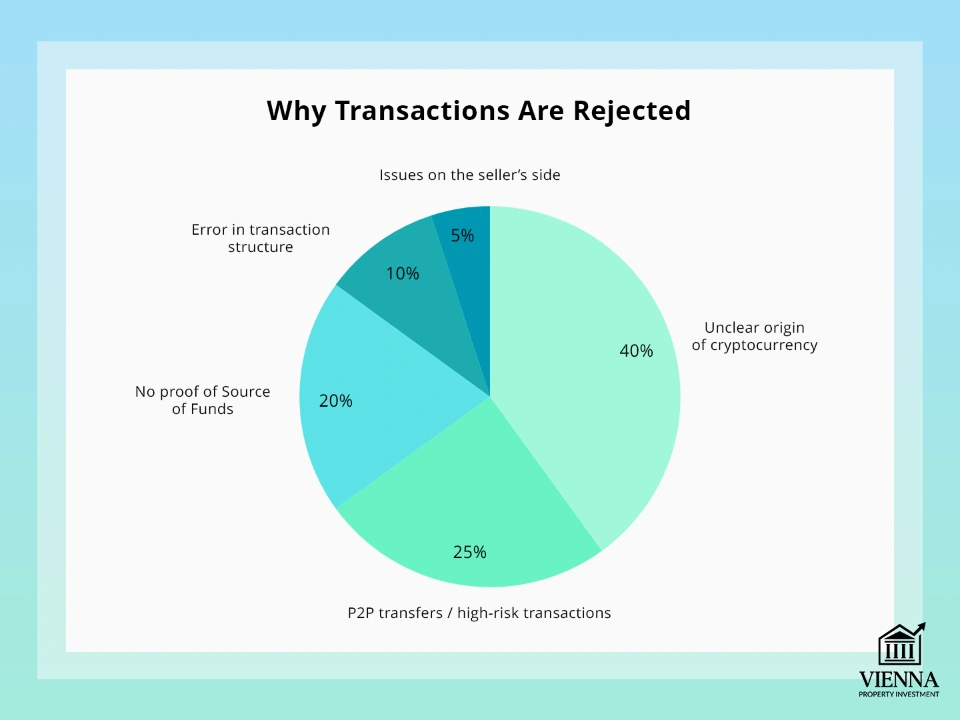

- Direct "bank-free" transactions —attempting to send cryptocurrency directly to a seller, without an escrow account or bank—typically results in notary refusal and the risk of the transaction being deemed illegal.

- Unverified origin of funds - If there are no documents showing where the cryptocurrency came from, the bank or notary may stop the payment.

- P2P platforms → high-risk transactions — transfers via P2P services (e.g., Binance P2P) do not provide notary control or AML verification, so such transactions are not accepted in Austria.

- Purchasing before opening an escrow account —transferring funds before setting up a trust or escrow account increases the risk of loss of funds and problems with property registration.

Always plan your purchase of an apartment in Austria with cryptocurrency in advance. Use only trusted and legal platforms for conversion. Be sure to open a secure notary account (escrow) before depositing funds and prepare a full set of documents confirming the origin of your digital assets. This will help avoid problems and significantly speed up the finalization of the transaction.

How to properly formalize a transaction

To buy an apartment in Austria with cryptocurrency legally and safely, it's important to follow a clear sequence of steps:

- Due diligence on a property includes checking the legal status of the property, the absence of encumbrances, and analyzing the market and contract terms.

- A notarized contract —a purchase and sale agreement—is prepared and signed by a notary; the notary ensures the transaction is legal and complies with anti-money laundering (AML) requirements.

- Escrow — an escrow account is opened with a notary or a reliable trust agent; funds are reserved until all terms of the transaction are met.

- Converting cryptocurrency to euros : digital assets are sold through a licensed exchange or OTC platform, after which euros are deposited into an escrow account.

- Payment confirmation – the notary verifies receipt of funds and confirms that the transaction is ready for registration.

- Registration of the transaction with the Landesgericht – at the final stage, ownership is officially transferred to the buyer, and the transaction is considered complete.

Follow this procedure strictly: never transfer funds directly to the seller, and always coordinate the cryptocurrency exchange procedure with a notary in advance. This will significantly reduce the risk of bank rejection and speed up the title deed process.

"Investing cryptocurrency in real estate in Vienna or Salzburg is a reality. I'll tell you how to properly conduct a transaction through escrow, what documents are required, and how to avoid common mistakes that cause banks to refuse approval."

— Ksenia , investment consultant,

Vienna Property Investment

Comparison with other countries

In Austria, the rules for real estate transactions involving cryptocurrency are very strict, particularly regarding AML/KYC and mandatory notary participation. Below is how this compares to other countries:

- Germany: Rules are similar to Austria's, but cryptocurrency transactions can sometimes be conducted through special bank accounts with less bureaucracy.

- Portugal: Known for its lenient tax regime for cryptocurrency held by individuals, transactions are often tax-efficient, and a notary escrow account is not always required.

- Cyprus: The approach to cryptocurrency is more flexible, sometimes allowing direct use of digital assets through intermediaries, but the level of legal protection for the buyer is lower.

- Dubai: Actively developing cryptocurrency transactions through dedicated platforms, with simplified exchange and registration procedures. However, foreign investors must strictly adhere to local regulations and licensing requirements.

In what ways is Austria stricter:

- All transactions are processed through a notary and an escrow account.

- The source of money is checked very carefully (source of funds / source of wealth).

- Bank accounts undergo full AML/KYC checks.

It is not possible to send cryptocurrency directly to the seller's wallet.

| District | Character | Average purchase prices (€ per m²) | Average rent (€ per m²/month) | For whom |

|---|---|---|---|---|

| Innere Stadt | Historic center, prestige, monuments | 9 000–12 000 | 17–19 | Foreigners who value status |

| Geidorf | Universities, students, youth | 5 500–6 000 | 15–17 | Investors for rent |

| Lend | Art quarter, cafe, creativity | 5 500–6 000 | 14–16 | Young professionals, tenants |

| Jakomini | The station area is vibrant | 4 800–5 500 | 15–16 | Families, young couples |

| Mariatrost | Calm and green | 4 000–4 500 | 12–14 | Pensioners, families |

| Puntigam | Industry + housing | 3 500–4 200 | 11–13 | Workers, accessible segment |

Is it possible to buy completely anonymously?

The short and straightforward answer: no, it's impossible to buy real estate in Austria completely anonymously. Austria strictly controls transactions to combat money laundering, and every real estate transaction is automatically verified by banks, notaries, and the court. All parties to the transaction are required to verify their identity, show the source of the funds, and prove the legitimacy of the payment.

However, there are legal ways to reduce the publicity of a transaction:

- Without disclosure of personal data - only the ultimate owner (person or company) is indicated in the land register, and the details of the transaction are not published.

- Purchasing through a company (SPV or Austrian GmbH) —the legal entity, not the private buyer, is entered into the register. However, the actual owner still undergoes a full KYC/AML check with the bank and notary.

Important: These schemes make the transaction less visible to the public, but they do not relieve you of the obligation to disclose your identity and source of funds to the state, bank, and notary. In Austria, there are no legal ways to completely conceal the real owner.

How can you verify the origin of cryptocurrency?

If you want to use cryptocurrency to purchase real estate (even if you exchange it for fiat currency before the transaction), the main requirement for banks, notaries, and other parties will be to prove that your funds are "clean" and obtained legally.

- Transaction history — downloads and reports from an exchange or wallet, showing when and which account or wallet purchased cryptocurrency, where the funds came from, and how they were transferred.

- Bank statements —especially if the cryptocurrency was purchased with fiat currency—confirm the transfer of euros or dollars to the exchange and the purchase of crypto.

- Exchange receipts — transaction confirmations, orders, trading history, and reports from the platform where the cryptocurrency was purchased.

- Wallet reports —for self-custody wallets (hardware wallet, self-hosted wallet)—show the wallet address, all fund movements, and confirm that the wallet belongs to you.

- Tax returns/income reports - if cryptocurrency income was declared, this confirms that the money was received and processed legally.

- Blockchain forensic reports/expert opinions (forensic blockchain reports) — in complex situations (large amounts or complex transaction histories), expert opinions may be required to analyze the transaction chain and confirm the legal origin of the funds.

Why these documents are important:

- From 2023–2024, stricter regulations (TFR and MiCA) will be in effect in the European Union. Crypto services are required to make transfers transparent, transmit sender and recipient information, and store transaction information.

- When purchasing real estate, KYC/AML checks become stricter. Banks, notaries, and exchange services only accept funds with a clear and fully traceable history, otherwise the transaction may be halted.

- Self-custody wallets (if you held the crypto yourself) — if the cryptocurrency was stored in a personal wallet, you'll need to provide more proof: prove that the wallet belongs to you and that all transactions were legitimate.

- When conducting an audit, banks want to see not only the fact of income declaration but also the complete, uninterrupted flow of funds from the declared income (e.g., dividends or profits), their deposit into the bank account, their subsequent conversion to cryptocurrency/back to euros, and the final payment. This entire chain must be documented and easily traceable.

"Planning to buy an apartment in Austria with cryptocurrency?

I'll help you through every step, from the legal exchange to registering the transaction with the Landesgericht. I'll explain the process, the required documents, and how to avoid problems and bank blocking in plain language

— Ksenia , investment consultant,

Vienna Property Investment

Will it take longer than just buying via bank transfer?

The short and sweet answer is yes, purchasing with cryptocurrency generally takes longer than a regular transaction. But it's important to understand: the issue isn't the speed of the transfers themselves, but the need to go through an additional legal and banking process—verifying the legal origin of your digital funds.

Why does a deal usually take longer:

- Additional KYC/AML checks. The bank and notary are required to thoroughly verify the origin of the funds: transaction history, exchange reports, and tax documents. With a standard bank transfer, some of these checks are already performed by the bank itself.

- Exchanging cryptocurrency for euros requires working with a licensed exchange or broker, passing their checks, waiting for the exchange to complete, and ensuring all documents meet the requirements of the Austrian bank and notary. This typically takes 3 to 10 business days.

- Notary confirmation. The notary must ensure that the funds are of legitimate origin and will be deposited into the escrow account without any problems. To do this, they often request additional documents, clarify the transfer of funds, and verify the intermediary.

- Exchange rate fluctuations and confirmation waits. Due to cryptocurrency exchange rate volatility, some buyers exchange funds in increments, which also increases the overall transaction time.

How long does the transaction take:

- A typical purchase through a bank takes approximately 10-21 days from the moment the contract is signed to the registration of ownership.

- Purchasing using cryptocurrency—taking into account all checks, exchange to euros, and additional confirmations—the process typically takes 3 to 6 weeks.

Sometimes it takes longer if: there is no clear history of the cryptocurrency, P2P transfers or anonymous wallets were used, or the exchange is processed through an exchange with particularly strict AML checks.

If you prepare everything in advance—collect a full set of documents, complete KYC before the transaction, choose a reliable broker, clearly define the transaction plan, work with a licensed OTC in the EU, store cryptocurrency on a trusted exchange, and notify the bank in advance—the difference in terms of time will be small, usually only 5-7 days longer.

In this case, the order of actions will be as follows: sale of crypto → receipt of EUR → escrow → transaction.

A transaction using cryptocurrency is a bit more complicated and often takes longer, not because the market is against crypto, but because of additional AML checks and the euro exchange step.

Results

Briefly and to the point: it's possible to buy real estate in Austria with cryptocurrency, but only through an exchange of crypto for fiat currency and with the assistance of a notary. Directly transferring cryptocurrency to the seller is not possible due to strict banking requirements and AML/KYC regulations.

Austria is one of the countries with the strictest regulations in Europe. This ensures the security and transparency of transactions, but also means very high requirements for documentation and verification.

The best option for a safe transaction:

- An escrow account with a notary —money is kept there until the title deed is registered.

- Official cryptocurrency exchange for euros is through licensed exchanges or OTC services.

- Expert assistance— lawyers and real estate consultants— will help you meet all requirements and reduce risks.

Plan your purchase carefully, consult with experts at every step, and cryptocurrency will help you easily invest in Austrian real estate or prepare for your move to the country.