Buying an apartment in Austria for cash: is it possible and how does the deal work?

The Austrian real estate market is one of the most tightly controlled in Europe. Despite this, many people mistakenly believe that with the right amount of money, they can easily buy any property. The reality is more complex.

Buying an apartment in Austria for cash doesn't require paying in cash. It simply means the buyer already has the necessary funds and isn't tied to a bank loan, which speeds up the process. All mandatory procedures remain in place, including KYC and AML checks, proof of legal capital, and obtaining permission from the state office.

Is it possible to buy an apartment in Austria with cash?

Yes, purchasing real estate "in cash" is permitted under Austrian law. However, it's important to understand that this doesn't mean paying in cash—the exchange of banknotes is simply not used. The term "cash purchase" simply means that the buyer is paying with their own funds and is not tied to a mortgage.

The key here isn't how the payment is made, but that the funds are properly documented and their source is clear. In Austria, KYC and AML checks are taken very seriously: the notary, the bank, and sometimes even the state office must ensure that the funds were obtained legally. Therefore, during the transaction, documents confirming income, cash flow, and tax compliance are usually required.

Even if the purchase is made without a loan, a notary and a bank are still necessary. The notary is responsible for the legal aspects of the transaction, submitting documents to the land registry and monitoring its legality. The bank also opens an escrow account (Treuhandkonto) —a mandatory part of the transaction in Austria, even when paying with personal funds. Funds are first transferred to this account, where they are blocked until state registration, and only then are they transferred to the seller.

Thus, it is possible to buy an apartment in Austria for cash, but only if all regulations are followed, the transaction is fully transparent, and the participation of a notary, bank, and government agencies is involved.

"Buying an apartment in Austria without a mortgage is quick and safe, without any unnecessary bank procedures. I'll help you choose an apartment and region so your investment generates income and your money is securely protected."

— Ksenia , investment consultant,

Vienna Property Investment

What are the restrictions and requirements?

Buying real estate in Austria is strictly regulated: transactions are subject to scrutiny at various levels, and even the simplest purchase requires official inspections and permits.

1. Verification of the origin of capital (AML)

Austria has very strict anti-money laundering regulations. Buyers must prove their funds were obtained legally.

Usually they ask to provide:

- documents confirming income (salary, dividends, business income);

- bank statements showing cash movements;

- papers on the sale of other property or assets;

- tax returns.

The notary is responsible for the accuracy and completeness of the AML check. Without it, the transaction will not take place.

2. Permission from Erwerbskommission

In most regions of Austria, foreign buyers cannot freely purchase real estate. Before purchasing, they must obtain permission from the local Erwerbskommission, which determines whether the buyer can proceed with the transaction. For more details, see the article on restrictions on foreign property purchases in Austria .

The commission checks:

- whether the buyer is a resident or non-resident;

- for what purposes the property is being acquired;

- Are there any special restrictions in the region (for example, in resort areas);

- whether the transaction complies with local laws and the interests of the specific state (Bundesland).

Without such permission, it is impossible to register ownership and enter it into the land register.

3. Additional checks for non-residents

For foreign buyers, a more thorough check is carried out:

- check the legality of stay and status in the EU;

- they look to see if there are connections with Austria (sometimes it is necessary to explain the purpose of the purchase);

- analyze the tax status;

- They check in detail where the money came from.

In some regions, non-residents are severely restricted from purchasing real estate, requiring proof that the property is truly needed, as is the case in Tyrol.

How does a transaction work when paying in cash?

Even if the buyer pays the entire amount for an apartment in Austria out of their own pocket, the purchase process itself remains very formal, strictly regulated, and follows established stages. I always tell my clients: having the necessary funds makes the process simpler and faster, but it doesn't eliminate the need to go through all the mandatory legal steps. Any real estate transaction in Austria must be notarized—it's a legal requirement, and there's no way around it.

1. Selecting an object

The buyer selects an apartment, checks the neighborhood, infrastructure, building condition and status, and any restrictions (for example, whether the property can be rented out short-term). At this stage, important details often become clear that many are unaware of: in some regions, real estate may initially be closed to non-residents.

2. Due diligence

This is a comprehensive check of the property and the owner:

- Do the actual meters match what is stated in the documents?

- are there any hidden encumbrances or debts on utility bills;

- Are there any restrictions on redevelopment, reconstruction or leasing of the property?.

There have been cases where an apartment seemed ideal, but an inspection revealed problems—for example, a dispute over the boundaries of utility rooms or illegal redevelopment. It's best not to buy such properties.

3. Preliminary agreement (Kaufanbot)

The price, terms, and conditions of the transaction are specified. A small deposit is usually made, which is later transferred to an escrow account. For foreign buyers, a clause is often added stating that the transaction will only become effective upon approval from the "Erwerbskommission.".

4. Escrow account with a notary or bank

In Austria, it's not possible to pay for real estate in cash directly—payments are made only via bank transfer and escrow account. A notary or lawyer overseeing the transaction ensures its legality: the funds must be transparent and verifiable, with a verified source and taxes and fees paid, not simply handed over in cash.

- When purchasing housing on the secondary market or in a new building, an escrow account with a notary or lawyer (treuhandkonto / Notartreuhandbank) is usually used.

- The buyer transfers the deposit or the entire amount to this account. The funds are transferred to the seller only after all transaction conditions are met—signing the contract, registering the title, paying taxes and fees, etc.

- This protects the buyer: if the transaction does not take place (for example, due to registration refusal or lack of permits), the funds are returned.

The escrow and bank transfer system is mandatory—without it, no seller will transfer property.

5. Verification of the origin of funds

At this stage, the notary conducts a full check in accordance with AML regulations. Typically, buyers are asked to:

- bank statements for the last 6-12 months;

- documents confirming the sale of a business or real estate;

- tax returns.

From experience: if funds came from a foreign account and it is unclear where they came from, the notary may request additional confirmation—until this is provided, the transaction will not proceed.

6. Payment

Once all checks are successfully completed, the Treuhänder receives permission to transfer the funds to the seller. "Payment in cash" means only one thing: the buyer already has the funds in their account and doesn't need to wait for mortgage approval. This speeds up the transaction, but the sequence of steps (checks, notary, funds transfer) remains the same.

7. Registration of property rights

The notary submits the documents to the land registry (Grundbuch). Once the registration is completed, you become the legal owner of the apartment, and the seller receives payment from the security deposit.

| Stage | Average time (days) | Comment |

|---|---|---|

| Selecting an object | 7–14 | Market research and analysis |

| Due diligence | 7–21 | Checking documents and property conditions |

| Preliminary agreement | 3–7 | Kaufanbot, deposit payment |

| Escrow/AML verification | 14–28 | Verification of the origin of funds |

| Payment and registration | 7–14 | Transfer to escrow, registration in the land registry |

When is buying for cash an advantage?

Buying an apartment in Austria in cash offers advantages for the buyer. In Austria, where all transactions are governed by strict rules, the lack of a mortgage speeds up the process and makes you a more desirable buyer to the seller.

1. Operational transaction

If you don't wait for bank approval, the process goes faster:

- fewer documents are required,

- the bank does not conduct a property appraisal,

- there is no need to agree on loan terms.

In my experience, such deals usually take 2-4 weeks less time.

2. Negotiating a discount

Sellers in Austria prefer predictable outcomes. A buyer with cash is seen as more reliable, making their offer stronger in negotiations.

Sometimes you can even get a small discount of 1-5%, especially if it is important for the seller to close the deal quickly.

3. Faster approval of the transaction by all parties

The notary, seller, and realtor have more confidence in buyers who pay directly with their own money, without a bank loan. The fewer parties that need to be coordinated, the lower the risk of delays.

Even mandatory anti-money laundering (AML) verification will go faster if you have all the documents ready in advance showing where the entire amount came from, and this story looks clear and legitimate.

4. Often wins over buyers with mortgages

In popular cities like Vienna, Salzburg, and Innsbruck, there are often multiple buyers for a single apartment. Buying without a loan almost always wins:

- for the seller there is no risk that the bank will not approve the transaction;

- registration is faster;

- fewer conditions that could cause a deal to fall through.

Sometimes sellers directly state in their adverts that they give preference to buyers with their own funds.

Payment in cash ≠ a suitcase of money

It's worth clarifying a common misconception among foreigners. In Austria, you can't simply bring a large sum of cash and buy an apartment outright. This is illegal, and in practice, such a transaction will never take place: neither the notary nor the bank will accept this method of payment.

"Buying property abroad with cash makes the process easier and gives you more confidence in negotiations. I'll help you find proven options and calculate your profit, ensuring your investment is profitable from the start."

— Ksenia , investment consultant,

Vienna Property Investment

If you try to buy an apartment in Austria with cash, the transaction will simply be stopped. A notary cannot accept such funds and is legally obligated to report such a violation.

Why so strict:

- Legislation: All transactions comply with the Austrian Anti-Money Laundering Act (Finanzmarkt-Geldwäschegesetz, FM-GwG). The notary is required to verify each transaction and has the right to stop it if there is any doubt.

- Restrictions on cash payments – using cash when purchasing real estate is considered high-risk and is not practiced. By law, payments must be made through banks and special controlled accounts.

The main barrier is not money, but permits

Many people believe that the most important thing to buy an apartment in Austria is having the necessary funds. But in reality, for foreigners, the main challenge isn't finances, but obtaining the necessary permits.

- EU citizens have significant advantages: in most federal states, the procedure is simpler for them, and there are significantly fewer restrictions.

- Buyers from non-EU countries face stricter rules. In some regions, such as Carinthia and Tyrol, purchasing real estate without compelling reasons is nearly impossible—you must prove a connection to the region or a clear purpose for the purchase (work, business, or permanent residence).

- In Vienna, foreigners can purchase an apartment but only after receiving all the required permits from the Erwerbskommission. Without this approval, the property title will not be registered.

My observation: many wealthy clients waste not months raising funds, but months obtaining permits (especially from land authorities). Therefore, when planning a purchase, first check the regulations in your region and prepare all the necessary documents in advance.

How to prove the origin of funds

If you want to buy an apartment in Austria in cash, the notary and bank are legally obligated to verify that your funds were obtained honestly. This is a mandatory requirement under AML and KYC procedures. To ensure the transaction goes smoothly and without delays, it's best to prepare all documents proving the origin of your funds in advance.

Typically, the following documents are suitable for confirming the source of funds:

- Sale of a business - sales agreement, transfer documents and confirmation of tax payment.

- Real estate sale - transaction documents and bank statements after receiving funds.

- Deposit programs and investments - bank statements and proof of legitimate investment income.

- Income for recent years - tax returns, salary certificates and dividend documents.

- Cryptocurrency : funds are first transferred to a bank account, then to an escrow account for the transaction; the entire transaction history and the legitimate origin of the funds must be verified.

My advice: the simpler and more familiar the source of your funds is to the bank and notary, the faster they will complete the verification. Unusual sources (for example, a large withdrawal from a cryptocurrency account without clear documentation of its origin) require much more time to approve and may raise suspicions.

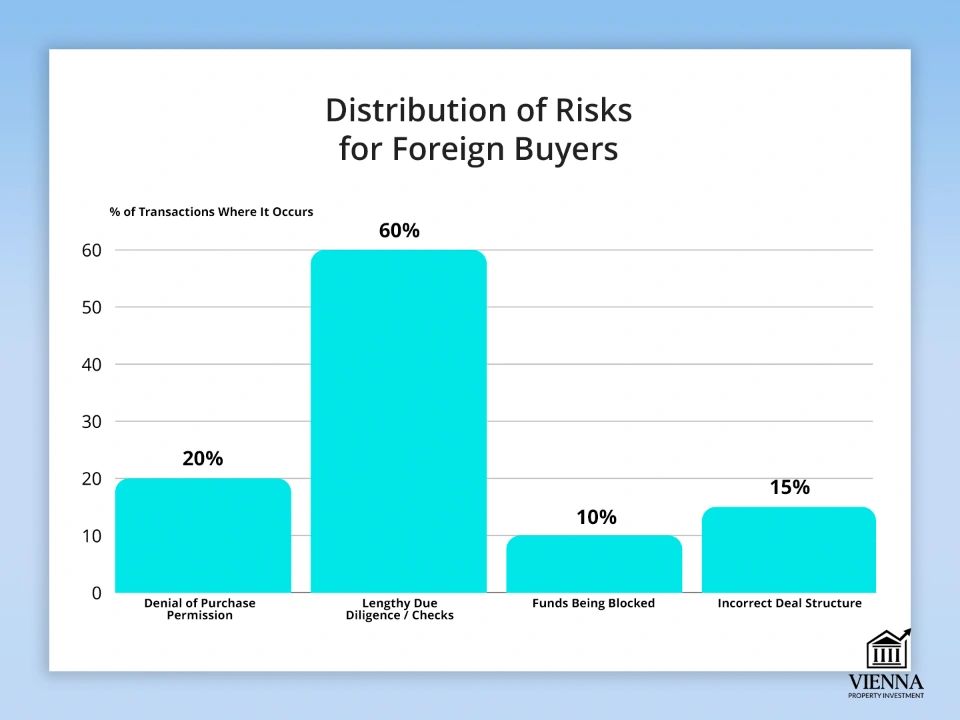

Foreigners and buying for cash: risks

Even with the full purchase amount, a foreign buyer in Austria is not immune to risks. Having the full amount does not exempt them from complying with all local laws and regulatory requirements.

Main risks:

- Denial of a purchase permit. In certain regions, such as Carinthia and Tyrol, a non-resident may be denied permission without explanation. Even in Vienna, a refusal is possible if the documents do not meet the requirements of the Erwerbskommission.

- Lengthy checks. Verification of sources of funds, as well as KYC and AML procedures, often take several weeks. Any errors or missing documents significantly slow down the transaction.

- Dependence on the accuracy of documents. All transactions are overseen by banks and notaries, so any inaccuracies in the documents can halt the process and require additional confirmation.

- Freezing funds if there are suspicions. If the bank or notary has doubts about the legitimacy of the funds, the funds may be frozen in an escrow account until the investigation is completed. In extreme cases, the transaction may be cancelled.

The clearer and more official the source of the funds, the faster the bank and notary will conduct the verification. However, unusual transactions, such as large transfers from a crypto account without supporting documents, take longer to verify and often raise additional questions.

Commissions and expenses when purchasing

When buying an apartment in Austria for cash, you need to consider more than just the property price. There are additional costs that significantly increase the overall budget—typically around 7-10% of the property's value.

| Type of consumption | Approximate rate/amount | Comment |

|---|---|---|

| Notary | 1–3% of the cost | A specialist guides the entire process, prepares the contract, and formalizes the ownership rights. |

| Broker/Agent (Makler) | 3–4% + VAT | If a realtor is involved, their services are usually paid for by the buyer, and sometimes the costs are shared with the seller. |

| Acquisition tax (Grunderwerbsteuer) | 3,5% | A mandatory payment that is calculated based on the cost of the apartment. |

| Money transfer | Bank fees | When transferring money from abroad, it is important to consider fees, especially for large amounts. |

| Escrow account (Treuhandkonto) | 0,5–1% | A bank or notary account where money is kept until the transaction is fully completed. |

Sometimes buyers don't understand why additional costs still arise when buying in cash. This is normal in Austria: even without a mortgage, the notary, bank, and other parties to the transaction are required to ensure complete legal and financial security.

Is it possible to buy for cash and register it in the name of a company?

Yes, it's possible to purchase an apartment in Austria using a company name. This is sometimes more convenient for foreigners, but it comes with its own set of rules and formalities that must be observed.

Possible design options:

- GmbH (Austria) is a local limited liability company established under Austrian law.

- A foreign company can be established in any country in the world, but must comply with all laws and regulations of Austria.

Nuances and mandatory checks:

- WiEReG (Austrian Beneficiary Transparency Law) requires disclosure of the true owners of a company. All beneficial owners must be officially disclosed.

- Registration of owners - information about the company and its actual owners is indicated in the land register when registering real estate.

- Compliance/AML/KYC — all payments undergo strict banking and notary controls. If there are any inaccuracies in the documents, the transaction may be temporarily suspended.

Purchasing real estate through a company speeds up the process and offers tax advantages. However, to avoid any delays, prepare documents in advance to prove who actually owns the company and where its funds come from.

"Buying property abroad with cash isn't just about convenience; it's a well-thought-out approach. I'll help you mitigate risks, inspect the property, and choose a country where your money will be securely stored and can grow."

— Ksenia , investment consultant,

Vienna Property Investment

Is it possible to buy with cash if the investor has cryptocurrency?

Yes, purchasing is possible, but very strict rules apply. You can't simply transfer cryptocurrency directly to the seller. All funds must go through official banking channels to comply with Austrian AML and KYC laws.

Typical transaction scheme:

- Crypto → bank / non-bank. Cryptocurrency is first exchanged for fiat money (euros or dollars) through a licensed exchanger or bank.

- → Escrow account. Funds are deposited into a notary or bank escrow account (Treuhandkonto) and remain there until the transaction is registered.

- → Transaction. After the funds are confirmed to be legitimate and all documents are verified, the money is transferred to the seller.

What is prohibited:

- It is not possible to use USDT or any other cryptocurrency directly as "cash" to purchase real estate.

- Exchanging cryptocurrency for euros in cash and attempting to pay rent is a violation of the law and AML regulations.

It's possible to buy real estate with cryptocurrency, but only with complete transparency: you must confirm the origin of the funds and pass all bank and notary checks. Attempts to circumvent these rules almost always result in the transaction being blocked.

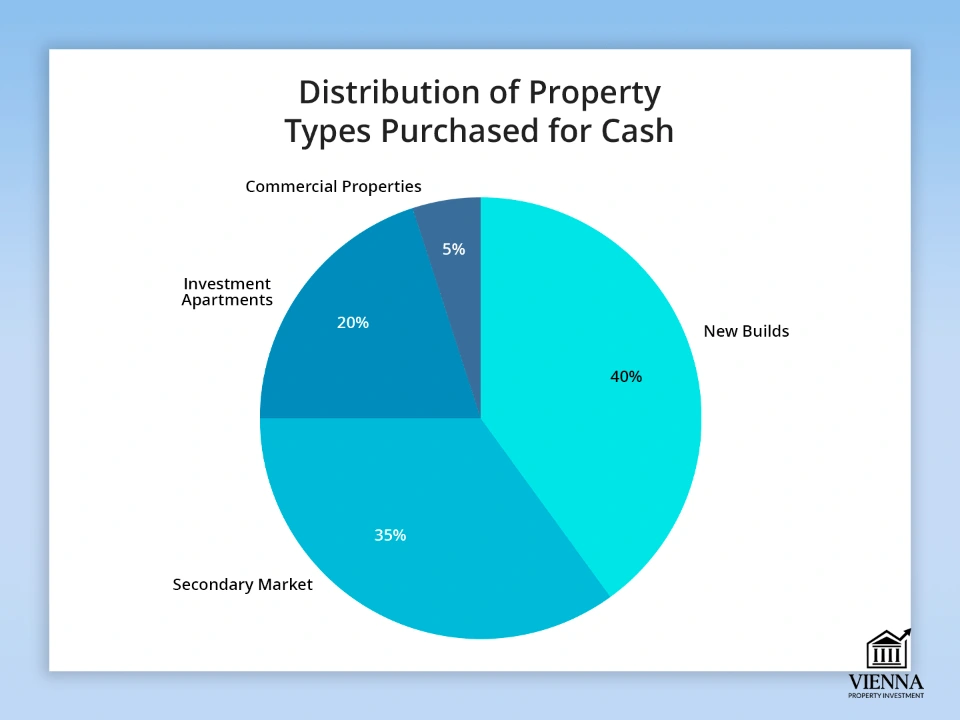

What properties are most often purchased for cash?

Buying an apartment in Austria for cash isn't just about convenience; it's a well-thought-out approach. I'll help you mitigate risks, inspect the property, and choose a country where your money will be securely stored and can grow.

Main categories:

- New developments. Many investors choose new apartments, especially in Vienna and resort areas. Paying without a loan allows for faster closure and sometimes a discount from the developer.

- The secondary market. When purchasing an existing home, buyers with cash are immediately more attractive to sellers—such transactions close faster, especially in popular areas.

- Apartments as investments . Those who buy rental properties often pay upfront to avoid waiting for bank approval and close the deal faster.

- Commercial properties. Purchasing offices, shops, or small hotels in cash is less common, but the advantages are the same: faster transactions, the possibility of favorable terms, and minimized bureaucratic risks.

Purchasing offices, shops, or small hotels for cash is less common, but it offers the same advantages: the transaction is faster, it's easier to negotiate favorable terms, and there's less paperwork and risk.

Where is the real benefit of buying with cash?

Purchasing an apartment in Austria for cash offers investors significant advantages. This is especially valuable in Austria, where the market is competitive and transactions are fast.

Key benefits:

- Discount of 2%–7%. It's important for sellers to ensure the transaction goes smoothly. When the buyer pays cash upfront, they can often get an additional discount, especially if there are many bidders for the property.

- Auctions are more profitable. At auctions, bidders with credit are dependent on the bank's approval process. A cash buyer has an advantage: they can pay quickly and close the deal immediately.

- Faster and less bureaucratic. Without a mortgage, there's no need to wait for bank approvals, appraisals, or inspections. The transaction goes directly through a notary and an escrow account, saving a significant amount of time—sometimes weeks or even months.

It's especially profitable to buy apartments with your own money on the existing market or in new buildings, where there's competition among buyers. In such situations, the one who can pay immediately and quickly often wins—speed and having the full amount on hand determine the outcome of the transaction.

Why the EU is tightening controls on cash payments

In recent years, a general trend has emerged in the European Union: restrictions and controls on cash circulation, especially when it comes to real estate transactions, large purchases, or cross-border transactions. There are several reasons for this:

- Anti-money laundering (AML). The EU is introducing strict rules to make money easy to trace. Large cash transactions are considered risky, as they may be linked to money laundering or illegal activity. Each country has a threshold above which the source of funds must be verified.

- Combating tax evasion. Cash is more difficult for tax authorities to control. Bank transfers are easier to track, allowing for official records of transactions and increasing tax transparency.

- The rise of digital payments. Since almost all payments now go through banks and electronic systems, large amounts of cash raise suspicion. EU countries are encouraging cashless payments, reserving cash mainly for small expenses.

- Legislative update. Austria and other EU countries have laws such as the Finanzmarkt-Geldwäschegesetz (FM-GwG), which require clear proof of the source of funds when purchasing large amounts of real estate. Violating these rules can result in the transaction being stopped, and fines may be imposed.

Even if the buyer has the entire amount in cash, paying with banknotes is not possible. By law, large purchases must be processed through a bank: funds are transferred from card to card or through a special secure account. This ensures the transaction is fair and secure for both parties.

What's changing in the EU from 2026: increased controls on cash

- The European Union (EU) is introducing a general limit on cash transactions as part of its anti-money laundering regulations, meaning large cash transactions will either be banned or strictly controlled.

- The limit is being discussed: if the cash transaction exceeds the amount of ~€3,000–€3,000+, the seller (company or business) is obliged to record the buyer’s details and carry out their identification.

- Some countries, such as the Netherlands, plan to ban cash transactions over €3,000 from January 1, 2026, if a professional seller is involved in the transaction.

- Other EU countries are proposing to set a general maximum for cash payments across certain categories (business, real estate, luxury goods and services) at around €10,000. This limit will be mandatory, but countries will be able to impose even stricter restrictions.

How does this affect the real estate market and major transactions?

- If an investor tries to pay a large sum in cash directly, it will most likely not be possible: companies, brokers, notaries, and real estate sellers do not accept cash above established limits.

- Even a buyer without credit is usually required to transfer funds through a bank account or escrow to comply with anti-money laundering regulations.

- If the transaction is formalized and involves legal entities (a company, agency, seller as a business), cash restrictions and mandatory identification apply in any case.

- For foreigners, especially if using non-standard sources of funds (such as converting cryptocurrency to fiat), verification and transparency requirements are even stricter—transactions with unclear origins may not be approved.

"Planning to buy property abroad but worried about risks and unexpected expenses? I'll find you a profitable and reliable property, calculate everything, and handle the entire transaction."

— Ksenia , investment consultant,

Vienna Property Investment

Conclusion

When buying an apartment in Austria, the most important thing isn't how much money you have. Even millions won't help if you don't do everything right.

Key points:

- To properly formalize a transaction , it is essential to work with a notary and follow legal procedures.

- Pass checks - AML, KYC and verification of source of funds are key.

- When selecting a site and land , please take into account regional restrictions and the requirements of the Erwerbskommission.

- Structure the purchase correctly —through a private individual or company, having thought through the legal and financial arrangements in advance.

Investors who have gathered all the necessary documents in advance, chosen the right region, and thought through the purchase plan reap more benefits from purchasing with their own funds—the transaction is faster, safer, and has minimal risks.