Real Estate Loans in Austria 2026: How to Get and Apply for a Loan

Buying a home in Austria is becoming increasingly popular for both locals and foreigners. In 2025, the average mortgage rate in the country is approximately 3.4% (OeNB data), making real estate loans affordable compared to other EU countries. However, obtaining a mortgage requires knowledge of local regulations, document preparation, and an understanding of banking terms.

As an Austrian real estate expert, I help clients navigate all the nuances and offer assistance with obtaining a mortgage—from choosing a bank to signing the loan agreement. In this article, I'll explain in detail the requirements in effect in 2025 and how to properly apply for a home loan in Austria.

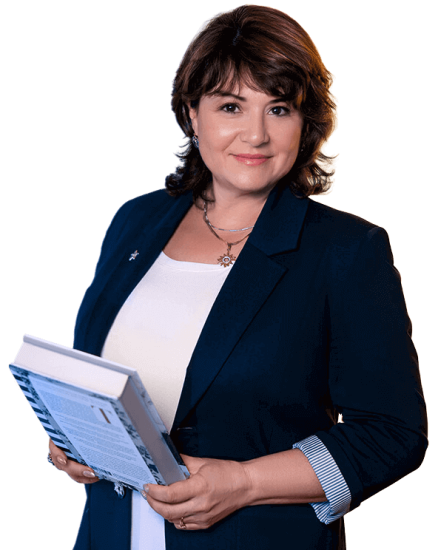

The Impact of KIM-VO on Mortgage Lending

The introduction of the KIM-VO in 2022 led to a significant decline in mortgage lending in Austria. According to the Austrian National Bank (OeNB), the share of sustainable loans increased from 12% in the first half of 2022 to 84% in the first half of 2024, reflecting stricter requirements for borrowers' creditworthiness.

However, as of July 1, 2025, the KIM-VO ceased to be binding, giving banks greater flexibility in assessing borrowers' creditworthiness. Despite this, the FMA continues to recommend adhering to the KIM-VO's core principles to ensure financial stability.

Key provisions of KIM-VO:

- Maximum loan-to-value (LTV) ratio: 90%.

- Maximum debt-to-income ratio (DSTI): 40%.

- Maximum loan term: 35 years.

Changes from July 1, 2025:

- Elimination of mandatory requirements: Banks have gained more flexibility in assessing the creditworthiness of borrowers.

- FMA Recommendations: The FMA continues to recommend adherence to the KIM-VO core principles to ensure financial stability.

- Mortgage flexibility: Possibility of an individual approach to borrowers, including the possibility of increasing LTV and DSTI, subject to proper justification.

Impact on the conditions for obtaining a mortgage:

- Mortgages for buying an apartment in Austria: Banks may offer more flexible terms, but it's important to consider the borrower's individual financial situation. When planning your budget, consider current apartment prices in Vienna .

- Mortgages for renting out apartments in Austria: Terms may vary depending on the property's profitability and the borrower's credit history.

Note: Despite the abolition of the mandatory KIM-VO requirements, it is recommended to adhere to its principles to ensure financial stability and minimize risks when obtaining a mortgage in Austria.

Who can get a mortgage in Austria?

Mortgages in Austria are available to both Austrian citizens and foreigners, subject to certain conditions.

- Citizens of Austria and the EU. For them, the process is simpler: simply prove a stable income, make a down payment, and meet the bank's standard requirements.

- Foreigners with a permanent residence permit (VNZh). They can obtain a mortgage and purchase real estate for their own residence. Having official residency status significantly increases their chances of loan approval.

- Foreigners without a residence permit. Obtaining a mortgage is possible, but municipal approval is required. This is only granted if the purchase meets the social, cultural, or economic interests of Austria.

- Investors from non-EU countries (including Ukraine and Russia) are also eligible for mortgages, but banks conduct more thorough checks of their documents, financial history, and source of income.

Basic requirements for borrowers

In 2025, the mortgage process in Austria underwent changes, especially for foreign buyers. Although the KIM-VO (Kreditinstitute-Immobilienfinanzierungsmaßnahmen-Verordnung) became mandatory as of July 1, 2025, banks are maintaining a cautious approach, taking into account the individual financial circumstances of borrowers.

1. Age and legal capacity

The borrower must be of legal age and fully capable. For some programs, banks set an upper age limit at the end of the loan—usually 65–70 years.

2. Legal residence

Austrian citizenship, a permanent residence permit, or a residence card are required. Foreign investors without a residence permit require municipal approval to purchase real estate. Having legal residency significantly increases the chances of loan approval.

3. Financial stability

Banks verify the borrower's income for the past 12-24 months, taking into account all sources of income: salary, business activities, rental property, and investments. They also analyze their credit history, and the debt service ratio (DSR) measures the ratio of income to mandatory payments. Typically, the monthly mortgage payment should not exceed 30-40% of income.

Foreign borrowers are often required to provide credit reports from their home country. A good credit history significantly speeds up the mortgage approval process.

For example, to buy an apartment in Vienna worth €400,000, an EU citizen needs an income of €2,500–3,000 per month, while Ukrainians or Russians need €3,500–4,000 per month. One of my clients, with an income of €3,800 per month, received a mortgage of €350,000 with a 30% down payment.

4. Confirmed income

For Austrian and EU citizens, an employment contract and proof of income are usually sufficient. Entrepreneurs are required to provide a tax return and financial statements. Foreign borrowers often require notarized translations of documents into German or English.

5. Own funds

Since 2022, banks have required a minimum of 20% of the property value and additional expenses (notary fees, registration, insurance) to be covered from personal funds. Non-EU citizens (e.g., Ukrainians and Russians): 30–50% of the property value.

The higher the down payment, the higher the likelihood of loan approval and the more favorable the interest rate terms. When planning your budget, it's important to factor in all property purchase expenses . For many banks, this is also an indicator of the borrower's financial discipline.

6. Additional guarantees

In some cases, banks require a guarantor, collateral, or life and property insurance for the loan repayment period. This is especially important for foreign borrowers without a long credit history in Austria.

The process of obtaining a mortgage in Austria

Obtaining a mortgage in Austria can seem complicated, especially for foreign buyers. However, with proper preparation and knowledge of the key steps, it becomes clear and manageable. In 2025, banks will continue to consider KIM-VO recommendations when assessing risks, which will impact lending terms.

1. Submitting an application to the bank

The first step is choosing a bank and applying for a mortgage. Leading banks offering mortgages to foreign buyers include:

- Erste Bank is one of the largest banks in Austria, offering a wide range of mortgage products.

- Raiffeisen Bank is known for its reliability and variety of mortgage solutions.

- UniCredit Bank Austria offers competitive terms for foreign clients.

- Sparkassengruppe Österreich is a network of more than 700 branches across the country, ensuring accessibility of mortgage services.

It is important to note that for third-country nationals (such as Ukrainians and Russians), the process may require additional steps, such as obtaining permission to purchase real estate from local authorities.

2. Real estate valuation

After submitting an application, the bank initiates an independent property appraisal. This is necessary to determine the property's market value and calculate the maximum loan amount the bank is willing to provide. The appraisal is typically conducted by certified experts and is paid for by the borrower.

Some banks charge a fixed fee for a property appraisal, which can amount to around 0.5% of the loan amount. For example, at Bank Austria, the appraisal fee is approximately €261 for a €400,000 loan.

3. Providing the necessary documents

At this stage, the borrower must provide a complete package of documents, including:

- Passport or identity card;

- Proof of income (salary certificates, tax returns);

- Purchase and sale agreement or preliminary agreement;

- Extract from the land register (Grundbuchauszug);

- Confirmation of availability of down payment.

All documents issued outside Austria must be translated into German and notarized. Without a complete set of documents, the bank will not be able to proceed with the application.

4. Signing the loan agreement

Once the application and all documents are approved, the borrower signs a loan agreement with the bank. The agreement contains the loan terms, including the interest rate, repayment term, and other important details. It is recommended to carefully review the terms of the agreement and, if necessary, consult a lawyer.

5. Registration of the transaction in the land registry

The final step is registering the transaction in the land registry (Grundbuch). This is the official confirmation of ownership of the property. The registration process can take anywhere from a few weeks to several months, depending on the complexity of the transaction and the region. Once registered, the borrower becomes the official owner of the property.

Important! Property insurance is a mandatory requirement for obtaining a mortgage. It covers damage to the house or apartment, as well as the owner's liability. It is also recommended to purchase Hauschaltsversicherung (homeowners' insurance) to protect your belongings.

Mortgage rates in Austria in 2025

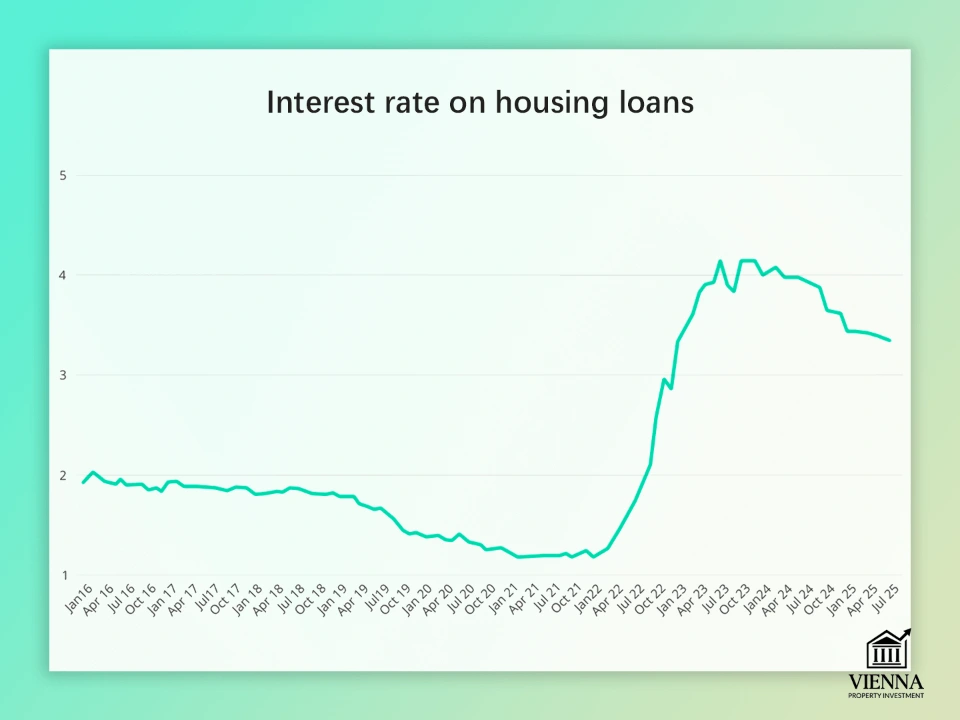

Interest rate on housing loans

(source: https://www.oenb.at/en/Statistics/Charts/Chart-4.html )

Mortgage rates in Austria are traditionally considered very attractive, typically fluctuating between 2% and 5%. According to the OeNB, the average mortgage rate as of April 2025 is 3.42%, lower than the October 2023 rate of 4.17%, but higher than the record low of 1.18% in 2021–2022. Rate dynamics are directly dependent on the financial stability of banks and the reliability of borrowers.

In 2025, mortgages will remain available to both Austrian residents and foreign buyers, including Ukrainians and Russians. Basic lending terms depend on the property type, borrower status, region, and the specific bank.

| Bank | Property type | Citizenship of the borrower | Down payment | Bid (%) | Loan term |

|---|---|---|---|---|---|

| Erste Bank | Apartment | EU/EEA | 20% | 2,10%- 3,60% | 25 years old |

| Raiffeisen Bank | New houses | EU/EEA | 20% | 2,05%-3,55% | 30 years old |

| UniCredit Bank Austria | Secondary housing | Third countries | 35% | 2,25%-3,50% | 20 years |

| Sparkasse | Apartment | Third countries | 30–40% | 2,20%-3,75% | 25 years old |

| Bank Austria | New houses | Foreigners | 30% | 2,15%-3,65% | 25 years old |

How much can I borrow?

In Austria, the mortgage amount depends on the property value and the loan type. Typically, with a fixed rate, you can borrow up to 70% of the property's value, sometimes up to 80%. The remainder must be covered by a down payment.

Examples:

- New construction typically requires a 40% down payment.

- For secondary housing - 50%.

- Loan repayment terms are usually up to 35 years, the minimum loan amount is €25,000, there is no upper limit.

If you already own real estate in Austria, you can use it as collateral. It's important to keep in mind the rule: monthly expenses plus mortgage payments should not exceed 40% of your gross income. Additional rental income can reduce this percentage.

Types of mortgages in Austria

1. Fixed rate. The most popular option. Terms typically range from 15 to 30 years, but may vary depending on the bank.

2. Floating rate. Also known as an adjustable-rate mortgage. The interest rate is tied to the Euribor and is adjusted every three months.

- Pros: The rate may decrease, which will allow you to pay off the loan earlier.

- Cons: Euribor may rise, which increases the overpayment.

3. Combination mortgage. Combines both options. For example:

- 60% fixed rate loan for an agreed term

- 40% loan with a floating rate of 1.5% + Euribor

Suitable for commercial and residential properties, resale or renovation.

Special Purpose Mortgages and Green Programs

In Austria, banks offer mortgages not only for the purchase of a primary residence, but also for special purposes, including green projects.

Main options:

- Second mortgages are available for vacation homes or rental properties. They allow you to invest in real estate and generate rental income.

- Loans for renovation and reconstruction - for renovating existing homes or apartments, including upgrading to energy efficiency standards.

- Commercial mortgages – for offices, retail and industrial properties.

Green mortgage programs:

- UniCredit Bank Austria offers green mortgage bonds, the proceeds of which are used to build environmentally friendly and energy-efficient buildings.

- Erste Bank and Sparkasse offer loans with reduced interest rates for highly energy-efficient homes.

Risks and restrictions for foreigners

Purchasing real estate in Austria for foreign citizens, including Ukrainians and Russians, involves a number of legal and financial considerations. While the process is accessible, it's important to consider the following:

1. Restrictions on real estate purchases. In Austria, there are regional restrictions on the purchase of real estate by foreigners. In particular, the federal states of Tyrol and Vorarlberg restrict real estate purchases by foreigners, requiring permission from local authorities. In other regions, such as Vienna, purchases are possible with a residence permit or proof of "social interest" in purchasing real estate.

2. Permit requirement. Third-country nationals require permission from local authorities (Grundverkehrsbehörde) to purchase real estate. The permit process can take 3 to 6 months and depends on the region and type of property. Refusal is possible if the purchase is not in line with local interests.

3. High down payments. Foreign buyers are typically required to make a down payment of 30-50% of the property's value. This is significantly higher than for EU citizens, where the minimum down payment is 20%. Additional documents, such as proof of financial solvency and a credit history, may also be required.

4. Difficulty obtaining a mortgage. Foreign citizens have a harder time obtaining a mortgage in Austria. Banks require proof of a stable income in euros and may also require a residence permit or a local guarantor. The application process can take 4 to 6 months, and the maximum loan-to-value (LTV) ratio is usually limited to 50–70%.

Alternative financing methods

For foreign buyers of real estate in Austria, there are alternative financing options that may be useful depending on the situation and purpose of the purchase. Let's look at three main options:

1. Using an Austrian company. One way to circumvent restrictions on foreigners purchasing real estate is to purchase real estate through a registered Austrian company. This approach can be advantageous for investors looking to rent out the property or engage in commercial activities. However, it's important to note that this requires registering a company in Austria, which entails additional costs and administrative procedures.

2. Involve a local partner. Purchasing real estate jointly with an EU citizen can simplify the acquisition process, especially in regions with restrictions for third-country nationals. Such a partner can act as a co-investor, sharing costs and risks. However, it is important to carefully consider the terms of joint ownership and profit sharing to avoid potential legal and financial problems down the road.

3. Using savings schemes (Bauspar). The Bauspar system in Austria is a form of savings loan designed to accumulate funds for the purchase or construction of a home. The process involves two steps: saving for a certain period and then receiving a loan on preferential terms. The maximum loan amount under the Bauspar scheme is €300,000, with interest rates typically below market rates and fixed for the entire loan term.

Conclusion: Steps to a safe and profitable mortgage in Austria

Obtaining a mortgage in Austria is a process that requires careful consideration and meticulous preparation, especially for foreign citizens, including Ukrainians and Russians. Success depends largely on choosing the right bank, preparing all the necessary documents, and understanding legal regulations, such as regional government requirements and FMA lending guidelines.

Even after the abolition of mandatory KIM-VO requirements, banks continue to consider its principles when assessing borrowers' creditworthiness, ensuring financial stability and transaction security. Following these recommendations, budget planning, and competent legal support will allow you to obtain a mortgage on favorable terms and confidently invest in Austrian real estate—both for your own residence and for rental purposes.