How to profitably invest in real estate in Thailand

Investing in Thai real estate is becoming an important option for those seeking both income and a comfortable place to live. While investors in Europe often face high entry costs and limited returns, Asia, and especially Thailand, offers new opportunities.

This article aims to provide not just a market overview, but a systematic analysis of the country's investment attractiveness: from residential opportunities and rental income to its role in an international asset diversification strategy.

The topic's relevance is determined by several factors. Tourism, which has always been one of the main drivers of the Thai market, is actively recovering from the pandemic, and visitor flows from China, Russia, and Europe are once again growing.

At the same time, the phenomenon of digital migration is developing – professionals in the IT and creative industries are increasingly choosing Bangkok or Chiang Mai as their base for work and life.

The country is implementing large-scale infrastructure projects, including the development of the Eastern Economic Corridor and the construction of new airports and highways, which inevitably increases the value of real estate in key regions.

"Real estate in Thailand is sought after by investors who value both income and lifestyle. There's high demand from tourists and digital nomads, and the barrier to entry remains relatively low. My job is to structure the transaction so that the property generates income, is legally secure, and fits seamlessly into an international portfolio."

— Ksenia , investment consultant,

Vienna Property Investment

Expert guidance on this topic is especially important, as the legal environment in Thailand is more complex than in Europe. I, Ksenia Levina, am a lawyer with experience in transactions in the EU and Asia. I specialize in international ownership structuring and KYC/AML procedures. This allows me to view the market not only from the perspective of developers' marketing promises but also from the perspective of actual law enforcement practices.

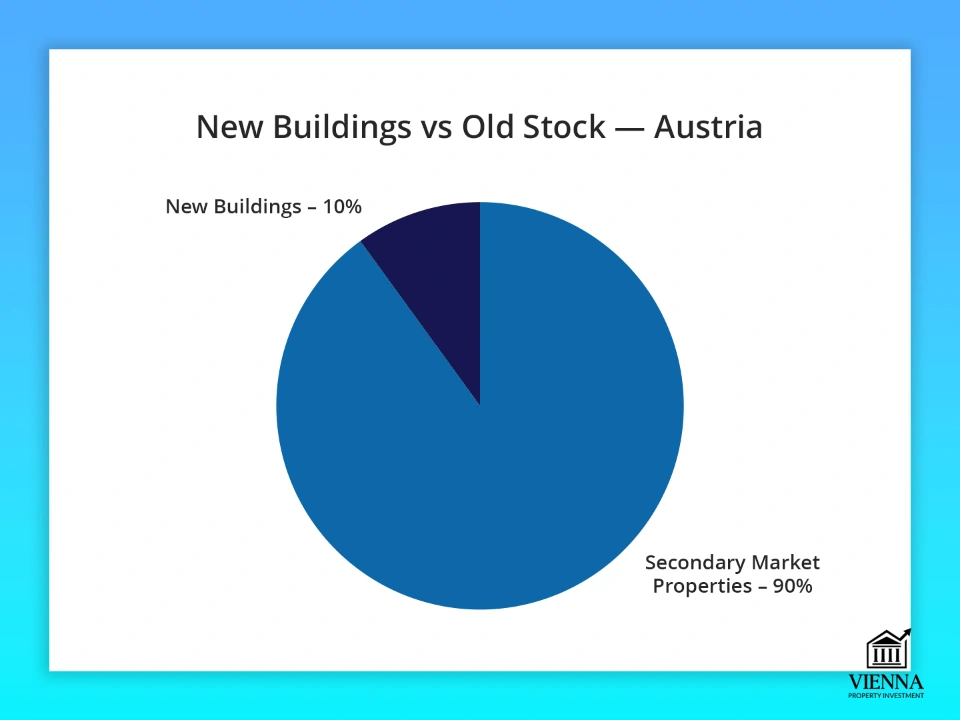

To better understand Thailand's direction, it's useful to compare it with traditionally stable Austria. Austrian real estate offers a convenient benchmark for rights protection and regulatory predictability. The comparison reveals two different worlds. Austria remains a symbol of reliability: predictable regulations, protection of property rights, but also low yields – rarely exceeding 2-3% per annum.

Thailand, on the other hand, offers a completely different model: high returns and a low entry threshold (sometimes from $70,000 to $100,000 per apartment), while the country is embedded in a dynamic Asian context, where growth rates are higher than in Europe.

Thailand's Place on the Asian Investment Map

Thailand's real estate market is a complex, multilayered organism. It combines the large metropolis of Bangkok, comparable in scale to leading global capitals, with developed resort areas like Phuket and Koh Samui, considered symbols of Asian tourism. There are also specific destinations:

- Chiang Mai, home to students and digital nomads

- Hua Hin is a popular destination for wealthy Thais and foreigners who appreciate a more relaxed pace of life.

This diversification makes the market stable: it does not depend on one source of demand.

The legal environment in Thailand imposes certain restrictions. Foreigners cannot directly own land, but they can enter into long-term leaseholds or use corporate structures.

Foreign ownership of up to 49% of condominiums is permitted making the apartment segment the most accessible. For many investors, apartments in Bangkok or beachfront condos are their first entry point.

Interest in Thailand isn't just driven by its climate and culture. The cost of living here is significantly lower than in Europe, and English is widely spoken in tourist areas, making it easier to adapt. Added to this are attractive visa programs: from the long-term Elite Visa to the LTR (Long Term Resident) and Smart Visa, which are designed for investors, professionals, and retirees.

Thailand Real Estate Market Overview

The history of the Thai real estate market is one of alternating crises and booms. After the severe Asian crisis of 1997, the country built a regulatory system designed to protect the market from overheating.

The 2010s saw rapid growth, particularly in Bangkok and the resorts, where new residential complexes, condo hotels, and villas were springing up. The COVID-19 pandemic in 2020-2021 presented a serious challenge: tourism fell sharply, and with it, investor interest.

But a rapid recovery has begun since 2022, according to Bangkokpost. Phuket and Koh Samui have once again become magnets for international capital, while Bangkok has demonstrated resilience and price stability.

Development is uneven across different regions. Bangkok remains the main center of business activity, with premium condominiums being built near metro stations and business districts.

Phuket is focused on seaside villas and apartments, which are in particularly high demand during the peak season. Koh Samui is perceived as a lifestyle destination for people who want to live and work remotely. Chiang Mai attracts students and IT professionals, while Pattaya and Hua Hin represent a more affordable market segment.

in terms of property types . Condominiums are the most popular, as they are the most easily accessible to foreigners. Villas are most often acquired through leasehold arrangements or corporate structures. Condo hotels represent a special segment, where investors receive a guaranteed income and do not have to manage them themselves.

Demand is driven by three groups of renters. The first are tourists who choose short-term apartments or villas. The second are digital nomads who prefer long-term rentals with the option to work in coworking spaces. The third are expats working for international companies and renting for years.

When compared to Austria, the differences become clear. Thailand is a market with distinct resort characteristics and strong seasonality. During the high season, returns can reach double digits, while during the low season, they can plummet.

Austria, on the other hand, represents a nearly opposite model: urban markets with long-term leases, stable prices, and low volatility. For investors, the choice is clear: Thailand offers the chance for high returns, while Austria offers peace and predictability.

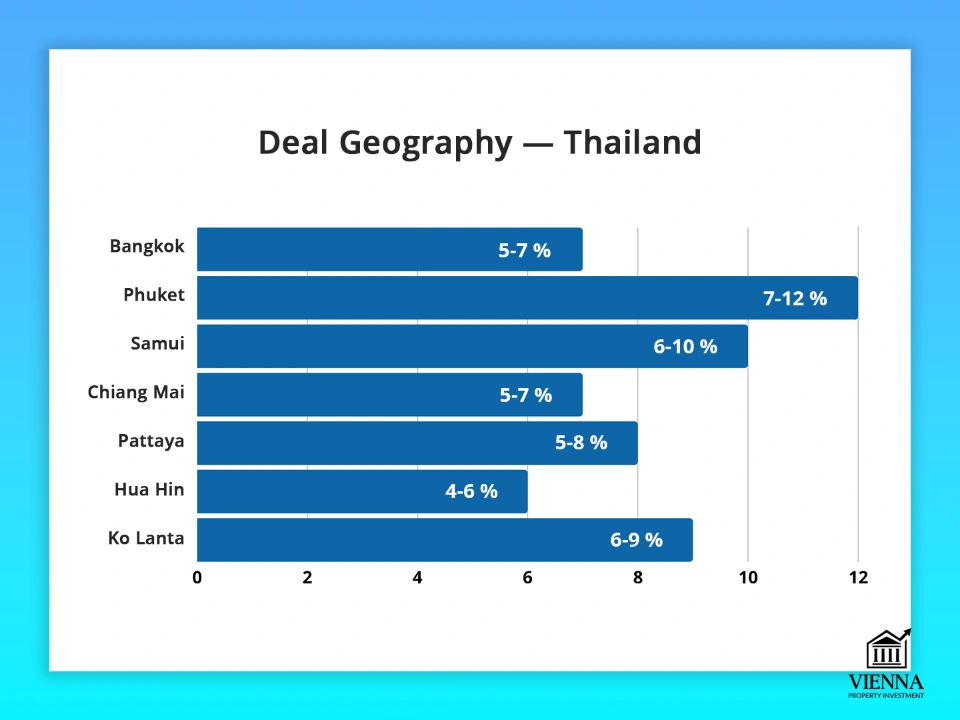

Geography of transactions

| Location | Property type | Main demand | Average rental yield | Market Features | Target audience |

|---|---|---|---|---|---|

| Bangkok | Condos, apartments, offices | Long-term rentals for expats and company employees | 5-7% | A stable urban market, developed infrastructure, metro and BTS | Expat IT, businessmen, digital nomads |

| Phuket | Villas, condos, condo hotels | Short-term rental for tourists | 7-12% | High seasonality, peak demand in winter, resort area | Tourists, investors in condo hotels |

| Samui | Villas, condos | Medium and short term rentals | 6-10% | A lifestyle trend popular among digital nomads | Digital nomads, lifestyle investors |

| Chiang Mai | Condo, apartments | Long-term rentals for students and IT professionals | 5-7% | A quiet city, stable demand, universities | Digital nomads, students, IT sector |

| Pattaya | Condos, apartments | Short-term rental for tourists | 5-8% | Affordable segment, high tourist flow in summer | Tourists, expats on a budget |

| Hua Hin | Villas, condos | Long-term rentals and lifestyle | 4-6% | A calmer market, local demand | Thai families, retirees, lifestyle investors |

| Koh Lanta / other islands | Villas, resort apartments | Short-term rental for tourists | 6-9% | More niche market, limited liquidity | Tourists, niche lifestyle investors |

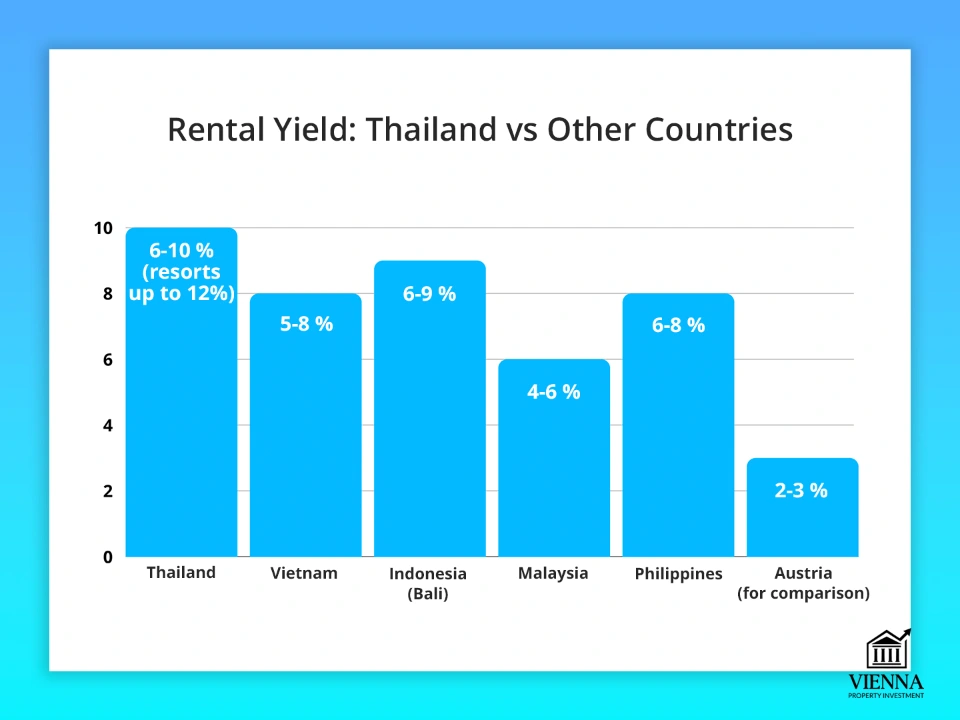

Competitors

In the Asian context, Thailand competes with Vietnam (for more details, see the article "Real Estate in Vietnam "), Indonesia, and Malaysia. Vietnam has a faster economic growth rate, but its legal system is less predictable for foreigners.

Indonesia and Bali are popular among expats, but ownership regulations are more complex. According to HMLF, Malaysia offers attractive visa options but lags behind Thailand in terms of tourist appeal. Ultimately, Thailand offers a balanced choice: a developed market, convenient rental conditions, and an established international image.

To understand the differences with Europe, it's useful to look at Austria. While rental yields in Vienna and Salzburg rarely exceed 2-3% per annum, in Bangkok or Phuket you can expect 5-10%, and sometimes even higher.

The Austrian market is transparent and stable, and land ownership is easy for foreigners, but the high entry costs (from €300,000 to €400,000) make it inaccessible to many private investors. In Thailand, however, entry costs are significantly lower, and high tourist traffic maintains rental demand.

| Country / Market | Rental yield | Legal restrictions for foreigners | Main locations | Strengths | Weaknesses |

|---|---|---|---|---|---|

| Thailand | 6-10% (resorts up to 12%) | Land is unavailable, condos are up to 49% foreigners | Bangkok, Phuket, Samui, Chiang Mai | High profitability, low entry barrier, strong tourism | Seasonality, complex ownership structures |

| Vietnam | 5-8% | Land is leased from the state, and foreigners are allowed to own apartments | Ho Chi Minh City, Hanoi, Danang, Nha Trang | Young market, economic growth, low prices | Complex regulation, limited rights of owners |

| Indonesia (Bali) | 6-9% | Foreigners cannot own land directly (only leasehold/nominees) | Bali, Jakarta | Popular among expats, high tourist flow | Legal risks, political instability |

| Malaysia | 4-6% | Ownership is possible, but there is a minimum purchase price for foreigners (varies by state) | Kuala Lumpur, Penang, Johor Bahru | MM2H (residence permit) programs, developed infrastructure | Lower returns, difficulty in obtaining a mortgage |

| Philippines | 6-8% | Land is unavailable, condos are up to 40% for foreigners | Manila, Cebu, Boracay | English-speaking environment, growing BPO sector | Weak infrastructure, legal nuances |

| Austria (for comparison) | 2-3% | Possession is possible, restrictions apply only to agricultural land | Vienna, Salzburg, Innsbruck | Stability, protection of rights, the EU | Low profitability, high entry threshold |

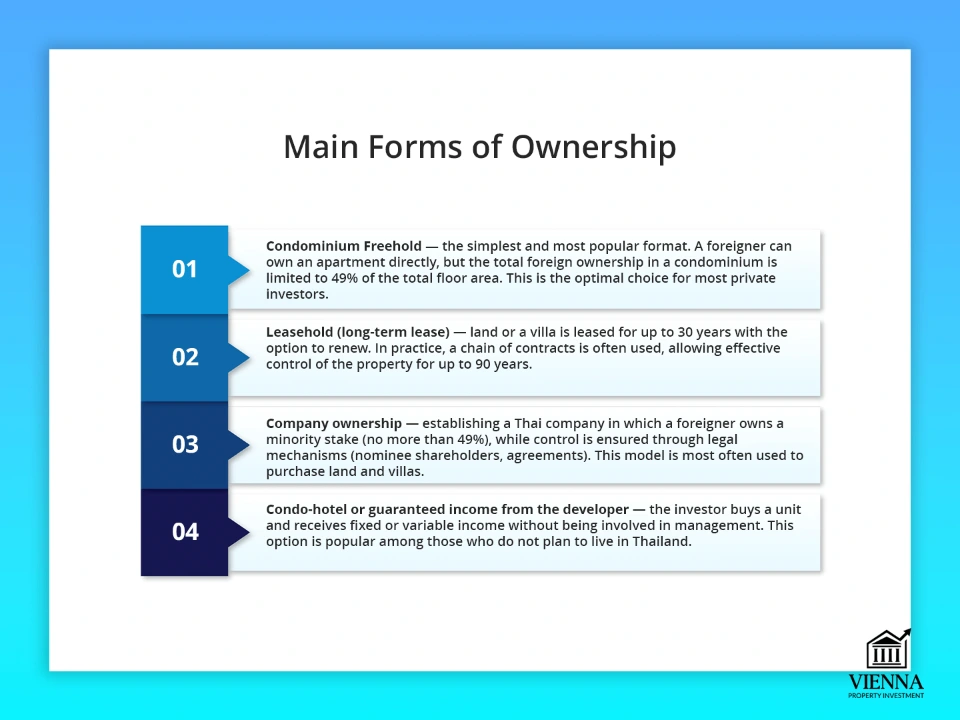

Ownership formats

Thailand's legal environment differs from Europe's, and this must be taken into account when planning a transaction. The main distinction is that foreigners cannot directly own land, and this prohibition remains a fundamental rule. However, in practice, several models exist that allow for legal and safe real estate investment.

Main forms of ownership

Condominium Freeho is the simplest and most popular format. A foreigner can own an apartment directly, but their share in the building is limited to 49% of the total area. For most private investors, this is the optimal choice.

Leasehold (long-term lease) – land or a villa is leased for up to 30 years with the option to extend. In practice, a chain of agreements is drawn up that allows for ownership of the property for up to 90 years.

Company ownership – establishing a Thai company where a foreigner holds a minority stake (up to 49%), and control is ensured through legal mechanisms (nominee shareholders, agreements). This model is most often used for purchasing land and villas.

A condo-hotel or guaranteed income from the developer – the investor purchases a unit and receives a fixed or variable income without any management responsibilities. This is popular among those who don't plan to live in Thailand.

For clarity, let's compare the available ownership formats in Thailand and Austria:

| Format | Thailand | Austria |

|---|---|---|

| Direct ownership of an apartment | Yes, but only within the quota (49% of the building) | Yes, without restrictions |

| Direct land ownership | No (only through leasehold/company) | Yes, subject to local regulations |

| Long-term lease | Yes, 30 years + extensions | Yes, usually 99 years |

| Ownership through a company | Yes, with restrictions on the foreigner's share | Yes, without any special restrictions |

| Condo-hotel programs | Very common | Rare, limited to resort areas |

Thus, the Thai market is more flexible in terms of instruments, but requires legal preparation. The Austrian system is simpler and more stable, but lacks the "exotic" features of high yields.

Investment methods

Investors can choose different strategies depending on their goals:

- Rental income – purchase an apartment in Bangkok or a resort condo, rent it out short-term or long-term.

- Lifestyle investment – purchasing a villa or apartment in Phuket/Samui for personal use, with the option to rent it out during the season.

- Speculative strategies – investments at the construction stage (off-plan), subsequent resale after completion of the project.

- Asset diversification – owning real estate as part of an international portfolio is especially important for investors from countries with currency risks.

By comparison, in Austria, the long-term rental model, focused on stability, almost always predominates. Speculative deals are rare, and yields rarely exceed 3% per annum. In Thailand, short-term rentals can yield 7-10%, and even higher in successful resort projects.

Legal aspects of buying property in Thailand

Purchasing real estate in Thailand has its own unique challenges related to the legal status of foreigners and the ownership structure. The main difficulty is that foreigners cannot directly own land, but can only own condos or through leasing or corporate structures. Therefore, the purchase process requires careful due diligence and the assistance of a professional lawyer.

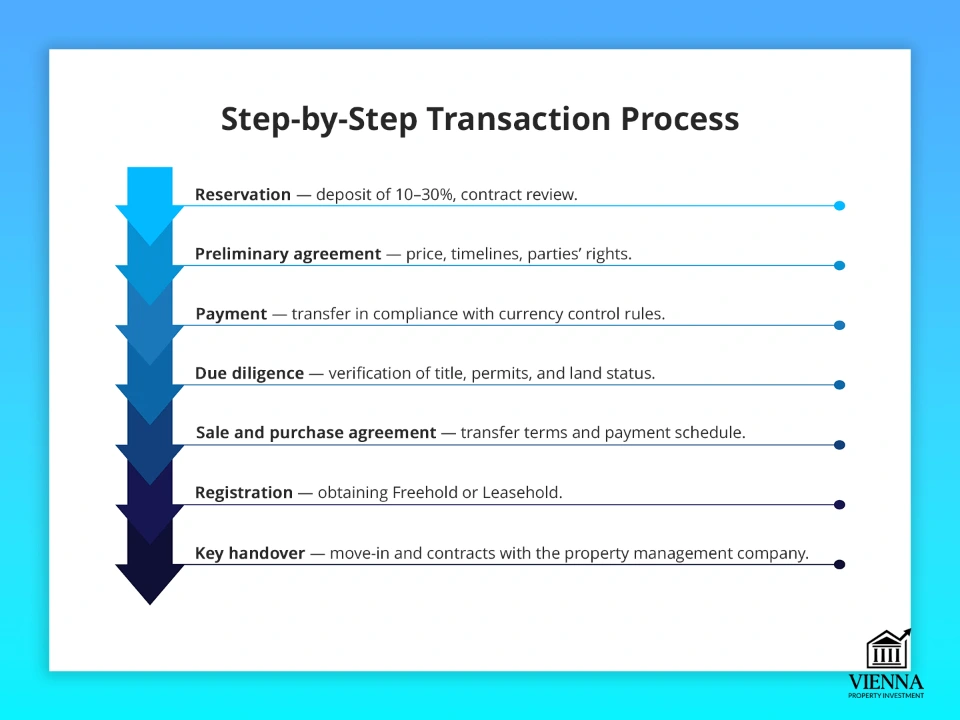

The step-by-step process of the transaction is as follows: first, the investor reserves the property and makes a deposit, after which a preliminary purchase and sale agreement is concluded, which fixes the price and terms.

The principal amount is then transferred, taking into account exchange restrictions and requirements for transferring foreign currency into Thailand. The final stage is registration of the transaction with the Land Department, where an official title deed or leasehold agreement is issued.

Due diligence is critical to the security of a transaction. A lawyer verifies:

- Title Deed,

- the presence of encumbrances or debts on the property,

- legal status of the developer and construction permits,

- the correct execution of leasehold agreements if the purchase involves land.

When purchasing off-plan (under construction), it's important for investors to agree on a payment schedule and guarantees. Most often, transactions are structured in stages: 10-30% at the reservation stage, subsequent payments depending on the project's completion, and the final payment upon transfer of ownership. Developers typically provide guarantees of refunds in the event of construction delays, but due diligence is mandatory.

Coastal features include zoning restrictions and urban planning regulations that govern building height, development density, and land use. This is important to consider for villas in Phuket or Koh Samui, where legislation and local municipal regulations may limit potential redevelopment and expansion.

Step-by-step process of buying real estate

| Stage | Commentary / What to look for |

|---|---|

| 1. Property reservation and deposit | Typically 10-30% of the cost. Payment is made via bank transfer or a lawyer's escrow account. Verify the accuracy of the reservation agreement. |

| 2. Preliminary purchase and sale agreement | The price, terms, and conditions of transfer are determined. The lawyer verifies the title and any encumbrances, and agrees on the rights and obligations of the parties. |

| 3. Transfer of principal amount | Please note foreign exchange controls: Transfers from abroad must be accompanied by documents for the Bank of Thailand to register the foreign currency. |

| 4. Due diligence | Title deed verification, building permits, and developer legal status. For villas, zoning and coastal restrictions are also checked. |

| 5. Conclusion of the purchase and sale agreement | The agreement is drawn up by a lawyer, outlining the terms of transfer of rights and the responsibilities of the parties. For off-plan transactions, a payment schedule and guarantees are included. |

| 6. Registration with the Land Department | The final stage: the official title deed (Freehold) or leasehold agreement is issued. Be sure to verify all information in the registration documents. |

| 7. Transfer of keys and registration of the right of use | After registration, you can move in and sign contracts with management companies and tenants. It's important to have copies of all documents and legal support. |

In general, legal security in Thailand is achieved through thorough due diligence and proper ownership structuring, while in Austria the process is simpler and more formalized, but the returns are lower.

Taxes, fees and expenses

The financial side of buying real estate in Thailand is significantly easier than in Europe, but it requires taking a number of factors into account.

When purchasing a property, investors are faced with registration fees and transfer taxes. On average, the registration fee is approximately 2% of the property's value, and the transfer tax ranges from 2-3%. If the purchase is made through a developer, a 7% VAT is also added on new buildings.

Owning real estate doesn't impose a high tax burden, according to Siamlegal . Annual taxes are low (0.02-0.1% of the cadastral value for residential properties), but investors must factor in utility costs and service fees (maintenance fees, complex maintenance, security, and cleaning of common areas).

Capital gains tax applies to sales calculated based on the official cadastral value and the length of ownership of the property. Most often, the tax ranges from 1% to 3%, but may be adjusted depending on the type of ownership (leasehold or freehold) and the method of sale.

Rental income for non-residents is taxed at a rate of 15-20%. If the owner uses a corporate structure or manages the property through a management company, additional social and corporate taxes may apply.

Comparison with Austria

If you're considering EU jurisdictions for portfolio balancing, it's worth examining Austrian real estate taxes —they directly impact net income and ownership strategy.

| Indicator | Thailand | Austria |

|---|---|---|

| Tax on purchase | Registration tax 2%, transfer tax 2-3%, VAT 7% on new buildings | Stamp duty + registration ≈ 4.6% |

| Annual taxes | 0.02-0.1% + utility bills | 0.1-0.2%, utilities |

| Sales tax | 1-3% | Up to 30% capital gain |

| Rental income | 15-20% (non-residents) | 20-55% progressively |

| Flexibility | Optimization through structures is possible | A minimal, strict system |

Thus, Thailand's tax environment allows investors to achieve high net returns, but requires careful consideration of currency transfers and transaction structuring. Austria offers transparency and predictability, but yields are significantly lower.

An example of buying real estate in Thailand

Object: 1-bedroom apartment 40 m² in a modern condo near the BTS station (center of Bangkok).

Purchase price: 5,000,000 THB (≈ $140,000).

1. Purchase costs

| Expense item | Amount (THB) | Comment |

|---|---|---|

| Price of the apartment | 5 000 000 | Base price |

| Registration fee | 100 000 | 2% of the cadastral value |

| Transfer tax (stamp duty / specific business tax) | 50 000 | On average 1% |

| Lawyer + due diligence | 50 000 | Checking the title and contract |

| Furniture and equipment | 300 000 | To hand over the property immediately |

| Total investments | 5 500 000 | ≈ $155 000 |

2. Rental income

- The average rent for a 1-bedroom apartment in this area is 25,000 THB/month.

- Annual income = 300,000 THB.

3. Annual expenses

| Article | Amount (THB/year) | Comment |

|---|---|---|

| Maintenance fee | 36 000 | 90 THB/m² × 40 m² × 12 months |

| Utility costs (electricity, internet, water – paid by the tenant) | 0 | Only if it's empty |

| Rent tax (15% for non-residents) | 45 000 | 15% from 300,000 |

| Depreciation/repairs | 20 000 | Furniture and appliances |

| Total expenses | 101 000 |

4. Net rental income

- Income: 300,000 THB

- Less expenses: 101,000 THB

- Net income = 199,000 THB/year (≈ $5,600)

- Net Yield = 199,000 / 5,500,000 ≈ 3.6% per annum

5. Exit after 7 years (resale)

Let's assume that prices in Bangkok grow by an average of 3% per year.

- Price after 7 years: 5,000,000 × (1.03)^7 ≈ 6,150,000 THB.

Selling expenses:

- Agency commission: 3% = 185,000 THB

- Capital gains tax (let's say around 2%): 120,000 THB

Net sale proceeds: ≈ 5,845,000 THB

6. Final calculation of profitability

| Source of income | Amount (THB) |

|---|---|

| Net rental income (7 years) | 1 393 000 |

| Resale income (net) | 5 845 000 |

| Total return of capital | 7 238 000 |

Investment: 5,500,000 THB

Refund: THB 7,238,000

Profit: 1,738,000 THB (~$49,000)

IRR (average return) ≈ 6.2% per annum

Conclusion:

- Net rental yield is approximately 3.5-4% per annum.

- Taking into account the increase in price and resale, the final profitability comes to 6-7% per annum.

- The advantages are low taxes and relatively inexpensive entry. The disadvantages are location dependence and seasonality of rentals.

Visas and residency

Investing in Thai real estate does not directly grant permanent residency, but the country offers several long-term visa programs that allow you to live and work in the country for an extended period.

The Thailand Elite Visa is a premium program valid for periods ranging from 5 to 20 years. It allows foreigners to enter Thailand without restrictions, without the need for regular visa renewals, and provides access to privileges such as expedited immigration clearance, healthcare, and lifestyle services.

This is convenient for investors, as the property can be used for personal residence and rental without visa restrictions.

The Long-Term Resident Visa (LTR) is aimed at investors, digital nomads, and skilled professionals. It allows stays in the country for up to 10 years, while offering tax breaks and employment freedom.

The Smart Visa is designed for IT professionals, startups, and highly skilled workers. It provides up to four years of residency, simplifies employment, and opens access to a range of benefits, including tax reductions.

It's worth noting that permanent residency cannot be obtained directly through purchasing real estate, as is the case in some European countries. Instead, foreigners use the aforementioned visas for long-term stays and integration into the country's lifestyle—comfortable living, high-quality healthcare, low crime rates, and a climate with year-round beaches and activities.

Thailand vs Austria

| Parameter | Thailand | Austria |

|---|---|---|

| Visa type | Thailand Elite, LTR, Smart Visa | Residence permit through income, business, and study |

| Term | 5-20 years | Depends on the category, usually 1-2 years with extension |

| Permanent residence through real estate | No | Partially possible through business investment/income |

| Lifestyle | Warm climate, sea, low cost of living, affordable healthcare | Clean environment, developed medicine, stable infrastructure |

| Target audience | Digital nomads, investors, expats | People with income, families, students, pensioners |

Thailand offers visas with a vibrant lifestyle component, allowing you to combine investment and comfortable living, while Austria focuses on formal residency categories with mandatory documentary proof of income or business.

Rent and profitability

Thailand's rental market is highly dynamic, particularly in resort areas and major cities. It is divided into two main segments: short-term rentals (tourists, Airbnb, Booking) and long-term rentals (expats, digital nomads).

Short-term rentals attract investors with high returns, but are subject to seasonality. In the resort areas of Phuket and Koh Samui, income can increase by up to 12% per annum in winter, but drop by half during the off-season. Rentals are often managed through management companies, which handle marketing, cleaning, and guest payments.

Long-term rentals are typical in Bangkok and Chiang Mai. Here, demand is more stable, but yields are lower—on average, 4–6% per annum. Digital nomads and expats ensure a year-round flow of tenants, minimizing seasonal risks.

Range of profitability by location

| Location | Rental type | Average yield |

|---|---|---|

| Bangkok | Long-term, expats | 3-6% |

| Phuket / Samui | Short and medium term | 6-10% |

| Chiang Mai | Long-term, students/IT | 4-6% |

| Pattaya / Hua Hin | Mixed | 5-8% |

In European cities, yields are 2-3%, but they are stable and virtually unaffected by seasonality. In Thailand, yields are 2-3 times higher, but investors must consider the risks: seasonality, property quality, management, and the legal aspects of leasehold.

Where to buy property in Thailand

The choice of location depends on the investment objective—rental income, lifestyle living, or a combined strategy. Different regions vary in yield, property types, entry costs, and rental demand.

1. Bangkok

Bangkok is Thailand's largest metropolis and a business and cultural hub. The main demand here is driven by long-term renters—expatriates, employees of international companies, and IT and financial sector professionals.

Types of real estate: condominiums, apartments in skyscrapers, rare villas in the suburbs.

Minimum prices: studios – from $60-70 thousand, 1-bedroom apartments – from $80-100 thousand, premium condos – from $200-250 thousand.

Popular areas:

- Sukhumvit (Thonglor, Ekkamai): active lifestyle, restaurants, shopping centers, popular with expats.

- Silom / Sathorn: business districts, prestigious rentals for office workers.

- Ari / Phrom Phong: quiet residential areas, high demand for long-term rentals.

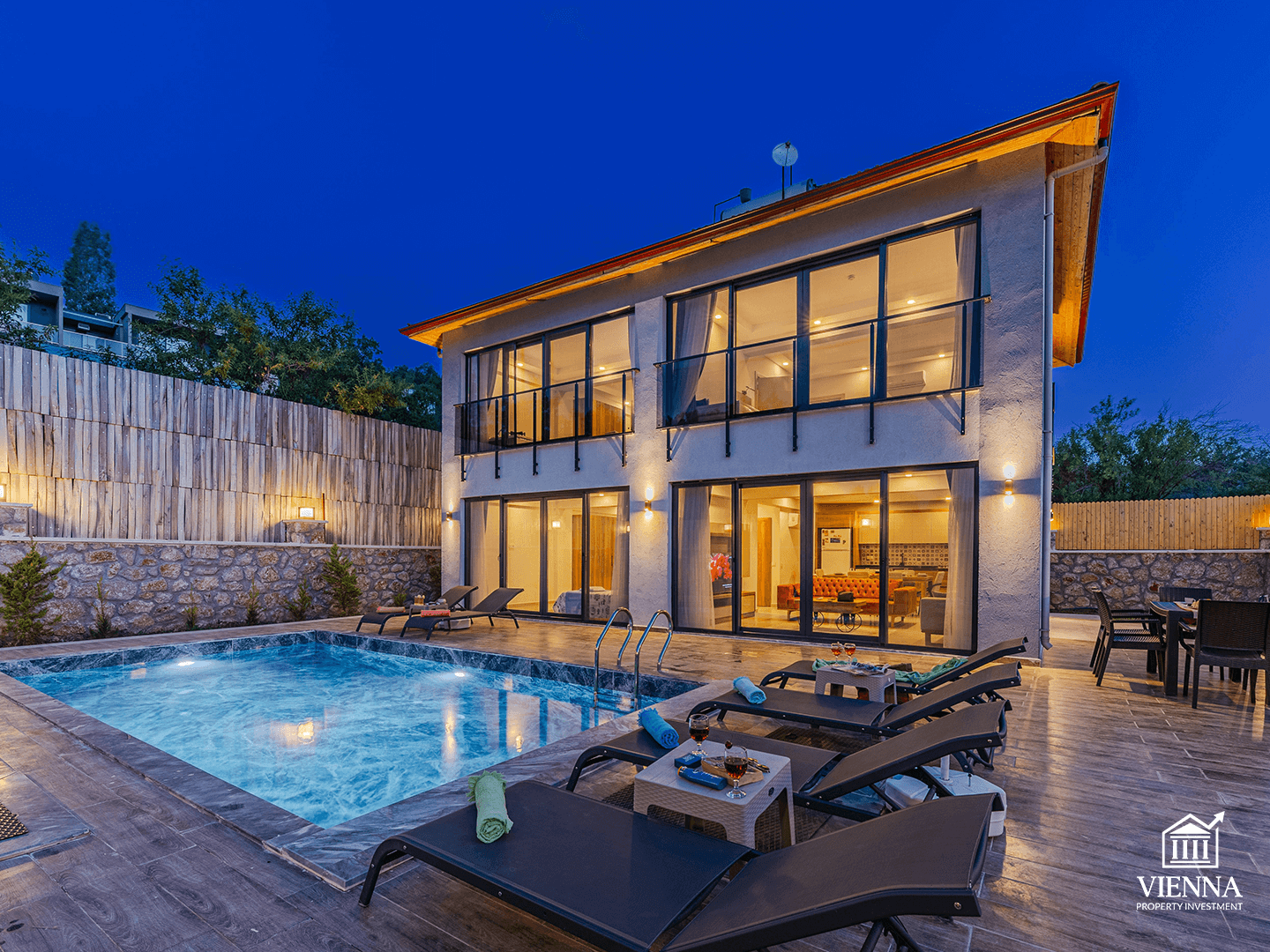

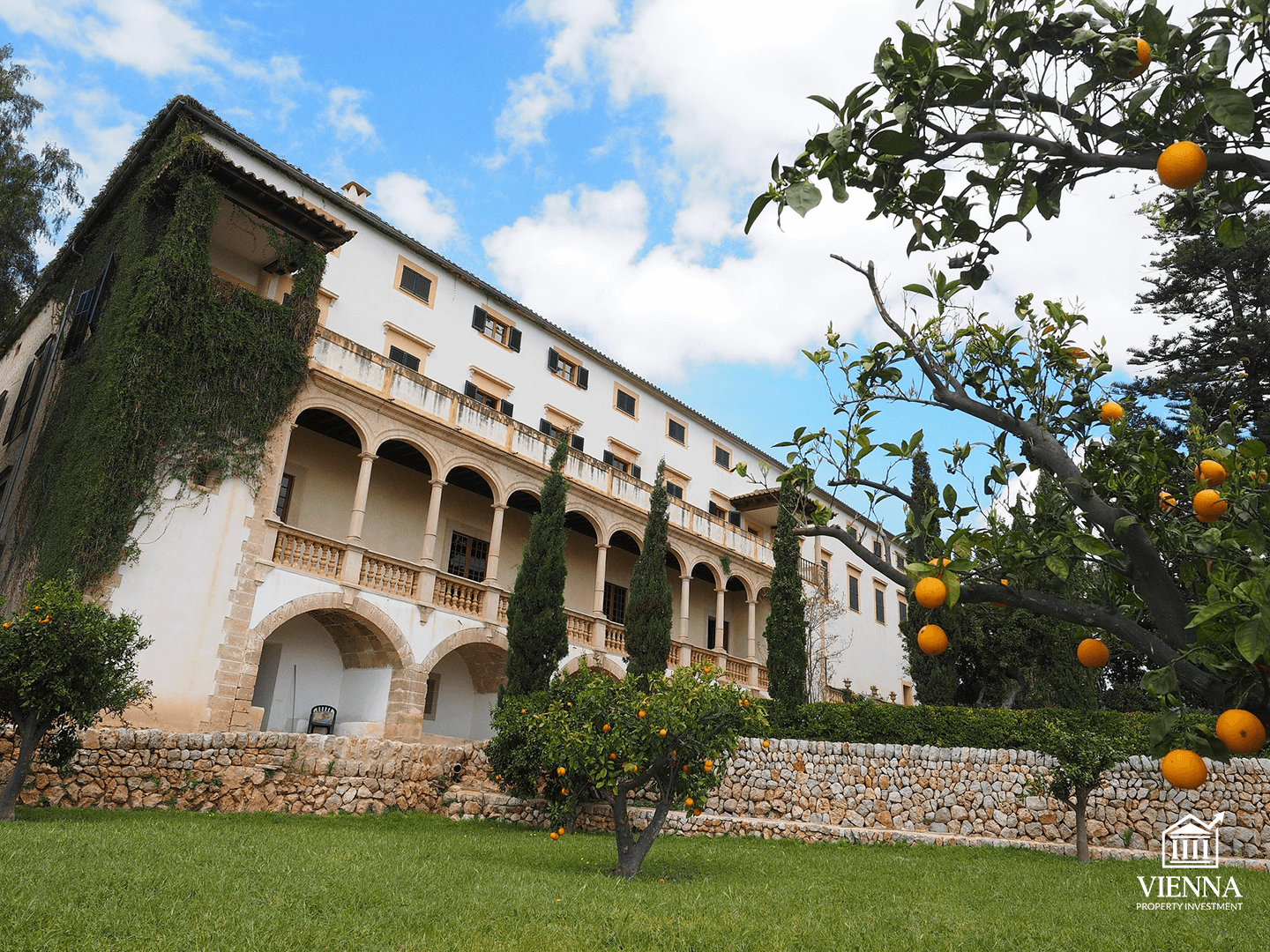

2. Phuket

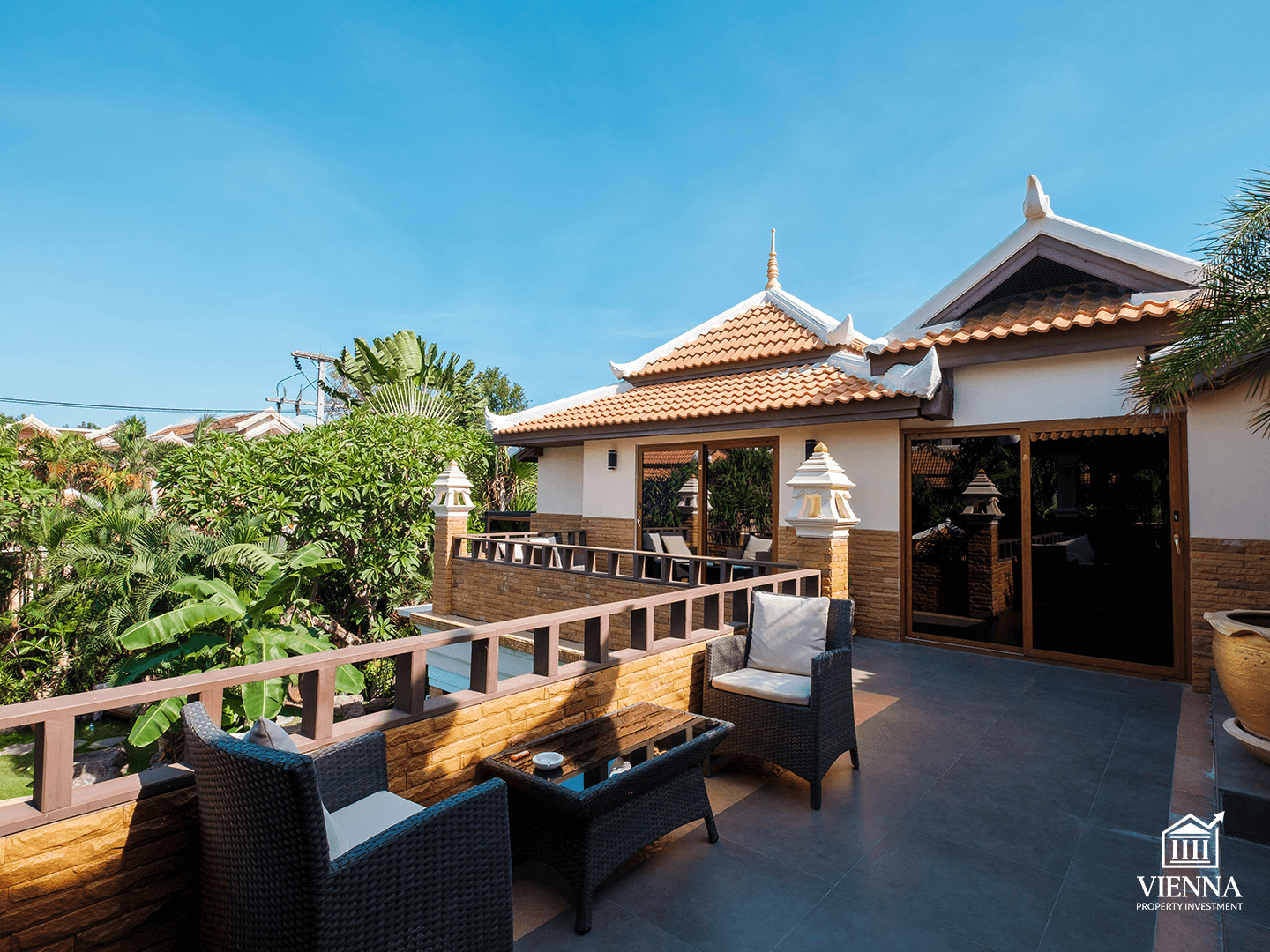

Phuket is a premium resort market with seaside properties, attracting tourists and condo hotel owners. It offers high short-term rental income potential, but is highly seasonal.

Property types: villas with pools, condominiums with sea views, apartments in tourist areas.

Minimum prices: condos – from $100,000–120,000, villas – from $250,000, premium villas – $500,000 and up.

Popular areas:

- Patong / Karon / Kata: tourist flow, high short-term profitability.

- Kamala / Surin / Bang Tao: premium villas, quiet areas, well suited for lifestyle investments.

3. Samui

Samui is geared toward lifestyle and mid-term rentals for digital nomads. Yields are slightly lower than in Phuket, but the market is stable throughout the year.

Property types: condos, villas, studios and apartments near the beaches.

Minimum prices: studios – from $80 thousand, 1-bedroom apartments – from $120 thousand, villas – from $200 thousand.

Popular areas:

- Chaweng / Lamai: central beaches with active rentals for tourists.

- Bophut / Maenam: Quiet areas with lifestyle and long-term tenants.

4. Chiang Mai

Chiang Mai is a student and IT hub where long-term rentals are in demand. Seasonality is low, yields are average, and entry barriers are low.

Property types: apartments and townhouses, detached houses in the suburbs.

Minimum prices: studios – from $50–60 thousand, 1-bedroom apartments – from $70–80 thousand, houses – from $150 thousand.

Popular areas:

- Nimman / Santitham: IT and coworking, digital nomads in demand.

- Old City / Riverside: close to universities and tourist areas.

5. Pattaya and Hua Hin

Pattaya and Hua Hin are a mass-market segment with affordable real estate. They are suitable for investors with limited budgets, with high competition and moderate returns.

Property types: condos, high-rise apartments, small villas.

Minimum prices: condos – from $50-70 thousand, 1-bedroom apartments – from $60-80 thousand, villas – from $150-180 thousand.

Popular areas:

- Pattaya Central / Jomtien: tourist centers, high short-term rentals.

- Hua Hin City / Khao Takiab: quiet areas, well suited for family lifestyle.

Comparison table of regions and characteristics:

| Region | Property type | Minimum prices | Market Features | Popular areas |

|---|---|---|---|---|

| Bangkok | Condos, apartments, rare villas | $60-250 thousand. | Long-term rental, stable demand | Sukhumvit, Silom, Ari |

| Phuket | Villas, condos, apartments | $100-500 thousand. | Short-term rental, seasonal | Patong, Kamala, Bang Tao |

| Samui | Condos, villas, studios | $80-200 thousand. | Lifestyle, medium-term rental | Chaweng, Bophut, Maenam |

| Chiang Mai | Apartments, townhouses, houses | $50-150 thousand. | Long-term rentals, students, IT | Nimman, Old City, Riverside |

| Pattaya / Hua Hin | Condos, apartments, villas | $50-180 thousand. | Affordable segment, high competition | Pattaya Central, Jomtien, Hua Hin City |

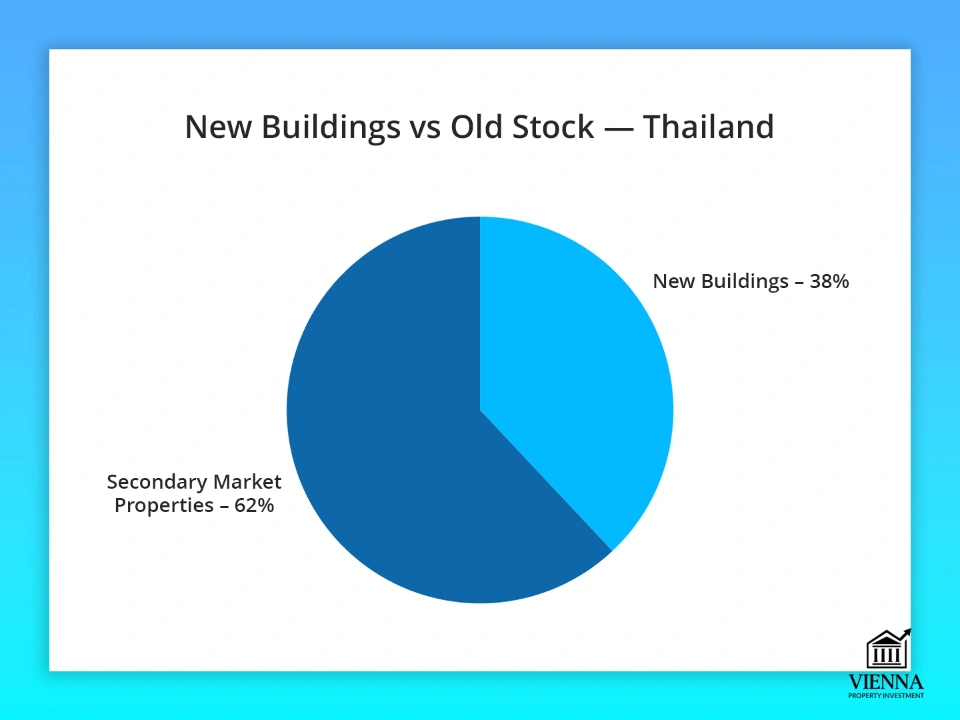

Secondary market and new buildings

The Thai real estate market is divided into secondary and primary (new buildings), and each category has its own characteristics from an investor's perspective.

The secondary market is characterized by more affordable prices and completed properties, allowing for immediate rental income. The investor's primary responsibility here is to thoroughly inspect the property: the condition of utilities, the deterioration of building materials, and the presence of defects or flaws that could impact renovation costs and future income.

It's also important to evaluate location and infrastructure—resales in prestigious areas of Bangkok or Phuket can be more profitable than new developments due to the immediate flow of tenants and established demand.

New developments (off-plan) offer the opportunity to purchase real estate at a lower price, but are associated with risks: construction delays, changes in delivery dates, the need to adhere to a payment schedule, and possible changes to the project.

Payments are typically made in stages: an initial deposit, several tranches as construction is completed, and a final payment upon handover of the property. Due diligence of the developer and the terms of the contract is crucial to mitigate risks.

The price range on the market varies: studios and small condos in Bangkok and Chiang Mai start at $50,000-70,000, while villas in Phuket and Koh Samui cost from $300,000 and up.

Thailand vs Austria

| Parameter | Thailand | Austria |

|---|---|---|

| Minimum entry price | Studios $50-70 thousand, villas $300 thousand+ | Apartments from €150-200 thousand, villas from €500 thousand. |

| Secondary market | More affordable, wider selection, risk of wear and tear | More expensive, high quality, stable liquidity |

| New buildings | Low entry potential, risk of delays | More expensive, high-quality construction, minimal risks |

| Profitability | Higher through short-term rentals | Below, focus on long-term rentals |

Overall, the secondary market allows for a quicker start to generating income and selecting completed properties in key areas, while new developments are suitable for strategic investors willing to wait and manage project risks.

Alternative investor strategies

In Thailand, there are many options for diversifying your investment portfolio beyond the standard condominium or villa ownership.

condo hotels are properties where the developer or management company guarantees a fixed income for several years. This reduces operational risks, but the yield is typically lower than with independent rental properties.

Managed villas offer higher returns through short-term rentals, but require professional management and maintenance. The investor receives a share of the income, and the company handles marketing, cleaning, and rental management.

Student rentals in Chiang Mai and Bangkok are targeted at students and young professionals. A steady flow of tenants makes income less seasonal, although properties require more frequent interior renovations and maintenance.

Commercial real estate, including offices, warehouses, and street retail, is in demand in major cities, but requires deeper market analysis and long-term management.

Land through an SPV allows a foreigner to bypass restrictions on direct land ownership. The investor creates a Thai company (SPV) and purchases the land through it. This provides flexibility, but adds legal and tax implications.

Comparison with Austria

| Strategy | Thailand | Austria |

|---|---|---|

| Condo hotels | Popular, yield 6-10%, managed through a company | Not very common, focus on the long term |

| Villas under management | High profitability, operational risks | Rarely used, long-term rental |

| Student rentals | Chiang Mai, Bangkok, stable demand | Small university towns, lower income |

| Commercial real estate | Offices, warehouses, street retail | Offices, long-term contract, high stability |

| Land via SPV | Allows foreigners to own indirectly | Direct ownership possible, limited tax schemes |

Thailand offers investors a wide range of short-term and specialized formats, where returns can be higher, but operational and legal risks are higher. Austria, on the other hand, focuses on stability and long-term leases, where returns are lower, but legal and market risks are minimal.

Remote purchase

The modern real estate market in Thailand is highly adapted to foreign investors, and a significant portion of transactions are completed remotely, without the buyer having to be physically present in the country. This has become especially relevant in the post-COVID period, when online processes have been built almost turnkey.

The process begins with choosing a property: developers and agencies provide 3D tours, video reviews, and detailed floor plans of apartments or villas. Many companies organize "virtual showings" via Zoom or WhatsApp, where an agent shows the property in real time and answers questions. After deciding to purchase, the investor signs a reservation agreement online, paying a deposit via international bank transfer.

Remote legal support is also In Thailand, notary representation is not mandatory, so contracts can be drawn up by a lawyer acting under a power of attorney. The client signs the power of attorney with a notary in their home country (with subsequent apostille or consular legalization), and the lawyer in Thailand is authorized to represent their interests before the land department.

Financial settlements are made via bank transfer from abroad. The law requires that foreign condo buyers bring funds into the country in foreign currency and then convert them into baht. To confirm the source of funds and comply with currency regulations, a Foreign Exchange Transaction Form (FET) is completed. This document is critically important: without it, ownership of the apartment cannot be registered.

The transaction is registered with the Land Department , the local land office. The investor does not need to be present: a lawyer or representative completes the process, obtains the Chanote (title deed), and transfers it to the client.

Therefore, purchasing real estate remotely in Thailand takes 4 to 8 weeks, depending on the type of property (completed or under construction) and the speed of bank transfers. This flexible model allows investors from all over the world to enter the market without complex bureaucratic procedures.

Comparison with Austria

| Stage | Thailand | Austria |

|---|---|---|

| Main person | Lawyer / agent | Notary |

| Signing | Possibly remotely | EU Notary, personal presence |

| Bills | Transfer through a developer or lawyer | Notarial escrow |

| KYC/AML | Yes, but more flexible | Very strict |

| Convenience for non-residents | Easier to get started, quick transactions | More formalized, but safer |

Risks and Disadvantages

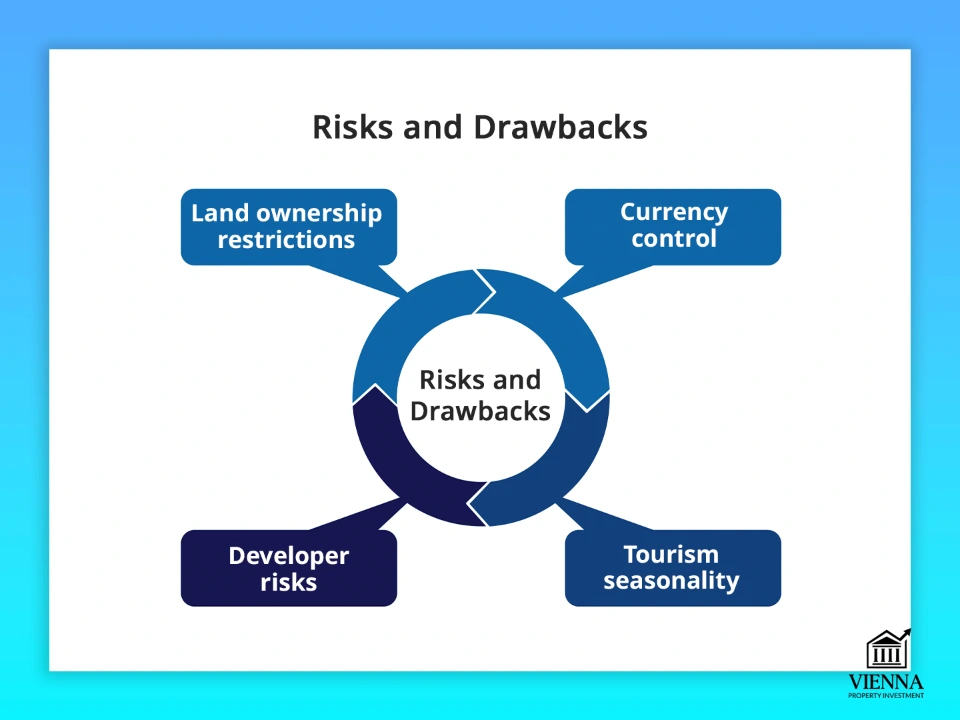

Investing in Thai real estate offers high returns and low entry barriers, but it comes with a number of specific risks that are important to consider before purchasing.

Land restrictions – foreigners cannot own land directly. Ownership is only possible through a leasehold (30-90 year lease) or an SPV (Thai company). This creates legal nuances and requires careful document verification.

Foreign exchange controls – large transfers from abroad must be accompanied by a declaration and proof of source of funds to register the foreign currency with the Bank of Thailand. Errors can lead to delays in property registration and legal complications.

Developer risks are especially relevant for new (off-plan) construction projects. Construction delays, payment schedule changes, or substandard project quality are possible.

Tourist seasonality – short-term rentals are highly dependent on the influx of tourists. In Phuket and Koh Samui, summer rental yields can drop by 30–50% compared to peak months.

Accommodation and lifestyle

Thailand attracts not only investors but also those looking to combine investment with a comfortable lifestyle. The country offers a unique combination of a tropical climate, seaside coastline, low cost of living, and developed infrastructure for expats.

Climate and ecology

A tropical climate with a hot season from March to May, a rainy season from June to October, and a cool dry season from November to February makes Thailand attractive for year-round living. Regional differences also impact comfort: the north of the country (Chiang Mai) is cooler and greener, while the south (Phuket, Koh Samui) provides access to the sea and beaches, but with high humidity. The sea and tropical forests create a unique lifestyle for nature lovers and outdoor enthusiasts.

Medicine and healthcare

Thailand has a well-developed network of international clinics and hospitals. Bangkok, Phuket, and Koh Samui boast facilities with high standards of care, English-speaking staff, and modern equipment. Medical costs for residents and long-term visa holders are significantly lower than in European countries, while maintaining comparable quality of services. Private insurance for foreigners covers treatment and consultations with specialists.

Cost of living and comfort

Living in Thailand is significantly cheaper than in Western Europe. Rent for a comfortable apartment or condo in Bangkok or Chiang Mai can range from $400-$800 per month, while renting a villa in Phuket or Koh Samui costs $1,200-$2,500. Grocery, transportation, utilities, internet, and housekeeping are all cheaper than in the EU. This level of expenses allows investors not only to live comfortably but also to keep most of their income from rental properties.

Expat community

Thailand actively attracts expats from Russia, Europe, China, and the United States. Large expat communities have formed in major tourist and business centers such as Bangkok, Phuket, Koh Samui, and Chiang Mai. They provide support with everyday matters, assist with legal and banking matters, and create clubs and schools for the children of expats. This facilitates adaptation and makes life comfortable.

Social and cultural environment

The country is renowned for its safe and peaceful atmosphere, with a low crime rate compared to major European cities. The local population is friendly and polite toward foreigners, especially in tourist and expat areas. International schools offering English-language programs are available for families with children, facilitating integration.

Accessibility of infrastructure and transport

Major cities and resort areas have a well-developed network of roads, public transportation, airports, and seaports. Bangkok has both the BTS and MRT, providing convenient transportation access. The tourist areas of Phuket and Koh Samui have extensive taxi, car rental, and ferry services.

Entertainment and lifestyle

Thailand offers a wide range of leisure opportunities: beaches, water sports, golf, yoga, fitness, international restaurants, spas, and cultural events. Cultural events and festivals, such as Songkran (Thai New Year) and Loy Krathong, create a special atmosphere.

| Region | Climate | Medical services | Cost of living | Expat community | Lifestyle / leisure |

|---|---|---|---|---|---|

| Bangkok | Tropical, hot | International hospitals, private clinics | Average | Big | City life, offices, restaurants, shopping, nightlife |

| Phuket | Sea, hot | International hospitals | High | Average | Resort life, beaches, water sports, golf, spa |

| Samui | Marine, tropical | Private clinics | Average | Average | Lifestyle, digital nomads, yoga, beaches, active recreation |

| Chiang Mai | Tropical, cooler in the north | Hospitals and clinics | Low | Average | Coworking spaces, students, IT, cultural events, mountain routes |

| Pattaya / Hua Hin | Tropical, hot | Mid-level clinics | Average | Average | Affordable resorts, beaches, active recreation, mass tourism |

Exit from investments

Exiting a real estate investment is a key stage in an investor's strategy. It depends on the property type, region, ownership structure, and market conditions. In Thailand, the market offers both high returns and certain challenges related to liquidity and seasonality, while Austria offers stability but low income potential.

Sales and the role of agencies

In Thailand, real estate sales are often handled through agencies, especially if the owner is abroad. Agencies help assess the price of a property based on seasonality, demand dynamics, and rental type (long-term or short-term).

In Bangkok and Chiang Mai, properties sell faster thanks to steady demand from expats and digital nomads. On the resort islands of Phuket and Koh Samui, the average sale period can be longer due to seasonal fluctuations in tourist flow.

Exit Timing and Liquidity

Average exposure time of real estate on the secondary market in Thailand:

- Bangkok: 3-6 months, high interest in condos and apartments for long-term rental.

- Phuket/Samui: 6-12 months, higher returns but seasonal market.

- Chiang Mai: 3-6 months, long-term rentals, stable demand from students and IT professionals.

- Pattaya/Hua Hin: 4-8 months, mass segment, high competition.

By comparison, liquidity in Austria is more evenly distributed: Vienna – 2-4 months, Salzburg – 3-5 months, Innsbruck – 3-6 months. Despite the lower yield, the market is less volatile.

Taxes on sale

Capital gains tax in Thailand for non-residents is approximately 5-10% depending on the property category and ownership period, plus a stamp duty of up to 2%. Taxes for SPV owners may vary and require legal advice. In Austria, capital gains tax for individuals is approximately 25%, which reduces returns but makes the sale process transparent and predictable.

Inheritance and structuring

Exiting an investment may involve inheritance or gifting. In Thailand, it's important to properly register the title, especially when holding through an SPV. Without this, asset transfers can be difficult. In Austria, direct ownership and the notarial system make property transfers simpler and more secure.

Profit on sale

Thailand offers high potential exit returns – up to 12% per annum for resort properties with short-term rentals. In urban locations such as Bangkok and Chiang Mai, returns are slightly lower (3-6%) but more stable. In Austria, exit returns are low – 2-3%, but the risk of capital loss is minimal.

Factors Affecting a Successful Exit

- Location: Tourist and business areas sell faster and for more.

- Seasonality: Resort areas depend on the influx of tourists; peak sales are during the high season from November to February.

- Property type: Apartments and condos sell faster than resort villas.

- Legal clarity: having a clear title and a verified SPV significantly speeds up the process.

- Income management: Properties with proven rental income attract more buyers.

Exiting Investments: Thailand vs. Austria

| Parameter | Thailand | Austria |

|---|---|---|

| Average sales time | 3-12 months depending on the region | 2-6 months, evenly distributed across cities |

| Liquidity | High in Bangkok and Chiang Mai, average in resorts | Stable, high |

| Capital gains tax | 5-10% + stamp duty up to 2% | 25% + stamp duty 0-2.5% |

| Potential profitability | 3-12% per annum | 2-3% per annum |

| Seasonality | High in resort areas | Almost absent |

| Risks | Regional, currency, legal (SPV, leasehold) | Minimal, predictable |

Exiting investments in Thailand is potentially more profitable, but requires planning and consideration of seasonality, legal aspects, and choosing the right region. Austria offers minimal risks and quick liquidity, but yields are low and less attractive for short-term strategies.

Real cases

Case 1: Bangkok – 60 m² condo, 4.8% yield

An investor purchased an apartment in a new residential complex in the Sukhumvit area, near the BTS Skytrain. The property is fully furnished by the developer and leased long-term to an expat from the IT sector.

The average rental rate provides a yield of 4.8% per annum, while the location's liquidity is high due to stable demand for housing from specialists at international companies. This case illustrates the strategy of "conservative investment in the capital with low risks.".

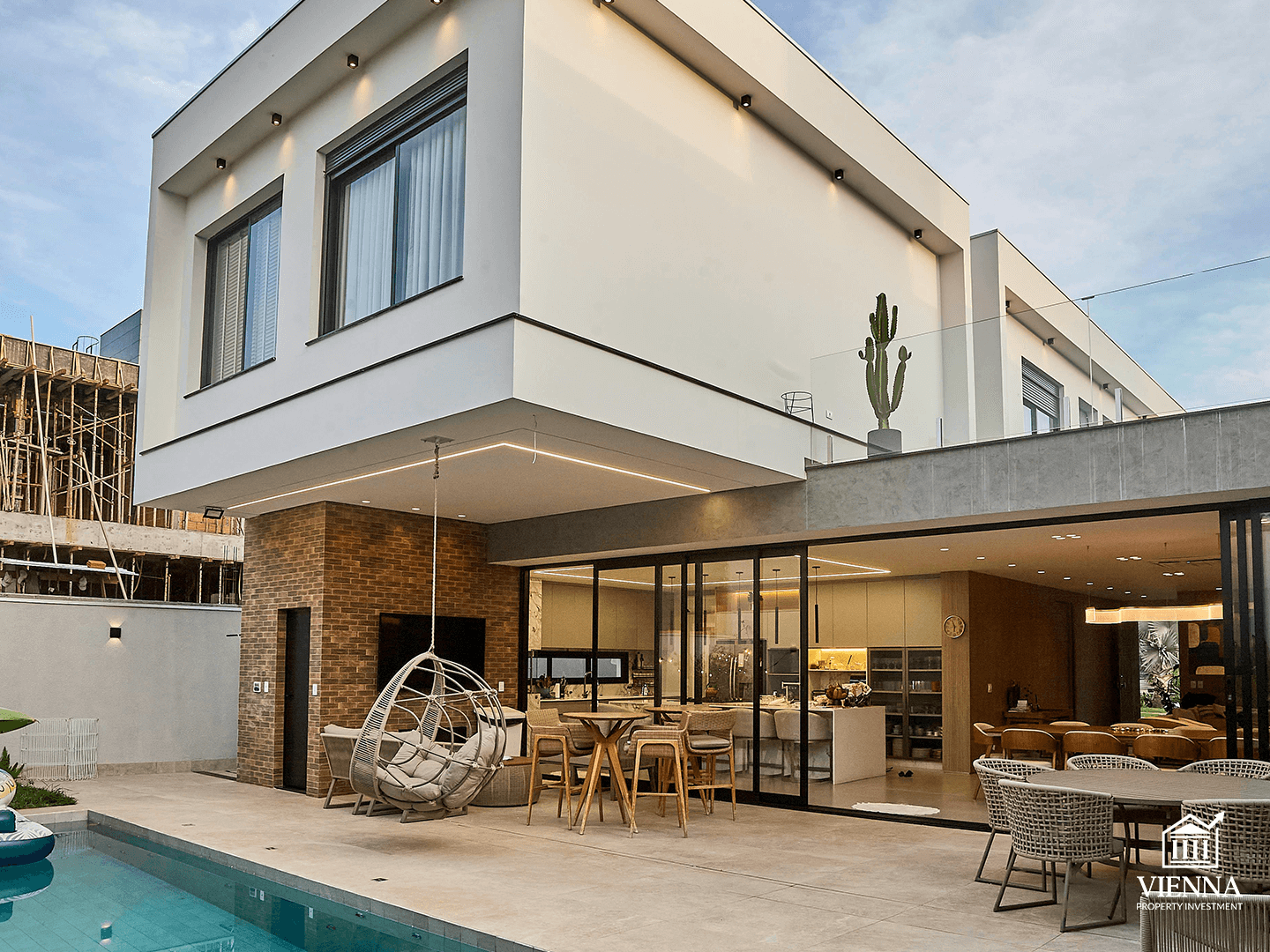

Case 2: Phuket – 250 m² villa with pool, yield 9.5%

A client from Dubai invested in a villa on the island's west coast, in the Bang Tao area, home to luxury resorts. The property is managed by an international company that offers short-term rentals through Airbnb and Booking.

Thanks to high tourist traffic and the premium segment, the property yields 9.5% per annum, and during the high season, returns exceed 12%. This is an example of an aggressive strategy – "resort real estate with an emphasis on short-term rentals.".

Case 3: Samui – 45 m² condo, 7.1% yield

A young European investor purchased a small apartment near Chaweng Beach. The property was purchased fully furnished and finished, with additional investment in a design package to enhance its rental appeal.

The apartment is rented to digital nomads and tourists for 3-6 months, yielding 7.1% per annum. The Koh Samui market is stable year-round, and the property combines income and lifestyle features.

Case 4: Chiang Mai – 35 sq m studio, 5.4% yield

A Singaporean investor purchased a studio in a modern condo near Chiang Mai University and the IT Park. Demand is primarily from students and freelancers working in the IT sector.

The yield was 5.4% per annum, and the property is not affected by the tourist season, with occupancy remaining high year-round. The case study's strategy is "stable cash flow in an educational and technology center.".

Case 5: Pattaya – 40 m² condo-hotel, guaranteed income of 6%

A client from Kazakhstan purchased an apartment in a condo-hotel complex with a guaranteed income from the management company. The management company handles marketing and rental operations, paying a fixed 6% annual interest for the first five years.

After the guaranteed period ends, profitability will depend on occupancy, but the property is located in the center of Pattaya within walking distance of the beach, which reduces risks.

Case 6: Hua Hin – 180 m² house, 4.2% yield

A European family purchased a house in a gated community near a golf course. They use the property partly as their own residence and partly as a rental through a management company.

The average yield is 4.2% per annum, but the main purpose of the purchase is a lifestyle investment: the opportunity to spend the winter in Thailand and earn additional income when the house is empty.

My opinion as an expert: Ksenia Levina

I've been working with real estate in Asia and Austria for over ten years and see how these markets differ greatly in structure, risks, and investment approaches. Thailand has always been an interesting platform for me – it combines high returns and lifestyle factors, but requires careful preparation and legal considerations.

The first thing I always advise my clients is thorough due diligence. In Thailand, it's crucial to check the title deed, developer permits, and ownership conditions, especially when it comes to villas and leasehold structures. The second key factor is analyzing tourist traffic and rental demand: this determines the return on investment and the exit timeframe.

When choosing a property, I base it on the client's strategy. If a conservative model is desired, it's better to consider Bangkok, with its long-term rentals for expats and international professionals. If a balance between profitability and stability is desired, then Koh Samui or Chiang Mai, where the market is less susceptible to seasonal fluctuations. For those prepared for a more aggressive strategy, I recommend Phuket, where short-term rentals offer yields of up to 10-12%, but seasonality and regulatory risks must be taken into account.

I also draw my clients' attention to ownership structures and tax optimization. Various structures are possible in Thailand, from directly owning an apartment to registering a company under a villa. Each structure has its own tax implications, and it's important to understand them beforehand.

For me, a smart strategy often involves combining two worlds: the stability of Austria and the profitability of Thailand. Vienna offers capital preservation and predictability, while Phuket or Koh Samui allow you to increase returns and add a lifestyle component to your portfolio. This balance works best for both family investors and those building an international portfolio.

"Investing in real estate in Thailand isn't just about the seaside lifestyle; it's also about the returns, which are often two to three times higher than in Europe. I support clients every step of the way: from choosing a location and vetting the developer to arranging the lease and exiting the investment. The only question is, what's more important to you—the stability of a metropolis or the dynamism of a resort? Which strategy will you choose?"

— Ksenia , investment consultant,

Vienna Property Investment

Conclusion

The choice between Thailand and Austria depends on the investor's objectives. If the primary goal is to preserve capital in a stable jurisdiction with predictable rules, Austria is the better option. However, if the investor is seeking returns linked to the region's booming tourism and development, Thailand offers a wider range of opportunities.

Thailand wins in terms of tax burden, entry costs, and profitability potential. However, it requires greater attention to legal aspects and professional support. Austria is a safe haven for conservative investors, where returns are low but risks are minimal.

Expert advice boils down to three key rules:

- It is essential to work with a lawyer who has experience in Asia.

- Check the developer and the legal history of the property.

- Plan your lease management and exit strategy from the outset.

The forecast for 2030 favors Thailand: tourism is expected to grow to 80-90 million people per year, along with large-scale infrastructure projects (airports, high-speed trains, roads), and stricter short-term rental regulations. All of this will lead to higher prices in key regions (Phuket, Bangkok, and Koh Samui), but will require more sophisticated deal structuring.

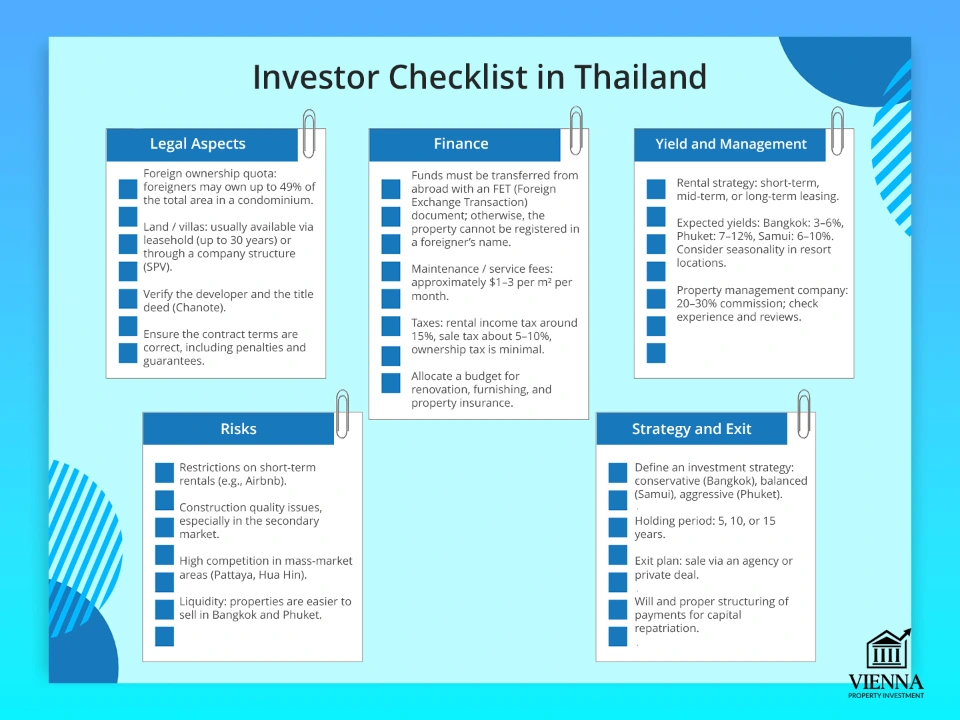

Investor checklist

1. Legal part

Ownership verification: Foreigners can own a condo within the 49% quota or leasehold a land/villa for up to 30 years (with an option to extend). For land, an SPV (private partnership) or a structure with a Thai partner is more commonly used.

Condominium Quota: Make sure that the foreign quota in the project is not exceeded (otherwise the purchase will not be possible).

Developer and property: check the legal purity of the project, the availability of permits, the history of completed projects, and the absence of lawsuits.

Due diligence: Hire a lawyer to check the title deed (Chanote), registered encumbrances, and outstanding taxes or utility bills.

Contract: carefully review the terms of the contract – penalties for late payments, developer guarantees, deposit return conditions.

2. Financial part

Currency control: funds must be transferred from abroad in a foreign currency with the correct payment purpose (Foreign Exchange Transaction Form), otherwise the property will not be registered to a foreigner.

Service fees: find out in advance how much it costs to maintain the complex (usually $1-3/m² per month).

Renovation and furnishings: New builds often have a bare shell or basic finish, but furnishings are required for rental properties. Calculate a budget for this.

Taxes:

- Rental income – 15% for non-residents.

- When selling – capital gains tax and stamp duty (5-10%).

- Ownership – minimal tax (0.01-0.1% of cadastral value), but service fees can be more significant.

Insurance: take out insurance for the property (against fire, flood, natural disasters).

3. Management and profitability

Choice of rental model: short-term (Airbnb, Booking), medium-term (digital nomads) or long-term (expats, students).

Management company: sign a contract with a property management company (commission is typically 20-30% of the rent). Check the company's experience and reviews.

Profitability: Estimate the actual yield – not only based on the developer's paperwork, but also on independent data. Compare with other regions (Bangkok 3-6%, Phuket 7-12%, Koh Samui 6-10%).

Seasonality: Keep in mind that in resort locations (Phuket, Samui) income varies greatly depending on the season.

4. Operational risks

Short-term rental regulations: In Thailand, laws restrict daily rentals, but in practice, they are not always enforced. It's important to understand the local risks and work with management companies that understand the nuances.

Construction quality: carefully inspect the property, especially the secondary market (moisture, air conditioners, electrical systems).

Competition: in mass segments (Pattaya, Hua Hin) there is a high supply, which reduces profitability.

Exiting an investment: Assess the location's liquidity in advance – selling in Bangkok and Phuket is easier than in Pattaya or smaller towns.

5. Strategy and exit plan

Investment scenario: define your strategy (conservative Bangkok, balanced Samui/Chiang Mai, aggressive Phuket).

Ownership period: Do you plan to hold the property for 5, 10, or 15 years? This affects taxes and profitability.

Access: through an agency or private deal. In resort locations, the exposure period can take 12-18 months.

Inheritance: Making a will (possible in Thailand) will make it easier for heirs to register their rights.

Capital repatriation: Make sure all payments are processed correctly, otherwise it will be difficult to transfer money back abroad.