How to buy property in France without making a mistake

In 2025, the French real estate market is showing a strong recovery after a slowdown in 2023–2024. In the first half of the year alone, the number of transactions increased by 12% compared to the first half of last year. The average price per square meter nationwide reached €3,017. Paris remains the most expensive market, with prices at €9,420 per square meter, up 0.4% from February 2025.

The purpose of this article is to discuss the investment appeal of French real estate. In this article, we will analyze key market trends, assess the legal and tax conditions, and discuss which properties and locations merit investor attention depending on their goals.

Why now?

- Market activity is growing. In the first six months of 2025, the number of transactions increased by 12% compared to 2024.

- Rising premium regions: Paris, the Côte d'Azur, and Provence continue to experience steady price growth.

- Changes to rental regulations. The new rules encourage long-term contracts and reduce the risks of short-term rentals.

- A reliable investment asset. Amid global economic instability, France remains a safe option for protecting capital.

"The French real estate market is traditionally perceived as reliable and predictable. However, behind this stability lie complex legal and tax mechanisms. My job as an investment advisor is to help you understand the nuances, minimize risks, and maximize your investment."

— Ksenia , investment consultant, Vienna Property Investment

My name is Ksenia Levina. I am a lawyer by training, and I specialize in real estate investments in EU countries, including France, Austria, and Germany. Over the years, I have supported transactions at every stage: from property selection and legal due diligence to tax optimization and ownership structure. My primary goal is to protect investments and make the investment process clear and profitable for clients.

France vs. Austria: Real Estate Investments

France offers investors high liquidity, a wide selection of properties, and a well-developed infrastructure. It offers everything from apartments in Paris and houses in the suburbs to Alpine chalets and coastal villas. France combines the appeal of lifestyle investments with comparatively high income potential, as tourism and high rental demand create sustainable yield potential, especially over the long term.

Austria, on the other hand, boasts a more stable market model. Risks are lower, legislation is more transparent, and investor rules are stricter, ensuring reliable capital protection. Rental yields in Austria are typically limited to 2-3% per annum, but this conservatism makes the market predictable. An important factor is the consistently high demand for Austrian real estate, which supports prices and confirms continued interest from buyers. Unlike France, where returns are largely dependent on tourism and market fluctuations, in Austria, real estate serves as a means of capital preservation. Therefore, investing in real estate here is often perceived as a secure, long-term strategy rather than a way to make money aggressively.

Thus, France is suitable for those seeking more dynamic opportunities and willing to accept risks for high returns, while Austria is better for conservative investors who value stability, legal security, and long-term growth in property values.

France's place on the European investment map

France has long held a strong position among Europe's leading markets. Its legal framework protects investors' rights, and its high liquidity allows properties to find buyers and tenants.

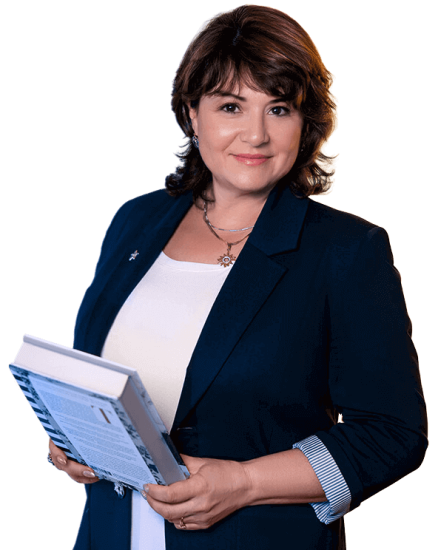

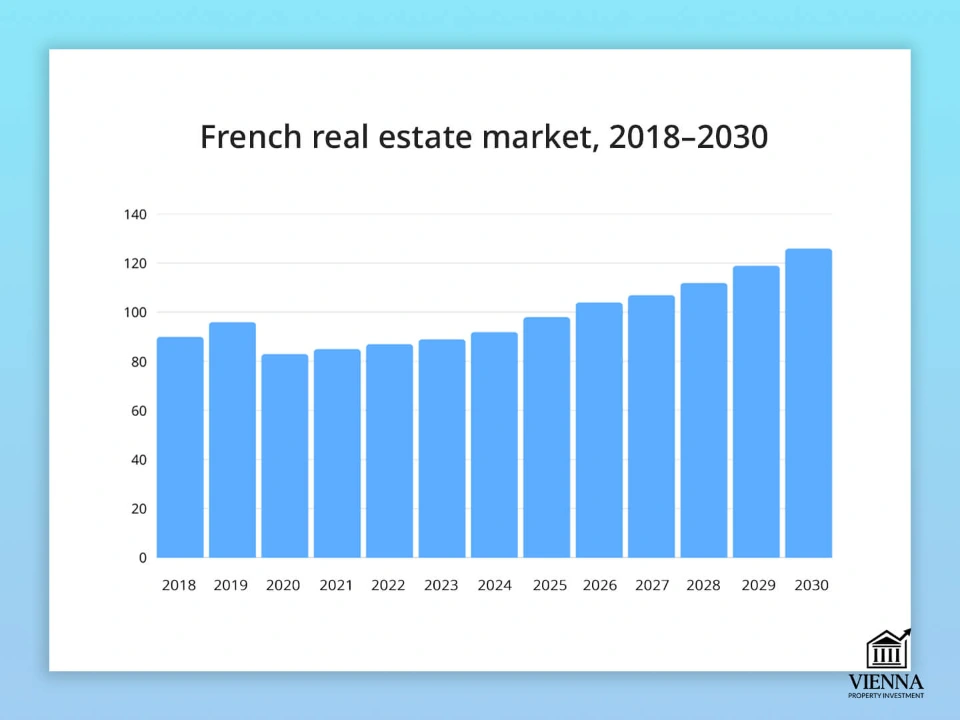

According to Mordor Intelligence Source, the French residential real estate market is valued at $528.33 billion in 2025 and is projected to grow to $697.52 billion by 2030, representing a compound annual growth rate (CAGR) of 5.92%.

The French real estate market

(source: https://www.mordorintelligence.com/industry-reports/residential-real-estate-market-in-france )

France as a mature and liquid market

The French real estate market is considered mature and stable: transparent transaction rules are established, and the legal system reliably protects investors' interests. As a result, real estate in France is quite liquid. This is especially noticeable in large cities and popular resorts, where properties rarely remain on the market for long, quickly finding new owners or tenants.

In our experience working with clients interested in purchasing affordable housing in France, we often considered options in the Parisian suburbs, as well as small apartments on the Côte d'Azur. Despite their relatively low prices, these properties demonstrated good returns, primarily due to the stable demand for long-term rentals.

Profitability and safety ratings

According to recent analytical reports from PwC and the World Bank, France consistently ranks among European leaders in terms of real estate transaction security and property rights protection. Moreover, rental yields in the country's largest cities exceed the average for the European Union, reaching approximately 4–5%.

Many investors underestimate the importance of legal protection. I always recommend that clients pay special attention to the legal due diligence of the property they are purchasing and work exclusively with reputable agents and notaries, especially when buying an apartment in France for rental purposes.

France's competitors

France combines relatively high returns, stability and predictability, and a lifestyle that is attractive to many buyers.

Why Investors Choose Paris and the South of France

Paris and the South of France traditionally remain key destinations for real estate investment in France. Their appeal is driven by a combination of high liquidity, stable demand, and a distinctive lifestyle appreciated by both locals and foreign buyers.

Paris is particularly attractive to investors seeking stable rental income and long-term capital appreciation. The Côte d'Azur and Provence, meanwhile, attract those seeking to combine investment with the region's prestige and tourism potential.

- Paris is the largest business and tourist center in Europe and has a high level of liquidity.

- The Côte d'Azur and Provence are premium regions where villas are in demand. There is also steady seasonal demand and consistent interest from foreign investors.

Even relatively low-priced properties in these areas can generate significant income. For example, one of my clients purchased a small villa in Nice: the rental income fully compensated for the investment in just the first two tourist seasons, even though the initial goal was to find an affordable home in France.

French Real Estate Market Overview

France generally maintains its status as one of the most stable and attractive markets in Europe. According to Notaires de France, 892,000 properties were sold in the country between April 2024 and April 2025 – 50,000 more than the previous year. The average home price reached approximately €2,953 per square meter.

History and Crises: How the Market Recovered

Market history shows that it can withstand serious crises. For example:

- 2008–2010: In major cities, existing housing prices declined by an average of 10–12%. A gradual recovery occurred due to sustained demand for long-term rentals.

- 2020–2021: During the COVID-19 pandemic, lockdowns and tourism restrictions led to a decline in interest in properties in tourist areas. However, domestic demand, particularly for new homes, supported the market.

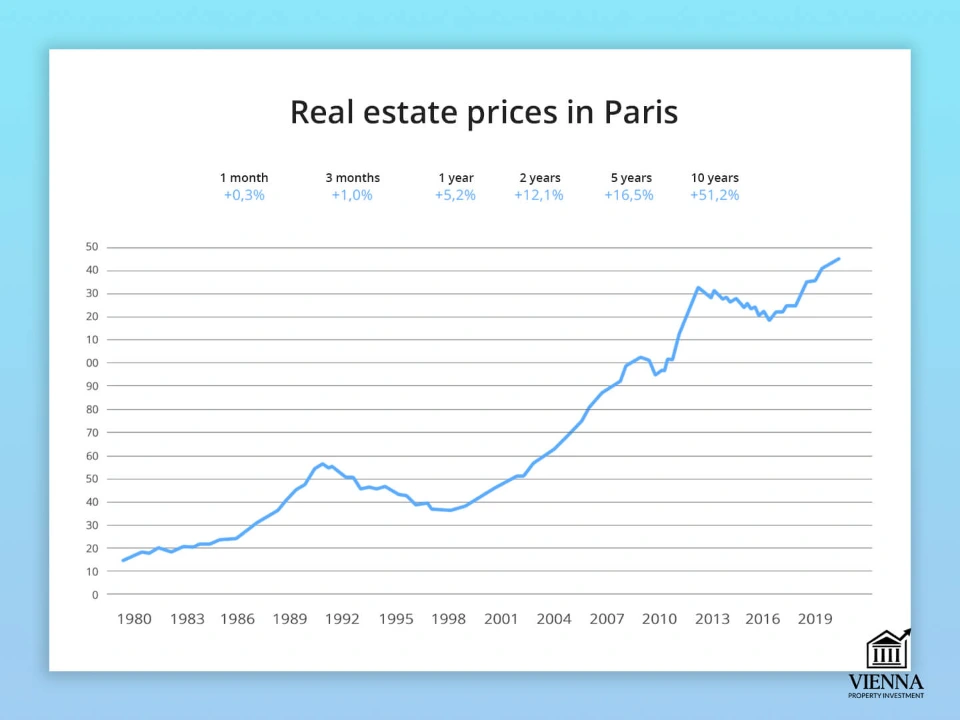

Paris property prices: +51% in 10 years

(source: https://foreignbuyerswatch.com/2019/02/21/property-prices-in-france/ )

French real estate has historically demonstrated resilience to economic crises. For investors looking to buy a home in France at an affordable price, it makes sense to look for options in regions with strong domestic demand.

A prime example: one of my clients purchased a small house in Provence immediately after the 2020 crisis. By 2022, the long-term rental income allowed him to fully recoup his investment.

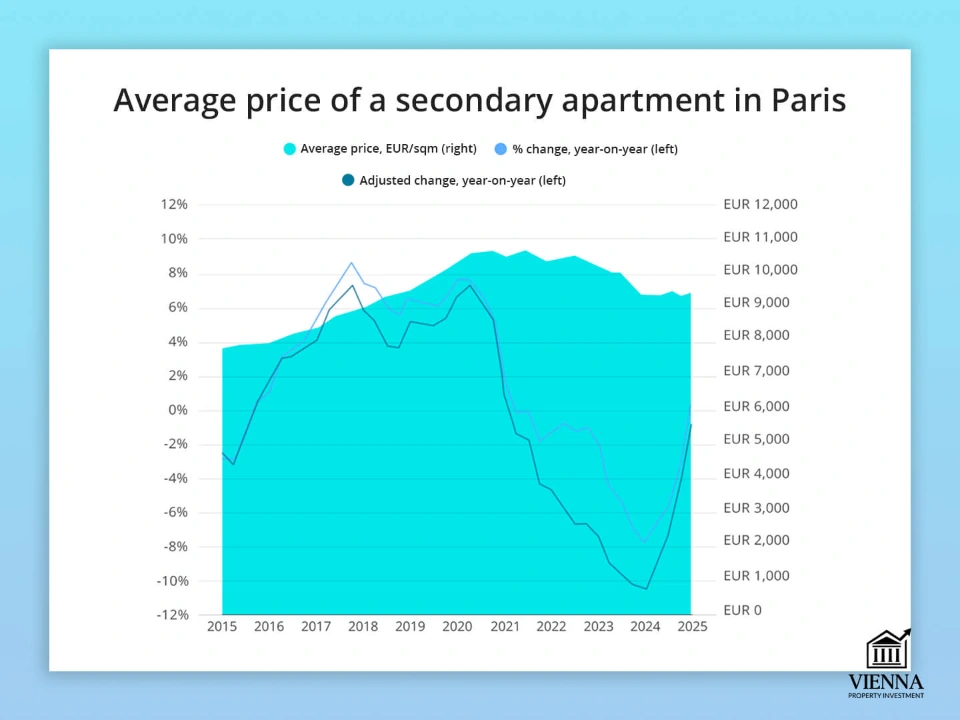

Price dynamics: growth in 2022–2025

Prices in major cities (Paris, Lyon, and the Côte d'Azur) grew steadily at 3-5% per year. However, the existing market grew more slowly than the new-build sector, opening up additional opportunities for investors looking to buy property in France for capital growth.

Even the most affordable properties in sought-after regions of France often remain liquid and generate stable rental income.

Geography of transactions: where they buy

It is important to understand that the country's market is highly regionally diversified, and the choice of property directly depends on the investment strategy.

- Paris : a cultural hub; housing from €350,000 to €900,000 for one- to three-bedroom apartments; premium penthouses from €1.2 million. Short-term rentals through Airbnb yield 4–5% per annum.

- Lyon : a university and industrial center; apartments from €250,000 to €600,000, large apartments from €700,000. Popular long-term rentals among students and professionals.

- Marseille : a port city with a large tourist flow; homes range from €180,000 to €450,000, with seaside homes starting from €500,000. Summer rentals yield 5–6%.

- Côte d'Azur : apartments from €300,000, villas from €1 million. Seasonal rentals are particularly profitable, with high liquidity.

- Bordeaux : apartments from €220,000 to €550,000, houses from €400,000. The region is steadily rising in price and is in demand among students and investors.

- Toulouse : apartments from €200,000 to €450,000, houses from €400,000. Popular long-term rentals thanks to the development of the aviation and IT industries.

- Alps : apartments from €250,000, chalets from €1 million. Popular among winter tourists, seasonal rentals bring in a stable income.

Object formats: what's in demand now

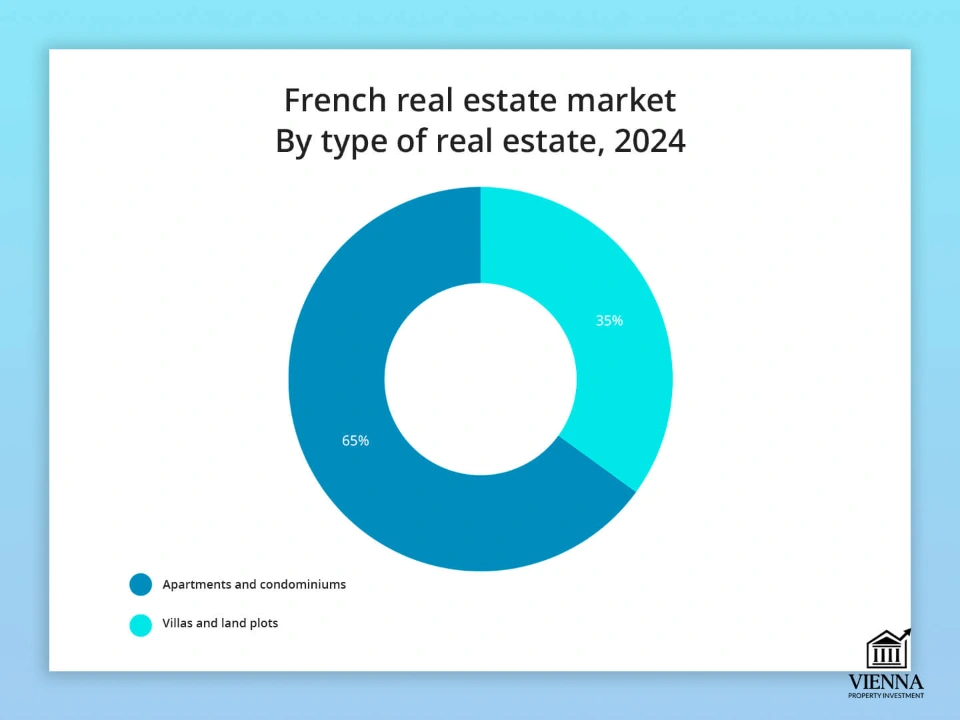

French real estate market by property type, 2024

(source: https://www.mordorintelligence.com/industry-reports/residential-real-estate-market-in-france )

Over 60% of transactions involve existing homes. Apartments and houses in city centers and suburbs are in demand for both rental and resale.

New developments remain popular, primarily in large cities and on the coast. Their advantages include modern layouts and tax incentives (such as the Pinel program). Prices range from €250,000 to €700,000, with premium properties starting at €1 million.

Apartments and studios are ideal for short-term rentals (Airbnb), especially in Paris, Lyon, and the Côte d'Azur. The average return is 4–5% per annum.

Chalets and villas are most popular in the Alps and the south of the country. Prices start at €250,000, with premium properties reaching €1 million. In tourist areas, they generate high seasonal income.

| Budget (€) | Property type | Area and district | Key Features |

|---|---|---|---|

| 180 000 – 450 000 | Studios and 1-2-room apartments | Marseille, Bordeaux, Toulouse | Resale, in demand for long-term rentals, liquid, suitable for beginning investors |

| 250 000 – 700 000 | New buildings, apartments with 1–3 rooms | Lyon, Paris suburbs, Côte d'Azur | Modern layouts, energy efficiency, tax benefits (Pinel), suitable for long-term rentals and capital appreciation |

| 300 000 – 700 000 | Apartments and studios for rent | Paris, Lyon, Côte d'Azur | Short-term rentals through Airbnb/Booking, high tourist flow, yield 4-6% per annum |

| 250 000 – 700 000 | Chalet, apartments in the Alps | Ski areas | Seasonal rentals, high winter returns, prestigious lifestyle |

| 600 000 – 1 500 000+ | Villas and premium apartments | Cote d'Azur, Paris, Bordeaux | Premium segment, high liquidity, long-term investment and rental income, prestigious lifestyle |

Who's buying: International investors

Foreign buyers account for only about 2% of the total volume of transactions on the secondary real estate market in France, but they are the ones driving steady demand for premium properties in tourist regions.

Main nationalities:

- Belgians account for approximately 20% of transactions involving foreigners. They are most active in the Var region and Provence-Alpes-Côte d'Azur (PACA).

- The British, at around 17%, prefer Dordogne and PACA. Their average purchase budget is approximately €500,000.

- Americans are the leaders in Paris, accounting for up to 25% of foreign transactions. The average budget is approximately €715,000. They are also showing interest in the Côte d'Azur.

- The Dutch – activity growth from 2022 to 2025 was +45%. Their choice is Creuset and Haute-Savoie, with an average budget of approximately €298,000.

- Germans traditionally buy property in the Var and Alsace for €400,000–600,000.

- Chinese investors account for up to 10% of deals in Paris and the Côte d'Azur. Their budgets often exceed €1,000,000.

- Lebanese account for approximately 12% of foreign transactions in Paris. They prioritize prestigious properties in the capital's prime locations.

The role of domestic demand

The French are actively investing in primary housing, which creates a solid foundation for long-term market stability.

Features of domestic demand:

- small apartments and houses in the suburbs of large cities are popular;

- apartments are in demand on the Cote d'Azur, as well as in Paris, Lyon, Bordeaux;

- housing is purchased not only for living, but also as a source of rental income;

- In megacities, domestic demand often exceeds supply, especially in the segment of new buildings with modern layouts.

When purchasing real estate in France, consider the balance between the interests of local and foreign buyers. This combination ensures high liquidity and stable returns, even if tourist traffic temporarily declines.

Ownership formats and investment methods

The choice of ownership structure depends directly on the investor's goals, budget, and strategy. There are several main methods for investing in real estate in France, each with its own advantages and limitations.

Direct ownership by an individual

The simplest option. Suitable for individual investors or partners who want to manage the property directly without complex legal structures.

Example: A client purchased a €320,000 apartment in Lyon in her own name for long-term rental. The return was approximately 4% per annum, while management was handled by a local real estate agency.

Société Civile Immobilière (SCI) is a French real estate company.

A form of joint ownership popular among families and small groups of investors. It simplifies the distribution of ownership shares and the transfer of inheritance.

Advantages of SCI:

- the possibility of ownership of an object by several participants at once;

- easy transfer of property by inheritance;

- tax benefits in certain cases.

Flaws:

- Mandatory accounting and reporting every year;

- more complicated registration procedure compared to direct ownership.

Example: A family decided to purchase a villa on the Côte d'Azur through an SCI, dividing the shares between parents and children. This simplified management and resolved inheritance issues in advance.

Investments through funds (SCPI, OPCI)

For those who want to generate income from real estate in France without directly managing the property, there are special funds:

- SCPI (Société Civile de Placement Immobilier) – investments in residential and commercial real estate with regular income payments.

- OPCI (Organisme de Placement Collectif Immobilier) is a more flexible structure that allows you to combine investments in real estate with financial instruments.

Example: One client invested €200,000 in SCPI, which specializes in office buildings and residential complexes in Paris. The average annual return was 4.2%.

Share purchases, trusts, inheritance

Another option is to purchase a property in shares between multiple investors. In some cases, trusts and special family structures are used to optimize taxes and simplify inheritance procedures. However, such transactions require qualified legal support and transparent agreements between the participants.

Local legal restrictions for non-residents

There are no legal barriers for non-residents in France. Foreign citizens can freely purchase a house, apartment, or any other type of real estate in France.

Key Features:

- Foreigners have the right to buy, rent and sell real estate without restrictions;

- there is no limit on the number or cost of objects;

- To purchase, you don't need a residence permit or citizenship; a passport is sufficient.

Legal aspects of buying real estate in France

Purchasing real estate in France requires a careful approach to legal procedures. Even if the property appears perfect, failure to conduct due diligence can lead to financial risks.

Step-by-step purchasing process

- Obtaining a NIF (Numéro d'Identification Fiscale) is a tax identification number required for all buyers, including foreign ones.

- Choosing a notary – In France, a notary is a mandatory participant in a transaction; he guarantees its legality and the registration of property rights.

- Compromis de vente – a preliminary purchase and sale agreement, upon signing which a deposit of 5-10% of the price is usually paid.

- The acte de vente is the final deed, signed before a notary. Once registered, the buyer becomes the full owner.

One of my clients purchased an apartment in Paris by signing a Compromis de Vente with a 7% deposit. After a thorough review of the documents, the notary issued the Acte de Vente, and the property was immediately ready for rent.

| Purchase stage | Description | Typical term |

|---|---|---|

| Obtaining NIF | Obtaining a tax identification number (required for all buyers) | 1–2 weeks |

| Search and selection of an object | Viewing and appraising real estate with an agent | 2–6 weeks |

| Compromis de vente | Signing a preliminary agreement, making a deposit (5-10%) | 2–4 weeks after selecting the property |

| Due diligence period | Checking the legal purity, debts, and status of the land | 4–6 weeks |

| Acte de vente (final act) | Notary signing and final payment | 1–2 weeks after Compromis de vente |

| Registration with the Service de publicité foncière | Official registration of property rights | 4–8 weeks after signing the deed |

The role of the notary and agent

In France, notarial representation of a transaction is mandatory by law. The notary plays a key role in ensuring the legal integrity of the transaction: they verify the title, identify any encumbrances and debts, draw up the Compromis de vente and Acte de vente , and then register the transfer of ownership with the Service de Publicité Foncière . Furthermore, the notary also calculates taxes and fees, ensuring the interests of both the buyer and seller are protected.

An agent plays a slightly different role: they select properties, assess their market value, organize viewings, and conduct negotiations, but they cannot replace a notary.

To illustrate, let me give you an example: a client from Germany wanted to buy an apartment on the French Riviera. The agent helped negotiate a 5% price reduction, and the notary ensured a full review of the transaction and registered the title.

Peculiarities of purchasing rural and resort real estate

- In rural areas and small French villages, houses of historical value are common. However, they may be encumbered by easements or debts, requiring special attention.

- In resorts such as the Côte d'Azur or the Alps, second-hand rental homes and condominium apartments are common. It's important to consider utility bills and property management regulations.

A client purchased a house in the French countryside for €180,000. At first glance, the property looked perfect, but during an inspection, I discovered outstanding land tax and utility bills. Without the inspection, the buyer would have faced unforeseen expenses amounting to several thousand euros and complications with property registration.

Remote purchase by proxy

French law permits the acquisition of real estate in France by proxy. This is especially convenient for foreign investors who are unable to attend the transaction in person.

A client from the US decided to purchase an apartment in Lyon remotely. I supported the transaction from start to finish: I organized the signing of documents at the notary, the deposit payment, and the title deed registration. As a result, the transaction was successfully closed without the client having to visit France in person.

Checking the object

Before purchasing any property in France, it is important to carefully check:

- presence of tax arrears;

- legal status of the land and possible encumbrances;

- legal purity of the property (ownership rights, absence of legal disputes).

One telling case occurred during the purchase of a house in Provence. During the property inspection, it was discovered that part of the land belonged to the municipality, not the seller. After adjusting the boundaries, the client was able to purchase the property without risking losing any of the land.

Registration with the Service de publicité foncière

The final step is registering the property with the Service de Publicité Foncière (the Public Property Service ). Only after this procedure is the property legally secured for the buyer. Signing the deed with a notary is important, but registration protects the owner from any potential claims by third parties.

Taxes, fees and costs when buying property in France

Purchasing real estate in France involves not only the property's price but also additional expenses, which are important to consider in advance. Proper tax and fee planning allows investors to save money and avoid unexpected expenses.

Property tax: Taxe foncière and Taxe d'habitation

Buying real estate in France involves not only paying the property's price but also accounting for taxes and fees. Proper planning for these expenses helps avoid unpleasant surprises.

- Taxe foncière is an annual property tax. Its amount depends on the size, location, and type of property.

- The tax on residence is a tax on accommodation. Since 2023, it has been almost completely abolished for primary residences, but remains applicable to second homes, especially in tourist regions.

Example: A client purchased a house in the countryside for €180,000. The annual property tax was approximately €1,200, while the habitation tax was practically zero thanks to existing tax incentives.

Stamp duty and notary fees

- Stamp duty ( taxes de publicité foncière ) on the secondary market ranges from 5.09% to 5.8%, and in some cases can reach up to 8.9% of the value of the purchased property.

- For new buildings commissioned less than five years ago, this fee is significantly lower – about 2–3%.

- Agent commissions range from 2% to 6% and are usually paid by the seller.

- Notary fees depend on the value of the property and include taxes and mandatory fees.

In total, the costs of purchasing a resale home typically amount to around 7-10% of the cost of the home.

VAT on new buildings

When purchasing a new building less than five years old, an additional 20% VAT is charged. This is the standard rate applicable to all types of new properties—apartments, houses, and apartments.

However, there are benefits for certain categories of buyers:

- young families and first-time home buyers can count on a partial rate reduction;

- In some regions (mainly in the south of France and the suburbs of large cities), there are incentive programs for the purchase of new buildings that reduce the tax burden;

- Investing in social housing or rental programs can offer additional tax benefits.

Furthermore, registration fees for new developments are significantly lower than for existing homes, amounting to only approximately 0.7% of the property price. This makes investing in new projects particularly attractive for those looking to optimize costs.

Real Estate Tax (IFI)

In France, the IFI (Impôt sur la Fortune Immobilière) property tax is paid only by owners whose taxable property within the country is valued at more than €800,000 as of January 1 of each year. A special rule applies to foreign investors: only property located in France is considered. The provisions of tax treaties between France and the owner's country of tax residence apply.

The objects of taxation include:

- apartments, houses, as well as auxiliary buildings (garages, basements, parking lots);

- buildings that have the status of historical monuments;

- objects under construction;

- agricultural land, land for development and other undeveloped areas;

- shares in companies that own real estate in France.

The following are not subject to tax:

- rural land transferred on a long-term lease;

- woodlands and gardens;

- certain categories of professional real estate.

To illustrate, let's look at an example. If the market value of real estate in France is €1.4 million, the tax base is calculated using a progressive scale. This means that different parts of the value are taxed at different rates:

- the first €800,000 are tax-exempt;

- amounts between €800,000 and €1.3 million are taxed at a rate of 0.5% (i.e. €500,000 at a rate of 0.5%);

- The amount from €1.3 million to €1.4 million is taxed at a rate of 0.7% (i.e. €100,000 at a rate of 0.7%).

| Property value (€) | Tax rate |

|---|---|

| 0 – 800 000 | 0% |

| 800 000 – 1 300 000 | 0,5% |

| 1 300 000 – 2 570 000 | 0,7% |

| 2 570 000 – 5 000 000 | 1% |

| 5 000 000 – 10 000 000 | 1,25% |

| 10 000 000+ | 1,5% |

LMNP regime – tax optimization

For those who want to purchase real estate in France for rental purposes, there is a special tax regime called LMNP (Loueur Meublé Non Professionnel). It is designed for owners of furnished properties and allows for a significant reduction in tax burden.

Advantages of LMNP:

- the ability to depreciate the cost of the property and furniture, thereby reducing taxable income;

- Qualification of income as business income (BIC), which reduces overall taxation;

- the ability to combine revenue from multiple properties for more profitable optimization.

One of my clients purchased a €450,000 apartment in Paris for subsequent rental through Airbnb. Applying the LMNP regime allowed him to reduce his taxable income from €35,000 to €20,000 per year, significantly increasing the net income of the property.

Comparison with Austria

| Expense item | France | Austria |

|---|---|---|

| Stamp duty / Grunderwerbssteuer | 5.8–6% (secondary market) | 3,5% |

| Registration fees | 0.7–5.1% depending on the object | included in Grunderwerbssteuer |

| Notary services | ~1% | ~1% |

| Agent services | 3–5% | 3–4% |

| VAT on new buildings | 20% off new construction, discounts for primary housing | There is no VAT on secondary housing, new buildings are subject to a 20% tax (sometimes a reduced rate of 10–13%) |

| Total additional costs | 7–10% for existing housing, 2–3% for new buildings + VAT | 3,5–5% |

Investors often compare France to Austria. The Austrian real estate market is valued for its transparent procedures, high liquidity, and stability, making it more predictable. France, on the other hand, attracts investors with the opportunity to acquire premium properties and combine investment with a personal lifestyle. However, the tax burden and associated registration costs are higher here.

Residence permit and investment in France

Purchasing real estate in France does not in itself grant the right to a residence permit. However, owning a home may be considered a positive factor when applying for a visa or residence permit for other reasons.

Passeport Talent – Investments and Business

The Passeport Talent program allows you to work in France, benefit from social security, and apply for citizenship after five years. To apply, simply:

- Invest from €300,000 in an existing French company;

- Open your own business with a share capital of €30,000, including innovative start-ups.

Visitor visa (VLS-TS Visiteur)

For those planning to reside in France without working, a visitor visa is available. One of the requirements for obtaining one is the ownership of a rented or owned home. This visa is the best option for foreigners purchasing homes in France for vacation or rental purposes.

Comparison with Austria

The classic EU residence permit by investment , which is obtained solely through the purchase of real estate, is not available in France. Therefore, in France, it is not possible to obtain a residence permit through real estate purchases, but you can obtain a residence permit through business and investment. In Austria, on the other hand, D-cards and Self-Sufficiency are available, allowing you to obtain a residence permit without the need to invest in a business, as long as you have a stable income and housing.

What changed in 2023–2025

- Since March 2024, the Passeport Talent program has been officially renamed to Talent Residence Permit , but the conditions for obtaining a residence permit remain the same.

- From June 2025, France has reduced the processing time for applications for residence permits , including the EU Blue Card.

- Checks on the legality of the origin of funds for investments have been strengthened, especially for investment programs.

- New minimum income verification requirements have been established for visitor visas. Starting in 2025, this requirement will be supplemented by proof of income equivalent to the French minimum wage (SMIC) – approximately €1,450 per month for one person.

Property rentals and income in France

The French rental market is strictly regulated. And when it comes to yields, they vary greatly depending on the region and rental type.

Short-Term Rentals: Airbnb and Control in Paris

In Paris and tourist areas, short-term rentals are particularly popular, but there are significant restrictions: mandatory registration of the property with the city hall and a limit of no more than 120 days per year for renting out the primary residence.

One of my clients purchased an apartment for €480,000 to rent out on Airbnb. We formally registered the property and developed a rental strategy within the established restrictions. The resulting yield was around 3% per annum, which, while lower than initially expected, was completely legal and penalty-free.

Long-term lease: stability with restrictions

Long-term leases are more stable and predictable, but the landlord faces significant tenant protections. Therefore, tenant changes are only possible within the law, with mandatory notice and rent increases capped.

My client purchased a house in rural France for €320,000 and signed a long-term lease. The return was approximately 4% per annum with minimal management involvement.

Profitability by region

| Region | Profitability (long-term) | Profitability (short-term) | Key Features |

|---|---|---|---|

| Paris | 2–3% | 3–5% | Strict restrictions for Airbnb rentals, high demand, expensive properties |

| Lyon | 3–4% | 4–6% | Student market, stable long-term demand |

| Cote d'Azur (Nice, Cannes) | 3–4% | up to 6–8% | Seasonality, premium properties, tourist area |

| Bordeaux | 3–4% | 4–5% | Wine region, growing interest in short-term rentals |

| Alps (chalets, ski resorts) | 3–5% | up to 7% | Seasonality, high income in winter, prestigious properties |

| French villages | 4–5% | 3–4% | Low purchase price, stable local demand, long-term tenants |

Management companies

Property management services are especially relevant for foreign investors. They provide:

- selection of tenants;

- control over payments;

- maintenance and repair.

Management company commissions typically range from 8-12% of rental income or a fixed amount per season (for example, for short-term rentals).

Comparison with Austria

Real estate investment returns in France and Austria remain comparatively low. However, the differences between the countries are clear:

- Austria provides greater stability and liquidity;

- France remains attractive for those looking to combine investment with personal use of housing and a premium lifestyle.

For an investor seeking stability and minimal risk, Austria is preferable. For those also considering real estate as part of a personal lifestyle project, France is a more attractive choice.

| Parameter | France | Austria |

|---|---|---|

| Long-term rental yield | 2–5% | 2–3% |

| Short-term rental yield | 3–8% (depending on region, Airbnb limits) | 3–4% (strict restrictions) |

| Rent regulation | Strict rules for short-term rentals, protecting tenants | Strict rules, low profitability |

| Market and liquidity | High liquidity in Paris and resort areas | High liquidity, stable market |

| Property management | Management companies (8–12% of income) | Management companies (10% of income) |

| Risks | Seasonality, legislative changes, tourist restrictions | The market is predictable, so low |

Where to Buy Property in France: A Regional Analysis

France isn't just Paris and the Côte d'Azur. When choosing a region for investment or personal residence, it's important to understand your goal: generating rental income, purchasing a home for personal use, long-term capitalization, or moving to the countryside for a quieter life.

Paris – premium segment and stable liquidity

The French capital remains the country's largest financial and cultural center. Apartments in central Paris and near business districts enjoy steady demand from expats, students, and corporate tenants. Even during times of crisis, Parisian real estate provides owners with a predictable income.

- Housing prices: €10,000–€15,000 per m² in the city centre, €7,000–€9,000 per m² in the suburbs.

- Ecology: urban infrastructure, parks, the Seine, and access to green suburbs.

- Profitability: 2–3% per annum for long-term lease.

The Côte d'Azur – a prestigious lifestyle and a high entry barrier

Nice, Cannes, and Antibes are cities where property is in demand primarily for seasonal vacation rentals. Summer rentals are easy to find, and premium apartments generate significant income for their owners.

- Housing prices: €8,000–€12,000 per m² in Cannes and Nice, €6,000–€8,000 per m² in less popular cities in the region.

- Ecology: mild Mediterranean climate, sea and abundance of green areas.

- Profitability: 4–6% per season for short-term rentals.

Lyon is a business and student center

Lyon is one of France's leading business and university centers. Its large campuses and office parks ensure stable rental demand.

- Housing cost: about €5,000 per m².

- Environment: better than Paris; the city is famous for its green parks and gastronomic culture.

- Profitability: 3–4% per annum for long-term lease.

Bordeaux is a city of wine industry and tourism

The city actively attracts tourists and business immigrants. Real estate in the central part and near the wine regions is in steady demand.

- Housing cost: about €4,500 per m².

- Environment: Garonne River, historic centre, vineyards and walking areas.

- Profitability: 3–4% per annum.

Toulouse – a space and aviation center

Toulouse is a leader in Europe's aerospace industry. Home to Airbus headquarters, it generates significant demand for housing among professionals and students.

- Housing cost: about €4,000 per m².

- Ecology: mild climate, proximity to the Pyrenees, green areas.

- Profitability: 3–4% per annum.

The Alps (Chamonix, Meribel) – a winter sports hub

The French Alps are a winter tourism hub. Apartments and chalets are especially popular during the high season, when rental prices reach their peak.

- Housing prices: €6,000–€12,000 per m² in popular resorts.

- Ecology: mountain air, ski slopes, lakes and beautiful views.

- Profitability: 5–7% in season, up to 3% in the off-season.

Rural France is a quiet area with low liquidity.

The country's rural regions are attractive for their low prices and ecological environment. Village homes are popular among those seeking a more relaxed lifestyle or exploring agritourism options.

- Housing costs: €1,200–€2,500 per m² depending on the region.

- Ecology: clean nature, forests, rivers and traditional rural life.

- Profitability: 1–2% per annum.

| Category | Region | Infrastructure and transport | Tenant demand |

|---|---|---|---|

| Where are they buying now? | Paris | Metro, TGV, international airports, schools, offices | Expats, tourists, students |

| Cote d'Azur (Nice, Cannes, Antibes) | Airports, ports, highways, golf clubs | Tourists, international premium segment tenants | |

| Lyon | Universities, highways, airport | Students, IT specialists, engineers | |

| Bordeaux | Wine regions, airport, railway junction | Students, tourists, young families | |

| Toulouse | Universities, airport, transport hubs | Students, IT specialists, engineers | |

| Alps (Chamonix, Meribel) | Cable cars, ski slopes, mountain roads | Winter sports enthusiasts, tourists | |

| Where growth is expected | Montpellier | Universities, new roads, port | Students, young families |

| Nantes | Airport, railway junction, universities | Students, mid-range renters | |

| Lille | High-speed rail lines, airport | Students, business professionals | |

| Marseilles | Port, highways, airport | Tourists, local tenants | |

| Cote d'Azur (secondary market development) | Airports, seaports | Investors in the premium segment, tourists |

The Secondary Market and New Builds in France: What Investors Need to Know

Investors should pay particular attention to price trends. The existing real estate segment is gradually recovering from the decline observed between 2021 and 2024. At the same time, the new-build market is demonstrating other advantages: properties are sold with quality guarantees and offer the opportunity to implement customized layout solutions. Regional restrictions on the purchase of second homes should also be taken into account. Such measures are being introduced by local authorities to alleviate the housing shortage and improve affordability.

| Category | Example of an object | Price | Peculiarities |

|---|---|---|---|

| Secondary market | Haussmann's apartment in Paris | €850 000 | Historical style, high liquidity, rent 3-4% per annum |

| New building | Apartments in Bordeaux | €380 000 | Energy efficiency, tax incentives, modern layout |

| Secondary market | House in a village in Provence | €220 000 | Spacious plot, in need of renovation, seasonal rent |

| New building | Townhouse on the Cote d'Azur | €750 000 | Premium, high tourist demand, low utility costs |

Dominance of the secondary market

Average resale property prices in Paris

(source: https://www.globalpropertyguide.com/europe/france/price-history )

Today, approximately 90% of transactions occur on the secondary market. This is explained by buyers' appreciation for historic architecture, central locations, and existing infrastructure. Haussmann-style buildings in Paris and similar buildings in other major cities are particularly popular, offering high rental potential and good liquidity.

Features of houses of the 19th–20th centuries

Old houses have a unique style, but they often require serious investment:

- Electrical and plumbing systems often require complete modernization;

- Energy efficiency does not meet modern standards, which increases maintenance costs.

Tip: When buying an old house, you should budget in advance for renovations of approximately 10–20% of the property’s value.

New buildings: advantages and limitations

New buildings occupy a smaller market share, but have their own advantages:

- reduced notary fees (2–3% instead of 7–8% for secondary housing);

- possible tax breaks, including temporary exemption from property tax;

- compliance with modern energy efficiency standards (RT 2012 and RE 2020), which reduces utility costs;

- guarantees from the developer and the possibility of customizing the layout and finishing.

In 2024, only 59,014 new homes were built in France, 29% fewer than the previous year and almost half the 2022 figures. The reasons include high mortgage rates and declining purchasing power. Construction rates are expected to stabilize at 28,000–33,000 units per year in 2026–2027.

ESG and energy efficiency

Another important trend in recent years is the transition to ESG standards and energy efficiency. For investors, this means:

- increasing the liquidity of facilities with modern energy saving systems;

- the possibility of using tax benefits;

- increased interest from tenants in comfortable and environmentally friendly housing.

Even when purchasing a historic property, investing wisely in modernization can increase its market value and ensure competitiveness in the rental market.

Comparison with Austria

Austrian new builds meet stricter quality standards, and the secondary market is highly predictable. In France, however, historic properties hold a special place: they offer unique opportunities for premium investors, but require careful consideration.

| Segment | France | Austria | Comment |

|---|---|---|---|

| Economy | €1,800–2,500/m² (rural France, small towns) | €3,500–4,500/m² (Vienna suburbs, small towns) | France is cheaper, but has lower liquidity; Austria is more stable and has better quality. |

| Average | €3,500–5,000/m² (Lyon, Bordeaux, Toulouse) | €5,000–7,000/m² (Vienna, Graz) | France attracts with its profitability, Austria wins in terms of reliability and liquidity. |

| Premium | €6,000–12,000/m² (Paris, Côte d'Azur) | €8,000–12,000/m² (Vienna city center, Salzburg) | France offers lifestyle and resort opportunities, Austria is more stable, but the entry barrier is higher. |

How to diversify investments in France

Investing in French real estate isn't limited to purchasing a single apartment in Paris. There are a variety of approaches to increasing returns, minimizing risks, and adapting to the specifics of the local market.

Several studios instead of one object

For example, one of my clients decided against purchasing a large apartment in central Paris and chose to spread his capital among three studios, each priced at €180,000–200,000. This choice offered several advantages:

- the risks were diversified – when one apartment was idle, the others continued to generate income;

- the total return turned out to be higher than when owning one large property;

- Rental management made easier through short-term platforms.

Renovation of old housing with tax benefits

France is actively promoting the restoration of its historic buildings. Under the Malraux and Denormandie programs, investors can receive substantial tax deductions for renovating old properties.

Example: A client purchased a 19th-century house in Lyon for €450,000, invested an additional €120,000 in renovations, and received significant tax benefits. As a result, the real value of the investment was lower, while the rental yield increased.

Investments in tourism infrastructure

The tourism sector remains an attractive destination. Aparthotels, mini-hotels, and resort residences on the Côte d'Azur generate income through short-term rentals.

For example, my client purchased an apartment in Nice for €600,000 and rents it out through Airbnb and Booking. The yield is up to 6% per annum, and a specialized management company handles the property. However, seasonality, commission costs, and strict legal restrictions (for example, in Paris, there's a 120-day annual rental limit for a primary residence) must be taken into account.

SCPI – collective investment in real estate

French SCPIs (similar to REITs) allow you to invest in real estate without the need for direct management. The minimum investment starts at €5,000, and the average return is 4–5% per annum.

A US investor invested €50,000 in SCPI and received dividends along with tax advantages, avoiding administrative hassle.

Land plots

Land investments in France rarely yield high returns without construction.

Example: A client purchased a plot of land in a rural area for €60,000 and was only able to sell it three years later for €75,000. Therefore, this model is more suitable for those planning further development.

Comparison with Vienna

The Viennese market is more predictable and stable, and real estate in Vienna is often viewed as a safe haven. However, the barrier to entry is higher, and rental yields are lower. The French real estate market is more diverse: there are opportunities to profit from tourist attractions and prime locations, but the risks are also significantly higher, especially when investing in existing homes.

The optimal strategy is a combination of various instruments: direct part of the capital into SCPI, part into the renovation of historical buildings, and some into tourist real estate.

Risks and Disadvantages: What to Consider When Investing in France

Investing in France is attractive, but it's important to understand the potential challenges and risks to minimize losses and make the purchase truly profitable. Based on my experience and client examples, I've outlined key points to consider.

High taxes and bureaucracy

French taxes are complex and multilayered: property tax, stamp duty, rental income tax, and, for new properties, VAT. Example: A client purchased a house in the countryside for €320,000, and without proper tax planning, additional expenses escalated by almost €20,000 above the expected budget.

Strong tenant protection

French law is focused on protecting tenants' rights. Therefore, the eviction process for late payments can be lengthy. One of my clients faced a situation where the tenant hadn't paid for three months, and the contract was only terminated through the courts.

Advice: Always sign detailed contracts, thoroughly vet tenants, and use management companies whenever possible.

Airbnb restrictions

Airbnb and other platforms are strictly regulated in France. In Paris and Nice, renting out your property requires registration and is limited to 120 days per year. One client planned to rent out his apartment in Marseille year-round, but had to shorten the rental period to avoid penalties.

It is important to remember that fines for violations can reach €50,000.

Slow transactions

The process of purchasing real estate in France takes between 6 and 12 months. This includes property selection, legal due diligence, approvals, and notarization. For example, purchasing an apartment in Bordeaux for one client took almost 10 months.

Liquidity

Resale speed varies by region. In Paris, prime properties sell quickly (on average, within 1-3 months). In rural areas, the opposite is true: sales can drag on for years. One client purchased a house in a small village for €180,000 and was only able to sell it two years later.

Comparison with Austria

France offers investors a wealth of opportunities. However, buying a home in France also carries significant risks: taxes, bureaucracy, and slow liquidity outside major cities. The Austrian market, by contrast, benefits from stability, high investor security, and predictable returns, especially in major cities like Vienna.

Accommodation and lifestyle in France

Investors are attracted to France not only for its income potential, but also for its standard of living, developed infrastructure, mild climate, and cultural diversity. For many buyers, real estate in France is not just an investment but also a chance to live comfortably and enjoy the country's unique way of life.

Climate: South of France vs. Paris

The south of France, including the Côte d'Azur and Provence, is known for its mild winters, hot summers, and abundant sunshine (up to 300 days per year). Paris has colder winters and rainier autumns, but compensates for these climate inconsistencies with a vibrant cultural scene and well-developed infrastructure.

Standard of living and cost of living

France is a country with a high, but also expensive, standard of living. Approximate monthly expenses are:

- food: €300–450 for a family of 3–4 people;

- utilities: €150–250;

- transport (metro, buses): €70–120;

- Housing: in Paris – about €3,500/m², in Lyon – €5,000/m², in the south of the country – €4,500/m².

A practical example: a client with a budget of €500,000 considered Paris, but after analyzing her expenses, she settled on Bordeaux. The cost of living and utilities there were significantly lower, allowing her to better allocate her funds.

Education

Public schools in France are free and accessible even to non-residents, but instruction is in French. Private and international schools offer programs in English, German, and other languages. These include options that meet international standards (IB, British curriculum, American diploma).

Tuition at private schools ranges from €5,000 to €15,000 per year, depending on the level and region. Higher education is also available to international students: the Sorbonne, Sciences Po, INSEAD, and other prestigious institutions accept students from various countries. However, proof of French proficiency or successful completion of entrance exams are almost always required.

Medicine, security, infrastructure

The French healthcare system is based on the state-run Assurance Maladie program, which covers approximately 70% of the cost of medical services. The remaining 30% is covered by supplementary insurance (mutuelle).

Average expenses:

- General practitioner consultation – about €30;

- consultation with a specialist – from €50;

- dentistry: filling €20–50, cleaning – about €30.

For non-residents living in France for less than three months, international insurance is recommended, with costs starting at approximately €35 per month.

Safety levels in the country remain fairly high, especially in rural and suburban areas. In large cities, petty theft and street crime may still occur, but police are actively working to maintain order.

France's infrastructure is well developed and includes a public transportation network, high-speed TGV trains, international and regional airports, modern highways, and ferry routes. Cities offer cultural and sports facilities, shopping centers, and healthcare facilities. In rural areas, infrastructure is limited but includes basic amenities such as shops, schools, and transportation hubs.

Comparison with Austria

France attracts with its way of life: a mild climate, sea, mountains, cultural and gastronomic diversity. Austria, on the other hand, is associated with order, security, and predictability.

If an investor is seeking comfort, tranquility, and guaranteed security, investing in Austrian real estate is a better option. If cultural diversity, access to the sea, developed tourist infrastructure, and a vibrant lifestyle are priorities, France is the optimal choice.

Real estate in France as a "European haven"

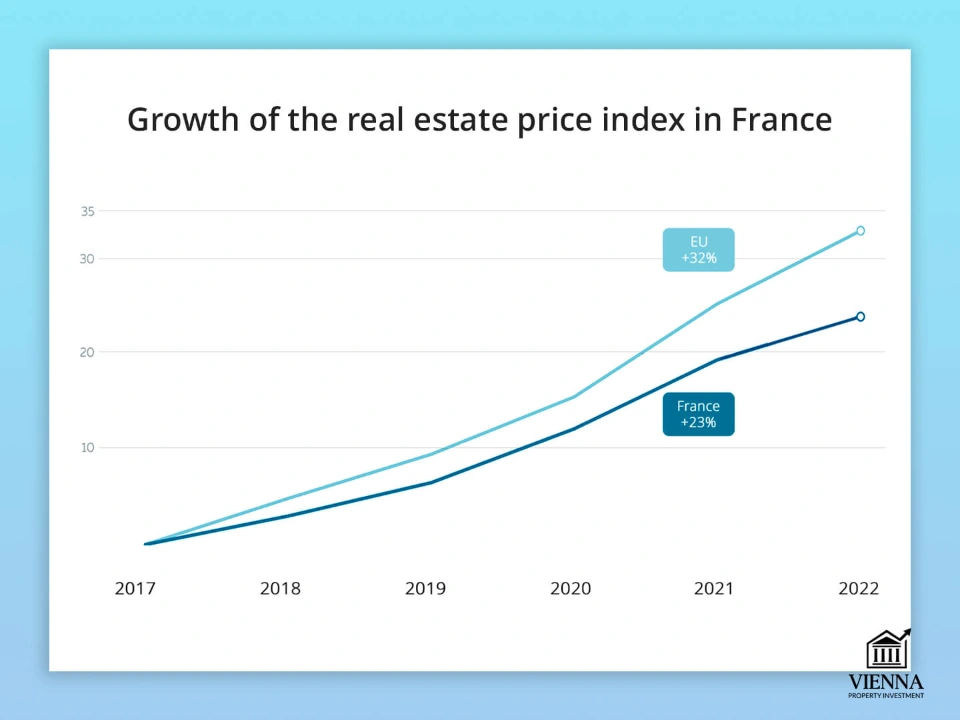

Rising property prices in France

(source: https://immigrantinvest.com/real-estate/guides/france/ )

The French market is of interest not only to investors, but also to those seeking a high quality of life.

Protection for citizens of unstable countries

For citizens of countries with political or economic instability, buying real estate in France becomes a means of preserving capital and protecting family. The most promising regions are Paris, the Côte d'Azur, and Bordeaux: here, liquidity is higher, and resale rates are significantly faster.

Comfort for pensioners

Retirees choose southern regions for their mild climate, high-quality healthcare, and relaxed pace of life. When buying an affordable home in France, it's important to consider the proximity of medical centers and transportation infrastructure.

Opportunities for digital nomads

Digital nomads and entrepreneurs appreciate France for its well-developed internet infrastructure, coworking spaces, and convenient international connections. Mid-sized cities like Lyon and Toulouse are ideal for such a lifestyle.

For example, one of my clients, an entrepreneur from the United States, purchased an apartment in Lyon for €350,000. He combines remote work with living in France and rents out the property during the tourist season, which further increases his income.

What to choose: lifestyle or stability

France attracts with its lifestyle and real estate liquidity, while Austria attracts with its stability and conservative market. For those seeking active investments and rental opportunities, France is the choice. For those seeking the safest and most predictable investment, Austria is the best option.

How to exit investments in France

Exiting a real estate transaction in France requires special attention. This is especially true for those planning tax optimization or transferring assets to relatives. Understanding the rules of sale allows you to avoid unexpected expenses and preserve as much of your income as possible.

Minimum period for benefits

French law provides for a full exemption from capital gains tax only after 22 years of ownership. Until then, the rate is 19% plus a 17.2% social security contribution. This results in a total tax burden of 36.2% of the profit.

Transfer to relatives

One of the effective methods of tax optimization is the transfer of property to family members (sale or inheritance).

A practical example: a family of investors transferred an apartment in Bordeaux to their children. As a result, they were able to avoid paying full capital gains tax on the subsequent sale, thereby reducing overall expenses.

Market liquidity

In major French cities—Paris, Lyon, Bordeaux, and the Côte d'Azur—the market remains quite liquid. Properties in these areas sell quickly due to high demand. Meanwhile, in rural areas and smaller towns, sales can take anywhere from several months to a year.

Resale terms

The average time to sell an apartment in Paris is usually 3-6 months. In tourist areas, this period increases to 9 months, and in villages and provincial towns, resale takes from six months to a year.

Impact on residence permit

Selling real estate does not directly affect residency status. However, when using the Passeport Talent or VLS-TS Visiteur schemes, it is important to maintain assets or prove income to demonstrate financial solvency.

Comparison with Austria

In Austria, the investment exit process is generally simpler. Capital gains taxes are lower, assets are more liquid, resale periods are shorter, and inheritance and property transfer taxes are less complex than in France.

Expert opinion: Ksenia Levina

"The French market offers a wide range of opportunities: from premium properties with high liquidity to affordable homes with growth potential. My goal is to find the best option for your individual goals."

— Ksenia , investment consultant, Vienna Property Investment

Over the years, I've handled dozens of transactions in France: from small apartments in Paris to luxury villas on the Côte d'Azur and country houses in rural areas. Experience shows that investment success depends, above all, on thorough due diligence.

I always pay special attention to the compromis de vente and acte de vente documents. It's important to ensure there are no outstanding taxes or utility bills, and to check the land's status, rental restrictions, and any encumbrances. This approach protects the client from any unpleasant surprises after the purchase.

I believe the optimal strategy is diversification: a combination of stable investments in Austria and more profitable projects in France. For example, part of the portfolio could be in Vienna, where the market is reliable and predictable, while the other part could be in Paris or the Côte d'Azur, where there's potential for capital growth and the opportunity to combine income with a prestigious lifestyle.

If I were to consider my personal preferences, I would choose France for capital preservation and a comfortable life, and Austria for stability and security. This balance provides investors with both income and comfort.

Conclusion

Buying real estate in France is suitable for investors seeking a combination of income, liquidity, and a premium lifestyle. Paris, the Côte d'Azur, or even a small village can be a profitable investment, depending on your goals.

Austria is a choice for those seeking security and predictability. It offers lower risks, a simpler tax system, and a high degree of property rights protection.

Before concluding a transaction, it is extremely important to check the complete package of documents in advance: Compromis de vente, Acte de vente, as well as registration with the Service de publicité foncière.

Understanding the structure of demand is equally important: the combination of interest from both local residents and foreign investors is a key factor in the liquidity of a property and the stability of investments.

Outlook to 2030 : The French market will show gradual growth in the coming years. Key trends include new taxes and energy efficiency requirements, increased government oversight of investments, increased interest in premium properties, and the active development of regional centers.

Investors considering buying a home in France today will be able to take advantage of rising prices and changes to the tax system in the future.

Appendices and tables

Table of yields by city in France

| Region / City | Average annual rental yield (%) |

|---|---|

| Paris | 2–3% |

| Lyon | 3–4% |

| Bordeaux | 3–4% |

| Toulouse | 3–4% |

| Cote d'Azur | 4–6% |

| Chamonix / Meribel (Alps) | 4–6% |

| Rural France | 2–3% |

Price/Profitability Map

| Region / City | Average price per m² (€) | Average annual rental yield (%) | Market Features |

|---|---|---|---|

| Paris | 10 000–12 000 | 2–3% | High liquidity, premium segment, strict rental rules |

| Lyon | 5 000 | 3–4% | Emerging market, demand from students and IT professionals, good transport links |

| Bordeaux | 4 500 | 3–4% | Price increases due to the wine region's attractiveness to tourists |

| Toulouse | 4 000 | 3–4% | Stable demand due to students and engineers, mild climate |

| Cote d'Azur (Nice, Cannes, Antibes) | 8 000–10 000 | 4–6% | High lifestyle, premium segment, seasonal rentals, high entry threshold |

| Chamonix / Meribel (Alps) | 7 000–9 000 | 4–6% | Winter tourism, chalets, seasonal rentals, energy-saving standards |

| Rural France | 1 500–3 000 | 2–3% | Low liquidity, cheap houses and apartments, limited rental demand |

Tax Comparison: France vs. Austria

| Tax / Fee | France | Austria |

|---|---|---|

| Purchase tax (Droits de mutation / Stamp duty) | 5.8–6% for secondary housing, 2–3% for new buildings + 20% VAT | Grunderwerbsteuer 3.5% + 1–3.5% registration |

| Notary services/fees | 1–2% (new buildings), 7–10% (secondary) | 1–3% |

| Property tax (Taxe foncière) | 0.2–1.5% per annum depending on the region | 0,2–1% |

| Housing tax (Taxe d'habitation) | Almost abolished from 2023 for primary residence | Not applicable |

| Tax on rental income | IR + prélèvements sociaux 17.2–30% | 20–30% progressively |

| Capital gains tax on sale | Up to 36.2% without benefits; exemption after 22 years of ownership | Released after 10 years of ownership |

| LMNP regime (tax optimization for rent) | Possible: reduction of the taxable base, depreciation | There is no direct analogue |

Investor's Checklist: Real Estate in France

1. Defining the goal

- Housing: for living, renting or resale.

- Short-term or long-term investments.

- Finance: calculation of budget and expected profitability.

2. Legal side

- Checking the legal status of the property: cadastral register, absence of debts and encumbrances.

- Conditions for foreigners: there are no restrictions for citizens of Ukraine and the CIS, but the process is more complicated.

- Preliminary agreement (Compromis de vente) and a deposit of 5-10%.

- Notary is required (Notaire).

3. Finance and taxes

When purchasing:

- Notary fees and duties – about 7–8% (secondary market).

- VAT (TVA) 20% – when purchasing new buildings.

Annually:

- Taxe foncière – property tax.

- Taxe d'habitation – a tax on residence (abolished for residents, but applies to second homes).

- Mortgages for foreigners: usually up to 70–80% of the cost.

4. Location and market

- Paris: high price, stable growth, rental yield 2-3%.

- Cote d'Azur: high liquidity, tourist demand.

- Lyon, Bordeaux, Nantes: balance of price and profitability.

- Ski resorts: high seasonal demand.

5. Management and rental

- Delivery: independently or through an agency de gestion locative.

- Rent taxation:

- Régime réel – accounting of expenses.

- Micro-foncier / micro-BIC – fixed deduction.

- Compulsory home insurance ( assurance habitation ).

6. Checking the object

- Diagnostics: DPE (energy efficiency), asbestos, lead, etc.

- Condition of the building (especially older houses).

- Utility costs (charges de copropriété).

7. Exiting investments

- Capital gains tax is reduced after 22 years of ownership.

- Registration through SCI ( Société Civile Immobilière ) – tax and inheritance optimization.

Investor scenarios

1. Investor with €500,000

Objective: to obtain stable income from short-term rentals and to preserve capital.

What I found: an 80 m² apartment in the heart of Paris. It has three bedrooms, has been modernly renovated, and is ready to be rented out on Airbnb.

Result: yields averaged 4-5% per annum. The prime location ensured a steady flow of tenants, and the high liquidity of central Paris allowed the investor to resell the property after just three years, with a 15% price increase.

2. Pensioner with €300,000

Goal: a comfortable life in retirement and security of invested funds.

What I found: a small house in a quiet area of a peaceful Provencal village with two bedrooms and a private garden.

Result: utility costs were minimal – around €200 per month. The building also offered the opportunity to rent out long-term to neighbors or tourists during the summer season (yielding a 3% return). Over five years, the property's value increased by 10%.

3. Family with children with €500,000

Purpose: Accommodation, education of children and investment.

What I found: a 3-room apartment in Lyon close to good schools and universities, well-developed infrastructure, parking.

Result: the family received comfortable housing with access to public and private schools. The apartment was consistently rented long-term, yielding approximately 3.5% per annum. Additionally, the property's value increased by 12% over four years, confirming the success of their chosen strategy.