How to Buy Property in Tyrol – A Detailed Guide to Prices and Procedures

Tyrol is an Alpine region of Austria, where the average home price in 2024 exceeded €4,727 per square meter. Renowned for its picturesque mountain landscapes, developed ski resort infrastructure, and high quality of life, the region is popular with both homebuyers and investors.

In recent years, interest in Tyrolean real estate has been growing due to steady demand (especially for slopeside apartments) and the prospect of price increases. However, the region's market has its own unique characteristics, ranging from limited land resources to special legal regulations for international buyers.

In this article, we'll cover every step of purchasing an apartment, house, chalet, or land in Tyrol—from prices and locations to legal and financial nuances—so you can make an informed decision, even if you're also considering buying property in Vienna and comparing different regions of Austria.

A variety of accommodation options in Tyrol: from cozy apartments to luxury villas

The Tyrolean real estate market offers a wide range of properties – from small studios and two-bedroom apartments in cities and mountain areas to spacious chalets and private homes near resorts, as well as exclusive villas and premium apartments.

There are both resale apartments (in old buildings, “Altbau”) and new condominiums (“Neubau”) with modern equipment.

Many houses are built in a traditional Alpine style with wooden trim—it's precisely these chalets that attract buyers. There are also apartment plans for rent to tourists (including those with management companies) and cottages for sale on the market.

Apartments. Various formats, from one-room studios to large lofts. Cities (Innsbruck, Kufstein) have more standard apartments in high-rise buildings, while resorts (Kitzbühel, Landeck) offer compact apartments for skiers.

Private houses and chalets. Single- and semi-detached houses on land, often with a garden and garage. Chalets are typically built closer to the mountains, sometimes in remote mountain villages. These properties offer privacy and space, but often require significant maintenance (heating, snow removal, etc.).

Luxury villas and apartments. Luxurious mansions with Alpine views, as well as high-end penthouses, are most often found in prestigious locations (Innsbruck, Kitzbühel, St. Johann in Tirol). Such properties cost millions of euros and are intended primarily for wealthy clients or as prestigious investments.

Land. Land is scarce in Tyrol, making available residential plots rare and expensive. Buyers should check the land's designated use (Bauzone), the availability of building permits, and federal/local planning requirements.

“I often tell my clients: every home starts with a plot – study the land use law and the Tyrolean urban development plan before investing.”.

— Ksenia , investment consultant,

Vienna Property Investment

-

Tip: Before choosing a home, consider the purpose of the purchase: a vacation home (second home), a permanent residence, or a rental investment. This will immediately narrow your search and help you prioritize location and type of property.

For example, apartments near resorts and student-friendly Innsbruck are suitable for rental, while a house in a quiet mountain village or an apartment in a city with good infrastructure is ideal for comfortable living.

Pricing and cost dynamics

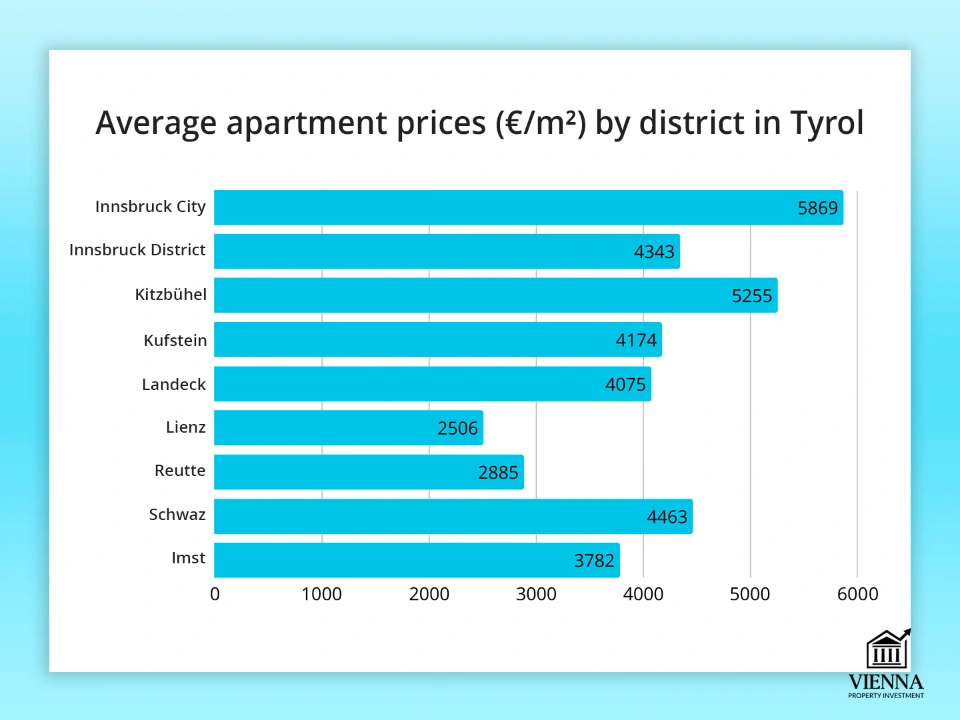

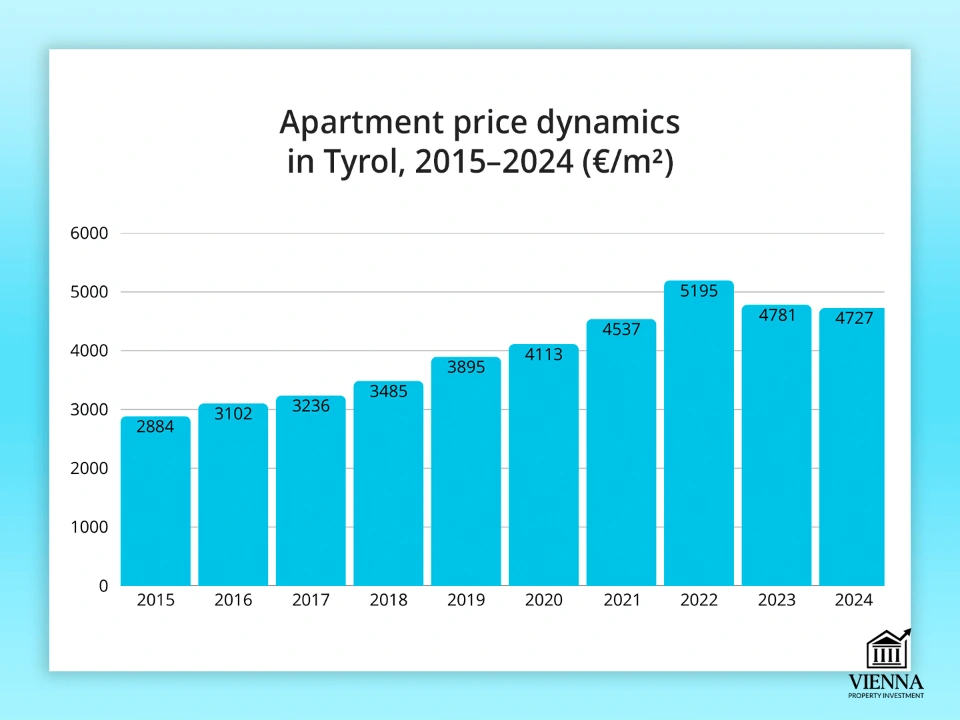

Property prices in Tyrol are traditionally higher than the Austrian average: in 2024, the average apartment price here was around €4,727 per sq.m. (the peak was reached in 2022 – around €5,195/m², after which prices adjusted).

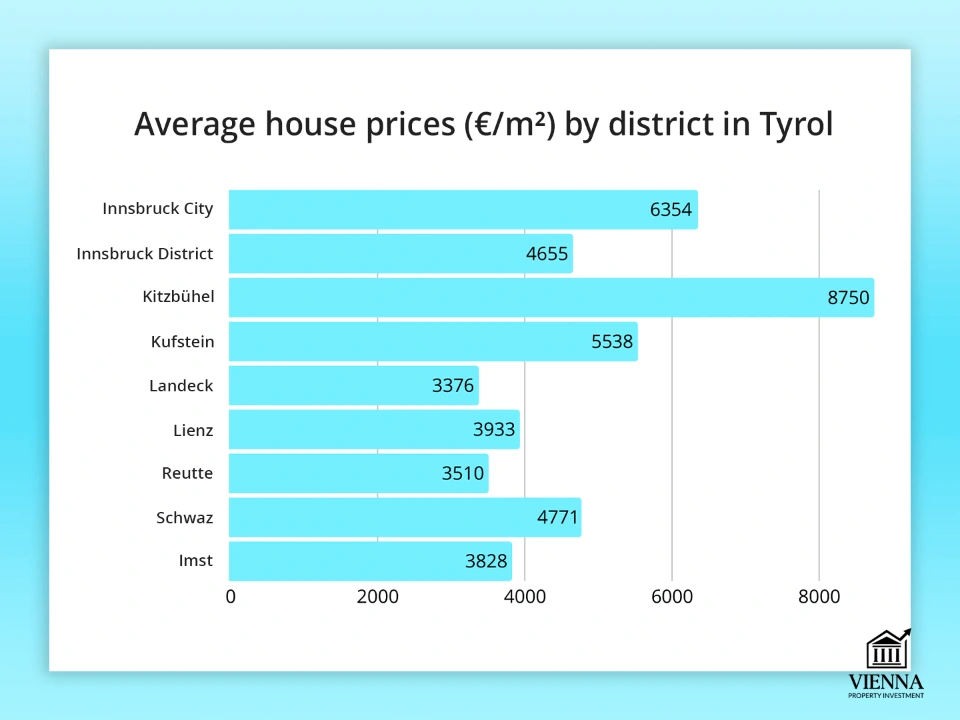

Prices for single-family homes were lower (several thousand euros per square meter), but have also increased significantly in recent years. For example, according to 2022 market estimates, the average price of a single-family home was approximately €4,660 per square meter.

| District (Bezirks) | Apartments, €/m² (2022) | Houses, €/m² (2022) | Land plots, €/m² (2022) |

|---|---|---|---|

| Kitzbühel | 7 287 | 9 758 | 883 |

| Innsbruck (city) | 5 760 | 6 653 | 1 155 |

| Landeck | 3 592 | — | — |

| Lienz | 2 090 | 2 207 | 218 |

| Reutte | 3 740 | 3 143 | 207 |

The data is taken from analytical reviews of the Tyrolean real estate market; please note that actual prices may vary depending on the condition and exact location of the property.

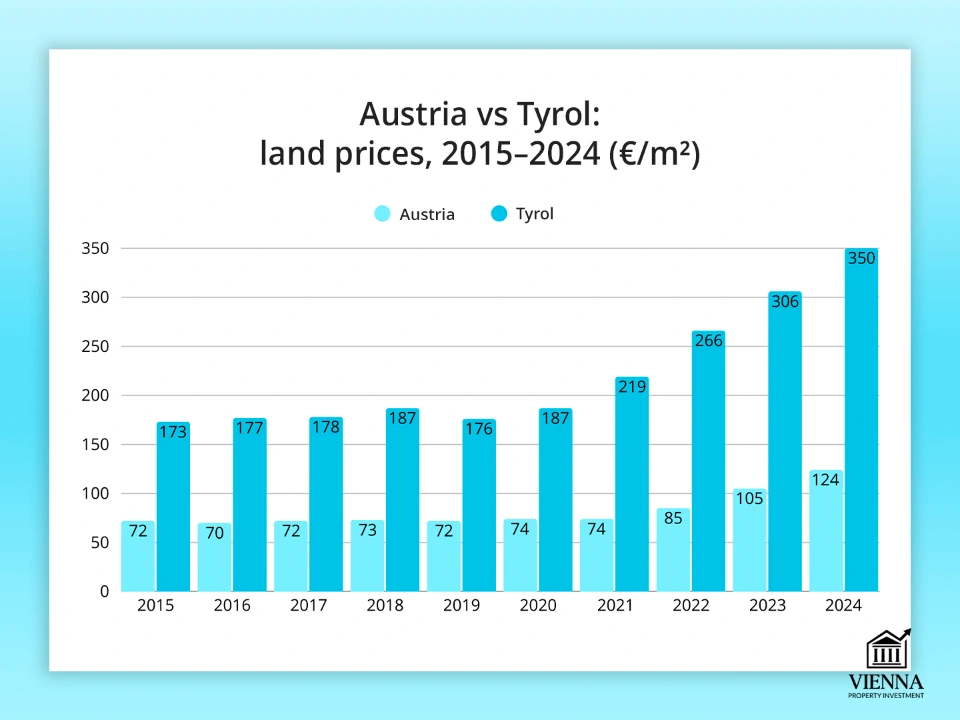

Demand and prices in the region are growing unevenly. Properties near ski resorts and in large cities are in the highest demand. From 2016 to 2022, apartment prices increased by approximately 60% (from €2,850 to €4,573/m²), while prices for private homes increased by almost 93%.

However, by 2023–2024, growth slowed due to high lending rates: according to Statistik Austria , in 2023, housing prices in Austria fell by 2.6% for the first time since 2010 (mainly due to existing housing).

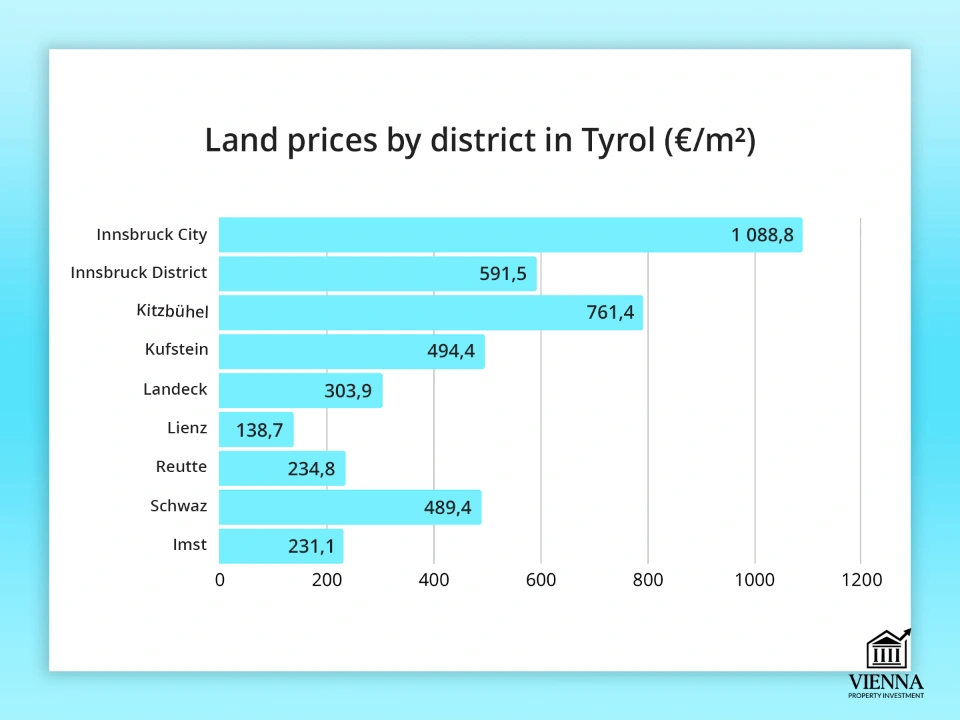

In Tyrol, the trend is similar: after peaking in 2022, prices have stabilized. For example, apartment prices have adjusted slightly in 2024, while land prices, despite stabilization, remain high (the average for Tyrol is €414/m² in 2024, more than double the 2016 level).

Seasonality also plays a role. Buyer activity typically increases in summer and fall (before the winter season), which sometimes pushes up prices, especially for properties near popular ski areas. Winter, on the other hand, can be characterized by lower activity due to holidays and weather conditions.

-

Case study: Recently, a client from Germany contacted us looking to buy a small chalet near Kitzbühel. I explained that prices there are among the highest in the region (around €7,000-9,000 per square meter) and suggested that he also consider neighboring, lesser-known but more affordable areas.

Ultimately, we found a good chalet in the Ortlertal for a significantly lower price, while Kitzbühel offered a profitable investment opportunity for rental income. This approach—adapting to a budget while maintaining proximity to the resort—often helps my clients optimize their purchases.

What does location affect? Top locations in Tyrol

Location is a key factor. Developed infrastructure (roads, schools, hospitals) and proximity to ski slopes or tourist attractions directly impact the price and marketability of a property.

For example, Innsbruck (the capital of Tyrol) is famous for its university, airport and transport hubs, so the average price here is noticeably higher than in remote valleys.

According to market data, the average apartment price in Innsbruck is approximately €5,700 per square meter, while in the mountains, such as Landeck or Lienz, prices can be significantly lower (€2,000–3,000 per square meter). The high prices are influenced by:

- Tourist appeal. Resort areas (Kitzbühel, Axam, Mayrhofen, etc.) attract buyers willing to pay for the convenience of skiing.

- Transport accessibility. The proximity to motorways and international routes (for example, the Innsbruck-Salzburg exit near Kirchberg) makes the property attractive for permanent residence and business.

- Infrastructure and services. Areas with developed social infrastructure (schools, hospitals, shops) are more expensive than those in the wilderness. City centers are typically more expensive than the surrounding areas.

You can compare prices and features by region in Tyrol:

Kitzbühel (Bezirk Kitzbühel). One of the most expensive districts, home to top resorts. Apartment prices here are hundreds of euros higher than the regional average. The area is popular with investors, but affordable options are scarce.

Innsbruck-Land and Innsbruck (Land & Stadt). Innsbruck (city) – high prices due to its city status (approximately €5,760/m² for an apartment).

The outlying areas (Innsbruck-Land) are slightly cheaper, but are also closed to mass development, so the price level is close to the city level.

Landeck (Bezirk Landeck). There are many small towns near the slopes ("ski villages"), and prices are reasonable: for example, the average apartment price is ~3,592 €/m².

Lienz (Bezirk Lienz). The easternmost district of Tyrol, with lower prices (around €2,090 per square meter for an apartment). Real estate in Lienz is suitable for those looking for more affordable options while preserving the region's natural environment.

The districts of Schwaz (Schwaz, Kufstein, Reutte, etc.) are popular with tourists and offer average apartment prices. Reutte is the least developed and offers the cheapest housing (apartments from ~€3,740/m²), but job and service opportunities are also more limited.

-

Each region of Tyrol has its own character. For example, I associate Innsbruck with dynamism and student life; Kitzbühel with luxury and polo tournaments; and Lienz with mountain tranquility and local crafts. These details are important to consider: buying a chalet in a bustling city may not live up to expectations, and vice versa – in the mountains, there may be a lack of entertainment.

If you're looking for city rentals without the "resort premium," it's helpful to compare Innsbruck with other city centers, including real estate in Linz .

-

Lorem ipsum dolor sit amet.

Steps to buying property in Tyrol

The process begins with selecting a site. Here, it's important to clearly define the goals:

- Live independently. Look for housing in cities or large towns with good infrastructure – close to work and schools.

- Invest/rent. Consider resort areas or student neighborhoods (Innsbruck). Small apartments or apartments near the ski slopes are suitable for short-term rentals to tourists.

- Second home (dacha). Look for secluded mountain locations, but consider the potential for tourism: even a dacha benefits from access and a minimum of shops nearby.

-

Real estate agencies play a vital role: specialized firms operate in the local market. A reliable agent will help filter listings and verify their authenticity.

However, it's also important to independently verify the information in advertisements: check the cadastral data of the property (Flächenwidmung), ask for photos of the property, and verify the transaction history. Never transfer funds to unfamiliar accounts without first verifying the seller's credentials.

Search checklist:

- Determine your goals and budget.

- Use portals and realtors, but then inspect several properties in person.

- Gather information about the area: rental demand, property taxes, any restrictions (no second homes).

- Ask an expert about the timing of the transaction: sometimes good offers disappear from the market quickly.

"When I'm selecting real estate for a client, I always clarify: what properties will you be comparing? It's often necessary to view apartments and houses in different locations to get a true price 'map' of the area.".

— Ksenia , investment consultant,

Vienna Property Investment

Legal procedures and permits

The purchase process in Tyrol is governed by Austrian state law (Grundverkehrsrecht), and detailed rules for foreigners may vary by federal state. Key considerations for non-residents:

Purchase Permit (Genehmigung). EU and EEA citizens are treated as Austrians and do not require a permit . For citizens of non-EU/EEA countries (e.g., the CIS, the US, etc.), restrictions apply to foreigners purchasing real estate in Austria : in most cases, the transaction must be pre-approved by the Grundverkehrsbehörde (municipal land acquisition authority).

Procedure: After signing the preliminary agreement, the buyer submits an application; a decision is usually made within a few weeks.

-

Legal note: The approval process should be completed promptly after the contract is signed. If the application is rejected, the contract may be invalidated. Please pay close attention to the terms and conditions of the permit.

Legislative changes. In 2024, amendments to the local land transfer law were adopted in Tyrol, introducing new checks and restrictions, particularly for transactions involving land and agricultural real estate.

Stay up-to-date: I suggest you read official Land Tirol publications or consult a lawyer to stay informed about any changes.

Required documents. Essential documents include a passport, tax identification number (Steuernummer) in Austria, proof of current residence, an extract from the land registry (Liegenschaftskataster), and a land plot identification number (KG, Grundbuchnummer). The seller provides a certificate of ownership (Grundbuchauszug).

Most often, the transaction takes place before a notary: you will need a power of attorney (if a representative is acting), a previous purchase agreement, etc.

Verifying the property's legal status. It's recommended to engage a local lawyer or notary during the negotiations: they will verify the absence of encumbrances, debts, and pending lawsuits, as well as the accuracy of the cadastral data and the legal form of the contract.

For example, I always ask a lawyer to check whether the property has cadastral approval and whether it is a "holiday residence," the purchase of which may be subject to restrictions.

-

Case study: One of my clients, a Polish (EU) citizen, was purchasing a chalet in Tyrol. We immediately found out that no permit was required (since it's an EU property).

However, it was important to take into account the local rules of "Zweitwohnsitz" (second residence): when signing the contract, he personally assured the notary that he would not use the property solely as a summer residence.

This wording ("kein Freizeitwohnsitz" - "not intended for recreation") is required in the Tyrolean contract. This simple clause protected the client from potential fines for violating the property's status.

Financial aspects: taxes, fees and budget

Purchasing real estate in Austria involves a number of mandatory expenses beyond the purchase price of the property itself. The main ones are:

- Real estate transfer tax (Grunderwerbsteuer). 3.5% of the purchase price.

- Registration fee (Eintragungsgebühr). 1.1% of the cadastral value (Einheitswert) or market price – paid when entering rights into the land register.

- Notary fees. Approximately 1–2% of the transaction cost, depending on the complexity of the transaction and the notary's fee.

- Real estate agent commission. Typically, it amounts to up to 3% + 20% VAT of the purchase price (paid by the buyer), but this fee can be conditional or mixed (half is paid by the seller, if specified).

- Other expenses may include property appraisal, document translation, insurance (bank insurance for mortgages), and an annual property tax (Grundsteuer)—usually small, based on the property's size and location, and charged annually to the owner.

In total, hidden costs when purchasing a property amount to approximately 9-11% of the purchase price. When financing with a loan, it's recommended to include at least a 20-30% down payment (in Austria, mortgages are often issued for up to 70-80% of the purchase price).

You also need to consider future monthly expenses: utilities (heating, water, snow removal, etc.), home insurance, and possibly condominium fees (for new homes).

Example of distribution of expenses when purchasing (approximately):

| Expense item | Percentage/amount of cost |

|---|---|

| Real estate transfer tax (3.5%) | 3.5% of the property price |

| Registration fee (1.1%) | ~1.1% of the estimate |

| Notary (~1–2%) | ~1,5 % |

| Broker commission (up to 3% + 20% VAT) | up to 3.6% |

| Total (approximately) | ~9–11% |

"When calculating a purchase budget, I always tell clients: in addition to the price of the house, be prepared for 10% 'commissions and taxes.' Many are surprised when the 'additional fees' turn out to be substantial. This needs to be taken into account in advance.".

— Ksenia , investment consultant,

Vienna Property Investment

To finance their purchases, foreign buyers can turn to Austrian or international banks. Europeans are generally offered the same terms as Austrian citizens.

If you're planning a mortgage, check with the bank in advance about the acceptable loan terms and requirements (there may be stricter income criteria due to new FMA standards introduced in 2022 ). Also, consider the future euro exchange rate and interest rates, as they affect the profitability of your investment.

Peculiarities of purchasing real estate by foreigners in Tyrol

As mentioned, the main legal requirement is permission from the authorities (Genehmigung durch Grundverkehrsbehörde) for non-residents who are not EU/EEA citizens. In this case:

- EU/EEA citizens are treated as Austrians and can purchase property freely without any additional approval (though sometimes notification of the local administration about the transaction is required).

- Third-country nationals are almost always required to submit an application for acquisition. The procedure is individualized for each case—they must justify the purpose of the purchase (e.g., personal residence or investment) and provide additional documents (financial statements, resume).

On January 1, 2023, a new law , tightening controls on foreign purchases. It is now possible to deny permission if the transaction is not in the region's best interests (for example, if the property is primarily for tourism or if the buyer does not reside permanently in Austria).

Therefore, it's important for citizens of the CIS or other "third countries" to obtain professional advice in advance. Compelling arguments for the "social necessity" or "economic benefit" of the purchase are essential.

Sometimes permission isn't required, even if the buyer is from a "third country": there are bilateral agreements (for example, with Switzerland or Liechtenstein) or specific benefits (changing the wife's/husband's name to Austrian citizenship). However, it's best to clarify these details well before the transaction.

Protecting the rights of foreign buyers

To avoid fraud and legal problems, make sure you have:

Notary. Transactions in Austria are conducted through a notary (notar). This ensures legal integrity: the notary will verify the ownership rights and the legality of the contract. It is important to choose a notary with experience in real estate.

Legal assistance. I recommend hiring a lawyer or real estate consultant, especially if you don't speak German. They can help you prepare and translate documents, verify the seller's obligations, and prepare the permit application.

Transaction insurance. You can consider risk insurance (Treuhandvereinbarung or escrow), where funds are held with a third party until all approvals are received. This will protect you from losing money if the transaction is cancelled during the closing stage.

Beware of fraudulent schemes. Typical schemes include "double sales" (selling one property to two buyers at once) or "sale of encumbered property" (the seller has not registered). Always request a recent extract from the land register (Grundbuchauszug) and verify the names of the parties.

-

Important: Many purchase agreements stipulate that the property will not be used as a "freizeitwohnsitz" (non-primary residence). For example, a standard phrase is: "The buyer confirms that he/she will not use the property as a second residence."

This reflects Austria's strict laws regarding second homes. Check these points to avoid a fine (violators in "second homes" face serious penalties).

Peculiarities of real estate ownership by foreigners

After purchasing, it is important for a foreigner to follow the rules of use:

Second home (Zweitwohnsitz). As already stated, the purchased property must be your primary or "work" residence (for example, if you are temporarily studying or working in Tyrol), otherwise it may be considered an illegal second home.

Doctors and teachers are sometimes granted exceptions. In any case, make sure you've completed all declarations of residence and don't fall under the restrictions of "preferred municipalities" (Vorbehaltsgemeinden), where new second homes are prohibited altogether.

Rental. Foreigners are allowed to rent out their property. However, if the property is considered a "Freizeitwohnsitz" (vacation residence), municipal regulations may restrict short-term rentals (such as Airbnb). Before renting, check local regulations and pay any applicable tourist fees.

Inheritance and resale. Foreigners have the same inheritance rights as Austrian citizens. If you later wish to resell the property, the same steps apply (primarily selling through a notary).

Depending on the terms of the contract, you may need to refund a portion of the taxes or pay a new cadastral valuation, but these details are usually resolved automatically upon resale.

Regular supervision. If you don't live there full-time, it's recommended to hire a management company or trusted person to oversee your property: checking its condition, paying utility bills, removing snow, etc. This will protect your property and avoid any problems.

Types and features of real estate for purchase: an overview of options

Apartments in Tyrol: A Choice for Living and Investment

Apartment types range from one-bedroom to four-bedroom apartments, in high-rise buildings or townhouses, with or without balconies. New properties are often built in complexes with parking and elevators; existing units are older, but sometimes boast unique character (wooden beams, antique finishes).

Keep in mind that prices in new buildings are usually higher (investors pay for modern amenities), while resale properties are cheaper but may require renovation.

Prices and audiences:

- For young couples or students, studios and one-room apartments are of interest (currently ~4000-5000 €/m² in Innsbruck).

- Spacious 2-3-room apartments are more suitable for families, especially in the suburbs or regional centers (around €3,500/m²).

- Apartments near resorts (for example, in Kitzbühel) are chosen by investors or families willing to pay for a mountain view.

- If you want to rent out your accommodation to tourists, it's best to choose compact units in popular locations (of course, taking into account the laws on secondary housing).

Pros: apartments are usually cheaper per square meter than houses, easier to maintain, and easier to rent out (no costs for clearing soil, snow, etc.).

Cons: less privacy, utility costs (Hausverwaltung, renovations) and often higher prices in the city centre.

Private houses and chalets: comfort and status

A private house or chalet is a large property on land.

Pros: more space and privacy, a private garden/garage, and individuality. These homes are often built from high-quality materials (stone, solid wood), retain heat well (important in the mountains), and look luxurious against the backdrop of the Alps.

Cons: price and maintenance. A house requires significant investment in heating, roof repairs, winter snow removal, etc. Also, you need to check permits: some areas prohibit the construction of new chalets (especially in protected areas).

If you are planning to rent out your home (including on Airbnb), please note that Austrian law may restrict short-term rentals (Zweitwohnsitz limits).

Purchasing considerations: The same land transfer management process applies to a villa or house. However, private homes often come with additional conditions requiring the owner to reside there for a certain period of the year (to avoid exacerbating the housing shortage).

Before buying a chalet, ask about the "social interest" - sometimes buyers are asked to provide plans for use (personal residence bkb investment).

Luxury villas and apartments

If you're looking for luxury, be prepared for very high prices: from several million euros. Villas often combine modern design with Alpine architecture, featuring spas, saunas, and panoramic windows. Prices for such properties (for example, in Kitzbühel or Axam) can exceed €10,000–15,000 per square meter.

Such objects are appropriate in the following cases:

- You want a second home in a resort.

- You view the property as a long-term investment in a future residential area (for example, a large new residence project).

- You plan to rent to exclusive tenants (the regional brand is important here).

The situation is similar for luxury apartments: they can be offered with hotel services, reception, and so on. This is a niche product.

Land plots: construction and investment opportunities

Selecting a plot. Look for plots in designated building zones (Bauzone). Residential plots are highly valued in Tyrol. If you plan to build a house, make sure the plot is approved for residential use, not just agricultural use. New spatial planning regulations ( TIROLER Raumordnungsgesetz ) may restrict the designation of new zones.

Land prices. In Tyrol, it's worth purchasing land early: the average price is estimated at €414/m² in 2024. In and around central Innsbruck, plots reach €786/m², and in the nearby Warrmarket, €689/m², while in most of the country, prices are significantly lower.

Investors expect land values to rise as new sites become scarce, especially near resorts.

Purchase considerations. Any land transaction often requires specific additional approvals (from plumbing to road construction).

After purchasing, you will most likely need to obtain design documentation and building permits (Baubewilligung) – this is a lengthy and expensive process in the Alps (due to impact checks on the landscape, drainage, etc.).

Latest changes and innovations in the laws and market in Tyrol

The Tyrolean market is subject to legislative changes. The following important changes have been introduced in recent years:

Second Home and Vacant Home Taxes (2023). On January 1, 2023, the Tiroler Freizeitwohnsitz- und Leerstandsabgabegesetz (TFLAG) (Vacant Homes and Accommodation Tax Act) came into effect in Tyrol. It requires municipalities to levy additional taxes on residential properties vacant for more than six months and on second homes.

The fees are set by municipalities; the upper limit is up to €2,500 per year for larger apartments. The idea is to encourage the rental of empty properties and discourage the purchase of unused second homes.

As a result, new rental housing has become a slightly more profitable option, and speculation on "wooden chalets" for second homes has become more difficult. Buyers should check with the municipality in advance whether the property they are buying is within the tax zone (this may vary by village!).

Amendments to the Real Estate Law. In 2025, it was proposed to tighten regulations for agricultural land and plots on slopes. For example, it is planned to revive the "land controller" institution and restrict the conversion of fields to solar power plants to preserve agricultural arable land.

There are also guarantees that farmers will have priority in purchasing neighboring plots. If you're planning to purchase land or a plantation, stay tuned: these changes may limit your freedom to manage such land.

Transaction procedures. Transaction processing has become more digital: many federal states, including Tyrol, are converting some applications to electronic form. However, a paper notary signature is still required. It is important to monitor current application forms on government websites.

Information resources. It's easy to keep up with changes on the official Land Tirol and legal information systems ( RIS ). I also recommend subscribing to the WKO Tirol and LK Tirol newsletters, as they frequently publish guides and analyses of changes to the real estate market.

Tips and common mistakes when buying property in Tyrol

Don't skimp on experts. The most common mistake is underestimating the costs of legal support and audits. Having a lawyer and a qualified appraiser will help avoid greater losses.

Look beyond the first apartment you see. The housing market in Tyrol is saturated, and a similar offer may be cheaper in a neighboring town. Compare options and take your time making a decision.

Consider all expenses. Don't limit yourself to the transaction price: include all taxes and expenses (at least 10%), as well as regular utility bills, especially if you plan to sell the property to a resale market or rent it out.

Check the contract details. Foreigners can often miss an important clause in the contract or underestimate the mandatory use clause (for example, that it cannot be rented out as a "vacation apartment" without permission). If necessary, hire a translator.

Realtor reputation. Trust only verified agents. There are fly-by-night brokers with dubious reputations on the market. Check reviews and their license (Maklerbefugnis – a document authorizing the broker to conduct transactions in Austria).

-

Case study: We once helped Israeli clients purchase a house in the Kitzbühel region. They immediately wanted to sign the contract and pay the deposit after seeing the beautiful chalet. I insisted on an additional document audit and a little tax modeling.

It turned out that the house wasn't built to all Alpine building codes (insufficient insulation), requiring additional repairs. If they had paid upfront, they would have lost money later on fixing the problems.

Thanks to our diligence and due diligence, we were able to factor these additional costs into our price negotiations, resulting in a better deal for our buyers.

Conclusion: Practical steps and what to do next

Tyrol offers an attractive, yet complex, real estate market. The following key points are important:

- Determine your goal and budget before you start searching (moving, renting, investing).

- Explore the regions. Learn about price differences and regulations (housing is more expensive in large cities, cheaper in the mountains, but there are restrictions on second homes).

- Estimate all expenses. Budget at least 10% of the transaction amount for taxes, fees, and paperwork.

- Consult professionals. Hire a local realtor and lawyer, especially if you don't speak German. This will protect you from misunderstandings and speed up the process.

- Plan the legal process. If you're not an EU/EEA citizen, obtain permission through the Land Transfer Office – without this, the transaction is impossible. Make sure all documents are in order before signing the contract.

You can start with simple steps: browse ads on trusted websites, subscribe to agency newsletters (for example, Vienna Property Investment, which publishes regional reviews), and gather information about the area.

Then contact local experts – they will advise you on which properties best suit your needs.

"If you have any questions or need transaction support, we are ready to help: our specialists have experience in the Austrian market and will be happy to advise you on any aspect of purchasing a home in Tyrol.".

— Ksenia , investment consultant,

Vienna Property Investment