How to Buy Real Estate in Lower Austria in 2026: Prices, Laws, and Tips

Lower Austria (Niederösterreich) is Austria's largest state by area and population (approximately 1.7 million residents), forming a ring around Vienna. It encompasses everything from the capital's suburbs (e.g., Mödling and Tulln) to spas (Baden) and the picturesque wine valleys of the Wachau and Wienertal.

Thanks to its convenient location, Lower Austria is just 30 minutes from Bratislava and 2–3 hours from Linz and Salzburg. Housing prices here are significantly lower than in Vienna, making it convenient for those comparing options in the capital's suburbs and real estate in Linz as an alternative to a major city.

Lower Austria has earned a reputation as Vienna's "garden belt" for its fertile land, vineyards, and orchards; homes with private gardens are more common here than in Vienna itself. It's ideal for those who value ecology and space while still maintaining access to city amenities.

Everything is here

- promising economy

- well-developed infrastructure (motorways A1, A2, S-Bahn network to Vienna and the international airport)

- excellent schools, diverse recreation areas

Many buyers come from neighboring federal states and from abroad, given the quality of local schools and the safety of the regions.

I am convinced that it is the combination of nature, comfort and stable legal conditions that makes Lower Austria an attractive place to live and invest.

Below, we'll take a detailed look at the current market situation in 2025, the main types of housing and areas where to look for a house or apartment, and explain the home buying process for Austrian citizens and foreigners.

General trends in the real estate market

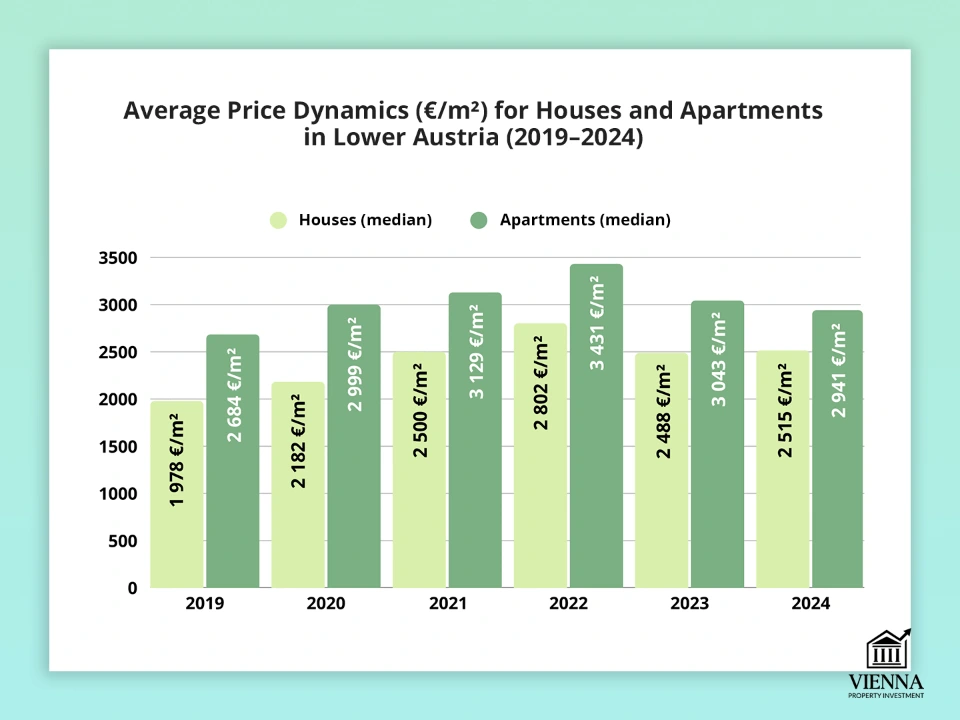

After several years of rapid growth, housing prices in Lower Austria have corrected. Based on the 2023 figures, Statistik Austria notes a -4.9% decline in house prices compared to 2022, and a -3.0% decline in apartment prices. For those comparing apartments in Austria by region, this correction is particularly noticeable in the housing segment around Vienna.

Overall, the Austrian housing market contracted by approximately -2.6%. Vienna led the decline (houses fell -6.7%), while in some western states (Styria, Salzburg, and Tyrol), housing prices even rose slightly. Therefore, when comparing regions across the country, it's useful to consider how real estate in Styria relative to the Vienna suburbs.

However, by the end of 2024, the market had stabilized. According to Raiffeisen Research , housing prices have fallen by only approximately -1% year-on-year, and the first months of 2025 are showing moderate growth in some segments.

"Real estate isn't just about square footage; it's also about the dynamics of the region. Lower Austria is growing thanks to its infrastructure and proximity to Vienna, which means prices here will be more stable.".

— Ksenia , investment consultant,

Vienna Property Investment

Banks are reporting an increase in mortgage lending (Lower Austria/Vienna loans +1% compared to March 2025), and buyers note that the key rate cut is making mortgages more affordable. Lower inflation and a gradual improvement in the economy are maintaining purchasing power.

At the same time, new supply has declined significantly. According to WKO , residential construction starts fell by -17.3% in 2024, and a further shortage of approximately 7,700 apartments is projected for 2025.

The shrinking supply is limiting price declines even with moderate demand. Following the easing of housing restrictions ( the lifting of the KIM-Verordnung ) by the end of 2024, the number of home sales transactions has risen sharply in many counties, indicating pent-up demand. A brief overview of the trends:

Lending is growing. Mortgage loans in Lower Austria have begun to increase (+1% in Q1 2025), indicating a pickup in demand.

A shortage of new housing. A decline in construction (-17.3% for 2024) is limiting price declines.

Remote work. Many Viennese are moving to Lower Austria for additional office space and leisure time. Many are now working from home several days a week, fueling demand for country homes.

Renting vs. buying. Rental demand has temporarily fallen, and some properties are vacant, making buying an alternative. Investors are once again increasingly looking at residential real estate.

Regional demand. Areas near major transportation hubs (railway stations, highways) are particularly in demand. These are where new projects are being developed most quickly.

As a result, as of the end of 2024, we can speak of a balance of interests: sellers are forced to be more realistic in their pricing, and buyers now have a wider range of options to choose from.

Many experts are calling this the optimal time to buy: the market has already recovered from a correction and is poised for moderate growth if economic conditions improve further. Consequently, in 2025–2026, housing prices in Lower Austria could begin to rise slightly (+1–2%), especially if the downward trend in rates continues.

Main types of real estate: houses, apartments, plots

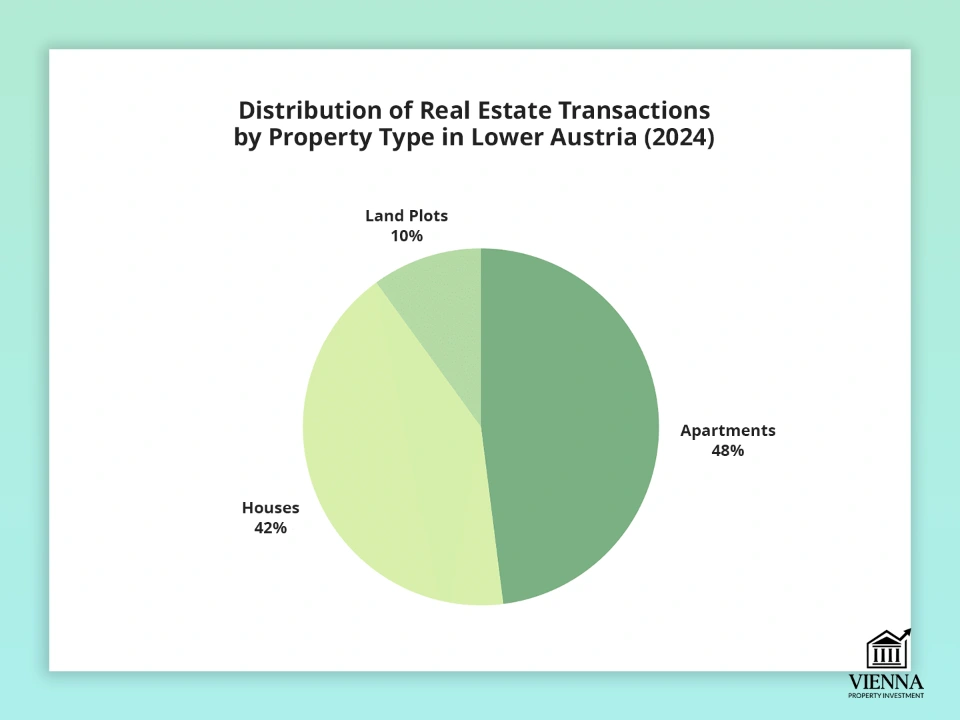

The Lower Austrian market offers three basic types of housing: private homes, apartments, and building plots. Let's look at the features of each:

Houses, villas and townhouses

Detached houses are the most common option for families. Lower Austria is renowned for its half-timbered cottages and modern one- and two-story houses with private plots. According to Statistik Austria , approximately 51% of all residential units in the region are detached houses (one apartment per building).

Houses usually have a garden or yard, which is highly valued by families with children. In rural areas, you can find old farmhouses (Bauernhäuser): they are cheaper than new cottages, but require significant renovation and are often sold with adjacent farmland.

Apartments

A practical choice for those who don't need a large plot or who frequently travel to the city. Multi-apartment buildings are common in Lower Austria: according to statistics, 13% of buildings contain two apartments, 17% contain three to nine apartments, and 12% contain ten to 19 apartments.

Apartments are often purchased by young families without children, older people, or working couples. They are less expensive than houses, require less gardening, and usually have better access to city centers: St. Pölten, Krems, and other cities have modern apartment stock. These buildings often have an elevator, underground parking, good heating, and nearby amenities.

Land plots

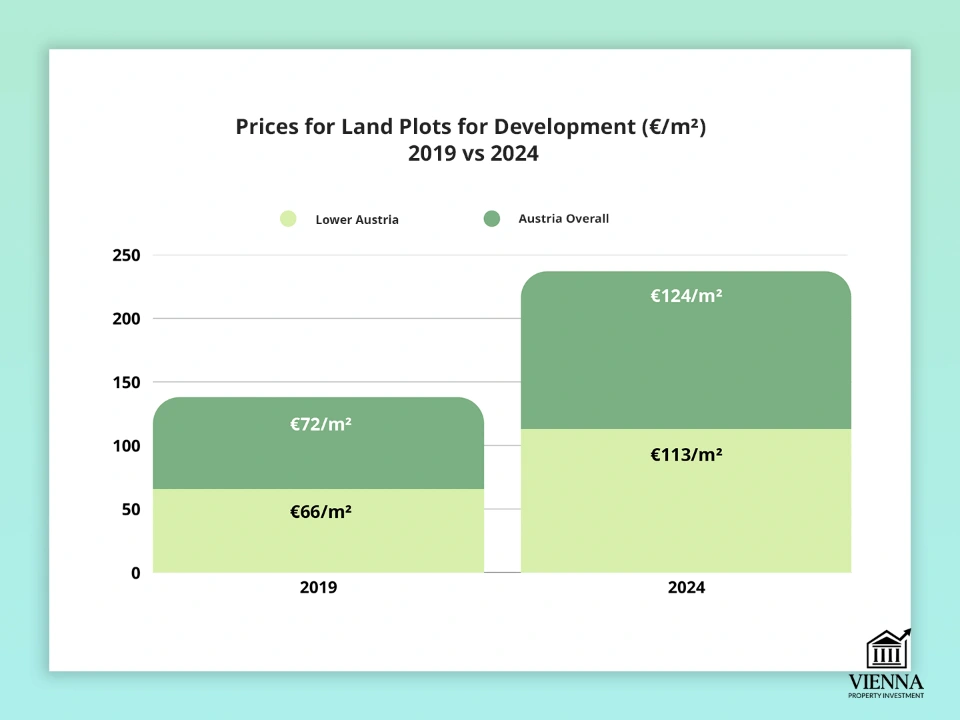

If you want to build a house according to your own design, you'll need to buy land. Land prices in Lower Austria vary by region : in 2024, the median price of building land was approximately €113/m² (slightly below the Austrian average).

Plots with utilities (gas, water, electricity) and in prime locations are more expensive. Plots are especially popular in rural wine-growing regions (Wachau, Wienertal) and suburbs, where you can build a custom home to suit all your needs.

Other types

The region also offers multi-family homes for sale (the main new development in cities), as well as farmsteads and even luxury mansions (chalets and villas). These options are suitable for investors or large families.

"Liquidity is important for investors. I often say: an apartment closer to Vienna sells faster than a house in the countryside. But a house offers more freedom and long-term appreciation in land value.".

— Ksenia , investment consultant,

Vienna Property Investment

Where to look for housing: Lower Austria's districts and their characteristics

Lower Austria is divided into four large districts (quarters), each with its own character. Here are the main ones:

Wienertal (northeast). A wine-growing region along the border with Slovakia. It features manicured hills with vineyards, small, cozy villages, and abundant green spaces. Wienertal residents choose it for its open spaces, clean air, and wine-growing climate, while still enjoying the convenience of commuting to the city.

- Key towns include Korneuburg and Mistelbach, as well as the municipalities in the Donau Valley.

- Housing prices here are generally lower than in the suburbs of Vienna: many houses and plots are more affordable.

- The region is well connected to Vienna: by train (S-Bahn) the capital is approximately 1 hour away.

Waldviertel (northwest). A wooded and rural region along the border with the Czech Republic. It features quiet villages, vast forests, and lakes. The region is ideal for those who appreciate winter ski resorts (such as Hochficht) and summer vacations, and don't mind a longer commute to major cities (Vienna is about 1.5–2 hours away).

- The main towns are Zwettl, Gmünd and Horn.

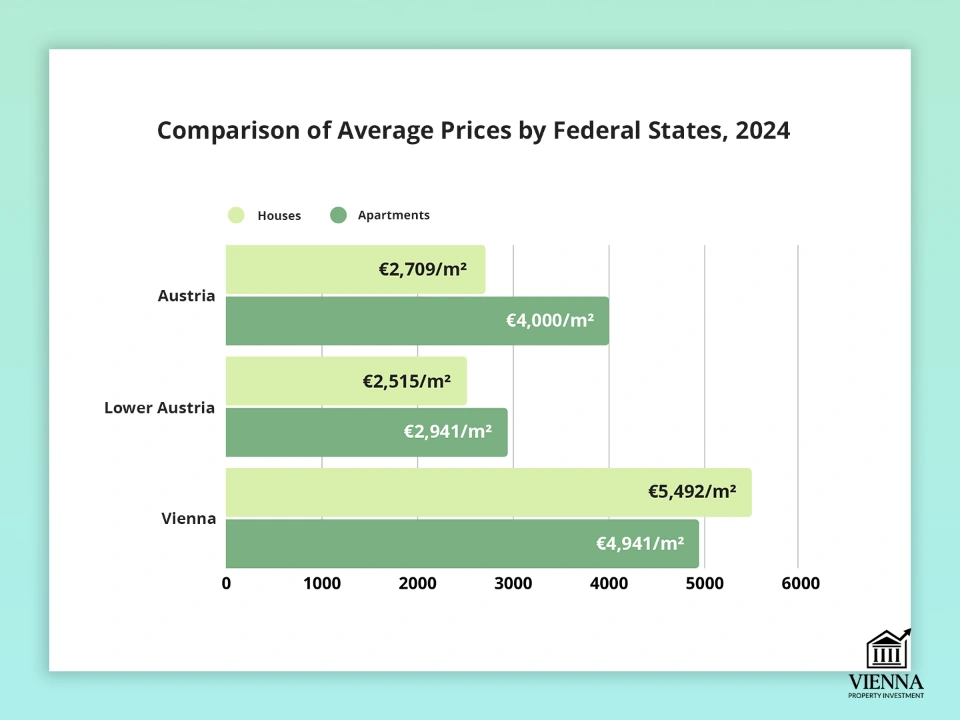

- Housing prices in the Waldviertel are among the lowest in the region: according to Raiffeisen Research, the average price of houses in the Zwezell district is only ≈€1,845/m².

- The infrastructure is simpler, but people here enjoy solitude and closeness to nature.

Mostviertel (central, southwest). An industrial and agricultural region with its capital, St. Pölten, a modern city with a university and a vibrant cultural scene. The A1 motorway (Vienna–Salzburg) and the railway to the west pass through here.

It's a good balance between city opportunities (work, education, leisure) and nature: nearby there's Lake Traisenberg and forests for walks.

- Large cities: St. Pölten, Amstetten, Melk, etc.

- Employers: local factories, agricultural enterprises, educational and research centers.

- Housing prices are average: not as high as in Vienna, but higher than in the northern regions.

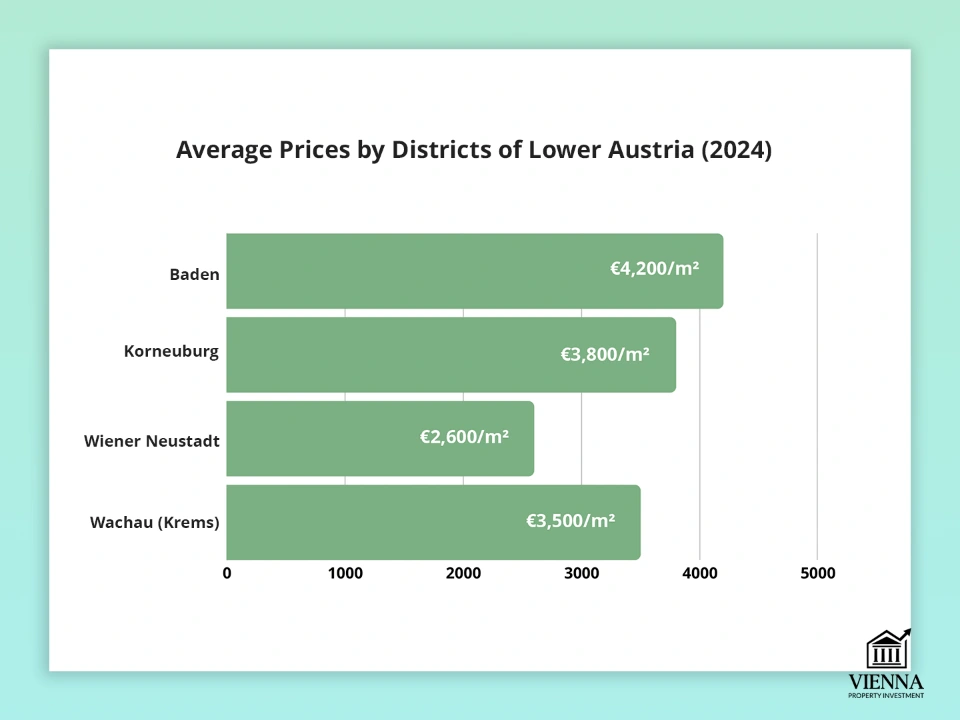

Industrial Quarter (southeast). The suburbs of Vienna and the southern regions of Lower Austria are the most expensive. If you work in Vienna or prefer to be "in the center of things," this area offers the most amenities, but will come at a premium.

- This includes the districts of Mödling, Baden, and Wiener Neustadt.

- Well-developed infrastructure (hospitals, universities, enterprises) and excellent transport accessibility to Vienna (20–30 minutes).

- Prices are high: for example, in Mödling the average house price is ≈€5,420/m² (2–3 times more expensive than in Waldviertel).

-

Case Study: A family from Ukraine was looking for a house near Vienna. They initially looked in the Baden district, but the prices seemed high. They eventually found a property in the Korneuburg district: a warm house with a garden, a school, and a kindergarten within walking distance. The price was 15% lower than in Baden, and Vienna was only a 25-minute train ride away.

Major cities. Popular settlements include:

- St. Pölten (capital of Lower Austria)

- Wiener Neustadt (industrial center in the south)

- Baden (a thermal spa in the west)

- Mödling and other suburbs of Vienna.

- In the north, Retz, Mistelbach, Krems (a university town), Amstetten and others are noticeable.

Most major cities lie along main roads (A1, A2) or rivers (Danube).

The choice of area depends on your priorities: whether you want peace and quiet and nature (then Waldviertel or Wienertal) or city services and proximity to economic centers (industrial quarter, St. Pölten).

For example, families with children often choose areas near large cities (St. Pölten, Krems) for the schools, while wine lovers choose the Wachau vineyards.

Types of Housing: Which House or Apartment is Right for You?

Every buyer is unique. Here are some recommendations based on your goals and lifestyle:

Families with children: They typically choose a house with a plot in a quiet area. This area has space for a playground and a garden with fruit trees, and there should be a good school or kindergarten nearby.

When choosing a home, consider neighborhood development plans (new schools, parking lots) and ensure the space fits your long-term plans. Consider future expenses as well: compare utility rates by neighborhood (or learn about other taxes).

Young couples and professionals. If you're young, work long hours, and don't plan to live with your parents, an apartment close to transportation and amenities is a convenient option. An apartment is usually cheaper to purchase and maintain, and unlike a house, you don't need to maintain a garden.

If you're looking for a bit of privacy, consider a townhouse (Reihenhaus) – it's like a small "cottage apartment": often in the suburbs with a small private yard, but cheaper than a detached house.

For young couples renting a home, buying a small apartment can also be an investment: by participating in the first-time homeownership program (Eigenheim-Förderung), the state repays part of the loan.

Pensioners and seniors. Seniors value convenience and ease of maintenance. They often choose apartments or houses in gated communities with elevators, parking, and proximity to clinics.

For example, in the areas around St. Pölten and Vienna, there are retirement communities and senior homes. The proximity of pharmacies, clinics, and public transportation is important. If you want to live outside the city, look for single-story houses without steps and with good access, and consider the possibility of reduced payments upon retirement in your mortgage agreement.

Investors. If you're buying for investment (renting or resale), consider the property's liquidity. These are often apartments in suburban areas or new buildings near train stations and highways. Popular options include St. Pölten and the Vienna region, where there's a high demand for rental properties.

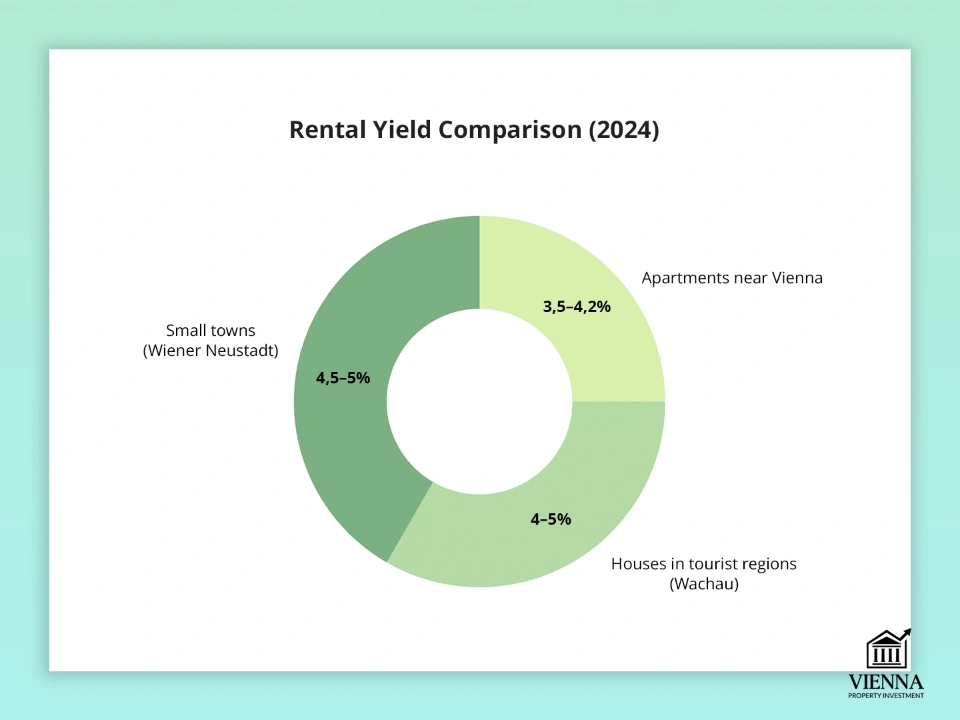

Before purchasing, analyze the market conditions: study rental yield statistics (e.g., yield ≈3–4% of the price) and compare with alternatives. Vienna Property Investment will help you evaluate which type of property best suits your strategy.

Students. Lower Austria has universities (St. Pölten, Krims). Students typically prefer renting, but those looking to invest in their future can consider affordable apartments near campus. A cheap studio or small apartment can be a profitable investment if prices continue to rise and rentals are available.

-

Case: An investor from Kazakhstan purchased a small studio apartment in Wiener Neustadt. The intention was to rent it out to students. The return was approximately 4.8% per annum (net), and demand was stable thanks to the university and military academy.

For those working away from home. If you commute to Vienna or another city, consider direct transportation access. Houses and apartments near S-Bahn stations and major highways are in high demand. For example, small towns around Tulln station or Wien er Neustadt are convenient for daily commutes to Vienna.

Animal lovers. Dog and cat owners need a separate yard or garden. New townhouses often have small garden plots where pets can roam. Avoid low-rise apartments without access to the street or where the homeowners' association rules prohibit keeping large animals.

For eco-enthusiasts. Demand for energy-efficient homes is growing in the region. If green technology is important to you, look for homes with Passive House certification or solar panels installed. These properties are more expensive to purchase, but they can save hundreds of euros per year on heating and utilities.

Short-term rentals and summer cottages. If you plan to use your property as a summer cottage or Airbnb, check local regulations. Many communities have introduced second-home taxes ( Zweitwohnsitzsteuer ) or restrictions on short-term rentals. Summer cottages in tourist areas (Wachau, Wien ) are popular, but may incur additional fees.

"Buyers often hesitate between an apartment and a house. I advise you to first ask yourself: do you want peace and quiet or a dynamic environment? This will determine not only your choice but also your future life in Austria.".

— Ksenia , investment consultant,

Vienna Property Investment

Prices and factors affecting cost

Housing prices in Lower Austria depend on many factors. As a guide, in 2024, the median price of a house in Lower Austria was approximately €2,515/m², and an apartment was €2,941/m². For comparison, in Austria as a whole, the median price is €2,709/m² (house) and €4,000/m² (apartment), while in Vienna, the median prices are €5,492/m² and €4,941/m², respectively. This difference reflects proximity to the capital and the size of the property.

To get a full picture, many compare not only Vienna and Lower Austria, but also Western markets—for example, real estate in Tyrol , where land shortages and tourist demand have a greater impact on prices.

Key price factors

District and location. The most significant factor. Proximity to Vienna and major cities significantly increases prices. For example, in the districts south of Vienna, prices are 2-3 times higher than in the north. For example, in Mödling, the average house price is approximately €5,420/m², while in Zwettle it is only approximately €1,845/m².

Water or mountain views, green areas, and the area's prestige (Knightsbridge in the region) also add to the price.

Property type and size. New construction is usually more expensive than existing housing (Altbau), especially if it's a "passive house" with high energy efficiency. A larger home or many rooms increases the overall cost, although the price per square meter may be lower.

Additional areas such as an attic, veranda, basement, garage, or private parking provide a significant bonus – they increase the comfort and value of the home.

Condition and year of construction. New or recently renovated buildings are valued higher. Older houses are sometimes cheaper, but often require investment (repairs, insulation), which lowers the starting price.

Pay attention to the quality of the windows, roof, and heating system: Austria has many buildings with a history, so checking their condition before buying is essential.

Infrastructure. The proximity of kindergartens, schools, transportation hubs, stores, hospitals, and parks increases property value. For example, a home in a good school district can cost 10-15% more than a similar home without a school nearby.

To make the right decision, consider the "comfort of location": as mentioned, the location of the home is just as important as its design.

-

Case Study: A Russian couple was considering buying a house on the Danube. They found two similar properties: one near the Wachau tourist region, the other further inland. The price difference was nearly 40%. They decided to buy the former because it was better suited for rentals to tourists and had potential for price appreciation.

Additional amenities. A terrace or balcony with a good view, a private garden, an elevator, a sauna, or a swimming pool in the building significantly impact the price. New homes with smart technologies (heat recovery ventilation systems, solar panels) are more expensive but increase the long-term value of the property.

Economic factors. Interest rates and inflation affect credit availability and purchasing power. Also consider taxes and unexpected expenses when purchasing: property tax (3.5% of the purchase price), stamp duty, and notary fees (~1%).

The government has temporarily waived the registration fee for up to €500,000 (saving up to €5,500), which is worth taking into account when calculating.

Future changes. Development plans for the area can increase (or decrease) prices. For example, the waiver of the registration fee to €500,000 and housing incentives are stimulating demand right now. Keep an eye on projects for roads, schools, power plants, and business centers in the area: their development usually increases the attractiveness of housing.

Please note that prices fluctuate and may differ from the median. To evaluate a specific property, it's best to conduct a comparative analysis with the help of experts. Our consultants at Vienna Property Investment will help you assess the true value of your chosen property and consider all factors.

"Price isn't just about the square footage. It's about transportation, the views, even the neighboring house. I always ask clients to look beyond just the price of the property.".

— Ksenia , investment consultant,

Vienna Property Investment

How a foreigner can buy property in Lower Austria

For EU/EEA residents, buying a home in Austria is almost the same as buying a home locally: no special permit is required .

Citizens of other countries must obtain consent (Genehmigung) from the local administration before purchasing, in accordance with the real estate law. This is a formal procedure to verify whether the property will be used as a primary residence. No new restrictions have been introduced for foreigners in Lower Austria.

The purchasing process is standard. After choosing a house or apartment, a preliminary contract (Vorkaufsvertrag) is signed and a down payment is made (usually 5-10% of the purchase price).

The transaction is then formalised by a notary (Notar) – he draws up the final sales contract and registers the transfer of rights in the land register (Grundbuch).

Foreigners must provide a passport, proof of income, and sufficient funds for the purchase. Banks typically require translations of documents into German, and often require family or visa/residency certificates. If you don't speak German, it's best to have a translator or lawyer accompany you through the transaction.

-

Case Study: A young family from Moscow purchased a house in the Tulln district of Lower Austria. We helped them gather documents, obtain permits, and organize the transaction. Thanks to Vienna Property's support, the transaction was quick and stress-free.

When registering, consider all costs. This includes the 3.5% tax and the registration fee. For transactions under €500,000 involving a residence, the registration fee is waived, but notary fees (approximately 1–1.5%) will remain.

Many foreigners take out mortgages from Austrian banks: interest rates are roughly the same as those offered by local clients, but the loan amount is typically smaller (LTV ≈50–70%). This means they'll need personal savings of around 30–50%.

It is useful to open an Austrian bank account and obtain a Steuernummer (tax number) in advance, as without these, banks will not issue a mortgage.

Primary or secondary market. Foreigners often prefer new buildings (with clear delivery dates from the developer), but resale (Altbau) properties are also available. New buildings are more expensive, but they come with quality guarantees from the developer; resale properties are often cheaper but require verification of documents and condition.

Non-resident status. When making large investments, it can sometimes be advantageous for a foreigner to register an Austrian company or foundation for the purchase. In this case, the real estate transfer tax will be 3.5% of the value (as with a standard transaction), and the registration process is simpler from an ownership perspective, but the tax rate increases.

Bank account and documentation. Before signing the contract, open an Austrian bank account and obtain a Steuer-ID (tax number) – this is required by banks and authorities. Without these, obtaining a mortgage and registering will be difficult.

-

Case: A client from Israel encountered a situation where his bank in Austria requested additional documents regarding the source of his capital. The transaction was delayed by two months, but ultimately went through. Foreigners should prepare a full set of financial documents in advance, including taxation in their home country.

I recommend engaging local lawyers or realtors: at Vienna Property Investment, we partner with experienced notaries and consultants who can handle the transaction in Russian and German.

"It's important to understand that Austria is investor-friendly, but the rules are strict. It's better to prepare your documents in advance than to waste time and opportunities later.".

— Ksenia , investment consultant,

Vienna Property Investment

Latest news and changes in legislation

Significant changes to the real estate legal framework took place in 2024–2025. Effective April 1, 2024, the registration fee for residential property purchases of up to €500,000 (for personal residence) was waived. This represents a savings of up to €5,500 for buyers. The 0.5% GrESt subsidy for intra-family transactions applies up to this limit, while other transactions are subject to a 3.5% tax.

Additionally, support programs continue to operate: for example, Lower Austria offers a 5% grant on the mortgage amount for new home construction (up to €10,000 per family). This reduces the real costs for families taking out housing loans. Federal authorities also offer subsidies for energy-efficient homes and green technologies.

Significant changes await corporate investors: starting July 1, 2025, when transferring property between real estate companies (Immobiliengesellschaften), the tax will be calculated based on the real (market) value of the property and will amount to 3.5%. Previously, the rate for transferring shareholdings within a family was reduced to 0.5%, but soon this benefit will be retained only for transactions between close relatives. While these changes are largely unnoticeable for ordinary buyers of apartments and houses, they affect investment and holding companies.

Overall, 2024–2025 is a time for adjustments and incentives: buyers who take advantage of these opportunities (GrESt incentives, construction subsidies) will receive additional benefits. It's also worth monitoring updates to property tax assessments (Grundstückswertverordnung) and local initiatives—for example, many cities are introducing a second-home tax (Zweitwohnsitzsteuer) and developing environmental grants.

Helpful tips for buyers

Get to know a property in person. Never buy by sight. Drive around the area you've chosen at different times of day and year. Make sure the neighborhood, infrastructure, and transportation are right for you. Sometimes a parallel road or highway noise can reduce comfort, while a good view can actually increase the price.

Estimate costs. Prepare a comprehensive budget: in addition to the house price, include agency fees, notary fees, GrESt (3.5%), and stamp duty (half of which may be discounted), as well as potential renovation and furniture costs. The cost of renovating older homes is often underestimated: request an estimate from the builder in advance.

Working with an agent and lawyer. It's recommended to consult with an experienced agent and notary. The agent will help you find options and negotiate the deal, while the lawyer/notary will verify the transaction's integrity. Vienna Property Investment experts have in-depth knowledge of the local market and can help you consider local nuances (such as land registry regulations and urban planning regulations).

Document verification. Request an extract from the Grundbuch (land register) to ensure there are no encumbrances (mortgages, easements). Also, check for outstanding local fees (property tax, waste disposal fees). It's better to trust a notary during the verification than to discover problems later.

Financing. Before searching for a home, get pre-approved for a mortgage. Compare bank offers: a fixed rate for 10-15 years is currently more favorable than a variable rate, given the potential for rate increases. Keep in mind the down payment (~20-30%) and additional costs.

Negotiations. Don't be afraid to negotiate. If there's an overabundance of similar offers on the market, the seller may be willing to compromise. During slow periods, a 5-10% discount off the asking price is realistic. Research recent sales in the same area to support your offer.

Planning. Consider how you'll use the property in 5-10 years. If you're planning a family, consider the proximity of schools. If you're buying to rent out, research average rental rates in the area. Also consider the second-home tax if the property isn't your primary residence.

"I always say: the main thing is not to rush. A good deal is when the location, price, and your goals align. If you rush, you could miss out on the best.".

— Ksenia , investment consultant,

Vienna Property Investment

Patience and professional assistance are the keys to a successful transaction. By following these recommendations and consulting with trusted experts, you can minimize risks and make an informed purchase.

A quick guide to buying land and building in Lower Austria

Search and verification. Before purchasing a plot, check with the municipality whether building permits (Flächenwidmungsplan). Request a cadastral plan (Katasterplan) – this will show the exact boundaries and any easements. Make sure the previous owner has no outstanding debts (Grundsteuer).

Utilities. It's preferable for the property to have water, electricity, and sewerage. If not, inquire about the connection timeframe. Sometimes installing utilities can take months. A good road and access to the property also affect the price and convenience.

Building permit. Hire an architect to prepare a plan in accordance with local regulations (Bauordnung). After the design is complete, submit an application for a permit (Baugenehmigung) to the local administration (Bezirkshauptmannschaft). Technical plans and calculations will be required—the process takes several months.

Financing. Construction financing is usually provided in conjunction with the purchase of land. Banks can issue a construction loan secured by the land plot, with funds gradually disbursed in stages. Keep in mind that banks require a fixed project timeline and budget. Government subsidies (such as the 5% grant from Lower Austria) reduce the total loan amount.

Construction supervision. Contract with builders by stages (foundation, walls, roof, etc.). Don't pay the entire amount upfront; pay only after the work is completed. I recommend engaging a construction supervisor (Bauüberwachung). Regular inspections of the work will help avoid errors and rework.

Seasonality. The optimal time to begin construction is spring or early summer. It's best to pour the foundation and walls before the cold weather sets in. Plan so the house has time to be roofed before winter sets in.

Building a home is a complex yet exciting process. Lower Austria has strict environmental requirements (energy-saving standards, Passive House), so the project must comply with green standards from the outset. With Vienna Property Investment, you'll find reliable contractors and receive support throughout the entire process, from site selection to handing over the keys.

Conclusion: First steps towards a dream

Buying real estate is a long-term investment that begins with a decision and the first steps. Lower Austria offers excellent opportunities: here you'll find a combination of European quality of life, vibrant nature, and attractive prices.

Start by analyzing your needs and budget—and move toward your goal step by step. Remember, smart planning and expert support will make the journey to your dream easier and safer. To get started, I recommend following these steps:

- Determine the purpose (to live, to rent, to invest).

- Choose the area that suits you.

- Calculate your budget and clarify taxes and expenses.

- Check the legal status of the property and prepare documents.

- Conclude a purchase and sale agreement through a notary.

- Register the property in the land registry.

Vienna Property Investment can assist you from the first step to receiving the keys – saving you time and effort.