How and Why to Buy Real Estate in Croatia

Croatia's real estate market is currently experiencing one of the most dynamic periods in its history. The country's accession to the Eurozone and Schengen Area in 2023 has dramatically simplified transactions for foreigners, eliminated currency risks, and made the market more predictable and transparent. Croatia has firmly established itself on the European map as an attractive destination for investors looking to buy an apartment in Croatia, a seaside home, or invest in tourist rentals.

The purpose of this article is to provide a comprehensive analysis of Croatia's investment appeal: from an explanation of why now is the time to consider buying, to a comparison with Austria, where real estate is perceived as a benchmark for stability. We'll cover all aspects: legal nuances, price trends, property options, and the best regions of Croatia to look for housing.

"The key is not just buying an apartment or house in Croatia, but understanding how this investment will work: generating rental income, growing in value, and remaining legally secure. I create a purchase plan for my clients, review documents, and select a location that best suits their goals."

— Ksenia , investment consultant,

Vienna Property Investment

Why now?

-

Price acceleration and high demand. Croatia's real estate market has been growing rapidly since the country joined the Eurozone and the Schengen Area in 2023. By 2024–2025, prices for seaside housing will have risen by 7–10% annually, and foreign demand has reached new records. In coastal regions such as Dalmatia, Istria, and Kvarner, apartments and houses are selling faster than they are being built. Buying an affordable seaside apartment in Croatia is becoming increasingly difficult: housing costs are rising alongside the influx of tourists.

-

Currency and tax predictability. With the adoption of the euro, Croatia has gained a reliable currency, reducing risks for buyers. Transactions are now as transparent as possible: they comply with European standards and EU legislation. Taxes are moderate: just 3% for existing property purchases, and VAT is already included in the price for new builds.

-

Tourism drives rentals. Croatia welcomed over 21 million tourists in 2024, and this number continues to grow. Seasonality remains, but even in winter, large cities like Zagreb and Split maintain rental activity. Seaside apartments in Croatia are easily rented out through Airbnb or long-term to expats. Rental yields range from 4-5% in Zagreb to 6-7% on the coast.

-

Lifestyle and Residence Permits in Croatia. Buying real estate in Croatia opens the door not only to investment but also to a life by the sea. Croatian residence permits can be obtained for various reasons, including long-term residence in your own apartment. Croatia's regions offer diverse lifestyles: Split and Dubrovnik are premium tourist destinations, Istria offers a relaxed lifestyle and wine traditions, and Zagreb is a business and educational hub.

Comparison with Austria

Austria remains a benchmark for stability. Everything here is clear and predictable: laws are understandable, courts protect property owners' rights, and prices in Vienna rise slowly but steadily. Rental yields typically do not exceed 2-3% per year, but demand is constant and liquidity is high—so apartments in Austria are often chosen as an anchor asset in a portfolio. Obtaining a residence permit through real estate in Austria requires an investment of €500,000 or more, and the process itself is fraught with significant bureaucracy. But in return, you receive confidence and long-term capital protection.

Croatia, on the other hand, offers more dynamism:

- the entry threshold is lower - you can buy an apartment in Croatia cheaply from €120–150 thousand;

- the yield is higher - renting by the sea gives 5-7% per annum;

- taxes are simpler - 3% when buying a used property and minimal bureaucracy;

- Tourism is growing and supporting demand for housing.

But the market is less predictable: prices depend on the season and economic situation, and liquidity is highest in coastal regions.

| Parameter | Austria | Croatia |

|---|---|---|

| Market stability | Slow, steady growth | Rapid growth on the coast, seasonality |

| Legal protection | EU standard, strict system | EU/Euro: simpler rules, but less practice |

| Taxes | 3.5% purchase tax + 30% CGT | 3% tax on secondary housing, VAT on new buildings |

| Entry threshold | From €500,000+ for a residence permit | From €120,000–150,000 per apartment |

| Rental yield | 2-3% stable | 5–7% per season on the coast |

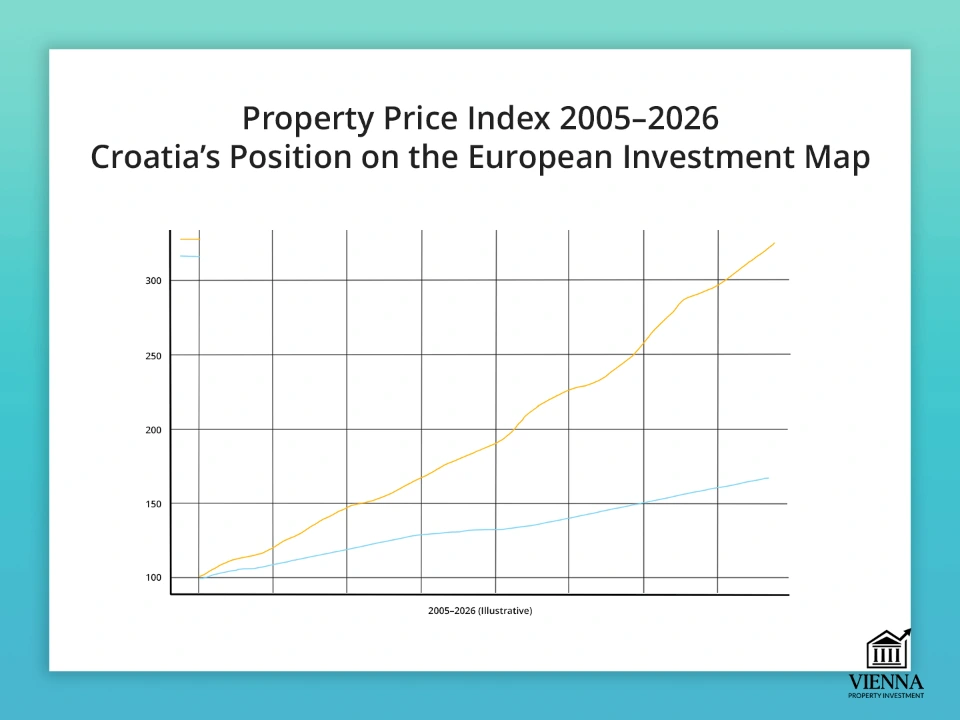

Croatia's place on the European investment map

Croatia's real estate market continues to grow rapidly following the adoption of the euro and accession to the Schengen zone in 2023. According to Eurostat and the Croatian National Bank, housing prices in the country increased by 8.3% , with growth exceeding 10% year-on-year on the coast. In Zagreb, Split, and Dubrovnik, the number of transactions reached record levels, with demand from both foreign and local buyers steadily increasing, particularly for apartments and houses by the sea.

Profitability, transparency, access

| Location | Average rental yield | Entry threshold (min.) | Main advantages | Main disadvantages |

|---|---|---|---|---|

| Croatia | 4–6% (up to 7% on the coast) | from €120,000 (apartments) | Euro, EU market, high tourism, affordable seaside real estate | Seasonal rentals, limited availability in top locations |

| Greece | 4–6% | from €250,000 | Golden Visa, islands, affordable properties in the regions | Bureaucracy, higher threshold for residence permit |

| Montenegro | 6–8% | from €80,000 | Low entry, sea view, profitable seasonal rentals | Not in the EU, less investor protection |

| Spain | 3–5% | from €180,000 | Strong market, developed infrastructure | High taxes, competition |

| Austria | 2–3% | from €300,000 | Stability, legal protection, and balanced demand | High taxes, expensive entry |

Why Investors Choose Croatia

In my experience, Croatia has become one of the most popular countries for those looking to buy an affordable seaside apartment, obtain a Croatian residence permit , and generate rental income. The combination of natural beauty, EU status, and moderate taxes makes it attractive to investors from Germany, Austria, Slovenia, and Scandinavia.

Stories of my clients:

- 🇩🇪 A client from Germany purchased an apartment in Split in early 2024. During the summer season, rental income was approximately 6% per annum, and the property's market value increased by 9% year-on-year.

- 🇬🇧 A Russian family bought a house in Istria near the coast for their own vacation and to rent out on Airbnb. The investment allowed them to obtain a Croatian residence permit, and the income exceeded expectations: the property was practically occupied during the summer.

- 🇸🇮 A young investor from Slovenia chose a studio apartment in Zagreb for €125,000. Thanks to steady demand from students and professionals in the capital, the property was completed in two weeks, with a projected return of 4.5% per annum.

Top reasons to invest in Croatia

- Low entry barriers – apartments can be purchased from €120,000–150,000, and houses by the sea from €200,000–250,000.

- The yield is higher than in Austria or Italy – 4–6% on average, up to 7% on the coast.

- Transparency of EU transactions – legal protection and registration through the state register.

- Croatian residence permit for real estate – with long-term residence and property ownership, residency is available for the entire family.

- Prices are rising , especially on the coast, where supply is limited and demand consistently exceeds it.

The key to successful investment in Croatia is choosing not only an apartment that offers immediate income, but also a location with future potential. New infrastructure projects, roads, universities, and tourist clusters (Split, Zadar, Rijeka) can generate above-average value growth.

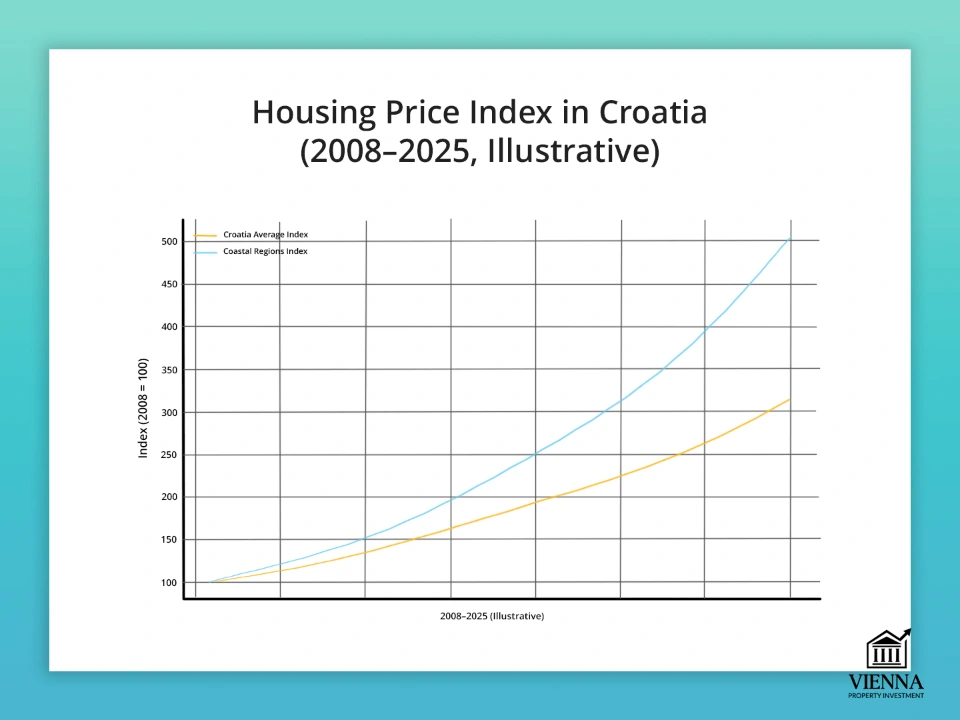

History and dynamics of the Croatian real estate market

When people ask me whether it's worth buying real estate in Croatia, I always answer: to understand the prospects, you need to know the market's history. Croatia has gone from the post-2008 crisis to rapid price growth after joining the EU, and especially after adopting the euro and joining the Schengen Area in 2023. Today, it is one of the most attractive markets in Southern Europe, especially for those looking to buy a seaside apartment in Croatia or a house in Croatia for vacation rentals.

Total amount of purchase and sale transactions 2017–2025

- 2008–2014: The global crisis hit Croatia hard, with property prices falling by more than 20%, especially in coastal areas.

- 2015–2019: gradual recovery, growing demand from foreigners (especially Germans, Austrians and Scandinavians).

- 2020: The pandemic temporarily reduced the number of transactions, but prices continued to rise thanks to domestic demand.

- 2023–2025: After the transition to the euro and Schengen, house prices increased by 8.3% on average, with increases exceeding 10% on the coast.

Market History: From Crisis to Growth

Understanding the future of Croatia's real estate market requires understanding the stages it has experienced over the past twenty years. Croatia is a country with a beautiful coastline, high tourism potential, and rapid integration into the European Union. But its market has had a challenging journey: from explosive growth to crisis and then renewed recovery.

The 2000s: The First "Golden Years"

In the early 2000s, Croatia became one of the most popular destinations for foreign buyers in the Adriatic region. Germans, Austrians, Britons, and Scandinavians were actively buying houses and apartments by the sea. The reasons were obvious: relatively low prices compared to Italy and Greece, a stunning coastline, and a growing tourist flow. During this period, many private transactions occurred: foreigners bought small villas and apartments on the islands of Hvar, Brač, Split, and Dubrovnik. Prices rose rapidly, with annual increases reaching 10-15%.

The 2008 crisis: decline and stagnation

The global financial crisis hit Croatia hard. Banks stopped lending, construction slowed sharply, and demand for real estate plummeted. Prices fell by 20–30% depending on the region, with coastal areas particularly hard hit, where prices had been overheating in 2007–2008. Many developers put projects on hold, and investors who had bought properties at the peak found it difficult to sell.

However, it was during this period that a new class of buyers emerged—cautious investors who viewed Croatia not as a speculative market, but as a long-term strategy. Those who purchased property between 2009 and 2012 saw steady price growth within a few years and were able to rent their properties to tourists at a good profit.

Recovery 2015–2020: Return of Interest

After Croatia joined the EU in 2013, the market gradually recovered. Since 2015, the number of transactions has steadily increased, and foreigners have once again begun actively buying property, especially on the coast. According to the Croatian National Bank, the share of foreigners in some coastal regions reached 15–20% of all buyers.

At this time, new infrastructure projects began to develop—roads, airports, and yacht marinas. Tourism reached record levels, with over 20 million visitors per year. All this fueled interest in apartments and houses by the sea. In Zagreb, demand was driven by students, IT professionals, and the business community.

2023–2025: The Euro, Schengen, and a New Growth Cycle

The adoption of the euro in January 2023 and Croatia's entry into the Schengen Area marked a turning point. Since then, the market has become even more transparent and understandable for EU investors. The risks of currency fluctuations have disappeared, and legal procedures have been simplified.

The results were already noticeable by the end of 2024: according to Eurostat, housing prices increased by an average of 8.3% , with growth in tourist regions (Dalmatia, Istria, and Dubrovnik) reaching 10–12% . Foreign demand increased, with buyers from Germany, Austria, and Scandinavia, as well as new investors from Central Europe, becoming particularly active.

My guide to the regions of Croatia

In Croatia, different locations serve different purposes: in some places, seasonal rentals by the sea are more successful, in others, year-round rentals in the capital and around universities are more popular, while premium villas and boutique apartments are a sign of status and rarity. To choose the most profitable property, it's important to understand where demand is concentrated and what rental format will be sustainable there.

Zagreb – a business center and year-round rentals

It's easiest to launch stable, long-term rentals here: the capital attracts students, IT specialists, doctors, government employees, and corporations.

- 1-2 bedroom apartments (approx. 45-75 m²): estimated price €150,000-240,000.

- Compact studios for daily/medium-term rent: €120,000–170,000.

- House/townhouse in the suburbs: from €250–400 thousand.

For whom: investors who need predictable occupancy and moderate returns without pronounced seasonality.

Split is the showcase of Dalmatia and a major tourist destination

High summer demand, coupled with the off-season due to business and medical travel, means the city center and beachfront are in short supply.

- 1-2 bedroom apartments by the sea: €200,000–370,000 (rarely cheaper)

- Historic center/apartments with a view: often a premium to the market

- Houses with a plot/view: from €400,000–700,000 and up

For those who want to combine lifestyle and seasonal income; those who are ready to manage short-term rentals.

Dubrovnik - premium and limited offer

Limited historical development and high tourist recognition create a “deficit” price.

- Apartments in good locations: €250–450 thousand.

- Villas by the sea/with panoramic views: from €700,000 to €1.5 million+

For whom: buyers seeking status and a "safe haven" by the sea; more conservative owners focused on capitalization.

Istria (Rovinj, Poreč, Pula) – a laid-back pace and a “gastro-boutique”

Germans and Austrians traditionally love Istria for its climate, road accessibility, and strong gastronomic/wine tourism.

- Houses/villas with land: from €280–600 thousand.

- Apartments by the sea/in the center: €180–300 thousand.

For whom: family lifestyle + seasonal rental, less crowded than in the "postcards" of Dalmatia.

Kvarner (Rijeka, Opatija) – a classic resort and proximity to Italy/Slovenia

Stable summer demand, developed embankment, medical and business tourism.

- Apartments: €170,000–€300,000 (location matters)

- Villas/houses with bay views: from €400,000–800,000.

For those who value infrastructure and predictability, but want the sea closer to the border.

Zadar and Šibenik are developing mid-table teams with potential

A good price/quality compromise and convenient geography; airports, yacht marinas, and a growing hotel base.

- Studios and 1-bed: €120–220 thousand.

- Houses near the sea: €250–450 thousand.

For whom: the first investment property on the Adriatic with growth prospects.

Islands (Hvar, Brac, Korcula, etc.) - “a picture from a postcard”

High summer demand and a premium for mode/transportation. Logistics are more complex, but the bill is higher.

- Apartments: usually from €220,000–400,000.

- Houses/villas: from €500,000 and significantly higher on the "front line"

For: experienced owners who understand seasonality and logistics; buyers of rare, collectible lots.

What properties are currently available: from studios to villas

| Object type | Investment threshold | Where to look | Risks | Expected return |

|---|---|---|---|---|

| Resale apartment (1-2 bedrooms) | from €120–150 thousand. | Zagreb, Zadar, Split (not first line) | House condition/energy efficiency | 4–6% |

| Apartments by the sea | from €180–250 thousand. | Split/Opatija/Istria | Seasonality, strict rules for short-term rentals | 5–7% (higher in summer) |

| House/townhouse by the coast | from €250–450 thousand. | Istria, Kvarner, Zadar | Maintenance/operation, logistics | 5–7% |

| Villa/premium property | from €700 thousand. | Dubrovnik, prestigious parts of Istria and the islands | Narrow circle of tenants, longer exposure period | 4–5% |

| Apart-hotel/tourist facility | from €250,000–400,000 per unit | Dalmatia, Istria | Licensing, operational risks | 6–8% |

Who buys real estate in Croatia?

- Germany, Austria, and Slovenia are the traditional leaders, actively buying in Istria, Kvarner, and central Dalmatia.

- Scandinavia, Benelux, and the UK —people choose islands and premium resorts, often for second homes and seasonal rentals.

- Russian-speaking investors – Dalmatia (Split, islands), Dubrovnik, Istria; some deals are aimed at personal use.

Why they buy: a second home by the sea, seasonal rentals with a yield of 5–7%, capital protection from inflation in the Eurozone.

Local families rent apartments in Zagreb and coastal towns outside the beachfront. A popular strategy for entrepreneurs is to buy several compact apartments and rent them out on a daily basis during the summer.

Expats

- Zagreb is popular among students, doctors and IT specialists.

- Split, Zadar, Opatija – a combined accommodation and rental format, which allows the owner to maintain occupancy during the off-season.

Expats help smooth out seasonal fluctuations in income, especially in coastal cities with good infrastructure.

Ownership Formats and Investment Methods in Croatia

When buying real estate in Croatia—whether it's a seaside apartment, a house in Istria, or an apartment in Zagreb—it's important to consider not only the location and class of the property but also the ownership structure, regulations for foreign citizens, and the chosen investment strategy. These factors influence taxes, profitability, and the speed of exit.

Individual (resident or non-resident)

EU and EEA citizens can freely purchase apartments, houses, and flats just like local citizens. Ownership is registered in the land register (katastar and zemljišna knjiga). The property can be rented, sold, or bequeathed without restrictions.

Citizens of non-EU countries can also purchase real estate, but only under the condition of "reciprocity"—if their country allows Croatians to purchase property there. Such transactions require the consent of the Croatian Ministry of Justice. This procedure takes 3 to 6 months, but is standard.

Example: A client from Germany purchased an apartment in Split and immediately rented it out through Airbnb. The return was 6% per annum. A family from Ukraine was able to purchase a house in Istria through a lawyer, receiving approval from the Ministry of Justice. The property is used as a second home and rented out to tourists during the summer.

Purchase through a company

Establishing a company in Croatia allows you to:

- acquire several properties for rental business;

- maintain VAT calculations when purchasing new buildings;

- Optimize the tax burden if the property is used as part of a business (apartments, mini-hotels, rentals).

Foreign companies can also purchase real estate in Croatia. This option is often chosen by investors who purchase hotels, aparthotels, or several apartments for short-term rentals.

Example: An Austrian investor registered a private limited company (DOO) and purchased three apartments in Zagreb to rent to students. The property is managed through a management company, which reduces his personal involvement.

Investments through funds and trusts

Croatia is developing real estate investment funds (REIFs), which allow investors to invest in a portfolio of properties, including residential apartments, aparthotels, and offices. For private investors, this offers a way to diversify risk and generate passive income.

Family trusts, common in the EU, can be used for asset protection and succession planning. This is especially relevant for foreign families purchasing a seaside villa or a house with land in Istria.

Joint purchase and inheritance

Real estate in Croatia can be registered in the names of multiple owners. This is convenient for family purchases—for example, parents and children can be co-owners of an apartment.

The inheritance is processed through a notary and registered in the land register. If the property was purchased by a foreigner, the heirs also retain ownership rights (subject to reciprocity for non-EU countries).

Example: A Slovenian family purchased a house in Opatija in the names of their parents and son. After the father's death, the inheritance proceeded quickly: a notary formalized the transfer of the shares, and the property remained in the family.

Restrictions and opportunities for foreign investors

Unlike Dubai, which has freehold and leasehold zones, Croatia is governed by uniform EU laws. However, there are a number of peculiarities:

1. Rules for foreigners

- EU/EEA: purchase of any flats, houses and apartments without restrictions.

- Non-EU: consent of the Ministry of Justice is required (reciprocity principle).

- Land plots: Foreign individuals cannot purchase agricultural land directly. The solution is to purchase it through a company or transfer it to a legal entity.

2. Commercial real estate

Foreigners can own offices, shops, and hotels. For larger properties and businesses, a DOO is more commonly used.

3. Rent

Any owner can rent out property, but short-term rentals (for tourists) require a license (tourist category). Long-term rentals are formalized by a notarized agreement and registered.

4. Mortgage

Foreigners can obtain mortgages from Croatian banks, but the terms are stricter than for local ones. Banks typically require proof of income, and interest rates are 1-2% higher. EU residents can finance up to 70% of the property's value.

Rental formats and income strategies

- Short-term rentals (tourists): high yield (5–7%), but seasonal. Particularly relevant for Split, Dubrovnik, and Istria.

- Long-term rentals (capital and cities): lower yields (3–5%), but stable demand and smooth cash flow.

- A combined strategy: daily rentals in summer and long-term rentals in winter. Available in Split, Opatija, and Zadar.

| Ownership format | Opportunities for foreigners | Restrictions | Where applicable |

|---|---|---|---|

| Individual (EU/EEA) | Free purchase of housing, renting, inheritance | No | All of Croatia |

| Individual (Non-EU) | Individual (Non-EU) | Long procedure, agricultural land is inaccessible | Coast, Zagreb |

| Company (doo) | Purchase of residential and commercial properties, tax optimization | Accounting, administrative expenses | Aparthotels, apartment portfolio |

| Investment funds/trusts | Diversification, asset protection, inheritance | For passive investors, a lawyer is needed | Premium villas, portfolios |

| Joint purchase/inheritance | Co-owners may be citizens of different countries | General liability, notary fees | Family properties, houses by the sea |

Legal aspects of purchasing real estate in Croatia

In practice, many investors pay insufficient attention to the legal details of the transaction. I always emphasize: the key task is not simply buying an apartment or house by the sea, but ensuring clear title deeds. Proper registration reduces risks, saves time, and allows you to immediately begin renting or living in the property.

Step-by-step purchasing process

1. Choosing a property – an apartment in Zagreb, a seaside apartment in Split, or a house in Istria. At this stage, it's important to evaluate not only the price but also the profitability, rental permits, and infrastructure.

2. A preliminary agreement – Predugovor (Predugovor Website) – formalizes the terms of the transaction and secures the property for the buyer. The deposit is typically 10% of the purchase price.

3. The main purchase and sale agreement – Ugovor o kupoprodaji – specifies the price, payment procedure, rights and obligations of the parties.

4. Payment – typically a single payment for resale transactions. For new builds, payment can be made in installments according to a schedule.

5. Notarization – the contract must be certified by a notary (javni bilježnik).

6. Registration in the land register – Zemljišne knjige – this is where the right of ownership is secured.

My advice: Make sure the property is registered in the land registry and there are no encumbrances.

The role of a lawyer and agent

- A lawyer checks the legal purity: the data in the land register is consistent, there are no encumbrances (mortgage, debt, arrest), and the correctness of the contract.

- An agent helps find an apartment or house, negotiate, and agree on a price.

If you involve a lawyer and agent from the very beginning, the risk of problems is reduced by at least 70%.

Requirements for the buyer

What you need to buy real estate in Croatia:

- Age from 18 years and a valid passport.

- EU citizens purchase directly; citizens of non-EU countries require the consent of the Ministry of Justice (reciprocity principle).

- Documents on the origin of funds for large transactions.

- Tax number in Croatia (OIB — osobni identifikacijski broj).

- For companies - statutory documents, registration of a limited liability company (DOO) or foreign legal entity.

Purchase of new buildings and existing housing

New buildings (new apartments, flats):

Prices are higher, but they already include VAT (usually 25%). You don't have to pay the 3% purchase tax. It's important to check the building permit and occupancy certificate.

Secondary market:

This includes apartments and houses with a history of ownership. A real estate transfer tax (3% of the purchase price) is payable upon purchase. A cadastral check for outstanding debts and the exact boundaries of the plot/apartment is mandatory.

Remote purchase by proxy

Foreigners can purchase an apartment or house in Croatia without being present in person. To do so, a power of attorney is issued by a notary, apostilled, and translated into Croatian. A lawyer, using the power of attorney, signs the contract and registers the ownership in the land registry.

Checking the legal purity of the object

Before signing a contract, I always check:

- Does the seller have legal title to the property in Zemljišne knjige.

- Are there any debts, liens or mortgages?.

- Does the area and purpose of the property in the cadastral register match the actual area?.

- Is there a permit for construction and commissioning (for houses/new buildings).

- All licenses must be in place when handing over the property to tourists.

Example: A client wanted to buy a house by the sea in Šibenik, but the lawyer discovered that part of the property was registered as agricultural land. The transaction was halted, and the client avoided registration issues.

Registration of property rights

The final stage is registration in Zemljišne knjige.

The land registry extract (Vlasnički list) records information about the owner, the property, and any encumbrances. Once registered, the buyer becomes the full owner and can rent, sell, or bequeath the property.

On average, the purchase and registration process takes 6-10 weeks. The timeframe depends on the readiness of the documents and whether approval from the Ministry of Justice is required (for buyers from non-EU countries).

Taxes, fees and expenses for real estate in Croatia

Investors often choose Croatia because of its relatively lenient tax system for property owners. Unlike many Southern European countries, the rates are simple and transparent. This allows for more accurate forecasting of rental income for an apartment or house by the sea.

One-time and regular fees

When purchasing real estate in Croatia, you should take into account the following mandatory costs:

- Property transfer tax (Porez na promet nekretnina) — 3% of the value of the property on the secondary market.

- VAT (PDV) is 25% on new buildings, but it is included in the price, so the buyer pays it without additional tax.

- Legal, notary, and agency services average 3–5% of the transaction value (land registry check, contract execution, and support).

- Utilities and maintenance costs average €1.2–2 per m² per month for an apartment in Split or Zagreb; for houses by the sea, costs are higher due to land maintenance.

Tax advantages and optimization schemes

The same rules apply for EU residents and foreign investors. In practice, I recommend:

- Please note that when renting out property, only net income is taxed (10–20% depending on the tax system);

- When purchasing multiple properties, consider registering a private limited liability company (DOU)—this allows you to account for expenses and operate officially in the tourism industry;

- Calculate utility bills in advance, especially in older buildings with low energy efficiency.

Comparison with taxes in Austria

In Austria, investors pay a 3.5% tax and 55% tax

-

For more detailed information, please see our article on the complete guide to property taxes in Austria .

In Croatia the situation is milder:

- the tax on purchase is only 3% (or VAT if it’s a new building),

- rental income is taxed at a rate of 10-20% under the simplified system,

- No capital gains tax on sale after 2 years of ownership.

This allows for a faster return on investment, but the market is more sensitive to seasonality and tourist flow.

Residence permit through real estate

Many clients ask whether it's possible to obtain a residence permit when purchasing an apartment or house in Croatia. Yes, this is possible, but there are some nuances. Purchasing real estate in Croatia doesn't automatically guarantee residence permit approval, but it does provide a compelling reason to apply. The key is to prove that the property is actually used for residential purposes and not simply purchased "on paper.".

Entry threshold and types of residence permits

- A short-term residence permit (up to 1 year) can be obtained based on real estate ownership, if you actually reside in the country.

- Extension - requires confirmation that the property is used for residential purposes.

- Permanent residence and citizenship are available after 5 years of residence with a temporary residence permit, subject to integration and language proficiency.

A practical example: a family from Austria purchased a house in Istria worth €320,000, obtained temporary residence, brought their children there, and opened a small business. They plan to apply for permanent residence in a few years.

-

For more details on the nuances of registration and renewal, see our guide to temporary residence permits, permanent residence permits, and citizenship in Austria .

What are the benefits of a residence permit in Croatia?

-

The right to legally reside in the country.

A residence permit allows a foreigner to officially establish themselves in Croatia, register a residential address, and reside here without visa restrictions. This is convenient for both those planning a seasonal stay by the sea and those considering Croatia as a permanent residence. -

Opportunity to open a business and bank accounts.

With a residence permit, you can open your own company (DOO) or register as an entrepreneur. Banks are more willing to open accounts for residents, which simplifies transfers, mortgage transactions, and property management. Many of my clients combine buying an apartment with launching a business in the rental or tourism industries. -

Access to healthcare and education in accordance with local regulations.

Residents have the right to use the public healthcare system on an equal basis with Croatians, as well as to enroll their children in kindergartens, schools, and universities on the same terms. This is especially important for families who want to relocate with their entire family and integrate into society. -

Right to family reunification.

Residence permit holders can obtain residency for their spouse and minor children. This makes real estate purchase a convenient immigration option not only for the investor but also for their entire family. -

Freedom of movement.

Although Croatia is already part of the Schengen Area, a residence permit facilitates travel within the EU and allows visa-free residence.

Important: A residence permit obtained through property ownership does not grant the right to work without a separate permit. To find employment, you must obtain a work permit or register a company and work as an entrepreneur.

A Croatian residence permit opens up a wide range of opportunities for living, studying, and doing business, but remains a residency tool rather than a work visa. Therefore, the "buy a home and move" strategy works well if the investor's primary income is already generated outside of Croatia or through their own business.

Renewal conditions and restrictions

To extend your temporary residence permit, you must:

- retain ownership of the property;

- live in Croatia most of the time;

- submit documents and pay state fees on time.

I always advise clients to check the status of the property in advance and renew the registration on time.

Common mistakes

- Direct purchase of agricultural land (this is prohibited for foreign individuals).

- Lack of registration of the agreement in the land register.

- Under-reporting of taxes when renting out apartments to tourists.

Comparison with Austrian Residence Permit

| Parameter | Croatia | Austria |

|---|---|---|

| Minimum investment | There is no fixed amount, but the property must be habitable | A residence permit requires a minimum of €45,000+ in the account and a stable income |

| Mandatory residence | Yes, you need to spend time in Croatia | Yes, at least 183 days a year |

| Period until permanent residence/citizenship | Permanent residence in 5 years, citizenship in 8 years | Permanent residence in 5 years, citizenship in 10 years |

| Family reunion | Yes, a residence permit can be extended for a family | Yes, with income and housing verification |

| Business activities | You can open a preschool and rent out your property | Permitted with a residence permit |

Croatia offers lower taxes on real estate purchases and ownership than Austria and offers family residency. However, long-term residency requires integration and residence in the country. This is a market with seasonal risks, but the entry barrier and tax burden are lower than in Western Europe.

Croatia's New Immigration Rules for 2025

- Residence permit through real estate. Owners of apartments and houses in Croatia can obtain a temporary residence permit for one year with the right to extend it. The property must be habitable and registered in the land registry. After five years of residence, permanent residence can be applied for, and after eight years, citizenship.

- Digital Nomad Visa. Croatia was one of the first EU countries to introduce a visa for digital nomads. It's valid for up to 12 months and allows you to work remotely for a foreign company. To apply, you must prove an income of at least €2,500 per month or sufficient funds in your bank account. You can reapply six months after the first visa expires.

- Family reunification. Croatian residence permit holders can bring their spouses and minor children with them. Proof of income and housing are required. The family receives the same rights to healthcare and education as the investor.

- Job Seeker Visa. Graduates of Croatian universities may be eligible to stay in the country for up to 12 months to search for work. This program is especially popular among students whose parents have purchased housing in Zagreb or Split.

- New rules for renewing a residence permit. Since 2024, renewals have become easier thanks to the e-Građani online system. Documents can now be submitted remotely, and the data is automatically updated in the biometric residence card. Proof of income is required for renewal: from €560 per month for a single person and approximately €1,200–1,300 for a family of four.

These changes have made immigration to Croatia more transparent and convenient: investors and families purchasing real estate can now obtain status more quickly, and digital nomads have gained a legal way to live by the sea and work remotely in the EU.

Rent and profitability

Profitability is one of the key reasons investors consider buying property in Croatia. Unlike Western European countries, higher tourist rental rates are possible, especially in coastal regions. With careful location and property management, seaside properties pay for themselves more quickly.

Short-term rental

Renting out apartments and houses through Airbnb or Booking in Croatia yields 6 to 10% annual returns, especially in tourist centers like Split, Dubrovnik, and Rovinj. During peak season (July–August), occupancy rates reach 90–95%, allowing for a quick return on investment.

Example: One client purchased an apartment in Split for €210,000 and rented it out to tourists on a daily basis. The net annual return was approximately 8.5% after taxes and management fees.

Long-term lease

For those seeking a stable income, renting out apartments for periods of six months to a year is a suitable option. Average yields in Zagreb and Rijeka are 3–5% per annum. This format is especially popular among students, IT professionals, and healthcare professionals.

Example: An investor bought an apartment in Zagreb for €160,000 and rents it out to university students. The annual income was approximately €6,500, representing a 4% yield, with minimal risk and stable occupancy.

Profitability by region

| Region | Average yield | Peculiarities |

|---|---|---|

| Dubrovnik | 6–9% | Limited supply, high tourist appeal, elite segment. |

| Split | 6–8% | Popular with tourists and students, strong summer season. |

| Zagreb | 3–5% | Year-round demand from students and professionals. |

| Istria (Rovinj, Pula) | 5–7% | High interest from Germans and Austrians in gastronomic and wine tourism. |

| Zadar and Šibenik | 5–7% | Affordable prices and growing tourist flow. |

| Islands (Hvar, Brac, Korcula) | 7–10% | Strong seasonality, premium prices in summer. |

The rental market in Croatia varies greatly depending on region and season. Dubrovnik offers higher yields due to a shortage of properties and the premium segment, but the entry barrier is also highest there. Split combines tourist and student demand, making it a more balanced market. Zagreb offers lower rates, but year-round income makes rental flow less risky.

Istria is enjoying steady interest from buyers and renters from Germany and Austria—it's a region known for its "quiet investments." Zadar and Šibenik are still cheaper than Dalmatia and Dubrovnik, but they are seeing steady growth in tourist traffic and new projects. Islands such as Hvar and Brač offer the highest rental yields, but their main drawback is their short season and high dependence on tourist traffic.

Management companies and services

Most foreign investors outsource their property management to agencies. They handle:

- short-term rental license (turistička kategorizacija);

- search and maintenance of tenants;

- cleaning, marketing and payments.

The commission is 20-25% of the income, but this allows foreign owners to make a profit without constant monitoring.

Taxation

- Short-term rental: 10% tax + tourist tax (based on the number of nights).

- Long-term rent: 12% + local tax (prirez, up to 18% depending on the city).

- Utility costs: on average €1.2–2 per m².

Thanks to a simplified tax system for private landlords, actual tax costs in Croatia are lower than in Austria or Germany.

Investor's Note: Croatia's Hot Spots

| Region | Characteristic | Average price per m² (2025) | Profitability potential |

|---|---|---|---|

| Dubrovnik | Premium location, limited offer | €4 000–6 500 | 6–9% short term |

| Split | Central Dalmatia, developed infrastructure | €3 200–4 500 | 6–8% |

| Istria (Rovinj, Pula) | Popular among Germans and Austrians | €2 800–4 000 | 5–7% |

| Zadar | Emerging market, airport | €2 200–3 200 | 5–7% |

| Zagreb | The capital, students, and IT | €2 000–2 800 | 3–5% |

| Islands (Hvar, Brac) | Tourist premium, season 3-4 months. | €3 500–5 500 | 7–10% |

One of my clients purchased an apartment in Split for €210,000 and earned about 8.5% per annum thanks to short-term rentals on Airbnb. Another investor chose a house in Rovinj for €420,000. The initial rental yield was only 4%, but after three years, the property's value had appreciated by 28%, resulting in a significantly higher total return upon resale.

"Buying real estate in Croatia is a strategy, not a chance decision. I help you choose a location, calculate profitability, and legally secure the transaction to ensure your investment truly works."

— Ksenia , investment consultant,

Vienna Property Investment

Tips from me:

- stability and minimal risk are important to you choose Zagreb or Rijeka—rentals are available year-round.

- If you're counting on rising tourist prices, consider Split, Zadar, or Istra.

- If you're looking to invest in prestige and rarity, Dubrovnik and islands like Hvar or Brač are good options.

- Always check not only the current yield, but also the development plans of the area: new roads, airports, or marinas immediately increase the cost of housing.

Infrastructure and demand

One of the main advantages of Croatian real estate is its high-quality infrastructure, especially in tourist centers and the capital.

- Transport accessibility. Zagreb is connected to Europe by direct flights, and Split, Zadar, and Dubrovnik have international airports, ensuring a steady flow of tourists. Good highways connect the coast with the interior.

- Commercial and social infrastructure. Coastal towns are rapidly developing shopping centers, restaurants, medical clinics, and international schools, making them attractive not only to tourists but also to expats.

- Ecology. Croatia is renowned for its clean sea, green spaces, and protected national parks. This is especially true in Istria and the islands, where ecotourism has driven up prices. In Zagreb, by contrast, the ecology is inferior, but this is offset by business activity and stable demand for housing.

Where to buy now and what to expect

In 2024–2025, the greatest investor interest is concentrated in Split, Dubrovnik, and Istria, where tourism is growing most rapidly. At the same time, experts note potential in Zadar and Šibenik —prices are currently lower there, but the development of airports and seaports is making the market increasingly promising.

Forecasts show that in the next 2-3 years, the most significant price increases are expected in Istria and the islands, where demand for premium housing consistently exceeds supply.

New build or resale in Croatia: what should an investor choose?

Choosing between new-build and existing properties in Croatia is one of the main questions for buyers. In recent years, more and more modern complexes have been built along the coast, but the resale market still accounts for the majority of transactions. The optimal choice depends on the investor's goals: quick rental income or long-term appreciation.

New buildings: what attracts investors

- Modern layouts, energy-efficient materials and new housing standards (A+/A class).

- Lower utility costs due to insulation and modern heating/cooling systems.

- Possibility of VAT refund (25%) when purchasing from the developer for legal entities.

- Price increase after completion: apartments by the sea increase in price by 10–20% in the first 2–3 years.

Example: A client from Germany purchased an apartment in a new building near Pula for €240,000. Just two years later, the price rose to €290,000 due to tourist demand and infrastructure development.

Secondary Market: Liquidity and Trusted Locations

- You can rent it out right away, especially if the property is located in a tourist center (Split, Dubrovnik).

- Most of the properties already have established infrastructure – schools, shops, transportation.

- A wide selection of old stone houses and apartments in city centres or on islands.

- Disadvantage: possible repair costs (window replacement, insulation, interior renovation).

Example: An Austrian family bought a 1970s house in Rovinj for €380,000. Thanks to its prime location, they immediately began renting it out to tourists and are earning a yield of around 7% per annum, despite the need for some renovations.

Comparison table

| Parameter | New building | Secondary market |

|---|---|---|

| Entry price | Above average, especially on the coast | There is bargaining, you can find affordable options |

| Installment plan | Sometimes available from the developer | No, only full payment |

| Profitability at the start | Income from price increase after delivery | Rental income immediately |

| Risks | Construction delays, limited choice | Repairs and hidden costs |

| Infrastructure | Formed around new complexes | Already ready, established areas |

| Popularity among investors | It grows especially in Istria and Dalmatia | Traditionally high |

Comparison with new buildings in Austria

In Croatia, the share of new construction is lower than in Vienna or Salzburg, but interest in them is growing, especially from foreign investors. Modern residential complexes on the coast and new homes in Zagreb are in the greatest demand. These projects offer improved layouts, energy-efficient materials, and convenient infrastructure, making them more competitive compared to existing properties.

Croatia still lags behind Austria in a number of indicators, but is gradually closing this gap.

- Energy efficiency. New projects in Croatia are built to A+/A energy efficiency standards, significantly reducing utility costs. In Austria, the standards are higher and enshrined in law.

- Construction speed. In Croatia, the average time to build a residential complex is 18–36 months, while in Austria the pace is higher, especially in larger cities.

- ESG standards. In Croatia, they are just beginning to be implemented, primarily on the coast, but in Austria, they are already mandatory for all projects.

- Price per square meter. On the Croatian coast, new buildings cost €2,200–4,500, while in Zagreb they range from €2,000–2,800. By comparison, prices in Austria are higher: €5,000–9,000 per square meter.

- Share of new construction. In Croatia, approximately 25% of transactions are for new projects, while in Austria this share reaches 30%, despite the market overall remaining secondary.

Bottom line: Croatia offers more affordable prices and a growing new build market, while Austria wins in terms of standards and stability.

How to go beyond classic shopping

In recent years, investors in Croatia have increasingly moved away from the traditional "buy a seaside apartment and rent it out in the summer" model. They're using combined strategies to increase returns and reduce risks.

- Several apartments instead of one villa. Investors are buying two or three apartments in Split or Zadar instead of one expensive villa in Dubrovnik. This approach provides flexibility: if one property is idle, the others continue to generate income.

- Aparthotels and condos. The owner receives a share of the income, and the hotel company manages it. This solution is especially convenient for expats living in another country.

- Old stone houses undergoing renovation. In Istria and the islands, traditional houses are being purchased, restored, and rented out to luxury tourists. Returns after renovation can reach 8-10%.

- Co-investments. Groups of investors join forces to purchase high-end properties, such as villas in Dubrovnik or apartment complexes on the coast.

This approach allows us to avoid dependence on just one format and better distribute risks.

Risks and pitfalls

The Croatian real estate market is attractive, but it has its own unique characteristics that are important to consider. The main one is seasonality. While occupancy rates for apartments on the coast reach almost 100% in the summer, demand drops sharply in the winter, directly impacting yields. The situation in Zagreb is more stable, but rental yields are lower there.

Another factor is bureaucracy. Not all land is accessible to foreigners, especially agricultural land, so it's crucial to carefully check the land registry documents before purchasing to avoid future problems.

Construction quality can also be a pitfall. New buildings sometimes suffer from inadequate thermal or sound insulation, while existing homes often face worn-out utilities and the need for repairs.

Utility costs should also be considered. In older homes with central heating, winter bills can be quite high and significantly reduce net rental income.

Life in Croatia: Comfort and Everyday Practices

Croatia combines a mild climate, sea and safety, making real estate here attractive not only as an investment but also as a place to live.

- Cost of living. Lower than in Austria: rent for an apartment in Zagreb is €600–900, while rent for an apartment by the sea is €800–1,200. Grocery and transportation are also cheaper.

- Healthcare. Accessible government services and a well-developed private sector; a clinic visit starts at €30.

- Education. The universities of Zagreb and Split are recognized by the EU, and there are international schools.

- Transportation. Airports in Zagreb, Split, Dubrovnik, and Zadar; a well-developed network of highways and ferries.

- Safety. One of the highest in Europe, especially in small towns and on islands.

This makes Croatia a safe haven for retirees, families and expats seeking a combination of European quality of life and affordable prices.

Croatia as an alternative to Western European real estate

Many clients view Croatia as a safe haven for capital. It's not only a country with beautiful landscapes and a favorable climate, but also a platform for preserving and growing investments. Unlike Austria or Germany, where the market moves slowly and steadily, Croatia combines European security with higher returns, albeit subject to seasonal fluctuations.

Retirees are increasingly choosing Croatia for buying a second home or permanent residence. The mild climate, affordable housing prices, and relaxed pace of life are decisive factors for them. At the same time, the presence of good medical centers and proximity to other EU countries ensure a feeling of comfort and safety.

Digital nomads see Croatia as an opportunity to combine business and leisure. With the introduction of a special visa for digital nomads, the country has become a popular choice for IT and creative industry professionals. Working with a sea view, living in apartments in Split or on the islands, and still having access to EU infrastructure are creating a new segment of demand for rental and purchase housing.

Families value Croatia for its stability, access to European education, and the possibility of EU integration. Many buy apartments or houses by the sea not only for summer rentals but also for personal travel or future relocation. The presence of international schools, universities, and a safe environment makes the country convenient for long-term residence.

Croatia thus strikes a balance between the stability of Europe and the dynamism of the tourism market. Here, one can expect higher returns than in Austria (5-8% versus 2-3%), but one must be prepared for seasonality: in summer, demand is almost unlimited, while in winter, returns depend on location and the careful selection of properties.

How to exit a real estate investment in Croatia

Sales periods depend on the region and type of property.

- In Zagreb and Split, apartments in good locations sell in 1–2 months.

- In Dubrovnik and the islands, expensive villas and old houses can wait 6–12 months for a buyer.

All transactions are recorded through the Land Register (ZK). A legal review of the property is mandatory—this protects the investor from unpleasant surprises.

Expert opinion: Ksenia Levina

Croatian real estate is a tool for income and capital preservation. I calculate profitability, review documents, and select a property that best suits your goals—from Zagreb to Hvar.

Ready to discuss a strategy to suit your needs?

— Ksenia , investment consultant,

Vienna Property Investment

My experience shows that the Croatian market has distinct regional characteristics. On the coast and islands, yields are higher, but seasonality is more pronounced. In Zagreb and larger cities, rates are more modest, but demand is stable year-round. I always verify documents through the Land Registry (ZK), examine the land's status (especially important for agricultural land), and only then recommend the transaction to the client. This approach minimizes risks and guarantees security.

I believe a combination is the optimal strategy. One of my clients purchased an apartment in Split for seasonal rentals and simultaneously purchased an apartment in Zagreb as a "safe haven." As a result, he receives high income in the summer and a stable flow of tenants in the winter. This balance is especially important for investors who want both profitability and security.

If I were building a portfolio for myself, I'd split it as follows: I'd allocate some to coastal properties with high tourist demand, and invest the rest in Zagreb's urban real estate. This approach allows me to simultaneously profit from seasonal tourism and have a steady source of income year-round.

My main advice: always start with your goals. Whether you want to earn a quick income on the coast, preserve your capital in a reliable asset, or find a home for your family, each goal requires a different strategy.

Conclusion

Prioritize, distribute capital across different regions of the country, be sure to conduct a legal audit through the Land Registry, and consider market specifics: coastal seasonality and stable demand in cities.

When Croatia is the best choice

- For those looking for higher returns than in Austria or Germany.

- If access to the sea, a mild climate and tourism as the main driver of income are important.

- Suitable for investors who are prepared to work with seasonality and take into account fluctuations in demand.

- For buyers who value EU property with transparent registration and the ability to obtain a residence permit.

When to consider Austria

- For those who value maximum stability and predictability.

- If the main goal is long-term capital storage without seasonal risks.

- For investors who want to minimize all possible legal nuances and choose a market with a long history of sustainable growth.

prospects through 2030 are optimistic. Joining the Schengen Area and the Eurozone has boosted confidence among foreign buyers, tourist traffic continues to grow, and interest in the coast from Germans, Austrians, and Scandinavians remains consistently high. A well-chosen strategy will allow for the combination of rental income and secure capital preservation in EU real estate.

Appendices and tables

Comparison table of profitability by region

| Region | Average annual rental yield (%) |

|---|---|

| Dubrovnik | 6–9% |

| Split | 6–8% |

| Zagreb | 3–5% |

| Istria (Rovinj, Pula) | 5–7% |

| Zadar and Šibenik | 5–7% |

| Islands (Hvar, Brac) | 7–10% |

Price/Profitability Map

| Region | Average price per m² (€) | Average yield (%) | Market Features |

|---|---|---|---|

| Dubrovnik | 4 500–6 000 | 6–9% | Limited supply, premium segment, high tourist activity |

| Split | 3 000–4 200 | 6–8% | Popular with tourists and students, strong summer season |

| Zagreb | 2 000–2 800 | 3–5% | Year-round demand from students and professionals, a growing IT sector |

| Istria (Rovinj, Pula) | 3 000–4 500 | 5–7% | High interest from Germans and Austrians in gastronomic and wine tourism |

| Zadar and Šibenik | 2 500–3 500 | 5–7% | More affordable prices, growing tourist flow |

| Islands (Hvar, Brac) | 3 500–5 500 | 7–10% | Premium summer rentals, strong seasonality, limited supply |

Tax Comparison: Croatia vs. Austria

| Indicator | Croatia | Austria |

|---|---|---|

| Property purchase tax | 3% of the price (porez na promet nekretnina), for new buildings – 25% VAT | 3,5–6,5% |

| VAT on new buildings | 25% on the primary market (with the possibility of return when renting through a company) | 20% |

| Annual property tax | No traditional tax, symbolic communal fee (30–200 €/year) | There is no ENFIA, but there is a municipal tax of 0.1–0.5% |

| Municipal fees | Utility bills depend on the city and type of housing | Up to 0.5% of the cadastral value |

| Tax on rental income | 10% fixed (from 2024), paid in advance | Up to 55% (Einkommenssteuer) |

| Capital gains tax | 10% upon sale in the first 2 years, then - not taxed | Up to 30% when selling in the first 10 years |

| Notary and registration fees | ~1–2% | 1–3% |

| Tax optimization | Income can be registered through a company (jdoo or doo) and expenses can be taken into account | Through trusts and companies |

An Investor's Checklist for the Croatian Real Estate Market

1. Formulate your investment goal

- Short-term rentals on the coast (Airbnb, Booking) or long-term rentals in Zagreb.

- Receiving income from rent, increasing the value of the asset, or obtaining a residence permit.

2. Select the appropriate object type

- Apartment in Zagreb or Split.

- House by the sea in Istria or Dalmatia.

- Villa on the island (Hvar, Brac, Korcula).

- Apartments in a tourist complex (condo format).

3. Clarify your budget and minimum entry threshold

- Apartments in Zagreb: from €120,000.

- Apartments on the coast: from €150,000–200,000.

- Villas in Dubrovnik: from €600,000+.

- Additional costs: 3% tax on the transaction, notary and registration 1–2%, utility bills.

4. Select a location

- Coast (Dubrovnik, Split, Zadar, Istria) – high seasonal profitability.

- Zagreb – stable year-round demand.

- Islands (Hvar, Brač, Korčula) – premium segment with strong seasonality.

5. Analysis of the object

- Check through the Land Register (ZK).

- Stage: new building or secondary market.

- Land status (not all agricultural land is available to foreigners).

- Building condition and energy efficiency (heating bills are a key factor).

6. Drawing up an agreement

- Preliminary agreement (predugovor) with a 10% deposit.

- The main contract is at the notary's office.

- Payment: immediately or in tranches (new buildings).

7. Real estate registration

- Entry in the Land Register (ZK).

- Entry into the cadastral register.

- Obtaining title to property.

8. Investment evaluation

- Rental yield: 5–8% on the coast, 3–5% in Zagreb.

- Utility costs: €100–300 per month for an apartment, higher for houses.

- Rent tax: 10% from 2024.

9. Planning for rental or resale

- Management companies in Dalmatia charge 20-30% for short-term rentals.

- In Zagreb, it is easier to rent out on your own (long-term contracts).

- Resale - higher liquidity in Split, Zadar, Dubrovnik.

10. Diversification of the investment portfolio

- Combine "tourist accommodation" (Split, islands) with "city" (Zagreb).

- Various formats: apartments + house by the sea.

- Reduce risks by choosing regions with different seasonality.

Investor scenarios

1. Investor with €150,000

Goal: to enter the market with minimal investment and generate rental income in the summer.

Options: small apartments in Zadar, Šibenik or Split.

Profitability: 6-7% per annum for short-term rentals.

Risks: seasonality, dependence on tourism.

Example: A client from Germany purchased a studio apartment in Zadar for €145,000. Renting it out through Booking during the summer provided 7% annual interest, and in the off-season, the apartment is rented to students, providing stability.

2. Family with €600,000–1 million

Goal: to buy a house by the sea for personal recreation and rental income.

Options: villas in Istria (Rovinj, Pula), houses on the islands of Hvar or Brač, premium apartments in Dubrovnik.

Profitability: 5–6% per annum + growth in value.

Risks: high maintenance costs and rental taxes.

Example: A family from Austria purchased a villa in Rovinj for €720,000. In the summer, it is rented out to tourists for €400 per night, and in the winter, the house is used as a personal residence. The overall yield is approximately 5% per annum.

3. Commercial real estate

Goal: stable rental income and growth in value.

Options: shops and restaurants in the tourist areas of Split and Dubrovnik, offices and aparthotels in Zagreb.

Profitability: 7–9% per annum.

Risks: seasonal traffic, high competition.

Example: A client from the Netherlands purchased a café-type space in the center of Split for €400,000. Thanks to year-round tourist traffic, the tenant pays a stable €2,800 per month, yielding an annual interest rate of 8.4%.

Croatian real estate investments can be tailored to a variety of goals. Apartments in Zadar or Split are ideal for passive income, villas in Istria or Dubrovnik are ideal for family and status, and commercial properties in city centers are ideal for business.