How and why to buy property in Greece

In recent years, demand for real estate in Greece has been steadily increasing. According to the Bank of Greece, apartment and house prices will have risen by an average of 13.8% nationwide and 15.9% in Athens in 2024. This growth has been ongoing for many years. The figures demonstrate that the market is vibrant, and that investing in the country is profitable for reasons other than tourism.

The purpose of this article is to understand why buying property in Greece is a good idea now. We'll cover all options: for relocation, rental, or obtaining a residence permit.

House price growth in Greece over 20 years

(source https://www.planradar.com/de/immobilienmarkt-griechenland/ )

Why now?

✓ Economic recovery . After a long crisis, Greece is on the rise: the economy grew by 2.4% in 2023, and growth in 2025 is expected to be higher than in Europe as a whole. Unemployment is declining, and conditions for investors are improving.

✓ Golden Visa . Greece's Golden Visa program remains very flexible. By investing at least €250,000, you can obtain a residence permit without having to live in the country permanently. While the amount may be higher in some places, the conditions are still more attractive than in Portugal, Spain, and, especially, Austria.

✓ Global trends . More and more people are buying property in warm, quiet places with good healthcare and a high standard of living. After the pandemic, the desire to own a second home or escape large cities has made this even more popular.

"The key isn't just buying a house by the sea, but understanding how it will benefit you. I'll help you create a plan with realistic calculations and reliable protection for your money."

— Ksenia , investment consultant, Vienna Property Investment

In this article, we'll explore why real estate in Greece is so popular today. It's not just a "house by the sea," but a profitable and reliable investment: everything is clear, the law is on your side, and you can start with a small amount. I'll explain the benefits of a Golden Visa, how to find a property that will appreciate in price, which areas offer great deals, and what to look for when buying to ensure a safe and secure purchase.

I've been working in this field for many years, helping clients purchase apartments in Greece, Austria, Cyprus, and other EU countries. My experience combines legal knowledge, international investment, and construction. Over this time, I've developed my own approach: I systematically solve problems, pay close attention to detail, and understand investors' needs. This includes profit, financial security, relocation, and a new lifestyle. I hope my knowledge will help you approach purchasing a home in Greece thoughtfully, with a clear plan and an understanding of all the important details.

Why not Austria?

Austria is a developed and attractive country, but investing there is more difficult. The minimum residency requirement is higher, the requirements are more stringent, and market prices are often inflated. Greece, on the other hand, offers more affordable conditions:

- A smaller starting amount (€250,000 versus €500,000+ in Austria),

- Simpler rules for moving,

- Higher rental income at resorts (up to 6-8% per annum),

- There is a good chance of price increases due to new roads and increased tourism.

At the same time, Austria also has its advantages: the market is more stable, legal processes are better regulated, and real estate is traditionally more expensive and of higher quality. This attracts investors seeking long-term security. For conservative investors, it makes sense to consider investing in the real estate market , with a focus on capital protection rather than maximum returns.

Interest in Greece has grown significantly in recent years, while inquiries about Austria remain consistently high—it remains a safe haven for capital. My approach: I approach problems systematically, pay close attention to detail, and understand investors' needs. This includes profit, financial security, relocation, and a new lifestyle. I hope my knowledge will help you approach purchasing a home in Greece thoughtfully, with a clear plan and an understanding of all the important details.

Greece's place on Europe's investment map

Today, Greece is more than just a tourist destination with a long history. It's a growing market that has been a top investment destination for several years now. It offers good returns, the laws are friendly to investors, and getting started is quite easy.

Back when I started working with Greek real estate, everyone saw it simply as a "house by the sea"—a vacation spot, not a place to make money. Things are different now. I'm increasingly seeing clients who are consciously abandoning the Portuguese, Cypriot, or Spanish markets and choosing Greece. Their needs are clear: a stable income in the future, the opportunity to relocate, and the confidence of a secure transaction.

Profitability, transparency, access

Greece is one of the best EU countries for short-term rental income (up to 7.5–8.3% per annum). It's especially profitable in popular tourist destinations like Athens, Thessaloniki, Rhodes, and Crete.

According to the World Bank's Doing Business ranking, Greece is now among the top 30 countries where it's easiest to register real estate. This is evident in practice: transactions proceed smoothly, especially when the realtor, notary, and lawyer work together.

According to Numbeo, bribes are much less common when registering real estate in Greece than in Turkey or Cyprus. Over the past five years, the process has become faster, more reliable, and more transparent.

Brief comparison: who are the competitors?

| Country | Residence permit by investment | Minimum entry | Rental yield | Peculiarities |

|---|---|---|---|---|

| Greece | Golden Visa from €250,000 | from €250,000 | up to 8% | Flexibility, islands, market recovery |

| Portugal | The program has been cut | from €500,000 | 4–6 % | The market is strong, but already overheated |

| Spain | Golden Visa from €500,000 | from €500,000 | 3–5 % | Taxes are higher, bureaucracy is more complex |

| Cyprus | Residence permit from €300,000 | from €300,000 | 5–7 % | Small market, instability in legislation |

| Türkiye | Citizenship from $400,000 | from $200,000 | 6–9 % | High risk, weaker protection of property rights |

Why are investors moving to Greece?

More and more often, investors come to me who have already tried buying in other countries. They encountered problems: poor rental rates, changing laws, or are simply tired of overpriced markets. So now they're choosing Greece.

For example, a couple from Copenhagen initially looked for housing in Valencia but bought two apartments in Athens. Why? It's more profitable there: flexible regulations, lower taxes, understandable price increases, and there's room for improvement.

Another example: a client from Israel sold an apartment in Limassol, Cyprus, and invested the money in Athens. He bought an old building and renovated it for rental use. He said, "In Cyprus, the market is stagnant, but here, life is in full swing: they're building, tourists are coming—I see development.".

I'm not saying Greece is ideal for everyone. But if you're looking for the perfect combination: a seaside vacation + income + residency, now is the perfect time. Especially if you act thoughtfully, without rushing, and with a clear strategy.

Greece's Real Estate Market: From Crisis to Steady Growth

I'm often asked, "Is it safe to buy property in Greece now?" I always explain what it was like before. After all, to understand where the market is going, you need to know where it came from.

From collapse to recovery

After the 2008 crisis, housing prices plummeted, in some places by half. Construction projects were frozen, banks refused to issue loans, and people sold their apartments in Greece for next to nothing to pay off their debts.

I've seen it myself, speaking with local lawyers and apartment owners: homes that used to cost €180,000 were then selling for just €90,000-€100,000. Those who bought back then, especially the calm and prudent foreigners, are now in a very advantageous position.

Since 2018, things have gradually improved. Greece's economy has strengthened, tourists have returned, and the Golden Visa program has been launched. And the real estate market has begun to revive and grow.

Statistics on price falls/rises in Greece since 2001

(source https://makroskop.eu/01-2021/der-fall-griechenland/ )

Prices are rising, but moderately

According to the Bank of Greece, the real estate market has been growing steadily from 2018 to 2025, averaging 5-8% annually. In 2024 alone, growth was +6.6%. Apartment prices have risen particularly significantly in Athens and Thessaloniki, as well as on popular islands like Crete, Rhodes, Paros, and Santorini. But most importantly, unlike inflated markets, this rise is natural. It depends not on artificial hype, but on economic recovery, rising rental demand, and investor interest.

Property price growth in Greece from 2022 to 2025

(source https://de.tradingeconomics.com/greece/housing-index )

Geography of transactions: where do people buy real estate in Greece?

In practice, I work most frequently with four main regions. Each has its own investment rules, market pace, and buyer audience.

Athens - Business and rental activity all year round

Athens is the most stable and understandable market. It boasts excellent urban living, education, healthcare, transportation, and housing rentals. The capital is the easiest place in Greece to buy an apartment that will immediately begin generating income.

- in the areas of Pangrati, Koukaki, Neos Kosmos, Kypseli - good apartments in finished buildings from 130-180 thousand €;

- by the sea (Glyfada, Voula, Alimos) - more expensive, from €250,000, but you can find luxury housing here.

Many of my clients start in Athens because it is a “safe first step”: stable tenants, an easy buying process and transparent legal transactions.

Thessaloniki is a growing market with local demand

Thessaloniki is the second most important city after Athens. Buyers are increasingly coming here. A key feature: Greeks themselves are more likely to buy (either for living or on credit), so the market fluctuates less.

- The city is developing: more and more tram and metro lines are appearing, and the center is constantly being restored.

- This option can replace Athens if you are looking for cheaper housing in Greece, as well as properties with potential for price appreciation.

- Prices: A one-bedroom apartment of 45–50 m² with cosmetic renovations can be purchased for €95,000–€110,000. New, larger apartments (80–90 m²) in areas like Kalamaria or near the port start at €190,000–€230,000.

I had a real-life case: a family from Vienna purchased a two-story apartment with a terrace in the center of Thessaloniki for €178,000. We checked all the documents, completed the purchase remotely (using a power of attorney), and they immediately received their Golden Visa. They now rent the apartment out on a daily basis, primarily to Erasmus students and medical students. The apartment brings them about 6% annual income, is in demand (it's liquid), and is almost always rented.

Islands – Emotions, Tourism, and Seasonal Profitability

The pace of life in cities like Crete, Rhodes, Corfu, and Paros is very different, so the types of investments they make are also different. People buy properties for vacations, seasonal rentals, and relocation.

- Houses in Crete are especially popular among the French and Germans, who most often seek villas by the sea.

- Paros: This island is increasingly being called "Greece, like the Balearics, but cheaper.".

- People from Scandinavia and Israel are constantly buying property in Rhodes.

- Prices: Apartments further from the sea can be found from 100,000 to 130,000 euros. Closer to the coast: A house with land will cost from 250,000 euros.

My experience on the islands has shown me that it's crucial to understand three things: the season, how easy it is to get there, and what the locals buy. If you choose the wrong place, you'll have problems. But if you choose well, your profits will be higher than in Athens.

The mainland is an alternative to islands with access to the sea

The Peloponnese, Halkidiki, and Volos are family-friendly destinations. They have fewer tourists, but the living standards are good, and Greeks themselves are increasingly vacationing there.

- Buyers from Serbia, Bulgaria, and Romania are very active in Halkidiki. They are primarily interested in villas and aparthotels.

- The Peloponnese has many historic houses suitable for renovation – these are attractive investment opportunities.

Here people most often buy houses to live in (permanently or seasonally) OR to rent out (from 3 to 6 months a year).

What objects are relevant?

My experience shows that demand in Greece is concentrated in the existing market. Buyers are looking for ready-to-move-in apartments and houses that can be quickly put into operation: rented out or moved in. There's the greatest interest in renovated properties (of any standard), with completed documentation and a clear history. Such purchases are safer and allow for faster income generation (rental or resale).

Since the market is not static, other formats are becoming more and more popular:

New developments. New developments in Greece are few, but attractive. In Athens (especially in developing areas), modern housing with amenities and energy efficiency is being built. Compact premium complexes are located near the sea in prestigious locations, with prices starting from €250,000 for 70-80 square meters. General advantages include low operating costs, reliable utilities, warranty, and the possibility of obtaining a Golden Visa.

Luxury segment. In Greece, houses are selling for €500,000 and up, often on the islands or in the best suburbs of Athens. Properties in Kefalonia, Mykonos, Paros, and Crete are particularly popular. The main buyers are investors from the UAE, the US, and Israel, for whom privacy, expansive views, and high-quality finishes are crucial. These homes are often offered with management and service, making it easy to own them from another country.

Aparthotels. Key-managed apartment complexes are an ideal vehicle for passive investment. With investments starting from €300,000, investors can earn 6-8% per annum, choosing between short-term rentals, professional management, or personal use.

Managed mini-hotels. Small boutique hotels (5-10 rooms) in popular Greek cities (Rethymno, Rhodes, Chania, Nafplio) are attractive investments. Often located in historic buildings, they attract a loyal clientele. Although success requires active management and a businesslike approach, such hotels can generate high returns (8-10% per annum) with proper management. The starting price for the purchase is €400,000. Owning such a property also offers the opportunity to create and develop your own unique hospitality brand.

From experience: a client from Peru purchased an aparthotel (6 studios) on Paros for €620,000. After engaging a local manager and assistance with tax registration, the property consistently generates approximately €52,000 in annual income with minimal owner involvement in operational management.

Table by object type: investment threshold, risks, profitability:

| Object type | Investment threshold | Risks | Expected return (annual) |

|---|---|---|---|

| Secondary apartment | from €120,000 | Repairs, legalization of redevelopment | 4–6 % |

| New building | from €200,000 | Few offers, waiting for input | 3,5–5,5 % |

| Apartment by the sea | from €180,000 | Rental season, taxes | 5–7 % |

| Luxury villa | from €500,000 | High maintenance costs | 3–5 % |

| Apart-hotel | from €300,000 | Operational risks, licenses | 6–8 % |

| Mini-hotel under management | from €400,000 | Experience required, seasonal demand | 8–10 % |

Who buys property in Greece?

The national composition of investors has changed dramatically over the past 10 years. Currently, the main players in the market are:

- China: Leader in the number of requests for the Golden Visa.

- Russia, Ukraine, Belarus: They are actively buying in Athens and on the islands, often looking for apartments as a "backup option" in case of unforeseen circumstances.

- Europe (French, Germans, Austrians): More and more people are choosing Greece over the overheated (expensive and competitive) Spanish property market.

- The UAE and Saudi Arabia invest primarily in hotels, luxury real estate, and new buildings.

In my experience, several clients who abandoned the Limassol (Cyprus) and Marbella (Spain) markets bought homes in Greece. Their decision was based on the more attractive prospects and less stringent regulations there.

What about domestic demand?

This is an important and often underestimated advantage. In many "sunny" markets (Cyprus, Montenegro), prices are driven primarily by foreign investment. Greece, however, has a strong foundation—its own, stable demand. Residents of Athens, Thessaloniki, and other cities are actively buying homes.

Thanks to this, even during a temporary outflow of foreigners (due to geopolitics or adjustments to programs like the Golden Visa), the Greek market does not experience sharp price drops. Local demand acts as a reliable safety net.

- Young families : take out a mortgage (current rates are 3.7-4.2%) to buy their own apartment. They often choose residential or new neighborhoods.

- Greeks from abroad (USA, Australia, Germany): return to their homeland or buy real estate “back to their roots”, helping relatives.

- Middle class (doctors, lawyers, IT): gradually saving up for housing - demand is growing for small apartments (1-2 rooms) priced up to €150-200 thousand.

- Students and their parents often buy small apartments in Athens and Thessaloniki instead of renting during their studies (4-5 years). It's more affordable than renting.

According to the Bank of Greece (2024):

- The majority of purchases (around 68%) were made by local buyers. This remains true despite the growing interest among foreigners in Greece.

- In Thessaloniki and the Peloponnese, there are even more local buyers – up to 75%.

Ownership formats and investment methods

When choosing real estate in Greece, it's important to consider not only what to buy but also how to register ownership. This format directly impacts your taxes, level of legal protection, inheritance rules, and even your ultimate profitability. In practice, I help clients find the optimal option—whether it's an apartment for personal use or a house for a rental business.

Individual

You buy real estate in Greece in your own name (as a private individual). This is the most popular option for a first-time purchase.

Suitable if you need to buy an apartment or house for yourself or to rent out, obtain a residence permit through a Golden Visa, or take out a mortgage from a Greek bank.

Pros:

- Easy to design

- Eligibility for a Golden Visa

- Clear rules of inheritance

Cons:

- You pay taxes yourself and resolve all issues

- You risk all your property

Through a company in the EU

Many of my clients purchase real estate in Greece through a foreign company (in Estonia, Cyprus, or Bulgaria). This is often done if they already own a business. This is convenient for professional investors, companies with assets abroad, and owners of hotels or multiple properties.

Case: A client from Vienna purchased a hotel in Crete through an Estonian company. This arrangement allowed him to pay lower taxes on renovations, conveniently receive profits, and easily transfer a portion of the business to his children through shares.

Pros:

- Tax savings are possible (subject to conditions)

- The risks are lower than with independent management

- Exiting an investment: selling your stake

Cons:

- The registration is more complicated than when purchasing in person

- You can't get a Golden Visa through the company

- It is necessary to keep the company's accounting records

Case: A client from Vienna purchased a hotel in Crete through an Estonian company. This arrangement allowed him to pay lower taxes on renovations, conveniently receive profits, and easily transfer a portion of the business to his children through shares.

REIC (Real Estate Investment Companies)

An REIC is a way to invest in real estate without having to manage it yourself. You buy a share of a company, and it owns and manages the buildings. This option is suitable for those who want to generate income but don't want to manage them, while also wanting to reduce risk.

Pros:

- You may not pay income tax and dividends (if the necessary conditions are met)

- The risks are minimal

- You can exit by selling your share

Cons:

- You need to invest a large amount (usually from €250,000 to €500,000)

- There is no way to directly manage individual objects

Share purchases, inheritance, and family trusts

Purchasing property in Greece jointly with a partner, child, or through a family trust offers greater convenience. This option is often chosen by families who want to share ownership of the property, simplify inheritance in advance, or invest jointly with children, parents, and friends. You can determine in advance who will own what share and how to divide the rental income—everything is clear and legally regulated.

Local restrictions

In Greece, there are virtually no restrictions on foreigners purchasing real estate, with the exception of certain border areas and military installations (for example, some islands in the Aegean Sea). However:

- If you are from a country outside the EU and the property is in a protected area, you will need a special permit.

- Every transaction goes through a notary, tax audit, and registration—it's important to formalize everything correctly with a lawyer.

My advice : Before buying a house or apartment in Greece, be sure to consult with a lawyer and tax advisor about how to register the property. This will affect taxes, inheritance issues, and the future sale price. If you plan to rent out the property or register it in family name, consider purchasing through a company or as a shareholder.

Legal aspects of purchasing real estate in Greece

Buying property in Greece is often easier than expected, especially with a good lawyer and a reliable agent. In my experience, transactions go smoothly when all the steps are followed and everyone knows their responsibilities.

Step-by-step purchasing process

Purchasing real estate in Greece consists of several key stages:

- Obtaining an AFM (Greek tax identification number) is the first step. With a lawyer, this process usually takes one day.

- Choosing a lawyer - he will protect your interests, inspect the property and prepare the contract.

- Property inspection. A lawyer ensures there are no outstanding debts, encumbrances, or illegal redevelopment.

- Preliminary agreement and deposit. An agreement is signed and 5-10% of the purchase price is paid.

- Notary. The main contract is signed before a notary, who also registers the transfer of rights.

- Cadastre. After the purchase, a lawyer registers the property in the state registry.

The role of a lawyer and agent

Without a lawyer, your transaction is unlikely to take place. He:

- checks that the object is okay,

- prepares a contract,

- issues a power of attorney if you are purchasing remotely,

- is present at the notary's office,

- registers property in the cadastre.

An agent helps select a property, conduct negotiations, gather the seller's documents, and coordinate the transaction. It's important that they work collaboratively with the lawyer, not replace them.

As practice shows, skimping on a lawyer when purchasing a property often results in utility bills or problematic documents. Paying for legal assistance means paying for peace of mind.

Requirements for the buyer

To buy an apartment or house in Greece you will need:

- Age: from 18 years.

- Possession of a valid international passport.

- Obtaining a Greek Tax Identification Number (AFM).

- Opening a bank account in Greece or another EU country.

- Providing proof of the legal origin of funds.

If you're from a non-EU country and want to buy property in "sensitive" areas (such as near the border or on certain islands), you may need approval from the Ministry of Defense. In Athens, Thessaloniki, Crete, and Corfu, such permission is not required.

Peculiarities of buying island real estate

On such popular islands as Crete, Paros, Corfu, Rhodes, there are their own nuances:

- It is necessary to carefully check the boundaries of the plot - old documents are often drawn up with errors.

- Some houses and plots are located in tourist or protected areas where special building regulations apply.

- The lawyer will check separately whether the site has access, water, and its documented status.

Tip: Before buying a house on the island, always ask for an architectural plan, building permit, land register extract and energy performance certificate.

Remote purchase by proxy

Most of my clients complete transactions without being present in person, using a notarized power of attorney issued in Greece or their home country and certified with an apostille.

Your lawyer:

- issues a tax number for you,

- conducts a property inspection,

- signs the contract with your participation or by proxy,

- opens a bank account,

- formalizes the registration of the transaction.

This is especially useful if you are out of the country or unable to travel to sign.

Checking the legal purity of the object

One of the most important stages. The lawyer checks:

- seller's ownership,

- no outstanding debts (for taxes, utilities),

- compliance of the object with urban development standards,

- history of ownership,

- whether there are any encumbrances or litigation.

This is a key stage of the transaction. The lawyer determines:

- is the seller really the owner?

- are there any outstanding debts for taxes and utility bills?

- does the property comply with urban planning regulations,

- What is the history of the owners?

- whether there are any encumbrances or legal proceedings.

I always recommend having an inspection done before placing a deposit, even if the property looks immaculate.

Registration of property rights

After the transaction is certified by a notary, the property is entered into the cadastral register, and you are issued:

- official extract of title,

- documents required for obtaining a residence permit under the Golden Visa program (if applicable),

- the right to draw up utility contracts in your name.

The entire process from signing the contract to full execution usually takes one to two months.

| Stage | What does it include? | Responsible | Deadlines |

|---|---|---|---|

| 1. Obtaining a tax identification number (AFM) | Registration of AFM at the tax office | A lawyer by proxy or in person | Day 1 |

| 2. Opening a bank account (optional) | In a Greek or European bank | In person or through a lawyer (with a power of attorney) | 1–5 days |

| 3. Object verification (due diligence) | Ownership, debts, permits, cadastral records | Lawyer | 3–7 days |

| 4. Signing a preliminary agreement | Making a deposit (usually 5-10%) | Buyer and seller + lawyer | 1-3 days after verification |

| 5. Preparing the transaction with a notary | Purchase and sale agreement, verification of final documentation | Notary + lawyer | 5-10 days |

| 6. Signing the main agreement | Final transfer of rights | Buyer (or lawyer by proxy) + notary | Day 1 |

| 7. Registration of property in the cadastre | Entering the property in the buyer's name | Lawyer | 2-3 weeks |

| 8. Obtaining a property statement | Official document of title | Lawyer or agent | 1-2 days after registration |

Taxes, fees and expenses when buying a home in Greece

When choosing real estate in Greece (an apartment or a house), it's important to consider more than just the property's price. Be sure to also factor in all taxes and additional expenses. In my experience, investors who see the full cost picture upfront make the right decisions and avoid unexpected charges later.

Unified Property Tax (ENFIA)

In Greece, all homeowners and landowners are required to pay an annual property tax (ENFIA). The tax amount depends on the cadastral value, area, and location of the property.

- Basic rate: approximately 0.1–0.3% of the assessed value of the property per year.

- In practice, the owner of an apartment in Athens (70 sq.m.) in 2024 pays an average of 250-350 euros.

- Local discount: in the provinces and on the islands the tax is lower than in large cities.

Municipal tax

This fee is collected by local authorities (in your district/city). The amount depends on the property's location and is approximately 0.2-0.3% of its cadastral value.

Stamp duty, notary, lawyer and agent services

The price of a property isn't everything. When purchasing real estate in Greece, the buyer pays mandatory additional fees:

- State duty: 3% of the value.

- Notary fees: 1-1.5% of the transaction amount.

- Lawyer/lawyer services: about 1%.

- Agent's commission: 2-3%.

Bottom line: these associated costs often amount to 7-10% of the purchase price of the property.

No VAT on new buildings until the end of 2025

An important benefit right now: when purchasing a new apartment in a new building, you don't have to pay VAT (24%) until the end of 2025. This is a great chance to save!

After 2025: VAT will return (24%), and housing in new buildings will become more expensive by this amount.

Comparison with taxes in Austria

In Austria, when purchasing real estate, you must pay:

- Grunderwerbssteuer - purchase tax, is 3.5%;

- Rental income tax (Einkommenssteuer) – can reach up to 55% depending on your income; plus other fees and charges, which can add up to another 10–12%.

In Greece, taxes are lower on average, and there are also various legal ways to optimize them.

Tax optimization schemes

For those who live or spend a lot of time abroad, Greece offers a "Non-Dom" tax regime—you pay a flat tax of €100,000 per year on all income from abroad. This helps significantly reduce taxes on profits from rentals or the sale of real estate.

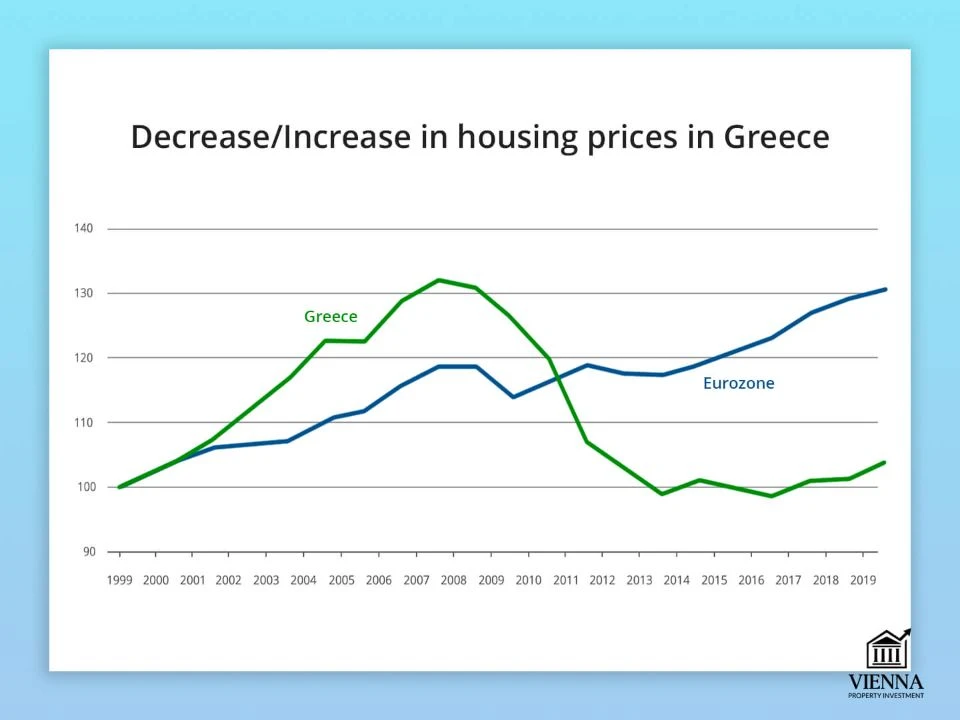

Golden Visa in Greece – a tool for free residence and movement

Trends in Golden Visa Application Processing

(source https://www.imidaily.com/europe/greece-cuts-golden-visa-backlog-set-for-record-year/ )

The Greek Golden Visa is one of the most convenient and popular ways to obtain EU residency through real estate purchase. Over the past few years, I've handled dozens of transactions where obtaining a Golden Visa was the clients' primary goal—especially for families, entrepreneurs, freelancers, and investors who value freedom of movement and don't want to be tied to one country.

The investment amount depends on the region and ranges from €250,000 to €800,000.

Since 2023, the minimum threshold has been different for different territories of Greece.

| Region | Minimum investment amount |

|---|---|

| Most areas of Greece | €250 000 |

| Athens city center, Thessaloniki, Mykonos, Santorini, Voula, Glyfada | €500 000 |

| New buildings from 200 m² and above | €800 000 |

In practice:

— Many of my clients invested €250–270 thousand and bought an apartment in Greece that could be profitably rented out.

— in Athens, especially in the center, you already need about €500 thousand, especially if it is a house or a penthouse.

What does a Golden Visa provide?

- It is possible to live in Greece without being there permanently.

- You can travel freely within the Schengen countries.

- You can open a business, teach children (in schools/universities), use European roads, hospitals, etc.

- It is possible to obtain a residence permit for the entire family at once: husband/wife, children under 21 years of age, parents.

What doesn't the Golden Visa provide?

- This visa does not allow you to work for a Greek company, but you can run your own business or simply own real estate.

- It does not guarantee citizenship, but may eventually provide such an opportunity through the naturalization process.

Possibility of citizenship after 7 years

If you live in the country for more than 183 days a year, pay taxes, learn the language, and become involved in local life, you can apply for citizenship after seven years. However, this is a separate process and is not automatic.

Comparison with Austrian Residence Permit

| Parameter | Greece (Golden Visa) | Austria (D-card, Self-Sufficiency) |

|---|---|---|

| Minimum investment | from €250,000 | There is no fixed amount, but a minimum of €45,000+ in the account |

| Mandatory residence | No | Yes, 183+ days a year |

| Time limit for citizenship | from 7 years old | from 10 years old |

| Family reunion | Yes | under a separate procedure |

| Business activities | Yes | partially, depends on the type of residence permit |

In my experience, for those planning to buy property in Greece and travel freely, the Golden Visa program is one of the simplest and most advantageous options. In Austria, the requirements are much stricter and include mandatory proof of integration into society.

Common mistakes when filing

- The purchase of real estate that does not meet the requirements of the Golden Visa (for example, several apartments worth €150,000 each per owner) does not count.

- Transfer of funds not from the investor's personal account.

- Incomplete set of documents – translations or apostilles are often missing.

- Mistakes when applying for a visa for the whole family, especially if the children are over 21 years old.

What changed in 2023–2025

- The entry fee now depends on the region: in central and popular tourist areas, the minimum amount has increased to €500,000.

- Verification of the source of funds has been strengthened, especially for citizens of non-EU countries.

- Processing times have been reduced: after signing the contract, the purchase must be completed within the timeframes established by law.

Rent and Income: How Much Does Real Estate Bring in in Greece?

Buying property in Greece isn't just about the beautiful view. It's a great way to generate a stable income. For several years now, I've been helping clients not only buy apartments but also set up rental businesses—whether they're short-term tourists or long-term tenants.

Short-term rentals: high income, but riskier

- Platforms: Airbnb, Booking, local booking services.

- Income: up to 8-10% profit per year, especially in popular tourist destinations (Athens, Crete, Paros, Rhodes).

- Success factors: location of the property, seasonal demand, quality of management, reputation and reviews, availability of permits.

- Risks: strong competition, increased costs, low occupancy during the off-season.

Let's say a property in Athens, located near a metro station, can generate an income of up to €1,100 per month during the summer, with a purchase price of €160,000.

Long-term rental: reliable and hassle-free

- Contracts are usually concluded for a period of one to three years.

- The profit is lower - about 3-5% per year, but it requires less personal involvement.

- Apartments are in demand among students, local residents and foreigners who have moved to Greece.

- A good option for investors who do not want to manage the property themselves.

Profitability by region (on average, based on my experience):

| Location | Property type | Profitability (gross) |

|---|---|---|

| Central Athens | 1-room apartment in Greece | 6–8% |

| Thessaloniki (center/universities) | studios, 2-room | 5–6% |

| Villas on the islands | houses by the sea | 5–9% (higher in season) |

| Peloponnese, Chalkidiki | houses in Greece for families | 4–6% |

New rules and restrictions

New regulations for short-term rentals have come into force in Greece in a number of regions since 2023:

- In certain parts of Athens and on the islands, there are restrictions or quotas on renting out accommodation through platforms like Airbnb.

- Authorities are encouraging a shift to long-term rentals, especially in areas where there is a housing shortage for local residents.

- Legal rental of properties requires a license from the Greek National Tourism Organization (EOT).

Who is in control?

For owners residing outside of Greece, rental management can be outsourced to a specialist company.

- The fee for services usually amounts to 10-20% of income.

- Services include organizing check-ins, cleaning, guest support, and reporting.

- Both local private operators and international networks operate on the market.

Taxation of rental income in Greece

| Income per year | Tax rate |

|---|---|

| Up to €12,000 | 15% |

| €12 001 – €35 000 | 35% |

| More than €35,000 | 45% |

Filing a tax return is mandatory. Tax optimization is possible through non-dom status or through the acquisition of real estate through a company. Non-residents are subject to a flat tax rate of 15% on rental income, regardless of its size.

Comparison with Austria

| Indicator | Greece | Austria |

|---|---|---|

| Average yield | 4–8% | 2–3% |

| Rent regulation | soft | hard (Mietrecht) |

| Price restrictions | no, in most cases | Yes, rent control |

| Simplified taxation | yes (Non-Dom mode, individual entrepreneur/LLC) | complicated and regulated |

Conclusion: Renting out property in Greece is more profitable and easier than in Austria. To maximize your income, it's important to correctly identify the property and rental type, minimize potential risks, and strictly adhere to applicable legal requirements..

But as an expert in Austrian real estate with extensive experience, I can say that, despite Greece's appeal, it's important to understand that Austria offers a different strategy: it's less about quick returns and more about capital preservation, stable growth, and prestige. The Vienna market is considered one of the safest havens for investors in Europe. If capital protection is a priority, it makes sense to initially purchase an apartment in Vienna as a base asset. Yes, you pay more for such a property and go through more complex procedures, but in return you receive secure rights, a predictable market, and real estate that only increases in value over time.

Where to Buy: Regional Analysis and Investment Map

If you're planning to buy a home in Greece, you need to consider many factors, such as cost, infrastructure, renter demand, growth potential, and liquidity. I regularly explain to my clients that for the same price, you can buy either an apartment in the heart of Athens or a house on the coast of Chalkidiki—the choice depends on your priorities.

Athens is the largest and most active real estate market in Greece

- Housing prices in Athens are steadily increasing, especially in the central areas, as well as in Glyfada, Kifisia and Paleo Faliro.

- The city is ideal for investment in short-term or long-term rentals, as well as for purchasing real estate for personal residence.

- Buying an apartment in Athens is beneficial both for generating income and for obtaining a Golden Visa.

For example, in the Pangrati area, housing can be purchased from €2,500 per m², with potential rental yields of up to 7%.

Thessaloniki is a cheaper alternative

- The second most important real estate market in Greece.

- Demand is predominantly from local residents, and housing costs are lower than in Athens.

- An ideal option for those looking for affordable real estate in a large city.

Due to the presence of universities, apartments for rent to students under the Erasmus program are in demand.

Greek Islands - Luxury and Resort Real Estate

- Popular islands such as Santorini, Mykonos, Rhodes, Crete and Corfu have high rental potential.

- Ideal for purchasing a home on the coast or investing in aparthotels.

- Property prices are higher and logistics can be more complex, but during peak season, returns are 9-10% per annum.

For example, a villa with a sea view in Mykonos will cost from €800,000, but with effective management it can earn up to €100,000 per season.

The Peloponnese is an undervalued market

- Affordable property prices, impressive landscapes, and a rapidly developing infrastructure with new hotels and golf complexes.

- Popular among families planning a summer holiday in Greece.

- High potential for aparthotel projects, especially in the Costa Navarino area.

Epirus, Thessaly, Macedonia - economy segment

In these regions, it is possible to purchase real estate from €30,000, however:

- demand for rentals is low,

- transport accessibility is limited,

- The prospects for significant growth in value are moderate.

Key criteria when choosing a location:

| Factor | Importance |

|---|---|

| Infrastructure | Transport, hospitals, schools |

| Proximity to the sea | Affects price and rent |

| Demand from tenants | Tourism, students, local families |

| Growth prospects | Urban development projects, metro |

| Legal status | Possibility of obtaining a Golden Visa |

Current investment trends: where are people investing now?

When planning a property purchase in Greece, the key question is not "where's the cheapest," but "where's the best prospect." The market is dynamic: some locations are becoming new growth areas, while others have already reached their price peaks.

Where to buy now:

- Central Athens (Koukaki, Pangrati, Keramikos) – investors from Israel, France, and America are still actively buying apartments here. They are mainly buying for rental purposes. Prices here have jumped by a third over the past three years.

- Glyfada, Voula, and Vouliagmeni are the areas of wealthy buyers from the UAE and Germany. They buy both for personal use and to rent out (often entrusting this to management agencies).

- Thessaloniki is attractive because it has its own local buyers, the city is developing, and prices are currently lower. It's a good choice if you're looking for a cheaper deal, but with the expectation that prices will rise.

- Mykonos, Santorini, and Corfu are the destinations for wealthy individuals from the US, Canada, and Lebanon. They buy expensive villas and houses by the sea, either to rent out to tourists for short-term stays or for their own family vacations.

Where growth is expected:

- Peloponnese (Costa Navarino, Tolo, Kalamata) : The tourism sector is actively developing here, with luxury five-star hotels and golf resorts appearing, making the region promising for investment in residential real estate and aparthotels.

- Piraeus and western Athens : These areas remain undervalued but are rapidly developing thanks to their proximity to the port, new metro lines and waterfront redevelopment projects.

- Central and Northern Greece (Volos, Ioannina) : housing here is cheaper, and popularity is growing due to domestic tourism and development programs supported by the European Union.

| Region | Who buys? | Why |

|---|---|---|

| Central Athens | Israel, France, USA | rent + price increase |

| Glyfada and southern Athens | investors from the UAE and Germany | comfort + premium |

| Thessaloniki | Austria, Serbia, Romania | availability + local demand |

| Santorini, Mykonos | USA, Lebanon, UAE | luxury, high-end rentals |

| Peloponnese | family buyers from the EU | ecology, children, sports |

Want to buy a good deal on an apartment in Greece? Consider three things: the development of the area, who you'll be renting to, and the local government's plans. Prices will rise until 2027, not only in Athens, but also on the southern coast (Peloponnese) and on the most touristy islands—those places where vacationers are always plentiful.

Secondary market and new buildings in Greece

The majority of real estate purchases in Greece (over 65%) are for existing homes. This is due to the country's historical construction practices, as well as market specifics: the availability of properties, their favorable locations, and the limited number of new construction projects.

Why does the secondary market dominate?

The Greek real estate market is dominated by resale properties, primarily apartments in Athens and beachfront homes on the islands. These properties typically come with all necessary utilities, are located in well-maintained areas, and are often rented out. In some cases, these are fully renovated apartments, ready for immediate occupancy for rental or personal use.

Example: A 65 m² apartment in the Pangrati area of Athens with cosmetic renovations costs approximately €145,000–€160,000 and can generate rental income immediately after purchase.

Features of buildings before the 1980s

A significant portion of houses in Greece were built before the introduction of new building standards in the 1980s. As a result, these buildings often have low energy efficiency, poor sound insulation, and require renovation, sometimes major repairs. In 2023, Greek authorities began providing subsidies for energy-efficient building retrofits, but these measures are only available to local residents.

New buildings: few, but interest is growing

Despite the limited volume of new construction in Greece, promising projects are being implemented in 2024-2025:

- In Athens (Glyfada, Voula, Nea Smyrni districts), modern buildings with energy-efficient technologies, elevators and parking spaces are being built.

- The cost per square meter in new complexes varies from €3,000 to €6,000, depending on the location and quality of finishing.

- New buildings in Greece are exempt from VAT until the end of 2025, making them more attractive to buyers.

Example: A spacious 90 m² apartment with a large terrace and panoramic sea views is for sale in Voula, priced at approximately €520,000. The purchase entitles you to a Golden Visa.

Comparison with new buildings in Austria

| Parameter | New buildings in Greece | New buildings in Austria |

|---|---|---|

| Energy efficiency | B–C (rarely A) | A+, A, often with solar panels |

| Construction rates | Slow | High in cities and agglomerations |

| ESG standards | Unregulated for now | Strict requirements |

| Average price per 1 m² | 3 500–5 500 € | 4 500–9 000 € |

| Share of new buildings on the market | < 20% | > 40% |

Conclusion: Planning to buy an apartment in Greece? Start with a resale property—it's quicker and easier, especially if you want to rent it out or move in immediately. New builds are less common, but are better quality and offer savings on utilities. Both options are currently profitable, thanks to the abolition of the new building tax and high demand.

Alternative investor strategies

The Greek real estate market is hot, but new developments are scarce. This opens the door not only to standard investments but also to unconventional approaches, especially if you're looking for higher returns or flexible options.

Buying several studios instead of one apartment

Instead of buying one large apartment in Greece, you can invest in two or three small studio apartments. This will allow you to:

- Earn more in total - up to 7-9% per year;

- Flexible rental management: rent out daily, for several months, or sell individually;

- Split the risks by owning homes in different areas.

Example: instead of an apartment for €300,000, you can buy three studios for €100,000 each in different parts of Athens and receive a more stable income.

Renovation of old stock for the purpose of resale

In Greece, apartments built before 1980 are typically below average. If renovated and energy-efficient, they can be sold for more, earning a profit of 20-40%.

- Plus: such options are available in almost every area;

- Cons: you will have to spend time and find proven professionals;

- In Athens and Thessaloniki it is often used as a "flip strategy".

Tourist infrastructure: apart-hotels and mini-hotels

For investors looking for income, real estate in Greece can be used as a business:

- You can buy an already operating mini-hotel with 10-20 rooms;

- Convert a residential building into an apart-hotel;

- Earn up to 10-12% per annum, especially on popular islands - Crete, Santorini, Paros.

This requires a license and registration with the Hellenic Tourism Organisation (EOT).

Investments through funds (REIC, AEEAP)

If you want to invest in real estate in Greece without managing it, you can invest through specialized funds:

- REIC (Real Estate Investment Companies) is a local version of REIT with tax breaks;

- AEEAP - regulated companies, which can be entered into with a minimum investment of €250,000.

Pros: Investments are distributed among different properties, managed by professionals, and income is passive.

Land plots for construction

Investing in land in Greece is becoming increasingly popular, although it is a more complex option:

- Plots of land in the vicinity of Athens and the tourist areas of the Peloponnese are especially in demand;

- They can be used to build a villa, a residential complex or apartments for subsequent sale;

- The main thing is to make sure the documents are “clean” and to comply with the building regulations.

Comparison with strategies in Vienna

| Strategy | Greece | Austria (Vienna) |

|---|---|---|

| Purchase of studios | High ROI, affordable | Limited, high prices |

| Renovation of the old building stock | Widespread, cheap entry | Strict rules, expensive |

| Aparthotels | High profit, flexibility | Highly regulated, complex licensing |

| REIC / funds | Low taxes, suitable for foreigners | Available, but high entry barrier |

| Land for development | Possible, especially outside the city | Almost impossible (limitations and high price) |

If you're looking to do more than just buy an apartment in Greece, but also earn more and be more proactive, you can choose other strategies. These strategies will help you increase your income and take advantage of the flexible opportunities of the Greek market, which is less restrictive than, for example, Austria.

Risks and Disadvantages

Although real estate in Greece is popular and profitable, there are pitfalls, especially if you prefer strict rules (like in Austria). Here are the main risks to consider before buying an apartment or house.

Bureaucracy and legislative instability

Yes, Greece is in the EU, with the euro and no capital restrictions. But be prepared for bureaucracy: obtaining a tax identification number, certifying transaction documents, and registering are time-consuming processes that require patience and the assistance of a lawyer.

I strongly advise against proceeding without a Greek lawyer. Without one, any transaction, even a simple one, risks getting stuck. Remember: real estate, rental, and tax laws are updated frequently. For example, short-term rental regulations change almost every season—be sure to factor this into your plans.

Difficulties with short-term rentals

In Greece, platforms like Airbnb and Booking are working well, but the authorities have introduced regulations:

- You can rent out your property for no more than 90 days a year.

- There are restrictions in apartment buildings.

- You need to register the property and obtain an EOT number.

Before renting, especially in Athens or on the islands, check local laws and conditions.

Seasonality: peak in summer, decline in winter

This is most evident in resorts (Crete, Santorini, Mykonos): houses are overcrowded with tourists from May to October, but from November to March it is quiet, and it is almost impossible to rent out.

I always tell my clients: calculate your income for the entire year, not just for the summer. If you rent out your property regularly (or bought it in a city like Athens), your rental income is more stable, and the winter dip isn't as significant.

Infrastructure and natural risks

If you are planning to buy a house on a Greek island, please consider

- Water is sometimes delivered by tankers.

- In winter, storms and strong winds can interfere with transport.

- During peak season, power grids may be overloaded.

These issues are not fatal, but require understanding of local conditions and proper planning of maintenance costs.

Liquidity: Not all regions are equally active

Selling an apartment in Athens or Thessaloniki is easy. But on the islands or in the countryside, it can take six months to a year, especially if the building is unique.

I recommend buying apartments in Athens—where the metro, shops, and schools are. It'll be easier to sell later, and there's less hassle.

Austria vs. Greece: Stability or Profitability?

| Parameter | Greece | Austria |

|---|---|---|

| Legislation | It's changeable and not always predictable | Very stable and predictable |

| Rental yield | 5–8%, sometimes more | 2–3% maximum |

| Taxes | Below, there are benefits | Much more, especially for foreigners |

| Bureaucracy | Slow but surmountable | Standardized |

| Infrastructure | In the cities – excellent, on the islands – ± | High quality throughout the country |

Accommodation and lifestyle

This is most evident in resorts (Crete, Santorini, Mykonos): houses are overcrowded with tourists from May to October, but from November to March it is quiet, and it is almost impossible to rent out.

I always tell my clients: calculate your income for the entire year, not just for the summer. If you rent out your property regularly (or bought it in a city like Athens), your rental income is more stable, and the winter dip isn't as significant.

Climate, medicine, education, security

Greece is Europe's sunniest country, boasting up to 300 clear, warm days a year. The sea, clean air, and mild winters make it ideal for permanent relocation or a winter getaway from the cold.

Treatment is available in both public hospitals and private clinics. The private sector offers high standards, reasonable prices, and is definitely cheaper than in Austria.

For children, there are international schools. Universities offer programs in English. Enrolling a child in a private school is a matter of budget, not opportunity.

As for safety, life here is peaceful, especially in small towns and on the islands. Crime is rare, and visitors are treated with openness.

Standard of living and cost of living

"Is it expensive to live in Greece?" many people ask. My answer: costs here are lower than in Austria, Germany, or France. Food, services, and rent are all reasonably priced. At the same time, life is comfortable, especially compared to large European cities. This is a key advantage when choosing a location and type of accommodation.

A couple dining out at a café or restaurant in a busy area of a Greek city can expect to pay around 25-30 euros. Monthly housing costs (utilities) typically range from 80 to 120 euros. A short taxi ride in Athens will cost at least 3.50 euros.

Communications, transport, banks

Regarding communications, transportation, and banking infrastructure, the capital, major cities, and famous islands are all well-equipped—everything you need is readily available. However, if you travel to rural areas, access to services, including logistics and healthcare, can significantly decrease. This is an extremely important aspect to consider before purchasing a home in rural Greece.

Legalization, medicine, schools – as for residents

After purchasing property in Greece and receiving a residence permit through the Golden Visa program, you effectively gain the same rights to government services as Greek citizens. This includes access to schools, healthcare facilities, and social programs.

- Healthcare: The EOPYY National Healthcare System provides basic medical care. The private sector offers a high level of service at relatively affordable prices—for example, a visit to a general practitioner costs approximately €30, and an ultrasound scan costs €40-50. Private insurance is available starting from €500 per year.

- Education: Athens, Glyfada, Thessaloniki, and Crete offer international and English-language schools with annual tuition ranging from €5,000 to €10,000. Public schools are free, but instruction is in Greek.

- Legalization: A residence permit grants the right to officially reside in the country, open bank accounts, obtain utility services, and enter into long-term contracts. Most formalities can be handled remotely with a power of attorney.

For many investors, real estate in Greece is becoming not just an asset, but also a way to move without unnecessary bureaucracy or spend a significant amount of time here in comfortable conditions.

Comparison with Austria – through the eyes of a professional

As an agent, I usually say that Austria is about order and clear rules, while Greece is about freedom and more life opportunities.

in Austria is very organized: everything is clear, rules-based, with convenient cities and well-designed infrastructure. But this order comes at a price: rent, utilities, services, and taxes are expensive.

In Greece , especially if you own your own property, life is much more relaxed. Utilities are typically €100-€150 per month, groceries are fresh and less expensive, and the climate is mild, especially away from the big cities. Of course, paperwork can be complicated and services aren't always reliable, but the warm weather, the sea, and friendly people make everyday life noticeably more comfortable and peaceful.

A few words about safety. In terms of organization and medical care, Austria is clearly superior to Greece. However, smaller Greek towns and regions offer a fairly safe and relaxed atmosphere. The key difference lies in priorities: the passion and seascapes of Greece versus the orderliness of Austria.

Buying in Greece as an alternative to a "European haven"

I increasingly see that people need not only investment returns but also personal space—a calm and safe place to live, take a breather from the instability of home, and have a secure foothold in Europe. In this sense, buying property in Greece seems like a very logical choice.

By purchasing property in Greece for €250,000 or more, you can obtain a residence permit. This is a good option for people from unstable countries who want to live in Europe without the lengthy procedures and huge expenses associated with other countries.

retirees often buy housing here because of the warm climate, simple life, and low prices. Food, doctors, electricity, and water are all cheaper than, say, Austria. At the same time, it's peaceful here, and everything necessary for life is available, just like in Europe.

If you're a digital nomad , Greece offers everything you need: reliable internet, affordable rental and purchase prices, hassle-free banking, and a unique, relaxing atmosphere. Plus, you can take advantage of a special residency visa.

When comparing with Vienna, the choice is determined by personal preference: the Austrian capital offers structure and reliability, while Greece offers a warm climate, freedom, and a more relaxed lifestyle. Those considering Austria in parallel would do well to explore Vienna's districts —from the historic center to the quieter residential areas—to consciously compare locations and understand how the Viennese structure differs from the more flexible Greek market. My approach: Vienna remains my base for work and market analysis, but Greece is increasingly becoming a place where I truly relax, both in body and soul.

What does an investment exit look like?

Selling real estate in Greece can take anywhere from a couple of months to over a year, depending on the location, type of property, and the sales strategy chosen. In large cities like Athens and Thessaloniki, properties sell faster, especially if they've been renovated and are generating good income. On the islands and in smaller towns, finding a buyer is more difficult, especially outside the tourist season or if the price is inflated.

If you purchased an apartment in Greece through the Golden Visa program, it's important to keep in mind the nuances associated with residency when selling it. For the new foreign owner to also qualify for a visa, their transaction must meet the current minimum investment threshold—from €250,000 to €800,000, depending on the region. If you sell the property before five years have passed, your residency permit will expire, unless you purchase another suitable property in its place.

Families often pass on Greek real estate to relatives—for example, by gifting it or selling it for a pittance. This helps control assets and simplify inheritance.

From experience: selling an apartment in Austria (especially Vienna) is easier. Everything is clear there: demand is predictable, prices are stable, and the market is open. In Greece, however, everything depends on the location and the condition of the property. But if you prepare well, present it well, and understand the local nuances, the sale will be a profitable outcome for your investment.

| Parameter | Greece (Athens, Thessaloniki) | Greece (Islands, Province) |

|---|---|---|

| Sale period | 2-4 months (if the area is good and the profit is high) | 6–18 months (depending on time of year and price) |

| Success factors | Restoration, rental income, competent presentation | Reasonable price, seasonality, niche demand |

| Golden Visa | A foreigner must invest between €250,000 and €800,000 depending on the region | Same principle, but lower demand |

| Sale up to 5 years | The residence permit is cancelled if another property is not purchased | Likewise |

| Alternative | Transfer of property to relatives through a deed of gift or a purchase and sale transaction | Likewise |

| Liquidity by experience | Average – determined by the quality of the object and the agent | Low - especially for secondary housing without renovation |

| Agent's advice | A presentation, a real assessment, and a local expert are the key to a quick deal | It's best to prepare for resale 6-12 months in advance |

Expert opinion: Ksenia Levina

"Buying real estate is a strategy, not a matter of square meters. We analyze the market, calculate profitability, verify legal compliance, and select the best solution: an apartment in Athens, a villa on an island, or a new building with a Golden Visa.

Let's discuss what will be your best investment?— Ksenia , investment consultant,

Vienna Property Investment

Working with real estate investments throughout the EU, I participate in transactions in both stable countries, such as Austria, and more dynamic and volatile markets, such as Greece. Each requires a different approach – both in the property due diligence process and in planning the investment strategy.

Features of inspections in Greece

In Greece, I always recommend starting with a thorough legal due diligence. Due to the large number of older buildings, especially in Athens and on the islands, it's essential to thoroughly review the land registry, permits, and any encumbrances. Without the support of a local lawyer and engineer, the risks can increase significantly. The situation here differs from Austria, where all documentation is prepared according to a uniform and clear standard.

How to allocate capital

I often suggest to clients that they allocate capital like this: approximately two-thirds into calm and predictable markets like Vienna, and the remaining third into more dynamic destinations like Athens or Crete. This way, they can maintain a balance between income and safety. In Greece, returns can reach 7-8% per year, but you need to be involved. In Austria, returns are lower, but the risks are virtually nonexistent.

What would I choose for myself?

If saving money, earning a stable income, or obtaining a hassle-free residence permit are important to you, choose Austria. It's a safe haven: everything is regulated, life is comfortable, and prices fluctuate predictably.

If you're willing to take risks for growth, capitalize on price differences, and invest effort, Greece can offer a much better return. This is especially true if you breathe life into an old house, rent it out for short-term rentals, or open a mini-hotel.

Greece offers excitement, flexibility, and the chance for high returns. It offers plenty of opportunities, but also plenty of challenges. Austria offers reliability, clear procedures, and a strategy for decades. Both countries are good choices if you have a clear vision of your goals and are prepared to achieve them.

Conclusion

When Greece is the best choice

Real estate in Greece is suitable for those who value high returns, the ability to manage properties independently, and desire greater investment freedom. It is especially attractive for:

- obtaining a residence permit through the Golden Visa program;

- investments in the tourism sector - from villas and aparthotels to Airbnb rentals;

- purchasing real estate with the expectation of growth in value and subsequent sale;

- retired people and remote professionals who value a warm climate, comfortable living, and affordable prices.

When Austria is better

Austria is ideal for those who prioritize secure asset preservation, value predictability, and don't plan to actively manage their property. It's a particularly good choice for:

- families with children who value a high quality of life;

- investors who prefer passive income without personal involvement;

- those who want to minimize legal risks and be confident in the stability of the rules.

General advice from an investment lawyer:

- Documents are your armor. In Greece, check everything three times: old houses, confusing plots, and unfinished permits are all sources of future problems.

- Consider not only profit but also liquidity. A beautiful villa by the sea isn't always a liquid asset.

- Diversify your assets: within a single country, you can combine residential, commercial, and land properties.

- Plan a financial cushion for taxes, repairs, and periods without tenants—this is especially important for daily rentals.

- Engage local experts rather than relying solely on large international agencies—they understand the specifics and nuances of the market better.

Vision 2030:

- Demand for residence permits in EU countries will continue to grow, and Greece will remain a favorite among investors from outside the EU.

- Tighter regulations are expected – restrictions on short-term rentals are already being introduced and the minimum investment threshold for Golden Visas is being raised.

- Key locations, especially Athens and popular islands, will see price increases, while prices in the provinces will remain average.

- Interest in eco-friendly real estate and projects that take ESG principles into account is growing, with Austria already leading the way.

Bottom line : those ready for change and looking to capitalize on growth should consider Greece. For those seeking a reliable and transparent asset, Austria is a better choice. The optimal option is to combine both approaches and reap the benefits of each country.

Appendices and tables

Comparison table of profitability by region

| Region | Average annual rental yield (%) |

|---|---|

| Athens | 5,5 – 7,0 |

| Thessaloniki | 5,0 – 6,5 |

| Crete | 6,5 – 8,0 |

| Mykonos, Santorini | 7,0 – 9,0 |

| Rhodes | 6,0 – 7,5 |

| Peloponnese | 5,0 – 6,0 |

| The islands are smaller | 5,5 – 7,5 |

Price/Profitability Map

| Region | Average price per m² (€) | Average annual rental yield (%) | Market Features |

|---|---|---|---|

| Athens | 2 500 – 3 500 | 5,5 – 7,0 | High demand, year-round rentals |

| Thessaloniki | 1 200 – 2 500 | 5,0 – 6,5 | Lower, domestic demand |

| Crete | 1 700 – 3 200 | 6,5 – 8,0 | Tourist season, short-term rental |

| Mykonos, Santorini | 3 500 – 7 000+ | 7,0 – 9,0 | Luxury segment, high seasonal demand |

| Rhodes | 1 500 – 3 000 | 6,0 – 7,5 | Growing popularity, excellent infrastructure |

| Peloponnese | 1 200 – 2 800 | 5,0 – 6,0 | Stable demand, seasonal rentals |

| Smaller islands | 1 300 – 3 000 | 5,5 – 7,5 | Niche audience, seasonal demand |

Tax Comparison: Greece vs. Austria

| Type of tax/fee | Greece | Austria |

|---|---|---|

| Property purchase tax | 3.09% (basic tax) + stamp duty 0.5%–3% (determined by region and type of transaction) | Grunderwerbssteuer 3.5% of the price |

| Value Added Tax (VAT) | Not paid for secondary housing, new buildings - 24%, but exemption until the end of 2025. | 20% on new buildings, rare releases |

| Annual property tax (ENFIA) | From 0.1% to 1.1% depending on size, region and cadastral value | There is no single tax, but there is a property tax and municipal fees |

| Municipal tax | About 0.1%–0.3% of the cadastral value | Part of the local fees, depending on the location |

| Tax on rental income | Fixed rate of 15%–35% depending on profit | The rate ranges from 0% to 55%, depending on the income and taxpayer status |

| Capital Gains Tax (on sale) | Typically 15% of income, but with a number of exceptions | Up to 30% (if the property has been owned for less than 10 years) |

| Notary and registration fees | About 1%–2% of the transaction value | About 1.5%–3% of the transaction value |

| Tax optimization | Non-Dom regime option - a fixed annual tax of €100,000 on foreign income | Tax breaks for residents and various investment programs are available |

A Greek Real Estate Investor's Checklist

1. Define goals and budget

- Understand why you are buying: for personal use, renting out, obtaining a Golden Visa, or reselling.

- Calculate an acceptable budget, including taxes and related expenses.

2. Choose the location and type of property

- Compare different regions: Athens, Thessaloniki, the islands or the mainland.

- Decide on the type of property—residential property, new building, villa, aparthotel, etc.

3. Conduct market and property analysis

- Explore price trends and yield levels in your area of interest

- Find out complete information about the property: history, condition, possible encumbrances.

4. Checking legal purity

- Apply for a tax identification number (AFM)

- Conduct a full legal assessment of the property with a lawyer

- Make sure that the data in the cadastral register is correct, that the necessary permits are in place, and that there are no debts or restrictions.

5. Organization of financing

- Choose the payment method: your own funds, a mortgage loan, or purchase through a company

- Calculate your taxes and find out what tax breaks you can expect.

6. Conclusion of the agreement and advance payment

- Only draw up a preliminary agreement with the assistance of a lawyer.

- Transfer the agreed deposit - usually 10-30% of the property price

7. Registration of the transaction with a notary

- Make sure the final contract is reviewed and notarized

- Carry out the procedure for transfer of ownership

- Enter information about the property into the state cadastre

8. Operation and management

- When planning to rent, choose a reliable management company or agency in advance

- Budget for regular expenses such as taxes, maintenance, repairs, and utilities

9. Obtaining a Golden Visa (if necessary)

- Collect a complete set of required documents.

- Ensure that investments are in line with the program's amount and timeframe

10. Investment exit strategy

- Think in advance about how and when you will sell your property

- Get the property in order: make repairs, prepare all the documentation

- Explore options for transferring property to family members

Greek Real Estate Investor Scenarios

1. Investor with €250,000

- Objectives: obtaining a residence permit under the Golden Visa program, forming a basic investment package, regular income from renting out housing

- What to buy: an apartment in Athens or Thessaloniki (50-70 m²), or a compact villa on the mainland

- Features: resale housing with high-quality renovations, ready for quick delivery; for investment variety, choose studios or aparthotels

- Profitability: projected annual profit – 5-7%

- Risks: seasonal fluctuations in demand, complex administrative procedures, possible delays during the due diligence stage

A client with a budget of €250,000 purchased a 65 m² property through us on the resale market. All that was needed was cosmetic renovations, which resulted in a discount on the purchase price and increased rental income from short-term tourists. The essence of our strategy: finding a property with potential and realizing it.

2. Pensioner with €500,000

- Goals: To live comfortably in good housing for many years, and also to earn a stable income by renting out part of the space

- What to buy: A large house/villa on popular islands (Crete, Rhodes) or a luxury apartment in Athens (Glyfada, Paleo Faliro)

- Features: The main thing is the quality of construction, developed infrastructure (schools, shops, transport), proximity to hospitals and services

- Return: 4-6% per annum. Reliability and peace of mind are more important than maximum income

- Risks: Significant maintenance and tax costs and seasonal drops in rental demand (especially in winter)

For a retiree with a budget of €500,000, we found a cozy 110 m² house in Crete, located near medical facilities and essential infrastructure. The property is fully habitable and yields approximately 4.5% per annum in long-term rental income. This is a perfect combination of comfortable living conditions and reliable investment income.

3. Family with children

- Goals: Permanent relocation, strong schools for children, safe environment, investment in the future

- What to buy: An apartment or house in quiet areas near Athens (Kifisia, Maroussi) or Thessaloniki – definitely close to schools and parks

- Features: Schools within walking distance, convenient transportation, parks/squares nearby, opportunity to obtain a residence permit

- Profitability: Secondary; the ability to sell quickly and comfort for daily living are a priority

- Risks: Many people want the best properties, amendments to laws (tax, residence permits)

We offered a modern 90 m² apartment in Kifisia, a prestigious suburb of Athens, to a family with children and a budget of over €500,000. The apartment is located in a new building with convenient amenities, and is close to schools and parks, creating a comfortable and safe living environment. Furthermore, the property is highly liquid and suitable for profitable resale in the future.