How and why to buy property in Dubai

The Dubai real estate market is currently experiencing a massive boom. According to Knight Frank and the FT, home prices have risen by a whopping 75% in the past few years. In the first half of 2025 alone, a record $117 billion worth of real estate was sold. This proves that Dubai is not just a growing market, but one of the most attractive and active investment destinations in the world.

In this article, we'll take a detailed look at why now is the best time to buy property in Dubai. Whether you're looking to move in and live there, rent it out to generate income, or as a reliable way to invest and save money.

According to Statista , the Dubai real estate market will continue to grow, growing at a CAGR of approximately 2.28% annually from 2025 to 2029.

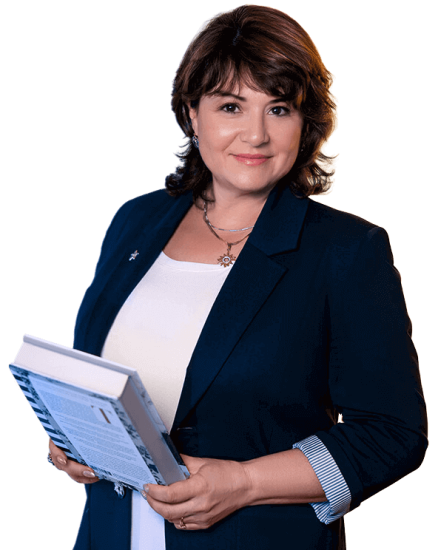

The number of residential property sales in Dubai

(source: https://intlbm.com/2023/07/06/dubai-real-estate-market-a-record-breaking-boom-in-2022/ )

Why now?

-

Price acceleration and record transactions. Dubai's real estate market continues to break records. At the beginning of 2025, transactions worth a staggering AED 142.46 billion were concluded, up 31% from a year earlier. The number of purchases also increased sharply—by 22%, reaching 45,376. This demonstrates that interest in Dubai real estate from investors around the world is only growing, and prices have reached new, higher levels.

-

Currency and tax security . In Dubai, there are no taxes on rental income or property sales, and all transactions are conducted in the local currency, which is tightly pegged to the US dollar. This makes investments more profitable and reduces the risk of losses due to exchange rate fluctuations.

-

Strategic Migration Policy. In recent years, the UAE has introduced more long-term visa programs for property owners, making it easier to relocate, start a business, and raise a family.

-

An infrastructure boom. New roads, waterfront development, and major construction projects like Dubai Creek Harbor are driving up real estate prices even before the buildings are finished.

"The key is not just buying a villa or apartment in Dubai, but understanding how this purchase will generate profit and save money. I'll help you create a clear plan with calculations, legal protection, and market analysis."

— Ksenia , investment consultant, Vienna Property Investment

As a lawyer, I help people buy real estate in other countries. My goal is to ensure that the purchase is not only a profitable investment but also safe and meets your personal goals (for example, for living or obtaining a residence permit). I have extensive experience working with the markets of Dubai, Austria, and other countries.

In this article we will cover:

- What makes the Dubai market so interesting? What are its features and great opportunities?.

- Why is it profitable? What taxes and laws help investors here.

- How to choose rising-value real estate and complete the purchase correctly and safely.

- Which areas are best to buy in to get the maximum income and the best conditions?.

Austria offers stability and gradual growth, but its market is already well-developed. Dubai offers dynamism, rapid growth, and ambitious projects. I'll help you figure out which of these strategies (reliable or riskier but with high potential) is right for you and why.

Comparison with Austria

Austria is a country where real estate prices steadily increase, and investments are completely secure. Everything is fair and transparent here: laws are clear, and the courts reliably protect rights. Prices rise slowly, but steadily and predictably. However, apartment prices in Vienna are traditionally higher than in most other cities in the country, and this is important to consider when planning your budget. Obtaining a residence permit through real estate purchase requires a larger investment than in some other countries. But in return, you gain guaranteed stability and confidence in the future.

Here's what Dubai has to offer:

- You can start investing without committing too much—homes in Dubai are available for a variety of budgets;

- the tax system is as advantageous as possible - there are no fees on rent or resale;

- In popular areas, you can get high rental returns;

- Real estate prices are rising due to the influx of new residents and city development.

This can be a great way to make money. Renting out property in prime, tourist-friendly areas will yield particularly high profits.

Property prices continue to rise as Dubai continues to attract new residents and large-scale projects are launched, such as the construction of islands and new districts.

But it's important to remember: the Dubai market is riskier and more unpredictable. Prices can change quickly, so careful planning and preparation for temporary price drops are essential. Therefore, if you're choosing based on reliability, Austria is the clear winner. It's the most stable and secure option for long-term investments.

| Parameter | Austria | Dubai |

|---|---|---|

| Market stability | Steady but not rapid growth | Significant fluctuations, abrupt changes |

| Legal security | A reliable legal framework, protection of owners | Clear rules, but fewer legal guarantees |

| Taxes | Average taxes on income and sales | No taxes on rent or capital gains |

| Entry threshold | High — €500,000+ for a residence permit | Low — from $130,000 per home |

| Rental income | 2–3% per year | 6-8% per annum in popular areas |

Dubai's place on the global investment map

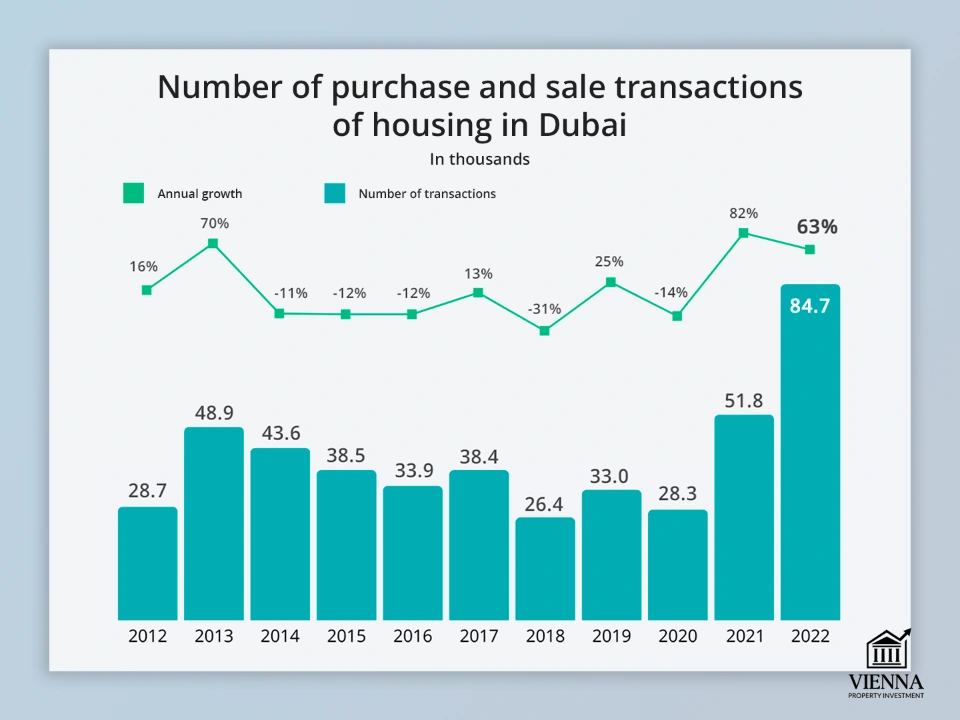

Number of transactions worth over $10 million

(source: https://content.knightfrank.com/research/2364/documents/en/dubai-residential-market-review-q1-2025-12222.pdf )

In my experience, Dubai is currently one of the most active markets for investors looking to buy an apartment, villa, or townhouse in the UAE. Over the past four years, housing prices have increased by approximately 70%, especially villas and apartments. This demonstrates that demand is high and interest from foreign buyers is growing.

Profitability, transparency, access

| Location | Average rental yield | Entry threshold (min.) | Main advantages | Main disadvantages |

|---|---|---|---|---|

| Dubai | 6–8% | from $109,000 | High price growth, simple rules for foreigners, developed infrastructure | High competition in popular areas |

| Abu Dhabi | 4–5% | from $150,000 | Stability, good social standards | Not as rapid growth, limited choice of properties |

| Qatar | 4–5% | from $200,000 | Development for the 2022 World Cup, modern infrastructure | Limited market, strict regulations |

| Bahrain | 5–6% | from $120,000 | Low taxes, affordability | Smaller market size, limited demand |

| London | 3–4% | from $400,000 | Prestige, developed market | High taxes, Brexit risks |

| Singapore | 2–3% | from $700,000 | Stability, security | High prices, strict restrictions for foreigners |

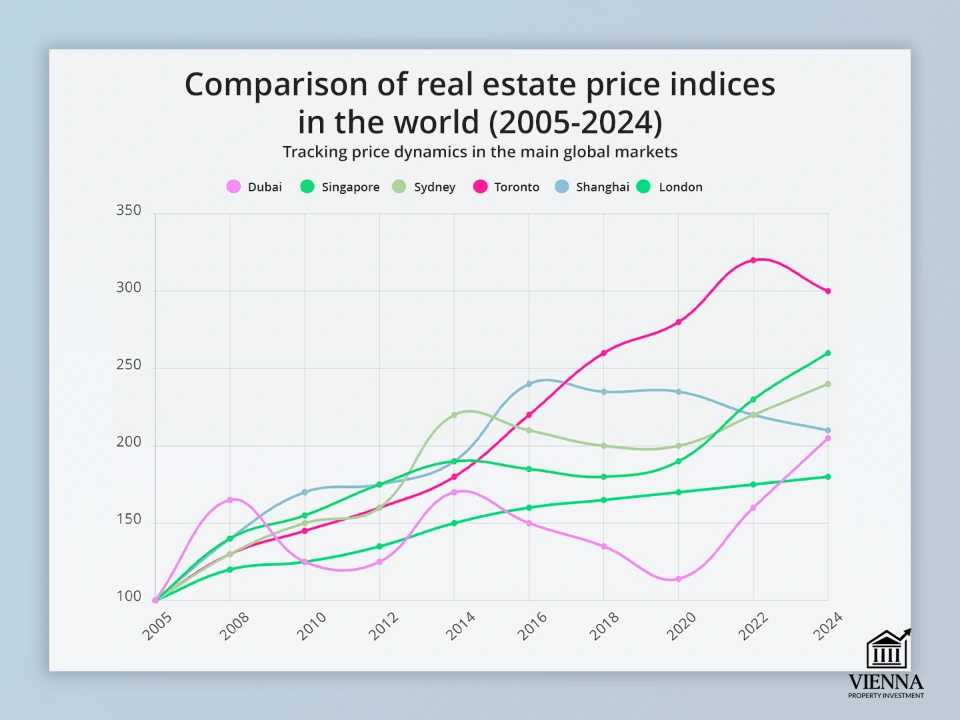

Comparison of global real estate price indices (2005-2024)

(source: https://realestateconsultancy.ai/dubai-real-estate-market-stability-future/ )

Why Investors Choose Dubai

In my experience, many clients ultimately choose Dubai after exploring other markets due to its high income, transparency of transactions, affordable prices, the possibility of obtaining a residence permit, and the rapid growth of property values.

Stories of my clients:

- A European client purchased an apartment in Dubai (Dubai Marina) in early 2024. After eight months of rental, the annual yield was 6.5%, and the property appreciated by 12% in the first year. The prime location with its well-developed infrastructure ensured continued rental demand.

- A Russian family chose a villa in the Jumeirah area to live in and rent out through Airbnb. I tailored the property to their needs, offering a location close to schools and shopping centers. The rental income exceeded expectations, and the investment also enabled the family to obtain residency in the UAE.

- A young investor purchased his first rental property—a townhouse in the Dubai Hills area. On my recommendation, he chose a location with promising infrastructure (schools, parks, and transportation under construction). As a result, the property quickly rented out, and its value increased by 10% in the first year.

Investors choose Dubai because:

- Low entry threshold - apartments from AED 400,000 ($109,000), villas from AED 1,500,000 ($410,000).

- High yields - especially in areas with stable rental demand.

- Transparency and reliability—all transactions are registered by the state, and laws clearly protect the rights of investors.

- Residence permit - purchasing real estate gives the right to obtain a residence visa.

- The rise in prices is particularly noticeable in the villa and townhouse segments.

At the same time, some clients are considering real estate in Abu Dhabi to diversify their portfolios: the city is more tranquil, demand is growing, and prices in prime areas remain competitive.

The key to successful real estate investments isn't simply high rental yields "here and now," but choosing the area and property type with future potential in mind. For example, locations with infrastructure under construction (metro, schools, business centers) often see greater long-term value appreciation.

The History and Dynamics of the Dubai Real Estate Market

When people ask me whether it's worth buying property in Dubai or the UAE, I always say: to understand what the market will be like tomorrow, you need to know what it was like yesterday. Without that, it's difficult to assess the risks and opportunities.

The Dubai real estate market experienced rapid growth in the 2000s and a severe crisis in 2008, but quickly recovered. Today, it's one of the most transparent and fastest-growing markets in the world. My clients regularly receive stable rental income and see their assets appreciate in value.

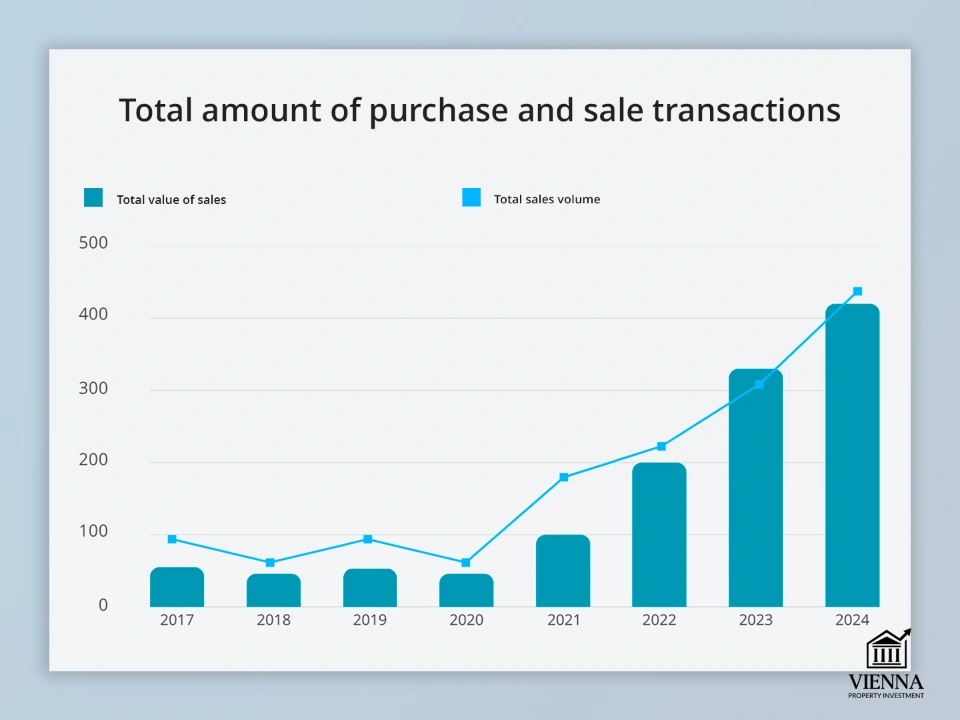

Total sales volume

(source: https://propnewstime.com/getdetailsStories/MTQ3MTI=/dubai-real-estate-market-sets-new-records-in-2024-with-aed-423-36-billion-in-sales )

Market History: From Rapid Growth to Recovery

2000s: Dubai was growing rapidly, and many were investing in real estate. But those who bought at the peak learned the hard way: it's important to look not only at the property but also at the overall economic situation.

The 2008 crisis: prices dropped, and construction slowed. I advised clients to take their time and invest in properties with long-term potential. This approach proved entirely successful.

Recovery (2012–2019): Dubai's new districts attracted investors, and those who bought property there began to earn rental income within a few years and were able to sell it for more.

Boom (2020–2025): Dubai real estate is rising in price, with villas and townhouses especially strong. Those who bought apartments at a bargain price saw a 15% increase in value within a year, along with stable rental income.

Dubai's experience proves that successful investments require not only selecting a good property but also understanding market cycles. In practice, this means that by cleverly combining affordable apartments, townhouses, and villas, you can create a portfolio that simultaneously appreciates in value and generates rental income.

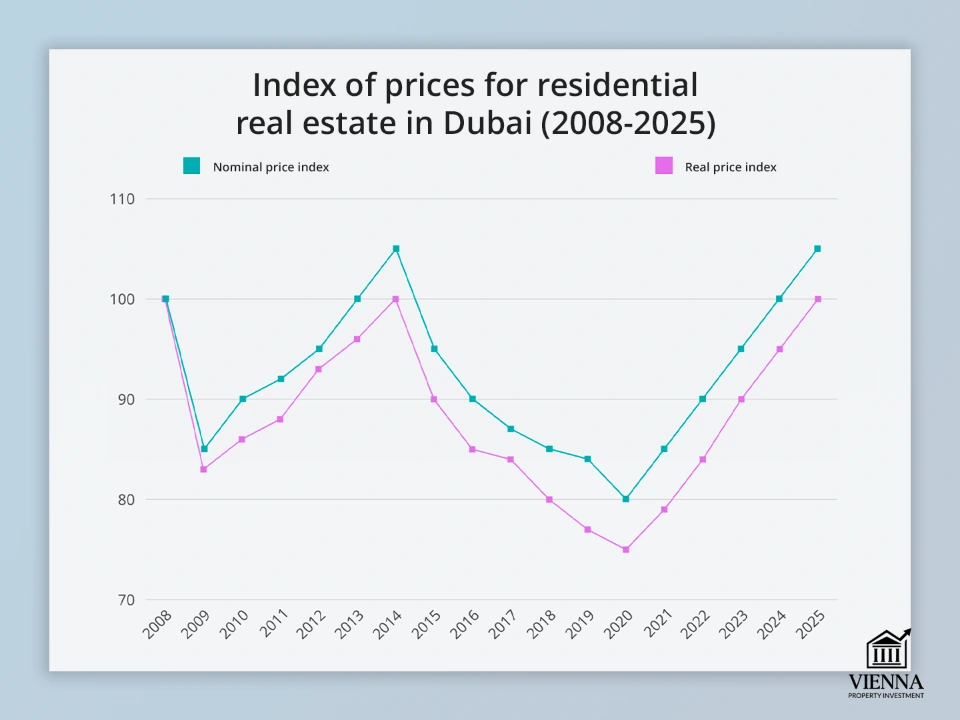

Dubai Residential Property Price Index (2008-2025)

(Source: https://premialivings.com/blogs/f/dubai-real-estate-market-forecast-2025-what-to-expect )

Prices are rising: how the Dubai real estate market is changing

Since 2020, the Dubai real estate market has been steadily growing: apartments have increased in price by approximately 15-20% year-on-year, while villas and townhouses have increased in price by 10-15% per year, which is especially noticeable in well-known areas such as Dubai Marina, Downtown Dubai, Palm Jumeirah and Business Bay.

In my experience, clients who invested in villas in DAMAC Hills or apartments in JVC in 2021-2022 were able to not only increase the value of their assets by 12-18% within 2-3 years but also generate stable income from rental income.

According to Statista forecasts, Dubai's real estate market will grow by an average of 2.28% annually from 2025 to 2029. In practice, I observe that the most significant price increases are expected in areas with new infrastructure and on man-made islands, such as Palm Jumeirah and Dubai Harbour. This is where demand for villas and apartments remains consistently high.

My guide to Dubai's neighborhoods

In Dubai, different areas are suitable for different purposes: some are ideal for rentals, others for living, and still others for purchasing luxury villas. To choose the best property, it's important to understand where demand is concentrated.

Downtown Dubai offers year-round business and rental activity

It's especially easy to buy an apartment in Dubai here, which will bring you profit in the shortest possible time:

- 1-2 bedroom apartments 60–90 m² — AED 1.5–2.2 million;

- luxury apartments and penthouses - from AED 3 million;

- Villas/townhouses - AED 4-6.5 million.

Dubai Marina: Waterfront Life and Tourism Demand

Dubai Marina enjoys high demand from tourists and expats, making rental income high. The area is suitable for all types of rental properties.

- 1-2 bedroom apartments 50-80 m² — AED 1.3-2 million;

- townhouses - AED 3.5-5 million.

Palm Jumeirah - prestige and premium segment

Dubai Marina enjoys high demand from tourists and expats, making rental income high. The area is suitable for all types of rental properties.

- apartments - AED 2.5-3.5 million;

- villas – AED 6–10 million.

Business Bay is Dubai's business district, home to office buildings and modern residential complexes. It's ideal for long-term rentals and real estate investments for workers and expats. Apartments are often purchased here for rent to foreign professionals.

- 1-2 bedroom apartments 60-90 m² — AED 1.4-2.1 million;

- townhouses - AED 3.8–5.5 million.

Dubai Hills Estate is a premium residential area with green spaces.

Suitable for families and long-term residents, Dubai Hills Estate enjoys high demand for villas and townhouses, and boasts well-developed infrastructure.

It's ideal for family living and long-term investments. Villas and townhouses are in particularly high demand, and the infrastructure includes everything you need.

- apartments - AED 1.8-2.5 million;

- Villas/townhouses - AED 4.5-7.5 million.

Jumeirah Village Circle (JVC) and DAMAC Hills are affordable areas with projected growth

These locations are in demand among young investors and families looking for more affordable housing with the potential for value appreciation.

- apartments — AED 0.9-1.4 million;

- townhouses - AED 2.5-3.5 million.

When choosing a neighborhood, I always consider whether it's likely to appreciate in price, how much rental demand is there, the price per square meter, and any planned construction nearby. This way, the client gets not just attractive real estate, but an asset that generates income.

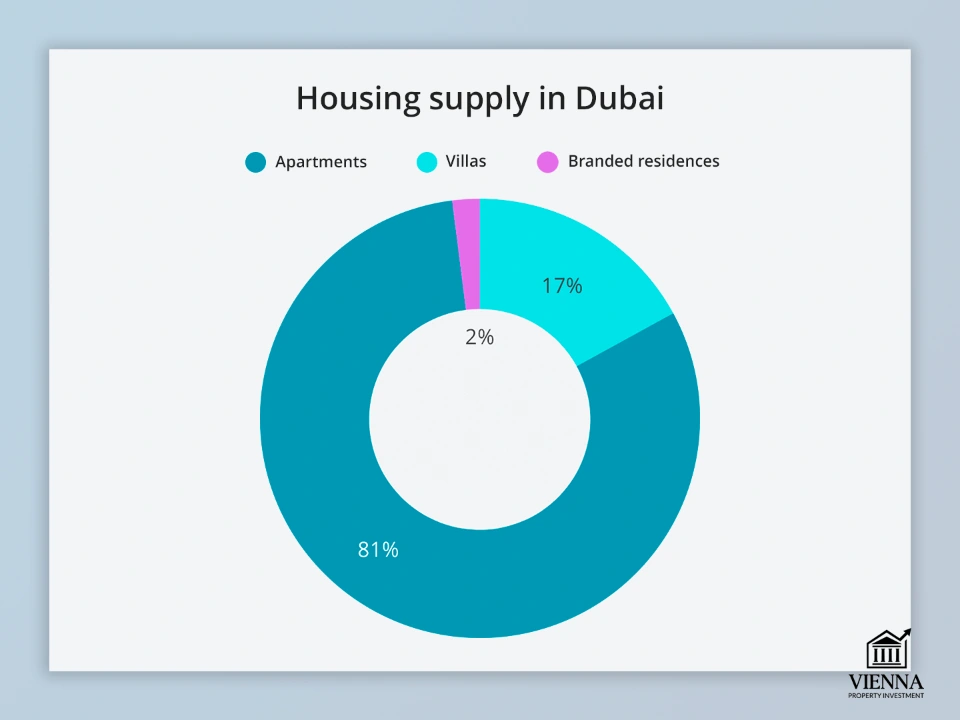

What properties are in demand: from studios to luxury villas

Dubai Residential Market Supply

(Source: https://content.knightfrank.com/research/2364/documents/en/dubai-residential-market-review-q1-2025-12222.pdf )

In Dubai, the most common types of property for sale and purchase are ready-to-rent apartments, townhouses, and villas with modern renovations and a clean legal history. These properties can be quickly rented out or immediately occupied. The most sought-after areas are Dubai Marina, Jumeirah Lake Towers, and Downtown Dubai.

New developments . Apartments and flats in Dubai with a full range of amenities: parking, elevators, fitness centers, and recreation areas. Popular areas include Business Bay, Dubai Hills, and Palm Jumeirah. These properties offer comfort, are ready for occupancy, and are suitable for long-term investment.

Luxury villas and townhouses . Luxury seaside locations: private, comfortable, and suitable for living or renting. Examples: Emirates Hills, Jumeirah, Al Barari, Palm Jumeirah.

Apartments with panoramic views and penthouses . Prestigious seaside neighborhoods offer privacy and a high level of comfort. Emirates Hills, Jumeirah, Al Barari, and Palm Jumeirah are ideal for both residential living and rental investment.

Commercial real estate and aparthotels . These areas are ideal for daily rentals or professional management. Jumeirah Lake Towers, Downtown Dubai, and DIFC offer steadily growing returns on investments starting from $500,000.

Interesting! At the beginning of 2025, 111 luxury properties over $10 million were sold in Dubai—5.7% more than during the same period in 2024. While this is slightly lower than the record of 153 transactions at the end of 2024, this figure was the highest ever for the first quarter.

When purchasing real estate in Dubai, it's more advantageous to choose completed or nearly completed properties. This speeds up the rental start, reduces risks, and generates income faster. Even small investments in renovations or furniture can significantly increase the property's value.

| Object type | Investment threshold | Risks | Expected return (annual) |

|---|---|---|---|

| Secondary real estate (apartments, houses) | from $200,000 | Low legal risks, the ability to make repairs to suit your needs | 5–7 % |

| New buildings (apartments) | from $250,000 | Possibility of delays in construction, underdeveloped infrastructure | 6–8 % |

| Luxury villas and townhouses | from $1,000,000 | High cost, not a large rental market | 4–6 % |

| Apartments with panoramic views, penthouses | from $500,000 | The danger of significant competition in the premium real estate segment | 5–7 % |

| Commercial real estate, aparthotels | from $500,000 | Focus on rental demand and management issues | 6–10 % |

Who buys property in Dubai?

Top Countries Buying Property in Dubai

(Source: https://www.azcorealestate.ae/who-is-buying-property-dubai-leading-countries-revealed/ )

Over the past 10 years, the investor structure has changed significantly. Currently, the market is dominated by:

- UK – investors are attracted by stability and potential profit; popular areas include Jumeirah Golf Estates, Arabian Ranches, Dubai Marina, JVC, Palm Jumeirah, Downtown Dubai, Dubai Hills Estate, and DAMAC Hills.

- India – of interest is the preferential regime without income and property taxes; areas: JVC, Business Bay, Dubai Hills Estate.

- China – Dubai South, Meydan, and Downtown Dubai are seeing the most activity, driven by new financial approaches and major global infrastructure projects.

- Russia – seeking protection from tax burdens and the risks of instability; popular areas: Palm Jumeirah, Jumeirah Bay Island, Emirates Hills.

- Pakistan – highly valued for profitability and capital preservation from currency fluctuations; areas include International City, Discovery Gardens, Dubai Silicon Oasis, Downtown Dubai, and Dubai Marina.

- Saudi Arabia – GCC investors prefer conditions that are more favorable than in their home countries: Arabian Ranches, Emirates Hills, Palm Jumeirah.

The Dubai real estate market remains highly attractive to foreign investors. Demand for luxury homes and apartments in new developments is growing year after year. Investors value not only profitability but also comfort, prestige, and investment security.

Domestic demand

UAE nationals buy property less frequently than foreigners, but their activity in the luxury segment helps stabilize the market. They typically choose villas and townhouses with private gardens and swimming pools. In practice, their transactions close quickly, thanks to transparent due diligence, mortgage-free payments, and minimal risk.

Families and investors from the UAE purchase real estate for two purposes: personal residence or long-term rental. Local companies also often invest in properties for corporate purposes, such as employee accommodation or subsequent rental.

Demand from expats

Dubai's real estate market relies heavily on expats, who make up the vast majority of the population (87%). They not only rent but also often become investors, purchasing properties for rental or personal use.

- Europeans and Russian-speaking clients are more likely to buy apartments for rent, both short-term and long-term.

- Families from India and Asia usually choose villas or townhouses for living.

- Arab investors are investing in premium real estate, both for personal enjoyment and to make money.

In practice, many of my clients purchase apartments in Dubai specifically for renting to expats. This ensures a stable income of 6-8% per annum, and thanks to a transparent legal history, the properties are easy to resell if necessary.

Ownership formats and investment methods

When purchasing real estate in Dubai—whether an apartment, house, or villa—it's important to consider not only the location and type of property, but also the ownership structure and investment strategies. The right approach to property registration helps reduce risks, save on taxes, and start generating income faster.

Individual (including non-resident)

Foreigners can fully own real estate in Dubai's designated Freehold areas. This allows them to freely rent, sell, or bequeath it to their heirs. For example, a European client bought an apartment in Dubai Marina, rented it out to expats a month later, and now earns approximately 6% annual income.

Company in the UAE (Free Zone, Mainland)

Setting up a company simplifies managing multiple properties, optimizing taxes, and controlling assets. For example, a client registered a company in the Dubai Free Zone and purchased two apartments in Downtown Dubai for rental through a management company.

Investment funds and trusts

Ideal for passive income and investment diversity (apartments, villas, commercial real estate). For example, clients own several properties in JVC and Dubai Hills through a single structure.

Purchasing for two, family trusts, inheritance

Property in Dubai can be registered to multiple owners. Family trusts help protect assets and simplify the transfer of property to heirs. This is especially convenient for families purchasing a villa for residential use and estate planning.

Restrictions and opportunities for foreign investors

Foreigners are allowed to buy property in Dubai, but it's important to know which areas are allowed and understand local laws to plan your investment strategy correctly:

1. Freehold and Leasehold zones

- Freehold: full ownership of apartments, houses and villas Dubai (Downtown Dubai, Palm Jumeirah, Dubai Marina, JLT, Arabian Ranches, Dubai Hills Estate).

- Leasehold: the right to use a property for up to 99 years without acquiring full ownership. Resale and rental options are limited.

2. Type of ownership

- Foreigners can only buy completed properties (apartments, villas) in special areas (Freehold), but not land outside them.

- Commercial properties and industrial zones in Dubai are mostly available only to UAE citizens or foreigners through local (Mainland) company registration.

3. Legal entities

- Free Zone companies can only own property within their zone; operations outside of it require additional permits.

- Mainland companies have access to residential and commercial properties throughout Dubai, but the registration process is more complex.

4. Mortgage

- Foreigners can obtain a mortgage in Dubai for an apartment (up to 75% of the cost) or a villa (50–60%), but at a higher interest rate and subject to proof of income and legal status.

5. Rent

- Freehold real estate allows for the free rental of apartments and villas. All leases are officially registered with RERA (the government regulator).

- Some residential complexes have restrictions on short-term rentals, which are set by the management company.

Most of my clients prefer freehold properties to have complete control over the property and the freedom to rent it out. For example, a family from Austria purchased a villa in Dubai Hills Estate for long-term rental and comfortable living.

| Zone / Ownership Format | Opportunities for foreigners | Restrictions | Examples of areas/objects |

|---|---|---|---|

| Freehold | Full ownership of a property in Dubai (whether it's an apartment, house or villa) allows you to rent it out and resell it freely without any restrictions. | There are no specific restrictions on the types of residential real estate, however, short-term rentals are subject to the rules of the management companies. | Downtown Dubai, Dubai Marina, Palm Jumeirah, Jumeirah Lake Towers (JLT), Arabian Ranches, Dubai Hills Estate |

| Leasehold (99-year lease) | Possession is granted for a limited period; rental and resale are permitted subject to agreement terms | There is no freehold title; there are mortgage restrictions and resale is difficult | Some projects outside the Freehold Zones |

| Free Zone companies (DMCC, DAFZA, JAFZA) | Purchasing real estate for a company; managing a property portfolio; tax optimization | The facilities may only be used for activities within the zone; they are not intended for residential projects outside the zone. | Apartments and offices within the Free Zone projects |

| Mainland companies | Ownership of commercial and residential properties makes it possible to open a business or rent out premises. | Registration requires government approval, and some properties are not accessible to foreigners. | Commercial properties and individual residential complexes located outside of Freehold Zones. |

Legal aspects of buying property in Dubai

In practice, many investors pay insufficient attention to the legal aspects of purchasing real estate. I always emphasize: the key goal is not simply acquiring a property, but ensuring full protection of property rights. Proper preparation reduces risks, expedites the process, and allows for control over the transaction budget.

Step-by-step purchasing process

1. Selecting a property – an apartment, villa in Dubai, or commercial real estate in Dubai. At this stage, I analyze the potential income, location, and potential for appreciation.

2. Reservation Agreement – confirms the desire to purchase and secures the property; the deposit is typically 5-10% of the price.

3. MOU (Memorandum of Understanding) – a detailed contract that specifies the price, payment terms and responsibilities of the parties.

4. Payment – step-by-step when purchasing Off-Plan real estate or in one payment on the secondary market.

5. Registration with the Dubai Land Department (DLD) is the final stage, as a result of which the ownership rights are secured for the buyer.

My advice: Make sure all documents are registered with the DLD and completed correctly.

The role of a lawyer and agent

The lawyer checks that the property documents are in order and looks at the contract (MOU) and payment terms.

An agent helps you choose an apartment or villa in Dubai, negotiates, and communicates with the developer.

If you involve both a lawyer and an agent from the very beginning, the risk of problems is reduced by at least 70%.

Requirements for the buyer

What you need to buy property in Dubai:

- Age from 21 years (in some cases 18 is enough) and a valid passport.

- Proof of income and source of funds when purchasing expensive properties.

- A bank account in Dubai and a credit history – if you plan to get a mortgage.

- Legal documents for purchasing companies (Free Zone or Mainland).

- Checking that the foreign investor is not subject to any restrictions or sanctions.

Off-Plan Purchase and Secondary Market

Off-plan is the purchase of real estate during the construction phase. Prices are usually lower than for completed properties, but it's important to thoroughly check the developer, completion dates, warranties, and deposit terms. I always recommend that clients include a payment schedule and clear completion dates in the contract.

The secondary market offers ready-made properties with full documentation, allowing you to quickly move in or begin renting out your property. A key step is verifying the property's legal status and freedom from any encumbrances.

Remote purchase by proxy

You can buy a house in Dubai without being present in person using a power of attorney. A lawyer is responsible for reviewing the documents, ensuring the correctness of the MOU, and ensuring payments are processed correctly and the property is registered with the DLD. The power of attorney requires notarization, apostille, and translation.

Checking the legal purity of the object

Before purchasing, I always make sure:

- the seller has legal title to the property;

- in the absence of debts, fines and legal proceedings;

- in the current status of the object in the DLD and its compliance with the design documentation;

- in the correctness of all permits and certificates (especially for townhouses and villas).

In practice, clients who skimp on due diligence later face problems: they are unable to register ownership or rent out their property.

For example, one client wanted to buy a villa in DAMAC Hills, but the lawyer discovered unregistered changes in the developer's documents. This helped avoid financial losses and litigation.

Registering property rights through the Dubai Land Department (DLD)

The final stage of a real estate purchase is registration of the Title Deed with the DLD. This document records the owner's details, the property's parameters, and the terms of the transaction. After registration, the buyer becomes the full owner and can freely dispose of the property: rent it out, sell it, or bequeath it to others.

On average, the process from property selection to registration takes approximately 6-12 weeks. The time frame depends on whether the property in Dubai is being purchased off-plan or on the resale market, as well as the degree of document readiness.

| Stage | What does it include? | Responsible | Deadlines |

|---|---|---|---|

| Selecting an object | Choosing a property in Dubai, analyzing the area and prices | Buyer, agent | 1–2 weeks |

| Booking Agreement | Signing the reservation agreement and paying the deposit | Buyer, agent | 1–3 days |

| MOU (Memorandum of Understanding) | Conclusion of the main agreement with the terms of the transaction | Buyer, lawyer, developer/seller | 1–2 weeks |

| Legal review | Legal verification of the property and documents | Lawyer | 1–2 weeks |

| Payment | Payment according to schedule (Off-Plan) or the full amount (secondary market) | Buyer, bank/lawyer | Depends on the contract |

| Registration in DLD | Filing documents and registering title deeds | Buyer, lawyer | 1–2 weeks |

| Transfer of the object | Receiving keys and inspecting the property | Buyer, agent, developer | On the day of registration or by arrangement |

| Post-registration actions | Connection of utilities, insurance, rent | Buyer | 1–2 weeks |

Taxes, fees and expenses for real estate in Dubai

Investors often choose Dubai because there are no property or rental taxes. This means you keep all the profits from renting out your apartment, villa, or house. The net income is significantly higher than in Europe, where taxes can take a significant chunk of your profits.

One-time and regular fees

When purchasing real estate in Dubai, you should take into account a number of mandatory costs:

- The DLD registration fee is 4% of the property price, paid when registering the title deed.

- Legal, notary, and agency services —in practice, my clients typically spend approximately 5-7% of the transaction value on legal support and document preparation.

- Utility bills and service charges vary annually depending on the property type and area: for an apartment in Dubai Marina, they are around 20-30 dirhams per square meter, while for a villa on Palm Jumeirah, they are higher, up to 40-50 dirhams per square meter.

Tax advantages and optimization schemes

UAE residents and foreign investors have access to advantageous property ownership schemes that help optimize tax expenses. In practice, I recommend:

- take into account the absence of income tax when renting out a property - this increases net profit;

- register ownership through a company in the Free Zone or Mainland - this protects assets and simplifies accounting;

- Clarify insurance and utility costs in advance so that they do not reduce your expected profitability.

Comparison with taxes in Austria

In Austria, high property taxes (Grunderwerbssteuer, Einkommenssteuer) and additional fees when purchasing real estate significantly increase the initial costs of investors. However, this market is characterized by stability: prices rise gradually, and legislation fully protects property owners' rights.

In Dubai, the situation is the opposite: there is no rental income tax at all, and the single registration fee is only 4% of the property value. This allows for a faster return on investment, but the market is more volatile, with prices heavily dependent on demand from foreign specialists and economic factors.

Residence visas through real estate purchase

When people ask me how to buy property in Dubai and obtain residency, I first talk about visa programs. Purchasing an apartment or villa in Dubai provides the opportunity to obtain a residency visa and other benefits, but it's important to understand the details.

Entry threshold and visa types

In Dubai, purchasing real estate allows foreigners to obtain visas of varying validity periods:

- 2 years - if the object costs from 750 thousand dirhams (~$204 thousand);

- 5 years – for investments from 1 million dirhams;

- 10 years (Golden Visa) - for purchases of AED 2 million or more.

A practical example: many choose the Golden Visa. For example, a client purchased two apartments in Dubai Marina and received a 10-year visa for the entire family, which helped him open a bank account and run his business without complications.

What does a resident visa provide?

- The owner and his family can legally reside in the UAE;

- You can open a business and open bank accounts;

- Access to medicine and education on preferential terms.

Visas obtained through real estate investment do not allow work without a separate permit.

Renewal conditions and restrictions

To extend your visa, you must maintain ownership of the property and maintain its value at least at the minimum required level. I recommend regularly checking the status of the property and updating all documents promptly to minimize the risk of renewal refusal.

Common mistakes when filing

- Purchasing an object for less than the required amount.

- Incorrect registration in the official register (DLD).

- Errors in documents when applying for a visa.

I guide clients from choosing a property (for example, an apartment in the UAE) to applying for a Golden Visa. This ensures no delays and proper paperwork for the entire family.

Comparison with Austrian Residence Permit

| Parameter | Dubai | Austria (D-card, Self-Sufficiency) |

|---|---|---|

| Minimum investment | 2-year visa: AED 750,000 (~$204,000) 5-year: AED 1,000,000 10-year Golden Visa: AED 2,000,000 |

There is no fixed amount, but a minimum of €45,000+ in the account |

| Mandatory residence | No, visas do not require permanent residency | Yes, at least 183 days a year to maintain a residence permit |

| Time limit for citizenship | A visa does not grant the right to citizenship | Typically 10 years of permanent residence for naturalization |

| Family reunion | Yes, visas apply to all family members | Yes, with income and housing verification |

| Business activities | You can open a company, a bank account and run a business | Permitted to work with a residence permit (RP) |

If reliability and stability are your top priorities, choose Austria. Here, the market is predictable, risks are minimal, and capital is protected. If, however, quick returns and simple procedures are your goal, Dubai is a better choice: returns are higher, but there are also risks due to the volatile market.

New UAE Immigration Rules 2025

Golden Visa. Now, a 10-year Golden Visa in Dubai is available not only to businessmen and investors, but also to people in many professions, such as doctors, teachers, environmentalists, and digital specialists. The visa allows you to live in the UAE without a sponsor, bring your family, and enjoy premium services.

Green Visa. The "Golden Visa" is designed for professionals, freelancers, and investors who want to live in the UAE without being tied to an employer. To obtain it, freelancers must prove an income of at least AED 15,000 per month and a higher education degree (bachelor's degree or equivalent).

Family sponsorship. Foreign professionals earning at least AED 4,000 per month can apply for visas for their families: spouse, children (sons under 25 and daughters of any age), and parents. If your visa is cancelled, your family will have six months to apply for a new UAE residency permit.

Job Seeker Visa. The Golden Visa can be extended for 120 days for recent graduates of leading universities and qualified professionals without sponsorship requirements. One requirement is maintaining a minimum account balance of AED 14,700 for the past six months.

New rules for visa extensions

- Online renewal via the Salama System. The AI-powered Salama system has been implemented, automating visa renewals and reducing application processing time from one month to five days. Information is automatically updated in your Emirates ID.

- Work Permit Extensions. For certain categories, the permit validity has been extended from 2 to 3 years, reducing the need for frequent renewals and cutting costs (fee: AED 100).

- Re-entry Permit. A UAE resident who has been outside the country for more than six months can retain their status if they return within 30 days of approval.

- Tourist visa extensions. 30- and 60-day visas can be extended for an additional 30 days for 600 AED, while 90-day visas can be extended for an additional 90 days without leaving the country.

These changes have made long-term residence in Dubai more accessible and comfortable for investors, professionals and their families.

Rent and profitability

Income is the main reason investors choose Dubai real estate. Unlike in Europe, here you can start earning stable rental income immediately after purchasing, especially with the right location and property type.

Short-term rental

Renting out apartments through Airbnb or Booking in Dubai can generate 10-12% annual income, especially in areas like Dubai Marina, Downtown, and Palm Jumeirah. This requires obtaining a license from Dubai Tourism and complying with local regulations. For example, one client in Dubai Marina rented out an apartment on a daily basis and earned 11% annual income.

Long-term lease

This option is suitable for those seeking a stable income of 5-7% per annum with moderate risk. It's an ideal solution for family investments or renting out to expats. The most popular areas are JVC (Jumeirah Village Circle) and Business Bay, where rental demand is constant and tenant turnover is low.

Profitability by region

| District | Average yield | Peculiarities |

|---|---|---|

| Downtown Dubai | 7–12% | The apartments are in high demand among expats and tourists, located near business districts and sought after for daily rentals, especially those with views of the Burj Khalifa |

| Dubai Marina | 6–12% | A constant influx of expats drives demand for long-term rentals, while the waterfront and views of the water make the location attractive to tourists seeking short-term accommodation |

| Palm Jumeirah | 7–10% | Luxury properties with a high acquisition price, with maximum profitability achieved through short-term rentals |

| Jumeirah Village Circle (JVC) | 6–8% | Affordable prices and stable demand for long-term rentals, as well as attractiveness for mid-range tourists for daily accommodation |

| Business Bay | 6–9% | Residential and commercial segments with potential for leasing offices and apartments simultaneously |

My advice: when choosing a property, it's important to balance the area, type of property, and rental approach. For example, villas on Palm Jumeirah are more often rented to tourists for short periods, while apartments in Dubai Marina are more reliably rented to expats for long periods.

Management companies and services

To reduce risks and simplify property management, many clients, especially those living abroad, use management companies. They handle tenant searches, rent collection, and property maintenance.

Taxation

Dubai attracts investors with its absence of rental income tax, which significantly increases net profits compared to other markets.

Comparing rental yields in Dubai and Austria

Compared to Austria, where rental yields are typically 2-3% and taxes and regulations are stricter, Dubai offers higher net returns and flexible property management terms.

| Indicator | Dubai | Austria |

|---|---|---|

| Average yield | Downtown 6–8%, Marina 7–9%, Palm 7–10%, JVC 6–8% | The rate across cities remains stable at 2-3%—relatively low, but with steady demand and reliable dynamics |

| Rent regulation | Short-term rentals require licensing, while long-term rentals are less strictly regulated | Tight regulation (Mietrecht) |

| Price restrictions | Almost none | There is rental rate control |

| Simplified taxation | Yes, rental income is tax-free, minimal fees | No, high tax burden and complex reporting system |

While rental yields are higher and the market is more active in Dubai, Austria offers stability, price predictability and strong demand, providing security for cautious investors.

Investor's Guide: Dubai's Hot Spots

| District | Characteristic | Average price per m² (2025) | Profitability potential |

|---|---|---|---|

| Downtown Dubai | Prime location, close to Burj Khalifa and Dubai Mall, good liquidity | 20,000–27,000 AED | 5-7% long-term, high price growth |

| Dubai Marina | A favorite spot for expats and tourists, it boasts a well-maintained promenade, a wide selection of restaurants, and a yacht club. | 15,000–20,000 AED | 6-10% short term |

| Palm Jumeirah | Premium level, prestige, rare species, limited access | 25,000–35,000 AED | 4–6%, rate of price increase |

| Business Bay | The epicenter of business activity, development underway, promising opportunities | 14,000–18,000 AED | 6–8% |

| JVC, JVT | Low prices, increasing demand from mid-range tenants | 9,000–12,000 AED | 7–10% |

| Dubai Hills, Damac Hills | Cozy neighborhoods for living with children, where there are golf courses, schools and recreational areas | 11,000–15,000 AED | 5–7% |

One of my clients purchased an apartment in the JVC area of Dubai for AED 950,000 and earned 9% annual interest in the first year thanks to short-term rentals. Another client chose a villa on Palm Jumeirah, where the initial yield was only 4%, but after two years, the property appreciated by 35%, ultimately yielding a significantly higher total return.

Tips from me:

- If a stable income and minimal risk are important, choose Business Bay or Dubai Marina.

- Rising prestige and market value - Palm Jumeirah or Downtown.

- If you are looking to buy a villa in Dubai for your family, consider Dubai Hills.

Always evaluate the area's infrastructure and development plans—this directly determines future property value growth.

Infrastructure and demand

One of the main advantages of Dubai real estate is its well-planned and constantly evolving infrastructure. The most popular areas typically offer everything necessary for comfortable living:

- Transport accessibility: metro, trams, buses, and expressways. For example, Downtown Dubai and Business Bay are well connected to the metro and Sheikh Zayed Road, and Dubai Marina is easily accessible by tram or ferry.

- Commercial and social infrastructure: shopping malls, restaurants, medical centers, and international-class schools. Dubai Hills and DAMAC Hills emphasize family comfort, with green parks, modern playgrounds, and international-class schools.

- Environmentally friendly: The Dubai Hills, DAMAC Hills, and Palm Jumeirah neighborhoods are attractive for their abundance of green spaces, golf courses, parks, and proximity to the sea. Meanwhile, business districts like Business Bay may be less environmentally friendly, but they benefit from their convenient location and excellent transport links.

Tenant demand:

- Short-term rentals are led by Dubai Marina, Downtown and Palm Jumeirah due to the large number of tourists.

- Long-term rentals – JVC, Business Bay, and Dubai Hills – the preferred location for families and professionals who have made Dubai their home.

If you're looking to make a quick buck, choose apartments in Dubai near the metro and tourist attractions. If you're looking for a stable, long-term income, it's better to invest in areas with parks, good schools, and well-developed family-friendly infrastructure.

Where to buy now and what to expect

In 2024–2025, the greatest investor interest is focused on JVC, Business Bay, and Dubai Marina. However, the most significant price growth prospects over the next two to three years are predicted for Business Bay and Dubai Hills, where next-level infrastructure is being developed.

New build or resale in Dubai: what should an investor choose?

Choosing between new-build and completed properties in Dubai is one of the most frequently asked questions from clients. Both options have their advantages, risks, and strategies. Over the years, I've helped clients purchase apartments in the early stages of construction and sell properties with existing leases. The bottom line: the optimal choice depends on your investment goals and risk appetite.

Off-Plan: Why New Buildings in Dubai Are More Popular

- Convenient payment options include interest-free installments until completion of the work and for an additional 1–3 years after the project is completed.

- A chance to enter a project at the initial stage and sell the asset before completion with a return of 20-40%

- Thoughtful modern layouts, environmentally friendly energy-efficient materials and smart home systems.

Example: An Austrian couple bought a two-bedroom apartment in Dubai Hills for AED 1.3 million, and in just two years its value increased to AED 1.75 million.

Secondary market: liquidity and nuances

- The property can be immediately put on the rental market and generate a stable income.

- An essential step is to verify the legal purity of the transaction through the Dubai Land Department.

- Properties older than 10 years may require additional investment in repairs.

- Villas and townhouses on the secondary market are often located in areas with fully developed infrastructure.

Example: A client from Ukraine purchased a villa in the prestigious Jumeirah Golf Estates neighborhood with existing tenants. This allowed him to immediately generate stable income, which exceeded the potential returns of many properties under construction.

| Parameter | New building (off-plan) | Secondary market |

|---|---|---|

| Entry price | Less than finished objects | More, but there is bargaining |

| Installment plan | Yes, up to 5-7 years | No, full payment |

| Profitability at the start | Resale profit (20-40% per cycle) | Rental income immediately |

| Risks | Construction delays | Need for repairs |

| Infrastructure | Formed over time | It's already ready |

| Popularity among investors | Very high, especially in the premium segment | Moderate but stable demand |

Comparison with new buildings in Austria

In Dubai, new developments are the main driver of the market: investors can enter a project at an early stage and maximize value growth by the time it is completed.

Austria has fewer new buildings, but those that do are focused on energy efficiency and ESG compliance, attracting conservative investors willing to expect long-term stable returns.

| Indicator | Dubai | Austria |

|---|---|---|

| Energy efficiency | Modern designs with thoughtful insulation, while the climate reduces the heating load | High-level energy efficiency, with mandatory certification and compliance with strict standards |

| Construction rates | Long implementation periods - 2-4 years from the start, many properties are sold at the Off-Plan stage | High in large cities and agglomerations |

| ESG standards | Step-by-step implementation, more focus on luxury projects | Strict environmental and social standards at every level |

| Average price per 1 m² | $3,500–$7,000 – depending on the area and class | $5,000–$9,000, especially expensive in Vienna and Salzburg |

| Share of new buildings on the market | High – more than half of transactions are Off-Plan | About 30%, the market is mainly secondary |

How to go beyond classic shopping

Investors in Dubai are increasingly moving away from standard models and seeking combined strategies: instead of purchasing a single apartment or villa, they are considering portfolios of different properties, commercial real estate, and participation in large projects. This approach helps spread risk, increase overall returns, and flexibly respond to market changes.

Several studios instead of one villa

Many of my clients prefer to buy three or four studio apartments in popular Dubai areas instead of one large villa. This allows them to diversify their risk, ensure a stable income throughout the year, and simplify the sale of their properties if necessary. For example, one investor purchased four studio apartments in JVC and Business Bay and is now consistently earning over 9% per annum.

Investments in hotels and aparthotels

The buy-to-let format in hotel complexes allows for passive income without personal involvement: the management company takes full responsibility for booking, cleaning, and marketing the property. Aparthotels in Dubai Marina and Downtown are the most popular.

Land purchase and construction

For experienced investors, purchasing a plot of land and subsequently building a townhouse or villa in the UAE can yield a 20-30% return on resale. Key factors for success include choosing a promising location and a reliable contractor.

Joint investments

Joint real estate investments allow you to participate in larger projects—for example, purchasing a villa on Palm Jumeirah or commercial space in Dubai Hills. I recommend clearly defining each partner's shares and exit terms to avoid any misunderstandings down the road.

Commercial real estate

Commercial real estate in Dubai (offices, retail space, warehouses) is actively attracting European and Asian businesses due to high profitability (higher than in Austria) and an affordable entry threshold of $300,000.

Comparing Strategies: Dubai vs. Vienna

| Strategy | Dubai | Vienna |

|---|---|---|

| Several studios | Excellent profitability, fast liquidity | Limited supply, high price per m² |

| Hotels and aparthotels | Developed segment, high tourist flow | Limited number of objects |

| Land + construction | Fast turnover, high demand | Strict regulations, long deadlines |

| Joint investments | Popular in large projects | Not so common |

| Commercial real estate | High demand, market dynamics | Stability, but lower profits |

If you're looking for rapid capital growth and high returns, Dubai offers more opportunities and flexibility. However, for conservative investors focused on long-term stability, Austria remains a reliable choice.

Risks and pitfalls

Buying property in Dubai offers great opportunities, but it's important to understand the risks to avoid any unpleasant surprises.

Dependence on tourism and expats

International demand has a significant impact on the market. During times of crisis, the number of tenants declines, especially in the short-term rental segment. I advise clients to choose areas with strong domestic demand, such as Business Bay or JVC.

Price volatility

Real estate values can temporarily decline due to external economic crises. However, liquid properties (such as apartments in Dubai or villas in popular areas) experience less depreciation and recover more quickly after downturns.

Climate and seasonality

Renters are less active in the summer. However, properties in Downtown Dubai, Dubai Marina, and Dubai Hills Estate are in demand year-round.

Off-Plan Risk

When purchasing off-plan property in the UAE, it's important to thoroughly check the developer's reputation and realistic completion dates. Partnering with reputable companies significantly reduces risks.

Service fees

In some projects, costs can reach 10-12% of the rental amount, and it is important to include this factor in financial calculations.

Comparison with Austria

Austria is attractive due to its price stability and predictability: the market is relatively unresponsive to external crises, and the legal and tax systems guarantee investor protection. Strong demand for housing, particularly in Vienna and major cities, supports the liquidity of properties. The main drawback is the relatively low yields of 2-3% versus 5-8% in Dubai, as well as strict rental market regulation and high property taxes.

Life in Dubai: Comfort, Service, and Everyday Practices

My clients often wonder whether buying an apartment or villa in Dubai is a good choice for lifestyle reasons. From my experience, I can say that Dubai real estate combines investment potential with the opportunity to live, work, and run a business comfortably.

Climate, medicine, education, security

Dubai's sunny and warm climate year-round makes it particularly attractive to Europeans. The city also offers a modern healthcare system: a visit to a doctor at a private clinic costs an average of AED 250–500 ($68–$136), and family insurance starts at AED 15,000 ($4,080) per year.

International schools offering the IB or British Diploma programs cost parents between 50,000 and 100,000 AED ($13,600 and $27,000) per year per child. However, Dubai is deservedly considered one of the safest cities in the world: the crime rate is extremely low, and laws are strictly enforced.

Standard of living and cost of living

The cost of living in Dubai is higher than the UAE average, but remains lower than in some major European capitals. Annual rent for an apartment here ranges from approximately AED 80,000 to AED 180,000 ($21,800 to $49,000), while villas range from AED 180,000 to AED 500,000 ($49,000 to $136,000), depending on location and size. Utilities and service charges should also be factored in: for villas and townhouses, these average AED 1,500 to AED 4,000 ($410 to $1,080) per month.

Transport, banks, communications

The city has a well-developed transportation infrastructure. The banking system is stable, and opening business and personal accounts is straightforward. Mobile phone service and internet are high-quality and reliable, which is especially important for remote work.

Social and business environment for expats

Dubai is an international hub with a large expat community. In my experience, clients easily establish both social and professional connections here, attending clubs, business groups, and various events.

Comparison with Austria

Austria stands out for its stability, developed infrastructure, environmental friendliness, and high level of security. Dubai, meanwhile, attracts with its dynamism, low taxes, and conditions for comfortable living in an international community.

My advice: if peace and European comfort are more important to you, choose Austria. If you're looking for business opportunities, high income, and an active lifestyle, Dubai is the perfect choice.

Dubai as a strategic alternative to European real estate

In my practice, I often encounter clients who value not only investments but also a reliable, comfortable alternative to Europe. In this regard, Dubai is a unique jurisdiction: for citizens of unstable countries, purchasing real estate here is a way to preserve capital and ensure the legal transparency of the transaction.

Pensioners are attracted by the mild winter climate, high-quality medical services, and the opportunity to live in comfortable villas or apartments with established infrastructure.

Digital nomads value a developed IT and financial infrastructure, access to global markets, and tax advantages that provide flexibility in managing their income.

Vienna is the choice for those who value stability, a high quality of life, and transparent regulations. The real estate market here has been well-established for decades, laws and taxes are clear, and prices are not subject to sudden fluctuations. Therefore, investments in Austria are typically used as the "anchor" of a portfolio—the portion responsible for stability and capital protection. This is a city with a centuries-old history, where your investments are protected and daily comfort is the norm.

Dubai offers a completely different experience: a dynamic market with the potential for high rental yields. In my experience, clients who value stability and long-term security often choose Vienna. Those seeking high returns, flexibility, and an active lifestyle typically prefer Dubai.

How to exit a Dubai real estate investment

The time it takes to exit a Dubai real estate investment depends heavily on the location and type of property. For example, apartments in Downtown or Dubai Marina, with proper preparation, sell on average in 4-6 weeks, while villas in Palm Jumeirah or JVC may take longer. If you have a residency visa obtained through real estate, it's important to consider the terms of the visa program and notify the DLD of the planned sale. Transferring a property by inheritance or to relatives requires special legal support, especially if the property is registered through a company or trust.

The Vienna real estate market is predictable and stable: properties sell quickly, and legal procedures are extremely simplified. In Dubai, liquidity varies greatly depending on the location and type of property—for example, luxury villas and studios in popular areas sell quickly, while new projects may take time to gain market share.

| Parameter | Austria | Dubai |

|---|---|---|

| Sales speed | High, predictable | Average, depends on the area |

| Property type | Apartments, houses | Apartments, villas, townhouses |

| Risks when selling | Low | Averages, seasonality and demand |

| Legal complexity | Minimum | Average, requires DLD verification |

| A practical example | Vienna – 2-4 weeks | Downtown – 4-6 weeks; Palm – 2-3 months |

Expert Opinion: Investing Through the Eyes of Oksana Zhushman

Real estate isn't just square footage; it's a tool for achieving your goals, generating income, and ensuring security. We research the market, calculate potential income, verify legal compliance, and offer properties that meet your needs: whether it's a villa in Dubai, an apartment in the UAE, or a high-yield investment project.

Ready to find a solution tailored just for you?

— Ksenia , investment consultant, Vienna Property Investment

My experience with real estate in Dubai and Europe has shown that each market requires a unique approach. In Dubai, due diligence on developers and properties is especially important: I always check the developer's reputation, the availability of all permits, the project's compliance with RERA requirements, and the infrastructure's readiness. Only this approach allows you to safely purchase luxury real estate in Dubai or an apartment in the UAE, minimizing the risks to your investment.

When building an investment portfolio, I recommend combining more dynamic markets, such as Dubai, with stable and predictable ones, such as Austria. For example, one of my clients purchased an apartment in the UAE for rental purposes and simultaneously invested in residential real estate in Vienna for capital preservation. This approach provides both high returns and risk protection.

If I were choosing a strategy for myself, I would split my investments as follows: I would invest part of it in Dubai real estate to generate income and increase its value, and I would invest the other part in stable European properties, for example, in Austria, considering them as a reliable “margin of safety” and capital preservation.

My main advice: Always focus on your goals, distribute your capital across different areas, and carefully inspect properties before purchasing. This approach will make your investment reliable and profitable—whether it's a luxury villa or apartment in the UAE, or an apartment or house in Austria.

Conclusion

Determine priorities, allocate investments across different segments, conduct due diligence on properties, and consider the requirements of each jurisdiction.

When Dubai is the best choice

- Suitable for investors seeking rapid capital growth and high profitability.

- Relevant when focusing on rentals: short-term or long-term rentals of apartments or villas in Dubai.

- For those who are ready to work with a rapidly changing market and carefully analyze properties.

- It would be interesting to know if residency programs and tax incentives for foreign investors are important.

When Austria is the best choice

- For investors focused on stability and reliable returns.

- If the priority is long-term investment with a reduced level of risk.

- Suitable for those who value capital preservation and financial protection.

- This is relevant when transparent transactions, stable domestic demand, and developed infrastructure are important.

The outlook through 2030 looks very optimistic: Dubai continues to actively develop its infrastructure and introduce new tax and immigration incentives, while Austria is strengthening its position as a stable market with consistent demand and transparent regulations. A well-chosen investment strategy will allow you to earn a stable income, mitigate risks, and easily adapt to market changes.

Appendices and tables

Comparison table of profitability by region

| Region | Average annual rental yield (%) |

|---|---|

| Downtown Dubai | 5–6% |

| Dubai Marina | 6–7% |

| Palm Jumeirah | 4–5% |

| Business Bay | 5–6% |

| Jumeirah Village Circle (JVC) | 6–7% |

| DAMAC Hills | 6–8% |

| Dubai Hills Estate | 6–7% |

Price/Profitability Map

| Region | Average price per m² ($) | Average annual rental yield (%) | Market Features |

|---|---|---|---|

| Downtown Dubai | 7 200–7 500 | 5–6% | City center, high liquidity, popular among expats and tourists |

| Dubai Marina | 6 200–6 500 | 6–7% | Embankment, active short-term rental, in demand among young tenants |

| Palm Jumeirah | 9 000–9 500 | 4–5% | Premium apartments and villas, lower yields but constant demand |

| Business Bay | 5 700–6 000 | 5–6% | Business center, a combination of commercial and residential real estate |

| Jumeirah Village Circle (JVC) | 3 900–4 200 | 6–7% | New area, low prices, high growth potential |

| DAMAC Hills | 3 600–3 900 | 6–8% | Family-friendly villas, growing domestic demand, and active rental activity |

| Dubai Hills Estate | 4 100–4 400 | 6–7% | Good infrastructure, apartments and villas, popular with families |

Tax Comparison: Dubai vs. Austria

| Indicator | Dubai | Austria |

|---|---|---|

| Property purchase tax | 4% registration fee (DLD) | Grunderwerbssteuer: 3.5-6.5% of the price |

| Value Added Tax (VAT) | The rate is 5% for new properties, with partial relief for residential properties. | 20% standard VAT on new buildings |

| Annual property tax | No | There is no annual ENFIA tax, there is a municipal tax (0.1-0.5% of the cost) |

| Municipal tax | Included in service charges | Up to 0.5% of the cadastral value |

| Tax on rental income | No | Up to 55% depending on profit (Einkommenssteuer) |

| Capital Gains Tax (on sale) | No | Speculationssteuer: up to 30% sold in the first 10 years, no income tax. |

| Notary and registration fees | 1–2% | 1–3% |

| Tax optimization | Privileges for residents, tax solutions for expats | Deductions, registration of assets in the names of companies and management through trusts are allowed |

An Investor's Checklist for the Dubai Real Estate Market

1. Formulate your investment goal

- Long-term or daily rentals (Airbnb)

- Generating income, increasing the value of an asset, or obtaining a Golden Visa

2. Select the appropriate object type

- Apartment in Dubai

- House in Dubai

- Villa Dubai

- townhouse

3. Clarify your budget and minimum entry threshold

- The required amount to purchase an apartment, house or villa

- Associated costs: registration, legal support, service fees

4. Select a location

- Freehold: A path to full ownership for foreigners

- Leasehold: long-term land lease

- Examples: Downtown Dubai, Dubai Marina, Palm Jumeirah, Dubai Hills Estate, Business Bay, JVC

5. Analysis of the object

- Legal Transparency Review (DLD, RERA)

- Project stage: Off-Plan or ready-made property

- The developer's reputation and availability of licenses

6. Drawing up an agreement

- Booking an object

- Signing of the MOU/SPA

- Payment and deposit terms

7. Real estate registration

- Dubai Land Department (DLD)

- Property title check, real estate title

8. Investment evaluation

- Expected rental yield

- Utility and operating costs

- Taxes and other fees

9. Planning for rental or resale

- Selecting a management company

- Strategy: Short-term or long-term rental

- Developing an investment exit plan

10. Diversification of the investment portfolio

- Combine Dubai real estate with assets in other stable markets

- Risk and liquidity analysis

Investor scenarios

1. Investor with $200,000

- Goal: to enter the market with minimal investment and receive passive income from rentals.

- Options: apartments in Dubai in the JVC, International City, or Discovery Gardens areas. Consider the secondary market or small new developments.

- Profitability: on average 6-7% per annum from rent.

- Risks: possible rental delays, seasonal fluctuations in demand, tenant instability.

An example of a successful investment: for a client with a budget of $200,000, we found a studio apartment (55 sq m) in the Jumeirah Village Circle area on the resale market. The apartment was completely move-in ready, allowing us to rent it out immediately and generate 6-7% annual income. This example demonstrates how you can start investing with minimal risk and quickly achieve a stable passive income.

2. The $1 million family

- Objective: to purchase comfortable premium-class housing for long-term rental or personal use.

- Options: villas in Dubai Hills Estate, Palm Jumeirah or Meadows, or townhouses with private territory and swimming pool.

- Profitability: 5-6% per annum from rent + potential increase in the value of the property.

- Risks: high maintenance and utility costs, risk of overpaying when reselling in an overheated market.

A successful example for a family with a budget of $1 million: we found a villa in Dubai Hills Estate (220 sq m) with partial renovations and furniture. The property is suitable for both personal residence and long-term rental with a yield of 5-6% per annum. This case demonstrates how to combine comfort, prestige, and investment benefits in a single transaction.

3. Commercial real estate

- Goal: stable passive income through long-term rentals and growth in the property's value.

- Options: Office space in Business Bay, Jumeirah Lake Towers, or Dubai Marina; retail space or café/restaurant locations in high-traffic areas.

- Profitability: 7–9% per annum (depending on location and type of tenant).

- Risks: High competition, possible periods of facility downtime, dependence on economic conditions.

A successful example of a commercial real estate investment: for a client with a budget of $450,000, we found office space in Jumeirah Lake Towers (80 sq m) with a long-term 5-year lease. The property generates 8% annual income, and stable rental payments reduce financial risk. This case illustrates how to choose real estate with guaranteed returns and minimal risks.