How and Why to Buy Real Estate in Bulgaria: An A-Z Guide for Investors

When clients come to me for consultations, their requests often fall into two broad categories. The first are investors seeking a safe haven for their capital: stability, rock-solid liquidity, and predictability for decades to come. For them, the answer is almost always the same: Vienna.

The second group is those looking for an entry point into Europe: something accessible, understandable, with the potential to earn an income and perhaps even obtain a residence permit. And here's where the question often comes up: "What about Bulgaria?"

Bulgaria is perhaps the most talked-about "budget" real estate market in the European Union. The sea, the mountains, low taxes, and prices that seem unbelievable after Vienna or Munich.

That's why I decided to write this article: to systematically, without rose-colored glasses or advertising slogans, analyze what real estate in Bulgaria really is today.

My name is Ksenia, and I'm an investment consultant at Vienna Property Investment. My job is to help clients make informed financial decisions based on numbers, laws, and long-term strategy, not emotions. And I always say: there are no perfect investments, only those that suit a specific goal.

The purpose of this article is to provide you with just such a framework. We'll honestly examine all the advantages of the Bulgarian market—from coastal profitability to ease of registration. But, more importantly, we'll compare it to the benchmark market—Austria.

Why? Because only through comparison can one truly understand the value of an asset. We'll look at where Bulgaria wins in price, and where Vienna wins in reliability, liquidity, and capital quality.

Bulgaria on the European Investment Map: A Catch-Up Market with Nuances

When clients come to me for a consultation, they've often already sifted through mountains of information online. And many have the same image in their heads: Bulgaria is an investor's paradise. Cheap, beautiful, part of the European Union.

But my first question is always the same: "What's your goal? Buying a 'dacha by the sea' or preserving and growing your capital?" And here we begin to understand what this market really is.

If you think of the European real estate market as a football league, Austria, Germany, and Switzerland would be the top-flight teams. They play consistently, their transfer values rise smoothly and predictably, and each match is a carefully crafted strategy.

This is where conservative investors come in, for whom reliability and predictability are paramount. For them, real estate isn't so much about income as it is a safe haven for capital.

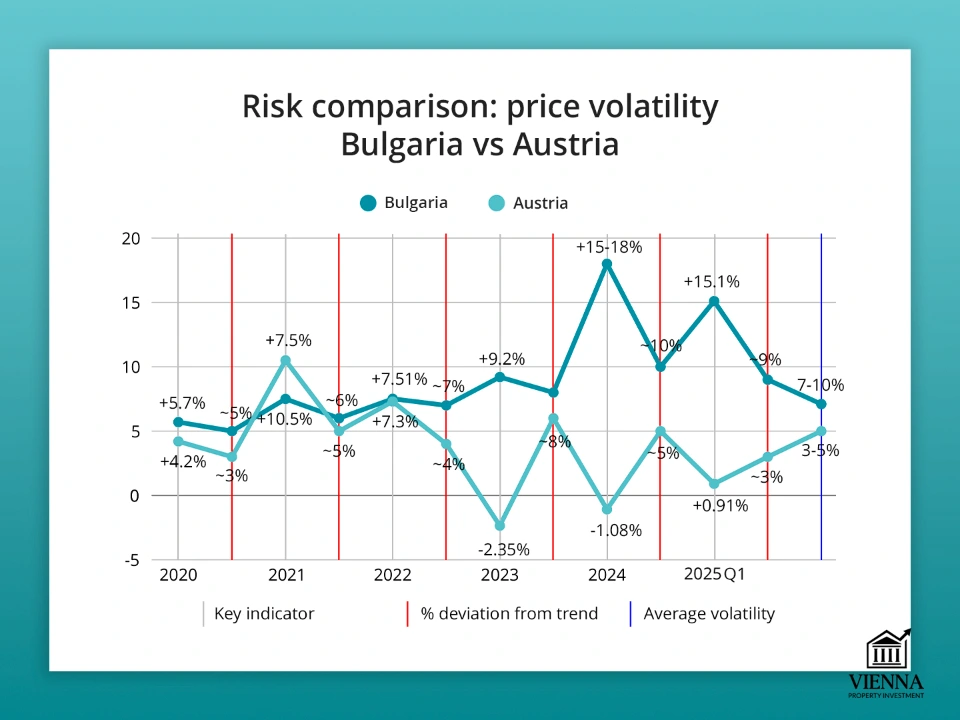

So where does Bulgaria come from? They're a promising team, just emerging from the minor leagues into the main squad. It's a market with enormous potential, but also a high degree of unpredictability. You could call it a "catch-up" market. It's developing, it's growing, but its history isn't a smooth curve, it's a rollercoaster.

Story

After joining the EU in 2007, Bulgaria's real estate market experienced a real boom. Prices soared, and investors snapped up everything they could find. But then came the global financial crisis of 2008.

And here, Bulgaria's "immature" market showed its true colors: resort property prices plummeted by 40-50%, sometimes even more. The market froze for a long time, and only in 2016-2017 did a cautious recovery begin.

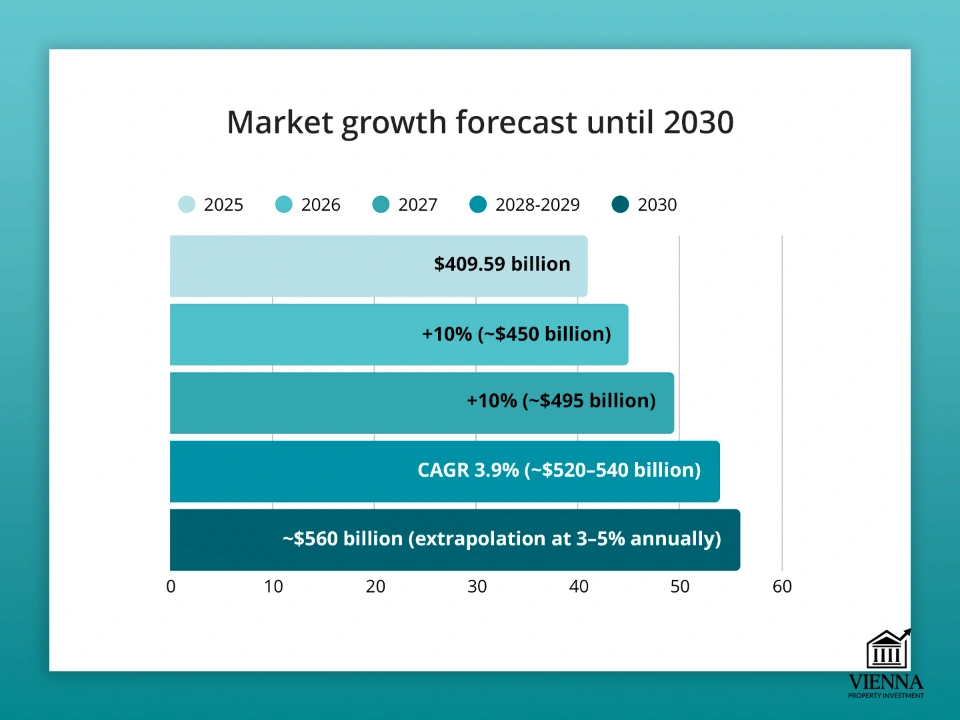

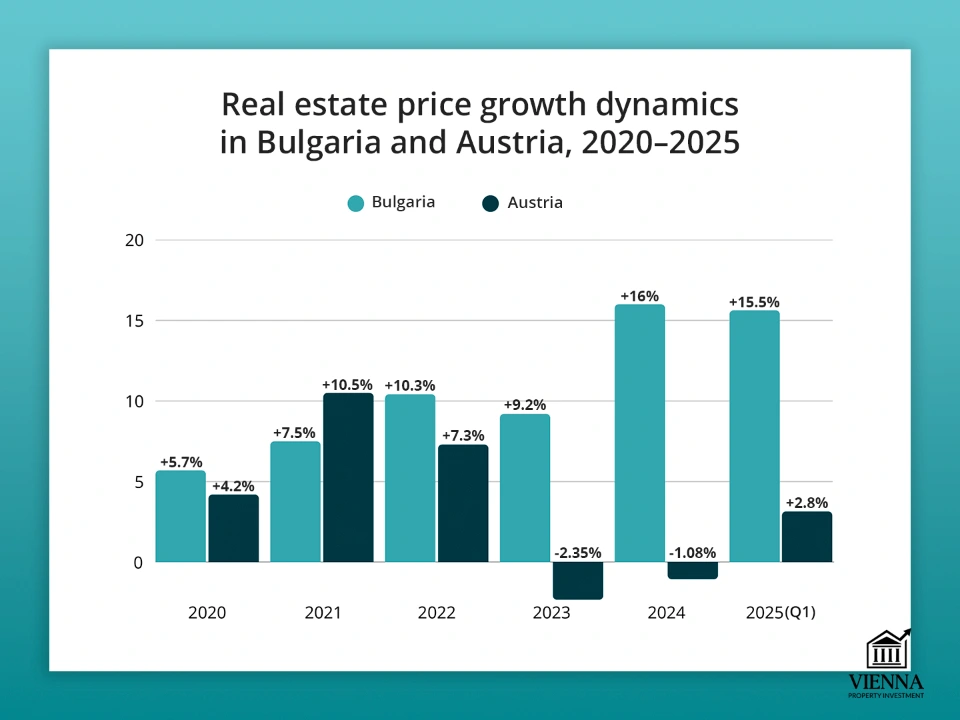

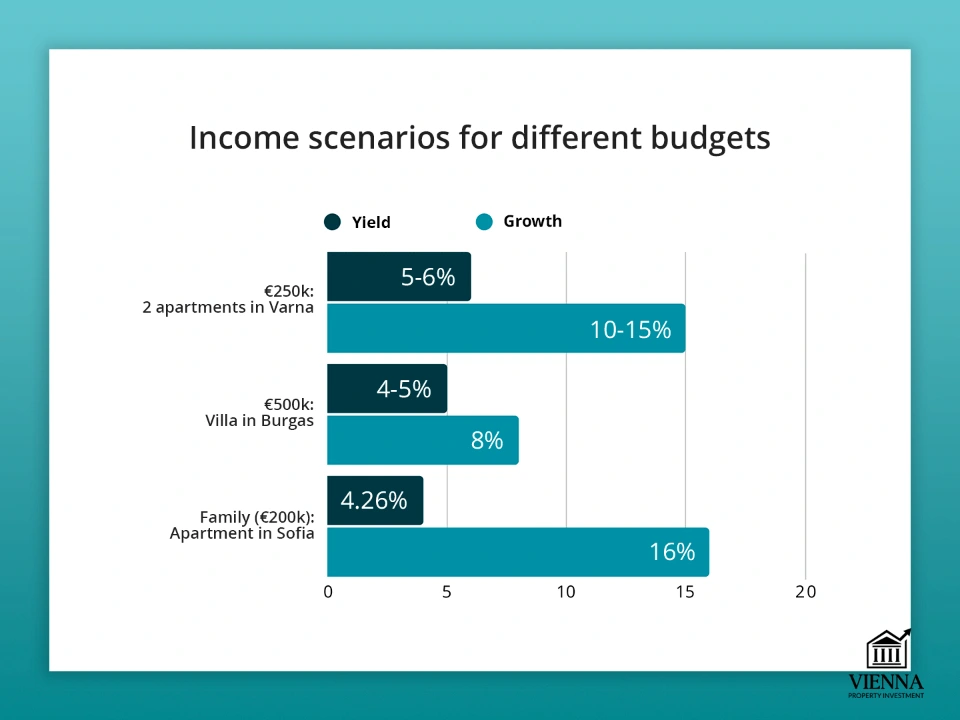

I often see clients marveling at the figures from recent years: "Ksenia, I read that housing prices in Bulgaria are growing by 9-10% per year! That's incredible!" And it is indeed true. According to the Bulgarian National Statistical Institute (NSI), these growth rates are among the highest in the European Union.

But I always explain that you need to look at the base from which this growth occurs. A 10% increase on $50,000 is $5,000, while a 3% increase on $500,000 is $15,000. In the first case, the percentage seems higher, but the absolute amount is smaller, and the risks are disproportionately higher.

-

Case study: A Moscow family saved for four years to invest, then bought an apartment in Varna in the summer of 2024. Thanks to the booming market, the price of their property had increased by almost 20% by the end of 2024.

Sharp price surges only occur in emerging markets. On the one hand, this offers a chance to quickly increase capital. On the other, there's a risk that prices will eventually level off or even fall, especially in less attractive regions.

This important nuance is key to understanding the Bulgarian market. It's not a marathon, but a sprint with an uncertain finish. One day you see impressive growth, and the next, stagnation returns because the market hasn't fully stabilized yet.

At the same time, the Austrian market is truly a marathon. It can grow slowly but steadily, without sharp spikes or painful declines.

Competitors

Of course, Bulgaria isn't the only country in the "budget" entry category for Europe. Let's see who it's competing with.

Romania. Property prices here are also among the lowest in the EU, but it's landlocked and lacks a developed resort infrastructure. Its main market is large cities like Bucharest, where demand, like in Sofia, is growing due to the IT sector.

Hungary. Budapest offers higher liquidity and stable demand, but the entry barrier is also higher. It is no longer considered a "budget" country in the same sense as Bulgaria.

Greece is a very strong competitor. It has a Golden Visa program that allows you to obtain a residence permit with a real estate purchase of at least €250,000. This makes it much more attractive to investors who value not only the asset itself but also the immigration status.

Montenegro. It competes in the resort real estate segment. Prices there are comparable to those in Bulgaria, but it is not a member of the European Union, which is a critical factor for many investors.

Compared to these competitors, Bulgaria has one undeniable advantage: its combination of EU membership and exceptionally low entry barriers. You can buy a coastal apartment for €40,000-€60,000, which is simply unthinkable in other EU countries. In Vienna, you wouldn't even buy a parking space in the city center for that price. Therefore, those considering Austria as an anchor market need to consider their budget and scenarios: where and when to buy an apartment in Vienna to maintain high liquidity.

"I often tell my clients: don't confuse affordability with value. A cheap asset can be a 'liquidity trap,' where it's easy to buy but nearly impossible to sell without a significant discount.".

— Ksenia , investment consultant,

Vienna Property Investment

That's why, when comparing Sofia and Vienna, we're talking not just about different prices, but about different asset classes. In Vienna, you're buying a stake in one of the world's most stable markets. In Bulgaria, you're buying into a market with high potential, but also high risk.

This is not a battle of "good versus bad," but an analysis of two different strategies: quick tactical gain versus long-term strategic growth.

Bulgarian Real Estate Market Overview: Three Different Worlds

Trying to talk about the "Bulgarian market" as a whole is like talking about the "average temperature in a hospital." It's extremely heterogeneous and essentially consists of three completely different segments that don't even compete with each other.

When a client approaches me with the request "I want to buy an apartment in Bulgaria," my first question is: "Where exactly? By the sea, in the mountains, or in the capital?" Because the entire subsequent strategy depends on the answer.

First World: Large Cities (Sofia, Plovdiv, Varna, Burgas)

This is the heart of the Bulgarian economy. The main market here is domestic. Residential properties are purchased by Bulgarians themselves, as well as foreigners who move here to work or study.

Drivers of Demand. The main drivers are the development of the IT sector and the influx of young professionals from other countries. Demand is also driven by students and employees of international companies opening offices in major cities. This segment is the most predictable and stable.

Liquidity. It's the highest in the country. Properties in good areas sell quickly. If you're looking for a long-term rental, this is an ideal option. Demand is year-round, not just seasonal.

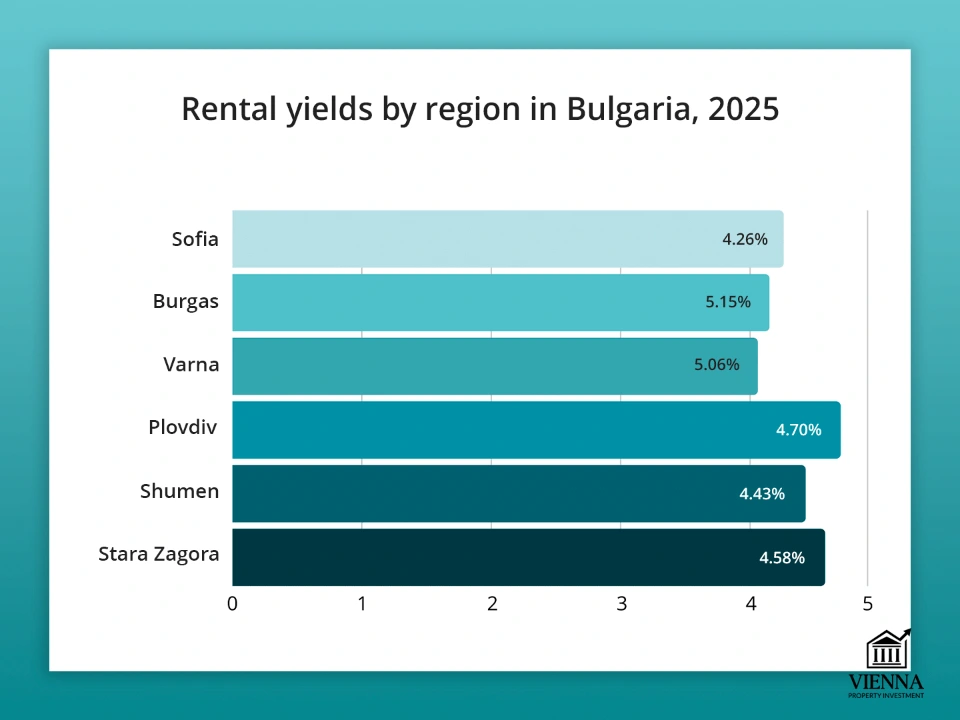

Profitability. Moderate, typically 4-5% per annum on long-term rentals. These aren't exorbitant figures, but they are stable and predictable.

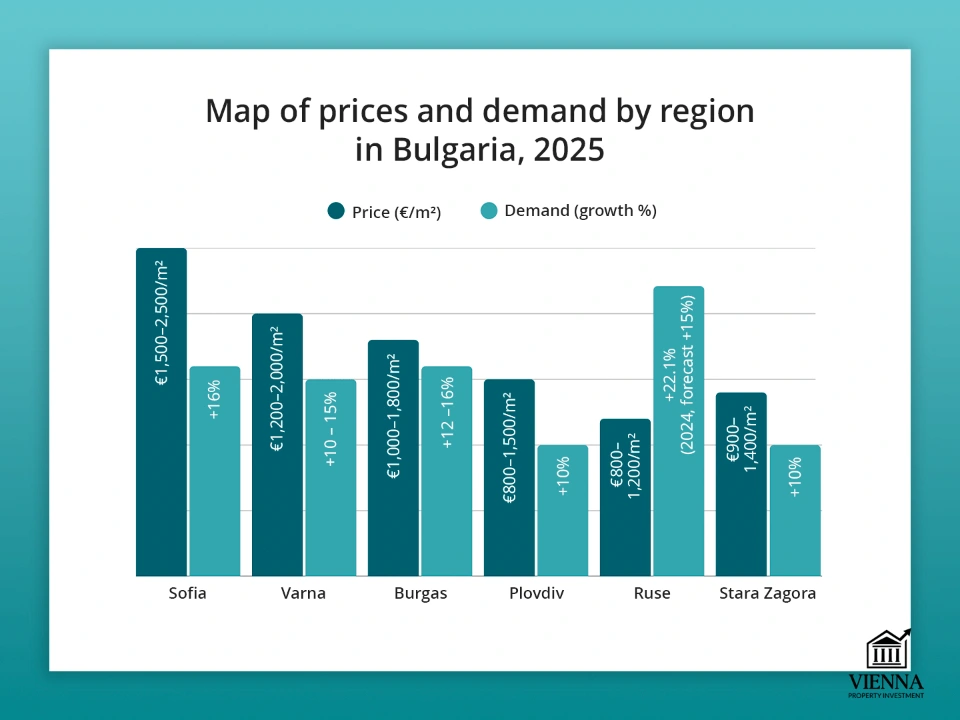

Prices. In Sofia, the average price per square meter in good areas reaches €1,600–€2,200. This is no longer the €500–€700 of 10 years ago, indicating the maturity of the capital's market.

-

Case study: Anna, an IT specialist from Vienna, bought a two-bedroom apartment in Plovdiv (€600/m²). She currently rents it out for €350/month (€6/m²) – that's ~5.5% per annum, excluding expenses. "I wanted to generate passive income and was considering the suburbs of Vienna, but it turned out cheaper in Bulgaria. But I know that in Vienna my apartment won't be rented for less than €1,800 – demand from students and expats is consistently high."

Second World: Seaside resorts (Sunny Beach, Golden Sands, Sozopol)

It's a purely tourist market, where 90% of transactions are made by foreigners. People come here for the sun, the sea, and an inexpensive summer "dacha.".

Demand drivers: Tourism and the desire to own a private corner by the sea. This isn't a pure investment, but rather a personal purchase with the option to rent it out for a few months.

Liquidity. Monstrously low. Selling an apartment in these areas urgently almost always means a 20-30% discount. The market is oversaturated, and you'll have to compete with hundreds of other properties. Buyers always have a choice.

Profitability. High, but only during peak season. During peak months (June-August), it can reach 7-8%, but the rest of the year it's zero. Forget about income from September to May. You also need to factor in the "maintenance fee"—an annual fee for property maintenance, which can range from €400 to €800 per year, even if you don't use the apartment.

Prices range from €800 to €1,500 per square meter. The price difference depends on the property's proximity to the sea, its condition, and its age.

Third World: Ski resorts (Bansko, Pamporovo, Borovets)

Similar to the maritime market, this market is oriented towards seasonal tourism, but winter tourism.

Demand drivers: Winter sports and investors from the UK and neighboring countries seeking affordable vacation spots.

Liquidity. Very, very low. The Bansko market is particularly oversaturated, and finding a buyer here is a real art. Often, the only way to sell a property is to significantly reduce the price.

Profitability. Depends on the weather and tourist flow. If it's a snowy season, there might be some income. If not, it will be close to zero.

Prices. Often the lowest in the country. Studios can be found for €25,000–€35,000, making them attractive for those looking to own their own little corner of the mountains.

Comparison with Vienna

In Vienna, 99% of investment-attractive properties are concentrated within the city limits. The market is homogeneous, demand is stable 12 months a year, and the main tenant is a long-term contract with a solvent resident.

In Bulgaria, you'll have to make a difficult choice: the stability of Sofia with its moderate returns, or the high, but "paper" income of resorts with their enormous downtime risks and low liquidity.

| Sofia (major cities) | Seaside resorts | Ski resorts | |

|---|---|---|---|

| Purpose of purchase | Long-term investment, rent | "Dacha by the Sea", summer vacation | Winter holidays, "dacha in the mountains" |

| Liquidity | High, stable | Low, only during the season | Very low, oversaturated market |

| Profitability | Stable, 4–5% (long-term lease) | High (up to 8%), but only 3 months a year | Low, depends on the season and snow |

| Risks | Moderate, as in any market | High (simple, "maintenance fee", low liquidity) | Very high (simple, low liquidity) |

| Main buyer | Bulgarians, foreigners (residents) | Foreigners (tourists) | Foreigners (tourists) |

So, as you can see, before buying an apartment in Bulgaria, you need to understand which of these three worlds you want to enter. And most importantly, don't mix them.

Ownership formats and investor strategies

Individual. The simplest option is to purchase an apartment or house in your own name. Bulgarian law allows foreigners to own residential properties (apartments, rooms) without restrictions.

This requires minimal formalities: a tax identification number (foreigner's ID), a local bank account, and a notary agreement. This format is convenient because the owner makes all decisions regarding the property independently.

Through a company. If you're not an EU citizen, you can't formally purchase land (or a house with a plot) in your own name—only an apartment. However, you can establish a Bulgarian LLC (OOD/EOOD) and use it to purchase any property (including commercial properties).

Many investors use this method for operational flexibility and tax optimization. For example, when selling a property, the company pays a 10% income tax on the proceeds, while the owners pay only on the dividends paid.

Through trusts or funds. An alternative option is to invest in a business (Real Estate Investment Company, REIC) or a closed-end fund that owns real estate, rather than buying real estate directly.

Bulgarian law doesn't officially prohibit such schemes. However, such instruments are rare—in practice, it's more convenient to purchase "physically" through a company or independently than to search for a registered REIC.

Investor strategies

The investment objective greatly influences the strategy:

Long-term rentals (buy-to-let). We select apartments in major cities (Sofia, Plovdiv) with stable demand. The main goal is a stable income of 4-5%.

Short-term rentals, often on the coast. The seasonal tourist flow is important here, especially at holiday markets (Sunny Beach, Nessebar). Sometimes, the cost of an apartment in a good location can be recouped in 7-10 years thanks to high summer rental rates.

Speculative investments (fix & flip). Buying a property (often a resale) at a low price, renovating, and reselling. This scenario requires in-depth knowledge of the local market and construction nuances. It's risky for beginners, as costs can eat into profits.

Permanent residence/residence permit. If the goal is emigration, then an apartment for personal use is chosen (at least 60-80 m² for a family). The right location—with a school and infrastructure—and the possibility of renting out rooms for yourself while you're not living there.

Legal aspects of purchasing: Simple, but with pitfalls

When we discuss legal procedures with clients in different countries, Bulgaria usually evokes a sigh of relief. Compared to, say, Austria, where every piece of paperwork passes through dozens of authorities, the Bulgarian system seems incredibly simple and fast.

The entire process, from making a deposit to receiving the notarial deed, can take as little as 2-3 weeks, and this is certainly one of the biggest advantages. But, as I always say, simplicity doesn't always mean security. This apparent ease may conceal important nuances that you need to be aware of in advance.

Let's break down what awaits you step by step. Imagine you've found your dream apartment in Sunny Beach. What's next?

A reservation deposit. This is the first step. It's usually a small amount, around €2,000–€3,000, which is deposited into the seller's or agency's account. The purpose of the deposit is to "freeze" the property so it can be removed from the market.

It is crucial that the deposit agreement clearly states that it is refundable if legal issues are discovered during the due diligence process.

Due diligence. This is the most critical stage, and should be conducted by your independent lawyer. Don't rely on the seller's or agency's lawyer! Your lawyer must check the property against all state registries:

- Property register. Encumbrances (mortgages, liens, liens).

- Cadastral register. Conformity of the actual area and boundaries of the property with the documents.

- Owner verification. No inheritance disputes or other legal proceedings.

- Checking for outstanding debts. Unpaid utility bills, taxes, or "support fees" are common. Incidentally, this is a very common problem in resort complexes.

Signing the Preliminary Agreement. This document sets out all the key terms of the deal: the full price, payment schedule, deadlines, and responsibilities of the parties. It serves as your roadmap and guarantee until the final signing.

Obtaining a BULSTAT . Every foreigner purchasing real estate must obtain a BULSTAT, the equivalent of a tax number. This procedure is simple, takes 1-2 days, and is required for registration in state registries.

Signing the Notarial Deed. This is the final deed of sale, signed before a notary. The notary plays a crucial role: they verify all documents, verify the identities of the parties, and confirm the legality of the transaction. At this point, full payment is made to the seller.

Registration in the Property Register. After signing the Notarial Deed, the notary enters the new owner's information into the state Property Register. From this moment, you become the full owner.

List of documents you will need (for an individual):

- A valid international passport.

- Power of attorney (if you cannot be present in person).

- Marriage certificate (if you are married).

- A certificate of legal origin of funds (usually required for amounts over €10,000).

Pitfalls and comparison with Austria

Now let's talk about the most important thing: what distinguishes Bulgarian simplicity from Austrian reliability.

1. Land ownership. This is the most important detail I always discuss with my clients. According to Bulgarian law, foreign individuals (non-EU citizens) cannot purchase land.

What does this mean in practice? If you buy a house with a plot of land, you can register the house itself in your name, but not the land. The only solution is to register a legal entity (company) in Bulgaria and register the land in its name. This creates additional costs, accounting issues, and complicates the process. Buying an apartment where you only own part of the building doesn't require this.

In Vienna, this problem doesn't exist. Any investor, regardless of citizenship, can purchase either an apartment or a house with land.

2. Simplicity as a risk. The simplicity of the procedure in Bulgaria is also its weakness. It leaves more room for fraud or dishonesty on the part of the seller.

The lack of mandatory involvement of a trustee (Treuhänder) for settlements is the main difference from Austria. In Austria, all buyer funds are deposited into a special trust account, from where they are transferred to the seller only after all legal conditions have been met and ownership has transferred to the buyer. This is a powerful filter that guarantees the security of the transaction.

3. The role of the notary and lawyer. In Bulgaria, a notary primarily certifies signatures and verifies documents, but is not fully responsible for their content. This is why it's so important to hire your own independent lawyer to conduct all verifications.

In Austria, the notary (or lawyer acting as a trustee) bears full legal and financial responsibility for the integrity of the transaction, which is part of the high price you pay.

| Indicator | Bulgaria | Austria |

|---|---|---|

| Transaction term | 2-3 weeks | 1.5–2 months |

| Procedure | Simple, step by step | Complex, multi-stage |

| Land rights | Limited to non-EU individuals | Available to everyone |

| Financial security | Depends on the lawyer's review | Guaranteed by a trust account |

| The role of a lawyer | Be sure to hire your own | The trustee is responsible for everything |

Taxes, Fees and Expenses: Is Cheaper Only Free?

Every time I start discussing expenses with clients, I can see the question on their faces: "Ksenia, can anything really be expensive in Bulgaria?" And it makes sense.

We're used to Bulgaria being a country where everything costs pennies. And yes, the costs here are indeed some of the lowest in Europe. But they do exist, and they need to be taken into account to avoid any unpleasant surprises.

Let's immediately divide expenses into two categories: those that you pay once upon purchase, and those that will be annual.

One-Time Costs

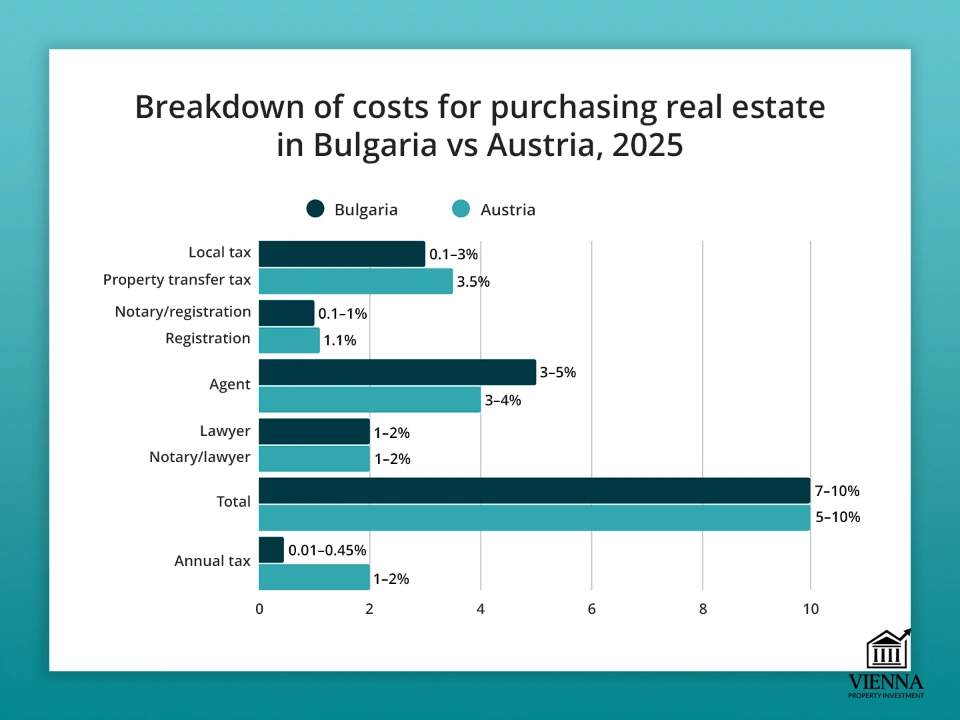

Let's imagine you're buying an apartment for €60,000. How much will it actually cost?

Local acquisition tax. It ranges from 2% to 4% depending on the municipality. Let's say 3%. That would be €1,800.

Notary fees. Approximately 1% of the transaction amount, but can be higher. Let's take €600.

Registration fee: 0.1%. That's only €60.

Lawyer and agent fees. This can make a significant difference. On average, it's 3-5% of the cost. If we take 4%, that's another €2,400.

Total expenses can range from 5% to 9%. In our example, with an apartment priced at €60,000, total expenses would be approximately €4,860. This is, of course, much less than in Austria, where purchase expenses can reach 10-12% of the purchase price. But it's important to remember what you're getting in the end.

In Austria, these costs include not only taxes but also the fees of the trustee, who guarantees the security of your transaction. In Bulgaria, these funds go toward government fees, and you are responsible for security yourself, hiring a separate lawyer.

Annual Costs

Here, Bulgaria truly is a tax haven. Annual taxes are laughably low compared to most EU countries.

Property tax. It amounts to 0.15–0.3% of the property's taxable value, which is usually lower than the market value. For our €60,000 apartment, this would be only €100–€150 per year.

Municipal tax (garbage tax). It's also very low, around 0.14–0.45%. In our case, that would be €80–€100 per year.

Maintenance fee. This is an important expense that applies only to resort properties. It's an annual fee for grounds maintenance, pool, security, cleaning, and so on.

Its size can range from €400 to €800 per year or more. It's essentially a fee for infrastructure you may not even use, but which is mandatory.

The comparison with Austria simply doesn't hold up here:

Annual tax. In Austria, it's around 1–1.5% of the taxable value, plus income tax on rental income. For a €300,000 apartment, annual expenses can easily exceed €4,000–€5,000. In Bulgaria, we calculated this would be several hundred euros.

Infrastructure. Low taxes in Bulgaria are certainly easy on the wallet, but they also directly reflect the level of public services.

In Vienna, you pay more, but in return you get a near-perfect urban environment, impeccable roads, cleanliness, public transportation that runs like clockwork, and a sense of safety. In Bulgaria, however, outside the major cities, infrastructure can be in poor condition.

So, what do we get? In Bulgaria, you pay fewer taxes and fees, but you still bear all the risks and spend money on asset maintenance, especially in resort areas.

In Vienna, you pay more, but this money is invested in infrastructure, which directly affects the capitalization of your property and makes it more attractive to tenants.

| Flow type | Bulgaria | Austria | Conclusion |

|---|---|---|---|

| Acquisition tax | 2–4% | 3.5% | Comparable, but in Bulgaria there may be additional fees |

| Registration in the registry | 0.1% | 1.1% | In Austria it is 11 times higher |

| Annual tax | ~0.2% of the tax assessment | ~1–1.5% + tax on rental income | In Bulgaria it is 5-7 times lower |

| Quality of infrastructure | Depends on location | The highest, one of the best in the world | A direct consequence of the tax level |

| Total tax burden | Very low | High | Bulgaria is a tax-saving paradise, but this is also reflected in the level of public services |

Ultimately, choosing between these two markets is a choice between "pay now and get nothing" (Bulgaria) and "pay now and invest in your future" (Austria). In Bulgaria, you save on taxes but have no guarantee of capital growth, while in Vienna, you can be sure your money is working for you.

Residence Permit by Investment: The Bulgarian Path Is No Longer About Real Estate

When clients come to me planning to buy property in Bulgaria, one of the first questions they ask after the price is, "Will this give me a residence permit?" And I understand why.

Until recently, this was the case. Bulgaria, like many other countries in Southern and Eastern Europe, offered a kind of "golden visa" for purchasing real estate. This was attractive, especially for citizens of non-EU countries. But those days are over, and this fundamentally changes the entire investment strategy.

As of today, in 2024-2025, the direct route to temporary or permanent residence through the purchase of real estate in Bulgaria is closed. If you see information to the contrary, it's either outdated or, worse, an attempt to mislead you. This is a key difference from Greece or Portugal, where such programs are still in effect, albeit with ever-increasing entry barriers.

However, Bulgaria still offers opportunities to obtain residency through investment, but these are no longer directly linked to purchasing real estate. These are generally more complex and less popular among private investors:

Investments in business projects. To obtain a residence permit, you must invest at least €250,000 in certain Bulgarian enterprises. These projects must create jobs, which requires constant monitoring and active participation from the investor.

Investing in government bonds or investment funds. The entry threshold here is higher—from €512,000. This is a more passive investment, but, as with business projects, it does not grant you the right to use the property for personal purposes.

Therefore, purchasing an apartment in Bulgaria today is an investment in an asset or lifestyle, not in immigration status. This is an important point that investors should clearly understand before making the transaction.

Comparison with Austria: Quality vs. Quantity

Unlike Bulgaria, Austria has never offered a "golden visa" for real estate purchases. It has always focused on the quality of investors, not the quantity. It has a prestigious and transparent residence permit program for financially independent individuals—the Aufenthaltstitel "Privatier." Although it's not related to real estate, it's an excellent example of how different countries approach capital attraction.

Requirements for a residence permit in Austria:

Sufficient income. You must prove that you have a stable monthly income independent of employment in Austria. This could include income from property rentals, dividends, interest on deposits, or a pension. The required amount is approximately €45,000 per year for a family of two.

Housing. You must own or rent housing in Austria.

Medical insurance. Comprehensive medical insurance is mandatory.

Complexity. The main barrier is that the program is quota-based. Applications are accepted only at the beginning of the year, and their number is strictly limited.

The key difference: in Austria, you obtain a residence permit in one of the most stable and safest countries in the world without tying up hundreds of thousands of euros in risky assets. Your money remains liquid and can be invested in a diversified portfolio.

In Bulgaria, even if you decide to invest in businesses or bonds, you are essentially "freezing" your capital for the sake of status.

-

Case study: One of my clients, a family from Kyiv, was considering Bulgaria as a "backup option." They were very attracted by the price—€100,000 for a large apartment by the sea. But when we sat down to investigate, they were surprised to learn that this didn't entitle them to long-term residency.

We calculated their budget and realized they could afford to rent an apartment in Vienna and apply for a residence permit for financial independence. As a result, they received status in a country with the highest standard of living, and invested their €100,000 in a diversified portfolio rather than in a low-liquidity seasonal asset. This was a much more balanced and strategic choice.

| Bulgaria | Austria | |

|---|---|---|

| Path to a residence permit | There's no direct route through real estate. Only through business investments (€250,000+) or bonds (€512,000+). | Not through real estate. Through a program for financially independent individuals with income verification. |

| Real Estate Relations | Purchasing a home does not provide a residence permit. | Purchasing a home does not grant a residence permit, but having one is a mandatory requirement. |

| Availability | Low entry threshold, but only for investments in business/bonds. | Requires proof of high income and availability of a quota. |

| Capital liquidity | Capital is “frozen” in an investment project or bonds. | Capital remains liquid and available for other investments. |

Rent and Income: Seasonal Peaks and Winter Hibernation

For an investor, return is perhaps the most important metric. And here, at first glance, Bulgaria looks very attractive. We're being promised 7-8%, maybe even more!

But, as always, the devil is in the details. And the most important thing to understand about the Bulgarian market is that profitability here directly depends on location and rental type.

Let's look at the two main types of rental agreements you can get when purchasing real estate in Bulgaria.

Short-term rentals (Airbnb, Booking)

This is what attracts most investors to resort areas.

Where? Seaside (Sunny Beach, Golden Sands, Sozopol) and ski resorts (Bansko, Pamporovo).

Returns. At the peak of the season (June-August for seaside properties, December-February for mountain properties), returns can reach truly high levels—up to 8% per annum.

Risks. And here we come to the main problem. The season lasts only 3-4 months a year. The rest of the time, your apartment will not only be empty but also incur expenses for a "maintenance fee" and utilities.

One bad season (due to weather or geopolitics, for example) can wipe out your entire profit. Furthermore, short-term rentals require constant monitoring, cleaning, and guest interactions, which are often delegated to a management company, which charges up to 25-30% of revenue. These are colossal risks that many investors fail to consider.

Long-term lease

This option is much more stable and predictable.

Where? Large cities (Sofia, Plovdiv, Varna).

Profitability. Here, it's significantly lower—4-5% per annum. But demand is year-round, not just seasonal.

Risks. The risks are minimal, as tenants are students and young professionals who sign contracts for 1-2 years. This is essentially the only "quiet" segment of the Bulgarian real estate market.

Comparison with Austria: Turnover vs. Capital

The average long-term rental yield here is 2-3.5% per annum. At first glance, this seems much lower than in Bulgaria. So why overpay?

The answer is simple: the main income for an investor in Vienna is not rent, but the growth in the value of the asset itself (capitalization).

- Investor income structure (10 years example):

Bulgaria (resort). 80% of income comes from rent (unstable, seasonal), 20% from capital growth (unpredictable). You earn on turnover, not on the asset itself.

Text

Vienna. 30% of income comes from rent (stable, long-term), 70% from capital growth (organic, stable). You earn on capital, which is much more reliable.

According to Statistik Austria , real estate prices in Vienna have increased by more than 90% over the past 10 years, and this growth has been organic and stable.

Buying an apartment in a Bulgarian resort is like speculating on the stock market, where you're trying to profit from rapid fluctuations. Buying in Vienna is like investing in a blue chip, where you don't expect huge dividends but are confident of long-term, stable growth for your portfolio.

| Bulgaria (resort) | Bulgaria (Sofia) | Austria (Vienna) | |

|---|---|---|---|

| Basic income | Short-term rental (high) | Long term rental (moderate) | Capital growth (high) |

| Profitability | Up to 8% (but only 3-4 months a year) | 4–5% (all year round) | 2–3.5% (all year round) |

| Liquidity | Very low | High | High |

| Risks | Very high (simple, "support rate") | Low | Minimum |

| Strategy | Fast but risky income | Stable but moderate income | Long-term preservation and increase of capital |

Where to Buy: Analyzing Regions for Different Purposes

As we discussed in a previous section, Bulgaria is not one, but three completely different real estate worlds. Therefore, the question "Where to buy?" is truly the most important one to ask yourself.

There's no universally best location, only the one that's ideal for your specific purpose. Let's take a closer look at the key regions and understand which ones are best for which audience.

Sofia: Bet on the capital

If you're considering Bulgaria not just as a vacation spot, but as a serious investment to preserve and grow your capital, then this is the place to start.

Sofia is the only city in the country that can be compared to European capitals like Vienna, Budapest, or Prague. It is the economic, cultural, and educational center of Bulgaria. Let's take a closer look at the pros and cons:

-

Best liquidity. This is the most liquid location in the country. Housing here enjoys stable demand year-round, especially in central areas and near business parks.

-

Year-round demand. The main tenants are students, young professionals, families, and expats. They are looking for long-term rentals, which guarantee a stable income and minimize the risk of vacancy.

-

Developed infrastructure. In Sofia, you'll find everything you need for a comfortable life—modern shopping centers, restaurants, parks, international schools, and, most importantly, well-developed public transportation and a metro system.

-

Prices are above average. The price per square meter in Sofia is significantly higher than in resort areas. You won't be able to buy an apartment for €40,000, but that's the price you pay for stability and security.

-

The yield is moderate. Long-term rental yields, as we've already mentioned, are 4-5%. This isn't the 8% promised at resorts, but it's stable and doesn't depend on the season.

-

Investment idea: The ideal option for Sofia is to purchase a small two- or three-room apartment (one or two bedrooms + living room) within walking distance of the metro or in an area with well-developed infrastructure. These apartments are most popular among young professionals and students, guaranteeing a steady flow of tenants.

Seaside resorts (Sunny Beach, Golden Sands): The classic "dacha by the sea"

This is perhaps the most well-known market segment for foreigners. Sunny Beach, Golden Sands, Nessebar, Sozopol—these names are familiar to everyone. This is where those who want to own their own "dacha" in the European Union buy property, and the rental income is a pleasant bonus

-

Lowest prices. A small studio or apartment can cost €40,000–€60,000.

-

Huge selection. The market is oversaturated with options, so you'll always be able to find something suitable.

-

Terrible competition. With so many properties on offer, you'll have to work hard to rent out your apartment and compete with hundreds of other owners.

-

Poor construction quality. Many complexes were built during the construction boom (2005–2010) without adhering to all regulations. Problems with waterproofing, mold, and poor soundproofing are unfortunately common.

-

Liquidity is virtually nonexistent. Selling an apartment quickly and at market price is nearly impossible here. The main buyer is the same foreigner who comes here once a year for vacation. You'll be waiting for a buyer for months, even years.

-

Investment idea: Consider purchasing in this region only for personal use. Rental income is a nice bonus, but not the primary goal.

Ski resorts (Bansko, Pamporovo, Borovets)

Similar to seaside resorts, this is a market that operates only during the season – from December to March:

-

Very low prices. This is one of the cheapest ski resorts in Europe, and a studio apartment here can be purchased for €25,000–€35,000.

-

Extreme oversaturation. The Bansko market was already oversaturated with offers 10 years ago. Many complexes are empty, and competition for tenants is incredibly intense.

-

Very low liquidity. Selling an asset here is the most difficult. If you're not prepared for the asset to be "frozen" for many years, this isn't the option for you.

-

Income instability. Profitability is directly dependent on snowfall and tourist flow.

-

Investment idea: Only for big ski fans who are looking for their own house in the mountains and are prepared for the fact that it will not bring them income.

| Sofia | Seaside resorts | Ski resorts | |

|---|---|---|---|

| The main goal | Investment, rental | "Dacha by the sea", vacation | "Dacha in the Mountains", vacation |

| Liquidity | High | Low | Very low |

| Profitability | Stable, 4–5% | High, but only in season | Low, depends on snow |

| Risks | Moderate | High (simple, "support fee", low quality) | Very high (simple, low liquidity) |

Risks and Disadvantages: What Sellers Don't Tell You

No honest review would be complete without a thorough risk analysis. Unfortunately, many sellers and agents in Bulgaria tend to downplay these risks, promising mountains of gold. I always tell my clients: no investment is perfect, but it's important to be aware of all the potential pitfalls.

Low liquidity: Selling quickly almost always means a discount

Low liquidity is the main problem in the Bulgarian market, especially outside of Sofia. While in Vienna, an apartment in a good area sells in an average of 2-4 months, in Bulgaria you could wait months or even years for a buyer. Why this happens:

Oversaturation. At resorts, supply exceeds demand several times over.

A specific audience. Buyers of resort properties are primarily foreigners who are in no rush. They don't need to buy right away, so they can spend time choosing and negotiating.

The need for a discount. If you need to sell your apartment urgently, be prepared to reduce the price by 20-30% or more.

Seasonality: Income or Expenses?

If you buy property by the sea or in the mountains, be prepared for it to sit idle for nine months a year. During this time, it won't generate income, but will instead require expenses. Annual idle expenses:

Maintenance fee. This is the most important "hidden" expense. You are required to pay for grounds maintenance, pool maintenance, security, and cleaning in the complex, even if you don't use the apartment. This amount can range from €400 to €800 per year.

Utilities. Even if you don't live in the apartment, you still have to pay for electricity, water, security, and so on.

Unexpected repairs. Poor construction quality can lead to problems that require additional repair costs.

Construction Quality: When "Cheap" Becomes "Expensive"

Particularly in buildings built during the mid-2000s boom, construction quality often leaves much to be desired. The most common problems include:

Waterproofing. Poor waterproofing leads to mold, mildew, and a damp odor.

Communications. Poor quality pipes, electrical problems.

Decrepit condition. Many buildings are rapidly deteriorating and require constant repairs.

Austria, on the other hand, has strict building codes ( ÖNORM ) that guarantee the highest quality. Here, you're buying an asset that will serve you for decades without the need for constant repairs.

Currency Risks: A Fatal Outcome?

Although the Bulgarian lev (BGN) is tightly pegged to the euro, Bulgaria is still not part of the eurozone. This creates certain risks in the event of global economic upheaval. While the likelihood of Bulgaria leaving this peg is minimal, it is still a risk worth keeping in mind.

In Vienna, you buy an asset in euros, which guarantees you complete currency stability.

Risk Comparison: Bulgaria vs. Austria

| Bulgaria | Austria | |

|---|---|---|

| Liquidity | Very low (outside Sofia) | High |

| Seasonality | High risk (resorts) | There is no risk |

| Hidden costs | Very high (support fee) | Very low |

| Construction quality | Uneven, often low | Highest, strictly regulated |

| Currency risks | Pegged to the euro, but not a member of the eurozone | Euro |

Accommodation and Lifestyle: Sun and Sea versus Order and Quality

Now that we've broken down all the numbers, let's talk about the most important thing: quality of life. After all, investing in real estate isn't just about the money, but also about the lifestyle you gain. Where do you want to raise your children, where do you want to spend your retirement? Where will you simply feel comfortable and peaceful? The answer to this question can completely change your choice.

Life in Bulgaria: Low Prices, But…

Life in Bulgaria is attractive to many because of its affordability. According to Eurostat, prices for consumer goods and services in Bulgaria are only about 60% of the European average. This is reflected in everything from the cost of groceries to the restaurant bill.

Climate. The climate here is undoubtedly wonderful. Along the coast, it's mild, with warm, long summers and short, mild winters. In the mountains, conditions are ideal for winter sports from December to March.

Affordability. In Bulgaria, you can afford a standard of living that would be unimaginable in Western Europe. A house with a swimming pool that would cost millions of euros in Austria can be purchased here for a few hundred thousand.

Healthcare and education. This is where one of the main drawbacks lies. The level of healthcare and education is significantly inferior to Western European standards. Although large cities like Sofia have private clinics and international schools, the overall system has not yet reached EU standards. Many wealthy Bulgarians and expats prefer to receive healthcare or educate their children in Western Europe.

Infrastructure. Outside of major cities and main tourist routes, the condition of roads, public transportation, and utilities can be poor. This contrasts sharply with the impeccable order of Austria, where even the smallest villages have perfect roads and trains run on schedule.

Pace of life. In Bulgaria, especially in the south, life is more relaxed and unhurried. For some, this is a plus, for others, a minus. If you're accustomed to Swiss punctuality and German efficiency, the Bulgarian slowness can be a real challenge.

Life in Austria (Vienna): Order, Quality, and Stability

Vienna has been named the world's best city to live in by Mercer for over 10 years in a row . It has earned this title for a reason. Vienna embodies order, quality, and safety.

The climate is temperate continental. There are four distinct seasons: hot summers, cold, snowy winters, and beautiful spring and autumn.

The cost of living is high, but entirely justified. High taxes support world-class infrastructure, education, and healthcare. You pay more, but you also get more.

Healthcare and education. Austria's healthcare system is one of the best in the world. Public schools and universities provide top-notch education. It's an ideal place for families with children.

Infrastructure. It's simply impeccable here. Public transportation runs like clockwork, the streets are clean, and the parks are well-maintained. The entire city exudes order and quality, and this directly impacts the value of your property.

Pace of life. Vienna is a fast-paced city, but without the rush. Everything runs smoothly and according to a schedule, allowing people to plan their time and enjoy life.

I always ask my clients to answer the question honestly: "Where do you want to raise your children?" If the answer is "in an environment with the best schools, safety, and access to first-class healthcare," then the choice is clear, and it's not Bulgaria.

If your goal is an affordable home for summer vacations or retirement, where sunshine and low prices are key, then Bulgaria could be an excellent option.

| Bulgaria | Austria | |

|---|---|---|

| Cost of living | One of the lowest in the EU | High |

| Quality of medicine | Significantly inferior to EU standards | One of the best in the world |

| Quality of education | Heterogeneous, inferior to the Western one | The highest, strict |

| Infrastructure | Developed only in large cities | Flawless throughout the country |

| Pace of life | Relaxed, unhurried | Tall but orderly |

Exiting an Investment: How to Sell Bulgarian Meters?

The final stage of any investment is the exit. And here, the differences between Bulgaria and Austria are perhaps most acute. How do you exit the investment? With a profit or a loss? Quickly or slowly? The answer to this question can completely ruin your expectations.

Bulgaria: The Long Game

As we've already established, liquidity on the Bulgarian market, especially in resort areas, is extremely low. This means selling a property quickly and at a reasonable price is a stroke of luck.

In Sofia. The sale process will be relatively quick if the price is right for the market. The majority of buyers are Bulgarians, so there won't be any language barriers, and demand is year-round. However, be prepared for a sale to take anywhere from several months to a year.

At the resorts. This is where the fun begins. To sell your apartment in Sunny Beach, you'll have to compete with thousands of similar offers. The main buyers are foreigners who aren't in a rush. They don't need to buy right now, so they can spend a long time choosing, haggling, and waiting.

The "Discount Trap." If you need to sell your property quickly, you'll fall into the "discount trap." The only way to stand out from the crowd is to drastically lower your price.

"I've seen many cases where investors, desperate for cash, sold their apartments at 20-30% below market value. As a result, all the rental income they'd been earning for years was simply eaten up by this discount.".

— Ksenia , investment consultant,

Vienna Property Investment

Austria: Projected Profit

In Vienna, the market is so stable that good properties often have waiting lists. Selling real estate here is a straightforward and predictable process.

High liquidity. In Vienna, apartments in good areas sell in 2-4 months. Demand is strong year-round, from both local residents and foreign investors.

Capital gains. An investor's primary income in Vienna is not rent, but rather asset appreciation. Over the past 10 years, real estate prices in Vienna have increased by over 90%, and this growth has been stable and organic.

Predictability. Exiting an investment in 5-10 years with a 50-100% return is standard practice, not a stroke of luck. You can calculate your return in advance, which gives you a sense of confidence and control.

| Criterion | Bulgaria | Austria |

|---|---|---|

| Sales speed | Very slow (outside Sofia) | Fast, predictable |

| Main buyer | Foreigners (resorts), locals (Sofia) | Local and international investors |

| Discount for urgent sale | High (20–30%) | Minimal or none |

| Main profit | Rent | Capital growth |

| Liquidity | Low | High |

Conclusion: Which choice is right for you?

We've come a long way in analyzing Bulgaria and Austria across the most important parameters: from the market and legal intricacies to risks and quality of life. Now we have all the information we need to draw the most important conclusions.

The key dilemma: Bulgaria or Austria? Buying real estate in Bulgaria and Austria aren't just two different investments. They're two completely different philosophies.

| Criterion | Bulgaria (Resort) | Bulgaria (Sofia) | Austria (Vienna) |

|---|---|---|---|

| Target | Rest and temporary housing | Investing in the rental business | Long-term investment in capital |

| Philosophy | Speculative asset | Revolving business | Safe Haven, Preservation and Enhancement |

| Entry threshold | Low (€40,000+) | Moderate (€100,000+) | High (€300,000+) |

| Profitability | High, but seasonal and unstable | Moderate but stable | Low, but the main income is capital growth |

| Liquidity | Very low | High | Very high |

| Risks | High (simple, discount on sale) | Moderate | Low |

| Quality of life | Low cost but low quality infrastructure | Compromise option | The highest standard of living |

Bulgaria: If you're looking for a "dacha." If your goal is to own a house by the sea or in the mountains, where you can spend a month or two a year, and you're prepared to pay for its upkeep, Bulgaria is an excellent option.

This is a country with a wonderful climate, beautiful nature, and very affordable housing and living costs. If you're considering buying a home as an investment, Sofia is the only city worth considering. Here, you'll find stable demand for long-term rentals and higher liquidity compared to resorts.

Austria: If you're looking for an asset. If your goal is to preserve and grow your capital in a reliable and stable jurisdiction, then Austria, and Vienna in particular, is just what you need. You won't get quick and high rental yields here, but your capital will be reliably protected from inflation and crises.

You'll be able to invest your money in an asset that will grow in value, guaranteeing you long-term profit. And, just as importantly, you'll gain access to the highest standard of living, order, and security.

Before making a decision, honestly answer one simple question: what do you really want? A resort vacation and low prices, or order, reliability, and stable capital growth? Once you find the answer, the right choice will become clear.