How and why to buy property in Abu Dhabi

Abu Dhabi is experiencing an economic boom: in 2024, the real estate market hit record highs, with the number of transactions up 24%, reaching AED 96 billion. The tourism sector is also showing strong growth: in the first quarter of 2025 alone, the emirate welcomed 1.4 million guests, leading to an 18% increase in hotel revenue and a significant increase in revenue per available room (25% to AED 484).

This article provides clear instructions on how to profitably and risk-freely buy a home or invest in real estate in Abu Dhabi. You'll learn how to save your money, grow it, and be fully protected by law. Everything is clear, well-thought-out, and safe.

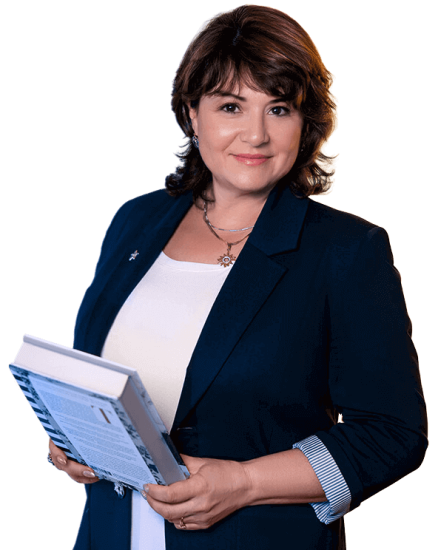

Average property price in Abu Dhabi per square meter (2021-2025)

(source: https://theluxuryplaybook.com/abu-dhabi-real-estate-market/ )

Abu Dhabi is rapidly becoming a major global investment hub, and there are several reasons why now is an especially opportune time to consider this market.

- New visa programs – “Golden Visa” for investors and owners of real estate worth at least AED 2 million.

- There are no taxes – individuals pay neither income tax nor capital gains tax.

- Growing tourism – Abu Dhabi welcomed over 18 million tourists in 2024, a 12% increase from the previous year.

- Cultural projects – development of Saadiyat Island: Louvre Abu Dhabi, Guggenheim (opening in 2025), Zayed National Museum.

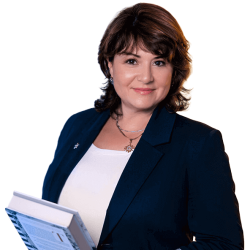

"An apartment in Abu Dhabi can be not only a place to live, but also an investment that will generate income for many years. My goal is to help you understand where emotion ends and calculation begins, and to find a profitable solution."

— Ksenia , investment consultant, Vienna Property Investment

My name is Ksenia Levina, and I'm an investment consultant specializing in international real estate and complex transactions. In this article, I'll explore the benefits of investing in Abu Dhabi real estate and compare it to Austria, where the rules and approach to investing are completely different.

From my experience, I see that buying an apartment in Abu Dhabi, especially on Saadiyat Island or Al Reem Island, is more than just a place to live; it's an investment with good income potential and stability. For example, one client bought a two-bedroom apartment on Al Reem Island, immediately leased it out, invested the profits in similar properties, and began earning a stable income within three months of the initial purchase.

Austria vs. Abu Dhabi: Which is Safer?

Austria is attractive due to its stable market, clear laws, and constant demand—from both locals and foreign investors. In Vienna and other major cities, housing prices are rising slowly but steadily, and real estate there is considered a reliable and safe way to preserve capital.

Abu Dhabi, on the other hand, is seeing rapid growth in prices and incomes, but the market there is still relatively young and more dependent on global changes.

While investments in Vienna are generally considered part of a conservative portfolio, they offer more predictable growth in value and a high level of legal protection, but without the same yield dynamics as in the UAE.

Abu Dhabi's place on the global investment map

Abu Dhabi is arguably the safest place to invest in the Middle East. It boasts transparent regulations, low risks, and strong investor protection, which is often challenging in neighboring countries.

According to reports from reputable organizations—the World Bank and Numbeo—the United Arab Emirates (UAE) is among the world leaders in terms of investment attractiveness and the level of security of real estate transactions.

Knight Frank research confirms that Abu Dhabi's luxury residential real estate market is experiencing annual price growth of between 7% and 17%. While neighboring countries, particularly Qatar and Saudi Arabia, are also experiencing high growth rates, their markets are less transparent and more susceptible to sharp fluctuations driven by local factors.

For overseas real estate investments, Abu Dhabi is one of the best choices. Risks are minimal here, and prices for luxury properties are growing by 7-17% annually. Neighboring countries, while offering high returns, lack the same stability and transparency.

Abu Dhabi's Competitors and Advantages

Prices in neighboring countries such as Qatar and Saudi Arabia are rising faster, but their markets are less transparent and more vulnerable to local fluctuations.

| Country / Emirate | Transparency of transactions | Price increase | Risks | Minimum entry | The Abu Dhabi Advantage |

|---|---|---|---|---|---|

| Qatar | Average | High | Average | ≈ 1.5–2 million AED | The market is safe and clear |

| Saudi Arabia | Medium-low | High | High | ≈ 2–3 million AED | Reliable protection and open transactions |

| Dubai (UAE) | High | High | Average | ≈ 1.2–2.5 million AED | Stability and high class |

| Oman | Average | Average | Average | ≈ 1–1.5 million AED | Prices are lower, but it's difficult to sell quickly |

| Bahrain | Average | Average | Average | ≈ 0.8–1.5 million AED | Low entry barrier, but few amenities |

| Abu Dhabi (UAE) | High | High | Short | ≈ 1–2 million AED | There is stable growth, liquidity and transparency |

Why investors are shifting from Europe to the UAE

More and more investors, having tried European or neighboring markets and faced with high taxes, bureaucracy and empty properties, are ultimately choosing Abu Dhabi.

- A client from Switzerland initially considered buying apartments in Munich and Zurich, but ultimately purchased two apartments in Al Marsa. The reasons were the low entry costs, quick transaction times, and high rental yields from premium apartments.

- A family from the UK sold their London apartment and bought a new building on Yas Island. They explain their choice: "We needed an asset that would generate a stable income on its own—we rent out the apartments, but there's a chance their price will appreciate.".

More and more investors, having tried European or neighboring markets and faced with high taxes, bureaucracy and empty properties, are ultimately choosing Abu Dhabi.

Abu Dhabi Real Estate Market Overview

Abu Dhabi appeals to investors because it's stable, everything follows the rules, and there's a wide variety of properties to choose from. Prices are constantly rising, with both locals and foreigners buying. And most importantly, foreigners can now confidently buy property.

History: Opening Freehold Zones to Foreigners

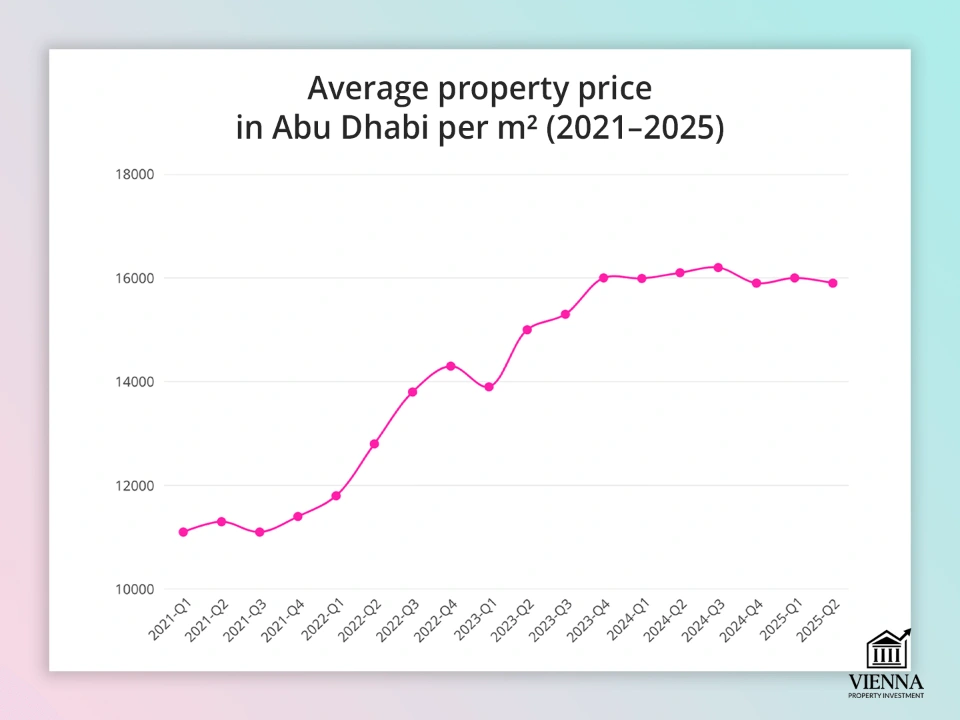

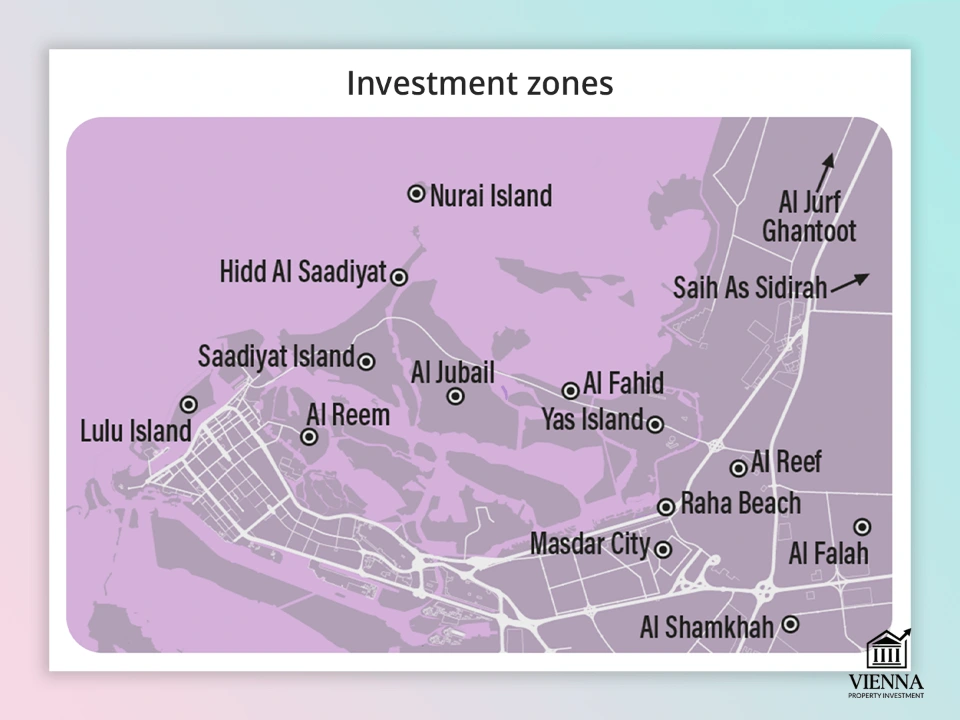

The best freehold areas to buy property in Abu Dhabi

(source: https://mybayutcdn.bayut.com/mybayut/wp-content/uploads/map-abu-dhabi.jpg )

Previously, foreigners couldn't simply buy an apartment or villa in Abu Dhabi outright—they could only rent long-term or invest with a host of restrictions. This deterred many. But in 2006–2008, the authorities changed everything. They created special areas (freehold zones) where any foreigner could buy real estate (an apartment, villa, or townhouse) and become its full owner. This significantly revived the market.

Dubai offers over 40 freehold zones for foreigners, ranging from expensive seaside apartments to affordable family-friendly residential complexes. These areas were first established on Saadiyat and Al Reem Islands, followed by Yas and Al Raha. In these zones, foreign buyers enjoy full rights: they can own an apartment or villa permanently, rent it out, bequeath it, or sell it—without any restrictions.

Tip : When choosing a neighborhood, consider not only its status but also how easy it will be to sell your home there, the surrounding infrastructure, and convenient transportation. These factors will determine your profit and how quickly you can sell your property.

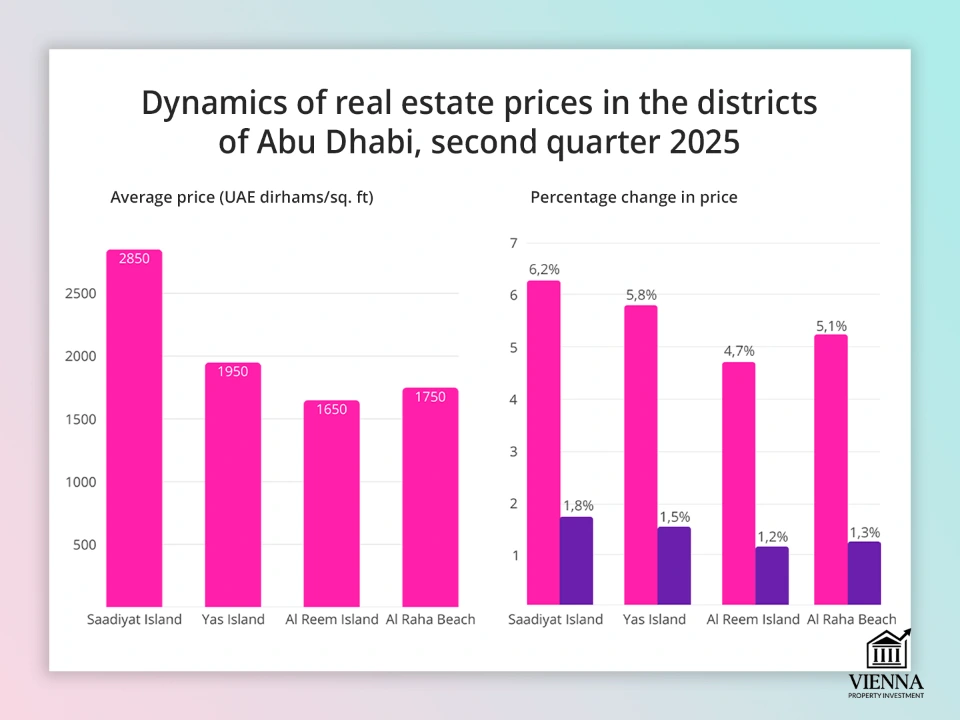

Price dynamics 2018–2025: stable growth

From 2018 to 2025, real estate prices in Abu Dhabi have been steadily rising for several years, by 7-17% annually. Even high-end properties are in demand among investors. For example, apartments on Saadiyat Island increased in price by 12% in 2024, and villas on Al Reem by 15%.

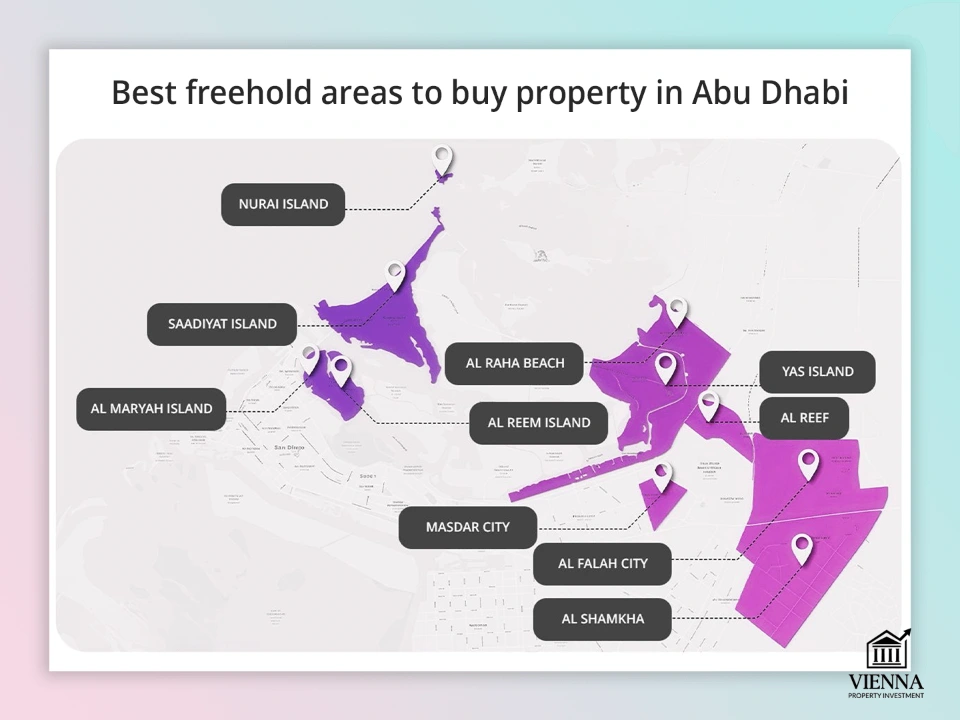

Geography of transactions: where demand is concentrated

Abu Dhabi Real Estate Price Trends, Q2 2025

(Source: https://xisrealestate.com/market-report/ )

Yas Island is known as a tourism and entertainment hub, boasting theme parks, golf clubs, and short-term rental apartments. Studios and one- to three-bedroom apartments start at $150,000 to $500,000, while townhouses start at $750,000.

Saadiyat Island is a prestigious location with cultural attractions and luxury housing. Prices for luxury apartments start at $500,000 and can exceed $1.5 million. This makes the area attractive to investors seeking long-term investment opportunities.

Al Reem Island is a modern neighborhood with well-developed infrastructure, high-rise buildings, and apartments with sea views. Housing prices vary: studios and one- to three-bedroom apartments can be purchased for $150,000 to $600,000, depending on the size and location.

Al Raha Beach is a neighborhood primarily built for family townhouses, villas, and spacious apartments. Prices range from $400,000 to $1 million. The area is popular with long-term renters and investors seeking stable rental income.

Al Maryah Island is considered a financial hub, home to professionals and numerous businesses. Apartment prices range from $250,000 to $700,000, with office and premium properties priced even higher. Therefore, it is often chosen for large investments.

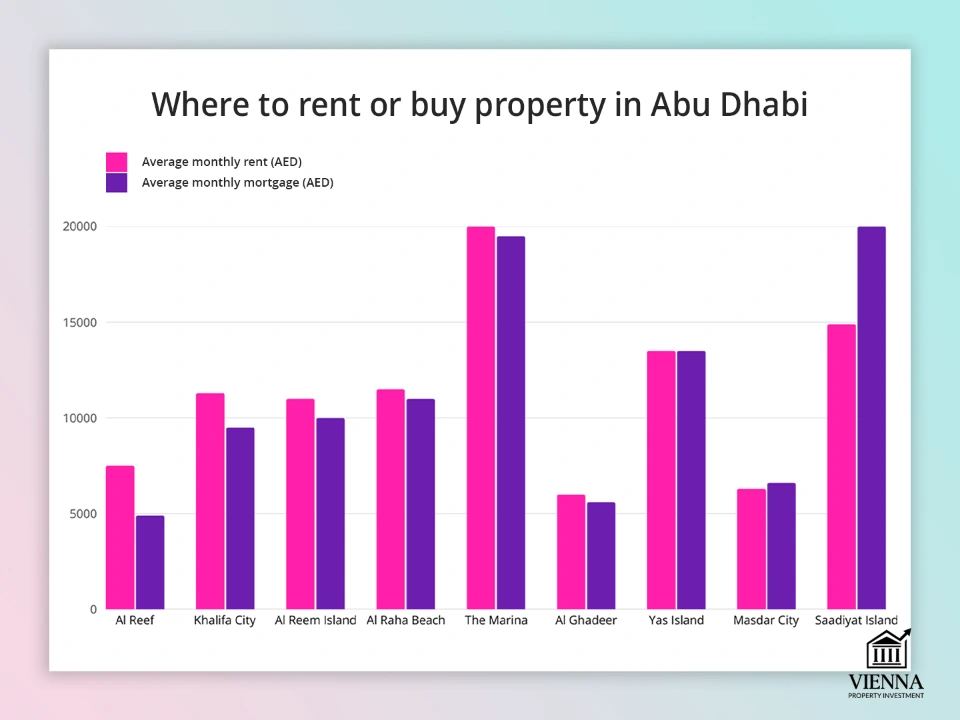

Where to rent or buy property in Abu Dhabi

(source: https://www.thenationalnews.com/news/uae/2025/08/19/uae-property-rules-and-law/ )

In practice, it's clear that the neighborhood directly determines the profitability and rental rates of real estate. Investors typically combine locations: choosing prestigious areas to preserve and grow capital, and more accessible ones for quick liquidity.

Growth rates: how much prices have increased in recent years

Abu Dhabi's real estate market offers a wide range of options for investors with varying goals and budgets.

Luxury apartments in Abu Dhabi are in demand among foreign investors seeking prestige, high rental yields, and long-term value growth. These typically include properties on Saadiyat Island or Al Reem Island, featuring modern finishes, sea views, and access to premium amenities.

Villas and townhouses in Abu Dhabi are ideal for families seeking spacious homes with privacy and high resale potential. The Al Raha Beach and Yas Island areas attract buyers with their water views and private gardens, while villas on Saadiyat Island are prized for their prestigious location near cultural attractions.

In addition to residential property, Abu Dhabi offers commercial real estate , such as offices, shops, and shopping centers, especially on Al Mariah Island. These investments are suitable for those who want to spread the risk and receive stable rent from companies and businesses.

| Budget (USD) | Property type | Area and district | Key Features |

|---|---|---|---|

| 150 000 $ | Studio or 1-room apartment | 35–60 m² in Al Reef, Masdar City, Al Ghadeer | Modern infrastructure and amenities within the complex, including parking |

| 300 000 $ | 1-2-room apartment | 60–110 m² on Al Reem Island, Khalifa City | Panoramic sea views, private fitness center, swimming pool and easy access to shops |

| 500 000 $ | 2-3-room apartment or small townhouse | 100–150 m² on Yas Island, Saadiyat | Prestigious location within walking distance of golf courses and the beach |

| 750 000 $ | 3-room townhouse or large apartment | 180–220 m² at Al Raha Beach, Yas Island | Private garden, water views and allocated parking spaces |

| 1 000 000 $+ | Luxury villa or penthouse | 250+ m² at Saadiyat, Yas Island | Exclusive access to a private beach, custom finishes, and smart home technology |

The most effective strategy is a combination of different types of real estate in a portfolio. For example, investing in a luxury apartment, a townhouse, and commercial space allows for a premium income, long-term rental income, and a stable cash flow. This diversified approach reduces risk and increases overall investment returns.

Who is buying property in Abu Dhabi?

Foreign investors (especially from the UK, Russia, China, and India) are actively buying up real estate. Aldar Properties reports that their share of sales has grown by 40% year-on-year, reaching 78% in 2024.

Among foreign buyers we can highlight:

- Arab investors are traditionally a large group, preferring premium properties.

- Russians are actively investing in Abu Dhabi real estate, especially in recent years.

- The Chinese are showing interest in both residential and commercial properties.

- Indians are one of the largest groups of foreign investors actively investing in Abu Dhabi real estate.

- Europeans —including citizens of the UK, Germany, and France—are looking for reliable real estate investments. For some, French property remains a familiar choice, while Abu Dhabi offers a way to boost portfolio returns.

The role of domestic demand

Domestic demand remains strong—government officials, oil industry employees, and business clients continue to invest in real estate. This creates a reliable source of income for owners and maintains market activity.

Tip : When investing in Abu Dhabi real estate, consider two key factors: international and local demand. This is especially important for long-term rentals.

Ownership formats and investment methods

Abu Dhabi offers several forms of property ownership:

Freehold (full ownership) : Available to UAE and GCC citizens in all areas, and to foreigners only in designated investment zones. When purchasing freehold, you become the full owner of the land and property.

Leasehold : Typically, the agreement is for 50-99 years. The land remains the property of the state or the developer, but you can live in or use the property for the entire period.

Usufruct (lifetime use) : the ability to own and use real estate for up to 99 years, but without the right to change anything in it.

Masataha (construction right) : valid for 50 years with extension, allows the construction or renovation of buildings.

| Aspect | Freehold | Leasehold | Usufruct | Masataha |

|---|---|---|---|---|

| Ownership | Full ownership of the property and land | Ownership of real estate for a limited period without ownership of the land | The facility may be used for 99 years without any changes | Permitted to use, build or modify for 50 years (or more) |

| Term | Indefinitely | Usually 50-99 years old | 99 years old | 50 years (can be extended for another 50) |

| Resale | Selling and transferring rights is effortless | Acceptable, but the remaining lease term is reduced | Conditions may affect the price | Perhaps the conditions may determine the price |

| Reconstruction | Ability to make changes freely | Contractual restrictions apply | Changes are prohibited | Right to build or reconstruct |

| Suitable for | Suitable for long-term investment and living | Suitable for short-term tasks and temporary use | Long-term ownership of real estate without the right to build or modify the property | Long-term ownership with the right to build or change buildings |

Since 2019, more areas in Abu Dhabi have become available for foreigners to purchase freehold property. Currently, these include Saadiyat Island, Yas Island, and Al Reem Island. I always advise foreign buyers to choose these options—they're more reliable, easier to sell and transfer, and offer a more stable income.

Ownership as an individual or through a company

Investors can purchase real estate in Abu Dhabi themselves or through a company. The latter option is more convenient: it's easier to manage multiple properties, optimize taxes, and control everything remotely.

Example : a client of mine from Europe bought a studio through a company—this makes it easier for her to rent it out to different tenants and protect her rights.

Family trusts and inheritance

To transfer property to relatives, investors often use family trusts. Setting them up is a complex process that requires experts. Abu Dhabi has flexible inheritance laws that allow for continued control over assets and ensure their security.

The DIFC (Dubai International Financial Centre) and ADGM (Abu Dhabi Global Market) are the best financial centers for establishing family trusts in the UAE. Their legal systems operate according to international standards, and local courts specialize in such cases, protecting assets and simplifying management.

I often recommend registering real estate through a trust, especially if you own multiple properties—this simplifies property transfers and helps reduce the tax burden.

Restrictions for non-residents

Since 2019, foreign buyers can only purchase apartments in Abu Dhabi in designated freehold zones. There are no citizenship restrictions, but they must comply with transaction regulations, tax requirements, and provide the necessary documentation. Previously, foreigners could only own property through long-term leases of up to 99 years.

In practice, it's important to conduct thorough due diligence: many clients avoid unnecessary costs and hassles by engaging experienced lawyers and agents in advance.

Comparison with Austria: fewer barriers, but less stability

In Abu Dhabi, the property purchasing process is more accessible: foreigners can quickly complete the transaction, obtain title deeds, and begin renting out the property immediately. In Austria, the situation is more complex: a special license is required for purchase, strict corporate regulations apply, and there's also a more extensive bureaucracy to navigate.

At the same time, Austria benefits from stability, gradual price growth, and high demand: real estate there is slowly but surely appreciating in price, and rental income in most cases covers maintenance costs.

I recommend a systematic approach to my clients: Abu Dhabi is suitable for a quick start and portfolio diversification, while Austria is for reliable long-term stability. The combination of the two markets allows for reduced risk while simultaneously generating stable returns.

Legal aspects of buying property in Abu Dhabi

While buying property in Abu Dhabi seems simple, there are legal nuances at every stage. Choosing the right ownership structure and properly completing the necessary paperwork are key to ensuring your security.

How does the transaction process work?

The step-by-step process for purchasing real estate in Abu Dhabi is as follows:

- Reservation of an object – an advance payment is made and a memorandum of understanding (MoU) is signed.

- A sales and purchase agreement (SPA) is a document that records all the details: the price, payment schedule, and terms of transfer of the property.

- Payment of principal/mortgage approval.

- Registration in the DARI system—a government platform where property rights are confirmed and buyer information is entered.

- Obtaining a Title Deed.

Purchasing real estate, including apartments and one-bedroom flats, in Abu Dhabi takes between 2 and 6 weeks. The process duration varies depending on the developer and the type of transaction.

The role of specialists in the process

In Abu Dhabi, the agent is the key player in the transaction: they handle the process and inspect the property. A lawyer is only needed for large purchases or when working through a company.

In Austria, you can't do without a notary—they register the transaction and keep the money until it's completed.

In practice, things are simpler in Abu Dhabi: my client from London bought an apartment remotely through a power of attorney at the consulate and became the owner without even visiting. In Austria, this is almost impossible, as a personal presence is required.

Requirements for the buyer

To purchase real estate in Abu Dhabi, a foreigner must meet the following basic requirements:

- age from 21 years;

- possession of a valid passport (a resident visa is desirable but not required for purchase);

- confirmation of the legal origin of funds in large transactions in accordance with international AML standards;

- bank approval and compliance with credit requirements when applying for a mortgage.

Remote purchase

Many clients are currently purchasing property in Abu Dhabi remotely:

- the power of attorney is issued through the UAE consulate in the country of residence,

- All documents are registered electronically through the state DARI system,

- Payments are transferred directly to the developer's secure escrow account.

For example, a couple from Warsaw recently purchased an apartment in Abu Dhabi in just a week while in Europe. Speed was critical for them, as the price of their chosen property could rise significantly in the near future.

Legal Due Diligence Check

Before purchasing real estate, it is essential to check:

- the developer's reputation,

- availability of all permits (especially for facilities under construction),

- absence of legal encumbrances on the property.

Advice : If you plan to purchase property in Abu Dhabi for rental purposes, it is recommended to choose projects that are officially registered with the DARI system and have active management companies – this will minimize potential risks.

Comparison with Austria

In Austria, purchasing real estate is fraught with bureaucratic procedures: taxes are higher, notary representation is mandatory, and strict rules apply to foreign buyers. However, the market is characterized by stability, long-term price growth, and strong demand from European investors.

In Abu Dhabi, the procedure is significantly simpler and faster, especially if the goal is to acquire real estate for profit and to obtain residency status.

Taxes, fees, and expenses when buying real estate

Purchasing an apartment in Abu Dhabi requires a preliminary analysis of the tax burden and associated costs, as this aspect is often decisive when choosing a jurisdiction for investment.

| Expense item | Comment |

|---|---|

| Registration fee | 2% of the property value |

| Real estate agency commission | 2% (usually) |

| Mortgage registration fee | 0.25% of the loan amount |

| Real Estate Appraisal Fee | 2,500–3,500 AED ($680–950) |

| Transfer fee | 1,000 AED ($270) |

| Administrative fees | Depends on the developer and the property |

| Service fees | Annually 10–20 AED ($7-8) per sq.m. m |

Minimum taxes in Abu Dhabi

In Abu Dhabi, there are no taxes on rental income or property appreciation. The only mandatory fee is 2% upon transaction registration. This is a major advantage: investors often choose real estate here precisely because of the simple and transparent rules.

Service fees

In addition to the registration fee, homeowners pay an annual service fee, typically $7-8 per square meter. This money covers security, cleaning, reception, and the maintenance of the pool, gym, and other common areas. In luxury complexes, such as Saadiyat Island, these fees are higher than in areas like Masdar City, but the service is also significantly better.

Comparison with Austria

By comparison, in Austria, when buying real estate, you must pay a 3.5% acquisition tax, notary fees, and registration fees. A capital gains tax (27.5%) applies when selling, making it more expensive to enter and exit the investment. However, Austria is attractive due to its stable price growth and high demand for long-term rentals, particularly in Vienna.

Residence programs for purchasing real estate in Abu Dhabi

Investing in Abu Dhabi real estate offers not only financial benefits but also the opportunity for long-term residency. In practice, many of my clients choose apartments here not only for income but also to ensure a safe and comfortable living environment for themselves and their families.

Golden Visa: Long-term investment residency

- Requirements: A minimum investment of 2 million dirhams (approximately $545,000) in real estate is required. The visa is valid for up to 10 years and is valid for the entire family.

- What it provides: the opportunity to live in the UAE, work, and also use schools and healthcare for the whole family.

- What it doesn't provide: a visa doesn't automatically grant citizenship; it will need to be renewed after its expiration.

- Mortgage: Available through UAE banks if the property is worth more than AED 2 million. The investor must have at least AED 2 million invested. For example, if the property is worth AED 5 million, the mortgage can cover a maximum of AED 3 million.

In one completed case, a European investor purchased real estate in Abu Dhabi for AED 2.2 million, which allowed him to obtain a Golden Visa for himself and his wife, as well as provide for their children's education at an international school in the emirate. This allowed them to officially reside and conduct business in the UAE without additional visas.

Retirement Visa: For investors 55+

- Requirements: You must purchase real estate for at least AED 2 million or have at least AED 1 million in a UAE bank account. You must be 55 years of age or older.

- Duration: the visa is issued for 5 years with the possibility of extension.

- What it gives: the right to live in Abu Dhabi, obtain health insurance, and include a spouse and dependents in the visa.

Many clients see this as a good alternative to a European pension, thanks to the absence of income and capital gains taxes, as well as the security of residency status.

Common mistakes when filing

- Undervaluation of real estate or capital - the property must be worth at least AED 2 million.

- Errors in property registration - especially if the purchase is made through a company.

- Lack of supporting documents - bank statements, income certificates, information about the source of funds.

- Inaccuracies in powers of attorney and notarial documents are especially important when purchasing remotely.

Work with lawyers and reliable agents, and gather all the documents in advance—this will help reduce the risk of refusal and speed up the process.

Changes 2023–2025

Since 2023, important changes have come into effect in the UAE's Golden Visa application rules:

- The minimum investment amount has been reduced: now you can get a Golden Visa with a property purchase of AED 2 million (previously the required amount was AED 10 million).

- Mortgages are allowed: up to half the cost of the property can be paid through UAE banks.

- Under construction: Golden Visa is also available for purchases of properties under construction.

- Family: The visa holder can apply for a spouse and children of any age without any additional conditions or deposits.

Buying property in Abu Dhabi has now become more convenient and profitable for investors and their families.

Comparison with Austrian Residence Permit

| Parameter | Abu Dhabi (Golden / Retirement Visa) | Austria (D-card / Self-Sufficiency) |

|---|---|---|

| Minimum investment | AED 2 million ($545k) in real estate | €500k–€1 million in business or real estate |

| Visa validity | Golden Visa - 10 years, Retirement - 5 years (renewable) | D-card – 1-2 years, Self-Sufficiency – 1 year with extension |

| Opportunity to work | Golden Visa — yes, for the holder; Retirement — no | D-card - may include work; Self-Sufficiency - no |

| Family sponsorship | Spouse and children of any age without additional deposits | Previously, only a spouse and children aged 18-25 were eligible, and it was necessary to confirm income |

| Taxes on income and capital gains | No | There is income tax, capital gains tax, and other fees |

| Visa extension | Golden Visa - automatically renewed every 10 years; Retirement - every 5 years | D-card / Self-Sufficiency - renewal upon verification of finances and fulfillment of conditions |

| Ease of obtaining | Fast - if real estate and financial requirements are met | More complicated - more bureaucracy, you need to prove a stable income or investments |

| Risk and stability | Greater flexibility, but the UAE market is more volatile | A more predictable market, strong legal protection and expected price increases |

Abu Dhabi offers the opportunity to quickly obtain long-term residency, especially when purchasing family property. In Austria, the process is longer and more complicated, but it has a stable market and predictable price growth. The choice between the two options depends on your priorities: quick results and income in Abu Dhabi or the leisurely but reliable stability of Europe.

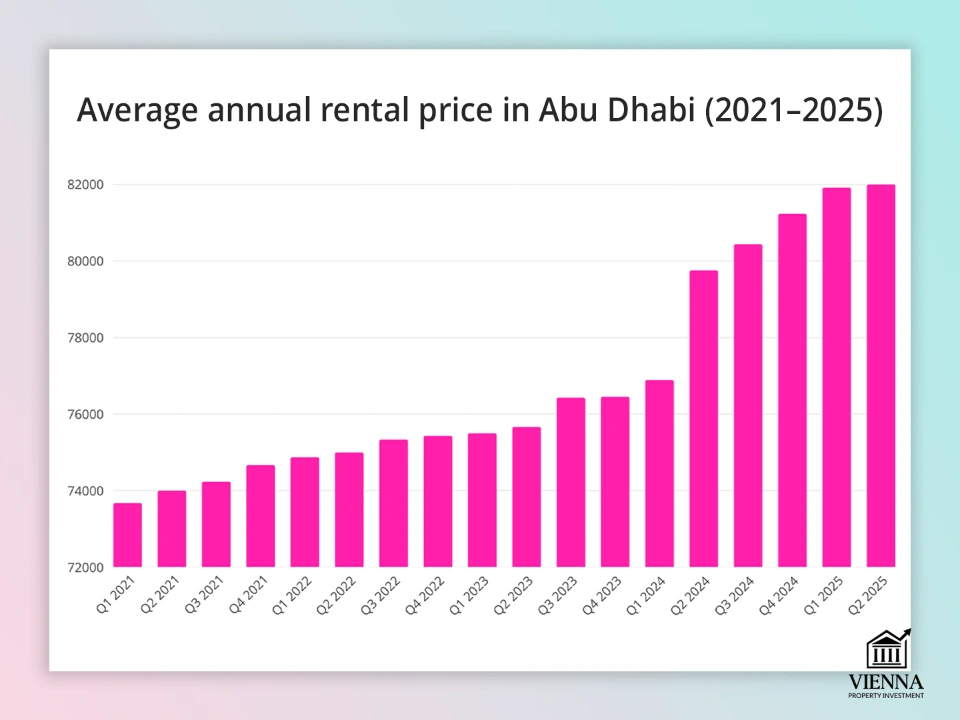

Property rentals and income in Abu Dhabi

Abu Dhabi remains attractive to investors thanks to high yields of 5-8%, depending on the area and rental type. The right property can generate stable passive income, especially when professionally managed.

Average annual rental price in Abu Dhabi (2021–2025)

(source: https://theluxuryplaybook.com/abu-dhabi-real-estate-market/ )

Short-term rental

Short-term rentals, such as those offered through Airbnb, are particularly popular on Yas Island, Saadiyat Island, and Al Reem Island. This format offers higher income but requires active management and strict adherence to regulations and licenses.

One of my clients purchased an apartment on Saadiyat Island and, by transferring it to a specialized company for management, receives a return of about 8% per annum, combining comfort with a constant flow of tourists.

Long-term lease

For expats, families, and government employees, long-term rentals with a 5-6% annual return are best. This option provides a stable income and requires less maintenance. In practice, I recommend choosing apartments near business centers and international schools—they're easier to rent out and have virtually no downtime.

Profitability by region

| Location | Property type | Profitability (gross) |

|---|---|---|

| Yas Island | Apartments, villas | 7–8% |

| Saadiyat Island | Apartments, villas | 6,5–8% |

| Al-Reem Island | Apartments, townhouses | 5,5–7% |

| Al Raha Beach | Apartments, townhouses | 5–6,5% |

| City center | Apartments | 5–6% |

| Al Maryah Island | Apartments, commercial real estate | 5–7% |

Management companies and agencies

Using professional management services allows property owners to generate income without wasting time on ongoing management. This is especially convenient for foreign owners who don't live in Abu Dhabi.

What is included in management:

- Finding tenants and advertising housing

- Preparation and signing of contracts, acceptance of payments

- Organization of repairs and maintenance

- Payment of utility and service bills

- Legal assistance with rental matters

Typically, the commission for such services is 5-10% of the annual rental income.

Taxation

In Abu Dhabi, you receive the entire rent as there is no tax on this income. This allows you to earn more. In Austria, rental income is small (2-3%), but there are clear rules and tenant rights are better protected.

Where to invest: top locations for buying property in Abu Dhabi

Investment zones of Abu Dhabi

(source: https://blog.psinv.net/freehold-investments-in-abu-dhabi/ )

Abu Dhabi is vast and diverse. Here, you can buy an apartment either in the heart of the action, surrounded by landmarks, or in a quiet area ideal for family living. It all depends on your plans: whether you're looking for a home for yourself or a profitable investment to rent out.

Saadiyat Island is an elite area for art and luxury living.

- The island is the center of cultural life: the Louvre, the future Guggenheim Museum, universities.

- Developed infrastructure: beaches, 5-star hotels, international schools.

- Price: Apartments from AED 2.5-3 million ($680k–820k), villas are significantly more expensive.

- Rentals: High demand from expats working in culture and education.

Al Reem Island – a neighborhood for living and working

- One of the most popular among young professionals and foreigners.

- Everything is nearby: office centers, schools, clinics and large shopping centers.

- Price: 1-2 bedroom apartments from AED 1.2-1.8 million ($326k-490k).

- Rent: 7-8% yield due to high demand from expats.

Yas Island – an island of tourism and entertainment

- The main entertainment venues are concentrated here: Ferrari World, a water park, a Formula 1 track, and concert arenas.

- Amenities: hotels, shopping centers, beaches and tourist areas.

- Price: apartments from AED 1.5 million ($408k).

- Rentals: High demand for short-term rentals from tourists and through Airbnb.

In fact, many investors are buying property here for tourist rentals. With proper management, yields can reach 9%.

Al Raha Beach – a family-friendly neighborhood

- Modern residential complexes by the sea with amenities for families.

- Infrastructure: schools, kindergartens, parks and beaches.

- Price: Apartments from AED 1.4 million ($381k).

- Rent: Popular with expat families and government employees.

Al Reef – Affordable Housing

- An area with apartments and villas at lower prices.

- Price: from AED 800k to 1 million ($218k–272k).

- Rent: Suitable for middle class and government employees.

Tip : Many investors view Al Reef as a launchpad—an opportunity to test the market and see if returns are possible.

Masdar City – the city of the future

- It is the world's first "smart city" created with an emphasis on ecology and sustainable development.

- It has solar power plants, modern eco-buildings and its own university.

- Apartments cost from AED 900k to 1.2 million ($245k–326k).

- The accommodation is particularly popular with students and companies working in the green technology sector.

| Category | Region | Who buys? | Why |

|---|---|---|---|

| Where are they buying now? | Al Reem Island | Expats, young professionals, investors | City center, business and residential, high rental demand |

| Saadiyat Island | High-income families, foreign investors | Prestige, museums (Louvre, Guggenheim), luxury housing, long-term value | |

| Al Raha | Families, civil servants, top managers | Infrastructure, schools, transport, and living conditions | |

| Where growth is expected | Yas Island | Rental investors, second home owners | Tourism, entertainment, Airbnb, price increases due to new projects |

| Masdar City | Environmentally oriented investors | The "green" project, eco-friendly development, attracts the attention of foreign companies | |

| Al Reef | Targeted at the middle class and investors seeking profit | Attractive due to its affordable price, stable rental demand and 7-8% yield |

Currently, the most popular areas for buying are Reem and Saadiyat. People buy there both for personal use and to rent out. These are already established, stable locations. But if you're thinking about future profits, it's worth taking a closer look at Yas and Masdar. Prices and rental demand are expected to grow faster there in the next few years. Therefore, the best strategy is to "mix things up": buy something in a proven area for reliability and invest some of the money in more promising locations to capitalize on growth.

Ready-made housing or dream construction: what to choose in Abu Dhabi

Abu Dhabi's real estate market is extremely diverse today. You can choose a resale apartment to move into right away, or invest in a new development—this often offers better prospects for capitalizing on future price appreciation. Therefore, there are opportunities for everyone: both those buying an apartment to live in and investors.

Secondary market

According to Metropolitan Capital Real Estate (MCRE), the secondary real estate market posted record results in early 2025. In the first quarter, transaction volume increased by 53% year-on-year, reaching AED 5.04 billion ($1.37 billion), compared to AED 3.3 billion ($0.90 billion) the previous year. The secondary market now accounts for 11.4% of the total market.

Main customer groups:

- End-users are families who want to move into a finished home immediately without any additional investment.

- International investors are looking for stability and returns that are higher than in Europe.

My observation : buying apartments that are already rented out is becoming popular. This is profitable because you receive the rent from the tenant literally the day after the transaction. For example, on Al Reem Island, my client purchased an apartment for $410,000 with an existing lease. Thanks to this, he immediately began making a profit—6.5% of the apartment's value annually.

New buildings in Abu Dhabi

The new construction sector in Abu Dhabi is very vibrant. Developers are actively constructing new residential complexes in the most promising areas. A major advantage for buyers is the convenient installment plan. The down payment is often only 5-10%, with the remaining payments spread out over the entire construction period.

Investors value new buildings due to:

- Convenient payment schemes (70/30, 60/40 and other options).

- Increase in cost during the construction process (by the time the project is completed +15-25%).

- Modern infrastructure and technologies: smart home systems, swimming pools, fitness centers, playgrounds.

When choosing a new development, it's important to consider not only the developer's name but also the infrastructure. For example, projects in Masdar City are popular due to their environmental friendliness and convenient transportation accessibility, as the airport is nearby.

Examples of offers on the new building market

- Studio in Masdar City - prices start from $120,000.

- One-bedroom apartments on Yas Island - prices from $280,000.

- Villa on Saadiyat Island - offers start from $1,800,000.

Abu Dhabi vs. Austria: Where New Construction Offers Greater Potential

The new-build market in Austria is not developing as rapidly as in Abu Dhabi, but it has a number of other advantages.

- High construction and energy efficiency standards: modern residential complexes comply with ESG principles, utilize green technologies, and are designed for long-term operation.

- Transparency of transactions and stable regulation: transactions are protected by clear regulations, and buyers' rights are reliably protected by law.

- Investment predictability: the market is characterized by the absence of sharp price fluctuations and demonstrates stable dynamics over decades.

When choosing Vienna or Salzburg, my clients say, "Yes, the yield is lower—2-3% versus 5-8% in the UAE. But such real estate is reliable and holds its value for decades."

Alternative investor strategies

Investing in Abu Dhabi real estate offers broad prospects for investors who take a systematic approach. Along with traditional options for purchasing apartments and villas, there are alternative investment strategies that allow you to diversify your asset portfolio, increase returns, and minimize risks.

Buying several studios instead of one apartment

Sometimes, buying two or three studios in different areas makes more sense than one spacious apartment. This makes your investment more liquid and reduces risk. A prime example is a client of mine from Europe who bought three studios on Al Reem Island. Now he's receiving a steady rental income from each one, and even if one sits empty for a while, the others continue to generate income.

Investments in hotels and serviced apartments

Investing in hotel-managed apartments or mini-hotels is a hassle-free way to generate income from short-term rentals. Here's a real-life example: a client purchased an apartment on Yas Island and transferred it to a hotel management company. As a result, their income increased by 5% compared to a typical long-term rental, while the operator took care of all maintenance and risks.

Investments in land plots for construction

Purchasing land for future construction is a strategy for experienced investors that can significantly increase their capital. A key condition for success is thoroughly checking building codes and obtaining all permits in the freehold zone. This ensures not only the legality of the investment but also a high return on investment in the long term.

Comparison with strategies in Vienna: stability versus dynamism

In Austria, purchasing completed apartments and complexes is popular among investors: the yield here is moderate—around 2-3%—but the market is predictable and reliable. Abu Dhabi offers higher yields—up to 5-8%—but price fluctuations are more pronounced.

The optimal strategy is to combine both: small apartments in Abu Dhabi for profit and Austrian real estate for capital protection and stability.

Risks and pitfalls of the Abu Dhabi real estate market

Investing in Abu Dhabi real estate can be profitable, but it's important to consider potential market fluctuations and risks.

Key challenges for investors

- Maintenance and operation fees: Annual maintenance costs for common areas vary depending on the neighborhood and property class. For example, on Saadiyat Island, they can range from $8-10 per square meter per year.

- Limited areas for foreign investors: Although the freehold zone is gradually expanding, opportunities for foreigners to purchase property remain limited, especially for luxury villas and apartments.

- Seasonal variations in rental income: Short-term rental income can vary greatly depending on the season, particularly during the summer and holiday periods.

Many investors entering the Abu Dhabi market don't consider additional expenses and seasonal rent fluctuations. For example, a client of mine bought an apartment on Yas Island and expected a return of around 8% per annum. However, due to high management fees and a drop in demand in the summer, the actual return was around 5.5%.

Another situation: an investor was planning to purchase a property on Al Reem Island, but after discussion, we settled on another option in the freehold zone. This property turned out to be more profitable, with lower maintenance costs and stable demand from long-term tenants.

Before investing in apartments in Abu Dhabi, plan ahead for all expenses, assess seasonality, and focus on locations with stable long-term rentals.

Comparison with Austria

Abu Dhabi offers a more dynamic market with the potential for high returns, but also higher risks: price fluctuations and a limited choice of locations. Vienna, by contrast, demonstrates stable apartment price growth, robust demand, and predictable rental yields, making it ideal for the conservative investor.

| Parameter | Abu Dhabi | Austria |

|---|---|---|

| Legislation | A vibrant market, but with limited areas for foreigners | A stable market, but with strict rules for foreigners |

| Rental yield | 5–8% | 2–3% |

| Taxes | There is no income or capital gains tax, only a 2% registration fee | Income tax, stamp duty and VAT |

| Bureaucracy | The process is simpler, and remote transactions are possible | Standardized |

| Infrastructure | Modern, developing | High level throughout the country |

| Seasonality and demand | Seasonal fluctuations, especially in summer due to tourism | Demand is steady and predictable, with low seasonality |

| Liquidity | Fast in popular areas, slower in new ones | High and stable across all regions |

Accommodation and Lifestyle in Abu Dhabi

More and more people see Abu Dhabi not just as an investment, but as a place to live comfortably. Those buying property or building a second home here often choose the emirate for its mild climate, high level of safety, and high-quality service.

Climate, medicine, education, security

Abu Dhabi's climate is warm and sunny almost all year round, but summer (June to September) can be extremely hot, with temperatures often exceeding 40°C. At the same time, the city is considered one of the safest in the world: the crime rate here is much lower than in Europe.

Medicine here is private and modern, with international clinics. A doctor's consultation starts at $100, and annual insurance for the entire family starts at $5,000. Abu Dhabi also has schools offering British, American, and French curricula, with annual tuition ranging from $8,000 to $20,000.

Standard of living and cost of living

The cost of living in Abu Dhabi varies greatly depending on the area. A one-bedroom apartment in the city center costs at least $1,200 per month, while a three-bedroom villa starts at $3,500. If you're considering buying real estate, a one-bedroom apartment can be purchased starting at $200,000, while apartments in luxury residential complexes on Saadiyat Island start at $600,000.

Everyday expenses are higher than in Europe: groceries and restaurant meals are more expensive, but fuel and taxis are cheaper. A monthly grocery basket (dairy products, meat, fruits, vegetables, and grains) costs $600-800. Dining out three to four times a week adds another $300-500, and meal delivery costs an average of $8-12 per meal. Utilities and service fees amount to $3,000-$5,000 per year.

One of my clients purchased an apartment in Abu Dhabi for $280,000 for winter living, and rents it out to tourists in the summer – the rental income fully covers the maintenance costs.

Communications, transport, banks

The city is rapidly developing its infrastructure: new highways are being built, a metro is planned, and an extensive air travel network is in place. Taxis and rental cars remain the most popular modes of transportation. Internet connections are high-speed, banks actively serve residents, and opening an account typically takes up to two weeks.

Recommendation : When purchasing property in Abu Dhabi, it is advisable to immediately open an account with a local bank - this will simplify managing payments and receiving rental income.

Legalization, medicine, schools - for residents

Purchasing real estate in Abu Dhabi for at least $204,000 qualifies you for a residence visa. This allows you to open bank accounts, obtain health insurance, and enroll your children in local schools. The visa also gives you access to mortgages (up to 70% of the purchase price), credit cards, and other banking services—all of which simplifies both purchasing a home and living in the emirate. The visa is valid for two to 10 years, depending on the property value.

Austria: Standard of Living Comparison

Austria attracts with its mild climate, affordable public healthcare with insurance, and high-quality schools and universities. The cost of living is lower thanks to accessible transportation, utilities, and food prices. However, purchasing real estate in Vienna requires a significant investment: even a compact apartment costs from $400,000, while luxury homes start at $800,000.

The main advantage is stability and social guarantees: healthcare is practically free with insurance, schools are funded by the state, and the standard of living remains safe and comfortable.

Real estate as a safe haven for capital and life

Abu Dhabi has long attracted investors, families, and individuals who value stability. There are no income or property taxes, and the level of security is extremely high. And purchasing an apartment starting from 750,000 AED (~$204,000) opens the door to a Golden Visa valid for up to 10 years. For many of my clients, this is the key selling point: they're buying not only real estate but also a way to legally establish themselves in the country.

Who is it suitable for and why:

- Investors are interested in apartments in Abu Dhabi due to the 5-8% annual yield, easy rentals, and the prospect of a profitable resale.

- For pensioners , safety, healthcare, a mild climate, and the ability to easily acquire housing for relocation are important.

- Digital nomads choose apartments in areas with coworking spaces and developed infrastructure, such as Al Reem or Yas Island.

What to choose?

- Vienna – reliable construction, high standard of living and social security.

- Abu Dhabi offers favorable taxes, dynamic development, and more opportunities for investors.

My advice is this: if your primary goal is to preserve your capital in a secure and safe environment, consider Europe. But if you're interested in a rapidly growing market with high returns and the opportunity to obtain a Golden Visa, consider an apartment or studio in Abu Dhabi.

How to exit real estate investments in Abu Dhabi

Abu Dhabi Property Market Report 2025

(source: https://uaenews247.com/2025/04/11/q1-2025-abu-dhabi-property-market-investment-hotspots-and-emerging-opportunities/ )

When buying real estate in Abu Dhabi, it's important to think ahead not only about the purchase but also about how you'll manage the property. Whether you're selling, transferring the property to relatives, or maintaining your Golden Visa—all these decisions directly impact your income, convenience, and future plans.

Selling a property: timing and finding a buyer

Selling real estate in Abu Dhabi typically takes between two and six months, depending on the area and type of property. For example, luxury apartments on Saadiyat Island take longer to sell because they attract a narrow clientele. Meanwhile, mid-range apartments on Al Reem Island are in constant demand, quickly snapped up by both investors for rentals and those seeking personal residences.

Tip : Take high-quality photos, check all documents, and research current market prices. This will help you close the deal 20-30% faster.

Selling with a Golden Visa: Keeping or Cancelling

It's important to keep in mind that selling a property that qualifies for a Golden Visa may cancel the visa. However, some investors transfer the property to relatives to keep the residence permit in the family.

A foreign investor received a long-term visa when purchasing an apartment for $2 million. When selling it, he transferred the property to his wife in advance—the visa remained valid because the property remained in the family's name.

Possibility of re-registration to relatives

In Abu Dhabi, it's easy to transfer property ownership to family members—for example, a spouse or children. This is a popular way to keep assets within the family and avoid additional costs in repeat transactions.

Liquidity Comparison: Abu Dhabi and Austria

Abu Dhabi is a market for medium-term investments. Real estate here is most profitable with a holding period of 5-7 years, especially in new areas where infrastructure development is ongoing. However, a quick resale with a high profit is not guaranteed: demand depends on the economic situation, and the market reacts to global crises.

In Austria, things are a little different: the market is considered stable and long-term. Prices don't rise as quickly, but they almost always rise smoothly and reliably, and rental income can be predicted with greater certainty.

Expert opinion: Ksenia Levina

Investing in real estate isn't about "to buy or not to buy," but about "why and where." I research markets, compare different options, and select properties that truly deliver results. For some, that's an apartment in Abu Dhabi with high rental demand, for others, a house in Europe as a reliable asset.

Which option is right for you?

— Ksenia , investment consultant, Vienna Property Investment

Over the past few years, I've helped dozens of clients purchase real estate in Abu Dhabi. In practice, the market here has proven to be more transparent than many people think: all stages of transactions are clearly outlined, mandatory registration with the municipal department is required, and payments are processed according to strict rules. Moreover, transactions close faster than in Europe—often the entire process from search to completion takes just 2-4 weeks.

When purchasing real estate in Abu Dhabi, it's important to clarify the type of ownership right away. Unlike Dubai, 99-year leaseholds are common here, especially in older areas. Therefore, always check whether you're purchasing a freehold property or just a long-term leasehold.

I compare investing in Abu Dhabi real estate to a smart portfolio allocation. It's a market with high growth potential, offering rental yields of 5-7% per annum, plus profits from future property appreciation. The most promising options are mid- and premium-class properties on Yas and Saadiyat Islands, where demand is steadily growing.

The Austrian real estate market operates differently—it's an investment in stability.

Returns are more modest (2-4% per year), but prices grow predictably and reliably. My clients often split their capital: they invest part of their assets in Abu Dhabi for rapid growth, and the other part in Austria to preserve their assets for decades to come. It's a strategy that balances risk and security.

Personally, I would choose a combined approach. I would buy an apartment in Abu Dhabi for rental income and appreciation—you can quickly start making money renting out your property. I would invest the remaining funds in Austria for security and long-term capital preservation. I consider this balance between active income and stability to be the ideal strategy and often recommend it to my clients.

Conclusion

In fact, I often notice that the choice between real estate in Abu Dhabi and Austria is determined not by what is “better or worse”, but by the specific goals of the investor.

If your goal is income, stable rental demand, and access to a dynamically growing market, then Abu Dhabi . There's high domestic demand, development is booming, and prices are projected to rise until at least 2030. Areas with limited supply are particularly promising: Saadiyat Island, Yas Island, and Al Reem Island.

Austria offers reliability and predictability. I often see clients who started investing in the UAE for high returns, only to transfer a portion of their funds to Vienna or Salzburg a few years later to protect their capital. For example, after selling an apartment in Abu Dhabi, one client bought an apartment in Vienna. Rental yields are lower here, but inheritance and long-term prospects are much better protected. This strategy is for those who value peace of mind and legal clarity.

- If you want income and growth , consider Abu Dhabi.

- reliability and stability are more important , Austria will do.

The optimal option is to distribute investments: keep one part in the dynamic UAE market, and the other in stable Europe.

Abu Dhabi is expected to experience rapid growth through 2030, driven by public investment and a growing population. Property prices here will rise faster than in Europe, but the risks are also higher due to market volatility. Austria will remain a safe haven—it won't generate super profits, but it will reliably preserve capital. This strategy is for those who value predictability and long-term stability. The ideal option is to combine both markets: capitalize on growth in Abu Dhabi and protect assets in Europe.

Appendices and tables

Comparison table of profitability by region

| Region | Average annual rental yield (%) |

|---|---|

| Yas Island | 6–7% |

| Saadiyat Island | 5–6% |

| Al Reem Island | 7–8% |

| Al Raha Beach | 5–6% |

| Al Maryah Island | 6–7% |

| Khalifa City | 6–7% |

| Masdar City | 7–8% |

Price/Profitability Map

| Region | Average price per m² ($) | Average annual rental yield (%) | Market Features |

|---|---|---|---|

| Yas Island | 3,000–3,800 | 6–7% | A family-friendly area with high demand for long-term rentals, located in close proximity to Ferrari World, the water park and beaches. |

| Saadiyat Island | 3,500–4,200 | 5–6% | A premium neighborhood with museums, cultural infrastructure, and beaches. It emphasizes capital appreciation over income maximization. |

| Al Reem Island | 2,300–2,800 | 7–8% | A highly liquid market: attractive prices, stable tenant interest, and convenient infrastructure. |

| Al Raha Beach | 3,000–3,600 | 5–6% | This resort-style seaside neighborhood is popular with expat families and boasts a longer payback period. |

| Al Maryah Island | 3,200–3,900 | 6–7% | A business center with business-class apartments surrounded by offices of international corporations. |

| Khalifa City | 2,000–2,500 | 6–7% | The suburb is undergoing rapid development, with villas, schools, and a comfortable environment that attracts families and long-term renters. |

| Masdar City | 2,200–2,700 | 7–8% | An eco-friendly neighborhood with a focus on innovation and sustainability, ideal for renting to students and aspiring professionals. |

Tax Comparison: Abu Dhabi vs. Austria

| Indicator | Abu Dhabi (UAE) | Austria |

|---|---|---|

| Property purchase tax | 2% registration fee | 3.5% acquisition tax + 1.1% registration fee |

| Tax on rental income | 0% | 10–55% (progressive scale) |

| Capital gains tax | 0% | ~30% |

| Property tax (annual) | No | 0.1–0.5% of the cadastral value |

| VAT on purchase | No | 20% (when purchasing new buildings or commercial real estate) |

| Inheritance/gift tax | No | Yes (progressive, up to 60%) |

| Notary and registration fees | 1–1.5% of the transaction value | 1.1–1.5% of the transaction value |

An Investor's Checklist for the Abu Dhabi Real Estate Market

1. Determine your investment goals

- Rental income or asset appreciation.

- Short term transactions or long term ownership.

- Portfolio diversification between different markets (e.g. Abu Dhabi and Austria).

2. Selecting a location

- Consider popular areas: Yas Island, Saadiyat Island, Al Reem Island, Al Raha Beach, Al Maryah Island, Khalifa City, Masdar City.

- Compare the average price per m² and the rental yield level.

- Analyze the infrastructure: transport accessibility, availability of schools, as well as proximity to business centers and recreation areas.

3. Property type

- Options: apartments (studios, 1-3 bedrooms), villas, townhouses, commercial properties.

- Ownership: freehold or leasehold.

- Market segment: primary real estate or secondary housing.

4. Legal verification

- Proof of ownership through the Abu Dhabi Municipality Department.

- Checking the availability of all necessary permits and certificates.

- Determining the type of ownership (freehold or leasehold).

5. Financial analysis

- Determining the cost of the property (apartment/villa) and the minimum down payment.

- Calculation of registration, notary and service fees.

- Projected rental income.

- Estimation of potential growth in value over a 3-5 year period.

6. Taxes and fees

- No taxation on rental income.

- No capital gains tax.

- One-time costs upon purchase (registration, notary services) - within 2-3.5% of the property value.

7. Rental strategy

- Short-term rentals through platforms (Airbnb, Booking).

- Long-term lease agreements for a period of 1 year.

- Selecting a management company or realtor.

8. Exiting investments

- Analysis of the liquidity of an object on the market.

- Possibility of re-registering property to family members.

- Sale with retention of rights to Golden Visa (if available).

9. Legal and financial protection

- Consultations with a lawyer and/or investment advisor.

- Preparation of an agreement with clearly defined terms for the return of the deposit.

- Audit of the financial profitability model.

10. Personal control and practice

- Inspection of the property in person or through a trusted person.

- Assessment of actual living and rental conditions.

- Analysis of the balance between profitability and location status.

Investor scenarios

1. Investor with $250,000

Goal: maximum rental income with minimal risk.

I found a client a studio apartment on Al Reem Island for $245,000 to rent out to expats long-term.

As a result, the client received a 7% annual return, all documents were verified, and the investment will pay off in 12-13 years.

2. Retired with $500,000

Goal: comfortable living and capital preservation.

A two-bedroom apartment on Saadiyat Island was found for $495,000. The client wanted to live by the sea, near cultural attractions, and in a safe location.

Additionally, part of the apartment is rented out through a management company, providing passive income. The price per square meter and the yield level create an optimal balance between personal comfort and investment appeal.

3. Family with children

The goal: comfortable housing for a family, close to schools, in a safe area and with the prospect of price growth.

We chose a 180-square-meter villa on Yas Island for $750,000. The family has their own garden, an international school, and all the necessary amenities for children nearby. Plus, property values in this area are expected to rise until 2030.