Investing in the Austrian Real Estate Market: What You Need to Know

When inflation is high and the economy is in turmoil, investing in real estate is one of the most effective ways to not only preserve your capital but also increase it.

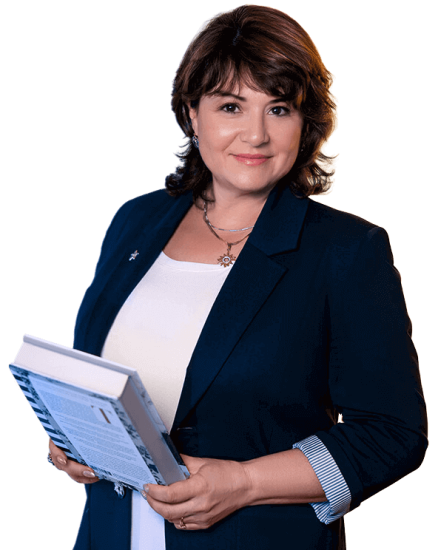

According to publicly available Infina data Austria’s economy is known for its stability, and the Viennese real estate market has been growing for decades without sharp downturns or speculation. Thanks to the steady growth of housing prices in Vienna over the past 30-40 years, this market has become one of the most reliable and predictable for long-term investments.

Inflation at 8-10% (and in some places up to 15-20%) is forcing more and more investors to seek refuge not in cash, not in assets that depreciate when the state prints large amounts of money, and not in "shaky" digital assets. Therefore, real estate in Vienna is not just a "safe haven," but a true protection for savings.

This works most reliably with real estate, the income from which is predictable - or example, rental apartments or medical centers. Their profits can not only cover losses from inflation but also generate income. With a competent and professional approach, certain properties can protect up to 80% of your capital, despite crises and global instability.

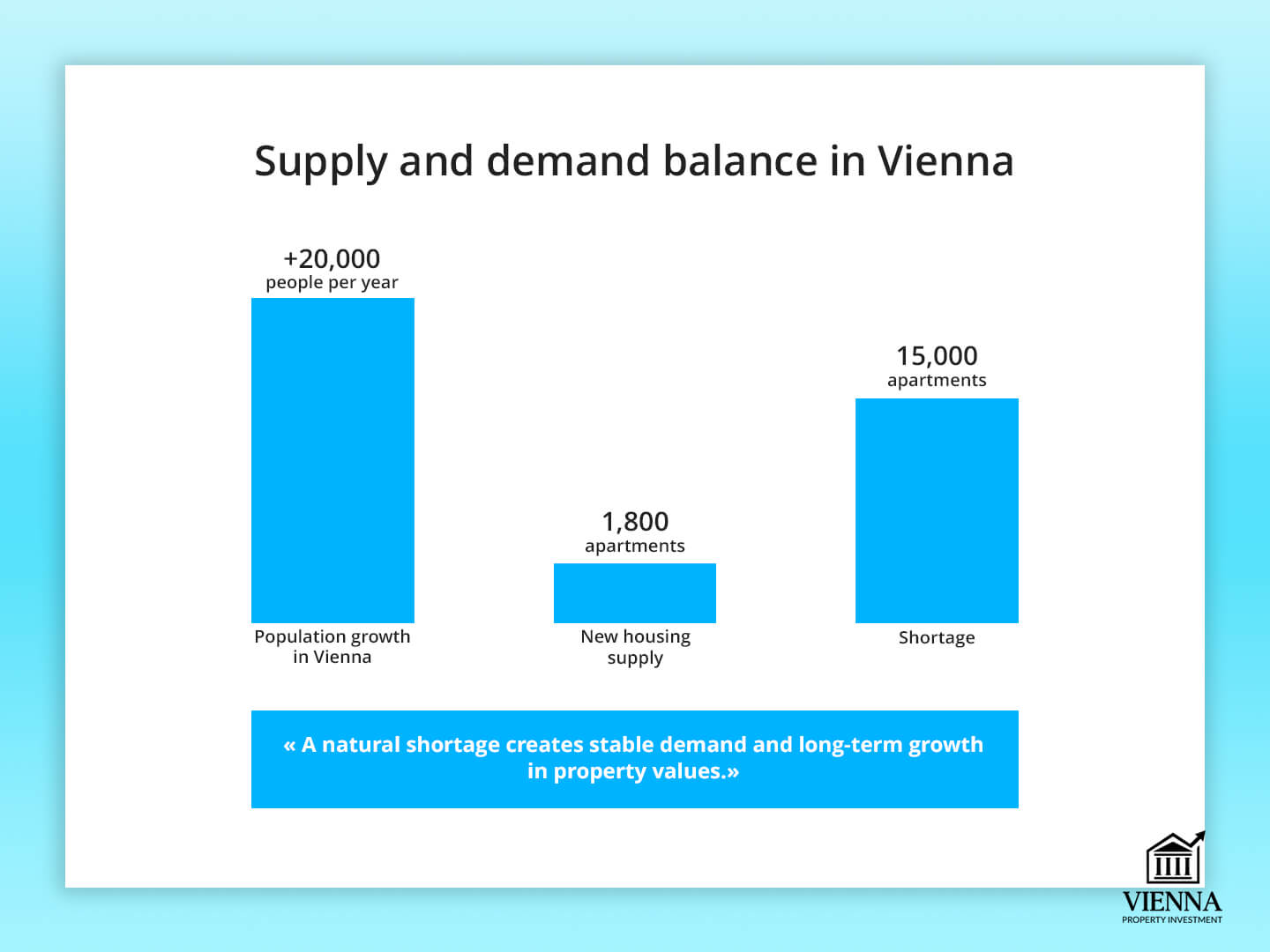

Vienna deliberately keeps investment potential limited , and this is a wise policy: new construction is strictly controlled, historic buildings are protected, and the balance of supply and demand in the market is carefully maintained.

For this reason, demand here is always higher than supply, and such properties not only remain in demand (they are easy to sell), but also steadily increase in price.

In this article, we'll explore why investing in Austrian real estate remains profitable, what investment options are available to everyone—both EU citizens and those living outside the EU—what factors to consider when choosing a property, and how to develop a reliable plan that will ensure stability, complete legality, and a clear return.

I'll share my findings and practical experience gained over years of working with real estate and helping investors. My goal is to help you understand how to invest in Austria wisely and with minimal risk.

Why Vienna is one of the best real estate markets in Europe

If you seek stability in volatile markets, then Vienna's investment real estate is your safe haven. It's time-tested and has withstood crises. For decades, the Viennese market has been one of the most reliable in Europe , steadily growing even during global upheavals. This is why more and more individuals and large funds are choosing Vienna for long-term capital preservation. It's important to understand not only the "why" but also the practical steps: how to buy an apartment in Vienna, taking into account local regulations and costs.

Economic sustainability as a basis for trust

Austria isn't just a stable country, it's a well-oiled machine. In 2023, inflation (price increases) was better controlled here than in many of its eurozone neighbors. Vienna is the heart of it all.

It's not only the capital, but also a powerful investment magnet. The city isn't solely focused on tourism or finance; healthcare, IT, and education are also developing. These factors contribute to the desire of many people to see their future in Vienna, which in turn inevitably leads to thoughts of real estate, whether rented or owned.

The rental market offers stable income with minimal risk

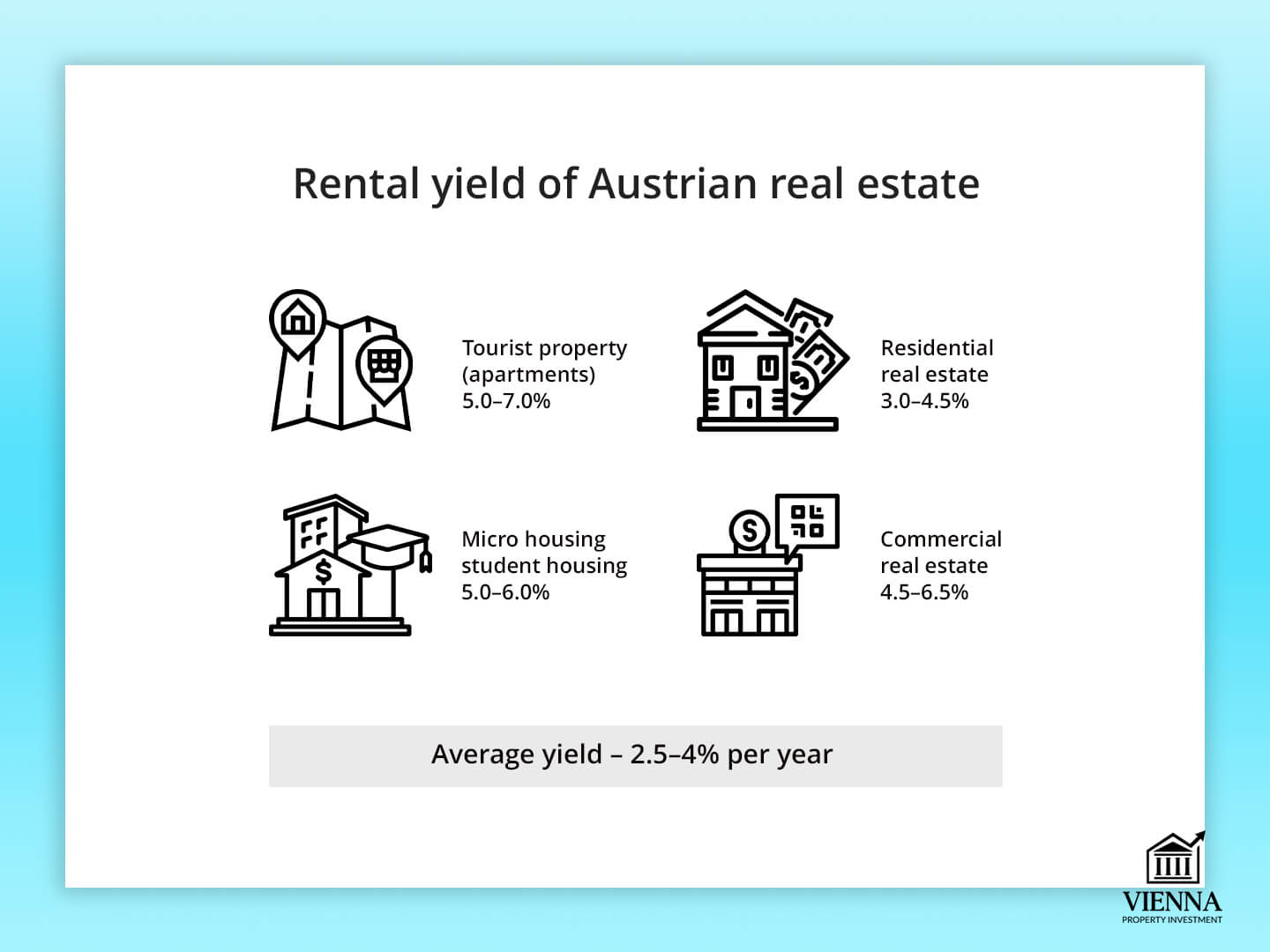

According to data from Statistik Austria, more than 75% of residents in Vienna rent rather than own their homes. This long-standing local tradition is supported by stable and clear rental laws, which in turn creates a favorable climate for landlords and tenants. The rental market is harmonious. For investors, this market offers a source of stable and predictable income. The average annual yield (before taxes, gross) ranges from 2.5% to 4%. However, for certain properties, particularly those in demand in the medical sector (e.g., clinics, offices) or by students, the yield can be significantly higher – up to 6-8% per annum.

As I've already noted, demand in the Vienna real estate market is so high that properties are often rented within 24 hours. This is a real market reality, no exaggeration.

Limited supply as a factor in rising prices

Housing prices in Vienna have been rising steadily for 30-40 years. Even in 2022-2023, when lending rates soared, the market didn't collapse, only slowing slightly. Since 2024, growth has picked up again, and all indications are that it won't end anytime soon. By 2034, prices are expected to increase by 55% compared to current levels.

Why are prices rising so steadily? The answer is simple: it's almost impossible to build new housing in the very center of Vienna. Due to the city's historic buildings, architectural regulations, and strict building codes, new housing is virtually nonexistent in the center. But people still want to live there - demand is unwavering! Compare this to Dubai: there, entire neighborhoods are built, while in Vienna, every new building in the center is practically a unique event, not a common occurrence.

Austria's investment real estate market is diverse, ranging from residential to commercial. Each option has its own unique features, yields different returns, and carries different risks. Which one to choose? It depends on your strategy: stable rents, asset appreciation over time, or portfolio diversification.

| Segment | Profitability (gross) | Main advantages | Main risks |

|---|---|---|---|

| Residential real estate | 3.0-4.5% | Constant demand, low risks | Strict rental laws |

| Commercial | 4.5-6.5% | Can generate above average income | Yields fall when the economy is in crisis |

| Tourist (apartments) | 5.0-7.0% | Can generate above average income | Yields fall when the economy is in crisis |

| Micro-housing / Student | 5.0-6.0% | Reliable, year-round income | Frequent change of tenants |

Prices in Vienna and comparison with other European capitals

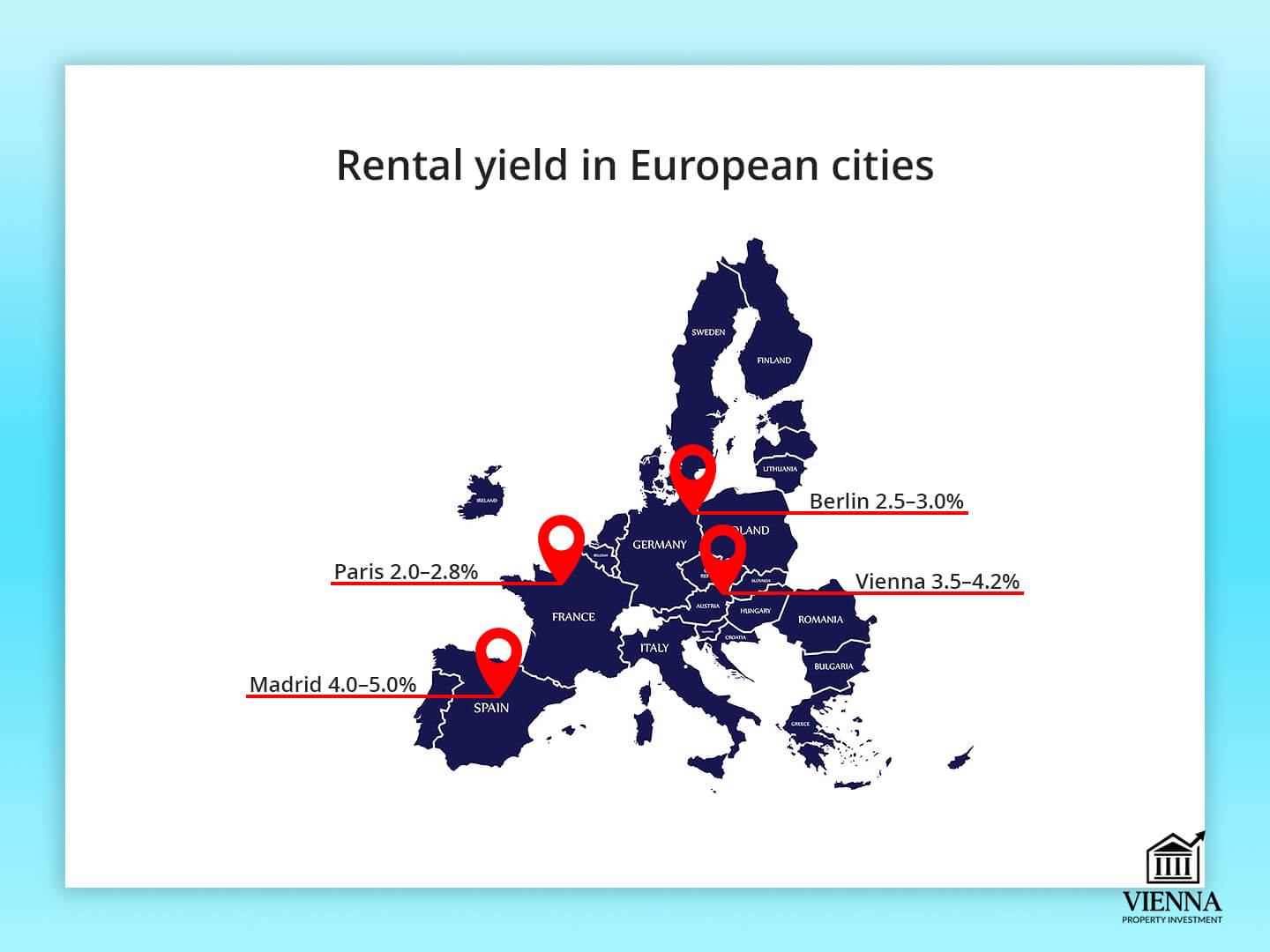

Investing in residential real estate in Vienna looks promising. Research by Knight Frank ranks the city among the top ten European cities for investor appeal. Eurostat: housing prices in Vienna are growing by 4-6% annually, with even more significant growth in developed areas. Compared to other major capitals, Vienna has demonstrated very stable results.

| City | Average rental yield | Price increase over 5 years | Level of regulation |

|---|---|---|---|

| Vienna | 3.5-4.2% | ~30% | Moderate, predictable |

| Berlin | 2.5-3.0% | ~45% | Very high (rent freeze) |

| Paris | 2.0-2.8% | ~25% | Strict regulation |

| Madrid | 4.0-5.0% | ~35% | Less regulated |

Vienna offers a favorable balance for investors. Its real estate is attractive due to reliable regulations, a high quality of life, and stable demand.

The market is deliberately moving away from speculation , emphasizing long-term leases, energy efficiency, and open transactions. Ultimately, everyone wins: residents enjoy comfort, and investors enjoy a stable and predictable market.

Key benefits of Vienna real estate for investors

Vienna consistently ranks among the most profitable cities in Europe for long-term real estate investments. There are several reasons for this: an excellent quality of life, convenient access to all amenities, and a stable environment. This is why international investors are so eager to invest in Viennese real estate.

Vienna has a distinct advantage over other EU capitals: the rules of the real estate market are clear and stable. This means moderate taxes and reliable protection of property rights. These conditions create the ideal environment for stable growth in the value of your investment and a steady income from rentals.

Resilience even during global crises

Transparency of legislation and transactions

Regulation of short-term rentals deserves special attention. Airbnb regulations in many areas curb market overheating and speculative price increases.

Harmonious development of districts without segregation

Effective protection of property rights

Macroeconomic stability and political neutrality

Growth forecast: up to +55% in 10 years

Despite all its advantages, Vienna is still cheaper than other European capitals. Why? There are many market regulations, there's no artificial price inflation, and growth is slow and cautious. But this is precisely the foundation for confident growth in the future. Analysts estimate that by 2034, prices could rise by 50-55%. This is especially true in areas where there's a shortage of apartments and houses.

Which properties are suitable for investment in Vienna?

To successfully invest in Vienna real estate , you first need to choose the right apartment or house. The market here is calm, but there are many rules. Therefore, an experienced person is especially needed: it's the purchase that can make you money. How? By accurately calculating the cost, planning carefully, and buying for less than the real price. There's no rush here, unlike in hot, overheated markets. Decisions are made after verifying the numbers and with a plan for the future.

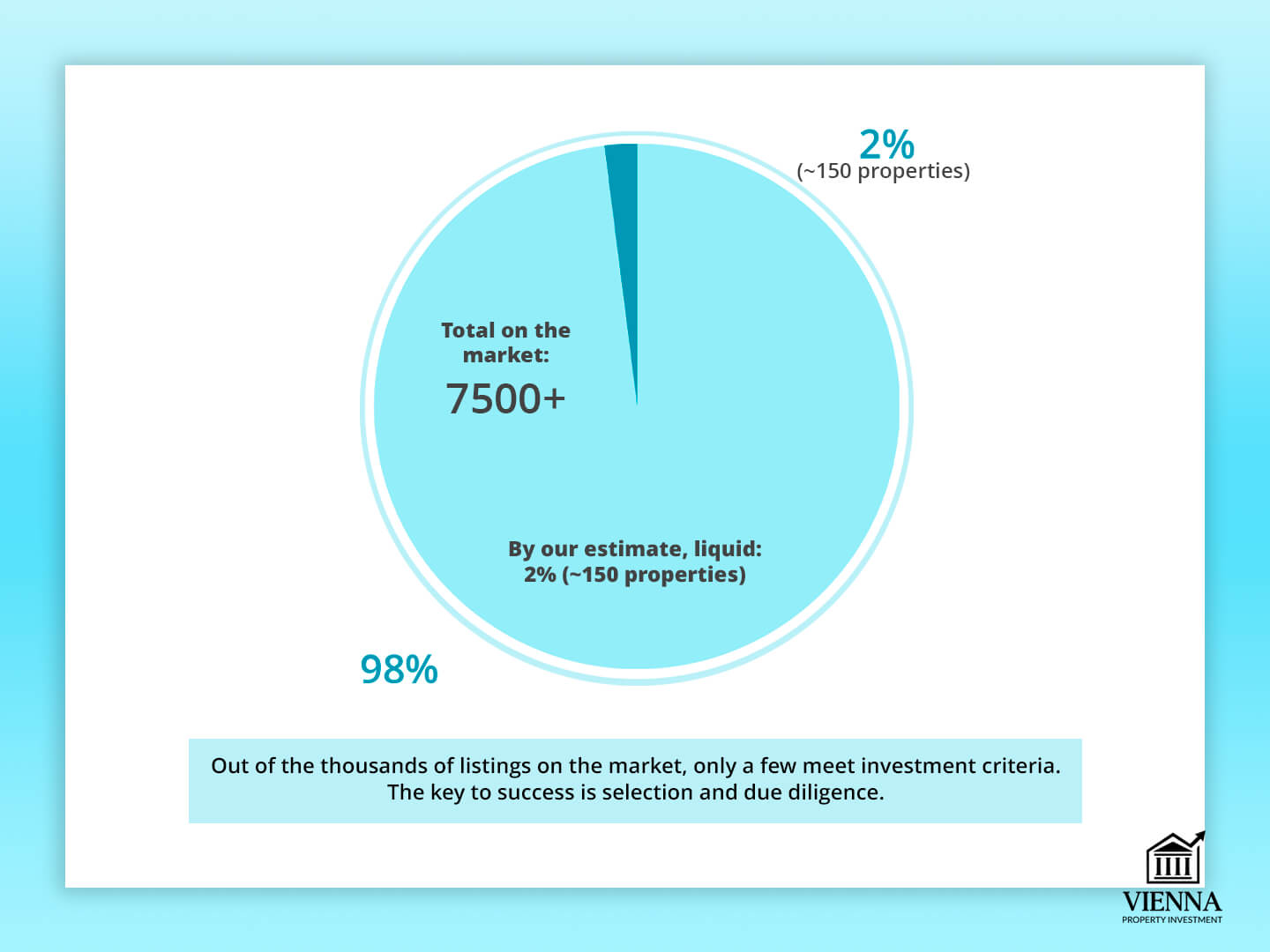

In Vienna, there are up to 7,500 properties for sale . But according to our estimates, only about 2% of them are truly good and a good investment. The bottom line: choosing wisely is key. You need to check a lot: the condition of the house/apartment, the legality of the documents, the potential for price appreciation, and the ease of renting it out.

We actively use artificial intelligence and machine learning to process massive databases. This includes data on prices, actual transactions, the development of different neighborhoods, the demand for rentals and purchases in different locations, and other important indicators. In the first stage, algorithms identify the most promising options. In the second stage, our experts personally inspect each such property.

Want to discuss your project?

Contact us, and we'll create a proposal tailored to you.

We'll handle everything from property searches to precise income calculations.

The secondary market offers the most liquid housing. These properties are often located in historic districts and are consistently in demand among long-term tenants. It's possible to find an apartment here at a lower price than the market price, considering the building's and neighborhood's development prospects, proximity to transportation, and the property's deterioration. However, the key is to verify the legal integrity of the transaction, the reliability of the tenants, and the proper functioning of all utilities.

Viennese new buildings ( Neubau ) are attractive for their style and modern design. They are energy-efficient and high-quality. However, their prices are often 30-40% higher than similar-sized apartments on the secondary market.

The high cost of new buildings isn't just due to their quality. It's also due to the high cost of the projects themselves, difficulties with material delivery, and the significant risks the developer takes on. The key for investors is to realistically assess whether the future price increase for this apartment will truly offset the initial premium

Small apartments are tempting because of their attractive yield, but they are not suitable for everyone in Vienna. Their main tenants are students, migrant workers, and migrants. This means more hassle: you're constantly looking for new tenants and constantly monitoring the rent. We recommend such properties only in trusted areas and only if you clearly understand who will be renting and how to manage them.

Long-term rentals are the most reliable option. Residents here live long-term, for 5-10 years, unlike those who rent for a few days. They usually rent the apartment empty, without your furniture, and all the terms and conditions are clearly defined by law. This helps save significantly on maintenance costs and ensure a precise income. Vienna's city authorities actively support this type of long-term rental.

Tourist rentals in Vienna are very complex, as the authorities have significantly tightened regulations. Since 2024, short-term rentals are only permitted in certain approved areas. This business requires constant oversight: you need to be thoroughly familiar with all the laws and be prepared to manage the apartment 24/7. Therefore, it is primarily pursued by experienced investors with multiple properties and their own cleaning and guest management team.

Commercial real estate is facing a turning point. The online shopping boom has left many stores and warehouses vacant. However, demand has grown for other formats: private offices, service outlets, and clinics. The key to success in this chaos is either a tenant with guaranteed solvency or a smart plan to completely redesign an old space for modern needs.

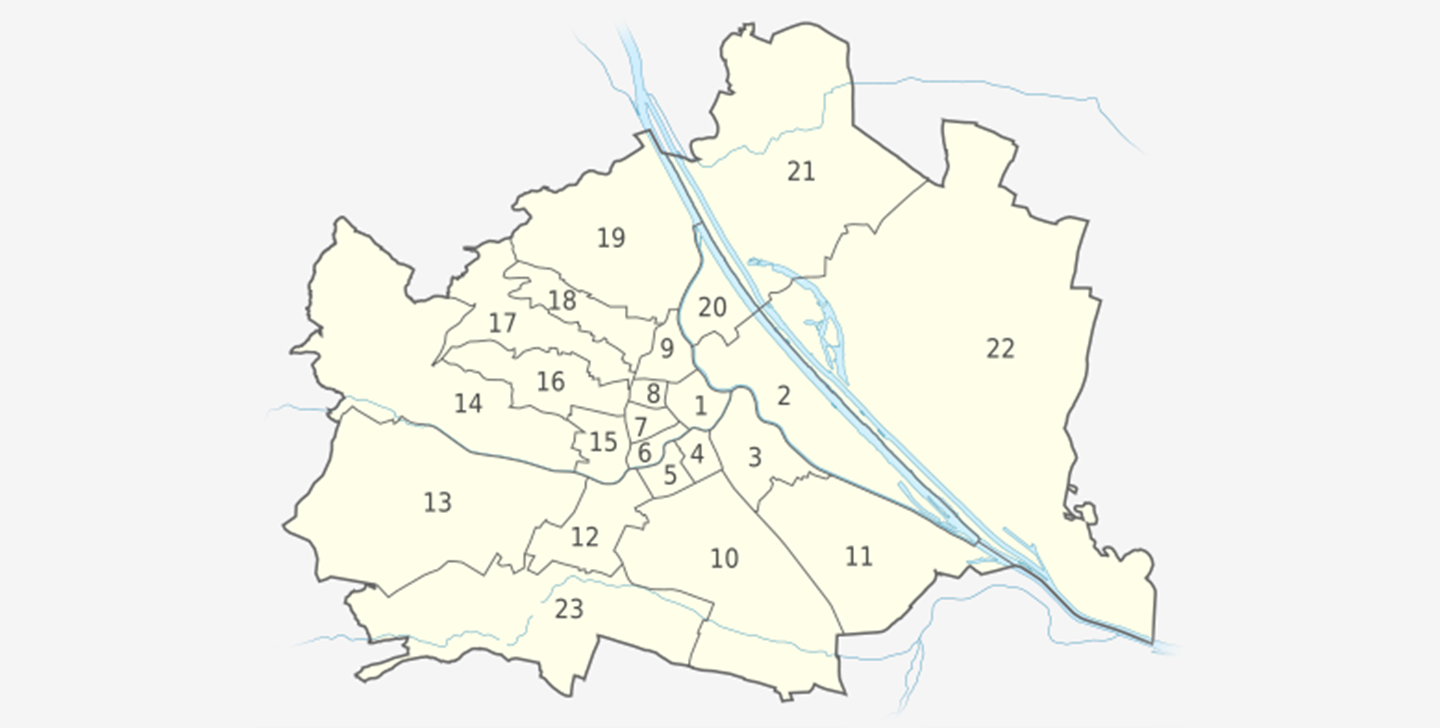

Neighborhoods matter. Vienna is made up of 23 completely different districts. Each has its own rules: prices fluctuate at their own pace, construction is limited everywhere, and the people who live there are diverse. Even within a single district, street prospects can vary dramatically! We dig deeper: we analyze vast amounts of sales data and find precisely those undervalued corners where prices are about to skyrocket. This way, our clients don't simply invest in Vienna real estate ; they buy properties with growth potential.

Available investment options in Austrian real estate

There are various ways to invest in Vienna real estate. It all depends on who you are (your citizenship), how much you want to invest, your goals, and how actively you're willing to participate. We offer a variety of options: from the simple purchase of an apartment in your own name to more complex options through EU companies or investments in large real estate funds.

Private purchase: opportunities and restrictions for non-residents

If you're a citizen of the EU or the European Economic Area (e.g., Germany, France, Poland), you can buy an apartment in Vienna freely, without any additional requirements . However, for citizens of other countries (such as Ukraine, the US, or the UK), the rules are stricter (see restrictions on foreigners purchasing real estate in Austria ): direct purchase is permitted only after approval of a special application by the Vienna Magistrate's Office.

Not everyone receives this permit. Only those with strong ties to Austria—living here, working, running a business, or paying taxes—have a chance. The wait for a decision can take months, and there's no guarantee it will be granted.

Investing through a company: flexibility and tax optimization

This is the most convenient and popular option for citizens of other countries. There are two main routes:

● Open your own Austrian company (for example, GmbH)

● Buy through a ready-made company from another EU country (for example, Slovakia, Cyprus or Ireland)

This approach eliminates the need to obtain special government permission to purchase, significantly simplifies the sale or transfer of real estate, allows for legally reducing the tax burden, and also allows for immediate rental or sale of the property.

It is important to remember:

● Mandatory maintenance of financial documents (accounting) and submission of annual reports

● Regular expenses for maintaining the company

● Taxes in Austria on company profits, rental income, dividends

If structured correctly, this is the most effective way to invest in real estate for the long term.

Co-ownership: investing in a shared investment

Pros:

- the opportunity to buy an elite property with a smaller investment,

- management is taken over by specialists

- lowering the entry threshold

Cons:

- clearly written contracts are needed

- limited influence on decisions

- risk of disagreements between co-owners

Real Estate Funds: Passive Income Without the Hassle

Don't want to manage your property? Real estate investment funds (REIFs) will handle everything for you. You buy a share in a pre-existing portfolio of properties, and professionals manage them. Your income depends on the amount of your investment.

An ideal option for those who don't like to take risks and don't want to waste time on transactions and tenants.

Pros:

- management of professionals,

- invest in multiple properties

- a modest budget will suffice

Cons:

- service fees

- lack of control

- a market decline or poor management will lead to negative consequences

Legal aspects and transaction structure in Austria

Who can buy real estate: resident status matters

Austria differentiates property buyers by citizenship. Therefore, EU citizens (such as Germans, Poles, and French) can buy without restrictions – in Vienna or any other city. Everyone else (Ukrainians, Americans, Britons, and others) must obtain permission from the Magistrat, the Vienna city government.

To obtain this permit, you must have a connection to Austria: hold a residence permit there, work or conduct business there, or pay taxes there. Without such a connection, the process can drag on for months and often ends in refusal.

In such situations, we advise clients to consider another option: purchasing the property through a company registered in the EU (for example, an Austrian GmbH or an Estonian company). This approach is fully legal, and you remain the full owner who can dispose of the property as you wish.

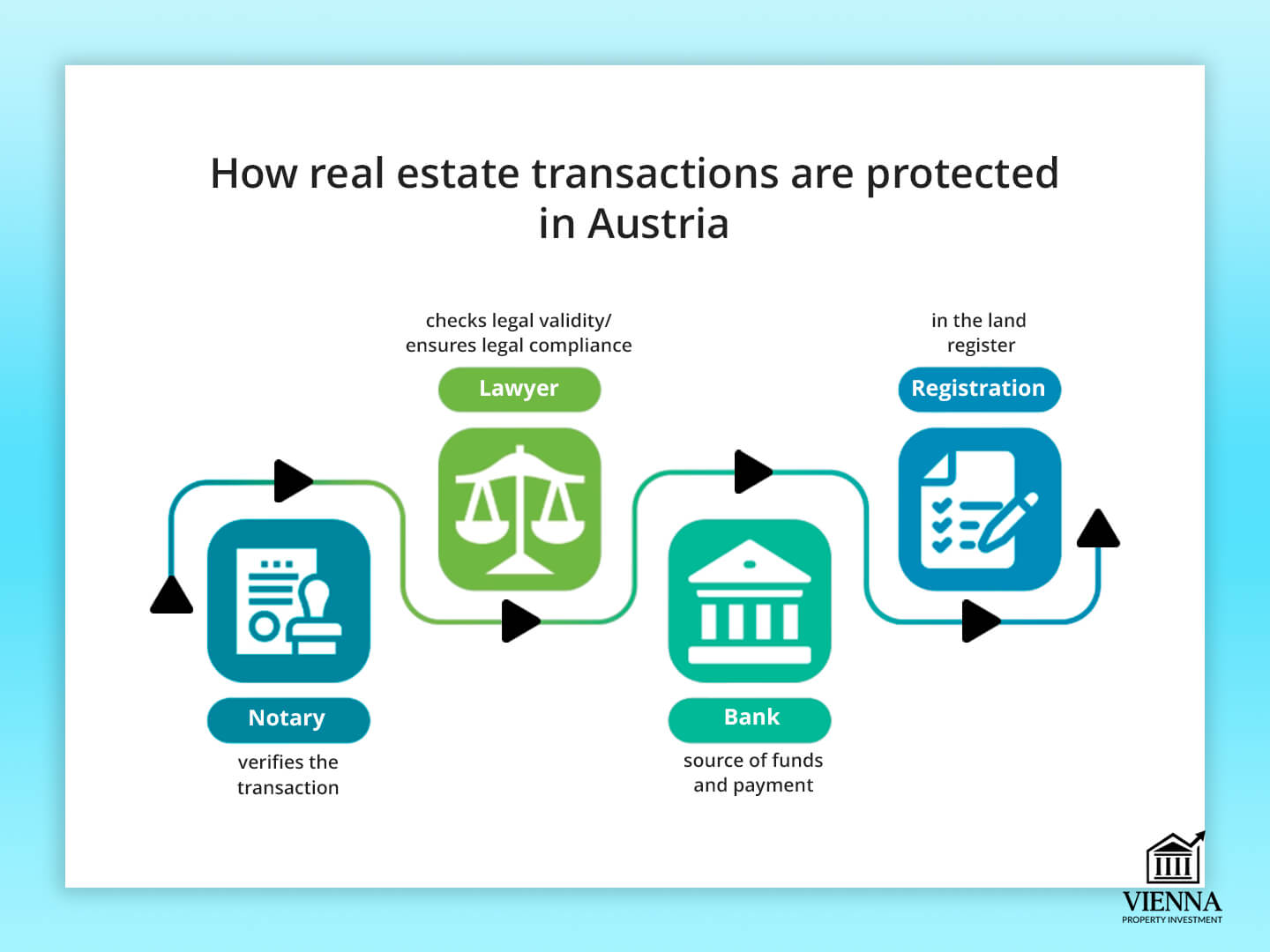

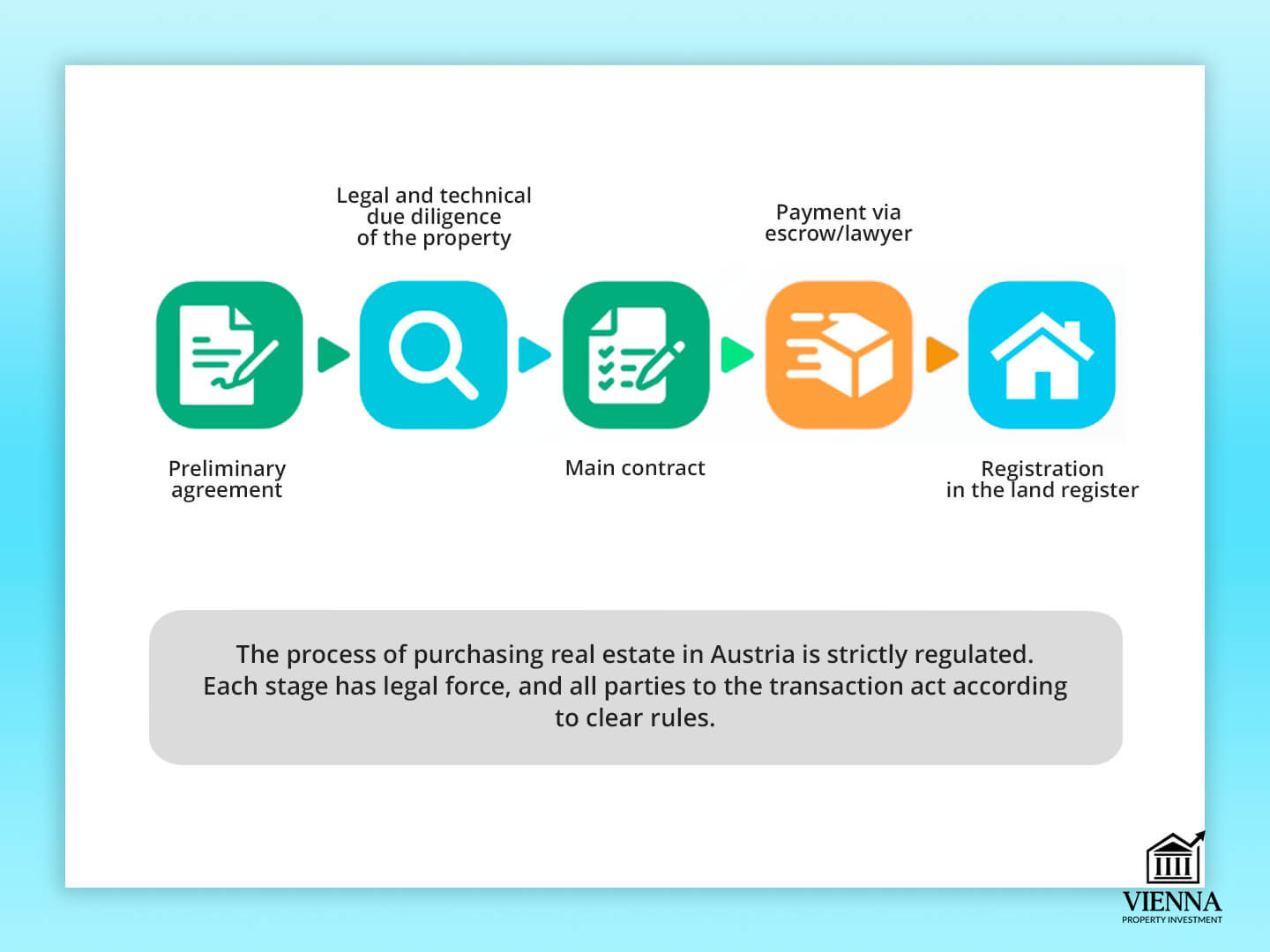

How the transaction works: a step-by-step process

1. Selecting the form of ownership

You can register real estate in your own name or in the name of your company. We'll help you understand how best to register your ownership to minimize taxes, protect your assets, and achieve your goals.

2. Object verification (Due Diligence)

Before purchasing, we check both technical and legal aspects: from the legality of rights to debts and hidden restrictions on the property.

3. Kaufanbot – preliminary agreement

A document that confirms your firm decision to buy. It outlines the key terms, and a notary's signature makes it binding. This guarantees the seller that you won't change your mind.

4. Purchase and Sale Agreement (Kaufvertrag)

This document is prepared by a lawyer, outlining all the terms of the transaction. Once signed by both buyer and seller, the paperwork and money transfer begins.

5. Registration in the land register (Grundbuch)

Our lawyer submits all the necessary documents to the official database (registry). Once everything is recorded and confirmed, the buyer officially receives title to the property.

6. Parties to the transaction

An Austrian transaction typically involves:

- Buyer and seller (or their representatives)

- A lawyer accompanies the transaction and can act as a trusted person.

- Notary – certifies signatures, checks documents

- A bank or trust payment system – such as Mclean Atalios or Banked Household

- Realtor – usually represents the interests of the seller

The transaction usually involves:

- Buyer and seller (themselves or through their assistants).

- A lawyer helps to conduct a transaction and can act under a power of attorney.

- The notary checks the documents and certifies the signatures.

- Special account : bank or payment system (e.g. Mclean, Atalios, Banked Household).

- A realtor most often helps a seller find a buyer.

7. AML control: transparency first

Austria has very strict anti-money laundering (AML) regulations. You are required to provide documents confirming the legal origin of your funds. This requirement applies to both individuals and legal entities. We will help you properly collect and prepare all the necessary documents to ensure everything goes smoothly, without errors or legal issues.

Why the Austrian model works without fail

Austrian laws make investing in Vienna real estate transparent and safe for everyone. A local peculiarity of this process is its lengthy process (Austrian bureaucratic processes, like the people in this field, are slow) and the need to involve paid third-party specialists of various disciplines (lawyers, realtors, notaries, and banks).

An undeniable advantage is that all stages are strictly regulated, resulting in minimal risk of errors or fraud. As a company with international experience, we consider the Austrian system to be perfectly balanced: it's structured, reliable, and provides confidence at every step.

How much can you earn: income, expenses, and taxes

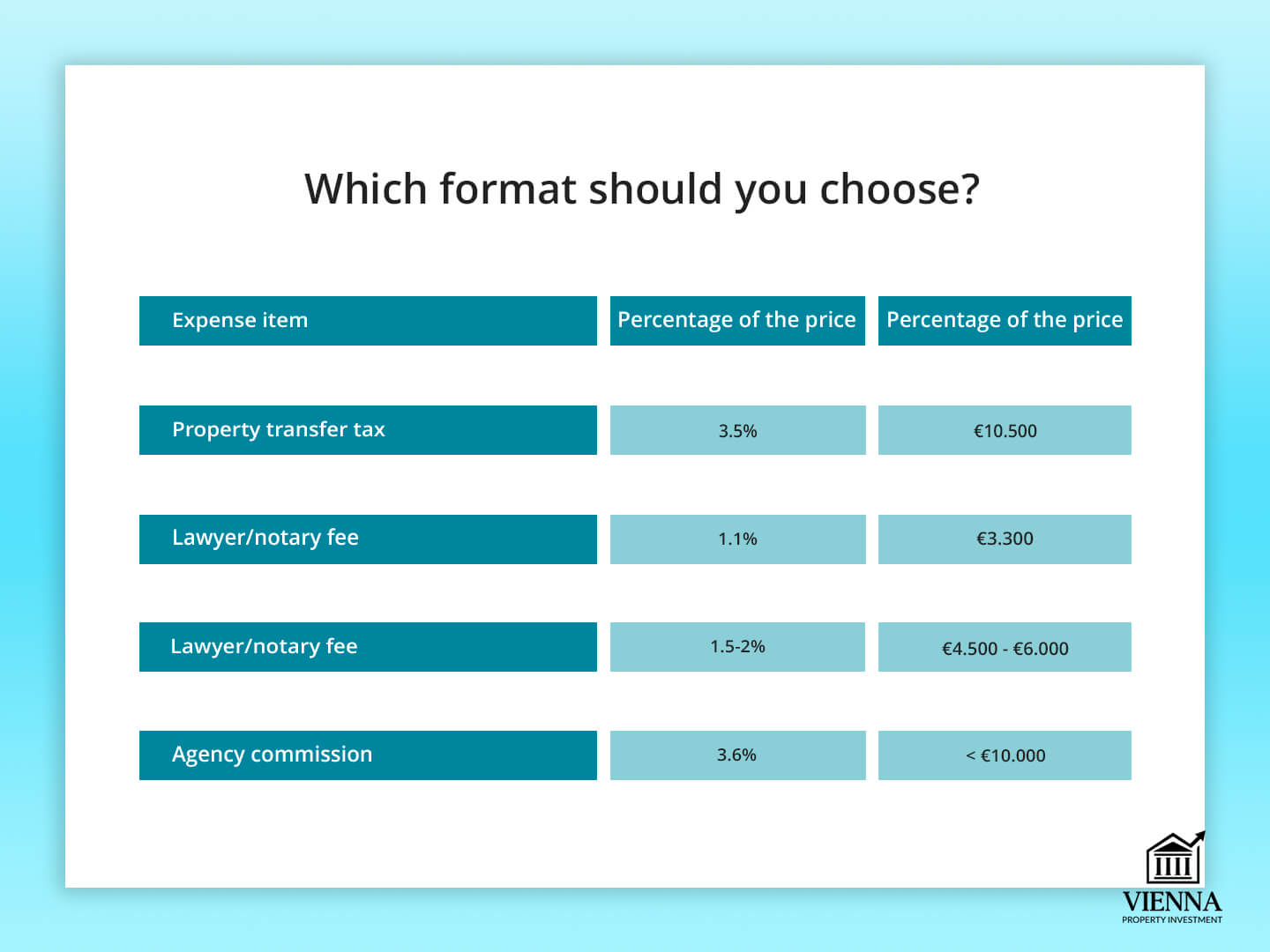

For a successful investment, it's important not only to choose the right property but also to carefully calculate the future profit. At the same time, don't forget about any additional expenses. Below is an example of a real transaction, showing how it works in today's market.

Example calculation:

Property : Apartment on the secondary market

Purchase price: €300 000

| Expense item | Percentage of cost | Approximate amount |

|---|---|---|

| Property transfer tax | 3,5% | €10,500 |

| Registration in the land registry | 1,1% | €3,300 |

| Lawyer/notary fees | 1,5–2% | €4,500–€6,000 |

| Agency commission | 3,6% | up to €10,800 |

Total transaction amount: approximately €330,000

Rental income

- Rental Income: €1,400 per month (€16,800 per year)

- Maintenance costs (insurance, major repairs, etc.): €300-320 per month

- Net income: ~€1,100 per month

- Annual yield: about 4%

Utility costs

For long-term rentals, the tenant is responsible for paying all utility bills:

- Electricity (under an individual contract)

- Heating and water (if not included in Hausbetriebskosten)

- Internet and TV

The lease agreement is drawn up in the tenant's name. This means the owner has fewer expenses, and their income is stable and clear.

Taxation

The amount of taxes depends on several factors, such as the form of ownership and the citizenship of the investor:

- Private individuals: Rent tax in Austria is up to 25%.

- Companies: the tax can be reduced (for example, taking into account the depreciation of property, management costs and repairs).

To minimize and optimize taxation, we recommend consulting with a tax expert. We can help you optimize your investment structure and build an effective ownership model – just contact us.

Your profit comes not only from rent but also from the appreciation of the property itself. Experts, including Publikationen, estimate that the Viennese property market could appreciate by up to 55% by 2034. So an investment of about €330,000 today could grow to roughly €510,000 within nine years. Adding rental income and price appreciation together, you'll receive approximately 6-7% per annum with lower risk than investing in stocks.

Investment strategies

- Long-term rental – stable income, minimum hassle, legal guarantees.

- Short-term speculation is profitable when buying below market price, but requires experience, speed, and a willingness to take risks.

- A hybrid model – rent for 3-5 years and sell at peak price. A flexible approach.

Mortgage: Is Financing Possible?

- For EU residents: Getting a loan is possible: you just need income and a good credit history. The procedure is standard.

- For non-residents: Possible through specialized intitutions. We'll help you select a bank and guide you step by step, from application to signing.

How to Invest Remotely: “Turnkey” Management

Finding tenants: selection and screening

One of the key stages is finding good tenants. This is handled by a management company that:

- looking for tenants through trusted websites;

- shows the apartment and negotiates with candidates;

- checks if they can pay;

- properly prepares the rental contract according to local laws.

As a result, you are less likely to encounter non-payment or vacant properties, and income comes in regularly.

Renovation and furnishing for maximum profitability

If the property is purchased with a "basic" finish or requires updating, the management company can fully provide repairs and a design project:

- development and approval of the layout with the selection of style;

- purchase of furniture, equipment, and materials;

- supervising contractors and construction work;

- obtaining a license for short-term rentals, if needed.

The goal is to create an attractive apartment that generates higher rental income.

Property Management Company: Your Local Partner

The management company provides a full range of maintenance services, including occupancy and repairs:

- communication with tenants;

- maintenance of engineering systems;

- payment of utility bills (if necessary);

- preparation and submission of reports to the owner (monthly, quarterly).

The investor has access to transparent reporting on income and expenses and makes decisions remotely.

Minimal involvement – maximum efficiency

The main advantage of our turnkey service is that it saves you time. You won't have to navigate local details yourself. You can live in another country and forget about paperwork – we'll handle it all.

We work with reliable property management companies in Vienna and across Austria. This gives you a trustworthy, transparent solution.

Main risks and how to minimize them

Currency, legal and rental risks

Currency risk affects those who receive income in other currencies, such as dollars. Since all payments in Austria are made in euros, exchange rate fluctuations can reduce profits. To avoid this, you can hedge against exchange rate fluctuations or invest only in projects within the eurozone.

Legal risks arise if the transaction is executed incorrectly, the documents are not in order, or the lease agreement is unfair. Protecting yourself is simple: simply hire a competent lawyer. They will review the apartment, the seller, and all the terms and conditions, and draw up a proper contract.

Rental risks include vacancy, non-paying tenants, or difficulties with eviction. Careful selection of tenants, negotiating a lease with an experienced agent, and insurance to cover loss of income can help mitigate these risks.

The role of insurance in protecting your investment

In Austria, you can purchase different types of insurance to protect your property:

- Insurance of the apartment or house itself ( fire, flood, damage, and other problems);

- Liability insurance (for example, flooding the neighbors below);

- Insurance against loss of rental income (if the apartment cannot be rented out for any reason).

These policies help you avoid spending money on unexpected expenses due to troubles, and also maintain a stable income from renting out your property.

How to check a developer before buying

If you're buying an apartment that's still under construction, be sure to check whether the developer is trustworthy. We recommend paying attention to the following:

- What buildings has the developer already completed?

- What do people say about them?

- Are their finances stable?

- Is everything clean with the land and documents?

Be sure to involve a professional lawyer and real estate agent to verify all information before entering into a transaction.

Real estate as protection against inflation

When prices rise (inflation), investment property in Austria remains one of the most reliable ways to preserve capital. Apartments and houses in Vienna historically appreciate in value, and renting them out provides income that offsets the rising cost of living. Furthermore, the very fact of owning a "real" asset gives investors confidence and peace of mind for the long term.

Current trends and forecasts

Between 2023 and 2025, apartment and house prices in Vienna remained nearly unchanged. This happened despite rising living costs (inflation), and borrowing costs in the eurozone increased due to the European Central Bank. This market stability is no coincidence: strict regulations, a small number of new listings, and a lack of speculation create a steady and predictable environment.

But changes are already visible. As ECB rates decrease, a new chapter begins: mortgages are becoming cheaper again, making it easier to buy property. Demand is growing not only from foreigners but also from Austrians. And since the housing supply is still limited, the market is slowly but surely shifting to higher prices.

Vienna isn't like Berlin or Prague, where prices can skyrocket. Here, everything changes gradually and smoothly. We're seeing more and more people looking to buy homes in established neighborhoods – those with parks, shops, schools, and good transportation.

Vienna is changing thanks to the Smart City Vienna program, one of the best in the world. The city is growing not through new suburbs, but through the renewal of older districts. Development is focused inward: renovation, mixed-use construction, energy efficiency, and digitalization. This approach creates a high-quality urban environment that is attractive for living and investment.

Vienna is stable and comfortable to live in, attracting people from all over Austria and abroad. By 2030, the city’s population is expected to increase by around 200,000 people. However, the pace of housing construction leaves much to be desired, which will undoubtedly maintain a significant shortage of residential real estate in the long term.

Importantly, people come to Vienna for the long haul: skilled workers, families with children, and people with stable incomes. These residents pay stable rent, making real estate investments more reliable and profitable.

Finally, Vienna remains among the world's best cities to live in. Yes, Copenhagen unexpectedly took first place in 2025, but Vienna still excels in many important areas: excellent transportation, good hospitals, safe streets, beautiful buildings, high-quality education, and a pleasant climate.

What does this mean for investors? Investing in Vienna real estate isn't about making quick profits. It is a long-term, 5–10-year strategy: well-thought-out, understandable, and with minimal risk. And right now, it's especially profitable: loans are getting cheaper, the city is becoming more populated, and the city is developing. This is a great opportunity, and it's already emerging.

Case Studies: Real Investment Examples in Vienna

To illustrate how this works in real life, I'll share a few real transactions we completed for clients in 2024. We searched for each apartment specifically based on the investor's goals and taking into account their budget, their level of involvement, and their desired return.

Case 1: Second District – 64 m², yield 4.5%

For an investor who wasn't afraid to buy an apartment that might appreciate in price, we found an option in Leopoldstadt (2nd district) . The 64 m² apartment is in a 1960s building. It was in poor condition—it needed some renovation, but that helped significantly lower the purchase price.

We did some renovations for rental purposes, and the apartment quickly began generating a 4.5% annual yield, which is higher than the market average. This example perfectly illustrates the rule: buy at a good price, get a good profit.

Case 2: Fourth District – 2-bedroom apartment, yield 3.8%

The client bought an apartment in Wiedenin, in a building built in 1973. The area is very prestigious, the apartment is in a quiet, green courtyard, and the metro is very close. The investor was not from the European Union, so we had to obtain a special permit to close the deal.

Although the price was higher due to the prime location, renting out the apartment yields 3.8% annual returns. Importantly, the price of this apartment is expected to appreciate faster than the city average. This option is ideal for those looking for a secure investment with the potential for a quick return.

Case 3: Tenth District – 71 m², yield 4.2%

We bought a large apartment right next to the metro in Favoriten. The neighborhood isn't exactly prime, but it's rapidly improving, and the prices are still affordable. It's only a 15-minute drive to the city center. We chose this location because of the convenient transportation and the possibility that the area will become more popular and more expensive. As a result, the apartment is already yielding 4.2% annual income, and there's a good chance its price will increase over time as the surrounding infrastructure develops.

Case 4: New building in District 22 – 54 m², yield 3.2%

For a client who wanted a “buy and forget” investment, we found a new, turnkey apartment of 54 m² in Donaustadt. This modern property required no renovations, and we rented it out immediately. The yield here is slightly lower - 3.2% per annum. However, this is an ideal turnkey option: minimal effort and minimal hassle. An excellent choice for those who value peace of mind and investment security.

Case 5: District 15 – 3-room apartment, yield 4.4%

We found an apartment for an investor from the UAE in the Rudolfsheim-Fünfhaus. The area is convenient for travel (good public transportation) and has strong rental demand. The apartment is a three-room, 70 m² apartment in a 1980s building, near the Westbahnhof train station.

The apartment was in good condition, only needing some cosmetic renovations. We organized everything remotely, including the renovation and furniture purchase, which cost about €15,000. Thanks to the update, we quickly found tenants.

The apartment now generates a 4.4% annual return. The owner requires almost no involvement. The management company handles all routine apartment management and tenant communication. This is an excellent option for those who want a stable income and expect the apartment to appreciate in value, while managing their investment remotely and without any hassle.

Tell us what's more important to you: regular rental income, property appreciation over time, or minimal hassle? I'll find the right strategy for investing in Austrian real estate. There's a wide selection, from new builds to properties with potential for appreciation. The key to success is choosing the right area and the right approach. – Ksenia, Vienna Property Investment

Why I do this and how I can help you

Investing in Vienna real estate isn't just about the beautiful architecture. It's a way to protect your money in a country where everything is clear, safe, and transparent. I do this because there's real value here: prices rise steadily, the rules are clear, and there are almost no surprises.

Over the past few years, we've helped many clients from Europe and other countries. We've helped beginners avoid mistakes, found properties with real potential for appreciation, properly executed purchases, and calculated future income. Most importantly, we always work for you, not the seller.

My goal isn't to sell you an apartment at any price, but to help you make a smart investment decision. We're not real estate agents, developers, or intermediaries. We're your consultants. And we know where in Vienna you can find an apartment that will appreciate in price, where you can find an apartment that's easy to rent out, and where it's best not to invest at all.

We only assist with outright property purchases. We do not work with properties that are divided between multiple owners. The minimum amount we begin working with is 250,000. If you're looking to buy an an apartment or house in Vienna for long-term rental, to save money, or simply to understand the local real estate market, contact us. We'll be happy to share everything we know and help you make the right decision.

Are you new? No problem! I'll help you every step of the way: I'll handle taxes and paperwork, find an apartment, and rent it out. You practically do nothing—I'll handle the turnkey project. Everything is simple and straightforward. The main thing is to take the first step. – Ksenia, investment consultant at Vienna Property Investment