Investing in Hungarian Real Estate: What You Need to Know

In recent years, Hungary's real estate market has become a prominent destination for investors seeking a combination of affordable entry and the stability of a European jurisdiction. This article aims to provide a comprehensive analysis of the country's investment appeal: from residential properties and student rentals in Budapest to villas at Lake Balaton and opportunities for preserving capital in the European Union.

The market situation is particularly interesting right now. According to Eurostat, Central Europe is experiencing a new wave of family and business migration following the pandemic: IT specialists are moving to Hungary, international companies are opening regional offices, and tourism is growing. Budapest has become one of the fastest-growing housing markets in Europe over the past ten years: prices have doubled, but remain lower than in Austria or Germany. Flexible visa regimes and affordable living costs are also factors.

"Real estate in Hungary is the choice of investors seeking a balance between capital preservation and stable income in the EU. Budapest remains a magnet for tourists, students, and IT professionals, while regional markets like Lake Balaton and Debrecen offer attractive rental and lifestyle investment niches."

— Ksenia , investment consultant,

Vienna Property Investment

Experience and an understanding of international law are crucial for supporting transactions in this market. I, Ksenia Levina, a lawyer with experience in the EU and Asia, have been advising clients on transaction structuring, developer due diligence, and KYC/AML procedures for many years.

When comparing Hungary with Austria, the difference is clear: Budapest and the resort regions offer higher returns with a low entry barrier, while Austria offers stability and predictable regulation, but with a significantly lower yield.

Hungary's place on the European investment map

Hungary is located in the heart of Central Europe, at the intersection of key EU transport and logistics corridors. The country has become a platform for companies serving both Western and Eastern markets, and for investors, this means stable demand for housing from expats, students, and tourists alike.

Budapest occupies a unique position: it's not only the capital, but also a center of education and the IT sector. International universities operate here, coworking spaces and startup hubs are emerging, and tourist flow has already exceeded pre-COVID levels. Beyond the capital, regional markets remain attractive: Lake Balaton attracts buyers of resort property, Debrecen and Szeged have become university centers with high rental demand, and smaller towns near the borders with Austria and Slovakia are attractive to those who combine living in Hungary with work or business in other EU countries.

legal environment is fairly transparent: foreigners can purchase real estate directly, although local government approval is required in some cases. Compared to its neighbors, the country is competitive: Poland and the Czech Republic offer more developed economies but higher housing prices, while Romania remains cheaper but has less predictable regulations.

Numbeo claims that Hungary's main selling points are its relatively low price per square meter, its EU jurisdiction status, and a steady flow of tourists and students. A comparison with Austria reveals a distinct difference in approach: in Hungary, you can enter the market with a smaller investment and expect higher returns, while Austria is more suitable for investors who value capital preservation and minimal risk.

Hungary vs Austria

| Indicator | Hungary | Austria |

|---|---|---|

| Entry threshold | from €70,000 (studio in Budapest) | from €300,000 (Vienna, Salzburg) |

| Rental yield | 4-7% (in the capital), up to 8% (Balaton | 2-3% |

| Jurisdiction | EU, direct ownership | EU, direct ownership |

| Risks | above (price volatility, developers) | below (stability) |

Competitors

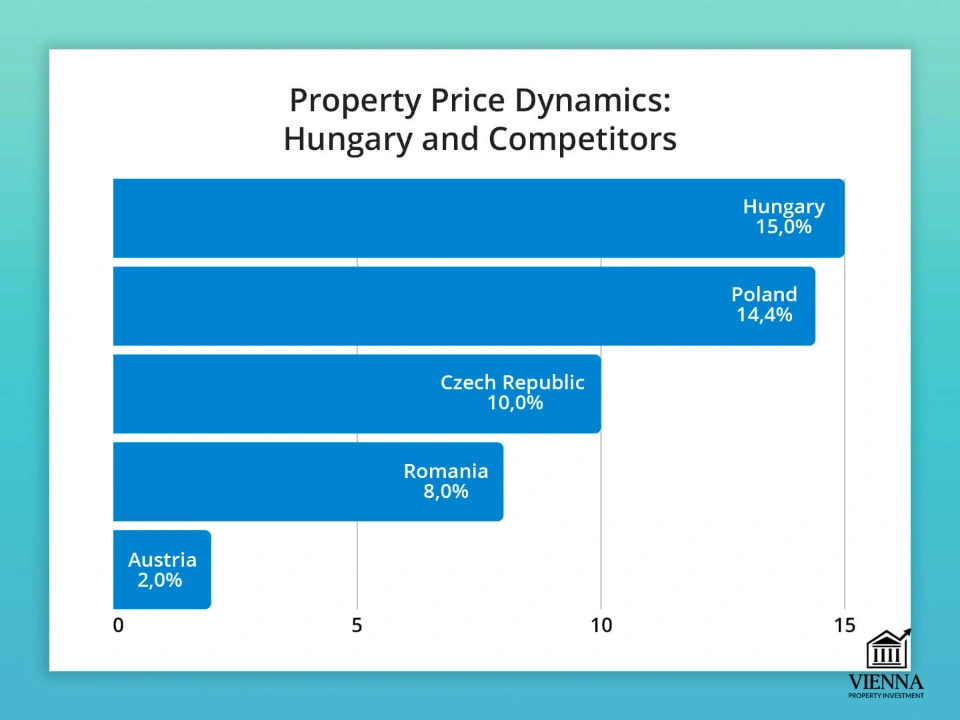

When considering Hungarian real estate investments, it's important to understand its position in the regional competition. Central and Eastern Europe has become a hotbed for capital movement, attracting both European investors seeking high returns and international buyers seeking to secure assets in an EU jurisdiction with lower entry barriers than Western Europe.

Hungary's main competitors are Poland, the Czech Republic and Romania.

Poland boasts a large domestic market and high levels of economic growth. Rental demand is strong, particularly in Warsaw and Krakow, but prices are already significantly higher than in Hungary, and yields are gradually declining.

-

For more information on scenarios, risks, and the logic behind property selection, see a separate article: "Real Estate in Poland ."

The Czech Republic, particularly Prague, is considered one of the most stable markets in the region: low risks, high rental demand, but the entry barrier is almost comparable to Austria, which limits the pool of private investors.

-

For information on rent, liquidity, and typical strategies in the Czech capital, see the separate guide " Investing in Real Estate in Prague ."

Romania remains the most accessible market in the region, particularly Bucharest and the Black Sea resorts. However, the legal system is less predictable, and the infrastructure lags behind Hungary's.

Austria can also be considered a competitor: the market is transparent and stable, but the cost of entry is several times higher, and the yield is in the range of 2–3% per annum.

Thus, Hungary appears to be an intermediate link: on the one hand, it is cheaper and more profitable than the Czech Republic or Austria, and on the other, it appears more predictable and attractive to foreigners than Romania.

| Country | Average rental yield | Prices (€/m², capital) | Accessibility for foreigners | Main advantages | Main risks |

|---|---|---|---|---|---|

| Hungary (Budapest) | 5-7% | 2 500-3 500 | Can be purchased directly (with permission) | EU jurisdiction, high tourist flow, student rentals | Short-term rental volatility |

| Poland (Warsaw) | 4-6% | 3 500-4 500 | Free access | Strong economy, population growth, expat rentals | Rising prices have reduced profitability |

| Czech Republic (Prague) | 3-4% | 4 500-6 000 | Access with permission | Stability, developed infrastructure | High entry barrier, low yield |

| Romania (Bucharest) | 6-8% | 1 500-2 000 | There is access, but the procedure is more complicated | Low entry cost, high growth | Legal and economic unpredictability |

| Austria (Vienna) | 2-3% | 6 000-8 000 | Full accessibility | High stability, developed market | Very high entry threshold, low profitability |

Hungarian Real Estate Market Overview

Over the past twenty years, the Hungarian real estate market has gone through several distinct stages, reflecting both domestic economic processes and global trends.

Since joining the European Union in 2004, Hungary has become more open and attractive to foreign investors. Buyers from Germany, Austria, and the UK, as well as investors from Russia and Israel, have actively entered the market.

Demand for housing was also stimulated domestically: Hungarian families gained access to new mortgage products, which had previously been limited. During this period, housing prices in Budapest and tourist areas (such as Lake Balaton) rose at double-digit rates.

the 2008 global marked a turning point. A sharp drop in liquidity and rising unemployment brought the real estate market to a virtual standstill. Apartment and house prices fell by an average of 20-30%, and some development projects were completely frozen. Many foreign investors abandoned the market, preferring more stable jurisdictions.

The period of stagnation lasted for several years. A new impetus only emerged in 2014-2015, when Hungary's macroeconomic situation stabilized and the country became attractive due to its relatively low prices compared to neighboring Austria and Western Europe.

The key drivers of new growth were:

- Tourism: Budapest has become one of the most popular cities for European tourists, and demand for short-term rentals has increased sharply;

- Education: Hungary's universities (including medical and technical faculties) attract students from the EU and Asia, which has created a robust student housing market;

- Foreign investment: interest was expressed by both private investors and companies looking for profitable properties for rent;

- Government policy: Tax incentives and mortgage support programs have helped increase housing affordability for local residents.

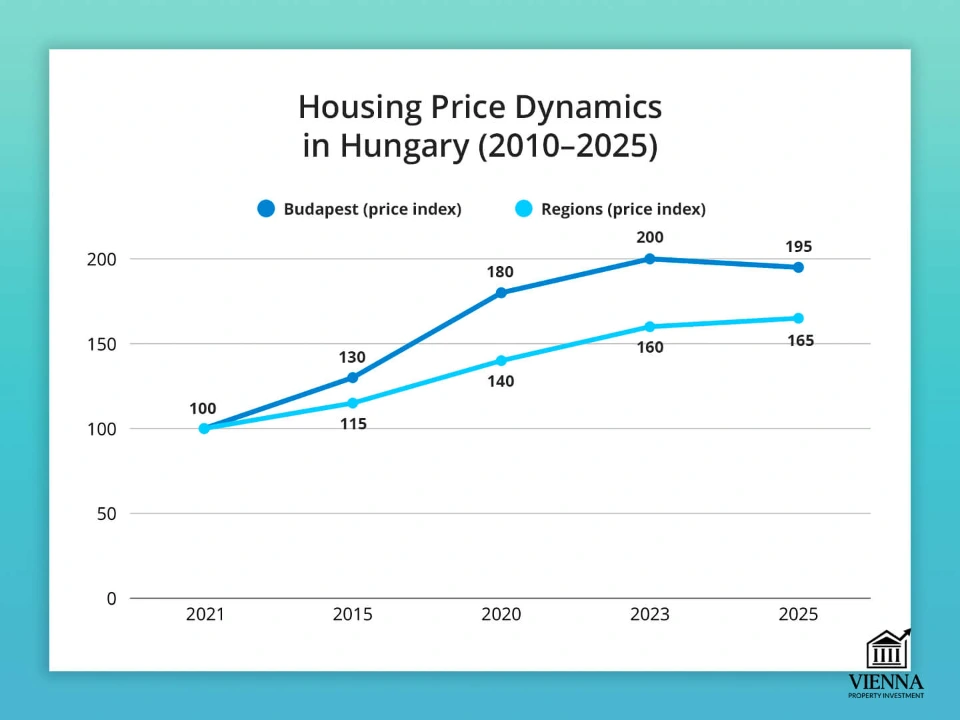

Since 2015, the market has entered a period of sustained growth. Residential prices in Budapest increased by approximately 100% over the decade (2010–2020), making the Hungarian capital one of the fastest-growing in Central and Eastern Europe. Regional growth was more modest, but even there, steady growth was observed thanks to infrastructure development and interest in resort areas.

By 2023, the Hungarian real estate market had reached its peak. Apartment prices in central Budapest had become comparable to those in second-tier Austrian cities, signaling overheating.

Against the backdrop of rising mortgage rates and declining buyer activity in 2024–2025, experts predict price stabilization with a possible correction in the secondary market, while liquid properties in the capital and near Lake Balaton retain their investment appeal.

Price dynamics (2010–2025)

The largest growth was recorded in the capital. Over the past decade, housing prices in Budapest have increased by approximately 100%, while in the regions, the dynamics were more moderate: +40-60% over the same period. Growth rates slowed in 2020-2023, but the market remained overheated due to high demand and limited supply. Stabilization is predicted by 2025, with a possible price correction in the existing market.

| Years | Budapest (price index) | Regions (price index) | Comment |

|---|---|---|---|

| 2010 | 100 | 100 | Baseline after the crisis |

| 2015 | 130 | 115 | The beginning of new growth |

| 2020 | 180 | 140 | Strong demand, growing tourism |

| 2023 | 200 | 160 | Peak prices, overheated market |

| 2025 (forecast) | 195 | 165 | Correction in the capital, stability in the regions |

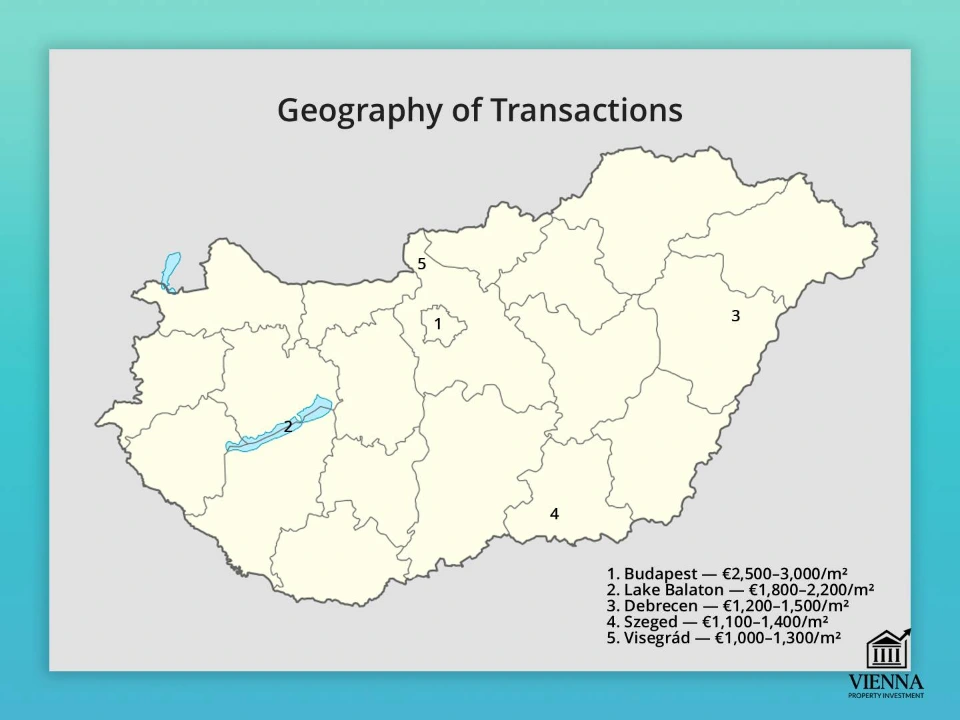

Geography of transactions

Budapest remains the central Hungarian real estate market accounting for the majority of residential transactions for both domestic and international buyers. The city attracts investors with several factors: developed infrastructure, business activity, tourist appeal, and a rich cultural heritage. Within the capital, the market is diverse: the historic center and districts along the Danube form the premium segment.

Apartment prices here and sometimes even exceed them, due to the limited supply and the prestige of the location. At the same time, the mass housing market is actively developing in residential areas – new buildings and resale apartments are in demand among young families, students, and investors looking for long-term rentals.

Budapest thus combines both the luxury and mass-market segments, offering a wide choice for buyers with different budgets.

The second major center of transactions is the Lake Balaton region , Hungary's largest resort area. Since the early 2000s, this region has consistently attracted foreign buyers, primarily Germans and Austrians, who see it as a Mediterranean experience at affordable prices.

Villas and apartments for summer vacations, as well as short-term rentals, are actively purchased here. Balaton is seen as a "resort investment" with a long-term outlook: prices are rising more slowly than in the capital, but the market remains stable thanks to a constant flow of tourists and high liquidity.

The third important destination is university towns, with Debrecen and Szeged particularly prominent. These centers of education and research provide a steady demand for rental housing from students and faculty.

Small apartments, which can easily be rented out during the school year, are particularly popular here. Investments in such properties are more pragmatic: profitability is generated by stable demand, and the risk of price declines is lower than in the overheated capital market.

close to Austria and Slovakia, play an important role in the geography of transactions They have become attractive due to the opportunity to combine lower housing prices with the benefits of working and living in neighboring countries.

Many residents of Austria and Slovakia are purchasing property here as a second home or as a base for a cross-border lifestyle. This segment has been growing particularly rapidly since 2015, when rising prices in the capital made regional real estate a more attractive alternative.

| Region | Minimum prices (€/m²) | Features that shape demand |

|---|---|---|

| Budapest | 2 500-3 000 | The capital, home to both the elite and mass-market segments, enjoys high interest from investors, renters, and tourists thanks to its developed infrastructure, business activity, and cultural appeal. |

| Lake Balaton | 1 800-2 200 | A popular resort area with strong demand from tourists and foreign buyers (especially from Germany and Austria), who prefer villas and apartments for seasonal vacations. |

| Debrecen | 1 200-1 500 | One of the largest university cities. Stable rental demand from students and faculty. Developing infrastructure and relatively affordable prices. |

| Szeged | 1 100-1 400 | A university and cultural center. Demand is primarily generated by students for long-term rentals of small apartments. It boasts a stable and predictable market. |

| Border towns (to Austria, Slovakia) | 1 000-1 300 | The proximity to Austria and Slovakia makes these regions attractive for a cross-border lifestyle. Residents of neighboring countries are showing interest, seeking to combine more affordable housing with a convenient location. |

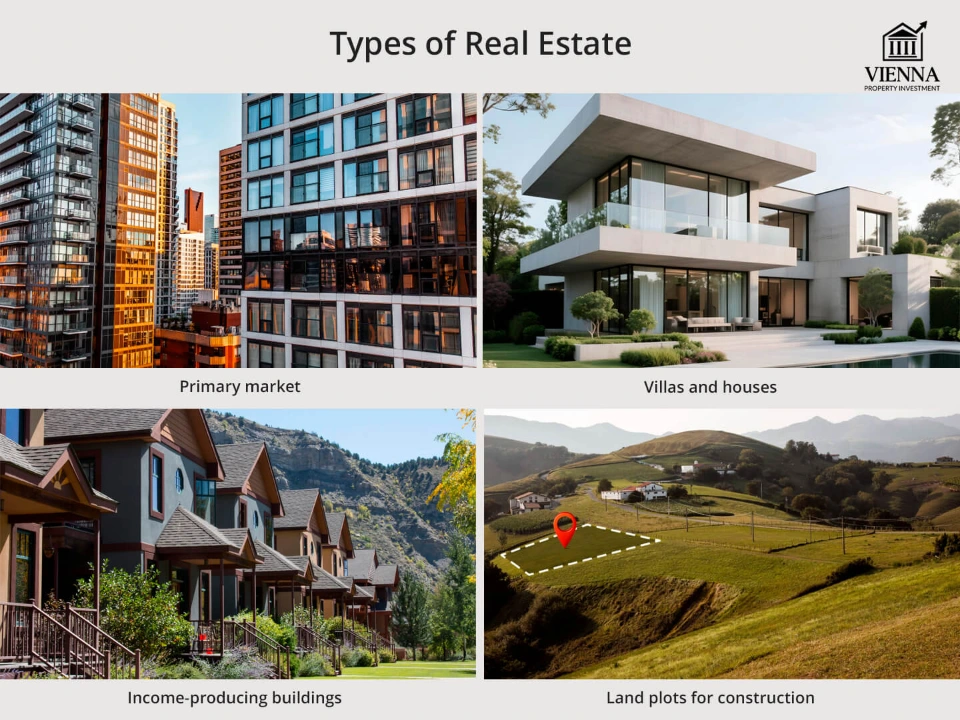

Object types

The Hungarian real estate market boasts a diverse range of formats, making it attractive to a variety of investors. Apartments represent the largest share, remaining the most liquid and sought-after asset class. Both the secondary market and a limited number of new developments are active.

The primary market is developing slowly: unlike Austria, where the construction of new complexes is institutionalized, in Hungary small projects by local developers predominate.

Villas and houses constitute a significant segment of the market especially in resort areas such as Lake Balaton. This type of housing is primarily aimed at seasonal use and short-term rentals. Many foreigners purchase homes here for personal vacations, while also considering them as long-term investments.

A special place is occupied by apartment buildings, which are particularly in demand in Budapest and university towns. These are entire buildings with apartments available for rent. This type of investment is popular among institutional and corporate investors, but is also found among private investors seeking portfolio diversification.

Finally, land for construction remains an important area. Although the acquisition process for foreigners is more complex and requires additional approvals, interest in land remains, particularly in the vicinity of Budapest and major tourist areas. This is an asset designed for the long term, driven by future urbanization and infrastructure expansion.

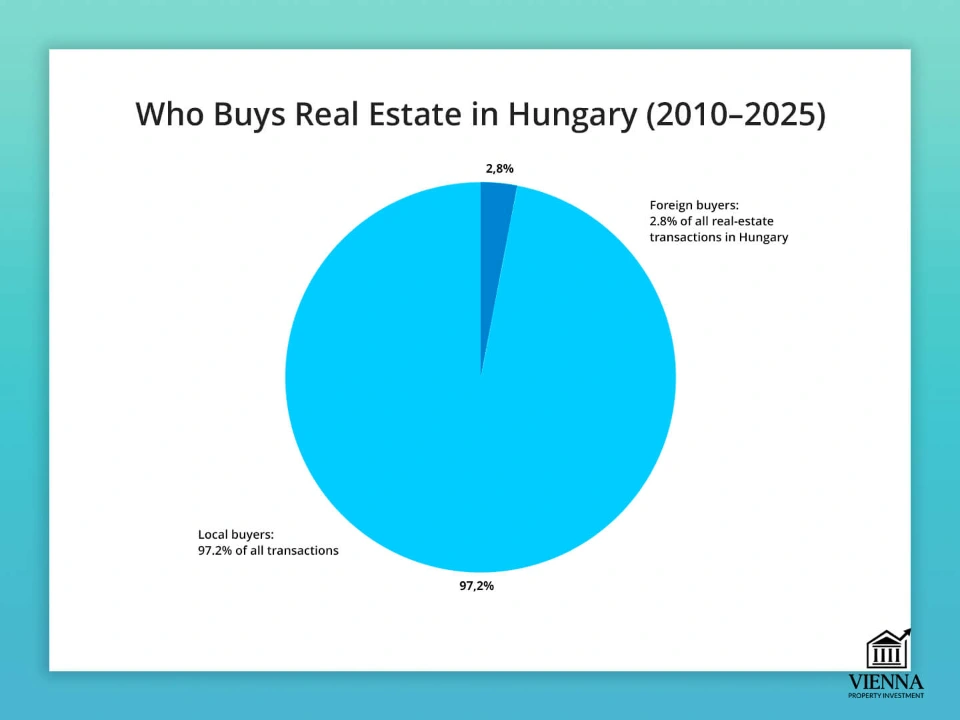

Buyers and tenants

The composition of buyers in the Hungarian market reflects its international nature. The most active foreign investors traditionally include citizens of Germany and Austria, who have historically viewed Hungary as a convenient investment destination due to its geographic proximity, linguistic, and cultural ties.

Russian buyers also play a significant role, particularly in the premium segments of Budapest and Lake Balaton, where they view real estate as a way to preserve capital. Chinese investors are entering the market through commercial real estate and apartment buildings, while Israeli investors are actively present in the residential rental segment.

From a tenant perspective, the market is divided into several key groups. One of the most significant is made up of students, who generate stable demand in university towns and Budapest. Tourists generate a significant flow of short-term rentals, particularly in the capital and resort areas.

Finally, an important niche is occupied by expats – employees of international companies and organizations working in Hungary. Their demand is primarily focused on mid- and high-end housing in prestigious areas of Budapest, where infrastructure and transportation are well-developed.

Thus, Hungary's real estate market is multilayered and oriented toward both domestic and foreign demand. Its stability is ensured by a combination of factors: its tourist appeal, educational potential, and the country's strategic location in Central Europe.

| Group | Purposes of purchase/rental | Property type |

|---|---|---|

| Buyers – Germany and Austria | Purchasing holiday accommodation (Balaton), investing in apartments and houses in Budapest. | Apartments, houses, villas near lakes |

| Buyers – Russia | Purchasing premium properties in the capital and resort areas to preserve capital. | Elite apartments, villas. |

| Buyers - China | Investments in commercial buildings and apartment buildings, long-term projects | Apartment buildings, commercial properties. |

| Buyers - Israel | Active participation in the housing market – purchasing apartments for rent. | Apartments for rent, small apartment buildings. |

| Tenants are students | Long-term rental apartments in university towns and Budapest for the duration of your studies. | Small apartments, studios. |

| Tenants are tourists | Short-term rentals in Budapest and Lake Balaton, focused on leisure and tourism. | Apartments and flats for short term rent. |

| Tenants are expats | Middle and high-class housing for rent, primarily in prestigious areas of the capital. | Business class apartments, houses in prestigious areas. |

Hungary vs Austria

| Category | Hungary | Austria |

|---|---|---|

| Foreign buyers |

|

|

| Main tenants |

|

|

| Rental format | Short-term formats predominate: daily and student rentals. | Stable long-term rentals, low market volatility. |

| Demand characteristics | A multi-level market: a combination of tourist attractiveness, educational potential and international investment. | Stability and predictability: demand comes primarily from local residents and long-term tenants. |

Ownership formats and investment methods

The Hungarian real estate market offers investors a wide range of ownership structures and investment instruments, depending on their goals, budget, and intended use. While the purchase process is generally accessible for foreigners, there are a number of considerations that must be taken into account at each stage.

Direct ownership of an apartment or house remains one of the most popular methods Foreign citizens can purchase residential property, but this requires special permission from local authorities.

Typically, the process takes several weeks and is rarely rejected, especially for residential properties without significant strategic value. This format is particularly popular with buyers considering a home for personal use, seasonal vacations, or long-term investment.

land acquisition is more complex Hungarian law more strictly regulates land transactions: foreigners are allowed to purchase land, but approvals take significantly longer, and in some cases, restrictions are possible, especially when it comes to agricultural land. However, if permission is successfully obtained, this format opens up opportunities for the construction of residential or commercial real estate.

For investors targeting apartment buildings, commercial real estate, or large projects, the legal entity model is often used. Registering a company in Hungary significantly simplifies the transaction process, as the company acts as the buyer in its own name. This approach is also convenient for those planning to manage a portfolio of properties and minimize tax risks.

Issues of co-ownership and family law deserve special attention In Hungary, property can be purchased jointly by multiple owners, making investment more accessible for partners or family members. Prenuptial agreements and inheritance law also play a significant role: having a will or agreement in place in advance helps avoid disputes and simplifies the transfer of ownership.

Opening bank accounts are an integral part of the investment process . Hungarian banks require transparency regarding the origin of funds, and foreign investors should be prepared for additional checks and documentation. Nevertheless, the country's banking system is considered reliable and actively engages with international clients.

Comparison with Austria

| Factor | Hungary | Austria |

|---|---|---|

| Direct ownership of housing | Available to foreigners with permission from local authorities. The process is relatively simple and inexpensive. | It is also available, but notary support makes the process more expensive and more formalized. |

| Land purchase | It is possible, but with restrictions and complex approval procedures, especially for agricultural land. | More strictly regulated, in some regions it is effectively closed to foreigners. |

| Purchase through a legal entity | A popular instrument for large investments. Requires company registration and accounting. | It is used, but high taxes and strict controls make this path costly. |

| Co-ownership and inheritance | A flexible system that allows for fractional ownership. Inheritance is regulated by civil law and prenuptial agreements. | More complex notarial procedures, but a higher level of legal transparency. |

| Taxes and expenses | Lower than in Austria, but bureaucracy can create delays. | Higher taxes on transactions and ownership, notary control makes the process stable. |

| Bank accounts and compliance | Transparency of the origin of funds is required; banks are actively working with foreigners. | Strict KYC rules, high requirements for proof of sources of income. |

Legal aspects of purchasing real estate

The process of purchasing real estate in Hungary is generally considered fairly straightforward, although for foreigners it requires certain approvals and the mandatory involvement of a lawyer. The transaction typically begins with the signing of a preliminary contract and the payment of a deposit, which is typically around 10% of the property's value.

This step secures the buyer's intentions and reserves the property for them. Next, the main purchase and sale agreement is drawn up and certified by a lawyer, outlining all the terms of the transaction, the payment procedure, and the timeframe for the property's delivery.

Non-EU citizens require additional permission from local authorities. This is typically a formal procedure that takes four to six weeks and rarely results in refusal, unless it concerns strategic facilities.

The final stage is registering the property rights in the land registry. Once the corresponding entry is made, the buyer is recognized as the full owner, and the entire registration process takes on average one to two months.

Due diligence is a crucial part of any transaction in Hungary. The buyer and their lawyer must ensure that the seller is indeed the sole owner of the property and that there are no outstanding debts, mortgages, or tax arrears.

A reconciliation of cadastral data and the actual condition of the property is mandatory, as discrepancies sometimes occur in practice. In cases where the property is jointly owned, notarized consent from all owners is required for the sale.

| Action | Comment |

|---|---|

| Selection of the object and verbal agreement | The buyer selects a property and negotiates a price with the seller. At this stage, the property is usually removed from the listing. |

| Preliminary agreement and deposit | A written preliminary contract is concluded. The buyer makes a deposit (usually 10% of the purchase price). This deposit reserves the property and serves as a guarantee of the buyer's commitment. |

| Due diligence | A lawyer verifies the property's ownership, any outstanding debts, mortgages, liens, and cadastral data. Without this verification, there is a high risk of potential misconduct. |

| Permit for foreigners | If the buyer is not an EU citizen, approval from local authorities is required. The process typically takes 4-6 weeks, and refusals are rare. |

| Main sales contract | The contract is prepared and certified by a lawyer, including payment terms, delivery dates, and penalties. |

| Payment of the cost | The remaining amount is transferred directly or through an escrow account (usually by agreement). |

| Registration of the transaction in the cadastre | The lawyer submits the documents to the land registry. Once the registration is completed, the buyer becomes the full owner. |

| Obtaining an extract from the cadastral register | The final stage: the buyer receives official confirmation of ownership. This typically takes up to 60 days after signing the contract. |

Comparison with Austria

The new-build market in Hungary is much less developed than in neighboring Austria. The majority of offers are on the existing market. While off-plan transactions are possible, unlike in Austria, they are not always accompanied by a well-developed buyer protection system, such as escrow accounts. This makes due diligence particularly important.

| Aspect | Hungary | Austria |

|---|---|---|

| The purchasing process | Direct contract through a lawyer. Foreigners require government permission. | A notarial system that eliminates most risks. |

| Due diligence | Conducted by the buyer's lawyer. Bureaucratic delays are possible. | Transparent and standardized procedure. |

| New buildings | Limited selection, weak buyer protection. | Strong escrow protection and a developed new-build market. |

| Transparency | The role of lawyers is less significant than in Austria. | A maximally formalized and transparent system. |

Remote purchase

Purchasing real estate in Hungary remotely is possible, but requires special attention to legal and organizational aspects. For a foreign investor, the key step is obtaining an acquisition permit, which is processed through local authorities and requires the submission of a package of documents confirming the source of financing and the legality of the transaction.

All stages, including property selection, due diligence, contract signing, and title registration, can be organized through a trusted representative or a local real estate agency with notary support. It's important to choose a reliable partner for remote support in advance to minimize the risk of errors and fraud.

When purchasing remotely, you also need to factor in taxes and additional expenses, including notary fees, transaction registration, and possible agency fees and property management costs. Remote property management is possible through professional rental services and management companies, especially if you plan to rent out the apartment short-term or long-term.

| Parameter | Hungary | Austria | Comment |

|---|---|---|---|

| Accessibility for foreign investors | High, requires permission | High for the EU, more difficult for third countries | Hungary is easier for newcomers from the CIS |

| Entrance fee | Below | Higher | Hungary offers better initial investment benefits |

| Profitability | Higher | Below | Hungary attracts investors with its returns under active management |

| Liquidity | Average | High | Austria is more stable, sales are faster |

| Bureaucracy and taxes | Average | Transparent, but higher | Hungary requires careful approach to documents |

| Remote control | Possibly, but more difficult | It's easier through agencies | Austria is more convenient for remote control |

Thus, remote purchasing in Hungary is a viable and legal strategy, but it requires careful preparation, a reliable partnership, and a systematic approach to management and profitability planning.

Taxes, fees and expenses

Hungary's tax system is significantly more lenient than Austria's, making the market attractive to investors. The main tax on property purchases is a real estate acquisition fee of 4% of the transaction price. Additional fees include legal fees, typically around 1%, and small administrative fees, rarely exceeding a few hundred euros.

Property ownership costs are minimal. Unlike Austria, where property taxes can be substantial, in Hungary they are symbolic and vary depending on the municipality, rarely exceeding €200 per year. This makes property maintenance inexpensive, and expenses are limited primarily to utility bills.

Selling a property can also be profitable: capital gains tax is 15% of the difference between the purchase and sale price, but it gradually decreases with each year of ownership and is completely eliminated after five years. Thus, long-term investors can completely avoid the sale tax.

As for rental income, a 15% income tax rate applies. In some cases, social security contributions are added if rental activity is regular. However, even taking these payments into account, the tax burden remains moderate, especially compared to Austria, where rental income is taxed progressively, ranging from 20% to 55%.

| Aspect | Hungary | Austria |

|---|---|---|

| Purchase tax | 4% | 3,5–-6% |

| Property tax | Symbolic, low | Substantial annual property tax |

| Sales tax | 15% in the first years, 0% after 5 years | Fixed 30% |

| Rent tax | 15% + possible social contributions | 2055% on a progressive scale |

| Additional expenses | Lawyer (1%), low registration fees | Notary (1.5-3%), registration fees are higher |

Hungary thus benefits from a low tax burden and cheaper transaction costs, making it attractive to those seeking affordable investment options and high flexibility. Austria, on the other hand, offers a more predictable and transparent system, which is particularly appreciated by investors willing to pay for maximum legal protection and minimal risk.

Example: buying an apartment in Budapest

Object: apartment in the center of Budapest (district VI, next to the Opera).

Area: 60 m².

Purchase price: €200,000.

Purpose: rent (long-term and short-term).

1. Initial purchase costs

| Expense item | Amount (€) | Comment |

|---|---|---|

| Price of the property | 200,000 | The price of the apartment is according to the contract. |

| Purchase tax (4%) | 8,000 | State tax on the purchase of real estate. |

| Legal services | 1,500 | Mandatory by law, fixed rate ~0.5-1% of the price. |

| Registration and cadastral fees | 200 | Duties and registration of the transaction. |

| Bank fees (if mortgage) | 1,000 | Bank commission for registration, property appraisal (optional). |

| Total initially | 210,700 | Total purchase costs. |

2. Annual Ownership Costs

| Article | Amount (€ per year) | Comment |

|---|---|---|

| Property tax | 150 | In Hungary it is very low, almost symbolic. |

| Maintenance and utilities (HOA, heating, repairs) | 1,200 | Depending on the house, ~100 €/month. |

| Apartment insurance | 100 | Basic property insurance. |

| Total | 1,450 | Annual maintenance costs. |

3. Rental income

Long term rent (12 months):

- Average rent in the center of Budapest: €12/m² → €720/month.

- Income per year: €8,640.

Short-term rentals (Airbnb):

- At 65% occupancy and €60/night → ~€14,000 per year.

- (But the costs of cleaning, service, and management are higher – up to 25% of income).

- Net income: €10,500.

4. Taxation of rent

In Hungary, the rental tax is 15% of income + social security contribution (up to a ceiling).

Let's assume a long-term lease (for a conservative scenario):

Income: €8,640

Tax (15%): €1,296

Net income: €7,344

5. Final calculation of profitability

| Indicator | Amount (€) |

|---|---|

| Initial investment (including taxes and legal fees) | 210,700 |

| Net rental income (long-term) | 7,344 / year |

| Net yield | ~3.5% per annum |

| For short-term rentals | ~5% per annum |

6. Capital gains

Historically, Budapest shows price growth of ~5-7% per year.

If the apartment is worth €250,000 in 5 years, then:

- Sale: €250,000

- Capital gains tax: 0% (if held for >5 years)

- Net profit: €39,300 (growth + rental income).

Thus, the investor receives a double effect:

- stable cash flow from rent (3.5–5% per annum),

- increase in asset value over a 5-10 year horizon.

Visas and residence in Hungary

Purchasing real estate and obtaining a residence permit. Hungary, unlike several southern European countries (such as Portugal, Greece, or Spain), does not offer a direct "golden visa" program. This means that simply purchasing an apartment or house, even one worth several hundred thousand euros, does not automatically grant residency.

However, owning real estate can serve as an indirect advantage when applying for other residency categories: it demonstrates the applicant's connection to the country, their financial solvency, and the presence of a center of interest in Hungary.

Alternative routes to obtaining a residence permit. Since real estate is not a valid basis for legalization, foreigners typically choose other channels to legalize their residence:

- Through business: opening a company in Hungary and registering your business activity. Having a real business, employees, and tax payments significantly increases your chances of obtaining a residence permit.

- Through income and financial independence: Wealthy foreigners can prove passive income (for example, from rental property or investments) and obtain residency on this basis.

- Digital nomad programs: A key tool in recent years is the White Card, which allows you to work remotely in Hungary while living in the EU. It's designed for freelancers, IT specialists, and remote employees of international companies.

- National visas: Certain residency categories may be issued for students, researchers, and family reunifications. In such cases, real estate plays a supporting role (as a guarantee of housing).

Lifestyle and quality of life. Despite the lack of a direct "golden visa," Hungary remains an attractive country for relocation.

- The cost of living is significantly lower than in Austria or Germany: rent, food, and services in Budapest are on average 20-40% cheaper.

- Medicine is more accessible than in Western Europe, and private clinics offer quality service at reasonable prices.

- The country's geographic location makes it convenient for travel: Vienna is just 2.5 hours away by train or car, and key transport corridors of Central Europe pass through Budapest.

Hungary vs Austria

| Parameter | Hungary | Austria |

|---|---|---|

| Golden Visa by Purchase | No | No |

| Residence permit upon purchase | Not provided | Not provided |

| Residence permit through income | Perhaps the demands are moderate | Yes, but there is a strict threshold (significant amounts) |

| Digital Nomad (White Card) | Yes, available to foreigners | There is no separate program |

| Cost of living | Below | Higher |

| Medicine | Affordable, cheaper | More expensive, but top-tier |

| An atmosphere for expats | Less formalized, easier to adapt | More formal, bureaucratic |

Rent and income in Hungary

The Hungarian real estate market is formed by two key rental areas:

Short-term rentals are primarily aimed at tourists. Budapest is among the top 10 European capitals for tourist overnight stays, and Lake Balaton remains a popular summer destination. Apartments in the city center or lakeside apartments can generate higher income than long-term rentals during the high season.

Long-term rentals are provided by students (in Budapest and university towns such as Debrecen and Szeged) and expats. Employees of international companies and organizations prefer housing in prestigious areas of the capital. This segment is more stable and predictable than short-term rentals, but yields lower returns.

Profitability by region

The yield in Hungary is significantly higher than in Austria, which is explained by the lower entry price and greater demand for rentals.

| Region | Average yield | Peculiarities |

|---|---|---|

| Budapest | 4-6% | Demand is high among students, expats, and tourists. Apartments in the city center bring in higher short-term rental income. |

| Balaton | 5-7% | Seasonal market. In the summer, rentals are almost completely filled, while in the winter, demand is minimal. |

| University towns (Debrecen, Szeged, Pécs) | 4-5% | Stable demand from students, relatively low entrance prices. |

| Small towns and regions | 3-4% | Less liquid market, demand is limited to local residents. |

Comparison with Austria

Austria is traditionally considered a more "conservative" market for rental investment:

- The yield in large cities (Vienna, Salzburg, Innsbruck) is 2–3% per annum.

- However, the rentals there are mostly long-term, with low volatility, which ensures high income predictability.

- Hungary, on the other hand, allows for 1.5-2 times higher returns, but at the expense of greater dependence on tourism and student demand.

| Parameter | Hungary | Austria |

|---|---|---|

| Yield | 4-6% on average, up to 7% at Lake Balaton | 2-3% on average |

| Main tenants | Tourists, students, expats | Local residents, families, long-term residents |

| Stability | Dependence on tourism and the economy | High predictability, low risks |

| Entry barrier | Low (apartments in Budapest from €150,000-200,000) | High (Vienna from €400-500 thousand) |

Thus, Hungary offers higher yields and an affordable entry threshold for investors, but requires careful selection of the region and rental strategy. Austria, by contrast, offers stability and low risk, but yields are significantly more modest.

Hungary vs Austria

| Parameter | Hungary | Austria |

|---|---|---|

| Yield | 5-7% per annum | 2-4% per annum |

| Entry price | Affordable (€60k-€250k) | High (€250k-€700k) |

| Investment objective | Rent, income, capital growth | Capital preservation, premium housing |

| Liquidity | Average | High (especially in Vienna) |

| Market | More dynamic, secondary prevails | Stable, high quality real estate |

Where to shop in Hungary

Budapest is the main market. Budapest is the capital and largest city of Hungary, home to the country's economic and cultural life. Real estate here is in demand for both long-term rentals and short-term rentals to tourists. The districts with the greatest liquidity are the 5th, 6th, and 7th arrondissements (the city center and surrounding areas).

High demand is driven by students, expats, and tourists. Investing in apartments in Budapest provides a stable income and relatively quick liquidity upon resale.

Lake Balaton – resort real estate. Lake Balaton is the largest lake in Central Europe and a popular tourist destination. Houses and villas are purchased here for seasonal rentals and vacations. During the high season, yields can be higher than in the capital, but off-season income declines. Resort real estate is ideal for investors focused on short-term rentals and portfolio diversification.

Debrecen, Szeged – student rentals. Debrecen and Szeged are university cities with a steady demand for student rentals. Investing in apartments near universities provides a stable flow of tenants, low competition, and a quick return on investment. Risk is limited, but liquidity is lower than in Budapest, and returns are not dependent on the tourist season.

Provincial Lifestyle. Hungary's small towns and villages attract buyers seeking a quiet life, a green environment, and country homes. Prices here are lower than in large cities, and properties often feature spacious plots. This is a suitable option for those who want to combine private living with the possibility of long-term capital growth, but rental yields are low.

| Region | Market Features | Target audience | Approximate prices | Advantages | Risks |

|---|---|---|---|---|---|

| Budapest | A major real estate market with a high number of transactions, developed infrastructure, and good liquidity | Rental investors, foreign buyers | Apartments: €100-250k, penthouses: €300-600k | High rental income (yield), liquidity, developed transport network | Higher competition, prices are growing more slowly than in the premium segment |

| Balaton | Resort property, lake, tourist area | Short-term rental investors, families, retirees | Houses and villas: €200-500k | High seasonal income, outdoor recreation | Seasonality of income, limited liquidity |

| Debrecen, Szeged | Student rentals, university towns | Investors in long-term student rentals | Apartments: €60-120k | Stable rental demand, low competition | Limited opportunities for capital growth, less liquidity |

| Province (Little Hungary) | Lifestyle real estate, country houses, nature | People looking for a quiet life | Houses: €80-180k | Affordable price, environmentally friendly | Low rental income, difficulty reselling |

Secondary market and new buildings

The Hungarian real estate market is predominantly made up of existing homes. These apartments and houses are immediately available for rent, making them attractive to investors. The existing market offers a wide range of quality, location, and price points, allowing for a variety of investment strategies. A potential downside is the need for renovation and modernization to increase returns.

New buildings represent a smaller market share, but they offer modern layouts, energy efficiency, and minimal operating costs. New buildings are priced higher than existing properties, and the payback period can be longer. For some investors, this is justified, as new buildings and apartments attract premium renters and buyers.

| Parameter | Secondary market | New buildings |

|---|---|---|

| Market share | The bulk of transactions (≈70-80%) | Limited offer |

| Quality | It varies depending on the year of construction | Modern standards, energy efficiency |

| Prices | Budapest: From €100,000 per apartment, cheaper in the regions | Budapest: from €150k-200k, Balaton: from €200k per house |

| Payback period | Faster with turnkey rentals | Longer, but higher potential returns |

| Advantages | Wide selection, possibility to choose the area, rental income immediately | Modern layouts, minimal renovations |

| Risks | Repair and modernization | Long-term construction, market may change |

Prices and examples:

- Budapest apartments: from €100k to €250k

- Houses near Lake Balaton: from €200k to €500k

- Resale properties are cheaper than new buildings, but require attention to the condition of the property.

Comparison with Austria

| Criterion | Hungary | Austria |

|---|---|---|

| Entrance fee | Below (€100k-200k per apartment) | Above (€300k-700k per apartment) |

| Secondary market volume | High | Limited, new build market prevails |

| Quality | Average, requires selection | Tall, modern construction |

| Rental yield | 5-7% | 2-4% |

| Sales speed | Average | High, especially in Vienna |

In Hungary, market entry is easier and the secondary market is more abundant, increasing investor flexibility. In Austria, prices are higher and construction quality is consistently high, making the market attractive for long-term capital holdings, but yields are lower.

Alternative investment strategies

Apartment buildings. Multi-apartment buildings offer a diversified income stream and reduce the risk of tenant vacancy. The main markets for such properties are Budapest and student cities. Management requires active oversight of tenants and maintenance, but yields are often higher than those of single-apartment buildings.

Student rentals. Investing in apartments near universities provides stable demand and a nearly constant income. Such properties are in demand regardless of economic downturns. The main drawbacks are seasonal fluctuations and relatively low resale value.

Resort properties. Properties at Lake Balaton and in Hungary's thermal spa areas are suitable for short-term rentals to tourists. The advantage is high income during peak season. The disadvantage is the need for property management and seasonal income instability.

Commercial real estate. Offices, warehouses, and retail space in Hungary offer opportunities for diversification and long-term income. They require more complex management and legal considerations, but often provide a stable rental income stream.

Land in the countryside. Land plots are relatively inexpensive and suitable for long-term investment or construction. The main advantage is the potential for appreciation. The disadvantage is low liquidity and the lack of income until the project is completed.

| Strategy | Description | Market / Target Audience | Advantages | Risks/Limitations |

|---|---|---|---|---|

| Apartment buildings | Apartment buildings for rent | Budapest, student cities | High returns, diversification | High entry cost, managing multiple tenants |

| Rent for students | Apartments near universities | Debrecen, Szeged, Pecs | Stable demand, low competition | Limited liquidity, seasonal fluctuations |

| Resort real estate | Houses and apartments near Lake Balaton and thermal spas | Tourists, families, short-term rentals | High income during the season, attractive location | Seasonality, management required |

| Commercial real estate | Offices, warehouses, retail space | Budapest, industrial zones | Portfolio diversification, long-term tenants | More complex management, legal nuances |

| Land in the province | Plots for construction or agriculture | Countryside Hungary | Affordable price, long-term value growth | Low liquidity, limited income without construction |

Comparison of strategies: Hungary vs. Austria

In Hungary, student and tourist investments are popular, as returns are higher and entry costs are lower.

In Austria, preference is given to offices and premium housing, where the market is more stable but rental yields are lower.

| Strategy | Hungary | Austria |

|---|---|---|

| Students | High rental potential | Limited demand |

| Tourism / resorts | Balaton, thermal baths, seasonal income | The Alps, premium properties, stable income |

| Offices / Commerce | Mid-market, limited growth | High demand, long term rentals |

| Premium housing | Fewer objects | Core segment, capital preservation |

Risks and Disadvantages

Before deciding to purchase real estate in Hungary, it's important to consider potential risks and disadvantages that may impact the timeframe, profitability, and ease of ownership. The main challenges relate to bureaucratic procedures, economic and political instability, and restrictions on short-term rentals, especially in tourist areas. Understanding these factors helps investors assess their prospects and make an informed decision.

Bureaucracy and purchase permits

Purchasing real estate in Hungary requires significant bureaucratic procedures, especially for foreign citizens. To purchase real estate, a foreigner must obtain permission from the Hungarian Ministry of Justice.

The process may include verifying funding sources, coordinating the transaction with local authorities, and preparing notarial deeds. This can take anywhere from several weeks to several months, depending on the type of property and the region

In Austria, the process is significantly simpler for EU citizens: there are virtually no restrictions on purchasing real estate, while for citizens of other countries, the procedure is also regulated, but is more transparent and predictable.

Economic and political volatility

Hungary is characterized by relatively high political instability compared to Austria. Political volatility can manifest itself in changes to tax policy, rental regulations, and investment incentives. Economic instability is also associated with fluctuations in the forint against the euro, which impacts real investment returns for foreigners.

Austria, by contrast, enjoys a stable political and economic environment, with low risks of legislative changes and high predictability for investors.

Rental Restrictions (Airbnb in Budapest)

Budapest has strict regulations on short-term rentals, including platforms like Airbnb. Some areas require special licenses, and tourist areas may impose quotas on the number of apartments allowed to be rented. Violating these regulations can result in fines and a ban on future rentals.

In Austria, there are fewer such restrictions, but major cities such as Vienna are also gradually introducing restrictions on short-term rentals to regulate the housing market.

Accommodation and lifestyle

Life in Hungary combines the comforts of modern infrastructure with a rich cultural and historical heritage. Cities and towns offer a well-developed public transportation network, modern healthcare services, and a wide range of amenities and recreational facilities.

The cost of living is generally lower than in neighboring Central European countries, allowing for a more free and varied lifestyle on the same income.

The lifestyle here is characterized by a relaxed pace, a combination of work and leisure, and active participation in cultural life: theaters, museums, concerts, festivals, and sporting events are available year-round.

The expat community is active and supportive, facilitating integration, and the availability of high-quality healthcare and educational institutions creates a comfortable environment for families. Overall, Hungary offers a harmonious combination of affordability, cultural richness, and a high quality of life, making it an attractive choice for permanent residence and long-term stays.

Hungary vs Austria

| Indicator | Hungary | Austria |

|---|---|---|

| Cost of living | Lower, more accessible | Higher, more expensive |

| Quality of medicine | Good, private clinics are better | Very high, public and private clinics at world level |

| Cultural life | Active, lots of events | High level, more conservative |

| Expat community | Developed, easy to integrate | Developed, but more expensive |

| Lifestyle | Southern, relaxed, leisure-oriented | A more stringent, higher level of comfort and safety |

Hungary as a "Central European hub"

Hungary's unique geographical location in the heart of Europe makes it a convenient and strategic location for both investment and residence. Easy transportation access, developed infrastructure, and proximity to the EU's major economic centers make the country attractive to investors, digital nomads, and families seeking a balance between quality of life and cost.

For investors

Hungary offers high yield potential with a relatively low entry cost. Residential apartments in Budapest and popular tourist areas can generate stable rental income, particularly in the short-term rental segment, despite existing restrictions.

Commercial real estate in major cities also attracts foreign investment due to its stable demand and business development opportunities. Hungary's main advantage is the opportunity to achieve attractive returns with moderate investment, which is more difficult to achieve in more expensive and stable Central European countries.

For digital nomads (White Card)

The White Card program allows foreign citizens to legally live and work in Hungary, creating a favorable environment for remote professionals, startups, and freelancers. Hungary offers a well-developed infrastructure for online work: high-speed internet, coworking spaces, cafes with coworking areas, and a vibrant expat community, making the country attractive to those seeking a combination of low costs and the opportunity to comfortably work remotely.

For families

Hungary offers affordable international schools and universities for families, which is essential when moving with children. A variety of cultural and sporting events, the safety of most neighborhoods, and the relatively low cost of living make the country a comfortable place to live. Furthermore, the country is actively developing its children's infrastructure, including kindergartens, sports clubs, and cultural activities.

Comparison with Austria

Compared to Austria, Hungary stands out for its accessibility and high investment returns. While Austria offers the most stable economic and political environment, a high standard of living, and prestige, its cost of living and real estate is significantly higher. Hungary offers greater returns on investment with lower initial costs, but the risks are higher due to greater political and economic volatility.

For digital nomads, Hungary offers simpler and more flexible conditions thanks to its White Card program and relatively low living costs, while Austria's freelance visa programs are accessible but more expensive, and the cost of living and rent is significantly higher.

For families, Hungary attracts with its affordable educational institutions and moderate living costs, while Austria offers a high level of comfort, prestige and stability, but requires a significantly larger budget.

Hungary thus emerges as a dynamic and accessible Central European hub with potential for profitability, while Austria is a more conservative choice with guaranteed stability, a high standard of living and prestige.

Exiting an investment

Selling. Real estate liquidity depends heavily on location. In Budapest, selling a home is relatively easy due to high demand, but in less popular areas, the process can take several months.

Exposure times. The average time to sell an apartment in Hungary is 3-6 months, depending on the property's condition, location, and market conditions.

Taxes on sale. When selling real estate in Hungary, the capital gains tax is 15% for individuals (if the property has been owned for less than five years, the tax is then reduced to 0%). In Austria, the capital gains tax is 30%, but exemptions are available for long-term leases or for using the property as a primary residence.

Comparison with Austria

| Indicator | Hungary | Austria |

|---|---|---|

| Liquidity | Below, depends on the city | High, especially in large cities |

| Sale period | 3-6 months | Usually faster, stable demand |

| Taxes on sale | 15% for short-term sale | 30%, discounts are possible |

| Income predictability | Average, depends on region and demand | High, the market is stable |

My expert opinion: Oksana Zhushman

I am a real estate consultant with over ten years of experience in the EU market. During this time, I have been involved in a wide range of transactions, from residential to commercial properties, including working with foreign investors and complex ownership structures.

In my experience, the key to successful investment is knowledge of local legislation and the specifics of regional markets. Working in various EU countries has allowed me to formulate universal rules for property valuation, risk minimization, and profitability planning.

When choosing a property, I always conduct a comprehensive due diligence process: verifying the legal documents, ownership history, encumbrances, debts, and whether the property meets the projected income target. I recommend calculating the potential rental income, taking into account seasonality, tenant type, and property management costs, to understand the real financial prospects in advance.

In Hungary, there are various forms of ownership: individual, company, and joint ownership. Each form has its own tax implications: property tax, rental income tax, and capital gains tax. Choosing the right form of ownership allows you to optimize taxes and minimize bureaucratic complications, and I always take this into account when planning a transaction.

Investment scenarios:

- In a conservative scenario, I usually recommend buying apartments in Budapest with long-term leases – this means minimal risk, stable income, and high liquidity.

- A balanced scenario would be to invest in real estate on Lake Balaton, combining rental income with the opportunity to use the property for recreation or lifestyle investment.

- The aggressive scenario involves apartment buildings or apartments for student rentals – these offer higher returns, but require active management and a willingness to cope with fluctuations in demand.

In my opinion, the optimal strategy often involves combining two markets: the stability of Austria and the profitability of Hungary. This approach allows for both minimizing risk and achieving high returns, combining predictability and dynamism.

"Investing in real estate in Hungary offers not only comfortable living and a cultural lifestyle, but also returns that often exceed the average in neighboring Central European countries. I support clients through every stage of the transaction: from property selection and due diligence to arranging rentals and exit planning."

— Ksenia , investment consultant,

Vienna Property Investment

Conclusion

Hungary and Austria offer different approaches to real estate investment. Hungary is better suited for investors seeking yield, affordability, and active property management. Austria is preferred by those seeking stability, prestige, and a predictable market. Therefore, real estate in Austria is often viewed as a defensive component of a portfolio, while Hungary is seen as a more profitable option.

For a successful investment, it is important to engage legal counsel, conduct thorough due diligence, and plan an exit strategy in advance, taking into account liquidity, taxes, and the timing of the sale.

The forecast to 2030 is as follows: Hungary expects tourism growth, infrastructure development, and increased regulation of short-term rentals, creating both new opportunities and risks. Austria maintains a stable market with moderate price growth and minimal yield fluctuations.