Investing in Prague Real Estate: What to Do and How to Do It

Prague is one of the most attractive markets in Central Europe for private investors seeking a balance between stability and strong growth potential. Unlike Western European markets, where prices have long peaked and rental yields are declining, Prague continues to grow, maintaining moderate prices and high demand.

The Czech Republic has a strong economy, supported by industry, the IT sector, banking, and tourism. The country's GDP is growing steadily, and the unemployment rate remains one of the lowest in the EU. This creates a foundation for long-term demand for housing, both from local residents and from foreigners looking to buy an apartment in Prague or simply an affordable house in the Czech Republic without intermediaries.

Prague is interesting for several reasons:

- The Czech Republic has a stable economy. Unlike many EU countries, the Czech Republic does not experience sharp economic fluctuations. The national currency, the Czech crown, remains relatively stable, and the central bank pursues a prudent policy.

- Growing tourist flow. Prague consistently ranks among the top 10 most visited cities in Europe. In 2024, the city was visited by over 9 million tourists, supporting high demand for short-term rentals and hotel projects.

- Huge domestic demand. Prague is a university hub for Central Europe. Tens of thousands of students from the Czech Republic and other countries study here, as well as a large population of digital nomads, creating a strong demand for long-term rentals.

- Affordable prices compared to Austria and Germany. The average price per square meter in Prague is half that of Vienna and almost three times lower than Munich, making market entry less capital-intensive and opening up opportunities for growth.

I, Ksenia Levina, have been supporting international real estate transactions for over 15 years, advising both private investors and investment funds. My experience includes transactions in the Czech Republic, Austria, Germany, and Switzerland. Thanks to my extensive experience, I have learned to recognize the strengths and weaknesses of different markets.

I view Vienna as a capital preservation market: it's stable and reliable, but doesn't offer significant price growth. Prague, on the other hand, is a market of opportunities, where you can find properties with good growth potential and yield, including through short-term rentals and renovation projects.

"The Prague real estate market combines stability and growth, attracting investors of all levels. The city's development and tourism potential support rental demand and price growth. I support clients through every stage: from property selection to legal formalities and investment management."

— Ksenia , investment consultant,

Vienna Property Investment

Prague on the European investment map

Prague occupies a strategic location in the center of Europe, making it a vital transport and logistics hub. Key cargo routes pass through the city, and Václav Havel International Airport connects the Czech capital with over 100 cities worldwide. This strategic location facilitates the development of business, tourism, and the economy as a whole.

The Czech Republic is a member of the EU and the Schengen Area, ensuring a high level of legal protection and transparency for investors. The country has an investment safety rating comparable to Austria, while remaining more affordable in terms of market entry costs.

Comparison with other Central European capitals:

| City | Average price per square meter in the city center | Long-term rental yield | Tourist flow (million/year) | Nature of the market |

|---|---|---|---|---|

| Prague | €6 000-7 500 | 4,5-6% | 9,2 | Dynamic growth |

| Vienna | €10 500-12 000 | 2,5-3,2% | 8,7 | Stability and predictability |

| Budapest | €4 500-5 500 | 5,5-7% | 6,5 | Strong growth, but higher risks |

| Berlin | €7 500-9 000 | 3,0-3,8% | 14,0 | Balance |

Prague offers the best of both worlds: it is more stable and predictable than Budapest, yet offers greater growth and profitability potential than Vienna or Berlin.

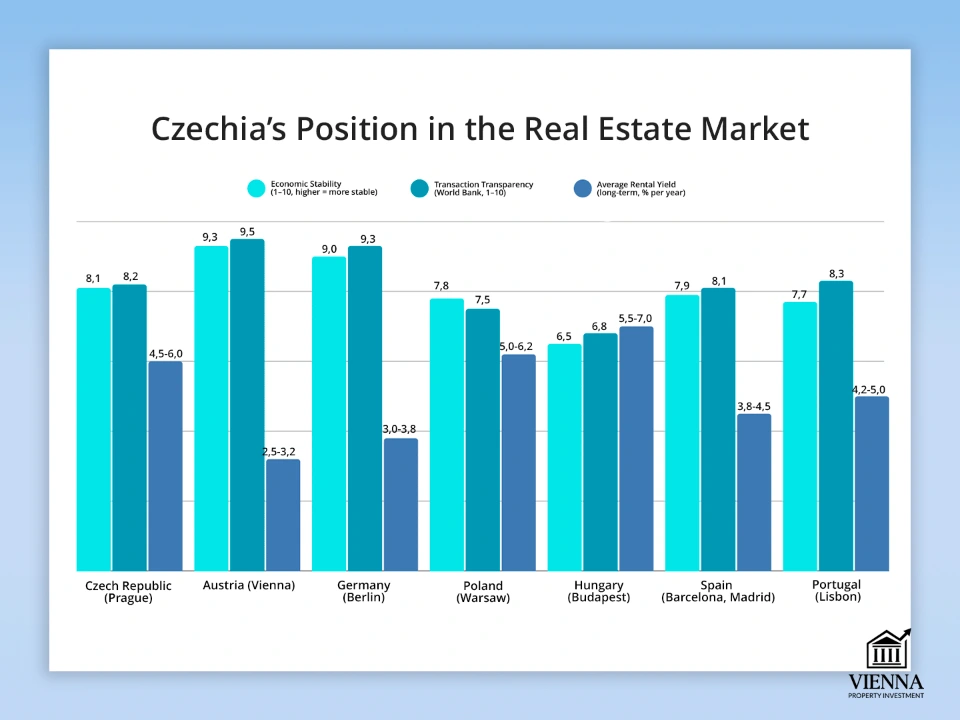

Below is a comparative ranking of European countries based on key parameters —economic stability, transaction transparency, and rental yield—based on data from PWC Real Estate 2025 , the World Bank , and Numbeo . This table helps you understand how Prague compares to its competitors and why interest in the Czech real estate market is growing.

| Country / Indicator | Economic stability (1-10, higher = more stable) | Transparency of transactions (World Bank, 1-10) | Average rental yield (long-term, % per annum) | Comment |

|---|---|---|---|---|

| Czech Republic (Prague) | 8,1 | 8,2 | 4,5-6,0 | A good balance between stability and profitability. High demand among tourists and IT professionals. |

| Austria (Vienna) | 9,3 | 9,5 | 2,5-3,2 | Maximum investor protection and transparency, but low profitability. |

| Germany (Berlin) | 9,0 | 9,3 | 3,0–3,8 | Stable market, but strong rent controls reduce returns. |

| Poland (Warsaw) | 7,8 | 7,5 | 5,0-6,2 | Growing market, moderate risks and good prospects for value growth. |

| Hungary (Budapest) | 6,5 | 6,8 | 5,5-7,0 | High returns, but unstable economy and weak legal protection. |

| Spain (Barcelona, Madrid) | 7,9 | 8,1 | 3,8-4,5 | Good tourist market, but highly seasonal. |

| Portugal (Lisbon) | 7,7 | 8,3 | 4,2-5,0 | Attractive for Golden Visa holders, high demand for short-term rentals. |

Tourism as a market driver

Prague is a European tourist magnet. Thanks to its architecture, cultural heritage, and local cuisine, the city attracts millions of visitors annually. In 2024, tourist arrivals exceeded 9 million, and by 2030, they are projected to grow to 11-12 million. This ensures high demand for short-term rentals, which is especially important for investors working with properties in the city center or in areas with developed infrastructure.

Domestic demand

Besides tourism, Prague has strong domestic demand for rental and purchase housing. The city is growing rapidly thanks to students, young professionals, and international companies opening offices in the Czech Republic. Many foreign professionals choose to rent apartments in Prague long-term, which supports long-term rental yields at 4.5-6% per annum—higher than in Vienna, where yields rarely exceed 3%.

Reasons for the interest of investors from the EU and CIS countries in Prague

In recent years, many investors have begun to shift from Austria and Germany to the Czech Republic. The main reasons include lower entry barriers, high price growth (averaging 6-8% per year), attractive yields, and less stringent rental restrictions. Vienna's market is more mature and regulated, while Prague offers more scope for active strategies: renovation of older housing stock, short-term rentals, and conversion of buildings into apartments.

Prague has thus become one of the key investment cities in Central Europe, offering an attractive balance between investment security and the possibility of high returns.

Prague's competitors in the real estate market

Prague is a strong player on the European investment map, but it's not the only city in the region attracting investors. Central and Eastern European markets are developing dynamically, and each has its own characteristics, levels of return, and risks.

Prague competes with both more stable markets like Vienna and Berlin, as well as more aggressive ones like Budapest and Warsaw. The choice between these cities depends on the investor's goals: capital preservation, rapid growth, or high returns through riskier strategies.

| Indicator | Prague (Czech Republic) | Vienna (Austria) | Budapest (Hungary) | Berlin (Germany) | Warsaw (Poland) |

|---|---|---|---|---|---|

| Average price per square meter, center | €6 000-7 500 | €10 500-12 000 | €4 500-5 500 | €7 500-9 000 | €4 000-4 800 |

| Long-term rental yield | 4,5-6% | 2,5-3,2% | 5,5-7% | 3,0-3,8% | 5,0-6,2% |

| Short-term rental yield | 7-9% | 4-5% | 8-10% | 5-6% | 7-8% |

| Time the property has been on the market (sale) | 4-6 months. | 2-3 months. | 6-9 months. | 3-5 months. | 5-7 months. |

| Risk of changes in legislation | Average | Short | High | Short | Average |

| Legal protection of investors | High | Very high | Average | Very high | Average |

| The main type of investors | Private funds | Funds, HNWI* | Private investors | Funds, institutions | Private, corporate |

| Tourist flow (million/year) | 9,2 | 8,7 | 6,5 | 14,0 | 4,8 |

*HNWI – high-net-worth individuals, wealthy private investors.

Vienna (Austria) – stability and capital preservation

Vienna is a premium, highly regulated market. Housing prices in Vienna remain virtually constant, and rental rates are stable. However, yields are low, and the market has seen slow growth in recent years. The city is suitable for investors who prioritize security and long-term capital protection.

- Pros: high level of legal protection, minimal risks, high liquidity.

- Cons: low profitability, high entry threshold.

Budapest (Hungary) – high returns and risks

Budapest is considered one of the most promising markets in the region in terms of yield. Real estate prices here are lower than in Prague, and short-term rental yields can reach 8-10% per annum. However, the market is less stable, and political and economic risks are higher.

- Pros: low prices, high profitability, active tourist flow.

- Cons: unstable economy, weak legal protection, possible sharp price fluctuations.

Berlin (Germany) – stability with restrictions

Germany's largest real estate market , attractive to large investors and funds. However, strict rent regulations and high taxes make it less attractive to private investors, especially those from abroad. Prices are rising, but at a moderate pace, and yields rarely exceed 3.5% per annum.

- Pros: strong economy, high demand for housing, transparency of transactions.

- Cons: Strict rent control laws, highly competitive market.

Warsaw, Poland – a growing market with moderate risks

Warsaw is rapidly developing and attracting international companies, stimulating increased demand for housing. , real estate in Poland is often viewed as a long-term investment option, especially in large cities. Real estate prices are lower than in Prague but higher than in Budapest.

- Pros: dynamic growth, moderate entry threshold, strong domestic demand.

- Cons: economic fluctuations, less predictable politics.

Prague Real Estate Market Overview

The Prague real estate market has demonstrated steady growth over the past decade. Since joining the European Union in 2004, the Czech Republic has been actively integrating into European economic processes. This has led to an influx of investment, infrastructure development, and an increase in living standards, all of which have directly impacted the housing market.

Between 2010 and 2020, the average price per square meter in Prague nearly doubled. The main factors driving this growth were:

- Migration processes: The Czech Republic has become a key destination for labor migrants from Eastern Europe and the CIS. Population growth has increased demand for rental and purchase housing.

- Tourism: Prague is one of the top ten most visited cities in Europe, creating high demand for short-term rental apartments and hotel properties.

- Economic stability: The Czech Republic enjoys steady GDP growth and low unemployment (around 3%), making it an attractive investment destination.

Vienna has a more mature market, where prices are growing more slowly. Over the past 10 years, the price per square meter in Vienna has increased by approximately 35–40%, while in Prague it has increased by over 70%. This makes the Czech market more dynamic and suitable for investors seeking capital growth.

| Indicator | Prague | Vienna |

|---|---|---|

| Price increase over 10 years | ~70% | ~40% |

| Average price per m² (2025) | 5 500-8 000 € | 8 500-12 000 € |

| The main driver of growth | Tourism, migration, urbanization | Domestic demand, stability |

Market dynamics 2018–2025

Since 2018, the Prague real estate market has shown stable price growth of 7-8% per year. Even during the pandemic year of 2020, Prague did not experience a significant decline: prices fell by only 1.5%, and by 2021, the market had recovered and returned to its previous growth rates.

The current dynamics are ensured by:

- development of transport infrastructure and the launch of new residential projects,

- stable demand for rentals from students and IT professionals,

- limited supply – the pace of construction cannot keep up with demand, which keeps prices high.

The forecast for 2025 is continued growth in the range of 5-7% per year, especially in areas with active development and near universities.

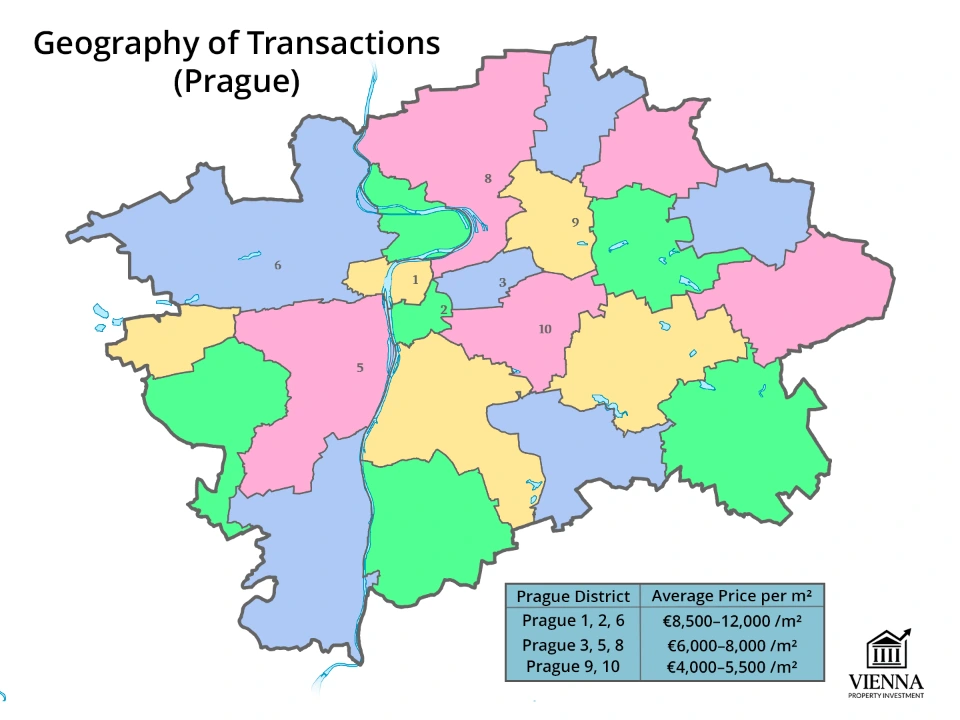

Geography of transactions

Prague is divided into districts, each of which has its own investment specifics.

| Prague district | Average price per m² | Market characteristics | Profitability potential |

|---|---|---|---|

| Prague 1, 2, 6 | 8 500-12 000 € | Historic center, luxury housing, active tourist flow | 3-4% |

| Prague 3, 5, 8 | 6 000-8 000 € | Stage of constant development, popularity among young people and students | 4-5% |

| Prague 9, 10 | 4 000-5 500 € | More reasonable prices | 4-4,5% |

Conclusion:

- Premium locations (Prague 1, 2, 6) are suitable for conservative investors and properties designed for short-term rentals.

- Prague 3, 5, 8 districts are ideal for long-term rental investments and capital growth.

- Prague 9 and 10 are a good option for people who want to buy an inexpensive apartment in Prague for their own residence or rent.

Types of real estate in Prague

The Prague real estate market offers a wide variety of options, allowing investors to find the perfect option based on their budget, strategy, and goals. Each segment has its own advantages and risks, as well as management considerations and potential for value growth.

1. Secondary market in old houses

Prague is famous for its unique architecture. Many buildings located in the city center (Prague 1, Prague 2) are of historical value.

Such properties are especially popular among tourists and renters who value authenticity and the atmosphere of the old city.

Peculiarities:

- They are located in the most prestigious areas – near Charles Bridge, Old Town Square, and Prague Castle.

- High prices – from €8,000 to €12,000 per m², which is comparable to prices in Vienna, but cheaper than in the central areas of Paris or London.

- Mandatory renovation every 10-15 years, agreed upon with cultural heritage protection authorities.

Pros:

- High prestige and status for the owner.

- Steady demand from tenants and tourists.

- Good liquidity – such properties are easy to sell even during a crisis.

Cons:

- High maintenance and repair costs.

- Difficulties with coordinating any redevelopment and reconstruction.

- Risk of restrictions on rentals through platforms like Airbnb.

Example:

A 90m² apartment in a historic building in Prague 1 costs around €950,000 and can generate short-term rental income of 3.5-4% per annum.

Comparison with Vienna:

In Vienna's historic center, similar properties cost from €12,000 per m² and up, while renovation regulations are even stricter and rental permits are issued less frequently.

2. Business-class new buildings

New buildings in Prague are popular in the districts of Prague 5, Prague 8, and Prague 9. These modern residential complexes are focused on comfortable living and often include underground parking, recreation areas, gyms, and Smart Home systems.

Due to the limited pace of construction, such projects are often sold out at the excavation stage.

Peculiarities:

- Compliance with ESG standards (energy efficiency, environmental friendliness).

- Legal purity – minimal risks of disputes over property rights.

- Prices range from €5,000 to €7,500 per m², making them more affordable than in the centre of Prague.

Pros:

- Minimal repair costs in the first years.

- Highly attractive to middle-class renters and expats.

- Possibility of price increase after completion of construction by 10-15%.

Cons:

- Limited choice in central areas.

- Competition between investors during subsequent sales.

- The yield is lower than that of historical properties – about 4–4.5% per annum.

Example:

A 65 m² apartment in a new complex in Prague 8 is available for €420,000. Long-term rental income is €1,800 per month, yielding approximately 4.3% per annum.

Comparison with Vienna:

In Vienna, new buildings are more common in areas outside the ring road, are more expensive – from €7,500 per m², and price increases usually do not exceed 3-5% per year due to market saturation.

3. Apartments for short-term rent

The short-term rental sector was booming in Prague until 2020, thanks to the city's huge tourist influx (over 9 million tourists annually). While interest remains strong today, city authorities have tightened regulations for platforms like Airbnb and Booking, particularly in Prague 1 and Prague 2.

Peculiarities:

- High level of profitability – up to 8% per annum, especially in the city center.

- A license is required for legal rental. Without one, you could face hefty fines.

- Seasonality risk – peak load in summer and winter holidays, decline in spring and autumn.

Pros:

- Possibility to quickly recoup the investment.

- Suitable for investors who are willing to actively manage the property.

- Popular among foreign tourists and students.

Cons:

- Constant changes in the regulation of short-term rentals.

- The need for professional management (or use of the services of a management company).

- Higher wear and tear on furniture and equipment.

Example:

A 40 sq m studio apartment in Prague 2 costs €280,000. With an income of €120 per night and an average occupancy rate of 70%, annual revenue will be €30,000. Net yield after expenses is approximately 7%.

Comparison with Vienna:

In Vienna, Airbnb regulations are much stricter. Most buildings don't allow short-term rentals without tenants' consent, making this segment virtually closed to foreign investors.

4. Commercial real estate

Cafes, shops, mini-hotels, and small office spaces are a distinct trend, attractive to investors with significant capital looking to buy real estate in the Czech Republic.

Peculiarities:

- The yield is higher than that of residential real estate – 6-8% per annum, and in the case of the hotel business – up to 10%.

- High dependence on the state of the economy and tourist flow.

- More complex legal registration and management.

Pros:

- Quick payback with the right choice of location.

- Possibility of concluding long-term lease agreements with major brands.

- Attractive to buyers from China and Arab countries.

Cons:

- Risks of falling profitability during periods of economic downturn.

- Difficulties with reorienting a business (for example, from a store to a restaurant).

- The need for in-depth market analysis before purchasing.

Example:

A 15-room mini-hotel in Prague 3 is for sale for €1.8 million. Annual operating income is approximately €160,000, with a net yield of 8.5%.

Comparison with Vienna:

Vienna is a more stable option for commercial properties – demand is predictable, but yields rarely exceed 5% per annum. Prague, on the other hand, is more dynamic and can generate high returns, but with increased risks.

Who buys real estate in Prague?

The Prague real estate market is international, making it one of the most open in Central Europe. Unlike Vienna, where most transactions are conducted by locals, in Prague, foreign investors play a key role.

| Buyer group | Preferences and strategies | Market share |

|---|---|---|

| Europeans (Germany, France, Scandinavia) | Premium segment, historical buildings, new buildings in the center | ~40% |

| Chinese investors | Mini-hotels, Airbnb apartments, commercial properties | ~15% |

| Americans | Commercial real estate and apartments for rent | ~10% |

| Ukrainians and Russians | Apartments for residential and long-term rent | ~20% |

| Czechs | New buildings and affordable housing on the outskirts | ~15% |

Key trends:

- European investors are looking to Prague as an alternative to the overheated markets of Paris and London.

- Chinese and Arab buyers are actively investing in the hotel sector.

- Ukrainians and Russians most often purchase housing for family or long-term rental purposes.

Comparison with Vienna:

In Austria, foreigners face strict restrictions: purchasing property in certain areas requires a special permit, and transactions are subject to strict scrutiny. Prague has no such barriers, making it a more flexible and attractive market for global investors.

Ownership formats and investment methods

The Czech Republic offers several types of real estate ownership, allowing investors to choose the best option for their needs.

Purchasing as an individual. This is the simplest option, suitable for most foreign investors looking to buy an apartment in the Czech Republic. The procedure is transparent and doesn't require complex legal procedures. There are no significant restrictions for non-residents: they can purchase both residential and commercial property.

Through a company. This option is chosen by large investors or those planning to own multiple properties.

- The management and taxation process is simplified.

- Tax optimization is possible through corporate incentives.

- The owner can remain anonymous in public registers.

Investments through real estate funds (SICAV). Similar to European REITs, this is a passive investment vehicle that doesn't require direct property management. Suitable for those looking to invest in the Czech market but not commit to purchasing a specific property.

Joint ownership and family trusts. Popular among families and friends, they allow for minimal entry costs and sharing of rental income.

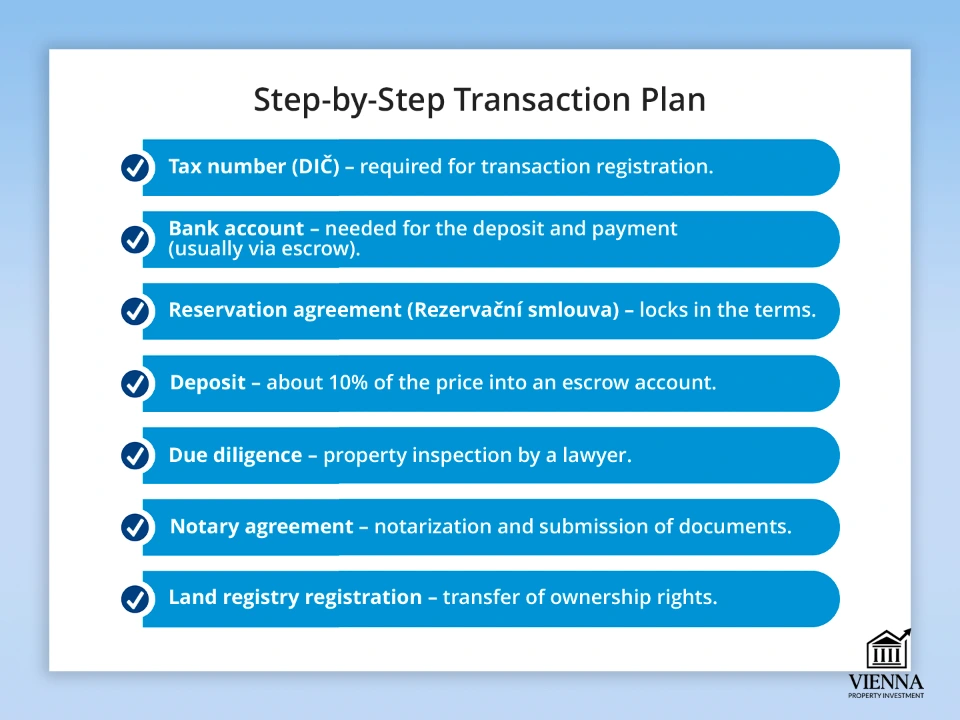

Legal aspects of purchasing real estate in Prague

The Czech real estate market, particularly in Prague, is considered one of the most transparent and structured in Central Europe. Thanks to the Czech Republic's EU membership and modern regulatory standards, the transaction process is simple and straightforward, even for foreign investors. However, despite this apparent simplicity, each stage requires attention and professional support to eliminate all potential risks.

| Stage | Description | Deadlines | Notes |

|---|---|---|---|

| 1. Obtaining a tax identification number (DIČ) | A mandatory procedure for all buyers, including foreign ones. Without it, title cannot be registered. | 2-3 days | Issued by the tax authority, passport and proof of address required. |

| 2. Opening an account in a Czech bank | An account is required for the deposit and payment of the transaction. An escrow account is most often used for the security of both parties. | 3-5 days | Some banks offer online account opening via video call. |

| 3. Conclusion of a preliminary agreement (Rezervační smlouva) | Reserves the property for the buyer and fixes the terms of the transaction. | 1-2 days | Typically includes a deposit deadline and penalties for canceling the deal. |

| 4. Making a deposit | The standard fee is 10% of the property's value. The funds are held in an escrow account with a notary or realtor. | Day 1 | Protects both parties: the seller is confident in the buyer's intentions, and the buyer is confident in the safety of the funds. |

| 5. Legal verification of the object (Due Diligence) | A lawyer checks the property's history, the presence of debts, litigation, and the building's status (e.g., cultural heritage). | 7-10 days | Particularly important when purchasing historical property in Prague 1 or 2. |

| 6. Signing the main agreement with a notary | The notary certifies the transaction and enters it into the registration system. | Day 1 | All documents are translated into Czech by an official translator. |

| 7. Registration of ownership in the land register (Katastr nemovitostí) | The final stage. Once the data is entered into the register, the buyer becomes the legal owner. | 1-2 weeks | After registration, the notary issues an extract from the cadastral register. |

The role of a notary and a lawyer

A notary and a lawyer are two key figures ensuring the legality and protection of investor rights when concluding real estate transactions in the Czech Republic.

Their functions are clearly delineated, which reduces the risk of fraud and errors.

| Participant | Functions | Cost of services |

|---|---|---|

| Notary (Notář) | — Certifies the authenticity of the transaction. — Verifies the identity of the parties. — Enters the transaction into the state register. — Ensures the safekeeping of the deposit in an escrow account. |

0.5-1% of the transaction value |

| Lawyer (Advokát) | — Checks the property for debts, encumbrances, and litigation. — Provides tax advice. — Prepares and reviews contracts. — Represents the client during remote purchases. |

100-200 € per hour, or a fixed amount – from 1,500 € |

Comparison with Austria:

In the Czech Republic, notary fees are 2-3 times lower than in Austria, where a notary can charge up to 3% of the transaction amount. Furthermore, the registration process in the Czech Republic takes only 1-2 weeks, while in Austria it can take up to a month.

Due Diligence

Before purchasing, it is extremely important to conduct a thorough legal check of the property, especially when it comes to historic buildings in the center of Prague.

The lawyer analyzes:

- History of the owners – to avoid disputes between heirs.

- The presence of debts for utilities and taxes.

- Encumbrances – arrests, liens, legal disputes.

- The status of the building – whether it is a cultural monument or an object under the protection of historical heritage.

- Compliance with design documentation is especially important for new buildings.

| Risk type | How is it checked? | Who is responsible? |

|---|---|---|

| Tax and utility debts | Requests to tax authorities and the management company | Lawyer |

| Arrest or bail | Extract from the cadastral register | Notary, lawyer |

| Litigation | Checking court registers | Lawyer |

| Architectural limitations | Request to the authorities for the protection of architectural monuments | Lawyer |

| Legal purity of the seller | Checking your passport and tax number | Notary |

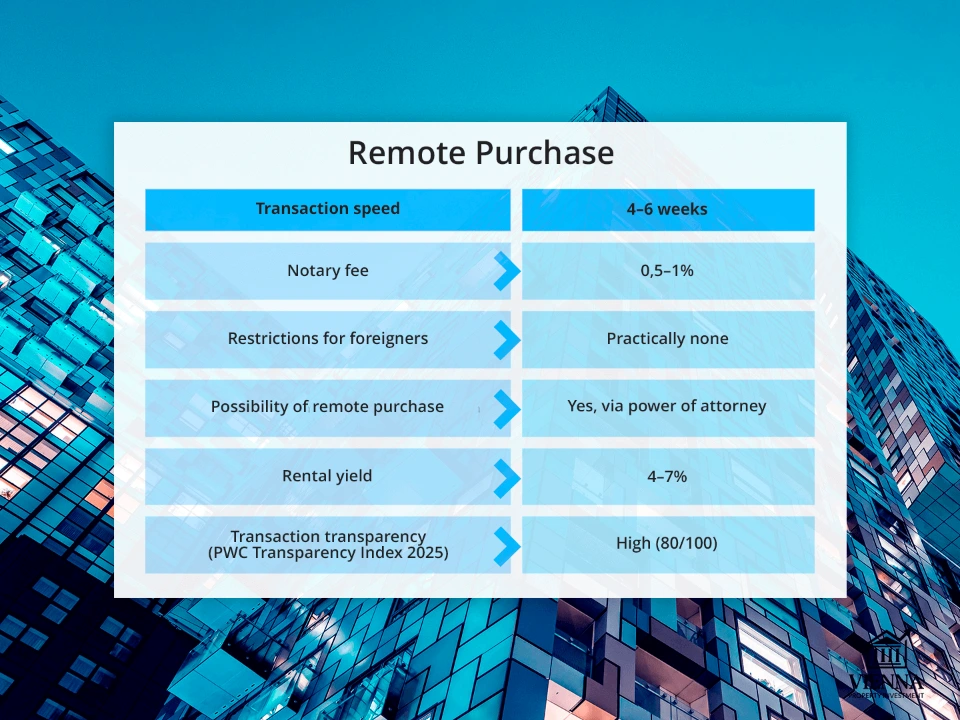

Buy remotely

Czech law allows foreign investors to purchase real estate entirely remotely.

This option is especially popular among buyers from the CIS countries, Asia and the Middle East.

How does this work:

- The buyer issues a power of attorney certified by a notary in his country.

- The power of attorney is apostilled and translated into Czech.

- A lawyer or agent, acting under a power of attorney, performs all actions: opens an account, signs contracts, and registers the transaction.

Advantages:

- The buyer's personal presence is not required.

- Fast processing, especially when purchasing multiple properties.

- Saving time on travel and organizational issues.

Czech Republic vs. Austria

| Parameter | Czech Republic (Prague) | Austria (Vienna) |

|---|---|---|

| Speed of transaction | 4-6 weeks | 6-8 weeks |

| Cost of notary services | 0,5-1% | 2-3% |

| Restrictions for foreigners | Almost none | Strict, permit required for some lands |

| Possibility of remote purchase | Yes, through a power of attorney | Limited |

| Rental yield | 4-7% | 2,5-4% |

| Transparency of transactions (PWC Transparency Index 2025) | High (80/100) | Very high (90/100) |

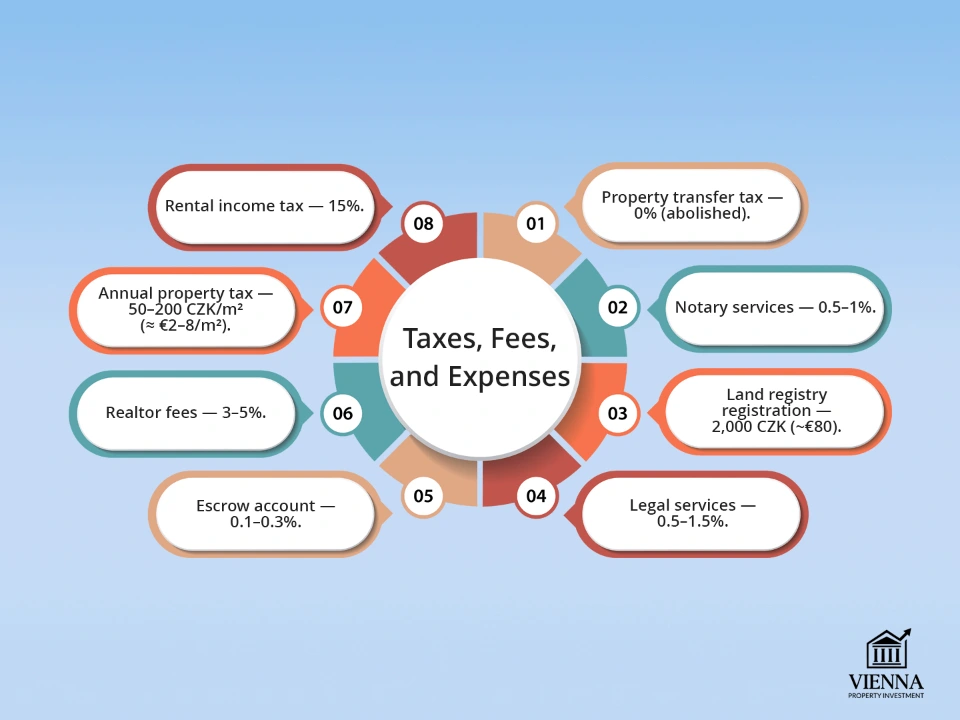

Taxes, fees and expenses for real estate in Prague

Investing in real estate in Prague is impossible without a clear understanding of the taxes and additional costs associated with purchasing and owning a property.

The Czech Republic has one of the most clear and transparent tax systems in Central Europe, making it attractive to foreign investors. However, it's important to consider local tax regulations to accurately calculate profitability and avoid unexpected expenses.

Rent tax

Income from renting out apartments or flats in Prague is subject to a progressive tax rate, which ranges from 15% to 23% depending on the owner's income level.

For private investors who own one or two properties, the minimum rate most often applied is 15%.

| Annual rental income range (€) | Tax rate |

|---|---|

| Up to €20,000 | 15% |

| 20 001 – 50 000 € | 19% |

| More than €50,000 | 23% |

Peculiarities:

- The tax is calculated on net income, that is, after deducting the costs of management, repairs and utility bills.

- Owners who rent out their properties through management companies can claim the management fee as a deductible expense.

- For legal entities (for example, companies that own real estate), the corporate tax rate of 19% applies.

Comparison with Austria:

In Austria, rental tax rates are fixed, making the system predictable but less flexible. At the same time, property maintenance costs are higher, especially in Vienna, due to expensive utility rates and mandatory fees.

| Parameter | Czech Republic (Prague) | Austria (Vienna) |

|---|---|---|

| Minimum tax rate | 15% | 20% |

| Maximum tax rate | 23% | 25% |

| Possibility of writing off expenses | Yes | Yes |

| Additional rental taxes | No | Local fees are higher |

Capital gains tax

In the Czech Republic there is a capital gains tax of 15%.

It is levied if the property is sold less than five years after its acquisition. If the property has been owned longer, no tax is levied.

Calculation example:

- The apartment was purchased for €400,000 and sold after 3 years for €500,000.

- The profit was €100,000, the tax was €15,000 (15%).

- If the owner had sold this property after 6 years, no tax would have been charged.

In Austria, the rules are different: tax is almost always levied, even with long-term ownership, but the rates are lower – 4.2-6%, making it more predictable but less beneficial for active investors who frequently buy and sell properties.

| Parameter | Czech Republic (Prague) | Austria (Vienna) |

|---|---|---|

| Capital gains tax | 15% | 4,2-6% |

| Benefits for long-term ownership | Full release after 5 years | Partial benefits |

| Frequency of tax application | Only when sold in the first 5 years | Almost always |

Other transaction costs

Purchasing an apartment in Prague, Brno, or Pilsen comes with a number of additional costs that are important to consider when calculating the final cost of your investment.

| Expense item | Czech Republic (Prague) | Austria (Vienna) |

|---|---|---|

| Real Estate Transfer Tax | 4% | 3,5% |

| Notary services | 0,5-1% | 2-3% |

| Agency commission | 3-5% | 3% |

| Registration in the cadastre | 0,2% | 0,3% |

| Total transaction costs | 8-10% | 7-9% |

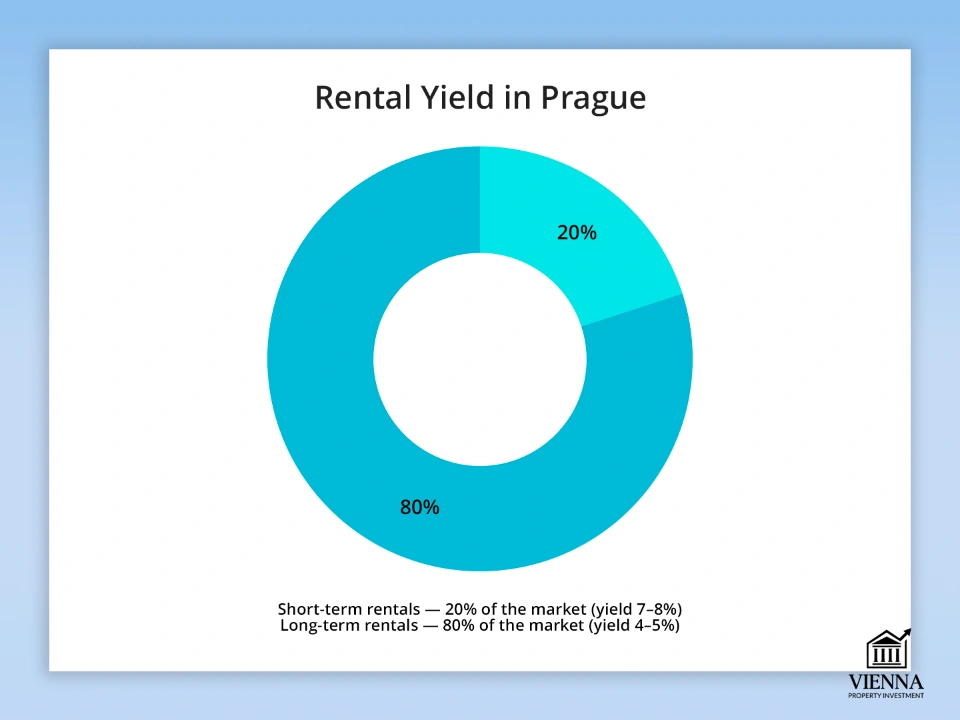

Rent and income of real estate in Prague

The Prague apartment rental market is one of the most dynamic in Europe. The city's growing population of students, expatriates, and digital nomads drives high rental demand.

For the investor, this means a stable flow of rental payments and potential returns higher than in most Western European capitals.

Short-term rental

Short-term rentals through Airbnb and Booking platforms remain a popular investment strategy, especially in the central areas of Prague (Prague 1 and 2).

Profitability can reach 7-8% per annum, especially during the tourist season.

Example:

- A 50 m² apartment in Prague 1 can bring in €120-150 per night.

- At 70% occupancy, this is about €3,000 per month or €36,000 per year.

- After expenses, the net return will be around 8%.

However, in recent years, Prague authorities have tightened rental regulations:

- In central areas, a license is required for short-term rentals.

- Restrictions are being introduced on the number of days for submission per year.

- Residents of the buildings can vote against using the apartment as a mini-hotel.

Czech Republic vs. Austria

| Parameter | Prague (central districts) | Vienna |

|---|---|---|

| Average yield | 7–8% | 2-3% |

| License restrictions | Strict, especially in Prague 1 and 2 | Very strict |

| Average cost per night | 120-150 € | 150-180 € |

| Risks | High competition, new laws | High fines, limited licenses |

Long-term lease

Long-term apartment rentals in Prague or Brno are suitable for investors who want to reduce risks and secure a stable income.

The average yield is 4-5%, while demand is consistently high thanks to universities, international companies, and active migration processes.

| Tenant type | Average rent | Peculiarities |

|---|---|---|

| Students | 600-900 € per month | High demand, especially near universities. |

| Foreign specialists | 1 000-1 800 € | They prefer modern new buildings and apartments in Prague 2 and 5. |

| Local families | 800-1 200 € | Looking for accommodation in Prague 8, 9 and 10. |

Czech Republic vs. Austria

In Vienna, yields are significantly lower – 2-3%, and the market is more regulated: there are strict rules on maximum rental rates and tenant rights, which limits profitability.

| Parameter | Prague | Vienna |

|---|---|---|

| Average long-term rental yield | 4-5% | 2-3% |

| Demand for housing | High | Very tall |

| Market regulation | Moderate | Strict |

| Rising rental rates | 3-4% per year | 1-2% per year |

The role of management companies

Rental management services are especially important for foreign investors.

Prague has a well-developed market of management companies that handle the entire housing management cycle: from finding tenants to repairs and legal support.

- Commission: 10-15% of income.

- Includes payment for advertising, concluding contracts and monitoring the condition of the apartment.

- This is especially relevant for short-term rentals, where management requires daily attention.

Where to Buy: An Analysis of Prague's Neighborhoods

Choosing the right neighborhood is a key factor in profitability. Prague has a clear segmentation based on property type, target audience, and profit potential.

| District | Average price per m² (€) | Characteristic | Profitability |

|---|---|---|---|

| Prague 1 (center) | 8 500 – 12 000 | Historic center, constant tourist flow, premium segment. High prices and limited availability. | 3-4% |

| Prague 2 and 3 | 6 000 – 8 000 | Young audience, rental for students and professionals, high investment potential. | 4-5% |

| Prague 5 and 8 | 5 000 – 7 500 | Areas of active construction of new buildings, growing demand. | 5%+ |

| Prague 9 and 10 | 4 000 – 5 500 | Affordable housing, demand from local residents and families. | 4% |

My recommendations:

- For short-term rentals, it is better to choose Prague 1 and 2.

- For long-term rent – Prague 3, 5 and 8.

- For long-term purchases, consider Prague 9 and 10, where prices are currently lower but expected to rise thanks to new infrastructure projects.

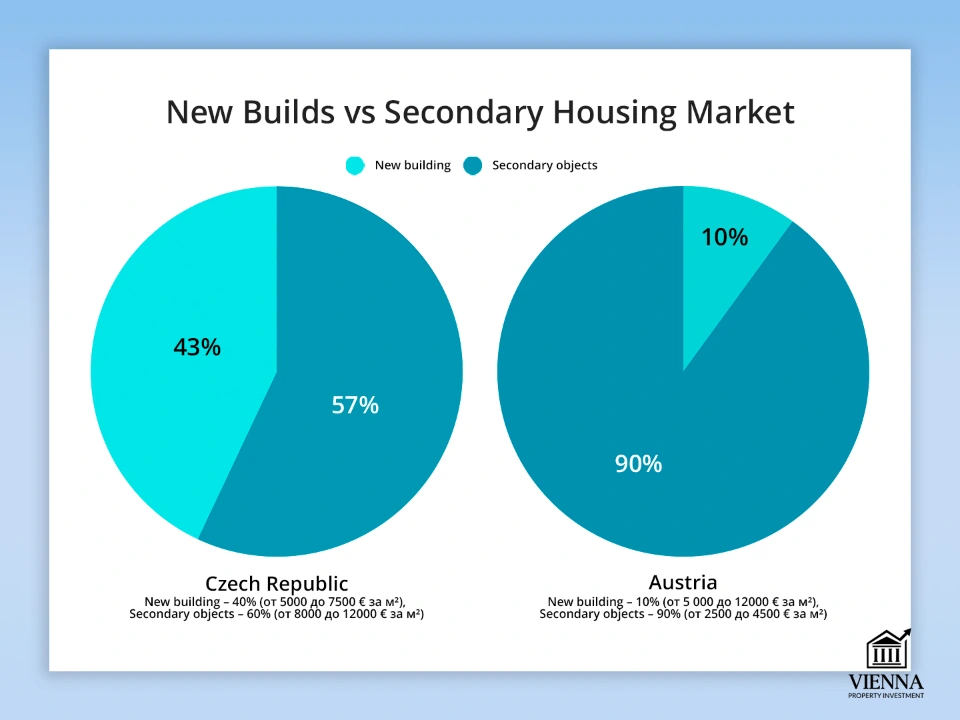

Secondary market and new buildings in Prague

The Prague real estate market is divided into two key segments – the secondary market and new developments. Each has its own characteristics, price dynamics, and attractive features. Understanding the differences between them is important for developing a sound investment strategy.

The secondary market is the dominant segment

The secondary market accounts for approximately 70% of all transactions in Prague. This is due to the city's historic architecture, which shapes the unique architectural appearance of the Czech capital. The central districts of Prague 1, 2, and 3 are dominated by 19th- and early 20th-century buildings, which are part of the country's cultural heritage.

Advantages of the secondary market:

- High demand from tenants and tourists due to the atmosphere and prestigious location.

- Lower price per square meter compared to premium new buildings.

- Possibility of increasing the value of the property after high-quality renovation.

Flaws:

- Old houses require constant maintenance, repair of utilities and facades.

- In some cases, it is necessary to coordinate redevelopment and renovation with architectural heritage protection authorities.

- High utility costs due to insufficient energy efficiency of buildings.

Example:

A 70 sq m apartment in a 19th-century building in Prague 2 is listed for €420,000, but requires significant renovation investment of approximately €40,000-50,000. After renovation, the property could be sold for 15-20% more or rented out to tourists through platforms like Airbnb.

New buildings – a modern segment with limited supply

New buildings in Prague are popular among foreign investors due to their transparent legal structure and high construction quality. Many projects are developed with ESG standards in mind, including energy efficiency, the use of environmentally friendly materials, and the installation of smart building management systems.

Features of new buildings:

- New complexes are often sold out even at the construction stage (at the excavation stage).

- Minimal risks of legal pitfalls.

- High liquidity – apartments in modern buildings are easier to resell.

- Lower operating costs compared to historic buildings.

The main problem in the market is the shortage of new buildings. Construction rates in Prague are significantly lower than in Vienna or other European capitals. These restrictions are due to bureaucracy and strict urban planning regulations.

| Indicator | Prague | Vienna |

|---|---|---|

| Secondary market share | 70% | 55% |

| Share of new buildings | 30% | 45% |

| Average price per square meter in a new building | 6 500-8 000 € | 9 000-12 000 € |

| Construction rates | Low, shortage of objects | High, stable supply |

Alternative investor strategies

Investing in Prague real estate isn't limited to the classic purchase of a rental apartment. The market also offers other strategies that allow for flexible capital management and increased returns.

Buying several studio apartments instead of one large apartment

This strategy is aimed at income diversification. Instead of purchasing one 100 sq m apartment in Prague, the investor acquires two 50 sq m studios in different parts of the city.

Advantages:

- Higher total rental income.

- The ability to sell one property and keep the other in the portfolio.

- It is easier to adapt to changes in the market.

Profitability: on average 10-15% higher than when owning one large apartment.

Renovation and resale of historic housing

Historic apartments in central Prague can be purchased at a relatively low price, renovated, and resold at a profit.

- Investments: 20-25% of the property value goes towards repairs and their approval.

- Profitability: the sales margin can reach 20–30%.

- Risks: delays with planning permission, difficulty finding qualified contractors.

Example:

Apartment for €350,000 + €70,000 renovation → sale for €500,000, net profit – around €80,000.

Mini-hotels and apart-hotels

Prague is one of the largest tourist centers in Europe, making mini-hotels and aparthotels an excellent choice for investment.

- Profitability: up to 10% per annum.

- Features: a hotel license and compliance with safety regulations are required.

- In recent years, this segment has been actively developing due to the increase in tourist flow after the pandemic.

Commercial real estate

Retail, restaurants, co-working spaces, and office spaces are great options for investors with higher levels of capital.

- Profitability: 6–9% per annum, which is higher than in residential real estate.

- Risks: depend on the economic situation and the solvency of tenants.

- Demand for coworking spaces and vacant offices is growing thanks to the trend toward remote work.

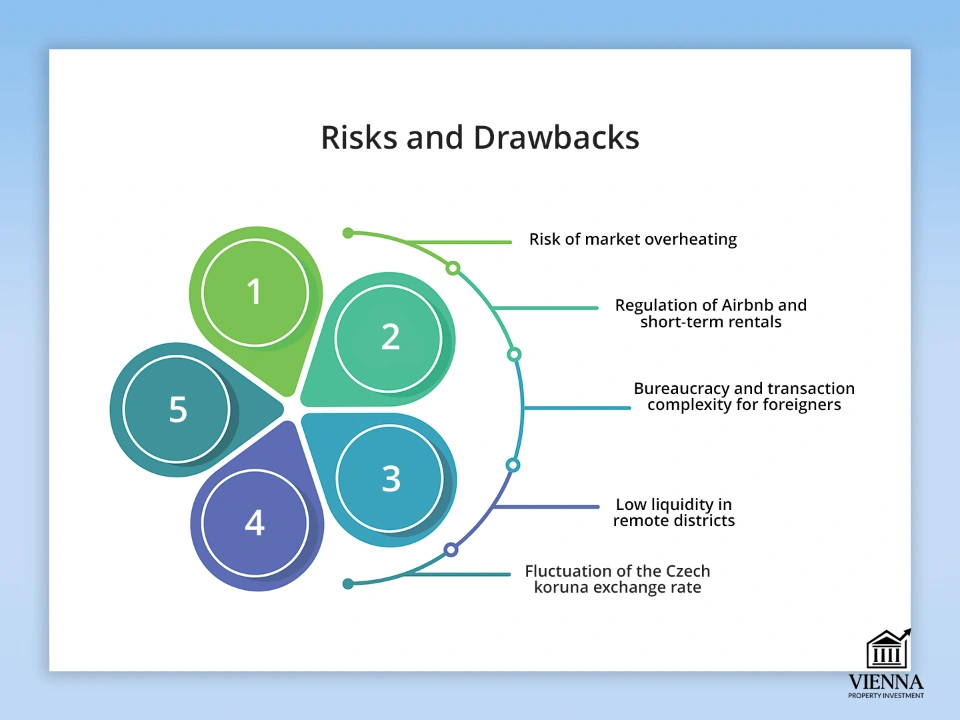

Risks and Disadvantages

Despite the attractiveness of the market, investors should be aware of a number of risks that may affect the profitability and liquidity of their investments.

Risk of market overheating. In Prague's central districts (Prague 1 and 2), prices have risen by 40–50% over the past five years, which could indicate the formation of a price bubble. If price growth slows or prices are adjusted, investors who purchased properties at peak prices will see their capital decline.

| District | Price increase over 5 years |

|---|---|

| Prague 1 | +48% |

| Prague 2 | +42% |

| Prague 3 | +35% |

| Prague 9 | +27% |

Regulation of Airbnb and short-term rentals. In recent years, Prague authorities have been actively restricting the activities of short-term apartment owners.

- In Prague 1 and Prague 2 a short-term rental license is required.

- In some areas, there are limits on the number of days per year during which an apartment can be rented to tourists.

- Violations of the rules entail fines of up to €20,000.

These changes may reduce the returns for investors targeting short-term rental apartments in Prague.

Bureaucracy and complex transactions for foreigners. Although the process of purchasing real estate in the Czech Republic is considered transparent, foreigners may still encounter difficulties:

- The need to translate documents into Czech and have them notarized.

- The registration process in the cadastral register is longer when purchasing remotely.

- Strong dependence on the professionalism and competence of the lawyer and realtor.

Low liquidity in outlying areas. In Prague 9 and 10, where prices are still lower, property liquidity is limited. Selling an apartment can take up to 9-12 months, especially during an economic downturn.

Czech Republic vs. Austria

| Parameter | Prague | Vienna |

|---|---|---|

| Price increase | High, 7-8% per year | Moderate, 3-4% per year |

| Rent regulation | It's getting stronger, but still soft | Very strict |

| Risks of short-term rentals | High, new restrictions | Very high |

| Liquidity in the center | High | Very high |

| Liquidity on the outskirts | Low | Average |

Accommodation and lifestyle in Prague

Prague boasts a high quality of life, while living costs remain significantly lower than in neighboring Austria. For investors planning not only to invest but also to buy an apartment in Prague or Brno to live in the Czech Republic, the combination of affordability, safety, and developed infrastructure is very attractive.

Cost of living and amenities. According to Numbeo, living in Prague is approximately 25-30% cheaper than in Vienna. The average rent for an apartment in central Prague is approximately €1,000-€1,200, while a similar property in Vienna costs €1,500-€1,800.

Food, transportation, and entertainment are also cheaper, making Prague particularly attractive to families and retirees looking to maintain a high standard of living while keeping costs low.

| Expense category | Prague | Vienna |

|---|---|---|

| Rent a 2-bedroom apartment in the city center | 1 100 € | 1 700 € |

| Transport pass (monthly) | 25 € | 52 € |

| Dinner for two at a mid-range restaurant | 55 € | 85 € |

| Private school, year | 6 000 € | 10 000 € |

healthcare system is deservedly considered one of the best in Central Europe. Residents have a mandatory health insurance system, which partially covers the costs of public hospital services. This makes medical care accessible even to families with moderate incomes. Private clinics offer a wider range of services and modern facilities, while their costs remain significantly lower than in neighboring Austria.

For example, a consultation with a specialist in Prague costs an average of €40–60, while in Vienna the same service can cost €80 or more. Thus, Prague attracts not only investors but also people seeking high-quality and affordable medical care.

transportation system is well-designed and convenient. The city is renowned for its metro and tram networks, which cover virtually every district, including the suburbs. This makes life in Prague comfortable even without a car.

A monthly pass costs around €25-30, making public transportation affordable for students, retirees, and young professionals. Taxis and car-sharing are also rapidly expanding – their costs are lower than in Austria, making them especially convenient for expats and IT professionals who value mobility and flexibility when traveling around the city.

financial system is open to foreigners, and opening a bank account is quite simple. All you need is a passport and proof of address. Czech banks offer modern online services in English, making financial management convenient even for those who don't speak Czech.

The Czech crown (CZK) remains a stable currency, and bank deposits are state-insured up to €100,000, increasing investor and private confidence in the country's banking system.

Prague is currently among the top ten most popular European cities among digital nomads and international professionals. This is due to its well-developed IT infrastructure, fast internet, and numerous modern coworking spaces. Programmers, designers, marketers, and online business specialists from Europe and the United States are actively flocking to the city.

This influx of professionals not only makes the city more international and dynamic, but also creates a steady demand for rental housing, which stimulates price growth and makes the Czech real estate market even more attractive to investors.

Prague as a “European refuge”

Prague is gradually becoming a "European haven" for people seeking to protect their capital and provide stability and security for their families. For citizens of countries with unstable economies, purchasing real estate in Prague is becoming a reliable way to preserve their savings.

As a member of the EU and NATO, the Czech Republic is a safe jurisdiction for long-term investment. Unlike Austria, the Czech market has virtually no restrictions on foreign buyers, making it more accessible to investors from the CIS, Asia, and the Middle East.

Families choose Prague not only for its high-quality healthcare but also for its affordable international schools, where tuition costs around €6,000 per year—almost half that of Vienna. Safety is also a key factor: Prague's crime rate remains low, especially in the central districts, making it a comfortable place to live with children.

For retirees, Prague is an excellent alternative to Vienna, offering a similarly high quality of life but significantly lower costs. Housing and utilities are 30–35% lower than in Austria, allowing you to save money without sacrificing comfort.

The Czech Republic is also popular among retirees from Germany and Switzerland, who value the mild climate, developed infrastructure, and high level of medical services available at reasonable prices.

As a result, Prague offers a unique balance between affordability and quality of life, providing opportunities for young professionals and families, as well as those seeking peace of mind and long-term financial stability.

Comparing Prague and Vienna as Places to Live

| Criterion | Prague | Vienna |

|---|---|---|

| Cost of living | Low | High |

| Quality of medicine | High, affordable | Very high, expensive |

| International schools | Yes, it's cheaper | Yes, it's more expensive |

| Regulations for foreigners | Minimum | Strict |

| Atmosphere | More free, more dynamic | Bureaucratic, conservative |

Exit from investments

Exiting an investment is a key element of any investor's strategy. In Prague, the real estate sales process is relatively simple and transparent, but it does have its own unique features that should be considered when planning the transaction.

Average property sale period:

- In the central districts (Prague 1, 2, 3) real estate sells quickly – on average in 3-6 months.

- In areas with lower demand, such as Prague 9 and 10, the sale period can extend to 9-12 months.

- High interest from buyers from the EU and CIS countries ensures stable liquidity for the market.

Capital Gains Tax. When selling real estate, investors are required to pay a 15% capital gains tax if the property is sold within five years of purchase:

- If the property is owned for more than 5 years, no tax is levied.

- For investors planning speculative transactions, this factor must be taken into account when calculating profitability.

| Period of ownership | Tax |

|---|---|

| up to 5 years | 15% |

| ≥ 5 years | 0% |

Czech Republic vs. Austria

| Parameter | Prague | Vienna |

|---|---|---|

| Average sales period | 3-6 months | 6-9 months |

| Capital gains tax | 15% (< 5 years) | 30% |

| Liquidity in the center | High | Very high |

| Liquidity on the outskirts | Average | Average |

Conclusions

Prague combines transparent investment exit conditions with lower taxes, which sets it apart from Vienna.

For long-term investors, Prague is attractive due to zero capital gains tax after 5 years of ownership.

Vienna, on the other hand, remains a more stable but less flexible market with a high level of bureaucracy and significant tax burdens.

Expert opinion: Ksenia Levina

Ksenia Levina is a Central European real estate expert with over 15 years of experience in the Czech Republic, Austria, and Germany. Over the course of her career, she has helped close dozens of transactions, including residential and commercial real estate purchases in Prague and Vienna, and has a keen understanding of the key differences between these markets.

According to Levina, Prague remains one of the most dynamic markets in the region today. Transaction processing here is simpler and faster than in Austria: from the preliminary agreement to property registration, it takes 4-6 weeks. In Vienna, however, the process can take 2-3 months due to stricter regulations and more complex bureaucracy.

The Czech Republic's main advantage is its accessibility for foreign investors. Unlike Austria, there are virtually no restrictions on purchasing residential or commercial property, opening the market to investors from the CIS, Asia, and the Middle East.

Levina emphasizes that a key stage of the transaction is a legal due diligence of the property. The lawyer is obliged to verify:

- history of the owners to exclude the possibility of disputes or third party rights;

- the presence of debts for utilities or mortgages;

- the correctness of cadastral data.

In the Czech Republic, this review takes 5-7 business days and costs approximately €500-€1,000. In Austria, the cost of due diligence is higher – starting from €1,500 – and the procedure itself can be more complex due to the multi-tiered approval system.

"Prague is a growth market with high yields due to stable rental demand. Vienna is a capital preservation market: yields are lower, risks are minimal. The optimal portfolio: Prague for growth, Vienna for stability."

— Ksenia , investment consultant,

Vienna Property Investment

The expert recommends diversifying investments between the two markets, as they solve different problems.

| City | The main purpose of investment | Advantages | Flaws |

|---|---|---|---|

| Prague | Capital growth and high returns | Rapid price growth, rental yields of 4-8%, flexibility for foreigners | Higher risks, heavy dependence on tourism |

| Vienna | Capital preservation and stability | Reliable market, low volatility, crisis protection | Low returns (2–3%), strict restrictions for foreigners |

Real cases

Case 1: A Prague apartment for long-term rental – a stable income

An investor from Germany decided to invest in residential real estate in Prague in order to generate stable rental income.

He purchased a two-bedroom apartment of 58 square meters in Prague 3 (Žižkov), a neighborhood popular with students and international companies. The property was priced at €320,000. The building was built in 2018 and required no renovations.

The apartment was leased long-term to an American IT specialist working for a major Czech startup. The average rent was €1,450 per month, or €17,400 per year. After three years, the property's value increased by 18%, to €378,000. Taking into account capital appreciation, the total return was approximately 8% per annum.

Case 2. A rural house – a project for resale

An investor from the Czech Republic purchased an old house in a village near Karlovy Vary, an hour's drive from Prague. The price was €95,000. The house was in poor condition, but it was located in a picturesque area popular with German tourists.

The investor invested an additional €45,000 in renovations, including a complete replacement of utilities, roof repairs, and interior renovations. The total cost was €140,000. Nine months later, the house was listed for sale and sold to a German family for €210,000.

Case 3. Brno Apartment for Students – High Demand for Long-Term Rentals

Brno is the second-largest city in the Czech Republic and a major university center. An Israeli investor decided to purchase a small 35-square-meter studio apartment in Brno near Masaryk University.

The property is priced at €155,000, and the building is new and will be built in 2023. The apartment is rented to students at €850 per month. The management company charges 12% of the income for full management, allowing the investor to focus on other projects.

Case 4. Apartment in Pilsen – a budget entry into the market

Pilsen, the fourth-largest city in the Czech Republic, is known as the region's industrial and university center. A Polish investor decided to invest in a small apartment for long-term rental.

Property: A one-bedroom apartment of 42 m² in a building built in 2010. Purchase price: €110,000. The apartment is rented to an employee of the Škoda automobile plant for €700 per month.

Case 5: A Family Home – An Investment and a Place to Live

A Ukrainian couple moved to the country with their two children. Their goal was to buy a house in the Czech Republic for permanent residence with the option to resell it. They found a modern 160 sq m house in Prague 9, a 20-minute drive from the city center.

The purchase price was €520,000. The house was in good condition and required no renovations. Three years later, thanks to rising market prices, the house's value reached €620,000. If the family decides to sell the house, their profit will be €100,000, not including maintenance costs.

Case 6. An investor with a budget of €300,000 – diversifying investments in Prague and Brno

An investor from Kazakhstan wanted to diversify his portfolio to avoid dependence on a single property. The strategy included purchasing two residential properties:

- Prague, Vinohrady district – 40m² apartment for €200,000 for long-term rent.

- Brno, studio apartment near the university – €100,000, rented to students.

The portfolio's total return was 8% per annum, and overall risk was mitigated by distributing assets between two cities. The investor also gained the flexibility to manage their capital: if demand declines in one city, they can offset the gains in another.

Case 7. Purchasing through a company – tax optimization

An American investor purchased two properties in Prague: an apartment for rent and a commercial space for a café. The total cost was €1.1 million. To reduce the tax burden and simplify management, he registered a Czech company with a registered office in Prague. Over four years, the value of both properties increased by 22%.

The investor saved approximately €60,000 in taxes and was also able to legally reinvest the profits into other projects without incurring additional taxes. This strategy is suitable for large investors with a budget of €500,000 or more, especially if they plan to purchase multiple properties or commercial real estate.

Conclusion

Prague and Vienna are two key real estate hubs in Central Europe, but their investment profiles have a number of fundamental differences.

Prague is ideal for those seeking rapid capital growth and rental income. The city is rapidly developing, annually attracting tourists, students, and IT professionals. Despite the risks associated with short-term rental regulations and overheating in central areas, the growth potential remains very high.

Vienna is a choice for investors who prioritize stability over profitability. While there's no rapid price growth, the market is protected from sharp fluctuations. This is especially important for those who view real estate as a long-term capital preservation tool.

Tips to minimize risks:

- Always conduct a thorough legal due diligence on the property.

- Don't invest all your money in short-term rentals – combine different types of properties.

- Rely on professionals: lawyers, tax consultants, management companies.

- Diversify your portfolio by investing in real estate in both the Czech Republic and Austria.

Experts estimate that by 2030 due to limited construction volume and rising demand. Local authorities will likely continue to regulate the short-term rental sector (Airbnb), which will lead to higher prices for long-term housing. The main potential growth areas are areas outside Prague 1-3, including complex development projects in Prague 5, 9, and 10.

Investor checklist

Preparing for purchase

| Stage | Details | Deadlines | Responsible |

|---|---|---|---|

| Determine the investment objective | Rental (long/short term), resale, family accommodation, asset diversification. | 1 week | Investor |

| Calculate the budget | Property price + 8-10% for taxes, notary fees and other expenses. | 1-2 days | Investor |

| Select a district of Prague | Prague 1-3 – premium segment and city center, Prague 5 and 8 – investment districts, Prague 9-10 – budget segment. | 1-2 weeks | Investor + agent |

| Research the market and prices | Analysis of offers on the websites Sreality.cz, Bezrealitky.cz, Reality.idnes.cz. | 1 week | Investor |

| Select object type | Resale properties in the center, new buildings, apartments, commercial real estate. | 1 week | Investor |

| Find a lawyer and agent | A lawyer checks the purity of the transaction, an agent helps with the choice. | 1 week | Investor |

Legal training

| Stage | Details | Deadlines | Responsible |

|---|---|---|---|

| Obtain a tax identification number (DIČ) | Required to complete a transaction and pay taxes. | 1-3 days | Lawyer / Investor |

| Open an account in a Czech bank | To settle the transaction and make a deposit. | 1-2 days | Investor |

| Check the object | A lawyer analyzes the history of the property: ownership rights, encumbrances, debts | 3-5 days | Lawyer |

| Assess legal risks | Particular attention should be paid to architectural monuments and houses in the historical center. | 2-3 days | Lawyer |

| Sign a reserve agreement | Reserves the property for the buyer and fixes the terms of the transaction. | Day 1 | Investor + agent |

Financial settlements and purchase

| Stage | Details | Deadlines | Responsible |

|---|---|---|---|

| Make a deposit | Typically 10% of the value is kept in an escrow account with a notary. | Day 1 | Investor |

| Pay taxes and fees | In the Czech Republic, the purchase tax is 4% of the property value. | 1-2 days | Investor |

| Sign the main purchase and sale agreement | In the presence of a notary. | Day 1 | Investor + notary |

| Registration in the real estate cadastre | The final stage is entering a record of the new owner. | 1-2 weeks | Notary |

| Obtain documents for the property | Certificate of ownership. | Day 1 | Lawyer |

Property management

| Stage | Details | Deadlines | Responsible |

|---|---|---|---|

| Conclude an agreement with the management company | The cost of services is 10-15% of income. | 1-3 days | Investor |

| Set up an income accounting system | Keep records for tax payments. | Constantly | Accountant / Investor |

| Choose a rental strategy | Long-term – stable income of 4-5%; short-term – up to 8%, but with possible restrictions | 1 week | Investor |

| Obtain a license to list your property on Airbnb (if required) | In Prague 1 and 2, licenses are strictly regulated. | 1-2 months | Lawyer |

Taxes and finance

| Stage | Details | Deadlines | Responsible |

|---|---|---|---|

| Payment of rental tax | Progressive rate of 15-23% of income. | Annually | Accountant |

| Accounting for expenses to reduce the taxable base | Repairs, management company services. | Constantly | Accountant |

| Check capital gains tax | 15% if the property is sold before 5 years of ownership. | Before the sale | Lawyer |

Exit strategy

| Stage | Details | Deadlines | Responsible |

|---|---|---|---|

| Determine the moment of sale | Monitor price dynamics on the market. | 1-2 years before sale | Investor |

| Prepare the property for sale | Cosmetic repairs, improvement of the presentation of the property. | 1 month | Agent |

| Selling through an agency or directly | In premium areas of Prague, the sales period is 3-6 months. | 3-6 months | Agent |

| Close all tax liabilities | Calculate capital gains tax and pay it. | 1 month | Accountant |