Investing in Cyprus Property: What You Need to Know

In recent years, the Cyprus real estate market has firmly established itself as one of the most sought-after destinations for investors. It is attractive to those looking to buy a home in Cyprus, while also seeking a combination of seaside living, stable rental income, and attractive tax conditions.

The purpose of this article is to provide a systematic analysis of the investment attractiveness of Cyprus real estate: from purchasing a home for personal use and recreation to using construction projects as a source of passive income and a tool for international capital structuring.

Why now? The Mediterranean market is seeing a shift in investor interest. Classic destinations like Spain and Portugal are becoming increasingly overregulated, while Greece is under pressure from its own bureaucracy. Cyprus, on the other hand, is benefiting from rising rental demand in seasonal locations, a steady influx of digital nomads and IT professionals, and flexible tax regimes for non-residents.

Furthermore, new programs for relocators, including the Digital Nomad Visa and simplified tax regimes for non-domestic citizens, have further increased the interest of international investors.

"Property in Cyprus offers seaside living and a profitable investment: a mild climate, tax breaks for non-residents, and stable rental demand. As a lawyer and investor, I help establish an ownership structure, take into account the non-domiciliary regime, and legally secure the transaction so that the property provides comfort and a stable income for the family."

— Ksenia , investment consultant,

Vienna Property Investment

I am Ksenia Levina, a lawyer with experience in real estate transactions in the EU, including Cyprus and Austria. My specialization is providing legal support to investors, formalizing ownership structures, complying with all KYC/AML requirements, and protecting buyers' interests within the Cypriot legal system.

To understand the overall picture, let's make a comparison with Austria (this will be discussed in more detail later in the article):

| Cyprus | Austria |

|---|---|

| High rental yields (especially on the coast) | Low profitability (2-3% on average) |

| Tax incentives, non-domiciliary regime, benefits for non-residents | Stricter taxes, no special incentives for foreign investors |

| Life by the sea, active tourist flow, flexible visa regimes | Stability, developed infrastructure, predictable regulation |

Cyprus's place on the European investment map

Cyprus occupies a unique position on the European investment map, combining the characteristics of a resort and business market. Three key segments can be identified:

The residential resort sector includes seaside villas and apartments in Limassol, Paphos, and Ayia Napa. These properties can generate the highest income when operated as seasonal rentals.

Urban real estate – apartments and houses in Nicosia, Limassol, and Larnaca. Here, there is a higher demand for long-term rentals from students, international company employees, and relocators.

Premium projects – luxury apartments and penthouses on the coast, often managed by international operators. This option is more suited to preserving capital and status than maximizing returns.

In terms of legal guarantees, Cyprus compares favorably with many Mediterranean countries. It operates under Commonwealth law, making the market more transparent and understandable for foreign investors. All documentation is available in English, transactions are supported by lawyers and intermediaries, and property registration is carried out through the state land registry.

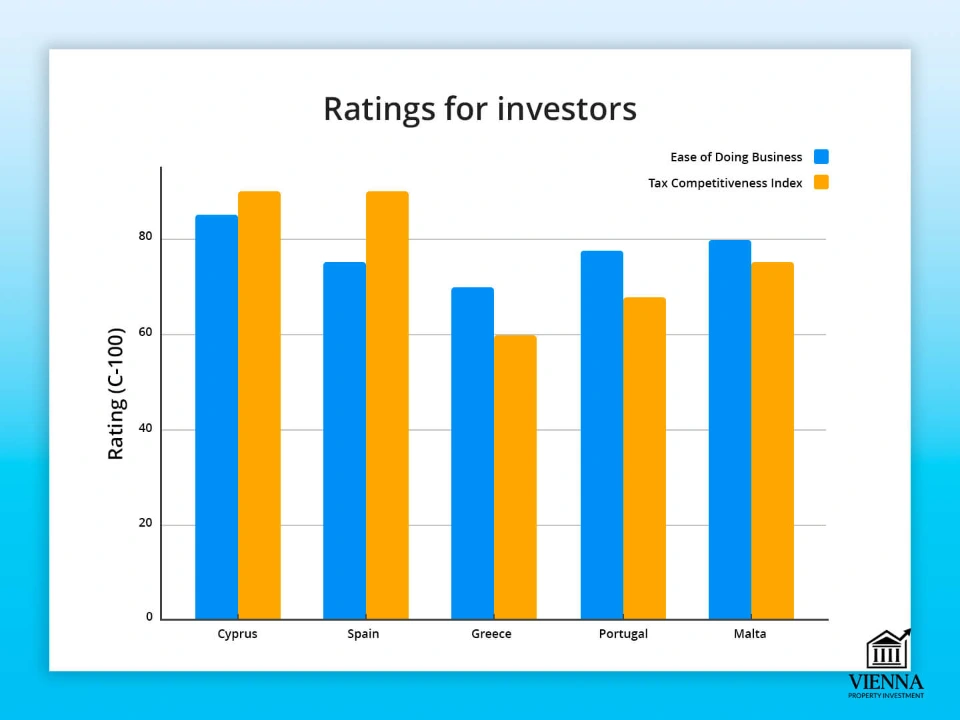

Cyprus consistently ranks high in all leading international rankings:

- Ease of Doing Business – the index is higher than most of its Mediterranean neighbors.

- Tax Competitiveness Index – Cyprus is among the most attractive jurisdictions for non-residents due to its non-domiciliary regime and low corporate tax rates (12.5%).

- Housing price dynamics – over the past 5 years, the market has shown steady growth, particularly in Limassol and Paphos.

Cyprus's competitors in the market remain Greece, Portugal, Spain, and Malta, but Cyprus wins due to its climate, English-speaking environment, developed infrastructure for expats and IT companies, and a flexible tax regime.

| Parameter | Cyprus | Austria |

|---|---|---|

| Rental yield | 4-6% in seasonal regions | 2-3% in Vienna and larger cities |

| Taxation | Non-domestic regime, tax benefits for foreigners | A strict tax system with no special tax regimes |

| Seasonal risks | High (tourism, vacation factor) | Minimal, the market is more even |

| Transparency of transactions | Anglo-Saxon legal system, English-language documents | Continental System, German-language documents |

| Investment strategy | Income + lifestyle | Stability + capital preservation |

Thus, Cyprus is the choice of those seeking a balance between seaside living, relocation opportunities, and higher income. Meanwhile, Austria is a priority for those seeking predictability and long-term stability.

Competitors

When investors consider Cyprus as a priority option, they almost always compare it to other European jurisdictions. The main competitors are Mediterranean and Central European countries, which offer comparable investment options: seaside apartments, long-term city apartments, or commercial real estate.

Austria is the complete opposite of Cyprus. It lacks the sea and resort seasons, but offers reliable stability. Vienna is one of the most reliable investment locations: prices start at €5,000/m² and yield 2-3% in the long term. In Salzburg and Innsbruck, prices are higher than the EU average, and yields are low but also stable. Austria is all about "capital preservation," while Cyprus is all about "income and lifestyle."

Spain and Portugal. These countries offer a developed resort property market with a vibrant tourist flow. In Spain, prices on the Costa del Sol start at €2,500-3,000/m², while in Lisbon and Porto they are even higher (€4,000-5,000/m²). Short-term yields can reach 5-6%, but rental regulations are quite strict, and licenses are more difficult to obtain than in Cyprus.

Greece. Comparable climate and tourism patterns. In Athens and Thessaloniki, prices start at €2,000/m², and are significantly higher in island locations. Yields fluctuate between 4-6%, but administrative barriers are higher than in Cyprus, and bureaucracy poses more challenges.

Malta is a direct competitor for the "island lifestyle." However, the real estate market is small and expensive: prices start at €4,000/m², and liquidity is limited by the country's size. For many investors, Cyprus appears to be a more affordable option, while still maintaining an English-speaking context.

Montenegro. A more affordable option for investors looking for seaside property. Prices start at €1,800-2,500/m², with yields of 5-7%, but the market is smaller and more volatile than Cyprus.

Cyprus Real Estate Market Overview

The Cyprus real estate market is one of the most dynamic in the Mediterranean. Its development is directly linked to tourism, international demand, and the island's tax policy.

History and Key Trends. Before the 2008 global crisis, Cyprus was experiencing a construction boom, with coastal cities, particularly Limassol and Paphos, experiencing rapid development. However, the crisis led to a drop in prices of nearly 30-40%.

In 2013, the European debt crisis and banking restructuring hit the market again, but foreign demand helped it recover. From 2013 to 2020, the main driver was the citizenship-by-investment program, which attracted billions of euros but was closed at the end of 2020 due to EU criticism.

The emphasis has now shifted to permanent residence through investment (from €300,000 in new buildings) and long-term rentals, especially in cities with active IT and financial migration.

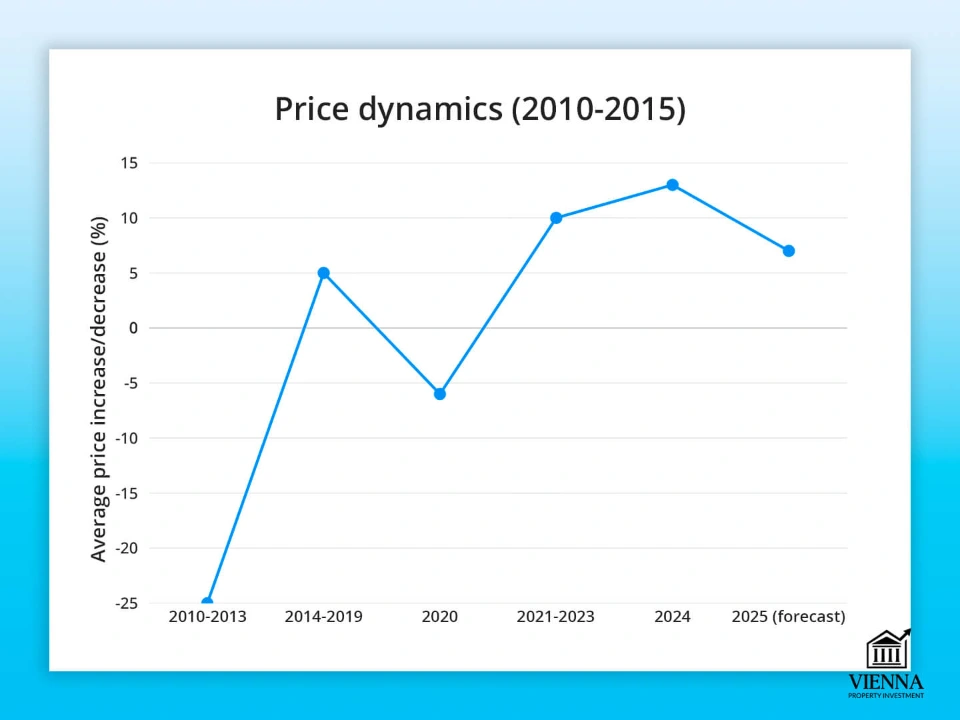

Real estate price dynamics (2010-2025)

| Period | Price dynamics | Features of the period |

|---|---|---|

| 2010-2013 | -20…-30 % | European debt crisis, bank collapses, falling demand |

| 2014-2019 | +5…+7% per year | Market recovery, increased interest due to CIP, foreign investment |

| 2020 | -5…-7 % | Covid-19, citizenship program closure, decline in transactions |

| 2021-2023 | +8…+12% per year | Relocation of IT professionals and families from Europe, high demand for rental space |

| 2024 | +10-15 % | Record sales: transactions increase in Larnaca, Paphos, Limassol |

| 2025 (forecast) | +5-10 % | Stabilization: growth in Limassol and Larnaca, moderate demand in Nicosia |

Geography of transactions

Limassol:

- The most expensive and developed real estate market in Cyprus.

- It is considered the “Dubai of Cyprus”: it is home to skyscrapers with business and premium class apartments, a harbor, yacht marinas, and offices of international companies.

- Limassol is a hub for relocators from the IT and financial sectors. It is home to numerous company headquarters operating in the EU and the Middle East.

- The cost of apartments by the sea and in new complexes in 2025 will reach €6,000–10,000 per square meter. Rents remain high throughout the year (especially for corporate clients).

Pathos:

- A more “family-friendly” location, with an emphasis on lifestyle and relaxation.

- Buyers: British (traditionally the largest group), Germans, Scandinavians.

- Villas with swimming pools and full-service complexes are popular.

- Prices are moderate: €2-3 thousand/m² for apartments and €3-5 thousand/m² for villas.

- There is a vibrant short-term rental market, but there is also demand for long-term rentals from families moving with children.

Larnaca:

- Long considered a secondary market, it has been actively developing in recent years thanks to a new port, marina, and large-scale development projects.

- The entry threshold is lower here (apartments from €2-2.5 thousand/m²).

- The main advantage is transport accessibility: the airport is located in the city itself.

- Significant price increases are predicted over the next 3-5 years due to infrastructure investments.

Nicosia:

- The capital and business center. It's not a tourist destination, but it's important for investors seeking stable rental income.

- Main tenants: government employees, university students, companies with long-term contracts.

- Prices are lower than on the coast: €1.5-2.5 thousand/m².

- Long-term rental yields in Nicosia can be higher than in resort locations (due to stability).

Ayia Napa and Protaras:

- Purely resort regions: high income is achieved through daily seasonal rentals (April–October).

- Demand from investors focused on short-term rentals.

- High seasonality: profitability can reach 8-10% per year, but during the rest of the year (winter), income drops sharply.

- Prices: €2-3 thousand/m², which is lower than in Limassol or Paphos, but the return on investment is higher with proper management.

| Location | Average prices (€/m²) | Object formats | Market Features |

|---|---|---|---|

| Limassol | €6 000-€10 000 | Business and premium class apartments, office buildings, seaside villas | The "Dubai of Cyprus" is a relocation hub for the IT and financial sectors. There is stable rental demand year-round, especially for corporate clients. |

| Pathos | Apartments: €2,000-€3,000, villas: €3,000-€5,000 | Villas with swimming pools, apartments in complexes with services | A popular option for families and Brits. Strong short-term rental market and stable demand for long-term rentals from families. |

| Larnaca | €2 000-€2 500 | New buildings by the sea, mid-range apartments | New port, marina, and development projects. Low entry barriers, high potential for price growth over the next 3-5 years. |

| Nicosia | €1 500-€2 500 | Apartments in the city center, studios for students | The capital and business center. The location is not a tourist destination, but there is stable demand for long-term rentals (government employees, students, corporations). |

| Ayia Napa / Protaras | €2 000-€3 000 | Apartments and villas for short-term rent | Purely resort segment. Profitability up to 8-10% per season, but high dependence on tourism. |

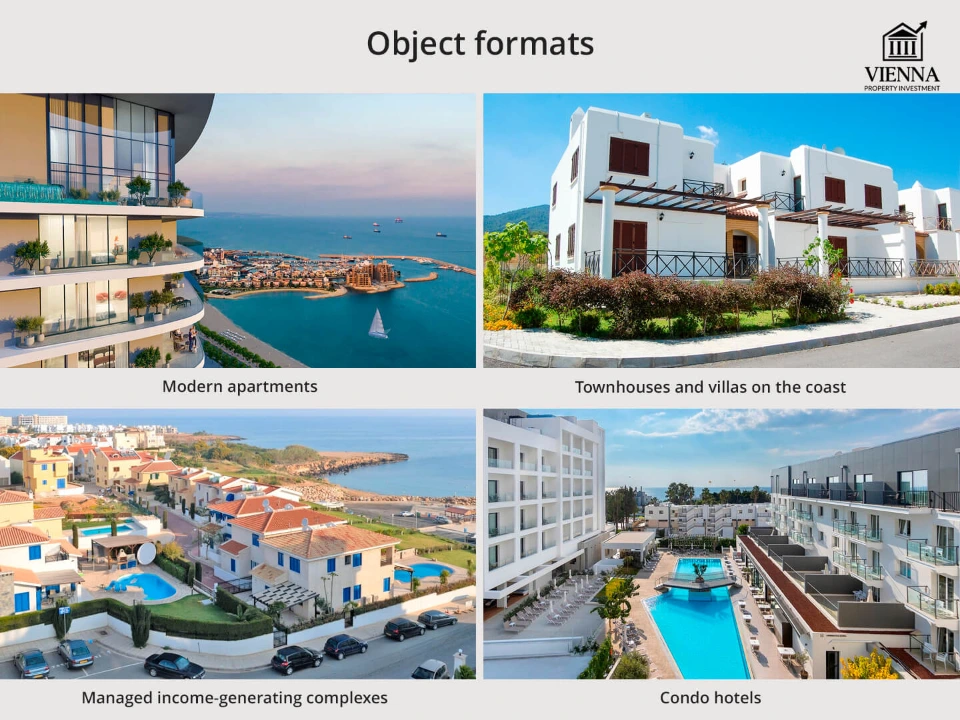

Object formats

Modern apartments in new buildings remain the most popular option for those planning to buy an apartment in Cyprus or investing in rental properties .

Developers are targeting the international market, so new residential complexes are being built to standards close to those in Europe and the Middle East. They feature extensive infrastructure, including swimming pools, gyms, gated courtyards, and concierge services. Premium projects also include spa areas, rooftop lounges, and secure parking.

This format is convenient for families with children and expats who want to live in a familiar and comfortable environment. Prices vary, from affordable properties in Larnaca and Paphos to more expensive apartments in Limassol, where prices can exceed €10,000 per square meter.

Townhouses and villas on the coast occupy a separate market segment . This is a more traditional and prestigious type of property, primarily targeted at wealthy buyers from the UK, Germany, and Israel. A villa by the sea is more than just a home; it's a status symbol and a promising long-term asset.

Prices start at €500,000 for compact homes in Paphos or Ayia Napa and can reach several million in Limassol and secluded coastal areas. For families choosing this country as a permanent residence, buying a villa in Cyprus is often the best option: it offers plenty of space, a private pool, and the opportunity to rent out the property to tourists during the summer season.

Of particular note is the format of income-generating residential complexes with delegated management , in the so-called "resort style." The investor purchases an apartment or studio, and the management company takes care of all operational activities: finding tenants, providing maintenance, and collecting payments.

This type of "passive investment" allows the owner to simply generate income while the property maintains its liquidity. This approach is increasingly being chosen by investors from Europe and the Middle East who want to own an asset in the EU but don't plan to personally manage the rentals.

A separate niche is condo hotels . This format, popular in Asia and the US, is also actively developing in Cyprus. The scheme involves an investor purchasing a stake in a hotel complex and receiving a fixed return, typically 4-6% per annum.

For the buyer, this is a safe and transparent option: the property operates as a fully-fledged hotel, managed by a professional network, and profitability is not dependent on seasonal fluctuations in demand.

| Format | Cyprus | Austria |

|---|---|---|

| Apartments in new buildings | The main choice for investors and relocators. Modern complexes by the sea and in large cities (Limassol, Larnaca), often with swimming pools, fitness centers, and concierge services. Prices: €2,000-€10,000/m² depending on location. | Vienna, Graz, Salzburg: a focus on urban living, with architecture in both historical and contemporary styles. New buildings are often more expensive than existing properties (€6,000-€10,000/m² in the capital). Indoor amenities are limited, with the focus on location. |

| Townhouses and villas | A strong segment. Seaside villas with swimming pools are particularly popular, with prices ranging from €500,000 to €3-5 million. Demand comes from families from the UK, Germany, and Israel. | Niche product: villas and townhouses in the Alps (Tyrol, Salzburg). Used as "chalets" for winter and summer vacations. Prices range from €800,000 to €3-7 million. Strict purchase regulations for foreigners (restrictions in some regions). |

| Income-generating complexes with management (resort-style) | A popular format: apartments or studios in a complex managed by a company, not the buyer. The management company takes care of rent and maintenance. Returns: 4-6% per annum. | Rarity: Traditionally, apartment buildings (Mehrfamilienhaus) are purchased as a single property, not as condos. Management is typically handled by tenants or specialized firms. Income yields are 2-3% per annum in Vienna, up to 4% in the regions. |

| Condo hotels | A growing segment. Investors purchase a stake in a hotel or a specific property and receive a fixed return (4-6%). | Underdeveloped: The classic hotel ownership model (either the entire property or a share in the stock) is still the standard. Condo ownership is rarely used, and regulation is strict. |

| Secondary market | Important for local buyers (especially in Nicosia and Larnaca). Prices are lower, liquidity is moderate. | A huge segment: "Old Vienna" is one of the most sought-after markets in Europe. Resale properties are often more liquid than new builds. |

| Rental housing | Strong demand among IT vacationers, corporate clients, and tourists. There are numerous options for both long-term and short-term rentals. Yields range from 4-8% depending on the format. | Traditionally one of the largest rental markets in the EU, yields are low: 2-3% in Vienna. Strict regulations protect tenants, and rental rates are tightly controlled. |

| Special formats (chalet, lifestyle) | Seaside residences, resort complexes, lifestyle villas by the sea. | Alpine chalets are a cult segment, often purchased as second homes or luxury properties. Restrictions for foreigners remain. |

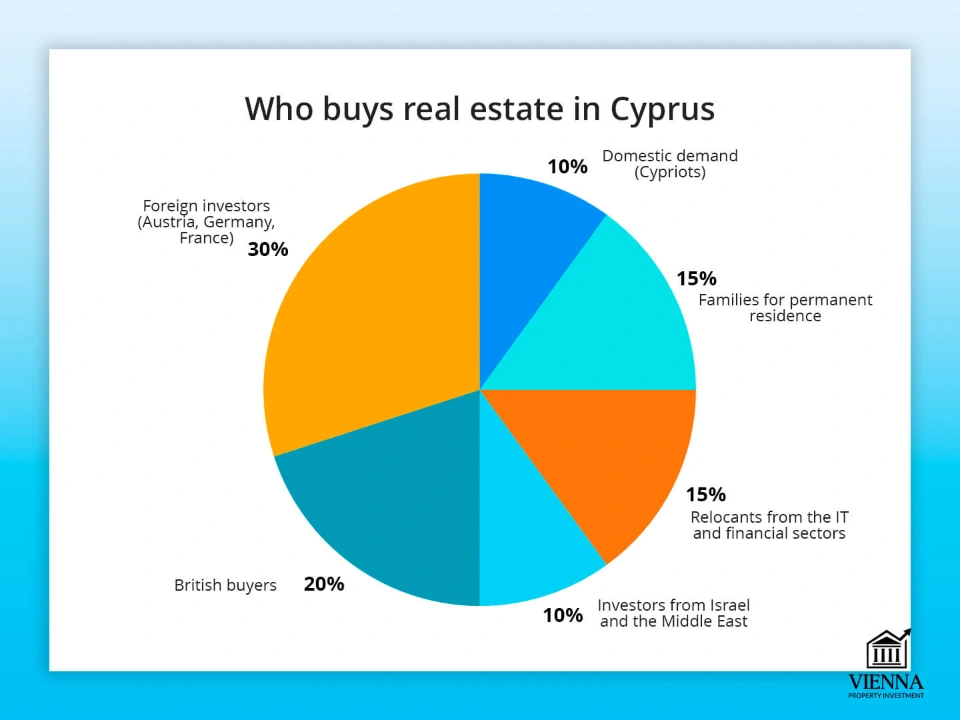

Who buys?

The profile of a buyer of Cypriot real estate is quite diverse, but several main categories can be identified.

Foreign investors account for the largest share . Among them, particularly prominent are citizens of Germany, France, and Scandinavian countries, who view Cyprus as a platform for capital diversification.

Cyprus has traditionally been popular with the British : since colonial times, they have actively purchased property on the island, particularly in Paphos and Limassol. Since 2022, interest from investors from Israel and the Middle East has increased, driven by political instability in the region and a desire to transfer some assets to EU jurisdiction.

The second group of buyers are relocators from the IT and financial sectors . In recent years, Cyprus has focused on attracting international businesses, launching a headquartering program, preferential tax regimes for companies, and special visas for IT specialists.

As a result, large IT companies are opening offices in Limassol and Larnaca, and the demand for housing from their employees is growing at a tremendous rate.

A separate category are families purchasing property for permanent residence . Infrastructure, schools, and healthcare are important to them. Cyprus has many international schools operating under the British and American education systems, making it attractive to families from the EU and the Middle East. These buyers often choose villas or spacious apartments with several bedrooms.

Domestic demand also exists, but it is significantly smaller. Cypriots more often purchase housing on the existing market, focusing on affordability and price, while foreign investors create demand for premium properties and new builds.

Tenant demand

The Cyprus rental market is divided into several segments, each with its own characteristics.

The long-term market is primarily targeted at employees of international companies, bankers, and relocators. In Limassol and Nicosia, rentals are in demand year-round, offering stable returns without pronounced seasonality.

The average rental price for a two-bedroom apartment in Limassol in 2025 exceeds €2,000 per month, and forecasts indicate further growth as supply is limited.

The short-term market is a classic tourist segment, most developed in Paphos, Ayia Napa, and Protaras. Here, profitability is directly dependent on the season: demand soars from April to October, with the summer months accounting for approximately 70% of annual revenue. However, activity declines sharply during the winter months, requiring careful strategic planning from investors.

The third niche is corporate leasing . Many companies rent apartments or houses to their employees working in Cyprus. This segment is particularly in demand in Limassol, home to the headquarters of IT and financial companies. Corporate tenants value the reliability and long-term nature of contracts, making such deals profitable for owners.

Comparison with Austria

| Parameter | Cyprus | Austria |

|---|---|---|

| Profitability | 5-7% (in resort areas up to 8-10%) | 2-3% |

| Rental type | Short-term (resorts), long-term (Limassol, Nicosia) | Mainly long-term, adjustable |

| Taxes | Non-domestic regime: tax exemption on dividends and interest for up to 17 years | Stricter system, few benefits |

| Risks | Seasonality, dependence on tourism | Minimum |

| Liquidity | Average, depends on location and object format | High, especially in Vienna |

Ownership formats and investment methods

Cyprus's legal system is based on English common law, making it one of the most transparent and predictable in the EU for foreign investors. Nearly all key documents are available in English, and transactions are structured to be understandable not only for local but also for international buyers.

This is why Cyprus is often referred to as a “convenient entry point into the European real estate market” for investors from various countries.

Below are the main ownership models and their features.

1. Individual

The simplest and most popular way to register real estate is to buy an apartment in Cyprus directly as an individual. This method is most often chosen by families purchasing a home for their own use or to obtain permanent residence. The process is straightforward: a purchase agreement is signed, the property is registered with the land registry, and the buyer becomes the official owner.

However, it's important to keep in mind that tax consequences depend on the country of tax residence. For example, residents of some countries will be required to report foreign assets and pay taxes at home.

2. Company (SPV)

For those who view real estate as an investment, especially when purchasing multiple properties or investing in income-generating projects, a Special Purpose Vehicle (SPV) is used.

Advantages of owning through a company:

- separation of assets and personal risks;

- corporate tax is only 12.5% - one of the lowest in the EU;

- the ability to flexibly optimize taxation, including in the event of a sale or inheritance.

SPVs are often used by investors purchasing income-generating complexes, condo hotels, or rental apartment portfolios. This format also facilitates the attraction of partners and the subsequent sale of the property when the transaction involves stakes in a company rather than real estate.

3. Trusts and foundations

For wealthy investors, Cyprus offers inheritance planning and asset protection tools – trusts and foundations. These allow:

- correctly transfer real estate to children or beneficiaries;

- avoid complex inheritance procedures;

- protect property from possible claims by third parties.

This approach is relevant when owning large portfolios or premium real estate worth several million euros. In practice, it acts as a family "shield," preserving capital and minimizing legal risks.

4. Joint ownership

Another option is to purchase property in Cyprus through shared ownership. This is most often used when purchasing large villas on the coast or apartment complexes, where several investors join forces to lower the entry barrier.

Co-ownership allows each partner to own a certain share of the property and receive income proportional to their investment. This approach is convenient for friends, partners, or families who want to own property together.

5. Features for non-residents

For foreign investors, entry into the Cypriot market has been simplified as much as possible:

- there are practically no restrictions on purchases (unlike in Austria or Switzerland, where foreigners often face strict quotas);

- It is mandatory to undergo bank verification (KYC, AML), where the origin of funds is checked;

- All transactions are conducted through licensed lawyers, which reduces the risk of fraud and guarantees transparency.

In fact, any investor can purchase real estate in Cyprus, provided they can prove the legality of their capital.

Cyprus vs. Austria

Private ownership predominates in Austria. The tax system is transparent but tightly regulated: investors understand all costs upfront, but there's virtually no flexibility. Structuring through trusts or foundations is expensive and complex, so such instruments are rarely used. Rental yields in Austria are low—2–3%—but risks are minimal, and the market is stable and predictable.

Unlike Austria, Cyprus offers a much wider range of ownership structures. Here, you can tailor a structure to your specific needs:

- for permanent residence – buy housing directly;

- for investments - register through a company or invest in a condo hotel;

- For estate planning, use trusts and foundations.

Additionally, a unique non-dom status is in effect: non-residents who receive this status are exempt from taxes on dividends and interest for 17 years. This makes Cyprus one of the most favorable EU jurisdictions in terms of tax burden for private investors.

Legal aspects of purchase

Purchasing property in Cyprus is a straightforward and streamlined process, but it has its own unique characteristics that differ from most continental Europeanized systems. The legal basis is the Anglo-Saxon approach to property law, making transactions relatively transparent for foreign buyers, but it does require careful preparation and compliance with all requirements.

Let's look at the entire sequence of actions from choosing a property to obtaining ownership rights, while revealing potential pitfalls.

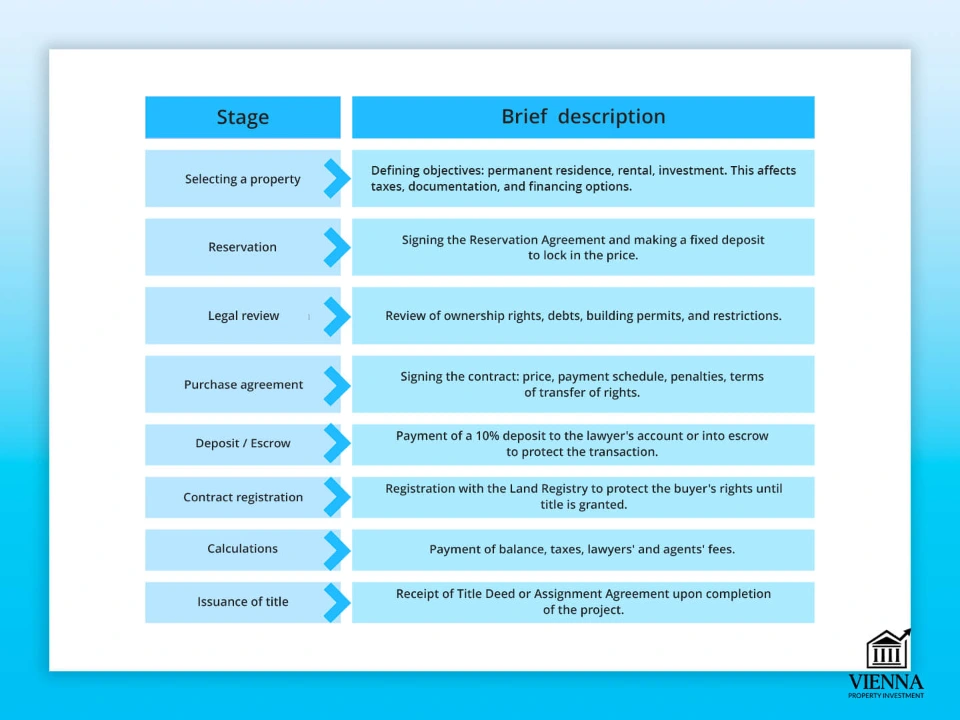

1. Selecting a property. First, determine the investment objective: "for living/permanent residence," "income through short-term rentals," or "corporate fund/portfolio." This influences the purchase format and document requirements (tax status, financing type, escrow requirements, etc.).

2. Reservation Agreement. The developer or seller signs a preliminary agreement with the buyer, which is usually accompanied by a fixed reservation fee (fixed price, inspection period). It's important to note that this stage is not a contract. It provides a small guarantee but does not protect against legal risks.

3. Legal due diligence. The lawyer conducts:

- Verification of the chain of ownership and title;

- Checking for possible existing complications – mortgages, liens, lawsuits, arrests;

- Analysis of planning documents and status of building permits;

- Check whether the site is protected (archaeology, regional restrictions, coastal area where construction is prohibited).

Due diligence is key to a secure transaction; skimping on legal services often results in unnecessary risks.

4. Contract/Agreement for Sale. Once the terms are agreed upon, a contract is signed, including the price, payment schedule, warranty provisions, default penalties, and commissioning dates. A schedule of payment stages and ownership transfer terms is often attached to the contract.

5. Deposit/escrow. Typically, at the contract stage, a deposit (usually 10% of the price) is made into the lawyer's client account or a separate escrow account (if agreed upon by both parties). In Cyprus, trust escrow with the lawyer is widely practiced; less commonly, third-party bank escrow is used.

6. Contract registration and temporary protection. After signing, the contract is usually registered (for example, by entering it in the land registry). Registering the contract provides the buyer with a certain degree of protection until final title is granted.

7. Settlements. Payment of the remaining contract price, taxes and fees, legal and agency fees, and, if necessary, notary/notary-qualified certifications.

8. Title Deed / Assignment Agreement. For the secondary market, you receive a title deed. For off-plan purchases, an assignment agreement is often drawn up (transferring the developer's rights to the buyer) and, upon completion of the project, title deeds are issued.

Important: The period between completion of construction and issuance of title can be significant – the buyer remains protected by contracts and registration, but does not legally own the property until the title deed is received.

Role of a lawyer / conveyancer (practice)

A lawyer is a key participant in the transaction: they perform due diligence, prepare and review contracts, facilitate the transfer of funds, and assist with the registration and transfer of ownership. Their responsibilities include:

- request and analysis of property title and plans;

- Checking the status of a building permit;

- requests to the cadastral register and local authorities regarding restrictions;

- agreeing on a payment schedule and reservations in the contract;

- organization of escrow/client account and control over the receipt of funds;

- support for closing the transaction and registering ownership rights.

Practical advice: Work only with licensed attorneys/lawyers who have experience in the Cyprus real estate sector and a proven track record of completed transactions.

KYC/AML requirements and practices

Any legitimate real estate transaction requires strict banking and legal controls:

- proof of source of funds (bank statements, asset sale reports, corporate reporting);

- identification of the buyer and beneficiaries (ID, passport, proof of address);

- Verification of the ultimate beneficial owner (UBO) when purchasing through a company;

- reporting on the transfer of large sums (banks require an explanation of the origin of the funds).

Failure to comply with KYC/AML requirements will result in account opening being denied, funds being frozen, and the transaction being cancelled.

Buying off-plan (new buildings): features and risks

Off-plan (purchase during the construction stage) real estate is very popular in Cyprus and offers competitive prices, but requires additional precautions.

Payment stages. Typically: reserve → 10% upon contract signing → stage payments as construction progresses (stages are defined in the contract) → final payment upon handover.

Bank guarantees. Reliable contracts include bank guarantees or partial payment retention until title is acquired or key work is completed. Try to obtain bank guarantees for the deposit/payment instalments.

Completion deadlines and penalties. The contract must include clear deadlines for commissioning and penalties/fines in the event of delays by the developer. Pay attention to force majeure provisions – they may waive the developer's liability in the event of pandemics, local restrictions, etc.

Assignment of rights. When assigning rights, provide a mechanism that protects you from hidden debts and liabilities, and agree on who will bear the tax costs in the event of a restructuring of the transaction.

Recommendation: For new developments, it's crucial to check the developer's reputation, current projects, ratings, and reviews, as well as the availability of funds to complete the project.

Buying property remotely in Cyprus

Today, more and more transactions are conducted remotely, especially when involving non-residents. This format has become possible thanks to the combination of the Anglo-Saxon legal model, the flexibility of local lawyers, and digital services.

Advantages of remote purchasing:

- Save time and travel costs.

- The ability to participate in a transaction while being in another country.

- Flexible mechanisms – electronic signatures and powers of attorney.

- The lawyer essentially “replaces” the buyer, overseeing the process.

How it works in practice

1. Selecting an object

The investor receives materials from the developer or agent: floor plans, photo/video reviews, virtual tours. Many companies offer live viewings via Zoom or WhatsApp.

2. Legal support

In Cyprus, a lawyer-intermediary plays a key role. They check the property's title, any potential restrictions, and building permits, and prepare the purchase and sale agreement. For the client, all of this can be done remotely, without having to visit the island.

3. Signing documents

The contract can be signed:

- electronically (via certified platforms),

- or by power of attorney certified by a notary in the buyer's country.

It is standard practice to send original documents by mail.

4. Financial settlements

The funds are transferred not directly to the developer, but to the lawyer's client account (escrow). The lawyer transfers them to the seller only after all contract terms have been fulfilled. This protects the investor from risks.

5. Property registration

After the transaction is completed, the lawyer submits the documents to the land department. The investor receives a title deed by mail or electronically.

| Element | Cyprus | Austria |

|---|---|---|

| Main person | Lawyer / Conveancer | Notary |

| Signing | Electronically / by proxy / by mail | EU signature, notarization |

| Account for settlements | Lawyer's client account, escrow | Notarial escrow |

| Bureaucracy | Delays may occur due to bank verification. | Standardized and fast process |

| Convenience for non-residents | High, flexible system | As formalized as possible, but predictable |

Features of the coast and coastal objects

Buying seaside property has a number of advantages, but it also comes with its own set of legal considerations. Here's what to consider:

Setbacks/coastal restrictions. Along the coast, development limits, setback requirements, special urban planning regulations, and natural area protections apply. Some areas may be unsuitable for construction or require special permits.

First line / second line. "First line" refers to land directly adjacent to the sea and commands a premium price. "Second line" is located a little further away and is less expensive, but has fewer restrictions. When purchasing first line property, be sure to check building restrictions and consider the risk of coastal erosion.

"Sea view" in the documents. Don't rely entirely on marketing: the presence or absence of official entitlement to an unobstructed sea view and building restrictions should be reflected in the documents.

Coastal protection, marine permits. Construction on the coast may require additional approvals from marine/environmental government agencies and organizations.

Comparison with Austria. In Austria, the transaction process is more formalized through the role of a notary public and clearly regulated escrow/funds, taxation, and transfers. It is more predictable, but the level of control is also much stricter.

In Cyprus, the Anglo-Saxon style of legal support emphasizes contractual protection and registration of contracts prior to the issuance of title. In Austria, notarial support and formal verification occurs "at the notary stage," whereas in Cyprus, a significant amount of work is performed by a lawyer/attorney.

This makes the Cyprus process flexible, but requires more discipline on the part of the buyer and a competent lawyer.

Taxes, fees and expenses

Below is a structured table that includes all the main taxes and fees associated with buying, owning and selling real estate in Cyprus.

Sources for key rates: tax and analytical publications 2024-2025: PwC Cyprus, George Konstantinou Law Firm, PwC Tax Summeries .

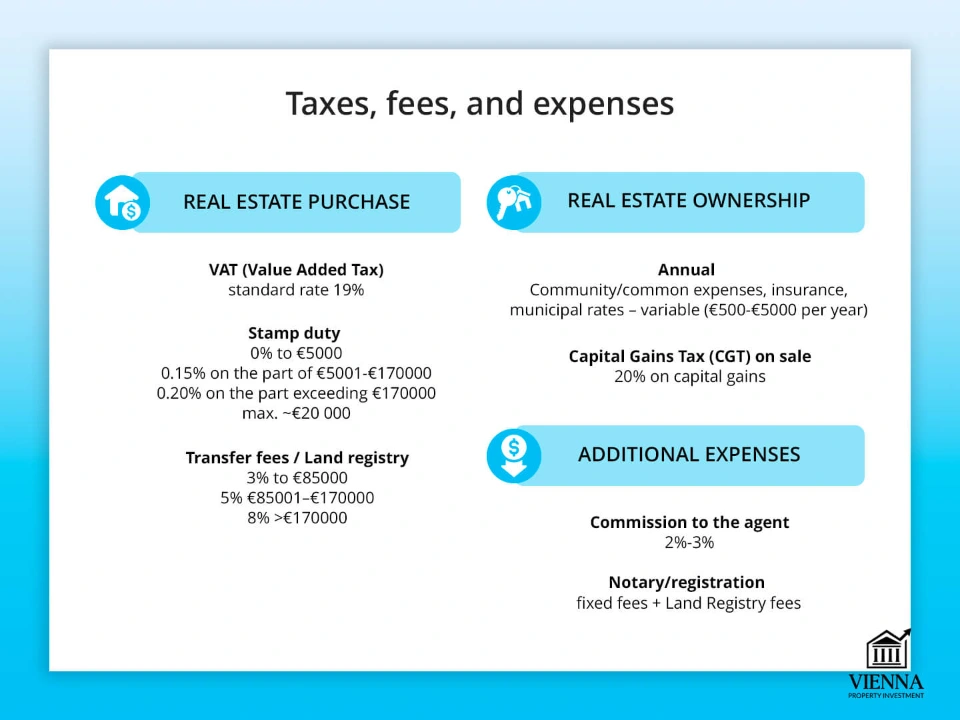

| Expense item | Rate / benchmark | Who pays / notes |

|---|---|---|

| VAT on new properties | standard 19% (there are programs with reduced 5%/0% under certain conditions and old projects with 5% during the transition period) | Applies to the primary market; reduced rate regimes apply for certain “primary residences” (see current terms) |

| Stamp duty | 0% up to €5,000; 0.15% on the portion from €5,001 to €170,000; 0.20% on amounts exceeding €170,000; max. ~€20,000 | Typically paid by the buyer; due within 30 days of signing the contract |

| Transfer fees / Land registry (upon resale, if there is no VAT) | 3% up to €85,000; 5% €85,001–€170,000; 8% >€170,000; often 50% off most deals | The calculation is based on the cadastral valuation or the contract price (depending on the specific case); when purchasing a new building with VAT, transfer fees are often not applicable. |

| Capital Gains Tax (CGT) on sale | 20% on the increase in value (tax applies to properties located in Cyprus) | Typically paid by the seller; there are exemptions and deductions (e.g., improvement costs, base deduction amount) |

| Legal/advocacy services | 1%-2% of the price (usually a sliding scale: the minimum is fixed) | Payment for legal/attorney services (due diligence, escrow, registration) |

| Agent commission | 2%-3% (negotiable) | Typically, the seller pays the agent; in some cases, the buyer pays by agreement. |

| Notary/registration fees | fixed fees + cadastral registry fees | Fee for registration of documents and registration of property rights |

| Annual / Ownership | General expenses, insurance, municipal taxes – vary (€500-€5000 per year) | Depends on the type of property (apartment or villa) and the complex (the premium segment has high overall costs) |

What an investor needs to know about key taxes and expenses

VAT. 19% VAT is the standard rate. It applies to new properties and construction services. However, there are programs and reduced rates for residential properties (previously, a 5% scheme was in effect for certain "primary residences" and projects, but the tax regulations for these reduced schemes are subject to regular changes in 2025-2026, so check the current conditions for the specific project you're interested in).

For resale (secondary market) VAT is usually not applied, but then transfer fees apply.

Stamp duty and transfer fees. Stamp duty is a small fee per contract. It is paid promptly—within 30 days of signing. Transfer fees (registration fees for transferring ownership) are calculated on a scale (3%/5%/8%), with a 50% discount often applied to the buyer for certain types of transactions.

These two components together represent a significant portion of transaction costs, especially when reselling.

Capital Gains Tax (CGT). A 20% CGT applies to profits from the sale of Cypriot real estate (and to shares in companies that directly own such property, under certain conditions).

There are deductions (original cost, reasonable improvements) and certain exemptions that need to be taken into account if you plan to exit the investment.

Legal expenses and agent commissions. Legal fees typically account for 1-2% of the total transaction price, and the agent commission is 2-3% (usually paid by the seller, but other options are possible). It's recommended to budget at least 3-6% for unforeseen and fixed transaction costs when calculating the total cost of entry.

Ownership and annual expenses. Annual expenses include complex utilities, insurance, municipal fees, and waste disposal fees. In expensive complexes (premium resorts), common expenses can be significant – up to several thousand euros per year, which reduces net rental income.

Taxation of rental income and corporate nuances. Rental income is taxed as part of the general tax base. For individuals, tax rates are progressive. Purchasing through a company (SPV) and managing through a corporate structure entails corporate tax, mandatory social security contributions on salary payments, dividend policy, etc.

Also important are double taxation agreements between Cyprus and the investor's country – they allow for a reduction in the tax burden if properly executed.

Tax regimes for non-residents: non-dom and the "60-day rule." Cyprus offers attractive tax mechanisms for new residents—in particular, the non-dom regime, which provides an exemption from tax on dividends and interest for an extended period (17 years under certain conditions), and the "60-day rule" for determining tax residency (an alternative to the 183-day rule)—a tool for planning temporary or partial tax residency in Cyprus.

These regimes make Cyprus attractive to investors who want to combine tax optimisation and EU residency, but the application of the incentives requires strict adherence to the conditions.

Sale and CGT. CGT of 20% applies to capital gains. Improvement expenses, legal costs, and basic deductions are taken into account to reduce the tax base. Plan for tax implications in advance: selling through an SPV may present additional challenges, and inheritance involves specific rules that make trusts/foundations more attractive.

Comparison with Austria. Austria has more formalities: the notary plays a key role, a predictable and strict tax system, and less flexible structuring (trusts/foundations are more expensive and complex). Rental yields in Austria, particularly in Vienna, are lower (around 2-3%), but market risks and volatility are also significantly lower. Cyprus offers higher potential returns (especially on the coast) and flexibility in ownership structures (SPV, non-dom), but also higher seasonal and operational risks.

Legally: In Austria, a notary makes the transaction formally secure and practically automated. In Cyprus, however, the lawyer/attorney plays a key role, managing the process and organizing the escrow account. This makes the process more flexible, but requires careful selection of the professionals you work with.

Visas and residency

Cyprus remains one of the few European countries where investing in real estate directly leads to residency status. The most popular tool is the fast-track permanent residence . It is available for those who purchase real estate in Cyprus worth at least €300,000 and provide proof of income from abroad. This status:

- perpetual and inheritable;

- does not require permanent residence (a visit once every two years is sufficient);

- extends to the applicant's family.

Alternatively, there are standard residence permits for retirees and individuals with passive income, as well as work visas for specialists, primarily in the IT and financial sectors.

Since 2022, a Digital Nomad Visa for remote workers earning at least €3,500 per month. For EU citizens, the process is even simpler: they can live and work in Cyprus without restrictions, simply by notifying local authorities.

In addition to the legal aspect, the lifestyle factor .

- In large cities there are English-language schools that meet British standards.

- The healthcare system combines state insurance (GESY) and a developed private sector.

- Cyprus is among the safest countries in Europe with low crime rates.

Taken together, this makes permanent residence in Cyprus not only an investment tool, but also a way to improve the quality of life of a family.

The situation is different in Austria. Resident status cannot be obtained directly through real estate. The main options are income-based residence permits and business or work permits. Unlike Cyprus, Austria requires actual residence; a "formal" residence permit is not possible.

Comparison with Austria:

- Cyprus: Flexible and practical options for investors and families.

- Austria: Strict and formalized rules for those who actually live in the country.

Rent and profitability

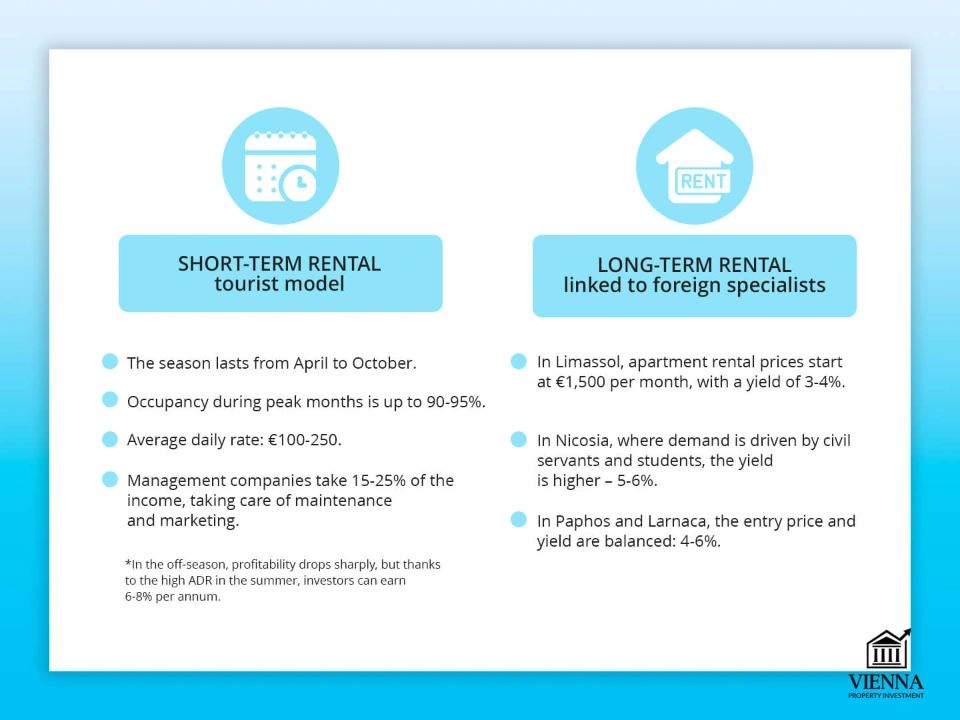

In Cyprus, the rental market is divided into two segments.

Short-term rental is a tourist model.

- The season lasts from April to October.

- Loading during peak months is up to 90-95%.

- Average daily cost: €100-250.

- Management companies receive 15-25% of the income by taking on maintenance and marketing.

During the off-season, yields drop sharply, but due to the high ADR in the summer, an investor can receive 6-8% per annum.

Long-term rentals are primarily associated with IT specialists and foreign experts.

- In Limassol, apartment rental prices start from €1,500 per month, with yields of 3-4%.

- In Nicosia, where demand is driven by government employees and students, yields are higher – 5-6%.

- In Paphos and Larnaca, the entry price and profitability are balanced: 4-6%.

In Austria, the market is more predictable but low-yielding. In Vienna and Salzburg, short-term rentals are not very popular, so investors focus on long-term contracts. Rates are stable, but yields rarely exceed 2-3%.

Total:

- Cyprus = high return potential, but highly seasonal.

- Austria = stability and low risks, but limited income.

Where to Buy in Cyprus: A Regional Analysis

Choosing the optimal location to buy a villa or apartment in Cyprus depends on strategy.

- Limassol is a premium market: offices, skyscrapers, a marina, and the status of a "business capital." Prices are high (€6,000-10,000/m²), yields are low, but liquidity is high.

- Paphos is a family-friendly and tourist destination, popular among Brits and Scandinavians. It offers a balance of price and liquidity, with yields higher than in Limassol.

- Larnaca – infrastructure upgrade (port, marina), affordable entry (€2,000–3,000/m²), capitalization growth potential.

- Nicosia is the capital and administrative center. Year-round rentals, low entry prices (€1,500-2,500/m²), and yields of 5-6%.

- Ayia Napa and Protaras – a resort model: in summer the yield is up to 10%, in winter – idle.

Cyprus vs Austria:

- Limassol is closest to Vienna – prestige and low profitability.

- Paphos is reminiscent of Salzburg – tourism and lifestyle.

- Nicosia is closer to Innsbruck – students and civil servants.

- Ayia Napa and Protaras can be compared to ski resorts due to their high seasonality.

Conclusion: The Austrian market is suitable for those seeking stability and long-term predictability. Cyprus, on the other hand, offers more opportunities for investors willing to work with a dynamic system, seasonality, and different strategies depending on the region.

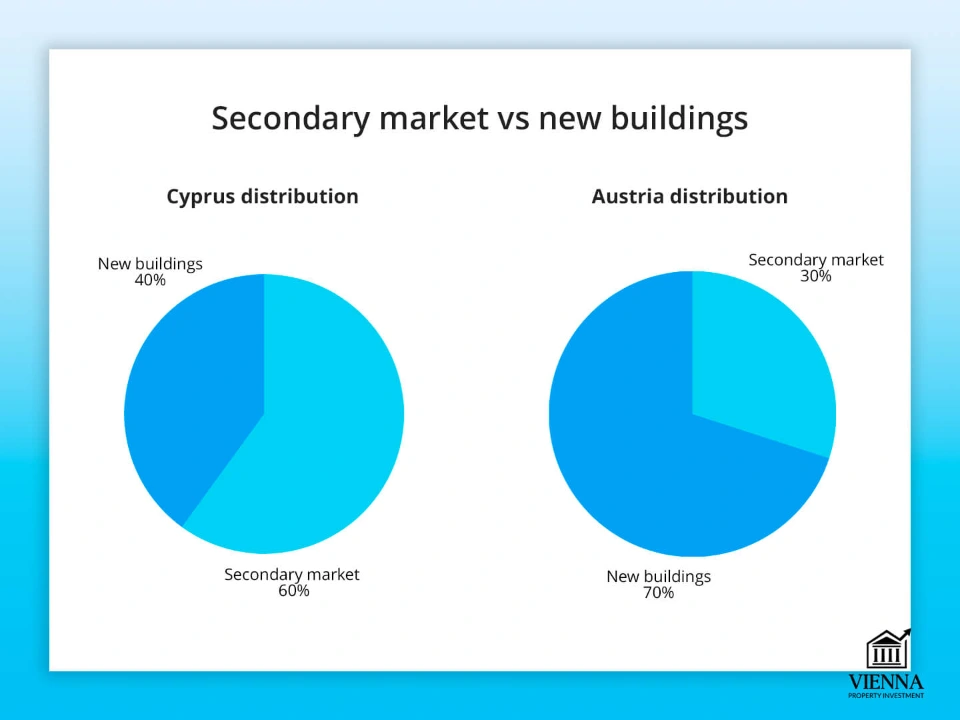

Secondary market and new buildings

In Cyprus, the market is divided into secondary and new build, with both segments having their own characteristics.

The secondary market is traditionally attractive due to the fact that the properties have already stood the test of time:

- it is possible to assess the actual quality of construction and operating costs;

- take into account utility bills and reserves for major repairs;

- check the history of the property – from ownership rights to the history of repairs.

New buildings are most often sold off-plan. Buying early allows for a discount of up to 10-15%, but requires greater due diligence:

- payment schedules are linked to construction stages;

- bank guarantees or insurance are used;

- The key risk is delays in delivery and construction quality.

Estimated prices (2024)

| Object type | Location | Price (from, €) |

|---|---|---|

| Studio / 1 bedroom | Inside the city (Larnaca, Nicosia) | 120000 – 180000 |

| Studio / 1 bedroom | Coast (Paphos, Limassol) | 180000 – 300000 |

| Villa (premium) | First line to the sea, Limassol | 1000000 – 3000000+ |

In Austria, new builds are generally more expensive and higher quality due to strict building codes, but yields are lower. In Cyprus, the price and quality range is wider, so choosing a reliable developer is a key element of any successful strategy.

Alternative investor strategies

Beyond purchasing a standard apartment or villa for rental, Cyprus offers alternative investment options that allow you to diversify your portfolio and expand into more niche segments.

Serviced apartments and condo hotels. Many developers offer turnkey complexes with third-party management, where the investor transfers ownership of the property to a management company. In exchange, they receive a guaranteed income (3-6% per annum) and no operational obligations. This format is suitable for those who value predictability and a "passive" approach.

Apartment buildings/mini-complexes. An option for larger players: purchasing a building or several apartments under a single management team. This requires significant investment and operational oversight, but with proper management, it can yield 7-9% per annum.

Student rentals (Nicosia, Limassol). In cities with universities, demand is consistently high throughout the academic year. This format ensures high occupancy and predictable income, although downtime is possible during the summer.

Commercial real estate:

- Street shops and offices are in demand in Nicosia and Limassol.

- Warehouses and logistics remain a niche for now, but may have long-term potential.

Land for development. Suitable for developers and funds. Risks are associated with urban planning restrictions, approval deadlines, and high capital costs, but the potential for above-average returns is also significant.

Comparison of strategies

| Format | Yield (YoY) | Difficulty of management | Risks | Investor type |

|---|---|---|---|---|

| Serviced apartments | 3-6% | Low | Operator dependency | Passive investor |

| Apartment buildings/complexes | 7-9% | High | Management, rental | Experienced, ready to get involved |

| Student rentals | 5-7% | Average | Seasonality | Private investor, long-term |

| Commercial real estate | 5-8% | Average | Segmental (location, market) | Medium/large investor |

| Land for development | 10%+ | Very high | Urban development, capital expenditures | Developers, funds |

Austria vs. Cyprus

- Austria → stability, emphasis on offices and long-term rentals, yields typically 2-4%.

- Cyprus → more niches (resort formats, short-term rentals, student segment), yield of 5-8% and higher.

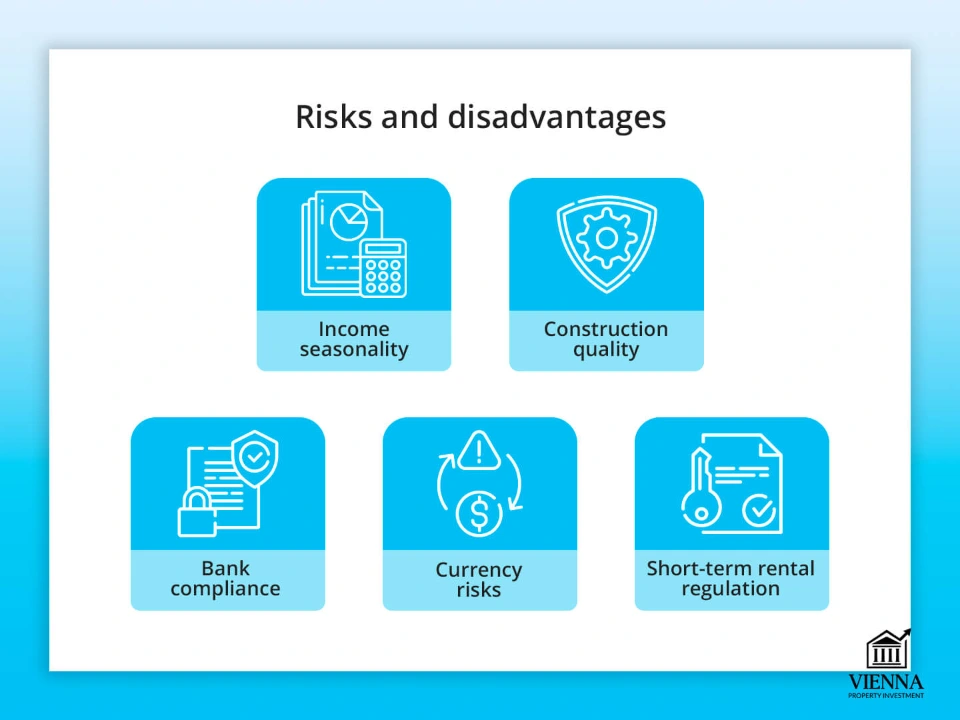

Risks and Disadvantages

Investments in Cyprus offer higher returns, but also higher risks than in Austria.

Key risks

- Seasonality of income and dependence on tourism: resort rentals are active from May to October. Demand drops significantly in winter.

- Construction quality and development risks: especially when investing in projects that are still under construction. Delays or cost reductions in materials are sometimes encountered.

- Bank verification (KYC/AML): Verifying the source of funds can slow down the transaction. It's important for investors to prepare documents in advance.

- Currency risks and remote management: for non-residents, these are separate expenses (management companies, insurance).

- Regulation of short-term rentals: registration in a special register and a license for renting out housing are required.

| Parameter | Cyprus | Austria |

|---|---|---|

| Seasonality | High (tourism) | Low (annual rent) |

| Construction risks | Medium/high | Low |

| Bank verification | Strict (KYC/AML) | Strict, but more predictable |

| Currency risks | Present | Eurozone (low) |

| Rent regulation | More difficult for short-term rentals | Clear laws for long-term rentals |

| Profitability | 5-8% | 2-4% |

Accommodation and lifestyle

Cyprus is not only a profitable investment destination but also an attractive relocation option. Many families, entrepreneurs, and IT professionals choose the island not only for its tax and visa advantages, but also to enjoy a pleasant combination of climate, affordability, and high quality of life.

The climate and ecology are among the main reasons Cyprus has become a magnet for immigrants. Around 320 sunny days a year, mild winters without prolonged rain, and the opportunity to swim in the sea for six to seven months at a time create a unique resort-like lifestyle.

At the same time, the island's ecology is considered quite favorable: compared to large industrial regions of Europe, there are no congested industrial zones, and the sea air has a positive effect on health.

Healthcare and education are available in both public and private settings. Since 2019, the national healthcare system GESY has been in operation, covering basic medical services. For more discerning clients, private clinics with internationally experienced doctors are available.

Education is also important for families: Cyprus has many English-language schools and universities, making the relocation process easier for children and teenagers.

The cost of living on the island is average: higher than in Eastern Europe, but lower than in Austria, Germany, or France. Rents and groceries in supermarkets may be cheaper, but imported goods and cars are more expensive. Since public transportation is poor, most families own a car.

A high level of safety also makes Cyprus an attractive place to live. It boasts thriving Russian-speaking, British, and Israeli diasporas, as well as vibrant communities of IT professionals and entrepreneurs. The island is among the safest regions in the Mediterranean, making it a comfortable choice for families with children and the elderly.

| Parameter | Cyprus | Austria |

|---|---|---|

| Climate | Sunny, sea air, mild winter | Moderate, cold and snowy winters |

| Medicine | GESY + private clinics, English-speaking doctors | Strong state healthcare + private sector |

| Education | English-language schools and universities | State schools, prestigious universities |

| Transport | A car is required | Well-developed public transport |

| Cost of living | Average, cheaper than Western Europe | Above the EU average |

| Relocator community | Active, multinational | There is, but it is less resort-like and “family-friendly” |

Real estate as a “European haven”

For many investors, Cyprus has become more than just an investment platform, but a “European haven” where they can invest capital, ensure family security, and maintain flexibility in asset management.

Reasons for interest in Cyprus:

- EU jurisdiction: real estate in Cyprus provides access to the European legal framework and protection of property rights according to EU standards.

- Anglo-Saxon legal system: transparent and predictable transactions that are understandable for foreign investors.

- Simple procedures for purchasing and registering real estate: minimal bureaucracy compared to other EU countries.

- English is widely used in both business and government, making it easier to adapt.

- Geography: Cyprus is located between Europe, the Middle East and Africa, providing fast flights to various regions.

IT professionals enjoy tax breaks, preferential visa regimes, and the opportunity to work in an international environment while enjoying a high quality of life.

Therefore, the decision to buy property in Cyprus is not only about investment income but also about risk diversification. For residents of countries with unstable political systems or currency restrictions, Cyprus becomes a "safe haven" that provides access to the EU and comfortable living.

| Parameter | Cyprus | Austria |

|---|---|---|

| Jurisdiction | EU + Anglo-Saxon legal system | EU, continental system |

| Flexibility of procedures | High, simple registration of transactions | More formalized processes |

| Use of English | Widely used | Limited, German is mandatory |

| Geography | Crossroads of Europe and the Middle East | Center of Europe, stability |

| Taxes and residency | Benefits for IT and relocators | Tougher conditions, higher taxes |

| Investor perception | Flexibility, profitability, and the sea | "Quiet Superstability" |

What does an investment exit look like?

Selling real estate in Cyprus is a separate stage of the investment cycle, and it is important to consider several factors: market liquidity, taxes, seasonality, and legal nuances.

Sales and time on the market:

- In Cyprus, the market is more volatile: demand depends heavily on seasonality (summer is more active than winter) and location.

- The average exposure period for properties on the coast can be 6-12 months, while for liquid apartments in cities (Limassol, Nicosia) it is much shorter.

- The sales period can be even longer for premium villas, especially if we are talking about properties over €1.5-2 million.

In Austria, the situation is more predictable: the market is less dependent on the seasons, and the time a property stays on the market is usually 3-6 months in Vienna and major cities.

Taxes and expenses

Cyprus:

- Capital Gains Tax (CGT) – 20% (with possible relief for first home purchases or long-term ownership);

- When selling through a company, tax optimizations may be offered;

- mandatory disclosure of sources of funds and transparency of the transaction.

Austria:

- capital gains tax (Immobilienertragsteuer) – 30%;

- The rules of inheritance and gift giving are transparent, but the rates are higher than in Cyprus.

Succession and estate planning. For long-term investors, asset transfer is often a concern:

- In Cyprus, it is popular to use companies or trusts to own assets, which simplifies inheritance and minimizes taxes.

- In Austria, the legal system is more strict, but it still guarantees full protection for heirs.

Comparison of liquidity and exit

| Parameter | Cyprus | Austria |

|---|---|---|

| Liquidity | Wavy: depends on the season, location and class of the object | Stable, especially in Vienna |

| Exposure period | 6-12 months (often longer for the premium segment) | 3-6 months |

| Capital Gains Tax (CGT) | 20% (with benefits in some cases) | 30% |

| Inheritance/donation | Trusts and structures are possible to streamline the inheritance process | A tough system, but more reliable protection |

| Risk factors | Tourism, developers, seasonality | EU regulations, high entry costs |

Expert opinion: Ksenia Levina

Based on my own experience working in Cyprus and Austria, I can say that both jurisdictions offer a number of advantages. When my clients seek reliability, peace of mind, and long-term capital protection, I refer them to Austria.

The yield here is lower, but the predictability and protection of rights are at the highest level. I recommend buying a house or land in Cyprus to those who want not only to preserve but also to grow their capital, while combining investment with a comfortable lifestyle.

When choosing a property, I always start by checking the developer and their legal background : ensuring they have clear title deeds, no financial encumbrances, and the correct building permits. Mistakes at this stage are extremely costly.

The second important point is a yield stress test : I simulate a situation where rental occupancy drops by 20-30% and assess how resilient the project remains. This approach allows us to understand in advance whether the property can withstand seasonal fluctuations.

Ownership type also plays a role. A small apartment can be registered to an individual, but if significant sums are involved, it's better to invest through a company (SPV). Cyprus has a non-domiciled regime, which allows for tax exemption on dividends and capital gains for up to 17 years, significantly improving the economics of the transaction.

In Austria, things are stricter, but double taxation agreements provide certain opportunities.

I typically offer three strategies. The conservative option is long-term urban real estate: for example, apartments in Nicosia or Vienna. A balanced approach works in Larnaca or Paphos: these have moderate prices and stable demand.

An aggressive scenario is short-term resort rentals on the coast of Cyprus. You can earn up to 8% per annum there, but you need to be prepared for seasonality and active management.

That's why I often tell my clients: "Diversify." The combination of Austria and Cyprus is an excellent working model. Austria provides stability, Cyprus provides income. Together, they form a balanced portfolio, where one market compensates for the weaknesses of the other.

Investor checklist

Before making a deal, I always advise investors to conduct a systematic check:

- KYC and bank account opening

- Checking ownership and the absence of financial encumbrances

- Analysis of the developer and its previous projects

- Short-term rental licenses (if planned)

- Property insurance

- Property management agreement

- Tax planning and accounting for non-domestic regime

- Exit plan (resale/long-term as a backup strategy)

Conclusion

In my opinion, buying property in Cyprus is the best choice when income, flexibility, and a high standard of living are important . It's especially relevant for families, IT professionals, and investors who want to combine investment with personal comfort—from relocation to children's education. Austria, on the other hand, wins for those who prioritize predictability and reliability, even if the returns are more modest.

That said, I always offer some general advice : be sure to work with a lawyer who understands local intricacies, independently vet the developer, and decide on a property management system in advance. And most importantly, always have a "Plan B": leave yourself the option to convert short-term rentals to long-term ones, reduce the price, or rethink your strategy if tourist traffic declines.

As for the future, I am confident that until 2030. Infrastructure will develop, tourism will remain stable, and tax incentives will continue to attract relocators.

But regulation will also become stricter : banks will be more careful about sources of funds, and short-term rentals will become increasingly regulated. Austria, as before, will remain an island of stability – without sudden movements, but with guaranteed liquidity and capital protection.

In short: Austria is about preservation, Cyprus is about profitability. Personally, I prefer to combine them in one portfolio to achieve both peace of mind and profitability.

"My approach is always based on finding the optimal strategy for each investor, one that suits their goals, budget, and lifestyle. Some value short-term rental income in Cyprus, others value stability and capital protection in Austria. And still others want to combine seaside living with a quiet asset in Europe."

— Ksenia , investment consultant,

Vienna Property Investment

Appendices and tables

Profitability by region of Cyprus

The Cyprus market is diverse: not only entry costs but also profitability models vary across cities. Short-term rentals with pronounced seasonality predominate on the coast, while stable long-term rentals prevail in the cities.

| Region | Average entry price (€/m²) | Long-term Yield | Short-term Yield | Liquidity | Seasonality |

|---|---|---|---|---|---|

| Limassol | 3000-5500 | 3,5-4,5% | 5-6,5% | Very high | Moderate (business + tourism) |

| Pathos | 2200-3000 | 4-5% | 6-8% | Average | High (resort) |

| Larnaca | 2000-2800 | 4-4,5% | 5-6% | Medium-high | Moderate |

| Nicosia | 1800–2500 | 5-5,5% | Almost none | High | Minimum (capital, offices) |

| Ayia Napa | 2500-3200 | 3-3,5% | 7-9% | Average | Very high |

Tax Comparison: Cyprus vs. Austria

The key difference is that Cyprus actively uses incentives (non-domestic, VAT reduction for primary residences), while Austria has a more conservative tax system, with an emphasis on long-term stability.

| Tax / Expense | Cyprus | Austria |

|---|---|---|

| Purchase | VAT 5% (first home) / 19% (other cases), stamp duty up to 0.2%, registration ~0.5% | 3.5% acquisition tax + 1.1% registration |

| Ownership | Municipal fees ~200-400 €/year, insurance, complex maintenance | Annual property tax (low), utilities |

| Sale | CGT 20% (with allowances and deductions) | CGT 30% (profit from sale) |

| Rent | Income is taxed at a progressive rate of 20-35%; non-domestic taxation and tax planning are possible. | Taxes on rental income up to 55% (progressive scale) |

| Non-residents | Non-domestic regime, 60-day rule, no tax on dividends and interest | The EU's common tax system, without any special benefits |

Investment scenarios

Investors in Cyprus have a variety of strategies available, from aggressive (short-term rentals in resorts) to conservative (long-term urban rentals).

Short stay by the sea (Paphos, Ayia Napa)

- Budget: 200-300 thousand €

- Average price per room: 90-140 €/night

- Payback: 6-9%

- Risks: seasonality, dependence on tourism

Long-term in the city (Nicosia, Limassol)

- Budget: 150-400 thousand €

- Profitability: 4.5-5.5%

- Tenants: corporate employees, students, government employees

- Pros: stability, minimal seasonality

Premium Beach (Limassol, Harbours)

- Budget: from €800,000 and up

- Profitability: 2.5-4%

- Scenario: Focus on capital growth and liquidity

- Pros: high prestige, protection from inflation

Diversification through management (portfolio)

- 2-3 objects in different locations

- Balance: one “resort” + one “city” + optional land or commercial

- Profitability: 5-6.5% with lower risks