Overseas Real Estate Investments: Trends, Forecasts, and Top Countries

In the first quarter of 2025, European real estate investment reached €45 billion, up 6% from the same period last year, CNBC reports. These figures confirm that overseas real estate, particularly in the European market, continues to be an attractive destination for investors.

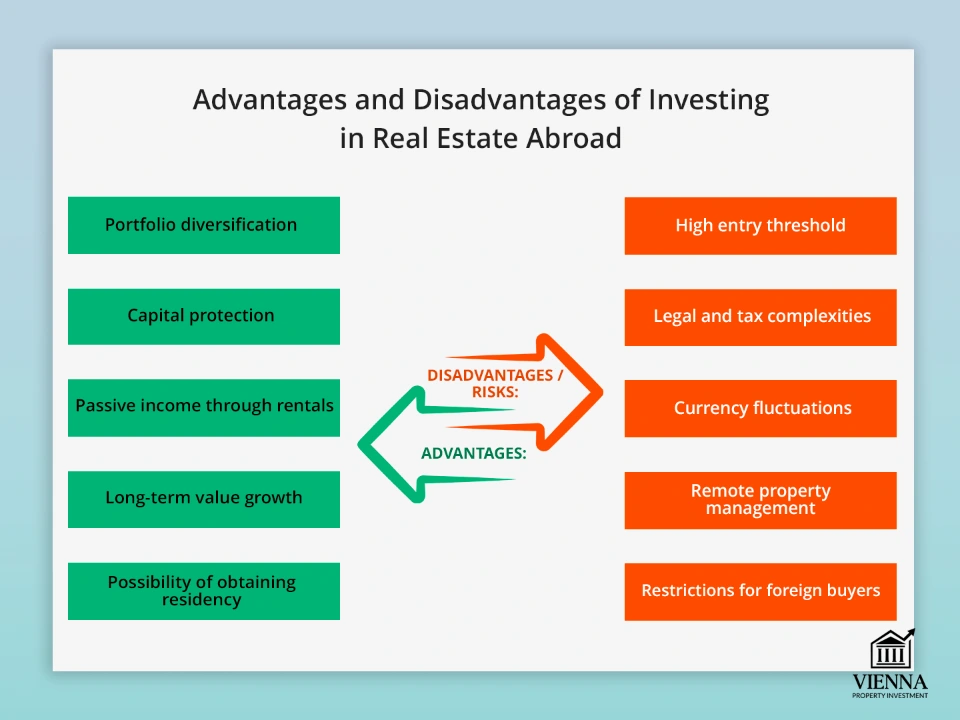

Investors are increasingly turning to foreign real estate as a tool for risk sharing, capital preservation, and stable income. Europe is of particular interest, with its market characterized by high legal certainty, transparent rules for purchasing and managing properties, and a stable economic system.

In this regard, Austria is a very promising choice: real estate in Vienna is often viewed as a "safe haven" asset due to its stable economy and transparent ownership rules. The country combines a strong economy and stable politics, excellent infrastructure, and a comfortable living environment. This makes buying real estate here a reliable investment: it will protect your funds from inflation and can generate income from rental income or rising market prices.

Why Investors Choose Foreign Real Estate

For many investors, the key reason to buy real estate abroad is to protect savings and spread risk. This step helps shield capital from economic or political problems at home and allows them to invest in different, independent markets. I generally recommend choosing countries with strong and stable economies where laws reliably protect property owners' rights, such as in Austria or Germany. This makes investing significantly safer and more transparent.

Another important advantage is that investing in foreign real estate can generate a stable rental income. Take Austrian cities like Vienna or Salzburg: there's always rental demand there. This allows you to not only cover utility costs and taxes but also generate additional income each month.

Investing in international real estate also opens the door to long-term capital growth. I can confirm from personal experience that apartments purchased in promising areas of Vienna 5-7 years ago are now worth 20-30% more. For clients who think long-term, this makes such investments a particularly attractive way to grow their wealth.

A separate strategic advantage for many investors is the opportunity to obtain a residence permit through real estate investment. Countries such as Portugal, Spain, Greece, and Cyprus offer residency upon purchasing property worth a certain amount. This is not only a financial investment but also a key to quality of life in Europe: access to advanced healthcare, education for children, and freedom of travel within the Schengen Area. Thus, investment becomes a tool not only for capital growth but also for long-term personal and family planning.

Green, energy-efficient homes are becoming increasingly popular The best choice is apartments with Class A certification or higher. They save you money on maintenance, are popular with residents, and retain high market value.

Many investors are also looking toward Eastern Europe and the Caribbean. Property here is more affordable, and high tourist demand offers good income opportunities. For example, summer rental apartments are popular in Croatia and Montenegro, while seaside villas are popular in the Caribbean.

In my opinion, Europe is a more reliable choice for long-term investments in foreign real estate. Transaction transparency is higher here, and investor rights are better protected, minimizing risks. Stable demand for housing ensures predictable income and capital preservation for years to come.

"Success in overseas real estate requires a well-thought-out plan. I'll help you choose a country and a property to ensure your investment generates a stable income and keeps your capital safe."

— Ksenia , investment consultant,

Vienna Property Investment

Country selection criteria

Choosing the right country is the foundation of successful overseas real estate investments. Your future returns, capital security, and long-term goals depend on it. In this article, I've summarized the key criteria to help you make an informed decision.

1. Economic stability and market predictability

Economic stability is the key factor for predictable housing price growth and stable rental income. The more stable the GDP and the lower the inflation rate in a country, the lower the risk that your investments will depreciate.

- Examples: Austria and Germany are often chosen by investors due to their stable economies and predictable housing market developments.

- What to consider: employment rates, inflation, rising property prices, and changes in rental demand.

2. Legal protection of investors

A strong and honest legal system ensures that your property rights are protected, you won't fall victim to fraud, and any real estate transactions will proceed smoothly.

- Examples: Germany, Austria and Switzerland have strict laws that govern real estate transactions and protect the rights of foreign buyers.

- What to consider: can a foreigner register ownership, how clear and transparent is the transaction, and are there official state real estate registries.

3. Possibility of obtaining a residence permit (RP)

The opportunity to obtain a residence permit or Golden Visa is a significant advantage for investors. It offers the opportunity to reside in the country and travel freely within the Schengen area.

- Examples: In Portugal, Spain, Greece and Cyprus, you can obtain a residence permit by purchasing real estate for a set amount – usually between 250,000 and 500,000 euros.

- What to consider: what is the minimum investment required, the country's residency requirements, and whether it is possible to extend a residence permit or eventually obtain citizenship.

-

For more information, see our article on temporary residence permits, permanent residence permits, and citizenship by investment in Europe .

4. Tax conditions and maintenance costs

When calculating profitability, it's important to consider not only the property's price but also any associated expenses. Property taxes, rental income taxes, and other mandatory fees can significantly reduce the net return on investment.

- Examples: In Austria and Germany, property taxes are relatively low, and rental income is taxed according to standard rules. In the US, taxes may be higher, but tax breaks are available for long-term investors.

- What to consider: annual taxes, rental income taxation, utility costs, and additional fees for foreign owners.

5. Rental demand and market liquidity

Strong rental demand allows for higher income and faster return on investment, while high market liquidity simplifies the subsequent sale of the property.

- Examples: Vienna, Lisbon and Barcelona have stable interest in both short-term and long-term rentals.

- What to consider: the level of tourist flow, the city's business activity, population growth, and seasonal fluctuations in demand.

6. Language and cultural factors

Knowing the language and understanding local rules and customs makes managing a property and working with tenants much easier.

- Examples: In Germany and Austria, German is most often required, while in Portugal and Spain, English is often used in business.

- What to consider: how easy it is to communicate with realtors and residents, as well as the local mentality and business culture.

7. Peculiarities of regions within the country

Even within a single country, profitability and risk levels can vary significantly depending on the city and specific region.

- Examples: In Vienna, central areas are more suitable for tourist rentals, while suburbs are more suitable for long-term renters. In Lisbon, popular tourist areas are favorable for short-term rentals, while less touristy areas provide more stable long-term income.

- What to consider: ease of transportation, infrastructure development, the area's appeal to renters, and the prospects for rising real estate prices.

Top countries for real estate investment

Choosing the right country is the foundation for a profitable overseas real estate investment. This selection features top countries that excel in three key criteria: economic stability, residency programs, and high rental yields.

Austria

- Cities: Vienna, Salzburg, Graz

- Market features: A robust economy, high levels of legal protection, and minimal price fluctuations in the real estate market.

- Income: Rent yields an average of 3-5% per year, while the value of properties in popular areas can increase by 20-30% in 5-7 years.

- Residence Permit: Purchasing real estate alone does not grant a residence permit, but it can make it easier to obtain a visa or long-term residence permit if additional requirements are met.

- Disadvantages: There are certain restrictions and strict procedures for foreign buyers that must be taken into account.

-

Find out more about restrictions on foreigners purchasing real estate in Austria .

- Tip: Downtown properties are better suited for short-term rentals, while suburbs and areas near universities are better suited for long-term renters.

Portugal

- Cities: Lisbon, Porto, Algarve

- Market Features: The Golden Visa program is available for investments of approximately €280,000 to €500,000, the market is actively growing, the climate is mild, and tourist demand remains stable.

- Income: Rentals can yield 4-6% per annum, especially in Lisbon and popular resort locations.

- Residence Permit: Golden Visa grants the right to a residence permit, which can be extended after 5 years and then permanent residence can be obtained.

- Disadvantages: In popular areas, there is high competition among landlords, and the Golden Visa application process can be quite bureaucratic.

- Tip: Tourist locations are better suited for short-term rentals, while less visited areas are better suited for more stable long-term income.

Spain

- Cities: Barcelona, Madrid, Valencia, Costa del Sol

- Market Features: Strong tourist flow, opportunity to participate in the Golden Visa program with investments of €500,000 and above, a wide selection of real estate—from apartments to villas and apartments.

- Profitability: Short-term rentals can yield 5-7% per year, long-term rentals – around 3-4%.

- Residence permit: Golden Visa gives the right to live and work in the country, as well as to move freely within the Schengen area.

- Disadvantages: The problem with repayments remains; in small towns and areas away from the coast, the secondary market is poorly developed.

- Tip: Resort areas and large cities are better suited for tourist rentals, while inland areas are better suited for long-term rentals and price increases.

Greece

- Cities/regions: Athens, Thessaloniki, islands (Crete, Rhodes, Santorini)

- Market Features: Relatively affordable properties can still be found on the islands, although prices in popular tourist destinations are rising. Foreign buyers still have relatively easy access to the market.

- Profitability: During the tourist season, rentals on the islands can bring in 6-8%, with long-term rentals – an average of 3-4%.

- Residence permit: Participation in the Golden Visa program is possible with the purchase of real estate from €250,000.

- Disadvantages: Tourism is seasonal, so income decreases during the off-season; infrastructure may be limited on some islands.

- Tip: Island properties are better suited for short-term rentals with high returns, while mainland cities are better suited for more stable long-term income.

Cyprus

- Cities: Limassol, Nicosia, Paphos

- Market Features: Seaside properties, as well as new residential complexes and villas, are in demand. Transactions are transparent, and stable demand is driven by tourists and expats.

- Income: Rentals can yield around 5-7% per year, with properties in popular areas easily resold.

- Residence Permit: Residence permits are available for investments of approximately €300,000 to €400,000, with permanent residence programs available for larger investments.

- Disadvantages: In popular resort areas, the market is overheated and resale property prices can fluctuate.

- Tip: Seaside properties are better suited for short-term rentals to tourists, while city apartments are better suited for stable long-term rentals.

Germany

- Cities: Berlin, Munich, Frankfurt, Hamburg

- Market Features: Strict regulation, high legal reliability for foreign buyers, stable demand for rentals, and transparent transaction terms.

- Income: Rent brings in an average of 2-4% per year in large cities, while the value of real estate can increase by 15-25% in 5-7 years.

- Residence Permit: Purchasing real estate does not directly grant the right to a residence permit, but it can simplify the financial side of applying for a visa or long-term residence.

- Disadvantages: Profitability is lower than in Southern European countries, and competition among investors and tenants remains high.

- Advice: Consider investing in real estate in the central areas of large cities—they provide high liquidity and a more stable income.

France

- Cities/regions: Paris, Nice, Cannes, Côte d'Azur

- Market Features: Large metropolitan areas and resort destinations with high liquidity, steady price growth, and stable rental demand from both tourists and local residents.

- Profitability: On the coast, rental income can reach 4-6% per year, in cities - around 3-4%, while the value of properties increases gradually and steadily.

- Residence Permit: Purchasing real estate does not directly grant a residence permit, but large investments can increase the chances of obtaining a long-term visa.

- Disadvantages: High tax burden and expensive property maintenance costs, as well as complex bureaucratic procedures during transactions.

- Tip: Resort locations are suitable for seasonal rentals, while Paris and Lyon are suitable for long-term investments and capital growth.

UAE (Dubai)

- Cities: Dubai, Abu Dhabi, Sharjah

- Market Features: Active construction of modern residential complexes, a steady influx of tourists, a large community of foreign residents, and well-established infrastructure.

- Income: In Dubai, rental properties can generate 7-9% per annum, while demand for apartments and villas remains consistently high.

- Residence Permit: With an investment of at least 1 million AED (approximately €250,000), investors can obtain a residence permit; for larger investments, long-term residence visas are available.

- Disadvantages: Prices for new builds can be volatile, transactions are subject to high commissions and fees, and rental income can vary depending on the season.

- Advice: The highest returns come from Dubai's central districts, Marina, and Dubai Hills, and it's wise to consider investments in new projects with an eye toward future price growth.

| Country | Average rental yield | Advantages | Risks/Features |

|---|---|---|---|

| Austria | 3–5 % | A stable economy, transparent laws, rising prices, and rental demand | No direct residence permit programs, moderate returns compared to other countries |

| Portugal | 4–6 % | Golden Visa, lots of tourists, steady price increases, mild climate | Strong seasonality in income and rapid growth in real estate prices in the capital (Lisbon) |

| Spain | 3–7 % | Golden Visa, wide selection of facilities, high tourist demand, advanced infrastructure | Seasonal fluctuations in rental income, the need for careful tax planning for non-residents |

| Greece | 3–8 % | Affordable property prices on the islands, the Golden Visa program, and high demand from tourists | Profitability is highly dependent on the season, with high price volatility at popular resorts |

| Cyprus | 5–7 % | Opportunity to obtain a residence permit through investment, a developed maritime real estate market, transparency of transactions, and rental income | The small and narrow market, the economy and investor income are directly dependent on tourist flow. |

| Germany | 2–4 % | Economic stability, stable rental demand, legal security, long-term capital growth | Relatively low rental yields, no direct immigration program for investors |

| France | 3–6 % | A stable market, high liquidity in major cities and resorts, and long-term price growth | High taxes, complex bureaucratic procedures for foreign buyers |

| UAE (Dubai) | 7–9 % | High income potential, modern infrastructure, immigration program for investors, growing expat market | Price volatility, the market depends on the economy and tourism |

Based on my clients' experience, Austria remains the most popular choice for long-term investment in foreign real estate. The reason is simple: it's the most balanced and reliable market. It boasts a stable economy, clear rules of the game, and constant rental demand. Other countries, such as Portugal, Spain, and the UAE, are also attractive, but Austria leads the way in terms of its combination of safety, profitability, and predictability.

"Investing in overseas real estate is a step toward financial independence. My goal is to build a reliable strategy for you that will reduce risks and ensure a stable cash flow."

— Ksenia , investment consultant,

Vienna Property Investment

Risks and restrictions for investors

Overseas real estate offers great potential, but it requires caution. Understanding local risks and restrictions is key to securing your investment and making informed decisions.

1. Currency risks

Be aware of currency risk: the asset's value and rental income may increase, but if the foreign currency depreciates against your own, the actual return will be lower. This is an important consideration for long-term investments.

Advice: Use financial instruments, hold money in local currency, or factor in possible fluctuations in your calculations in advance.

2. Financing and interest rates

Mortgage terms are a key factor in investment profitability. For example, rates in stable countries (Austria, Germany) are often higher than in Southern Europe, but the risks are lower there. My advice: always consider the possibility of interest rate increases and build up a financial reserve to cover this risk.

3. Economic and political instability

Investment risks exist even in the most stable countries—these include both general economic crises and legislative changes that can impact the profitability and value of an asset. In markets with high political instability, the risks are more specific: these may include sudden restrictions on foreigners, freezing of operations, or the introduction of new taxes. It is important to analyze both types of risks.

4. Tax liabilities

Tax regulations for real estate and rentals are unique to each country. Ignorance or failure to comply with these regulations not only leads to fines but also to a reduction in the overall profitability of the investment.

What to consider: Property taxes, rental income levies, special tax requirements for non-residents, and the presence of international agreements preventing double taxation.

5. Price adjustments for old housing versus new homes

Investing in existing properties in major cities can yield high returns, but is riskier due to wild price fluctuations. New buildings are generally more expensive, but they are attractive to renters due to their modern amenities and require virtually no renovations. The optimal strategy is to invest part of the capital in new properties for stable income and the rest in high-quality existing apartments with good growth potential.

6. Second home restrictions and environmental requirements

Some countries restrict foreigners from purchasing second properties or impose special rules for short-term rentals. At the same time, environmental regulations are becoming stricter, with high energy efficiency ratings becoming mandatory. I recommend choosing properties with the appropriate certification—this makes them more marketable and protects them from future fines or renovation costs.

7. Liquidity and rental yield

Not every property is equally easy to rent or sell. In areas with active tourism or stable demand for long-term rentals, properties sell and rent faster. I often notice that apartments in the center of Vienna and Salzburg find tenants in just a few days, while properties in more remote areas can sit empty for months. Therefore, when choosing a property abroad, it's important to consider actual demand and potential income levels.

8. Cost of property maintenance and servicing

Real estate requires regular expenses for maintenance, repairs, insurance, and utilities. These expenses can reduce the overall return on investment.

Tip: When assessing profitability, it is important to factor in all additional costs and possible unexpected expenses in advance.

9. Legal and bureaucratic risks

The rules for registering, purchasing, and owning real estate vary greatly from country to country. A mistake in the paperwork or a misunderstanding of local laws can easily lead to serious legal problems.

Advice: Always work with reputable lawyers and agencies and thoroughly research all stages of real estate transactions, from purchase to sale.

Which properties are more profitable to invest in?

Successful overseas real estate investments depend not only on the country but also on the right choice of property type. Each property class offers its own opportunities: some offer stable rental income, others rapid price appreciation, and still others offer high liquidity or compliance with green standards. Below are the main categories of properties I recommend and the situations in which they are most advantageous.

Residential real estate

- Regular apartments (in new buildings and on the secondary market), as well as townhouses.

- Best suited for long-term rentals, especially in large cities and areas with stable demand.

- From personal experience, such properties are well-suited for those seeking a secure and secure investment. New apartments are usually easier to rent out, and existing properties can sometimes offer greater appreciation if you choose the right neighborhood.

Resort/tourist real estate

- Villas, apartments in resort areas and short-term rentals.

- During high season, such properties can generate good income, especially in popular locations such as the Spanish coast or the French Alps.

- However, income can drop significantly off-season, so I always advise investors to research the region's tourism flow before purchasing resort property.

Commercial real estate

- Office premises, retail space, industrial buildings and warehouses.

- This type of property can provide stable rental income, especially if there are reliable and long-term tenants.

- But commercial real estate in Europe is currently facing challenges: rising interest rates, high construction costs, and other factors are reducing profitability.

- I recommend this option to experienced investors or those who are willing to work with large tenants or invest through funds.

Hotel and hospitality real estate

- Non-standard properties such as hotels, aparthotels and boutique hotels.

- They can generate high income in tourist countries, especially in regions with a constant flow of guests.

- At the same time, such projects are more difficult to manage, but with the right approach they can provide very good profits.

Social/specialized real estate

- Medical centers, homes for the elderly and student housing.

- Such properties are typically less susceptible to market fluctuations and have long-term tenants.

- In my experience, this segment is becoming increasingly popular: investors are increasingly choosing “social” real estate to combine stability and income.

Eco-real estate / energy-efficient properties

- Facilities with environmental certificates and energy-efficient technologies.

- They require less maintenance costs and are more attractive to tenants who value ecology.

- I often recommend considering such buildings, as they are easier to sell and better meet new government and regulatory requirements.

| Country | Residential real estate, €/m² | Resort/tourist property, €/m² | Commercial real estate, €/m² |

|---|---|---|---|

| Austria | ~ 5,900 €/m² for apartments (national average) | In ski resorts the price rises to ≈ 10,000-12,000 €/m² or higher | High prices, especially for premium properties - approximately €8,000-12,000/m² and above (depending on location) |

| Germany | ~ ≈ 5,000-6,000 €/m² in cities (e.g. Berlin ~5,379 €/m²) | In tourist areas, prices are sometimes higher than average, but information on them may be incomplete or contradictory. | Offices and shops in the city centre are expensive (from €6,000–8,000/m² ), but generate relatively little income. |

| Spain | ~ 2,517 €/m² national average as of September 2025 | In prime tourist areas: ≈ 5,000-6,000 €/m² (Balearic Islands ~5,068 €/m²) | Commercial real estate prices vary widely. In popular areas, prices can be expected to be around €4,000-€7,000 per square meter. |

| Portugal | Residential property: ~€1,700-2,000/m² in major cities (approximately) | In tourist areas the price may be higher - ≈ 3,000-4,000 €/m² and more | Commercial properties in large cities: approximately €4,000-6,000/m² |

| France | ~ ≈ 3,200-4,000 €/m² nationwide (but higher in Paris and prestigious areas) | Resort areas (Alps, coast): can reach ≈ 6,000-8,000 €/m² and higher | Commercial real estate in large cities: approximately €7,000-€10,000/m² and above |

| Cyprus | ~2,500–3,500 €/m² in cities (Nicosia, Limassol) | In tourist and coastal areas: ≈ 3,500–5,500 €/m² , in premium villas – up to 7,000 €/m² | Commercial real estate in cities: approximately €3,500–6,000/m² , in popular tourist areas prices are above average. |

How to Buy Overseas Property: A Step-by-Step Guide

Investing in foreign real estate smoothly requires caution, a thoughtful approach, and knowledge of local regulations. By following my detailed step-by-step plan, you can avoid common mistakes and ensure maximum protection for your investment.

1. Define goals and budget

First of all, you should decide what goal you are pursuing:

- Do you plan to rent out the property (monthly or daily)

- will you use it for personal residence?

- or is your primary goal long-term value growth and capital protection?

Then calculate your actual budget by including:

- the cost of the property itself,

- taxes and duties,

- regular costs for maintenance and possible repairs,

- the impact of exchange rate fluctuations.

2. Select your country and city

Assess the country's economic security, legal conditions, rental income potential, and residency options.

- Cities with a constant demand for rentals and a developed urban environment

- Tourist presence, seasonal fluctuations, and long-term prospects for property price appreciation

3. Research the market and property type

- Determine the property type: apartment, villa, condo or commercial property

- Compare the cost of similar properties and potential rental income

- Use reports from international and local analytical companies (e.g. Knight Frank, Savills, InvestFuture)

4. Prepare the legal basis

- Find out if foreigners are allowed to purchase real estate without restrictions

- Check the legal purity of the property, the presence of liens and the legality of the construction

- If necessary, make your purchase through a registered company

5. Find a reliable agent and lawyer

- Choose only reliable specialists with a good reputation for cooperation

- A legal expert will undertake the preparation and review of the transaction, document analysis, and tax issues

- A realtor will select suitable options, calculate the potential profit and represent your interests when negotiating terms

6. Checking and inspecting the object

- Be sure to visit the site yourself or entrust this to an experienced specialist.

- Conduct a detailed inspection of the property's condition, all utility systems and existing equipment.

- Analyze the location: ease of transport links, availability of infrastructure, and potential for value growth in the area.

7. Drawing up and signing the contract

- The agreement is drawn up in the official language and records all the details of the agreement.

- Pay special attention to the sections on payment schedules, penalties for violations, and buyer and seller obligations.

- Check whether the transaction requires notarization or registration with government agencies.

8. Payment and registration

- Transfer funds through a secure payment gateway or use an escrow account for security.

- Register your ownership rights in the official state cadastre or registry.

- Pay all applicable taxes and fees (for the transaction, registration and notary services).

9. Property management

- Decide on the management format: independent control or delegation of authority to a management company.

- If you rent out a property, enter into lease agreements and obtain property insurance.

- Maintain financial records (income and expenses) to understand real profitability.

10. Monitoring and optimization

- Monitor the current market situation and price dynamics for properties in your class.

- When conditions change, promptly change your rental or sale strategy.

- Plan smart investments in upgrading and improving your property to increase its value and income.

Latest news and trends

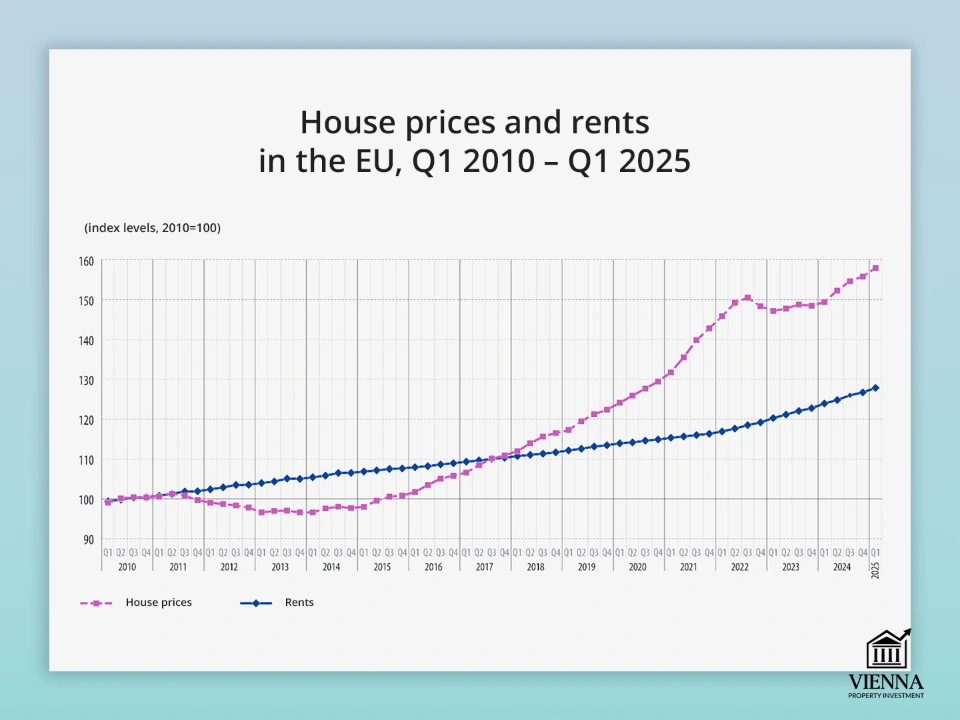

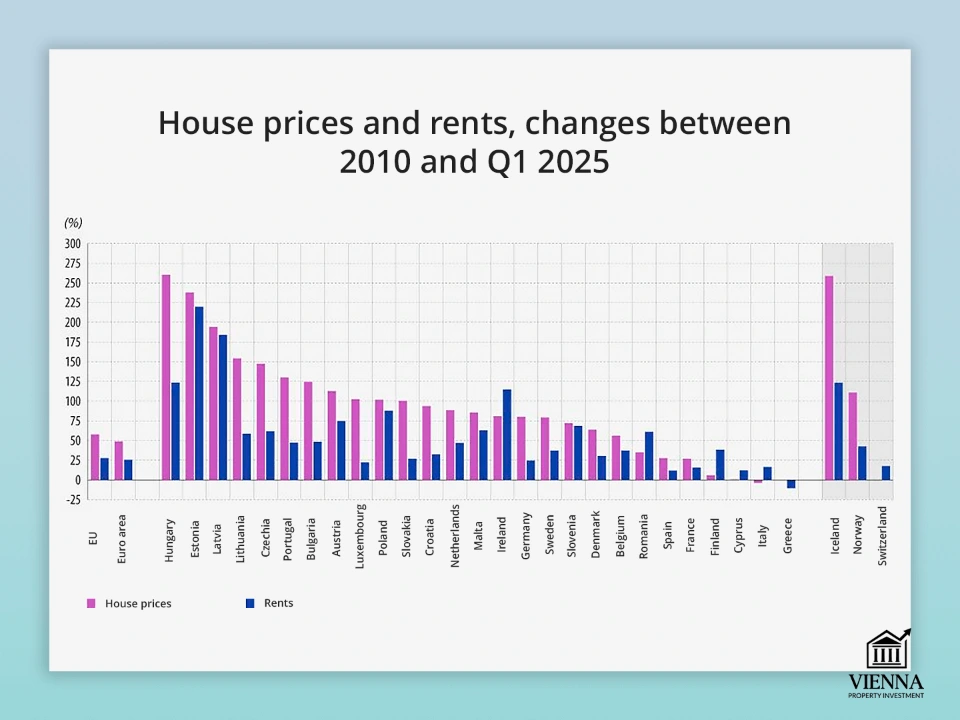

- The residential sector continues to show growth: according to a BNP Paribas Real Estate report, total residential real estate investment in Europe exceeded €29.3 billion in the first nine months of 2025. Urban housing prices increased by an average of 4.6% year-on-year, while rental rates increased by approximately 4.4% (Q2 2025 vs. Q2 2024).

- The Austrian real estate market is gaining momentum: between January and June 2025, transaction volume increased by 13.9% year-on-year, with the total financial value reaching ~€15.32 billion.

- There is a steady increase in interest in "green" real estate. Investors and investment funds are shifting their focus toward energy-efficient buildings that meet environmental standards and are equipped with modern systems.

- According to JLL's Global Real Estate Outlook 2025, even in challenging economic conditions, the residential sector remains the largest investment destination. Globally, transactions worth up to $1.4 trillion are expected over the next five years.

- According to forecasts from consulting firm C&W, rental rates for prime offices, warehouses, and high-quality retail space will increase. A decline in new residential and office projects is leading to a shortage of quality space, which is contributing to the maintenance and potential growth of rental prices.

- Cities such as Vienna, Madrid, Paris, Berlin, and Amsterdam retain their status as safe havens for capital. Real estate investments in these metropolises are still considered sound, especially for investors seeking long-term stability and high liquidity.