Investing in US real estate – houses, apartments, profitability, taxes

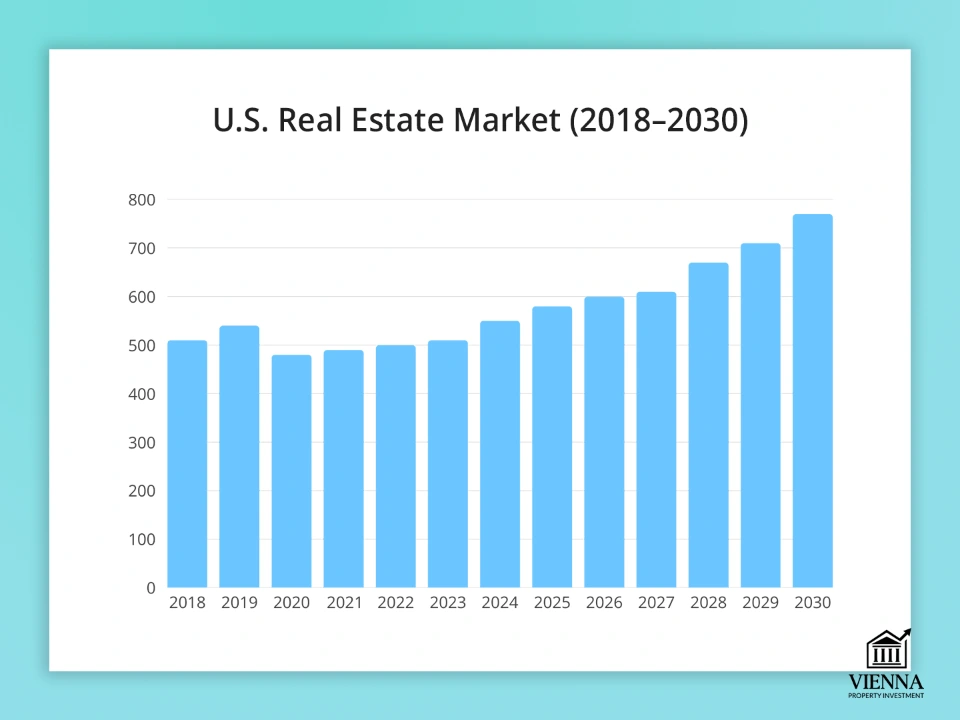

From 2020 to 2025, the US real estate market grew in value by a record $20 trillion, reaching a total value of $55.1 trillion. However, in 2025, growth slowed significantly: according to Zillow, the median home price increased by just 0.3% year-over-year to approximately $368,000. For investors, this is a signal that the market is becoming more balanced, meaning there is room for profitable deals.

My goal is to provide you with a systematic analysis of the investment appeal of real estate in the United States. I want to show you how the market works, which cities—from New York and Los Angeles to Miami and Florida—might be attractive for purchase, what taxes and expenses an investor can expect, and what legal nuances are important to consider.

Why now:

- Long-term price growth: Despite local slowdowns, the US remains one of the most dynamic markets in the world.

- The dollar as a safe haven: investing in American real estate protects capital from devaluation in unstable countries.

- Rental demand: Amid high mortgage rates, the rental market is growing from New York to California.

- Global migration trends: The United States remains a magnet for businesses, students, professionals, and investors, supporting long-term housing demand.

"Real estate in the US is a tool not only for living but also for preserving and growing wealth. I help investors evaluate properties based on profitability, legal clarity, and long-term prospects, ensuring every step of the purchase brings confidence and profit."

— Ksenia , investment consultant,

Vienna Property Investment

I am a real estate expert with a legal background and extensive experience in international investment and construction. I have supported transactions in Europe and the US, from the purchase of apartments and villas to complex projects in the commercial and hotel real estate segments.

My experience includes:

- legal support of transactions and due diligence of properties;

- analysis of investment attractiveness of markets and individual regions;

- development of capital allocation strategies between stable and growing markets;

- support of projects with the participation of foreign investors, including legal and tax aspects.

In this article, I've compiled my experience and practical scenarios that will help those considering buying a home in the US or investing in American real estate as a means of protecting and increasing capital.

The US or Austria: Where is it safer to invest?

When comparing the United States with Austria, it's worth noting several key advantages of the European country:

- Market stability: prices are growing moderately and predictably, without the sharp fluctuations typical of large American cities.

- Stable demand: Austrian real estate is in demand by both local residents and foreign investors, ensuring liquidity.

- Ease of planning: taxes and legal conditions are more transparent, making long-term investment management easier.

- High standard of living: infrastructure, healthcare, education and security create a comfortable environment for living and long-term property ownership.

While the US offers scale, dynamism and high returns, Austria benefits from predictability, stability and reliability – especially for conservative investors seeking a safe place to store and grow their capital.

The United States on the investment map of the world

The US remains one of the most attractive real estate markets for international investors. It's not only the largest market by transaction volume and capitalization, but also one with high liquidity and transparent procedures. Every year, investors from Europe, Asia, and the Middle East flock here to buy a home in the US or an apartment in New York City, diversify their portfolio, and generate stable rental income.

US rankings for profitability and deal transparency

According to the latest Knight Frank Global House Price Index report for Q4 2024, average annual home price growth in the US was 2.6%. While this figure is below the long-term trend of 4.8%, it indicates stability and moderate market growth.

The PwC and Urban Land Institute report, "Emerging Trends in Real Estate® 2025," notes that lower interest rates from the Federal Reserve are helping to revive the real estate market, increasing transaction volume and improving conditions for investors.

According to JLL, the US demonstrated a high degree of transparency in the real estate market in 2024, as evidenced by improved scores in the Global Real Estate Transparency Index. This makes the US market attractive to international investors, providing confidence in the legal and financial stability of transactions.

Competitors: Canada, UK, UAE

| Country | Advantages | Flaws |

|---|---|---|

| USA | High liquidity, market diversity, stability | High interest rates, high housing costs |

| Canada | Stable market, attractive conditions for investors | Limited liquidity, high taxes |

| United Kingdom | Attractive prices in some regions, stability | High taxes, limited profitability |

| UAE | Low taxes, attractive housing prices | Limited liquidity, political instability |

Why Investors Choose the US Over Europe and Asia

The US offers a unique combination of liquidity, market diversity, and stability. Unlike Europe, where high taxes and limited liquidity can be a barrier, and Asia, where political instability can impact the market, the US provides a more predictable investment environment.

For example, my clients investing in New York City real estate report high returns and market stability, despite high initial costs. One client purchased a New York City apartment for $1.5 million and, within two years, was generating $120,000 in rental income.

US Real Estate Market Overview

The US real estate market is one of the largest and most liquid in the world, offering investors a wide range of opportunities—from residential homes and condominiums to commercial properties and multi-family properties. A stable economy, developed infrastructure, and transparent legal system make the country particularly attractive to both local and foreign investors.

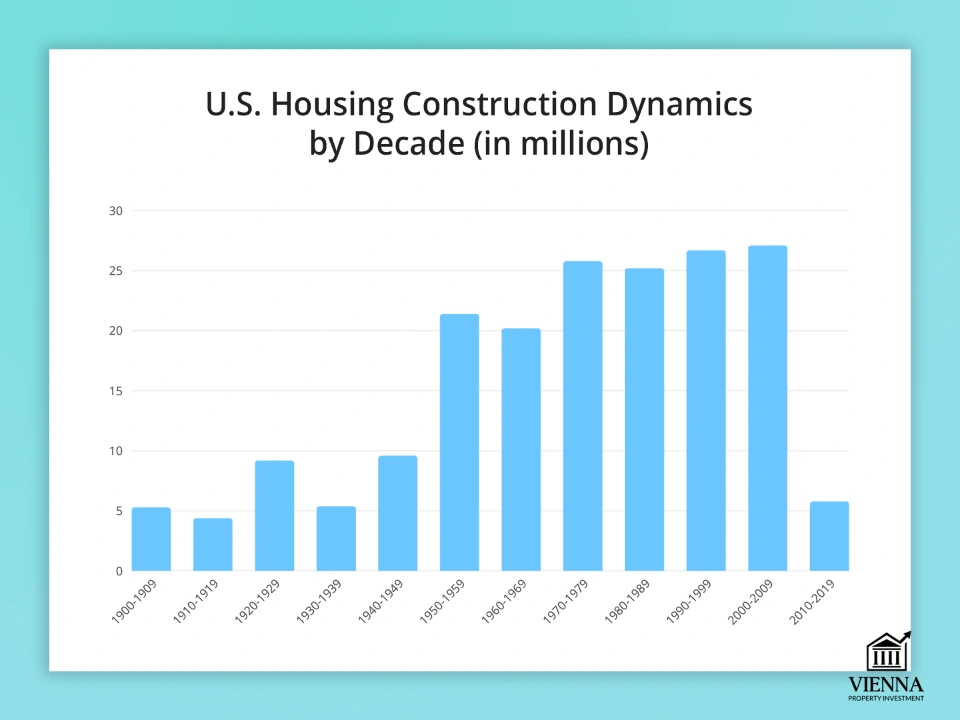

From the 2008 crisis to post-pandemic recovery

The US real estate market has experienced several key stages over the past two decades. The 2008 crisis was triggered by widespread subprime mortgages and speculation: home prices plummeted, many owners found themselves in negative equity, and banks defaulted.

In subsequent years, the market gradually recovered: from 2010 to 2015, there was moderate price growth, particularly in major cities such as New York, San Francisco, and Los Angeles, thanks to an influx of investors and limited housing supply.

The COVID-19 pandemic initially slowed the market, but by the end of 2020, demand had surged: low mortgage rates and interest in suburban areas accelerated price growth, especially for homes and condos.

By 2025, the market will stabilize: price growth is projected to be 3-4% per year, while high rental yields and interest from foreign investors make the US an attractive investment destination. My clients who have invested in New York and Miami note stable returns and predictable market dynamics.

Prices and rents: dynamics of major cities

The average price of an existing home in the US is $368,581, up 0.3% from the previous year. New York, Miami, and Los Angeles are seeing price declines, making these markets more attractive to buyers.

The average rental yield is 8%, which is high by global standards.

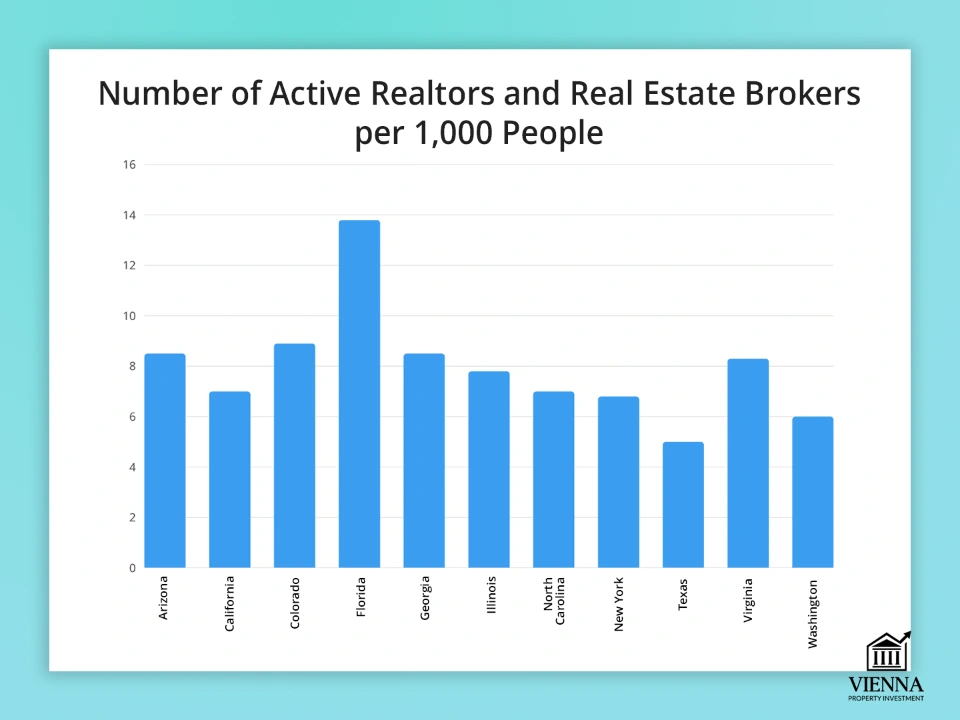

Geography of transactions: key regions and cities

The greatest interest from buyers is observed in the following regions:

- New York: Stable demand and developed infrastructure make the city attractive to investors.

- Miami: 2025 buyer's market transition makes terms more favorable.

- Los Angeles: Lower prices are increasing housing affordability, especially for multifamily properties.

- Texas: No income tax and low property taxes attract investors.

- Midwest: Cities like Detroit offer high rental yields of up to 21.95%.

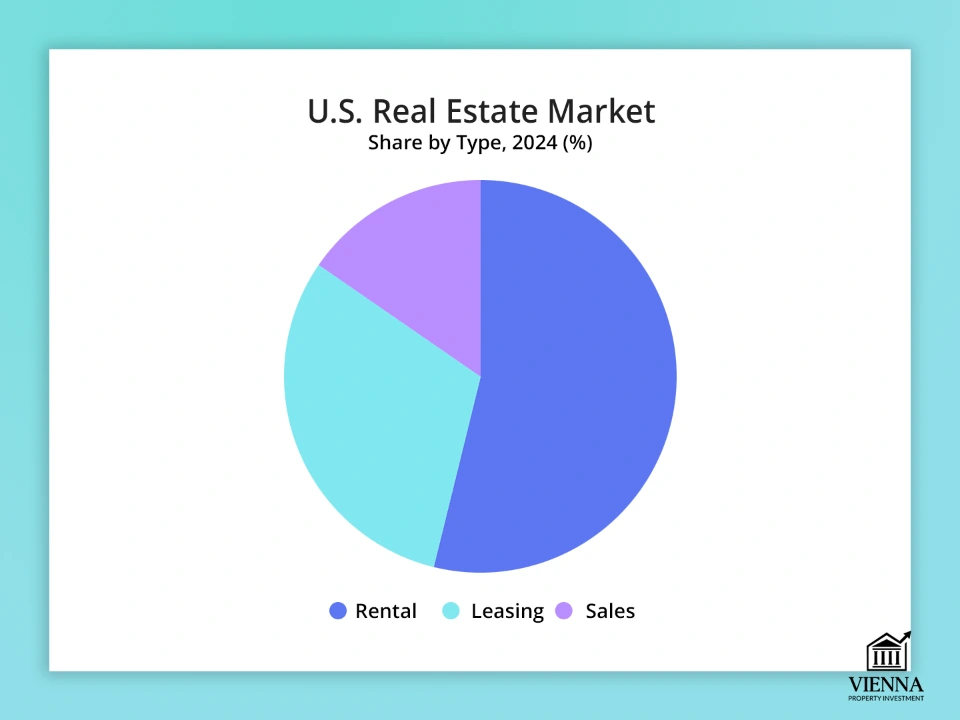

Popular types of objects

The US market offers a diverse range of properties, allowing investors to tailor a strategy to their budget and goals—from buying a home in the US to an apartment in New York City.

- Residential buildings provide stable rental income and long-term value appreciation, particularly in the New York City and Miami suburbs.

- Condominiums and townhouses are in demand in cities; they are easier to manage and offer rental yields of 5–7% per annum.

- Multi-family (multi-apartment) buildings offer high returns—up to 10% per annum—and minimize the risk of vacant apartments.

- Commercial real estate (offices, stores, warehouses) is attractive for long-term investment, especially in strategic locations, despite the rise of remote work.

- Luxury and short-term rentals offer high returns but require active management.

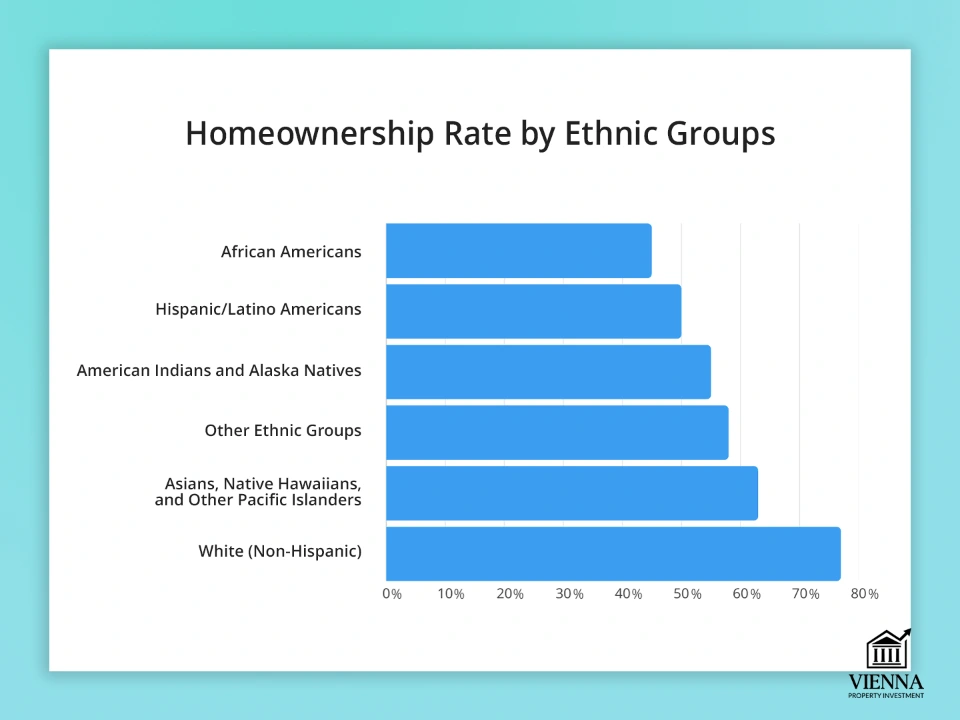

Who's buying: Americans and foreign investors

Foreign buyers spent $56 billion on U.S. real estate between April 2024 and March 2025, a 33.2% increase year-on-year. The main investor countries were China, Canada, Latin America, and Europe. Interest was primarily focused on major cities and prestigious areas—New York, Miami, and Los Angeles—where the average price per square meter is $1,100–$1,400. Rental yields for foreign investors average 6–8% per year, making the U.S. market one of the most attractive in terms of risk/reward.

American buyers are showing growing interest in inland regions like the Midwest, where average home prices are 25-40% lower than on the coasts, and rental yields reach 10-12% per annum. This creates attractive opportunities for those looking to buy a home in the US or real estate in the US with high yields and capital growth potential.

The Role of Domestic Demand: Mortgages and Migration

High mortgage rates (the average rate for a 30-year fixed mortgage as of August 2025 is approximately 7.2%) are temporarily holding back home purchase demand. However, a rate reduction of even 1–1.5% could significantly boost the market.

The migration of residents from expensive states like California and New York to more affordable regions (Texas, Florida, and the Midwest) is fueling domestic demand for housing. According to the Census Bureau, more than 3 million people move to more affordable states annually, creating a steady flow of potential renters and buyers.

Ownership Formats and Methods of Investing in US Real Estate

Investing in US real estate offers a variety of opportunities, and the choice of ownership structure depends on the investor's goals, tax preferences, and level of involvement.

Purchase by an individual

A simple way to invest is to purchase real estate in an individual's name. However, this can lead to higher taxes and limited asset protection. For example, my clients who invested in a home in the US this way faced higher tax rates and personal liability risks.

Peculiarities:

- Simple transaction processing and minimal bureaucracy

- Full control over management, repairs and rentals

- It is easy to get a mortgage in an individual's name, especially for US citizens

- Suitable for private property or family housing

Purchasing through an LLC (Limited Liability Company)

Establishing a Limited Liability Company (LLC) allows you to limit personal liability and optimize taxation. This is especially beneficial for foreign investors, as an LLC provides flexibility in distributing profits and losses and simplifies asset transfers.

Peculiarities:

- Limitation of personal liability of the owner

- Flexibility in distributing profits and losses among participants

- Simplifying the transfer of shares to other investors without reselling the property

- Possibility of tax optimization, including expense write-offs and depreciation

- Suitable for multi-family, commercial properties and property portfolios

Example: One of my clients purchased real estate in the US through an LLC, which allowed him to effectively manage tax consequences and protect personal assets.

REITs (Real Estate Investment Trusts) are exchange-traded funds

REITs are companies that own and manage real estate, offering liquidity and diversification. In 2024, public REITs paid out approximately $66.2 billion in dividends.

Peculiarities:

- Opportunity to invest in office buildings, shopping centers, warehouses and apartments without direct management

- Diversification by geography and type of objects

- Liquidity - REIT shares are easily traded in the market

- Suitable for investors looking for passive income

- Dividend yield averages 4-7% per annum, with additional capital growth

Partnerships and trusts

Partnerships and real estate investment trusts (REITs) allow you to pool capital to acquire large real estate assets, reducing risk and increasing potential profits.

Peculiarities:

- Access to high-value commercial and multi-family real estate

- Sharing risks and costs between partners

- Facility management is entrusted to a professional team

- The opportunity to participate in large projects without the need for large personal investments

Features for non-residents

In general, the US does not prohibit foreigners from purchasing residential property, including houses, apartments, and commercial real estate directly in their own names, through LLCs, REITs, or through partnerships and trusts. There are restrictions on purchasing land near strategic locations, such as military bases and critical infrastructure.

Some mortgage programs are only available to citizens and residents, so foreigners are more likely to use cash or financing through international banks. Ownership through an LLC or trust often helps bypass some bureaucratic complexities and simplify the process.

Legal Considerations for Purchasing Real Estate in the United States

The process of purchasing a home in the US is characterized by transparency and rigorous legal procedures, making the market attractive to both American and foreign investors. Below, we'll discuss the key steps and considerations to consider if you're planning to buy an apartment in New York City, a house in the US, or invest in Los Angeles.

Transaction stages: from offer to closing

The process of buying real estate in the US is clearly structured. Here are the main steps my clients go through when buying a home in the US or an apartment in New York or Los Angeles:

- Selecting an agent and property – selecting a property and submitting an offer (proposal to purchase) through a realtor.

- Acceptance of the offer – the seller confirms the terms of the transaction, the price is fixed in the contract.

- Escrow account – a special account is opened to store the deposit and funds until the transaction is completed.

- Inspection (Home Inspection) is a technical check of the condition of an object (roof, communications, systems).

- Appraisal (valuation) - carried out by a bank or an independent appraiser, especially if a mortgage is used.

- Title search and title insurance — checking legal purity and obtaining title insurance.

- Document preparation – a lawyer or escrow company prepares final contracts and settlements.

- Closing - the parties sign the documents, the money is transferred, and the property rights are registered in county records.

Example: one of my clients was buying a house in Texas, America, and the entire process from submitting an offer to registering the title took about 45 days—this is the standard timeframe for most transactions.

The role of a lawyer and a realtor

When purchasing real estate in the USA, two specialists play a key role: a realtor and a lawyer.

A realtor supports the client at every stage: from selecting a property and submitting an offer to negotiating with the seller. Unlike in Europe, realtor services in the US are paid by the seller, not the buyer, making their services particularly advantageous for foreign investors. For example, a client of mine planning to buy an apartment in New York City saved tens of thousands of dollars thanks to the agent's skillful negotiations, who secured a discount in a competitive market.

a lawyer , but in New York, New Jersey, and Massachusetts, their involvement is mandatory. They verify the transaction's integrity, analyze the title, draft the contract, and ensure compliance with tax regulations (such as FIRPTA for foreigners).

In my practice, I had a client who was planning to buy a house in Florida, and the lawyer discovered that the previous owner owed $15,000 in taxes. Thanks to this, the issue was resolved before closing, and the buyer avoided unnecessary expenses.

Requirements for a buyer of real estate in the USA

Buying an apartment in the US or investing in a home in the US doesn't require citizenship or permanent residency. The key requirements aren't a passport, but rather the financial and legal transparency of the transaction. Buyers must prove the legal origin of their funds, have sufficient funds to cover the down payment (if they're taking out a mortgage), and understand tax regulations, including FIRPTA and rental income taxation.

1. Identification number

- Residents need a Social Security Number (SSN)

- Non-residents - ITIN (Individual Taxpayer Identification Number) for paying taxes

2. Bank account in the USA

- Used to transfer funds to escrow and pay current expenses

- Can be opened with a visa and passport

3. Confirmation of identity and origin of funds

- The bank or escrow company checks documents to ensure there is no violation of AML (anti-money laundering) rules

4. Financing

- Most foreign investors pay for transactions in cash (according to NAR, more than 40% of foreign purchases are cash transactions)

- Mortgages are available, but the terms are stricter: the down payment is 30-50%, the interest rate is 1-2% higher than for US citizens

5. Tax liabilities

- Non-residents are subject to sales tax (FIRPTA - up to 15%)

- Having an ITIN allows you to file rental income tax returns

6. Age

- There are no restrictions on ownership; real estate can even be registered to a minor through a guardian or trust

- Banks set a minimum age limit for mortgages of 18 years

Buying real estate remotely

Foreign investors and buyers can purchase real estate in the US entirely online, without having to be present in person. Realtors offer virtual showings and 3D tours, and documents are signed through electronic services like DocuSign.

The financial portion of the transaction is handled by an escrow company: it accepts the deposit, verifies the title, and arranges title insurance. Funds are transferred via international bank transfer.

The closing takes place remotely, and the registered deed is sent to the buyer by mail or courier. I had a client who wanted to buy an apartment in New York, and we completed the transaction entirely online—his trusted representative received the keys.

This format is especially convenient for those who plan to rent out their property immediately: whether it's a house in America or an apartment in Los Angeles, Miami, or Florida, the property is immediately transferred to the management company.

| Stage | What does it include? | Responsible | Deadlines |

|---|---|---|---|

| Selecting an object | Property search, market analysis, virtual or offline showings | Buyer, realtor | 1–4 weeks |

| Offer | Preparing and signing a purchase offer, negotiating price and terms | Realtor, buyer | 2–7 days |

| Escrow opening | Deposit (usually 1-3% of the price), document verification, blocking the property | Escrow company, lawyer | 1–3 days |

| Inspection | Technical inspection of the housing condition, inspector's report | Licensed Inspector | 3–10 days |

| Title search & insurance | Checking the ownership rights, obtaining title insurance | Lawyer, title company | 1–2 weeks |

| Financing | Obtaining a mortgage (if not a cash deal), bank appraisal | Bank, buyer | 3–6 weeks |

| Closing | Signing the final documents, transferring the full amount, registering the transaction | Escrow company, lawyer, buyer | 1–3 days |

| Registration of property rights | Recording a deed in county records, issuing a deed | County records office | 1–2 weeks |

Taxes and Costs When Buying Real Estate in the US

Investors planning to buy a house or apartment in America should consider not only the property price but also the tax burden. Unlike Europe, where property taxes are often more transparent and predictable, the US has a multi-tiered system: federal, state, and municipal.

Property Tax

In the US, annual property taxes range from 0.3% (Hawaii) to over 2.4% (Texas, New Jersey). The average is about 1.1% of the property's value.

For example, if a home in America costs $500,000, the property tax will be approximately $5,500 per year. My clients who bought a home in Florida for $650,000 pay just over $9,000 in property taxes annually.

| Rating | States with the highest taxes | Property Tax Rate (Average) | States with the lowest taxes | Property Tax Rate (Average) |

|---|---|---|---|---|

| 1 | New Jersey | 2,44% | Hawaii | 0,30% |

| 2 | Illinois | 2,32% | Alabama | 0,41% |

| 3 | Texas | 2,18% | Louisiana | 0,51% |

| 4 | New Hampshire | 2,20% | Wyoming | 0,58% |

| 5 | Wisconsin | 1,96% | Seward | 0,59% |

Closing Costs

This includes attorney's fees, title insurance, escrow fees, appraisal, and transaction registration. It typically amounts to 2-5% of the property's purchase price. When buying a $400,000 apartment in the US, you should budget $8,000-$20,000 for closing costs.

Rental Income Tax

Income from rental properties is subject to federal tax (10-37%) and state tax (0-13%). Non-residents may be subject to withholding at a rate of 30% unless international agreements apply. Deductions for repairs, management, and depreciation can reduce the taxable base. For example, a client in Miami reduced the rental tax on his apartment in the US by almost half by covering management and repair costs.

Capital Gains Tax

It applies to the sale of real estate and amounts to 20% of the federal tax rate plus the state tax rate. Residents receive tax breaks for holding the property for more than two years; foreigners do not receive these benefits.

FIRPTA (foreign investor tax)

By law, FIRPTA withholds up to 15% of the sales price from non-residents. For example, an Austrian investor who sold an apartment in New York for $1.2 million withheld $180,000 in taxes. A portion of the amount can be refunded after filing a tax return.

Comparison with taxes in Austria

| Tax type | USA | Austria |

|---|---|---|

| Property Tax | 1–2.5% of the property value per year (varies by state) | ~0.1% of the cadastral value |

| Closing Costs | 2–5% of the transaction | 3–4% of the transaction (notary, registration) |

| Rental Income Tax | 10–37% federal + 0–13% state | 25% income tax on net income |

| Capital Gains Tax | 15-20% + state tax | Up to 30% on sale in the first 10 years; exemption after 10 years |

| FIRPTA / foreign taxes | 15% withholding on sales for non-residents | No, the conditions are the same as for citizens |

Austria offers more favorable and predictable real estate taxation for conservative investors. The tax burden is minimal, and rental income and capital gains are easier to plan for. The US offers higher returns, but the risks and costs are higher, especially for foreigners.

Tax optimization

To reduce the tax burden when buying a home in the US, investors use:

- LLC - limits personal liability and optimizes taxation of leases and sales.

- 1031 Exchange - deferral of capital gains tax when exchanging an investment property for another.

- Tax deductions – expenses for repairs, management, and depreciation reduce the taxable base.

- Property structuring – trusts or partnerships for asset protection and tax optimization.

- Income and expense planning - balanced allocation of rental income and capital expenditure.

Visas and immigration mechanisms through real estate

Owning real estate or an apartment in the United States does not provide a direct path to permanent residence. However, there are several visa programs that may involve investing in real estate and business.

EB-5 Immigrant Investor Visa

The EB-5 program allows investors and their families to obtain a green card by investing $1,050,000 in a commercial enterprise in the United States that will create at least 10 jobs for U.S. citizens. If the investment is made in a Targeted Employment Area (TEA), the amount may be reduced to $800,000.

However, in February 2025, US President Donald Trump proposed replacing the EB-5 program with a new $5 million "gold card" scheme that would provide a path to citizenship without the job-creation requirement.

E-2 Treaty Investor Visa

The E-2 visa is intended for citizens of countries with which the United States has treaties of commerce and navigation. Investors must invest a substantial amount of capital in an existing or new business in the United States and hold a controlling interest (usually more than 50%) in the company.

Real estate investments, such as the purchase of apartment buildings for management purposes, may qualify for this visa if the business is actively managed and profitable.

While there is no official minimum investment requirement for an E-2 visa, in practice, it is recommended to invest between $250,000 and $300,000, especially for small businesses.

L-1 Intracompany Transferee Visa

The L-1 visa is designed for employees of international companies transferring to branches or subsidiaries in the United States. To qualify for this visa, the company abroad must have operated for at least one year and have appropriate ties to the U.S. company. This can be beneficial for foreign company owners looking to expand their business, including real estate investments, in the United States.

Alternative Paths to US Residence

In the US, there are other legal ways to obtain a residence permit besides investment visas:

- Family reunification - for immediate relatives of US citizens and residents.

- Marriage to a US citizen gives the right to obtain a green card.

- Work visas - H-1B, O-1 and others for skilled workers.

- Education - F-1 student visas with the possibility of subsequent transfer to a work visa.

- The Green Card Lottery is an annual program of randomly allocating visas to citizens of countries with low immigration rates in the United States.

Comparison with Austrian residence permit mechanisms

ways to obtain a residence permit in Austria , including:

- D-card: Designed for highly qualified specialists, investors, and entrepreneurs, it allows legal residence and work in the country. For investors, the minimum investment is typically €300,000–500,000 in a business or the Austrian economy. The initial residence permit is issued for one year, renewable for up to five years, after which permanent residency can be applied for, and after six years, citizenship.

- Self-sufficiency: for individuals who can support themselves financially without government assistance. Proof of €30,000–60,000 in a bank account and ownership of a home are required. An initial residence permit is issued for one year, renewable annually for up to five years, and then permanent residence is possible.

Austria offers a simpler and more predictable route for investors seeking residency through investment, thanks to clear requirements, fixed investment amounts, and a direct path to long-term residency and citizenship.

Rental yields for real estate in the United States

Investing in real estate in the US can generate a stable income, but it's important to consider the differences between short-term and long-term rentals, tax considerations, and local regulations. My experience shows that choosing the right rental strategy directly impacts your investment profitability.

Short-term rentals (Airbnb, VRBO)

Short-term rentals offer high returns, often in the range of 12-15% per annum, especially in tourist and urban areas. For example:

- New York: Daily rate $159, 67% occupancy, annual income $39,983.

- Santa Monica: daily rate $216, occupancy 72%, annual income $58,184.

- Hollywood, FL: daily rate $197, 69% occupancy, annual income $47,000.

Risks and considerations: Many cities, including New York, Miami, and Los Angeles, impose strict regulations on short-term rentals, requiring registration, licensing, and compliance with rental day limits. Therefore, investors should carefully analyze local laws to avoid penalties.

Long-term lease

Long-term leases provide a more stable income with fewer regulatory risks. The average yield is around 8%, and in some regions it can reach 12–22%. Examples:

- Detroit: Yield up to 21.95%.

- Miami: yield around 7%.

Long-term leases are especially attractive to investors seeking stability and minimal operational complexity. My clients often choose this option in Texas and Arizona to lock in long-term income and mitigate risks associated with seasonality and fluctuations in demand.

| Region | Profitability (long-term) | Profitability (short-term) | Key Features |

|---|---|---|---|

| New York, NY | 5–6% | 12–14% | High housing prices, strict Airbnb laws, high demand |

| Santa Monica, CA | 4–5% | 13–15% | Tourist area, high occupancy, expensive real estate |

| Hollywood, FL | 6–7% | 12% | A popular resort, regulated by local laws |

| Miami, FL | 7% | 11–13% | Stable demand for long-term rentals, high tourist flow |

| Detroit, MI | 22% | 10–12% | Low purchase cost, high long-term rental yield |

| Austin, TX | 8–9% | 10–12% | A growing market with stable demand attracts young professionals |

| Phoenix, AZ | 8% | 11% | Affordable prices, growing rental market |

| Los Angeles, CA | 5–6% | 12–13% | High housing costs, stable demand for short-term rentals |

| San Francisco, CA | 4,5–5% | 12–14% | Limited supply, strict rental rules |

| Chicago, IL | 6–7% | 10–12% | Balanced market, affordable apartments for long-term rentals |

Taxation of rental income

1. Short-term rentals (Airbnb, VRBO)

- Federal income tax: 10–37% depending on the investor's total income.

- Example: If your annual short-term rental income from a New York City apartment is $40,000, your federal tax liability could be $4,000–$12,000 depending on your other sources of income.

- State Tax: New York - 4-8.82% of income; Florida - 0% (no state income tax).

- Tourist tax and sales fee: New York - 14.75% of each booking; Miami - about 12%.

- Non-residents: 30% tax on gross income is withheld through the management company.

2. Long-term lease

- Federal income tax: 10–37%.

- Example: Miami home renting for $2,800/month, annual income $33,600. Federal taxes $3,300–$12,500.

- State Tax: Florida - 0%; California (Los Angeles) - 1-13.3%.

- Withholding for non-residents: Generally 30% of gross income unless formed through an LLC with a tax return.

For my clients in Europe and Asia, I always recommend calculating their federal and local tax burden in advance and considering setting up an LLC for maximum optimization. For example, investors in Miami and New York benefit significantly from proper planning for expenses and depreciation.

Management companies

Management companies help investors, especially foreign ones, manage real estate without personal involvement. Their services include:

- Finding tenants and checking their solvency

- Rent collection and timely payment control

- Maintenance, repair and cleaning

- Bookkeeping and tax reporting

Cost of services:

- Long-term rentals: typically 8–12% of monthly income. For example, if an apartment in New York City brings in $3,000/month, the management company takes $240–$360/month.

- Short-term rentals (Airbnb, VRBO): typically 15–20% of revenue, as more booking management and guest service are required. Example: revenue $4,000/month — commission $600–$800.

- Additional fees: platform placement fees, one-time accommodation preparation fees, emergency repairs.

Comparing Rental Yields and Regulations: US vs. Austria

| Parameter | USA | Austria |

|---|---|---|

| Average long-term rental yield | 5–9% | 3,5–4,1% |

| Average short-term rental yield | 11–15% | 3,8–4,5% |

| Rent regulation | Strict in large cities, changes frequently | Clear, transparent, predictable |

| Taxes on rental income | Federal + state, 10-37%, non-residents - 30% withholding | 25% corporate or 20-25% income tax, predictable |

| Risks for the investor | High: price fluctuations, new laws, seasonality | Low: stable market, long-term predictability |

| Income predictability | Average - depends on the city and type of rental | High - you can plan 5-10 years ahead |

If your goal is stability, predictable income, and minimized regulatory risks, I recommend considering Austria. The US is attractive due to its high yields, especially through short-term rentals, but this comes with complex regulations and numerous risks.

Where to Buy: A U.S. Regional Analysis

Choosing a region for investing in US real estate depends on your goals, budget, and strategy: whether you're looking for a stable income, high liquidity, or the prospect of capital growth. My experience shows that choosing the right city directly impacts returns and risks.

New York - stability and liquidity

New York remains the country's most liquid market. The average price per square meter is $10,000–$18,000, making investments expensive but predictable.

- Long-term rental yield: 5–6%

- Short-term rentals: 12–14%

- Popular neighborhoods: Manhattan, Brooklyn, Queens

- Features: high liquidity, stable demand, strict Airbnb laws

Miami and Florida - Growth and Tax Advantages

With average home prices ranging from $5,500 to $9,000 per square meter, Florida is accessible to investors seeking capital growth and tax advantages.

- Long-term rental yield: 7%

- Short-term rentals: 11–13%

- Popular neighborhoods: South Beach, Brickell, Coral Gables

- Features: rapid price growth, high tourist flow, zero tax on income tax

For example, my client bought an 80-square-meter condo in Brickell for $600,000 ($7,500/sq.m.). Long-term rentals bring in $3,500 per month, while short-term rentals through Airbnb can reach up to $5,500 per season. After two years, the apartment's value has increased by 12%.

California (Los Angeles, San Francisco) - expensive, high-status markets

Prices here are among the highest: $8,500–$20,000 per square meter. Investment requires a significant budget, but provides prestige and liquidity.

- Long-term rental yield: 5–6%

- Short-term rentals: 12–13%

- Popular neighborhoods: Santa Monica, Hollywood, Downtown Los Angeles

- Features: prestigious areas, high rental demand, strict laws

Texas (Austin, Dallas, Houston) – Dynamic growth and migration

The average home price is $3,500–$6,500 per square meter, making Texas attractive to investors on a budget and looking for high capital growth.

- Long-term rental yield: 8–9%

- Short-term rentals: 10–12%

- Features: population growth, migration from expensive states, affordable prices

A Canadian investor purchased a 100-square-meter townhouse in Austin for $450,000 ($4,500/sq.m.). Long-term rental yields $3,200 per month. A year later, the apartment has appreciated in value by 10%. The local market is actively growing, and an influx of immigrants is increasing rental demand.

Midwest (Chicago, Detroit) - cheap but risky options

Home prices here range from $1,500 to $6,000 per square meter, making the Midwest an attractive option for budget-friendly investments with high returns.

- Long-term rental yield: 7–22%

- Short-term rentals: 10–12%

- Features: very low purchase price, high long-term rental yields, but volatile market and low demand for short-term rentals

A Swiss couple bought a 120-square-meter house in Detroit for $200,000 ($1,667/sq.m.). The long-term rental yields $2,200 per month—a yield of over 13% per annum. The risk of price fluctuation is higher, but the low entry cost allows the investor to reap significant returns.

| Region | Infrastructure and transport | Tenant demand |

|---|---|---|

| New York, NY | Metro, buses, international airports, office districts | Expats, students, professionals, tourists |

| Miami, FL | International airports, highways, ports, schools | Tourists, expats, young families |

| Los Angeles, CA | International airports, highways, metro, office centers | Tourists, professionals, long-term renters |

| San Francisco, CA | Metro, buses, international airport, office and IT hubs | Students, IT specialists, tourists |

| Austin, TX | Highways, universities, airport | Students, IT specialists, young families |

| Dallas, TX | Highways, airport, business centers | Young professionals, families, long-term renters |

| Houston, TX | Highways, airport, port, business centers | Long-term tenants, workers, families |

| Chicago, IL | Metro, buses, international airport, highways | Students, business professionals, tourists |

| Detroit, MI | Highways, railways, airport | Young families, students, budget renters |

| Phoenix, AZ | Highways, airport, new transport projects | Young families, professionals, long-term tenants |

Secondary market and new buildings: what should an investor choose?

In the US, approximately 70% of all transactions are for existing homes, while new construction accounts for approximately 30% of the market, including pre-construction condos and multifamily projects. The average price of existing homes in popular markets such as New York and Los Angeles is $10,000–$18,000 per square meter, while new construction costs $8,000–$15,000 per square meter, depending on the region and segment.

| Category | Example of an object | Price per object / m² | Peculiarities |

|---|---|---|---|

| Secondary market | 70 sq m apartment in Brooklyn, New York | $1,050,000 ($15,000/m²) | Liquid area, proven infrastructure, long-term rent 5-6% |

| Secondary market | 90 sq m house in Detroit, MI | $180,000 ($2,000/m²) | Low entry costs, high long-term rental yields of up to 12–15%, risk of market instability |

| New building | 80 sq m condo in Brickell, Miami | $600,000 ($7,500/m²) | Pre-construction, modern layout, short-term rent up to $5,500/month. |

| New building | 200 sq m multi-family project in Austin | $1,100,000 ($5,500/m²) | Long-term rentals for multiple apartments, capital growth, energy efficiency standards |

| Premium segment | 70 sq m apartment in Manhattan | $1,050,000 ($15,000/m²) | High-status area, high demand, short-term rent up to 12-14% |

Secondary market: liquidity and proven areas

In the US secondary market, large, liquid cities with proven infrastructure are particularly popular. Apartments and houses are most in demand in New York City, including Brooklyn, Queens, and Manhattan, where liquidity is high and demand for long-term rentals is stable.

The secondary market is also actively developing in Chicago, Detroit, and Cleveland, where housing costs are lower, allowing investors to enter with a small budget and receive high long-term rental yields of up to 12–15%.

Features: Older homes may require major renovations, but provide quick access to rental income.

New buildings: pre-construction and multifamily projects

New buildings attract investors with modern layouts and energy-efficient standards. Among the most popular regions are Miami, Fort Lauderdale, and Orlando, where pre-construction condominiums offer below-market prices and short-term rentals for up to $5,500 per month. In Texas (Austin, Dallas, and Houston), multifamily projects are actively being built, allowing investors to profit from multiple apartments simultaneously.

Features: risk of construction delays, but potential for growth in the property's value and flexibility in layouts.

Features of American construction and standards

American homes are often built using frame construction, timber, concrete, and modern energy-efficient materials. Standards include strict requirements for fire safety, sound insulation, and ventilation.

- New buildings typically feature smart home systems, modern kitchens and bathrooms, which increases their appeal to tenants.

- Construction times in the US range from 12 to 24 months for multi-family complexes.

Comparison with Austria

Austrian new buildings offer advantages in terms of construction speed, energy efficiency, and market stability. In the US, the process can be delayed due to bureaucracy, weather conditions, or contractor delays. For investors seeking reliability and long-term stability, Austria is often a preferred choice, despite the higher cost per square meter.

| Segment | USA | Austria | Comment |

|---|---|---|---|

| Economy | Resale and new buildings, price $2,000–$6,000/m², long-term rental yield 7–12% | Resale and new builds, price €3,000–€5,000/m², yield 3–5% | The US offers higher yields, but the market is more volatile; Austria is more stable and has fewer risks |

| Average | Apartments and townhouses $5,000–$10,000/m², yield 6–9% | Apartments and townhouses €5,000–€8,000/m², yield 4–5% | Austria wins in price stability and market predictability |

| Premium | Manhattan, San Francisco, Los Angeles, $12,000–$20,000/m², yield 5–6% | Vienna, Salzburg, €8,000–€12,000/m², yield 3–4% | The US offers high prestige and profitability, while Austria offers reliability, energy efficiency, and predictability |

Alternative Investor Strategies in the US

Investing in real estate in the US offers a wide range of strategies, from traditional rentals to land development. The choice of strategy depends on your goals, budget, and risk appetite.

Buying multiple properties instead of one

Buying older properties for renovation and resale is a strategy for active investors. Returns can reach 15–25% per transaction, especially in growing areas like Los Angeles or San Francisco.

Client examples: 1,200 sq ft house in Austin purchased for $450,000, renovated for $70,000, resold for $650,000 - net profit of about $130,000.

Buying multiple properties instead of one

Splitting capital into several smaller properties reduces risk and allows for income diversification. Clients' portfolios often include two or three apartments in different areas of Miami or Texas, ensuring a stable rental flow.

Investments in commercial real estate

Offices, warehouses, and retail properties generate income of 6 to 10% per annum but require higher initial capital. Example: purchasing a small office complex in Dallas for $1.2 million yields $80,000–$100,000 in annual income.

Investing through REITs and funds

REITs allow you to participate in the real estate market without directly managing the properties. Dividend yields typically range from 4–6%, and the low entry barrier makes them attractive to beginners.

Land plots and development

Purchasing land for construction or development is a riskier strategy with a long-term horizon. For example, a 1.5-hectare plot of land in Florida is purchased for $250,000. After permits and construction, the project could generate income of up to $600,000–$700,000 in 3–5 years.

Comparison with strategies in Vienna: stability versus dynamism

Vienna's market is more stable and predictable. Buy-to-rent offers 4-5% returns, while fix-and-flip and development are limited due to strict building regulations and high land costs. The market is less dynamic, but benefits from security, transparency, and long-term stability. For investors seeking capital growth with minimal risk, Vienna is preferable, while the US is better for active strategies with high returns.

Risk Factors for Investors in American Real Estate

Investing in US real estate comes with a number of unique features and risks that are important to consider when choosing a region and strategy.

High property taxes

The average property tax rate ranges from 0.7% to 2.3% per year depending on the state. In some states, such as New Jersey and Illinois, taxes can exceed 2.2%, significantly reducing net returns. Client examples show that for an investment in a $600,000 Miami home, taxes amount to approximately $12,000–$15,000 per year, which is important to consider when calculating return on investment.

Rent regulation

Local rental laws, especially short-term rentals through Airbnb and VRBO, can be strict. For example, San Francisco, New York, and Miami have restrictions on the number of rental units and licensing requirements, limiting investor flexibility.

Recession and mortgage market risks

High mortgage rates and market volatility could reduce demand for housing. For example, between 2022 and 2024, interest rates rising to 7% led to a slowdown in transactions and a decline in the number of buyers. This creates the risk of price declines during periods of instability.

Liquidity in non-capital states

In second- and third-tier cities like Detroit, Cleveland, and parts of Texas, property liquidity is lower, and the sale time can reach 6-12 months. This increases the risk for investors looking to exit the deal quickly.

Comparison with Austria

The Austrian market benefits from stability and predictability. Taxes are lower, legislation is more transparent, rental regulations are more relaxed, and the liquidity of properties in major cities like Vienna and Salzburg is stable. For investors who value long-term capital protection and risk mitigation, Austria is often a preferred option. The US, on the other hand, is suitable for those prepared to actively manage their portfolios and seeking higher returns while understanding potential market fluctuations.

Life and comfort of an investor in the USA

Investing in US real estate is tied not only to returns but also to the lifestyle and living conditions in different states. The choice of region affects climate, access to healthcare, educational opportunities, safety, and financial infrastructure.

Climate and diversity of the states

The United States boasts a vast diversity of climates, which is important to consider when choosing a property and rental strategy. Florida's cities boast a warm subtropical climate and beaches, making it popular for short-term rentals year-round. California offers a mild Mediterranean climate, particularly in Los Angeles and San Diego, attracting long-term renters and families.

At the same time, the Midwest and northern states (Chicago, Minneapolis) are characterized by cold winters and snowy periods, which reduces demand for short-term rentals, but can attract buyers focused on the economy segment and affordable prices.

Medicine, education, security

For non-residents, access to quality healthcare and education is important to consider. In New York, insurance for a family of four can cost $1,500–$2,000 per month, including basic coverage and specialist visits. In Los Angeles, similar costs range from $1,300–$1,800, while in Miami and Texas, it ranges from $700–$1,000 per month, depending on the plan chosen.

Education also varies: private schools and prestigious universities in New York and California cost $20,000–$50,000 per year, while in Texas or Florida you can find good schools for $10,000–$20,000 per year.

Banks and loans for foreigners

Foreigners can open accounts and obtain mortgages in the United States, but the process is more complicated than for citizens: an ITIN/SSN, proof of income, and a significant down payment (usually 30–40%) are often required. Some banks in Miami and California offer specialized programs for non-residents.

Standard and cost of living

Life in the US varies greatly depending on the city and state. Examples:

- New York (Manhattan): 2-bedroom apartment rent: $4,500–$6,000/month, groceries and services: +30–40% above average, cafes and restaurants: $15–$25 per meal, utilities: $250–$400/month.

- Los Angeles, California: 2 bedroom rent $3,500-$4,500, groceries 20-30% above average, restaurants $12-$20, utilities $200-$350.

- Miami, FL: 2 bedroom rent $2,500-$3,500, groceries and dining options close to US average, utilities $150-$300.

- Austin, Dallas, TX: 2 bedroom rent $1,800-$2,500, groceries average, restaurants $10-$18, utilities $120-$250.

- Chicago, Midwest: 2-bedroom rent $1,500–$2,200, groceries below national average, utilities $120–$250.

Comparison with Austria

Life in Austria is predictable and organized: healthcare is high-quality and accessible, education is high-quality, and bureaucracy is minimal. For example, health insurance for a family of four costs $300–$500 per month, and tuition at public schools and universities is often free or very affordable.

The city's infrastructure, transportation, and safety make for comfortable long-term living. I believe that in Austria, it's easier to plan expenses, minimize risks, and ensure family comfort.

American Real Estate Investments for Different Buyers

Choosing real estate in the US depends heavily on the investor's goals and their life situation. Different segments of the population navigate the market differently, and it's important to consider financial, legal, and personal factors.

For citizens of unstable countries, buying a house or apartment in the United States often serves as a way to protect capital. My clients from Eastern Europe and Latin America have purchased apartments in Miami and Los Angeles for $400,000–$700,000 to diversify their assets and ensure long-term wealth preservation.

for retirees thanks to its mild climate, low property taxes, and the absence of state income tax. For example, a $550,000 home in the Fort Lauderdale area, rented long-term, generated an income of approximately $2,800–$3,200 per month, while the property was used as a comfortable second home.

Digital nomads value the US for its developed infrastructure, high-speed internet, and short-term rental opportunities through Airbnb and VRBO. However, visa restrictions and the need for long-term documents create certain difficulties. Client example: purchasing an apartment in Austin for $350,000 and subsequently renting it out short-term yielded an income of $2,000–$2,400 per month, requiring an ITIN and a bank account for non-residents.

The US vs. Austria? Compared to Austria, this country wins for conservative investors: the market is stable, laws are transparent, taxes are lower, and returns are predictable. The US, on the other hand, offers higher returns, a variety of regions and investment strategies, but is associated with risks, market fluctuations, and property management challenges. For clients who value security and order, I often recommend Austria.

Investment exit strategies

Exiting an investment is a crucial step that directly impacts profitability. Property sales in the US are typically handled through the MLS (Multiple Listing Service) or through professional agents. The average sale time varies by region: in popular cities like Miami or Los Angeles, a property can sell in 30-90 days, while in less liquid states, it can take up to 6-9 months. My clients, selling apartments in Miami for $600,000-$750,000, often used the MLS and an agent to expedite the process and minimize commissions.

For non-residents, a key aspect is FIRPTA, which requires withholding up to 15% of the sale price for federal tax. It's important to calculate your tax liability correctly to avoid unexpected payments.

A 1031 Exchange allows you to defer taxes when selling a property and reinvesting in another US real estate asset. For example, one of my clients sold a Miami condominium for $650,000 and invested in several Austin properties, which allowed him to shift the tax burden and increase portfolio diversification.

Transferring real estate through inheritance or trusts is another way to effectively manage your estate and plan for your future. Trusts help manage assets, reduce tax risks, and protect your assets.

Compared to Austria, the investment exit process there is simpler and more predictable. Secondary market liquidity is high, bureaucracy is minimal, sales taxes are transparent, and transactions are concluded faster. The US offers higher returns, but is plagued by complex tax regulations and bureaucracy.

Expert opinion: Ksenia Levina

Buying real estate in the US combines profitability and dynamism: Miami and Los Angeles are ideal for active investing, while the Midwest is ideal for long-term capitalization. Austria, on the other hand, is suitable for conservative investors seeking stability and security.

— Ksenia , investment consultant,

Vienna Property Investment

For several years, I've been working with clients investing in real estate in the US and Europe. My experience shows that each market has its own unique characteristics, and the success of investments directly depends on proper due diligence.

Allocation of capital between stable and growing markets is the key to a balanced portfolio. In this approach, investments in Austrian real estate typically provide stability and predictability, while American properties offer growth potential and higher rental yields. I recommend combining US properties with more dynamic, profitable markets, such as Miami or Los Angeles, and stable European properties, such as Vienna. This approach allows you to diversify risks, generate rental income, and simultaneously accumulate capital.

When choosing a strategy, I consider my clients' goals: rental, status, or long-term capitalization. For example, for clients focused on income and growth, the United States is more suitable, especially through apartments in the US and properties in Florida. For those who value stability, predictability, and capital protection, Austria often wins.

Personally, I would split my investments between the US and Austria: the US offers growth and high returns, while Austria provides peace of mind, transparency, and long-term asset protection. This approach allows you to combine the best of both worlds and create a sustainable portfolio.

Conclusion

Real estate investments require a clear understanding of goals and markets. The US is a good choice for those seeking higher returns, a variety of strategies, and dynamic markets such as Miami, Los Angeles, or Texas. Austria is suitable for investors who value stability, transparent regulations, and predictable returns. In this context, Vienna real estate is often viewed as a "stabilizer" for the conservative portion of a portfolio, while the US is a source of growth and potentially higher returns.

General advice from an investment lawyer: thoroughly vet properties, consider tax obligations, diversify your portfolio, and always plan an exit strategy. For non-residents, it's especially important to consider FIRPTA, rental income taxation, and options through LLCs or trusts.

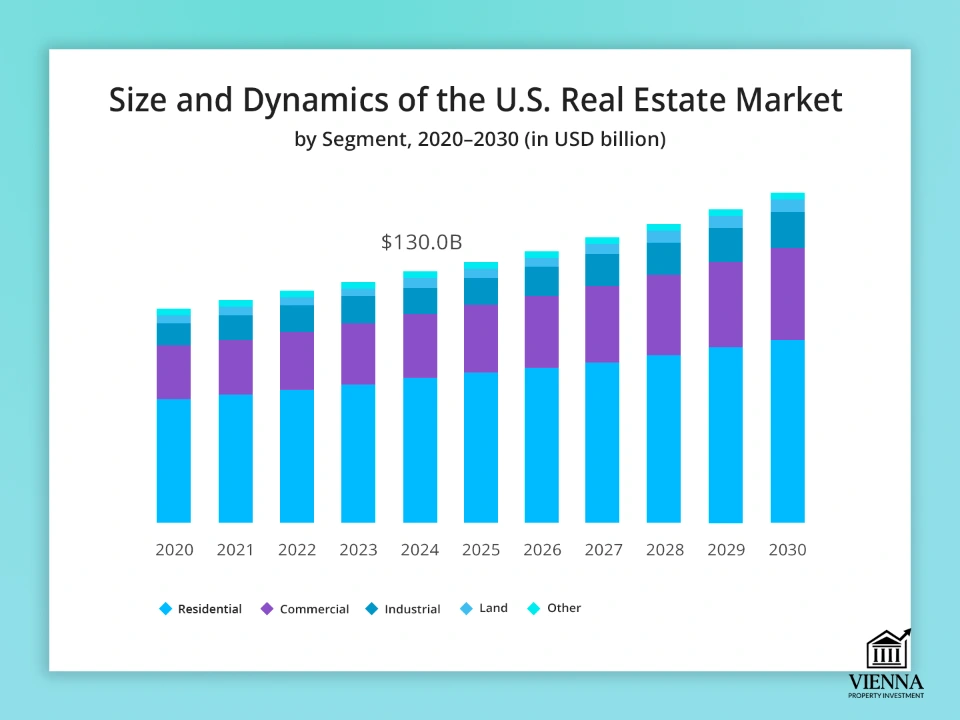

Outlook to 2030 shows population growth, internal migration, and active real estate market development. In the United States, demand for housing is increasing in cities with strong economic growth and attractive rental yields. In Austria, stability remains, and the development of the secondary and new markets continues to provide secure investments for long-term capital.

Appendices and tables

Rental yield by city

| Region | Average annual rental yield (%) |

|---|---|

| New York (NY) | 3,5–4,0% |

| Miami (FL) | 5,0–6,0% |

| Los Angeles (CA) | 3,5–4,5% |

| San Francisco (CA) | 3,0–4,0% |

| Austin, TX | 4,5–5,5% |

| Dallas (TX) | 4,0–5,0% |

| Houston, TX | 4,0–5,0% |

| Chicago (IL) | 4,0–4,5% |

| Philadelphia (PA) | 4,0–4,8% |

| Atlanta (GA) | 4,2–5,0% |

Price/Profitability Map

| Region | Average price per m² (€) | Average annual rental yield (%) | Market Features |

|---|---|---|---|

| New York (NY) | 12,000–15,000 | 3,5–4,0 | High liquidity, stable demand, expensive properties |

| Miami (FL) | 7,500–10,000 | 5,0–6,0 | Popular market for short-term rentals, growth in tourism |

| Los Angeles (CA) | 9,500–12,500 | 3,5–4,5 | Expensive market, high demand for rentals, premium segment |

| San Francisco (CA) | 11,000–14,000 | 3,0–4,0 | Limited supply, high demand for housing |

| Austin, TX | 5,500–7,500 | 4,5–5,5 | Dynamic market, population growth, young audience |

| Dallas (TX) | 4,500–6,500 | 4,0–5,0 | Stable demand, affordable prices, and infrastructure development |

| Houston, TX | 4,000–6,000 | 4,0–5,0 | Emerging market, affordable properties, industrial area |

| Chicago (IL) | 4,500–6,500 | 4,0–4,5 | Mid-market segment, stable rental flow, but there are risks |

| Philadelphia (PA) | 4,500–6,500 | 4,0–4,8 | Developed infrastructure, student demand, stability |

| Atlanta (GA) | 4,000–5,500 | 4,2–5,0 | Growing market attractive to young renters and expats |

Tax Comparison: USA vs. Austria

| Segment | USA | Austria |

|---|---|---|

| Property Tax | 0.5–3% per year depending on the state | 0.2–0.5% per annum |

| Tax on rental income | Federal 10–37% + state 0–13% | 20–27,5% |

| Capital Gains Tax | 15–20% + possible state taxes | 30% on sale up to 10 years, then reduced |

| FIRPTA / taxes for non-residents | 15% retention on sale | Not applicable for residents; separate rules apply for foreigners |

| Inheritance/Gift Taxes | Up to 40% (depending on the amount and state) | 0–30% |

| Optimization through LLCs/trusts | Yes, it allows you to reduce taxes and manage assets | Possible through GmbH and trusts, but more difficult |

A US Real Estate Investor's Checklist

1. Determine your investment goals

- Rental Income (Long-Term vs. Short-Term)

- Capitalization and growth in value

- Obtaining residency or visa strategies (EB-5, E-2)

2. Selecting the ownership format

- Purchase by an individual

- Purchasing through an LLC (Limited Liability Company)

- Investing through REITs and funds

- Partnerships or trusts

3. Market and regional analysis

- Cities and states: Miami, New York, Los Angeles, Austin, Midwest

- Rental yield and liquidity of properties

- Prices per square meter and market dynamics

- Infrastructure, transport, ecology, tenant demand

4. Inspection of the object and legal verification

- Title search and title insurance

- Inspection report: construction condition, utilities

- Checking the ownership history and encumbrances

5. Financing and buyer requirements

- Availability of SSN/ITIN for foreigners

- Bank account in the USA

- Initial contribution and proof of legal origin of funds

- Age (some banks require 18 years of age)

6. Purchase process

- Choosing a realtor and lawyer

- Preparing an offer

- Escrow account

- Closing and registration of property rights in county records

- Possibility of purchasing remotely

7. Taxes and expenses

- Property tax (0.5–3% depending on the state)

- Closing costs (2–5% of the transaction)

- Rental Income Tax (Federal + State)

- Capital Gains Tax on Sales

- FIRPTA for non-residents

8. Property management

- Choosing a management company (Property Management)

- Long-term and short-term rentals

- Tenant contracts and local regulations

9. Exit strategies

- Selling through MLS or an agent

- 1031 Exchange for Tax Transfers

- Transfer by inheritance or through trusts

10. Scenarios and diversification

- One object vs. multiple objects

- A combination of the US and Europe (Austria for stability, the US for growth)

- Balance of return and risk

Investor scenarios

1. "The $300,000 Investor"

- What the client wanted: to purchase an apartment in New York City that would provide a stable rental income and also be a liquid asset.

- What we found: a 70 sq m condominium in Manhattan, with modern renovations and convenient transportation access.

- Result: yield of 4–5% per annum, high liquidity, property value growth of +8% over 2 years.

2. “Retired with $500,000”

- What the client wanted: to buy a house in Miami, Florida, for comfortable retirement, with the option to rent it out if needed.

- What we found: a 90 m² house with 2 bedrooms in a quiet area, close to the beach and well-developed infrastructure.

- Result: average rental yield of 4.5%, value increase of +10% over 3 years, safe area for a peaceful life.

3. "Family with children"

- What the clients wanted: to buy an apartment or house in Los Angeles for their own residence, with good schools and a green environment.

- What we found: a 120 m² townhouse with three bedrooms and a small garden in a well-developed area. Price: $750,000.

- Result: high capitalization potential of 6-7% in 5 years, safe area for children, possibility of renting out if necessary.