Additional fees and hidden costs when buying real estate in Austria

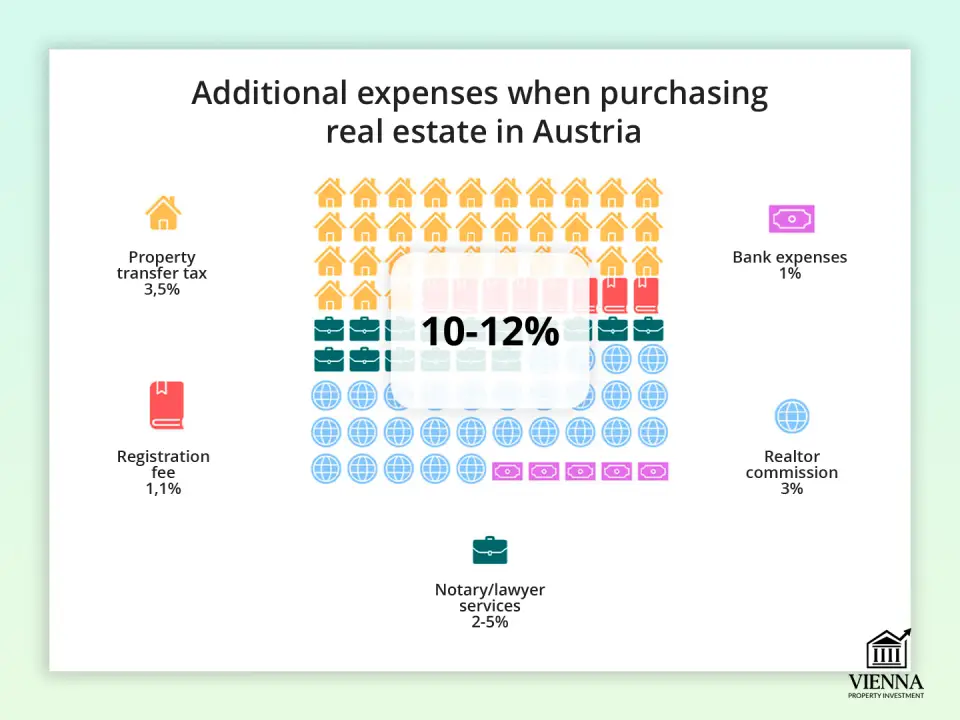

Purchasing real estate in Austria requires considering not only the property's price but also additional costs, which average approximately 10-12% of the purchase price. These costs are divided into mandatory payments—taxes, registration fees, and notary fees—and optional ones, such as realtor fees or mortgage processing.

Special rules may apply for foreign buyers. Furthermore, from July 2025, tax breaks for transactions up to €500,000 will be introduced, significantly reducing some registration fees.

Main fees and taxes

The main payments include the property transfer tax, land registry registration, notary or lawyer fees, and, if purchasing through an agency, the realtor's commission.

1. Property transfer tax (Grunderwerbsteuer)

This is the key tax when purchasing real estate in Austria. It amounts to 3.5% of the property price stated in the purchase agreement. For example, if you purchase an apartment for €400,000, the transfer tax will be €14,000. When calculating, it makes sense to add this amount to the base price of apartments in Vienna to understand the actual financial burden.

It is important to note that the tax is calculated based on the actual purchase price, but in some cases (for example, if the price in the contract is understated), the tax authority may use the market value as a guide.

2. Registration fee (Grundbuchseintragungsgebühr)

After the transaction, the ownership must be registered in the land registry. A fee of 1.1% of the property's value is charged for this. For a property purchased for €400,000, registration will cost €4,400.

Starting in July 2025, title registration and deposit fees may be waived for properties valued at €500,000 or less. For amounts above €500,000, the fee will only apply to the excess. This change will allow buyers to save significantly, especially when purchasing a mortgage.

3. Services of a notary or lawyer

The law requires the transaction to be certified by a notary or lawyer. This specialist verifies the legal status of the property, prepares the purchase and sale agreement, and opens a trust account (Treuhandkonto) for secure transactions.

The cost of services depends on the complexity of the transaction and ranges from 2% to 5% + 20% VAT of the contract amount. For example, for an apartment worth €400,000, legal fees could range from €9,600 to €24,000 (including VAT).

4. Realtor commission

If you buy through a real estate agency, you'll need to pay a commission. Typically, it's 3% of the property price plus 20% VAT. For a property price of €400,000, the realtor's commission would be €14,400.

Additional expenses

In addition to the basic taxes and fees, the buyer faces a number of additional costs that aren't always immediately apparent. These expenses depend on the terms of the transaction, the financing method, and the buyer's status.

1. Mortgage costs

If real estate is purchased with a bank loan, it is worth considering:

- The bank's commission for processing a loan depends on the terms of the specific institution and usually ranges from 0.5% to 1.5% of the loan amount.

- Insurance of the property and the borrower's life is usually a mandatory requirement of the bank: property insurance - 0.1%-0.3% per annum of the insured amount; borrower's life insurance - approximately 0.2%-0.5% of the loan balance per annum.

- Registration of a lien (Hypothekeneintragungsgebühr) is a one-time fee of 1.2% of the loan amount for entering the encumbrance into the land register.

- Down payment – in Austria it amounts to 20–50% of the property’s value, which significantly impacts the starting budget.

2. Purchase permit for foreign citizens

Non-EU citizens may need to obtain a special purchase permit from local authorities, which will incur additional costs (usually several hundred euros). Therefore, it is important for non-residents to check the restrictions on foreigners purchasing real estate in Austria : requirements vary depending on the federal state and the type of property.

In practice, this permit is often confused with the procedure for obtaining a residence permit or status such as Austrian citizenship , although legally these are different processes and require separate planning and consultation with relevant specialists.

3. VAT and special features for new buildings

When purchasing a new home, value-added tax (VAT) may apply, especially if the property is purchased from a developer. Additionally, VAT is charged for realtor and notary fees (20%), increasing the final cost.

4. Operating costs (Betriebskosten)

After the transaction is completed, the property owner is obligated to pay monthly Betriebskosten (rental fees), which include garbage collection, sewerage, home insurance, repairs and maintenance of common areas, and management company fees. On average, this ranges from €2 to €3.50 per square meter per month.

5. Real estate valuation and expert services

When applying for a mortgage, banks almost always require an independent appraisal of the property's value. The cost of this service ranges from €300 to €1,000, depending on the complexity of the appraisal.

Additional checks are also possible, such as:

- presence of harmful substances (asbestos, lead, mold) — €200–600;

- technical condition of the building (static checks, engineering systems) — €300–800.

These costs are paid separately and depend on the size and condition of the property, as well as the specialist selected.

6. Translations and notarizations

If the buyer does not speak German, all legally significant documents must be translated by a sworn translator. The average cost of translating a contract ranges from €100 to €300, depending on the length. Translation services for notarized translations are also charged separately.

7. Bank and administrative fees

- Maintaining an account for settlements costs approximately €30–60 per year.

- Cash costs for contract execution and other minor administrative fees range from €50 to €200.

Basic expenses for non-residents are approximately 1-3% higher than for residents, taking into account permit processing, document translation, additional notary services, and bank requirements. For example, for an apartment costing €400,000, this could amount to €4,000-€12,000 in additional expenses.

| Type of tax/fee | Rate / amount | Explanation |

|---|---|---|

| Real estate transfer tax (Grunderwerbsteuer) | 3.5% of the property value | Mandatory tax to the state upon purchase |

| Registration of ownership (Grundbuchseintragungsgebühr) | 1.1% of the property value | Entering an object into the land register |

| Registration of pledge (Hypothekeneintragungsgebühr) | 1.2% of the loan amount | For mortgage financing, registration of the encumbrance in the land register |

| Realtor's commission | 3% + 20% VAT | Real estate agent's remuneration |

| Notary/lawyer services (drafting of contracts, trust) | 2–5% + 20% VAT | Transaction support, opening of a trust account |

| Bank fees | individually | Bank commission for loan processing and account management |

| Real estate valuation | €300–1 000 | Independent assessment for a bank or expert |

| Insurance of the property and the life of the borrower | 0.1–0.3% (structure) + 0.2–0.5% (life) | Mandatory for a mortgage |

| Expert opinions | €200–800 | Checking static characteristics, presence of harmful substances, energy certificate |

| Translation of documents | €100–300 | For documents in a foreign language |

| Permit for foreigners (non-EU) | several hundred euros | It is necessary to obtain permission to purchase from the land administration |

| Real estate income tax (Immobilienertragsteuer) | 30% of profits | Only valid when selling an object |

| Monthly operating costs (Betriebskosten) | €2–3.5/m² | Payment of utility and operating costs |

How to minimize expenses in practice

Although additional costs when purchasing real estate in Austria can amount to up to 12% of the property's value, there are several practical ways to optimize them:

1. Real estate purchases up to €500,000. Starting in July 2025, properties valued at up to €500,000 will be exempt from some registration fees (Grundbuchseintragungsgebühr and registration of mortgage). This allows for significant savings when completing the transaction.

2. Transfer of shares and phased transfer. If ownership is transferred not for the entire property, but for a share of up to 50%, or the transaction is carried out in installments, the amount of tax payments may be reduced or even completely exempt.

3. Transfers of real estate to relatives. From July 1, 2025, the 0.5% rate will remain for transfers of real estate between immediate relatives, such as spouses, children, grandchildren, parents, and civil partners. However, it is important to properly document the family relationship to confirm the preferential rate.

4. Optimize mortgage expenses. Compare rates and loan processing fees from different banks. Consider choosing an insurance company with lower rates for both the property and the borrower's life insurance. Making a larger down payment (20-50% of the property value) reduces interest payments and mortgage fees.

5. Using long-term lease agreements (Erbpacht). Entering into long-term lease agreements can be advantageous, as formal ownership does not transfer, and no transfer tax is charged.

6. Minimize expert and appraisal costs. Order only the necessary inspections: technical condition, presence of hazardous substances, or energy efficiency. Combining several inspections into a single expert visit allows you to save on travel and documentation costs.

7. Reduced operating costs (Betriebskosten). Choose apartments or houses with an efficient management company and modern utility systems. New buildings with low energy consumption and optimized utility costs can significantly reduce monthly payments by 20-40% compared to older, mid-range housing.

Common pitfalls for foreign investors in Austria

Language barriers remain one of the most common and costly problems for foreign buyers in Austria. Misunderstandings of documents and regulations can lead to serious financial losses. This is especially critical for those considering real estate purchases as part of an investment strategy in Austria , where every mistake directly impacts the final return and risks.

| Error type | Cause of occurrence | Typical financial effect |

|---|---|---|

| Misunderstanding of the terms of the contract | All documents are in German only | €5,000–€15,000 for legal costs |

| Unexpected hidden costs | Lack of transparency of expenses in advance | 8-10% additional costs |

| Violation of the terms of use | Misunderstanding of local real estate regulations | Fines up to €40,000 + possible forced sale |

| Challenges in Negotiating Cultural Differences | Differences in business practices | Overpayment by 10–20% |

| Errors in real estate due diligence | Lack of knowledge of local inspections and requirements | €10,000–€50,000 losses |

| Delays in the approval process | Underestimating bureaucracy | Loss of deposits or missed opportunities |

| Tax planning mistakes | Complex rules of a multi-jurisdictional tax system | Risk of double taxation |

Banking and notary secrets: how to avoid overpaying

When purchasing real estate in Austria, a significant portion of additional costs is associated with banks and notaries. However, with a smart approach, these expenses can be significantly reduced.

1. Compare banks and loan terms

- Request offers from at least 3-5 banks and compare loan fees, interest rates, and insurance requirements.

- Inquire about the possibility of reducing the registration fee for the pledge and the optimal insurance package.

- If the bank requires a higher down payment for non-residents, try to negotiate a lower amount if you have a solid financial history.

2. Double-check the mandatory nature of insurance

- For mortgage transactions, banks require insurance for the property and the life of the borrower.

- Ask the bank to clarify in writing which insurance policies are mandatory and which are optional.

- Compare multiple insurance companies to find the best combination of price and coverage.

3. Negotiate fixed rates with the notary and lawyer

- Instead of the standard percentage of the property's value, you can negotiate a fixed fee for services.

- Compare 3-4 notaries or lawyers in the region to choose the best price.

- If the transaction is standard and does not involve complex international conditions, some of the consultations can be reduced.

4. Plan your expenses in advance

- Include notary and bank fees in your overall purchase budget to avoid surprises.

- Check if you can pay for several services at once (for example, notary and registration) - this can sometimes reduce additional fees.

5. Use professional help wisely

- Involve a lawyer or notary only for key stages of the transaction.

- For standard procedures (registration, powers of attorney), you can limit yourself to minimal support to avoid overpaying.

By following these steps, you can save several thousand euros, avoid unnecessary insurance, and avoid overpaying for legal or notary services, even when purchasing an expensive apartment or house in Austria.